In the first installment in my “Understanding ETFs” series, we toured the Canadian equity ETF landscape, covering solutions you can use for your investment portfolio’s domestic stock allocation. Today, I want to switch gears and head south of the border, to explore some of the U.S. equity ETFs you can add in, to diversify your Canadian-heavy portfolio.

Invasion of the S&P Spiders

In our last episode, we learned Canada created the world’s first ETF in 1990. The U.S. wasn’t far behind us though. In January 1993, State Street Global Advisors launched the first successful U.S.-listed ETF – the SPDR® S&P 500® ETF, or SPY. The SPY mission: to follow the S&P 500 Index, which Standard & Poor’s created in the 1950s to track the performance of around 500 larger U.S. companies.

SPDR (pronounced “spider”) is an acronym for “Standard & Poor’s Depository Receipt.” It’s trademarked by Standard and Poor’s Financial Services, but the acronym is so popular, it’s often confused as a generic term for any S&P 500-tracking ETF.

SPY’s largest holdings include a number of familiar names most Canadians will instantly recognize.

Top 10 Holdings by SPY Weight

| Company | Symbol | Weight (%) |

|---|---|---|

| Apple Inc. | AAPL | 4.2% |

| Microsoft Corporation | MSFT | 3.6% |

| Amazon.com Inc. | AMZN | 3.3% |

| Berkshire Hathaway Inc. Class B | BRK.B | 1.7% |

| Facebook Inc. Class A | FB | 1.6% |

| JPMorgan Chase & Co. | JPM | 1.5% |

| Johnson & Johnson | JNJ | 1.5% |

| Alphabet Inc. Class C | GOOG | 1.5% |

| Alphabet Inc. Class A | GOOGL | 1.5% |

| Exxon Mobil Corporation | XOM | 1.5% |

Source: State Street Global Advisors Funds Distributors, LLC as of September 28, 2018

Whether you are investing in U.S. or Canadian dollars, there are quite a few ETFs that track the S&P 500 Index and trade on either the U.S. or Canadian stock exchanges.

| U.S.-Listed | Canadian-Listed |

|---|---|

| SPDR® S&P 500® ETF (SPY) | BMO S&P 500 Index ETF (ZSP) |

| iShares Core S&P 500 ETF (IVV) | iShares Core S&P 500 Index ETF (XUS) |

| Vanguard S&P 500 ETF (VOO) | Vanguard S&P 500 Index ETF (VFV) |

Each company in the S&P 500 Index is weighted according to its “float-adjusted” market capitalization. For more information on float-adjusted market caps, please watch my last video or read my blog post on Understanding Canadian Equity ETFs.

A Vanguard of Vipers

As if the thought of spiders taking over the planet isn’t creepy enough, let’s add some venomous snakes to the mix. Not to be outdone by the success of the SPDRs, Vanguard launched their own version of ETFs in 2001, originally known as Vanguard Index Participation Receipts, or VIPERS for short.

The Vanguard Extended Market ETF (VXF) was the second ETF Vanguard launched. You may be familiar with some of its holdings as well.

Top 10 Holdings by VXF Weight

| Company | Symbol | Weight (%) |

|---|---|---|

| Tesla Inc. | TSLA | 0.7% |

| ServiceNow Inc. | NOW | 0.7% |

| Worldpay Inc. Class A | WP | 0.6% |

| Square Inc. | SQ | 0.6% |

| T-Mobile US Inc. | TMUS | 0.4% |

| Las Vegas Sands Corp | LVS | 0.4% |

| Workday Inc. Class A | WDAY | 0.4% |

| Palo Alto Networks Inc. | PANW | 0.4% |

| Dell Technologies Inc. Class V | DVMT | 0.4% |

| Splunk Inc. | SPLK | 0.3% |

Source: State Street Global Advisors Funds Distributors, LLC as of September 28, 2018

VXF complements SPY by following the S&P Completion Index, which in turn tracks the performance of over 3,000 U.S. mid-, small-, and micro-cap companies.

| Tracking ETF | Symbol | MER (%) | Underlying Index | Number of Stocks | Dividend Yield (%) |

|---|---|---|---|---|---|

| SPDR® S&P 500® ETF | SPY | 0.09% | S&P 500 Index | 505 | 1.9% |

| Vanguard Extended Market ETF | VXF | 0.08% | S&P Completion Index | 3,316 | 1.3% |

Sources: State Street Global Advisors Funds Distributors, LLC, The Vanguard Group, Inc., S&P Dow Jones Indices as of September 28, 2018

By allocating about 82% of your investment dollars to SPY, and the remaining 18% to VXF, you gain float-adjusted market-cap exposure to most of the U.S. stock market, at an annual MER of about 0.09%.

