Registered Education Savings Plans (or RESPs) are one of the best ways, if not the best way for Canadian parents to save for their children’s post-secondary education.

However, we all know kids grow up fast, which is why it’s important to have an RESP asset allocation strategy in place that adjusts as they get older. In this blog/video, I’ll give you some pointers on how to use low-cost ETFs to make that happen without too many hassles.

Investing in an RESP with one beneficiary

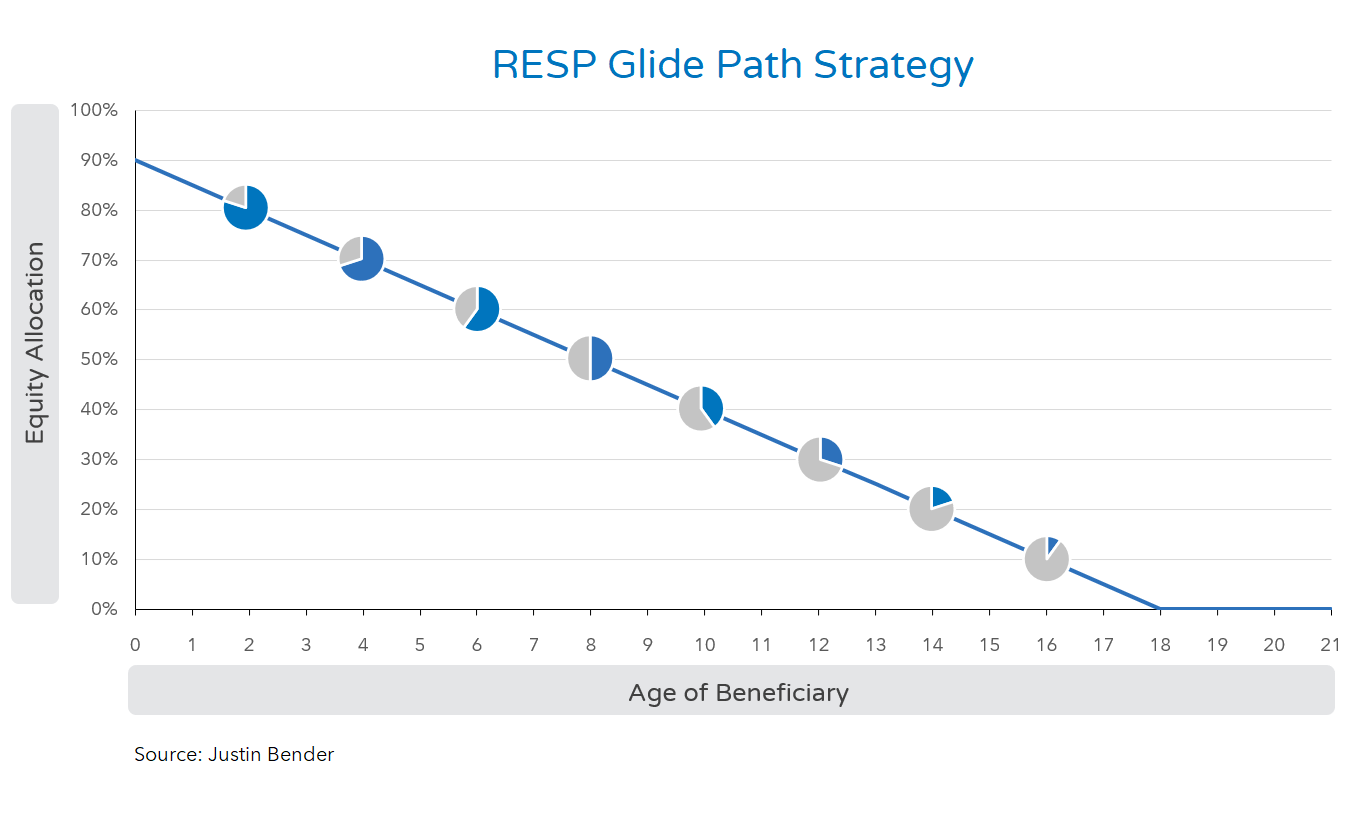

If you have an RESP with just one beneficiary, our general advice is relatively straight-forward. When your child is young, you can take more equity risk with their investments. As they get older, you’ll need to gradually reduce this risk to minimize the odds that their education fund might take a nose-dive right before they head off to school.

