In an epic scene from Spaceballs, Dark Helmet recklessly pushes his ship past Ludicrous speed and into Plaid. In the process, he way overshoots Lone Starr’s Winnebago Eagle 5, leaving a colourful, checkered display in his wake. Lone Starr’s co-pilot Barf marvels, “They’ve gone to plaid”.

Why “plaid”? I scoured the Internet, and found nothing definitive. Some fans suggest the plaid joke is a word play on the terms warp speed (i.e., faster than the speed of light) and the lengthwise warp or weft in a weave of thread. Warp + weft = plaid?

Well maybe. Another fan proposed it came from a 1950s Warner Bros. cartoon, “The Hypo-Condri-Cat”, where two mice, Hubie and Bertie, are messing with Claude, the hypochondriac cat. They worry him into turning green, then purple, and then (you guessed it) … Claude goes plaid. When Scottish bagpipes start to play, Hubie warns Bertie, “Don’t overdo it.”

Are you a Bertie investor, who loves to push the limits until you’re Looney Tunes? If so, today’s tour of our Plaid portfolios won’t overdo it for you. Even for those who are more cautiously Hubie-ish, if it’s anything like our Ludicrous discussion, it’s sure to generate more great questions.

Either way, let me know if you ever discover the true origin of Space Balls’ plaid reference. As we’re strictly evidence-based around here, only an original source will do.

Breaking Plaid

Similar to the Ludicrous portfolios, the Plaid portfolios also employ the same ETFs from the Ridiculous portfolios, but with a different asset location strategy. Unlike the Ludicrous portfolios, the Plaid portfolios are truly structured for optimal tax-efficiency.

The basic idea is to hold all equities in your TFSA and RRSP first, and your taxable account last. Within your TFSA and RRSP, you’re free to let your creativity run wild, with numerous ways to arrange your ETFs to reduce foreign withholding taxes. I’ve outlined one such process in a mere 10 steps below. (Note, you may need to tweak the process, depending on your specific tax situation.)

Step 1. Determine the after-tax value of your RRSP. This is easier said than done. A fee-only financial planner should be able to run retirement projections and provide you with a reasonable tax-rate assumption. But since you can’t know for sure what your tax rates will be on future RRSP or RRIF withdrawals, the entire process is more theoretical than exact.

We’ll continue with our example of our top-rate Ontario taxpayer “Pat”, who has found another $1 million to play with – once again with $100,000 in a TFSA, $500,000 in an RRSP, and $400,000 in a taxable account. Let’s assume Pat is also expected to pay top rates on her RRIF withdrawals in retirement. Therefore, her $500,000 RRSP is worth only $232,350 after the government gets its cut.

Step 2. Using the after-tax RRSP value, calculate your total after-tax portfolio value. Pat would have a total after-tax portfolio value of $732,350 [$100,000 TFSA + $500,000 RRSP × (1 – 53.53% tax rate) + $400,000 taxable account].

Step 3. Calculate how much to purchase of each ETF from an after-tax perspective. For example, if you’re targeting 18% after-tax in Canadian equities, you would want to purchase $131,823 after-tax of a Canadian equity ETF, like VCN ($732,350 × 18%). I’ve included the after-tax asset class weights Pat would have targeted at the end of December 2018:

| Asset Class | Asset % (After-Tax) | Total $ (After-Tax) |

|---|---|---|

| Canadian Bonds | 40.00% | $292,940 |

| Canadian Equities | 18.00% | $131,823 |

| U.S. Equities | 23.34% | $170,963 |

| International Equities | 14.16% | $103,709 |

| Emerging Markets Equities | 4.49% | $32,915 |

| Total | 100.00% | $732,350 |

Step 4. Fill your TFSA with Canadian and international equity ETFs. Next, locate as many of your Canadian and international equity ETFs as you can in your TFSA. As dividends from Canadian stocks are not subject to foreign withholding taxes, they are a natural fit for your TFSA. A Canadian-based international equity ETF is also a great option for your TFSA. Since it holds the underlying stocks directly, it has the same foreign withholding tax drag in both a TFSA and an RRSP. Make sure you don’t exceed the after-tax target value for either your Canadian or international equity ETFs though. In our example, there is only $100,000 of cash available in Pat’s TFSA, so she won’t go over her target by purchasing either asset class.

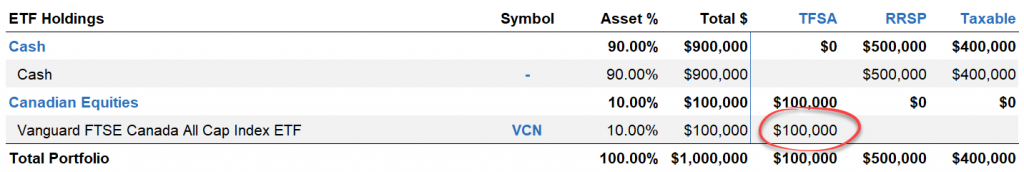

In our example, I’ve assumed Pat purchases Canadian equities in her TFSA first, but international equities would also be acceptable.

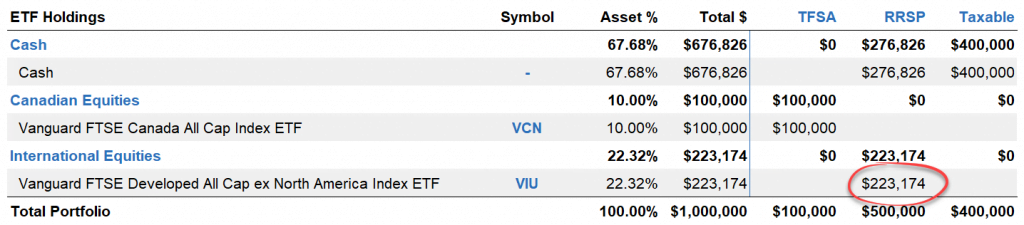

Step 5. Add international equity ETFs to your RRSP. Here’s the trick to managing your portfolio’s after-tax asset mix: Gross up your after-tax target values when dealing with your before-tax RRSP. So, even though you ultimately need $103,709 of international equities after-tax, you’ll actually need to purchase $223,174 before-tax in your RRSP [$103,709 ÷ (1 – 53.53% tax rate)].