Snakes and Spiders Combined

Good news for creepy-crawly lovers everywhere: There is a single index that follows a combination of the S&P 500 Index and the S&P Completion Index. It’s called the S&P Total Market Index. This index includes about 3,825 companies and covers the broad U.S. stock market.

Luckily, there also are ETFs that invest in all companies within the S&P Total Market Index – so you can invest in one fund instead of two, and achieve the same goal either way.

The iShares Core S&P Total U.S. Stock Market ETF (ITOT) trades on the U.S. stock exchange in U.S. dollars. When held in a tax-deferred account – such as an RRSP, LIRA, RRIF, or LIF – the usual 15% withholding tax on foreign dividends does not apply, saving Canadian investors about 0.26% per year in taxes.

Its sister ETF, the iShares Core S&P U.S. Total Market Index ETF (XUU), trades on the Canadian stock exchange in Canadian dollars. When held in a registered account, the 15% withholding tax on foreign dividends is lost, resulting in a tax drag of about 0.26% per year.

Both ITOT and XUU have lower annual costs than the weighted-average cost of SPY + VXF, which makes them more cost-effective alternatives to the multi-fund approach.

In choosing between the two (ITOT vs. XUU), the decision is typically driven by the impact of foreign withholding taxes. That’s a complicated topic, beyond the scope of today’s discussion. But at the end of this post, I’ve summarized the estimated tax drag of several broad market U.S. equity ETFs when a Canadian investor holds them in various account types. You also can refer to our white paper on the subject, as well as our YouTube videos on the Norbert’s gambit strategy (a cheap way to convert your loonies to dollars for purchasing U.S.-listed ETFs in your registered accounts).

| Tracking ETF | Symbol | MER (%) | Underlying Index | Number of Stocks | Dividend Yield (%) |

|---|---|---|---|---|---|

| iShares Core S&P Total U.S. Stock Market ETF | ITOT | 0.03% | S&P Total Market Index | 3,825 | 1.8% |

| iShares Core S&P U.S. Total Market Index ETF | XUU | 0.07% | S&P Total Market Index | 3,825 | 1.8% |

Sources: BlackRock Inc., S&P Dow Jones Indices as of September 28, 2018

Now for Some Crispy Critters

Vanguard has also released a number of ETFs that provide similar exposure to U.S. equity markets. Their most popular ETFs follow the CRSP indices. CRSP stands for Center for Research in Security Prices.

The CRSP US Large Cap Index includes about 602 U.S. large-cap stocks, so its exposure is very similar to the S&P 500 Index. If you combine about 85% of this large-cap index with roughly 13% of the CRSP US Small Cap Index, and about 2% of the CRSP US Micro Cap Index, you end up with the CRSP US Total Market Index, which is very similar in composition to the S&P Total Market Index.

Although Vanguard offers U.S.-listed ETFs that track the CRSP US Large Cap Index and the CRSP US Small Cap Index, they do not yet offer an ETF that tracks the CRSP US Micro Cap Index. That means combining multiple ETFs for total market exposure is not possible here.

| Tracking ETF | Symbol | MER (%) | Underlying Index | Number of Companies | Dividend Yield (%) |

|---|---|---|---|---|---|

| Vanguard Large-Cap ETF | VV | 0.05% | CRSP US Large Cap Index | 602 | 1.9% |

| Vanguard Small-Cap ETF | VB | 0.05% | CRSP US Small Cap Index | 1,388 | 1.6% |

| N/A | N/A | N/A | CRSP US Micro Cap Index | 1,692 | 1.2% |

Sources: The Vanguard Group, Inc., CRSP as of September 28, 2018

However, Vanguard does provide a pair of U.S.-listed and Canadian-listed ETFs that follow the broader CRSP US Total Market Index, tracking the performance of over 3,600 companies – including these missing micro-cap stocks.