To gradually adjust your RESP’s asset mix, you’ll place multiple ETF trades each year, so I would recommend opening an RESP at a commission-free brokerage that doesn’t charge trading commissions. Otherwise, those trading costs when buying or selling ETFs can really add up.

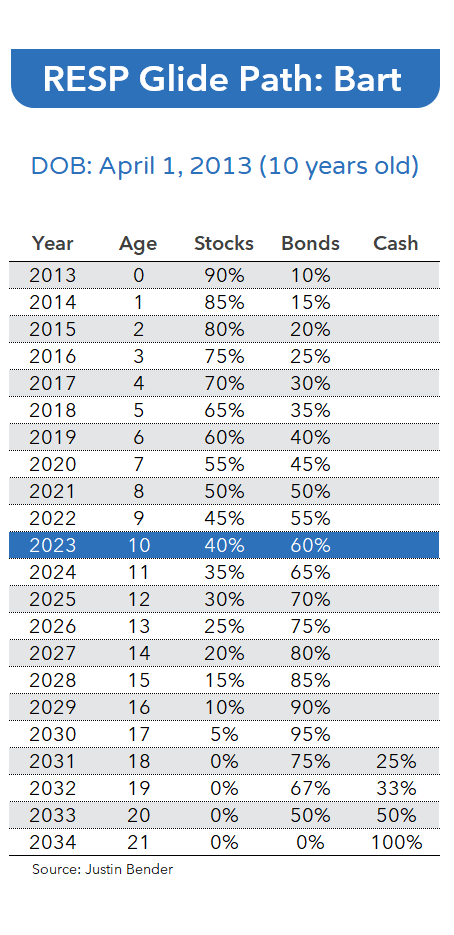

There’s no optimal asset allocation strategy that’s right for every investor. But a simple rule-of-thumb would be to start with a 90% stock, 10% bond allocation in the year your child is born, reducing the equity allocation by 5% in each subsequent year. By the time your kid reaches university age, your RESP should have zero exposure to stock markets, since they can swing up or down too wildly over short periods of time.

For example, suppose you have an RESP with one beneficiary named Bart, who turns 10 years old on April 1st of this year. You’d want to allocate 40% of your RESP to stocks, and 60% to bonds.

Each year, you would update the RESP’s target asset mix by allocating a greater proportion of the account to bonds. By the time Bart heads off to school, the RESP would only hold far more stable short-term bonds or cash equivalents.

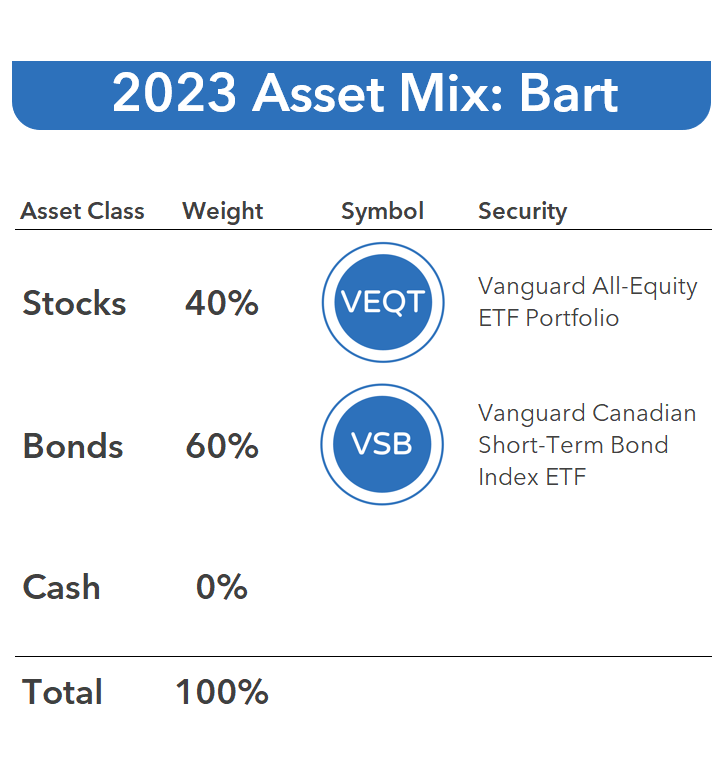

For your stock and bond allocations alike, we’ll want to keep things simple. You can do so by holding a single equity ETF and a single bond ETF. Equity, by the way, is just another term for stocks.