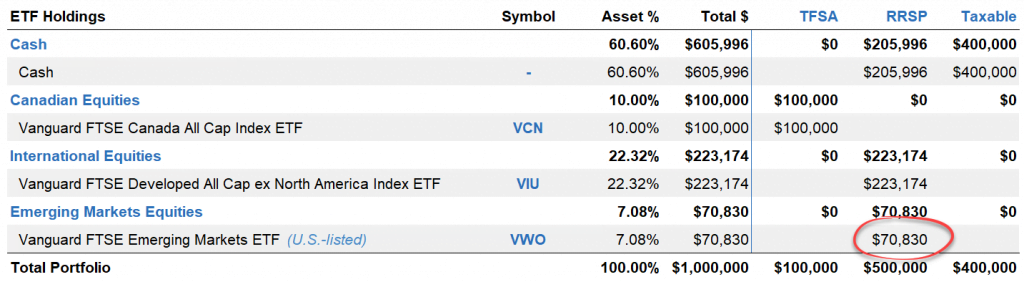

Step 6. Add emerging markets equity ETFs to your RRSP. The key here is to use a U.S.-based emerging markets equity ETF (like VWO or IEMG), to reduce your product costs and foreign withholding taxes. In other words, optimal asset location requires that you’re comfortable with the Norbert’s gambit process for cheaply converting from Canadian to U.S. dollars. As before, we’ll need to gross up the before-tax VWO purchase to $70,830 to create $32,915 of after-tax exposure [$32,915 ÷ (1 – 53.53% tax rate)].

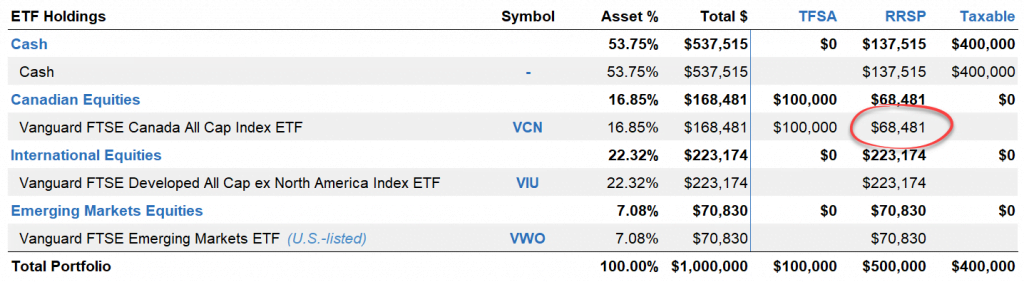

Step 7. Add any remaining Canadian equity ETFs to your RRSP. In Step 4, we bought $100,000 in after-tax Canadian equity ETFs, but we still need to buy an additional $31,823 to complete this asset allocation ($131,823 – $100,000). As in our prior RRSP purchases, we’ll need to gross up the before-tax VCN purchase to $68,481 [$31,823 ÷ (1 – 53.53%)].

As Pat is a top-rate taxpayer in Ontario, U.S. equity ETFs are actually more tax-efficient than Canadian equity ETFs in her taxable accounts. That’s why we’ve left the U.S. equities for last. If you have a lower tax rate, you might want to swap Steps 7 and 8. Either way, you don’t have to perfect this decision in pursuit of an overall asset location benefit.

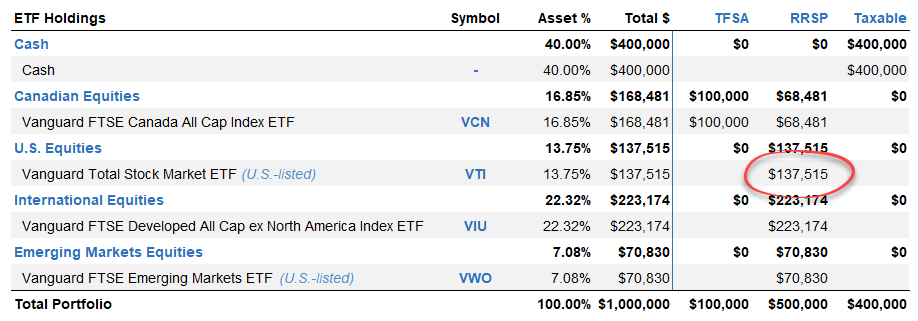

Step 8. Add U.S. equity ETFs to your RRSP. Before-tax, Pat would need to purchase $367,900 of U.S. equity ETFs in her RRSP to end up with $170,963 after-tax [$170,963 ÷ (1 – 53.53%)]. However, after Step 7, she only has $137,515 of cash available to invest in the RRSP. So, first, she can use all remaining RRSP cash to buy a U.S.-based U.S. equity ETF, like VTI. This will eliminate the 15% foreign withholding tax on U.S. dividends.

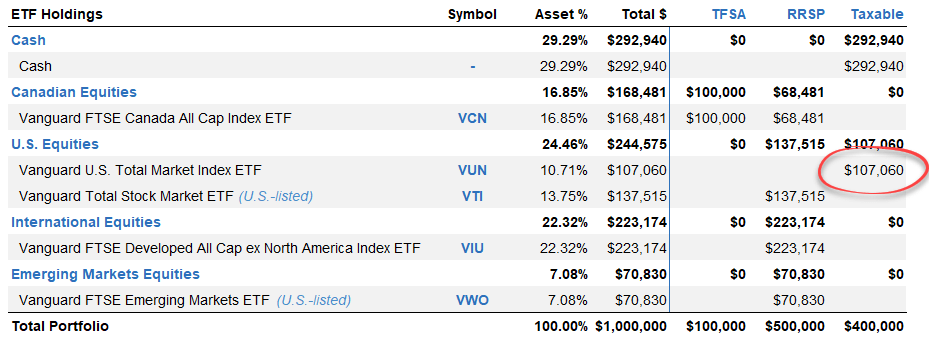

Step 9. Buy U.S. equity ETFs in your taxable account. The shares of VTI that Pat purchased in the RRSP in Step 8 are only worth $63,903 after-tax [$137,515 × (1 – 53.53%)]. This means she still needs to purchase $107,060 of after-tax U.S. equities in her taxable account ($170,963 – $63,903). Since there are no foreign withholding tax advantages of holding U.S.-based U.S. equity ETFs in a taxable account – and since Pat is ludicrously intelligent – I’ve assumed she purchases $107,060 of VUN.