The Vanguard Total Stock Market ETF (VTI) trades on the U.S. stock exchange in U.S. dollars (similar to ITOT). When held in a tax-deferred account – such as an RRSP, LIRA, RRIF, or LIF – the usual 15% withholding tax on foreign dividends does not apply, saving investors about 0.26% per year in taxes.

Its sister ETF, the Vanguard U.S. Total Market Index ETF (VUN), trades on the Canadian stock exchange in Canadian dollars (similar to XUU). When held in a registered account, the 15% withholding tax on foreign dividends is lost, resulting in a tax drag of about 0.26% per year.

| Tracking ETF | Symbol | MER (%) | Underlying Index | Number of Stocks | Dividend Yield (%) |

|---|---|---|---|---|---|

| Vanguard Total Stock Market ETF | VTI | 0.04% | CRSP US Total Market Index | 3,602 | 1.8% |

| Vanguard U.S. Total Market Index ETF | VUN | 0.16% | CRSP US Total Market Index | 3,602 | 1.8% |

Sources: The Vanguard Group, Inc., CRSP as of September 28, 2018

Again, remember that U.S.-listed ETFs like ITOT and VTI are only effective at reducing the foreign withholding tax drag in tax-deferred accounts such as RRSPs, LIRAs, RRIFs, and LIFs. Please refer to the end notes for a summary of the estimated foreign withholding tax drag when holding these ETFs in various account types.

Which Is “Best”? (a Trick Question)

So, we’ve now presented four basic single-fund choices for broadening your diversification by employing U.S. equity ETFs:

| Tracking ETF | Symbol | MER (%) | Underlying Index | Number of Stocks | Dividend Yield (%) |

|---|---|---|---|---|---|

| iShares Core S&P Total U.S. Stock Market ETF | ITOT | 0.03% | S&P Total Market Index | 3,825 | 1.8% |

| iShares Core S&P U.S. Total Market Index ETF | XUU | 0.07% | S&P Total Market Index | 3,825 | 1.8% |

| Vanguard Total Stock Market ETF | VTI | 0.04% | CRSP US Total Market Index | 3,602 | 1.8% |

| Vanguard U.S. Total Market Index ETF | VUN | 0.16% | CRSP US Total Market Index | 3,602 | 1.8% |

Sources: BlackRock Inc., The Vanguard Group, Inc., CRSP, S&P Dow Jones Indices as of September 28, 2018

Since 2005, the performance difference between the S&P Total Market Index and the CRSP US Total Market Index has been minimal, so investors should feel confident that any of the four ETFs discussed will provide them with the returns of the broad U.S. stock market, as illustrated in the graph below:

Why Go Global to Begin With?