For the equity ETF, you could use the Vanguard All-Equity ETF Portfolio (VEQT). This ETF invests in thousands of companies around the world, offering you extensive diversification for your investment.

For the bond ETF, we’ll opt for the Vanguard Canadian Short-Term Bond Index ETF (VSB). This ETF invests in Canadian government and corporate bonds with maturities ranging from 1 to 5 years.

[Note: You could also consider a broad market Canadian bond ETF, like the Vanguard Canadian Aggregate Bond Index ETF (VAB) – just remember to gradually shift the holding to VSB as your child gets older].

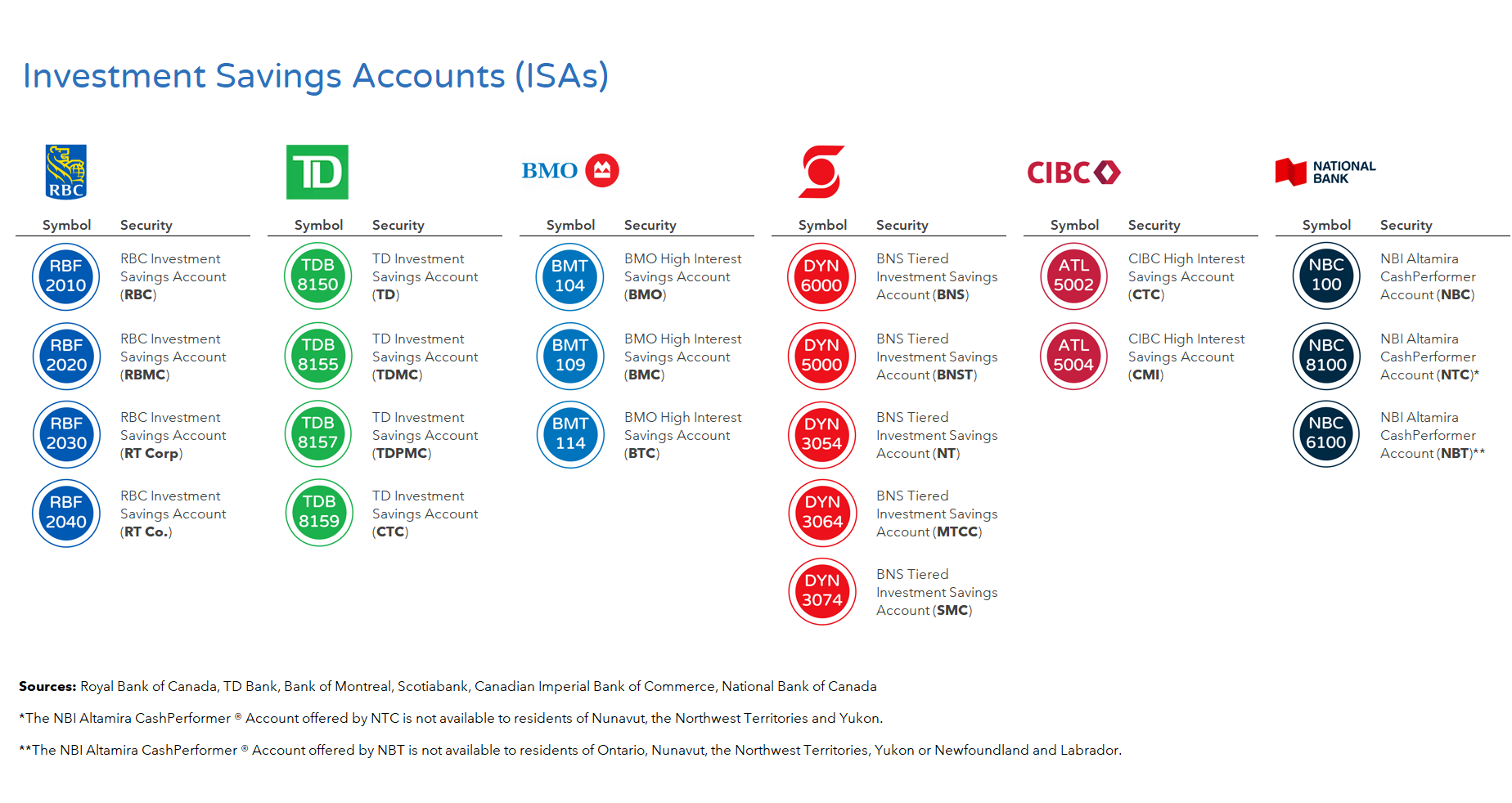

When it comes time to hold liquid cash equivalents to pay for upcoming education expenses, many big bank discount brokerages offer investment savings accounts, or ISAs, for short. ISAs typically earn a low, fluctuating interest rate, so you can reap a bit of reward, while still easily accessing the cash as needed to fund your kids’ college expenses. In the event of an ISA issuer default, most ISA deposits are protected by the Canada Deposit Insurance Corporation (CDIC), up to $100,000 per beneficiary in an RESP.

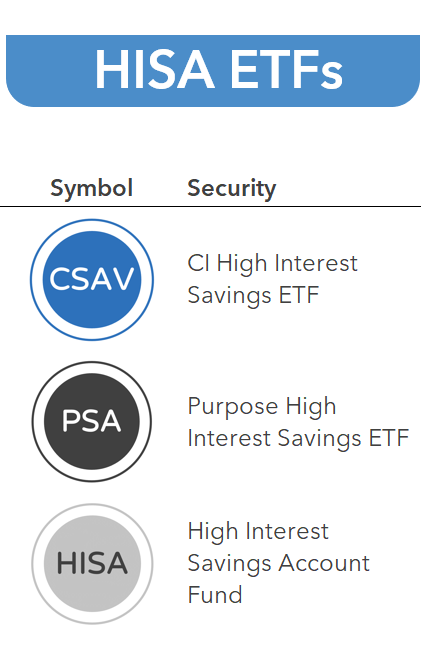

If you’d prefer to stick with ETFs for your cash holdings, you could also consider one of the various High Interest Savings Account ETFs (or HISA ETFs) available to investors. HISA ETFs are similar to ISAs, except that the Canada Deposit Insurance Corporation provides no protection for HISA ETFs. However, most HISA ETFs invest in deposits offered by the big 6 Canadian banks, so the likelihood of default is low.