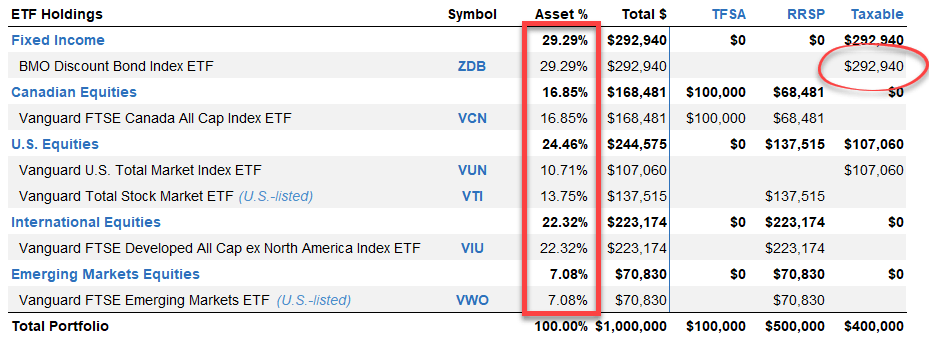

Step 10. Finally (gasp!), buy tax-efficient bond ETFs in your taxable account. With the remaining cash in her taxable account, Pat would purchase the tax-efficient bond ETF, ZDB.

Plaid Model ETF Portfolio (Before-Tax Asset Allocation): 29.29% bonds / 70.71% stocks

A Calculated Risk

In Pat’s final Plaid portfolio, we find her before-tax asset allocation is nearly 70% equity, 30% fixed income. But as with her Ludicrous portfolio, looks can deceive. Once Pat cleverly adjusts for future taxes due on the ETFs in her RRSP, she is in fact invested in her intended 60% equity, 40% fixed income after-tax asset allocation.

Plaid Model ETF Portfolio (After-Tax Asset Allocation): 40% bonds / 60% stocks

Is Plaid Making a Comeback?

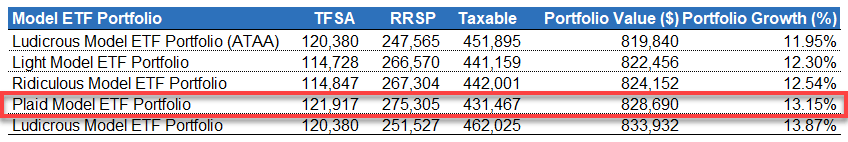

Wow, can it get any more plaid than that? If we compare Pat’s balanced Plaid portfolio to any of our other models’ 2019 60/40 after-tax portfolios, it had the highest after-tax portfolio value and after-tax return ($828,690 and 13.15% respectively). Ludicrous was the only portfolio that beat Plaid, but remember, this was because it took more after-tax equity risk than all other portfolios. That is, it wasn’t actually an after-tax 60/40 portfolio.

After-Tax Portfolio Values and Returns: Ludicrous (ATAA), Light, Ridiculous, Ludicrous and Plaid Model ETF Portfolios

The Good, The Plaid and the Ugly

Okay, that was exhausting. Who else feels like their brains have gone into their feet, and the sound of Scottish bagpipes is echoing in their now-empty head?

As with our other portfolios, let’s wrap with a review of the advantages and disadvantages of going to Plaid.

Advantages of the Plaid Portfolios

- It is officially the most tax-efficient portfolio in the bunch. As the Plaid portfolios offer the most portfolio management flexibility, you can hold U.S.-based foreign equity ETFs in your RRSP and Canadian equities in your TFSA, reducing your foreign withholding tax drag.

- Lower expected capital gains from rebalancing. Since you can hold most of your equities in your RRSP and TFSA, you can also do most of your portfolio rebalancing there. This can reduce the tax drag from occasional rebalancing. This may be more significant if you’re not adding enough new cash to your portfolio to rebalance it organically over time.

- Lower expected year-end capital gains distributions. Once again, since most of your equities are held in TFSAs and RRSPs, you won’t be hit with big year-end capital gains distributions from your equity ETFs (although this can still occur with your tax-efficient bond ETFs).

Disadvantages of the Plaid Portfolios

- You’re not Marty McFly. Without a time-traveling DeLorean, you will never know for sure what the future tax rates will be for your registered account withdrawals and taxable capital gains.

- You’ll need to take more before-tax equity risk. To go Plaid like Pat did, you’ll have to allocate 70% to equities before-tax, understanding it’s really just 60% after-tax. Pat can live with that. She has nerves of steel, and understands that it’s not her, but the government taking the extra equity risk. Not all investors are as rational. If you might blink when markets go risky, you may want to take Hubie’s advice and not overdo it.

- You need to love numbers. I personally love numbers, but even I got a splitting headache creating this post. And that’s using relatively straightforward, static examples. Your real-life, portfolio management will be much more complicated. You will need to continually update your after-tax ETF values: Especially as unrealized capital gains accumulate in your taxable account, they’ll create lower after-tax values for the appreciated funds you continue to hold.

- You’ll need to be a pro at Norbert’s gambit. Part of the Plaid portfolios’ tax efficiency comes from investing in U.S.-based foreign equity ETFs in your RRSP, which requires you to get up close and personal with Norbert’s gambit. Are you really ready for that?

- Higher expected minimum RRIF withdrawals. As your RRSP will be significantly biased toward equities, it will also be expected to grow faster than your taxable account. This sounds great, until your minimum annual RRIF withdrawals bump you into a higher tax bracket. Or worse yet, they might subject you to the dreaded Old Age Security claw-back.

Hitting the Emergency Stop Button

We’ve now reached the end of our portfolio journey. Our Plaid portfolios overshot the complexity of the rest of our models by about a million miles, so no one will blame you if you decide to stop and rewind. As I’ve said before, you can begin and end your adventures with a Light portfolio, and still be light years ahead of most DIY investors.

Then again, as your wealth (hopefully) accumulates, and your portfolio navigation skills mature, you may eventually want to accelerate your efforts.