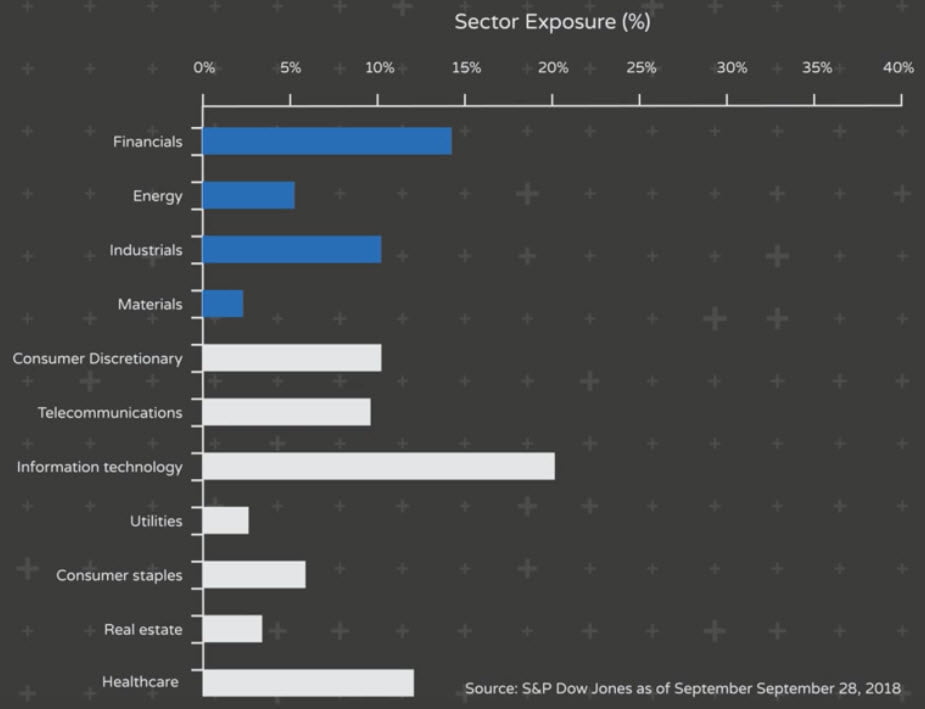

Before we wrap, let’s review why it might be worth adding in U.S. equity ETFs to begin with. In my last segment, Understanding Canadian Equity ETFs, I mentioned that nearly 75% of companies within broad-market Canadian equity ETFs were concentrated in the financial, energy, industrials and materials sectors. As shown in the chart below, the U.S. stock market is much more diversified across sectors, with only about a third of companies operating within these four sectors. By including an allocation to broad-market U.S. equity ETFs, Canadian investors can significantly increase the sector diversification within their overall portfolio.

If you’ve made it this far, though, you are now probably wondering about the rest of the world, i.e., international equities which exclude North American companies.

Good news: I’ll be covering that in my next “Understanding ETFs” presentation. Stay tuned!

End Notes: Estimated Unrecoverable Foreign Withholding Taxes: U.S. Equity ETFs

| Account Type | iShares Core S&P Total U.S. Stock Market ETF (ITOT) | iShares Core S&P U.S. Total Market Index ETF (XUU) | Vanguard Total Stock Market ETF (VTI) | Vanguard U.S. Total Market Index ETF (VUN) |

|---|---|---|---|---|

| Registered Retirement Savings Plan (RRSP) | 0.00% | 0.26% | 0.00% | 0.26% |

| Registered Retirement Income Fund (RRIF) | 0.00% | 0.26% | 0.00% | 0.26% |

| Locked-in Retirement Account (LIRA) | 0.00% | 0.26% | 0.00% | 0.26% |

| Locked-in Income Fund (LIF) | 0.00% | 0.26% | 0.00% | 0.26% |

| Tax-Free Savings Account (TFSA) | 0.26% | 0.26% | 0.26% | 0.26% |

| Registered Education Savings Plan (RESP) | 0.26% | 0.26% | 0.26% | 0.26% |

| Registered Disability Savings Plan (RDSP) | 0.26% | 0.26% | 0.26% | 0.26% |

| Taxable Accounts | 0.00% | 0.00% | 0.00% | 0.00% |

Sources: BlackRock Inc., The Vanguard Group, Inc., CRSP, S&P Dow Jones Indices as of September 28, 2018

Hi Justin,

I have an RRSP account, and I am contemplating either to go wiht IVV or VFV. I understand IVV in RRSP is not subject to withholding tax, however, I will be charged with the currency conversion. The question is will VFV in RRSP be charged the withholding tax (I am getting conflicting responses) so I wanted to get your thoughts on this?

@Dee – If you hold VFV in an RRSP, the dividends would be subject to non-recoverable foreign withholding taxes (there’s no debate on this :)

However, if you’re not planning to use Norbert’s gambit to reduce the cost of currency conversion, it’s probably best to just stick with VFV in your RRSP (instead of IVV or VOO).

Hi Justin,

Thank you very much for taking the time to educate us; your work has helped me a lot.

Any thoughts on ZPAY.U?

I cannot make a decision between VTI and ZPAY.U, it is new but pays a higher dividend. Or maybe I shouldn’t compare them at all?

Thanks

@sara – I prefer to invest in broad-market ETFs (this is true index investing), like VTI, ITOT, VUN and XUU. The dividend strategy is not relevant for investors (unless they want to pay more taxes each year! ;)

You can sell units of your ETF if you require cash flow.

Excellent article as always Justin!