Like astro-engineer Homer Hickman Jr. once wrote, “A rocket won’t fly unless somebody lights the fuse.” So, whether your personal preferences currently lean toward Light, Ridiculous, Ludicrous, or Plaid, I will continue to cover all our model portfolios in upcoming podcasts and videos. Subscribe to my podcast, and I’ll keep the fuse well-lit for your future adventures.

I realize this post is 3.5 years old, but I wanted to ask if October 2023 interest rates changed the calculation on whether fixed income should all be allocated at the end and into the taxable account. With a return to higher interest rates, might the old conventional wisdom to keep fixed income in an RRSP not make more sense?

Justin, are asset location strategies like plaid appropriate for early accumulators?

Obviously there is uncertainty in regards to the first few steps of the plaid strategy at a young age. Is it sensible to get “close enough” by being 100% equity for the first decade or two and follow the general advice of filling your TFSA with Canadian and International ETFs then the RRSP with International ETFs? Seems like this could naturally follow a glide path of sorts.

Once retirement accounts were close to full, the portfolio is of a large size, or you’re ready to accurately attempt this strategy an advisor could be sought out and you’d start at step 1 again.

My question assumes the following:

You’re already in a portfolio more complicated than VEQT

100% equity would have been your allocation anyways

Any other comments on Plaid for early accumulators would be appreciated!

Truly amazing work with your asset location deep dive.

Two things I am thinking about:

1) Tax rate: it appears in your example you use the “top tax bracket” example with Pat from Ontario. You quote a tax rate of 53.x%. Is this not the marginal tax rate and wouldn’t the average tax rate be a better rate to estimate taxes paid in the years that one is withdrawing from RIF? For instance, true top tax bracket of $315,000 in Ontario has a marginal tax rate of 53.53% but an average tax rate of 37.83%. Also, how many retirees have $315k of passive income! I wonder what the return difference would be in the case of using average tax rate or if someone lives on a more modest income in retirement.

2) What to you recommend for PLAID with people who are incorporated with a CCPC? Do you make some estimate of after tax investment income during decumulation years? This would get exceedingly complex I imagine with things like dividend, vs interest vs capital gains in CCPC, whether one begins to lose small business deduction by surpassing $50k annual passive income, whether they employ capital gains stripping or tax loss harvesting. Do you have a general recommendation for how to go about CCPC in PLAID??

Thanks, thanks, thanks

Hi Justin, just noticed you have replaced the section in your model portfolios where you used to link to the Light or Plaid portfolio examples, are these approaches no longer recommended?

@Dave – I took those down recently, as they’re not “model portfolios” per se, but asset location strategies (which was a bit confusing). I’ll be releasing videos discussing these asset location strategies shortly.

Hi Justin,

I’ve been reading through all of your ‘spaceballs’ portfolio articles and examples, and perhaps I missed it, but I don’t see an after-tax adjustment for the tax liability from capital gains in a taxable account when calculating the ATAA. Following on from the logic, shouldn’t one account for the after-tax amounts on equities based on the accrued unrealized capital gains, plus the long term expected gains?

Thanks

Rick

@Rick – All of the scenarios assume all registered accounts are deregistered (taxed) and all capital gains are realized (taxed), so this has already been accounted for behind the scenes.

@Justin – Thank you for the very speedy reply! I understood that all accounts are liquidated and taxed for the analysis. What I didn’t see in the example was an adjustment to the asset allocation to lower the value of appreciated equities in the taxable account due to the tax owed on their gains. I wasn’t sure if that’s because the example is at the very beginning of the portfolio before any gains have accumulated or if the adjustment is not necessary for tax on gains.

I re-read the article again, and I think I found my answer in the last sentence of your “Disadvantages point 3. You need to love numbers:” “…as unrealized capital gains accumulate in your taxable account, they’ll create lower after-tax values for the appreciated funds you continue to hold.”

Thank you!

@Rick – My apologies for the misunderstanding. As you mentioned, there were no unrealized capital gains on the taxable securities at the beginning of the period, and therefore, their asset allocation did not require adjustment. However, going forward, this after-tax adjustment would be required.

Hi Justin,

If Pat was on a different tax rate, could that change your decision of using ZDB on the taxable account and instead put bonds on the RRSP? How should one approach this? (in my case, for example, my marginal tax rate is 30.5%, so quite different from the 46.16% of the Ontario top bracket).

Thanks!

What is the rationale for holding XEF in the TFSA/RSP rather than the Taxable account? It appears that the total cost of holding this in a taxable account is 0.26% cheaper than in the TFSA/RSP?

@Klon – XEF has the highest dividend yield, which will result in the highest annual income taxes in a taxable account (you can’t just focus on the foreign withholding tax drag – this is only one piece of the tax puzzle, and can lead investors to make poor asset location decisions).

Hi Justin,

Really appreciate your content.

I wanted your input on a certain risk I believe you don’t assess with your ludicrous and plaid portfolio. Because you are having an asset LOCATION strategy, are you not at risk from having your RRSP outperform your TFSA? Because a TFSA is a more tax efficient account, the higher yields from these portfolios could be rapidly offset by this “bad luck”.

Example: I’m going 100% equity. I buy 50 000 $ of XIC in my TFSA and 100 000$ of a mix of 50% ITOT and 50% IEFA in my RRSP. After a few years, TFSA is worth 60 000$ (20% gain = 10 000$ gain) and RRSP is worth 150 000$ (50% gain = 50 000$ gain). From an after-tax perspective, I have 35 000 $ (10 000 + 50 000/2) if I’m in the highest tax bracket. If I had simply evenly split XIC, ITOT and IEFA across all accounts, I would have 40 000$ from an after-tax perspective. (50%+50%+20%)/3 = 40% so 20 000$ (50 000 * 0,4) from TFSA and 40 000$/2 (100 000 *0,4)/2 from RRSP.

@Thiéry – I discuss both TFSA approaches in the Ludicrous portfolios (you could always adapt your Plaid strategy in a similar manner):

https://canadianportfoliomanagerblog.com/canadian-portfolio-manager-introducing-the-ludicrous-etf-portfolios/

Hi Justin,

Can you comment on the best way to rebalance your portfolio in the Ludicrous/Plaid portfolios? I understand that you need to sell equities that are overweight and buy equities that are underweight. However, how would you do this across accounts, since the equities are held in different places (i.e., non-registered, TFSA, RRSP)? Wouldn’t this affect your taxes? For example, I need to sell equities in my RRSP to buy equities in my TFSA/non-registered. Is rebalancing with new cash the only way around this problem?

@Lester: If you’re selling equities in your RRSP, there won’t be any tax implications.

That part I understand. I was referring to having to use your proceeds from the RRSP to purchase underweight securities in your TFSA/non-registered, which is not possible without generating a tax hit.

@Lester: I’m still not sure if I’m following – please feel free to provide me with an example (of the amounts/ETFs held in each account), and that should help me to better answer your question.

For simplicity, let’s say I have 50% in ZDB in RRSP and 50% in VCN in TFSA. A year later, the allocation of ZDB increased to 60% and the allocation for VCN decreased to 40%. I need to rebalance back to 50% for each, which means that I will need to sell 10% of ZDB and buy 10% of VCN (I’m using the proceeds of ZDB to buy VCN). This means that I will need to move my money out of the RRSP, which is not practical.

What I’m trying to get at is that rebalancing is not easy across accounts. What is the best way to rebalance the portfolio?

@Lester: Gotcha! So in this case, you would sell a portion of ZDB (or ZAG) in your RRSP, and buy more VCN in your RRSP with the proceeds (to get you back to your overall 50/50 asset mix target).

Hi Justin,

I really enjoyed reading this article and all the comments below! I have two follow up questions:

Hypothetically speaking if I decide to live off the dividends, Canadian government would actually pay me 6.86% in Ontario on the first 43,906 of Eligible Canadian Dividends (assuming that is 100% of all my income). Here is handy link for the readers:

https://www.taxtips.ca/taxrates/on.htm

Would distributions from CE ETFs, such as XIC, be considered eligible (since it is 100% based on Canadian Equity which I am assuming are eligible)? So in this hypothetical scenario, would it be more tax efficient to shift CE into a non-registered account assuming that you have no taxable income other than the ~44k in CE dividends and ignoring realized capital gains?

Granted you would need a sizable portfolio to achieve this but I am curious how this beneficial tax treatment at the lowest tax bracket affect asset location.

Also, what are your views on adding Real Estate AC for diversification using REITs such as VRE or VNQ? In terms of building out a Plaid Portfolio, would they share the same step as Fixed Income AC?

Thank you!

@Dennis: The majority of XIC’s distributions will be considered eligible dividends (but a small portion could be comprised of return of capital, other income, capital gains, or ineligible dividends in some years).

There could be many situations where asset location rules of thumb no longer apply (your hypothetical example may possibly be one of them – I can’t be certain, as there are so many other variables involved).

Adding REITs increases the complexity of the portfolio (and the cost, and the tax-inefficiency), but if you’re going to add REITs, carve them out from the equity allocation (not from your safer fixed income allocation). REITs should not be considered part of your fixed income asset mix, as they can be very volatile.

Thanks Justin for another great post.

I was a bit confused with the ordering of steps 5-6-7: what’s the reason for prioritizing international over emerging over US in the RRSP? Without knowing which of these will perform best in the coming decades, I would have thought to prioritize US since it’s the only one that doesn’t result in unrecoverable FWT in an RRSP?

On a related note, I didn’t understand the part “As Pat is a top-rate taxpayer in Ontario, U.S. equity ETFs are actually more tax-efficient than Canadian equity ETFs in her taxable accounts.”: is this due to higher dividend yields in Canada or something else?

And one unrelated question: In all these blog posts you recommend holding Canadian-listed ETFs in taxable accounts. I’ve been holding IEMG (and ITOT) in a taxable account basically for the cheaper product costs (plus I had USD available). My understanding is IEMG’s wrap structure means the FWT is the same either way (unrecoverable L1, recoverable L2), but I know there’s also the tax inefficiency issue of distributions like capital gains getting reported as ordinary income for US-listed ETFs. So I’m curious if you’ve ever done any analysis on the cheaper product costs vs tax inefficiencies for ETFs like IEMG and ITOT in taxable accounts, or are the product cost differences small enough that it’s not something worth really considering?

Thanks as always,

Graeme

@Graeme:

– International equity ETFs have higher dividend yields than U.S. or emerging markets. Without knowing the future capital gains on each asset class, this is about as good as an investor can do.

– U.S. equities have a very low dividend yield, relative to Canadian equities. For top rate taxpayers in certain provinces, this can make U.S. equities more tax efficient than Canadian equities, even after accounting for the dividend tax credit (from an annual income taxation perspective).

– IEMG and ITOT have the same FWT implications as XEC and XUU in a taxable account. I recommend the Canadian-based ETFs, as most investors are not comfortable with Norbert’s gambit or T1135 reporting. If you are a pro at both of these, then IEMG and ITOT would have slightly cheaper product costs than XEC and XUU.

A question about the disadvantages of the Plaid Portfolios:

“You will need to continually update your after-tax ETF values” – is there any software (Excel spreadsheet?) to do that?

@Albert: I unfortunately don’t have a user-friendly spreadsheet available for investors. Perhaps Michael James can weigh in (he’s been using a customized spreadsheet for his own version of the “Plaid” portfolio).

Hi Albert,

For years I just used a fixed estimated tax rate (call it t) for each of my accounts. Then I’d take each asset class in the account and multiply it by 1-t before doing any asset allocation calculations. I estimated t for my RRSPs by just looking at my expected income in retirement, seeing what income range my RRIF withdrawals would fill, and calculating the tax rate I’d pay. Taxable accounts are a little trickier because withdrawals are made up of dividends, capital gains, and return of capital. But it’s still possible to estimate the overall tax rate. This is very rough, but it’s better than using t=0, which is what you’re doing if you ignore taxes.

Now I have my own full tax calculator (for the parts of the income tax rules that apply to me). My tax rate values for each account type update in real time. This was a lot of work to set up. I only did it out of interest. My old method of fixed tax rate estimates was perfectly fine.

Unfortunately, my spreadsheet is highly customized to my situation and wouldn’t be of much use to anyone else. I’ve tried a few times to make a generic version, but no success so far in making it general enough to be useful.