Just wanted to clarify a couple of additional questions

I’m a Canadian investor looking to invest in S&P 500 tracking ETFs. I’m looking at Canadian-based ETF’s tracking S&P 500 such as VFV (Vanguard), XUS (Blackrock) and ZSP (BMO). I wanted to get your thoughts on some questions around these 3 ETFs

a) Why is there so much difference in their price/unit even though each of them tracks the same S&P 500 index, VFV ($103), XUS ($72.62) and ZSP ($64). In this scenario, would it be a better choice to buy the ETF which has lower price (ZSP in this case) as you can get more number of units for the same amount

b) Similarly, each of these S&P 500 ETFs has slightly different return values over the same period. How is this possible if they are tracking the same index?

c) Lastly, in the long term…from a returns perspective, what would bettter between investing in S&P 500 ETF (Canadian version) vs S&P 500 ETF (US version), e.g. VFV vs. VOO

@Adhithya:

a) The price/unit is mostly irrelevant. ETFs are typically launched at $10 or $20 per unit, and their growth after that point increases their per unit value (so a fund that was launched earlier may have a higher per unit price than a fund that was launched later). Technically, if their bid-ask spread cost in cents are the same between the three options, you would generally want to trade the ETF with the higher price (as the bid-ask spread cost in percentage terms would be lower for the higher-priced ETF).

b) Over the past 5 years, ZSP returned 16.58%, VFV returned 16.58% and XUS returned 16.61% (nearly identical). Any slight differences would likely be due to fee differences.

c) Investing in a U.S.-based S&P 500 ETF in your RRSP would eliminate the foreign withholding taxes. In other account types (like TFSAs and taxable accounts), it’s more practical to hold a Canadian-based S&P 500 ETF.

Since you’re just getting started, I would also suggest you consider an asset allocation ETF instead of individual asset class ETFs.

Hi,

I already invested in ITOT, IEFA, XIC and IEMG in my RRSP

Would you recommend investing in XQQ or QQQ to get into Nasdaq ? I understand that it is high risk- high reward

@Ayon: You already have plenty of U.S. tech exposure in ITOT, so there’s no need to include XQQ or QQQ.

Hi Justin, Thanks for all the information. I’m new to DIY investing, and there’s something I don’t quite understand.

How does XUU and ITOT have the same currency exposure? Eg.If I buy 30k CAD worth of XUU, and in 1 year, it has gained 10%, my investment is now worth $33k CAD.If I had done my the same investment in ITOT, but did the Norbert Gambit to convert my CAD to USD. Current exchange rate is 0.72, so 30k CAD = 21,600USD.

I’m assuming that if one goes up 10%, the other does as well since it holds the same equities. My 21,600USD is now 10% more, which is 23,760USD.

Meanwhile, say the CAD gone stronger in the year, the exchange rate is now 0.80.

Wouldn’t this mean that now my $23760 USD, is only worth $29700 CAD, which is less than my original amount in CAD?

As a Canadian, wouldn’t it be best for me to hold most of my funds in CAD to avoid currency fluctuations?

Thanks for your insight!

@Marc B: When you invest in an unhedged Canadian-based U.S. equity ETF, you are actually exposed to the U.S. equity market and the U.S. dollar. iShares would immediately convert your Canadian dollars to U.S. dollars to purchase the underlying U.S.-based ETFs that XUU holds, so the currency exposure is identical to if you had simply purchased the U.S.-based U.S. equity ETFs directly on the U.S stock exchange.

In your example, U.S. equities went up by 10%, but the U.S. dollar depreciated against the Canadian dollar by 10% (0.72 / 0.80 – 1). As you also have exposure to the U.S. dollar (whether you hold XUU or ITOT), you receive both a positive investment return and a negative currency return. To determine how this impacts XUU’s performance, you would chain-link both returns together (i.e. add 1 to each return, and then multiply these figures together with your original $30,000 CAD XUU value:

= $30,000 x (1 + 10%) x (1 – 10%)

= $30,000 x (1.1) x (0.9)

= $29,700 CAD

As you can see, this is the same ending value (in CAD) as your ITOT holding example.

Hi Justin,

Thanks for taking the time to write this article.

Simply put, I’m 32 years old and I want to invest (monthly contributions) for the long-term in XUU. Is it best to hold this stock in my TFSA or RRSP? I’m confused between the tax implications and what’s ultimately best as I’ve read conflicting articles about the WHT.