Michael

Thanks as always for your fantastic post. With the market volatility I feel like it’s a great time to spend some time re-evaluating and really appreciate having your wisdom.

Question re: future tax bracket forecasting

What factors would one need to look for when traveling into the future ;) to get the presumed future tax rate?

RRIF annual payout + any other presumed income (CPP, OAS, residual salary, interest, 50% capital gains)? Would dividends count here as well and if so how (is it just the dividend or the gross up?)

Trying to see if I can give future forecasting a go…

@Steve W: I would recommend working with a fee only planner to run retirement projections, as there are many variables (such as pension income splitting with a spouse) that could impact your estimates.

Talking about spouse and income splitting and sharing finances.

What about a post about 2 spouses, integrating portfolio management.

Would that be 2 plaid portfolios or 1 big plaid covering across both sets of tfsa, rrsp and taxable accounts (with their respective cdn and US accounts) ? Or am I getting crazy now.

@Mike: Ideally, you would want 1 big plaid portfolio between the two of you. But as you said, this would increase the complexity even further.

Hi Justin great post, love the blog, thanks for providing all this free knowledge.

I have a question I don’t quite understand.

6. ” The key here is to use a U.S.-based emerging markets equity ETF (like VWO or IEMG), to reduce your product costs and foreign withholding taxes”

I understand the point of buying (example VTI) to avoid the Foreign withhold tax of US equities in an RRSP but not sure the point with emerging markets. It was my understanding that it’s the US government holding the money back because we are foreign to the US with TFSA and taxable accounts. And that there is a treaty between US and Canada which doesn’t penalize us in an RRSP. Which makes me wonder what problem we are solving by buying Emerging markets through a US traded equity as opposed to Canada. I would think it would be the reverse and we would be better to buy Emerging through a Canadian ETF instead. Maybe it’s not the US withholding it’s actually Canadian Gov instead? And the “emerging economy” withholding is avoided by using US ETFs?

Perhaps I just answered my own question.

@Martin: Glad you like it!

With U.S.-based emerging markets equity ETFs, there are two layers of foreign withholding taxes:

Level 1: From the emerging markets to the U.S. (this is not recoverable for Canadians)

Level 2: From the U.S. to Canada (this does not apply in an RRSP, is lost in a TFSA, and is recoverable in a taxable account).

If you hold a Canadian-based emerging markets equity ETF (like VEE or XEC) that holds a U.S.-based emerging markets equity ETF (VWO or IEMG), you do not avoid the Level 2 taxes in an RRSP. So it is generally better to hold VWO or IEMG in your RRSP, rather than VEE or XEC (all things equal).

https://canadianportfoliomanagerblog.com/part-i-foreign-withholding-taxes-for-equity-etfs/

https://canadianportfoliomanagerblog.com/tax-me-if-you-can-foreign-withholding-taxes-on-etf-distributions/

Hi Justin, thanks for writing such a good series of articles and helping DIY investors like me. I had re-read all of them before I listened to your podcast. I have the following questions:

• In your Ludicrous portfolio, your approach was to put bonds in the RRSP as a last step. I think this makes sense because all withdrawals from the RRSP (after retirement) are taxed as income with the highest tax rate; this is even worse if we are still at the highest tax bracket after retirement. If we put bonds in RRSP, we minimize its growth and hence future taxes. However, in your Plaid portfolio, your approach is reversed in that you put equities in RRSP first and bonds in the taxable account as a last step. As you explained, the Plaid portfolio is the most tax-efficient (I guess for now). But it won’t be tax-efficient at the time of withdrawal from the RRSP. Please explain why you used 2 different approaches, and why it may not be a good idea to put income investments like bonds in the RRSP.

• In Step 2 of your Ludicrous portfolio, you mentioned that you put mixed equities (CAN, US, EAFE, EM) or only CAN ETFs in TFSA for your clients. Is the second approach not better for sure, because you reduce the overall FWT?

• If I have a corporate account as well, should I put Canadian ETF and discount bond ETF in the account, leaving out foreign ETFs to other accounts as much as possible?

• I wonder if there is any currency exchange benefit in investing in an Asset Allocation ETF like VGRO. During rebalancing, Vanguard takes care of the buying and selling of the underlying foreign ETFs. Do they use a better exchange rate relative to the brokerage exchange rate when we do rebalancing ourselves with your say Plaid portfolio, assuming we don’t use Norbert’s gambit?

Thanks very much for your help.

@Joe: You’re very welcome – thanks for reading and listening :)

In regards to your questions:

– The scenarios assume all RRSPs are fully deregistered at the end of 2019 (so it is looking at a worst case scenario, where all withdrawals are taxed at the highest marginal tax rate). Still, Ludicrous beat Plaid, but only because it took more after-tax equityrisk. Once the after-tax asset allocation was accounted for, Plaid was the most tax-efficient portfolio. However, this does not take into account any claw-back of OAS (or many other factors), which could skew the results in a real-world setting. This is another reason to view the results with a grain of salt. I have explained the pros and cons of each strategy at the end of each post.

– Putting all Canadian equities in the TFSA is not better for certain from an overall after-tax return perspective. Although unrecoverable foreign withholding taxes will reduce the after-tax return over time, this could be made up for if foreign equities outperform Canadian equities by a sufficient margin over your investment horizon.

– If you’re managing a Plaid portfolio, equities should be held in the TFSA and RRSP first, and corporate account last. However, if you do need to hold some equities in the corporate account, Canadian equities could be an appropriate “spill-over” after TFSAs and RRSPs have been filled up with equities, as the personal/corporate tax integration of eligible dividends works well (the same cannot be said for foreign dividends in a CCPC).

– If you’re buying U.S.-based ETFs in your RRSP, you should be using Norbert’s gambit, or many of the tax benefits will be lost to high currency conversion costs. If you’re not going to use the gambit, you may want to consider just holding Canadian-based foreign equity ETFs.

Hi Justin,

You said that increased OAS clawback could be a negative for Plaid portfolios. If RRSP/RRIF growth is excessive (or likely to be excessive), doesn’t it then make sense to start drawing it down a little before starting to draw OAS? It seems to me that this would solve the problem, and that any remaining excess income in a Plaid portfolio is likely a sign that you’re making more money — a good thing.