@Brandon: From a foreign withholding tax perspective, the tax implications would be the same whether you hold XUU in a TFSA or RRSP. If you’re holding U.S. equities in an RRSP, the U.S.-listed version of this fund (ITOT) would be more tax efficient though.

Another outstanding article, Justin. When I set up my LIRA and my RRSP, I wasn’t aware of the problem of foreign withholding taxes. I understand everything you’ve explained and I can see the advantage of US listed ETFs. However, I am just about to enter the decumulation phase. If I am only drawing a few thousand dollars a month or less, would it still be worthwhile to do Norbert’s Gambit? It seems like a lot of trading. And can I be sure that my heirs would not some day be liable to pay US estate taxes?

Hi Justin, thank you for this blog. It still is very useful.

What would you suggest as a strategy if someone would like to sell a large amount of canadian listed ETF (lets say ZSP) to buy a US listed equivalent ETF (lets say IVV).

I find it risky to sell all ZSP, do a Norbert’s gambit, wait 3 days and buy IVV.

(A lot can happen on the market in 3 days … like last week)

Thank you

@Philippe: If you’re with a brokerage that allows you to place the ZSP sell, DLR buy, DLR.U sell, and IVV purchase on the same day (like RBC Direct Investing or BMO InvestorLine), this is your safest option (from an opportunity cost standpoint).

Alternative, if you have bond ETFs in your RRSP, you could consider selling these and converting the proceeds to USD using the gambit. Once the funds have been converted, you could then sell ZSP and immediately buy IVV.

Other than those options, there will unfortunately be a risk of being out of the market for a few days.

@Justin, thanks ever so much for your answers. Just realised you aren’t on direct emails since your blog states to ask questions in the comments but at the end of older videos you provide your email; I’m up to speed now.

When weighing up Norbert’s Gambit for buying US-listed ETFs, how can we estimate the cost of the gambit relative to the potential gain from dividends? Your FWT white paper is awesome for estimating the drag of WH tax; just wondering how to estimate the drag of the gambit itself. Thanks again.

@Nu: You would need to start by looking up the spot rate for the CAD/USD (which is the benchmark FX rate regular investors can’t receive). 1 CAD is currently worth about 0.7478 USD. If you could theoretically convert $46,002 CAD at the spot rate, you would receive $34,400 USD.

We’ll then compare this amount to Norbert’s gambit. Taking the same $46,002 CAD amount and dividing it by the current $13.53 CAD ask price of DLR (we’ll assume no trading commissions or ECN fees at Questrade to buy this ETF) gives us 3,400 shares of DLR.

Multiplying 3,400 shares by the current $10.11 USD bid price of DLR.U gives us $34,374 USD. We then subtract the Questrade trading commission of $9.95 USD to give us $34,364.

So the cost of Norbert’s gambit is the difference between the proceeds using the spot rate of $34,400 USD and the proceeds received on the sale of DLR.U of $34,364, which is $36 USD.

So your cost is basically the bid-ask spread of DLR/DLR.U, and the trading commission.

@Justin, if you were an ETF, you would be TB.P – The Bomb. Period. Thanks again, very much appreciated.

Nuru: Lol – you’re very welcome. Glad I could help :)

@Justin: one more question, weird but here goes: how do we know that 15% WHT doesn’t apply for reg accs holding US-listed ETFs? I mean you said it and calculated it but does the IRS know dividends are going into a registered Canadian account (or not) so don’t tax them (or do)? Thanks.

@Nu: The tax treaty between Canada and the U.S. exempts the 15% withholding tax on U.S. dividends (Article XXI paragraph 2(a)):

https://www.fin.gc.ca/treaties-conventions/USA_-eng.asp

2. Subject to the provisions of paragraph 3, income referred to in Articles X (Dividends) and XI (Interest) derived by:

(a) a trust, company, organization or other arrangement that is a resident of a Contracting State, generally exempt from income taxation in a taxable year in that State and operated exclusively to administer or provide pension, retirement or employee benefits; or

I’m uncertain exactly how the process unfolds behind the scenes of each financial institution, but can confirm that it works like a charm ;)

@Justin – some of us are late to the party but better to have seen this now than never; really helpful with the ETF selection. Why would one select a Total Market Index ETF over a S&P Index ETF? E.g. ITOT over IVV?

@Nu: A total market ETF (like ITOT) is more diversified than just a large cap ETF (like IVV), so you have less weight to the largest companies in ITOT, relative to IVV.

However, IVV is still a great choice for low-cost U.S. equity exposure (it just excludes thousands of mid-, small- and micro cap stocks).

ITOT, VTI, XUU,VOO all look good for USA but what if I want a bit more concentrated, riskier lean towards tech. what would you think about throwing in something like VGT, OGIG, QQQ, VFV, XQQ, ZQQ, any of these really. there’s going to be overlap but just boosting exposure to those tech companies. would you advise against this type of concentration and step back to just a 3-5 ETF. I really like the tech industry in the USA and think it will do good in the coming years, so trying to lean slightly that way instead of having an ETF with hundreds of companies in various sectors that may not fair as well.

@Benjamin Kempa: I don’t generally recommend overweighting any particular sector. There’s really no way of knowing which sector will outperform going forward, so guessing is just another form of active management.

Justin can you break down XUU vs XUH, as I thought XUU was the Canadian hedged version of ITOT, but from what I’m seeing (and maybe I’ve got this wrong) its just ITOT converted to CAD. What do you recommend in this situation when you have CAD dollars to invest in a US Total market ETF in a TFSA.

Thanks for the input.

@Kosta: Both XUU and XUH trade in Canadian dollars on the Canadian stock exchange (but that doesn’t necessarily mean your actually currency exposure is Canadian dollars).

When you purchase XUU, iShares converts your Canadian dollars to U.S. dollars, and purchases U.S.-listed U.S. equity ETFs (like ITOT) that trade in U.S. dollars. So you now have exposure to the U.S. equity market and U.S. dollars.

XUH simply holds XUU. However, iShares also sells forward contracts on the U.S. dollar exposure of the fund (which is a fancy way of saying that they are shorting your U.S. dollar exposure). With your U.S. dollar exposure cancelled out, you now have exposure to only the U.S. equity market. In a perfect world, you would receive approximately the same return in Canadian dollar terms as a U.S. investor would receive by purchasing ITOT in U.S. dollar terms.

Ah perfect. So to follow up would you recommend a 50/50 split between the two to have some diversity from the US Dollar impact? Assuming the complexity of rebalancing additional funds is not a an issues.

@Kosta: Some investors prefer the “hedge of least regret” (i.e. the 50/50 you’re proposing). I tend to go 100% unhedged, as I find the US dollar exposure can actually make the portfolio less volatile for a Canadian investor.

When constructing a portfolio using a combination of Canadian and US listed ETF’s, how do you determine asset allocation? In other words, if I’m building an all-equity portfolio that is 1/3 VCN, 1/3 ITOT, 1/3 IEFA with $300K, do I convert $100K CAD for each of latter two so that I have about $75K USD in each? Thanks.

@Rob: You got it! :)

Great post Justin. Wondering if there is an all in one USD ETF like VBAL that could work in a taxable account. I know it wouldn’t be tax efficient but I’m looking for simplicity while I’m in accumulation phase. Thanks

@Charlie: I’m not aware of any US-listed ETFs that are similar in composition to VBAL (you would likely need to combine 2-3 US-listed ETFs to gain the desired exposure).

Thanks Justin. Looking at Blacrock AOR, 60/40 balanced and has an MER .25. Wondering how tax efficient this would be for a Canadian. https://www.ishares.com/us/products/239756/ishares-growth-allocation-etf

@Charlie: Thanks for the link (I wasn’t aware of these products). Generally, a Canadian investor would not want to invest in an ETF that did not hedge the fixed income foreign currency exposure. Is there a reason you want to purchase your ETFs using US-dollars (i.e. are you investing in an RRSP account)?

Hi Justin,

We want to use incoming USDs from company stock sales and keep them invested in USD ETFS (non-reg account) to eventually buy a retirement property in Florida. TFSA’s and RRSP’s are all topped out in CDN. Thanks.

@Charlie: Other than the small amount of additional foreign withholding tax drag on the underlying US-listed international equity ETF (and the potential T1135 CRA tax reporting requirements), I would expect the funds to be similar in tax-efficient to Canadian-listed asset allocation ETFs.