@Michael James: With this strategy, you would be eliminating your long-term “tax-free” RRSP growth to reduce the OAS claw-back. You would also pay more tax earlier (technically reducing the value of your portfolio) and have more annual taxable income in your non-registered account (again, reducing the value of your portfolio). It could possibly come out ahead, relative to the scenario of doing nothing, but it’s anything but a sure thing (and would be very dependent on the specific situation).

Hi Justin,

I agree this area is complex, but let’s compare two scenarios. The first is Plaid as you’ve described it. The second modified Plaid using the Ludicrous asset-location strategy (which is roughly the same as Ludicrous modified to cap the after-tax risk level). It seems to me that the higher returns we expect from the first portfolio will translate into higher lifetime income, even with the problem of dealing with OAS clawback. That is to say, I’m doubting that the marginal tax rate on this extra income would exceed 100% over a lifetime. If this is right, then for someone who uses after-tax asset allocation, OAS clawback concerns are not a good reason to avoid Plaid-style asset location rules.

@Michael James: I unfortunately can’t comment on every possible investor scenario (there could be a situation where the tax in-efficient Ludicrous ATAA portfolio outperforms the Plaid portfolio after OAS claw-backs).

I would agree that OAS claw-backs shouldn’t be the top concern for investors when deciding on their asset location strategy. In my opinion, the overall complexity and unknown variables of a Plaid portfolio, along with the behavioural downsides (i.e. more before-tax equity risk) should be their main concerns. During the March 2020 downturn, I didn’t read a single article saying anything like “Don’t worry investors, most of the money your portfolio lost was actually the property of the government”. Investors just don’t think like this (especially during market panics), and probably never will.

Hi Justin,

Thanks for the discussion. I understand that your main concern is your clients and their overwhelming tendency to think in before-tax terms. As an ATAA investor myself, I was largely on my own before reading about your Plaid portfolio. My attempts to accurately model my own portfolio over a lifetime indicate that OAS clawbacks aren’t enough to push me away from filling my RRSP with stocks, but that only applies to my situation; I haven’t tried to prove anything more general.

I appreciate all the work you’ve done to explain these 4 portfolio approaches in detail.

Cheers,

Michael

@Michael James: I definitely would not categorize you as the average investor, Michael ;)

I think it’s great that you’re able to implement and manage this type of complex “Plaid” portfolio. I do have to be cautious about how I frame these discussions. The last thing I would want is for every reader of the blog to ditch their perfectly good asset allocation ETF and jump into a complex portfolio they shouldn’t be in.

Thank you for putting this up. I’ve been craving to read about things I actually have control over unlike Covid. Very refreshing:)

From reading all your past posts and piecing the info together I’ve been running a very similar portfolio for a while now except with a couple of the substitutions you mentioned in your response to micheal James (lower tax rate). Nice to see you pull it all together with these last few posts. I appreciate you sharing this quality info and I learn lots from your responses as well.

@Phil: Yeah, I was getting a bit exhausted with reading nothing but COVID news, so I decided to start releasing these blogs/podcasts I had held back when this all started.

I’m glad you’ve found the series useful (it has been a blast to write :)

If we look at risk-adjusted returns, Ludicrous has worse returns than Ridiculous or Plaid due to heavy bond holdings in RRSPs. However, incorrectly measuring asset allocation with pre-tax figures causes people to take more risk with the Ludicrous portfolio so that it more than makes up for its asset location problems with a boost to returns from holding more stocks (measured after tax). I find this troubling as a basis for building a portfolio.

@Michael Wiener: You’re free to choose whichever asset location method you prefer. I’ve provided detailed arguments and analysis for and against each of the methods.

Hey Justin,

Just wanted to say thank you for all the work you’ve put into this site. It is truly an incredible resource!

@Dustin: You’re very welcome – thanks for reading!

Hi Justin,

Nice to see the conclusion of your model portfolios.

Why not use VEA in place of VIU for developed mkt exposure, especially as the allocation is within the RRSP? You are already using US listed ETFs for your US and emerging mkt exposure. And if I’m not mistaken, the mer + fwt is significantly less with VEA vs. VIU within an RRSP. Thoughts?

Cheers!

@Chris: You definitely could! (although you would need to adjust your Canadian equity allocation downwards to account for the allocation to Canadian stocks in VEA). I show investors how to do just that in a recent blog post:

https://canadianportfoliomanagerblog.com/more-alternatives-to-vanguards-asset-allocation-etfs/

It’s great to see the new portfolios fully. I was really hoping that Plaid was going to weave together Vanguard and iShares ETFs to create the best possible world. Could you share what the rationale is for no longer doing this in your model ETFs?

@DJ: My rationale is that it doesn’t matter (and the discussion is extremely boring). Whether you use a broad-market Canadian equity ETF from either Vanguard or iShares is likely to make little difference in long-term returns (ditto for other asset classes). Once you’ve come to this same conclusion, you can start to focus on portfolio management concepts that actually add value.

So to clarify, it doesn’t matter if you choose ZAG over XBB or VAB, or if you choose VCN over XEC because it doesn’t actually add value? I ask because these are the choices you had made in your model portfolios last year and I’m trying to understand the rationale for the change.

@DJ: Correct – ZAG, XBB and VAB can be used interchangeably (I use all of them in my clients’ accounts).

VCN, XIC (not XEC), or ZCN can also be used interchangeably. Perhaps my equity ETF videos/blogs may help:

https://canadianportfoliomanagerblog.com/understanding-canadian-equity-etfs/

https://canadianportfoliomanagerblog.com/understanding-us-equity-etfs/

https://canadianportfoliomanagerblog.com/understanding-international-equity-etfs/

https://canadianportfoliomanagerblog.com/understanding-emerging-markets-equity-etfs/

Thank you for the insight. :)

Hey Justin, just a minor typo fix: “$170,060” in step 9 has the 7 and 0 mixed up. Please feel free to delete this comment once you’ve seen it. Thanks for the post!

@Nik: Thanks for the catch! :)

Thanks for the great blog post, Justin!