Hello, I am wondering if you will be releasing a 2019 Modified Dietz calculator tool for users to download? It’s been an extreme help to me and I’m sure many others in the past 5 years.

@Jeff: You can still use the existing calculator – the year column can be updated with 2019 instead of 2017.

Excellent article and very clearly presented Justin. Thank you. When we just buy one fund, do they rebalance the securities in the fund regularly to maintain the predetermined weight of different stocks and how frequently do they do it. Just wondering if it is worth buying SPY + VXF over buying ITOT

@Hemant Ghate: If you buy ITOT, you’ll have exposure to most of the stocks in the S&P 500 Index and the S&P Completion Index (the fund will take care of ensuring you have the correct underlying stock weights over time).

Fantastic explanation Justin! I will admit I was not aware that the Canadian market traded versions of these US index ETFs (ie XUU and VUN) were subject to US withholding tax, even when held in my RRSP!

For an RRSP portfolio currently around $50k, would you recomend using Norberts Gambit to purchase a US traded version of these ETFs to save the 0.26% tax? It appears that the US traded ETFs offer a more competitive MER as well, however this would add some complexity to my DIY operation. Thanks!

@James: It’s really a question of optimizing vs. simplifying your portfolio (with a possible benefit of $100-$150). I’m certain your investment plan won’t fall apart because you lost a bit extra to foreign withholding taxes ;)

Excellent resource. Very succinct!

@Michael DeKelver: Thanks! I’m trying to cut the material down as much as possible…maybe one of the future videos will even be under the coveted 3 minute mark ;)

Good afternoon Justin,

Excellent articles. Looking forward to the 3 installment. Succinct. Reassuring. Informative. Keep them coming.

@Curt: Thank you for the feedback – will do!

Amazing amount of info here as usual. Thanks Justin! It seems like iShares has a slight edge over Vanguard in this case. CRSP seems to perform marginally better than S&P, but that’s largely cancelled out by Vanguard’s higher MERs. Or maybe in the grand scheme of things, I’m just nitpicking :P

@GMMT: You’re very welcome! I use both VUN and XUU in my clients’ portfolios (they’re also ideal tax loss selling pairs for taxable personal accounts) – you really can’t go wrong with either choice for broad-market U.S. equity exposure.

Hey Justin, Is the currency exchange rate washed out over time when purchasing US listed indexes?

@Chris: First off, purchasing a U.S.-listed foreign equity index ETF trading in U.S. dollars will give you the same exposure as purchasing a Canadian-listed foreign equity index ETF trading in Canadian dollars. If you want to hedge your foreign currency exposure back to Canadian dollars, you will need to purchase a Canadian-listed currency-hedged foreign equity index ETF.

In terms of whether it’s worth purchasing a Canadian-listed currency-hedged foreign equity index ETF (rather than either a U.S.-listed foreign equity index ETF trading in U.S. dollars or a Canadian-listed foreign equity index ETF trading in Canadian dollars), historically, the returns in the local currencies (which is kind of like the currency-hedged return) vs. the returns in CAD have generally been within 0.50% of each other over longer time horizons (i.e. 20 to 50 years). Although this may seem like a small difference, it is an annualized figure (so the dollar differences would be larger). So I wouldn’t say the currency effects are washed out.

I see, so using ITOT and XUU are the same currency exchange exposure. Would there be an opportunity cost for having less amount of money invested after converting your cad to usd? Like if you had $100,000 Cad, converted it to USD and invested in ITOT at our current rate you would have less dollars invested vs putting $100,000 in XUU?

@Chris: Whenever you trade, there’s going to be a cost. If you use Norbert’s gambit, a $100,000 CAD conversion to USD would cost you around $120 CAD, or around 0.12% (and there will also be a cost when you convert the USD back to CAD to pay for your Canadian dollar expenses). The difference in MERs of ITOT and XUU (0.04%) would take about 3 years to offset each way.

However, if you’re holding ITOT in your RRSP, you’ll save on foreign withholding taxes, and this would more than offset the cost of conversion in less than a year (if you use Norbert’s gambit).

Thanks again Justin for a most informative article. Can’t wait for installment number 3.

@Bob Clark: I’m aiming to release a new video/blog every 2 weeks (our video editor, Ryan Conlin, is currently working on the international equity video), so stay tuned for more :)