I would love to see further examples in the months to come, for example I don’t think too many people would intentionally pay the highest possible tax rate in an RRSP. Some couples targeting an early retirement can craftily withdraw from a combination of their RRSPs and TFSAs to effectively withdraw $50,000 or more annually while paying the lowest tax rate (or maybe even no taxes) on their RRSP. See this blog post for example: https://www.myownadvisor.ca/they-want-to-spend-50000-per-year-in-retirement-did-they-save-enough/

I’d love to see a few examples where lower tax rates are assumed. (And perhaps other provinces too)!

@Mark H: If an investor is not expected to be in a high tax bracket in retirement (and only have RRSPs and TFSAs), asset location strategies are not as important for their overall investment plan.

I eventually plan to include other asset location examples, using lower tax rates. But the only real difference is that an investor with a lower tax rate may favour Canadian equities in their taxable account first after their TFSAs/RRSPs have been filled with equities (so it’s not a very exciting example).

My wife and I expect to have a lower tax rate in retirement than the top rate (at least as long as we’re both alive to split income). I’ve found that the details of the optimal way to fill accounts is different than what you have in this post. Have you found optimal asset location to vary with tax rate?

@Michael James: The equity asset location order could certainly change if you’re in a different tax bracket (i.e. in this scenario, Canadian equities would typically be the first to spill over into the taxable account once the TFSAs and RRSPs have been maximized with equities). In this case, it may make more sense to hold international equity ETFs in the TFSA first (then in the RRSP), and then fill the remaining RRSP in the following order: emerging markets equities, U.S. equities, Canadian equities.

In any case, the specific order of equities isn’t really as important as the overall concept of equities in the TFSA/RRSP first, fixed income last. As we never know what the gains will be on each equity asset class, it’s impossible to be optimal.

Thanks for the reply, Justin. I definitely agree with sheltering stocks in registered accounts. There is a lot of bad advice online about having fixed income in registered accounts. It’s been challenging to change people’s minds.

@Michael James: I personally don’t mind which asset location method investors choose, as long as they understand the arguments for and against each (or they should just stick with the same asset allocation across each account type). We use the Ludicrous asset location method with our clients. Although the Plaid method is optimal from a theoretical perspective, it has too much working against it from a practical perspective (i.e. impossible to optimize, increases the likelihood of bad investor behaviour due to increased before-tax equity risk, regulatory constraints due to higher before-tax equity risk, etc.).

@MichaelJames my wife and I are in a similar situation as you (we expect to be in a low tax bracket on retiremen). Can you share which asset location you found to be optimal in your case and how you got to that order? I’d love to try to apply for my case. Do you also find that bonds should go on taxable account?

Hi Liam,

In our taxable accounts we have fixed income, Canadian stocks, and some global stocks. Our TFSAs have non-US stocks, and our RRSPs have all our US stocks (in US ETFs) as well as some international stocks. I don’t claim to be certain that this is optimal, but I’ve made these choices based on an after-tax asset allocation view. There are many reasons you may take a different approach including the fact that you would have different amounts in your RRSP, TFSA, and taxable accounts than I do.

Hi Justin – In Step 7, what is the rationale for adding the remaining Canadian equity ETFs in a RRSP, rather than a Taxable account by switching with Step 9?

@Steve: Please see my response to @Samuel.

Wow, this is exactly what’ve been looking for. I aspire to be Pat.

@Ryan: Best of luck – I’m not ready to go Plaid just yet ;)

Thank you for this article, I couldn’t wait to read it! I am wondering how to calculate the after-tax risk exposure of holdings in the registered investment. I choose my words well, I speak of afer-tax risk exposure and not of after-tax value. For registered investments, these two concepts can merge, but not in the case of non-registered. In other words, I’m looking to estimate the after tax “beta” of my investments to have a proper after tax allocation.

In my opinion, we have to consider the tax rate on registered investments (including the capital gains inclusion rates). In my case, I use a factor of .75 for my RRSP and .9 for my unregistered equities for the after-tax adjustment (first tax bracket). This approach seems to me to make sense mathematically, but I have never seen it in an article anywhere. I know it’s certainly a bit complicated, but I like the numbers and I’m curious about what you think about this.

Justin as a follow-up: could you comment on the decision to prioritize bonds in the RRSP in the ‘ludicrous’ portfolio, versus bonds in non-registered accounts in ‘plaid’? I had always understood that the conventional wisdom was to keep bonds in the RRSP. Is the whole point of the ‘ludicrous’ portfolio to demolish this ludicrous idea? Or is it just that, while bonds are less tax-efficient than canadian equities, a tax-efficient bond ETF is still better than international / US ETFs from a tax perspective?

Thanks again.

@Niall: To sum up, Ludicrous wins against Plaid because it takes more after-tax equity risk by holding bonds in the RRSP. If you adjust for after-tax asset allocation, Ludicrous (ATAA) loses against Plaid, because the after-tax value of the RRSP effectively becomes a TFSA (and we know that it is more tax-efficient to hold equities in a TFSA, rather than a taxable account).

Hi Justin,

Thanks for the post. You are doing a great job to help us getting a better understanding of the ETF world. I have just a quick question about why you choose to put the VUN in the taxable account at the place of VCN. I know that Canadian dividends get a better fiscal treatment than US dividend. Is it because that VUN have a lower dividend yield that offset the fiscal advantage?

Thank in advance and have a nice day.

@Samuel: You are correct! The higher dividend yield on Canadian equity ETFs (relative to U.S. equity ETFs) can offset the tax advantages of Canadian eligible dividends (at least from an annual income tax perspective). However, this is the case in our example of a top-rate Ontario taxpayer. If you are not in the top tax bracket, or you live in a different province which provides more favourable tax treatment for Canadian eligible dividends, you may need to adjust these assumptions.

Hi Justin,

Thanks for the post! I’ve been watching this space for a while — very curious about ‘Plaid’!

How would you apply this in the case of an incorporated professional? If I want to use corporate investments in place of nonregistered investments, should I similarly ‘gross up’ when working out my pre-tax allocations?

Thanks for your excellent blog.

@Niall: You’re very welcome! That’s correct – you would need to gross up the amounts by the tax rate you pay on the corporate dividend distributions.

What’s the distinction between US and Emerging market equities that makes step 8 come after step 6? Aren’t the foreign withholding taxes the same? Is this because of the higher dividend yield?

@A: Correct – emerging markets equity ETFs generally have higher dividend yields than U.S. equity ETFs.