For the purposes of this video, we’ll invest our cash allocations in the following HISA ETFs. However, if your big bank brokerage has blocked you from buying HISA ETFs, you can simply invest in their ISAs instead.

To illustrate Bart’s RESP investment for the current year, we’ll assume his RESP holds $50,000 in uninvested cash. Following our RESP glide path strategy, we would purchase $20,000 of VEQT (or 40% of the total RESP value) and $30,000 of VSB (which is 60% of the total RESP value). At the beginning of each subsequent year, we would adjust the account allocations between stocks, bonds, and cash, based on Bart’s age. Whenever possible, we would use new contributions and any government grants to top-up the asset classes each year to their new target weights.

Investing in an RESP with multiple beneficiaries

As we’ve shown in our previous example, investing in an RESP with only one beneficiary is relatively straight-forward. Simply adjust the account’s risk level each year, starting with the suggested asset allocations found in our RESP glide path.

That said, a lot of you may have several children. On all sorts of levels, things can get more complicated when that happens—including if you’re investing in an RESP with multiple beneficiaries, also known as a “Family RESP”.

As the ages of most beneficiaries will differ, the overall risk of the RESP will need to reflect this. We often hear from parents struggling to determine an appropriate asset allocation for their family RESP, so we’ve put together a more intuitive method for handling this task.

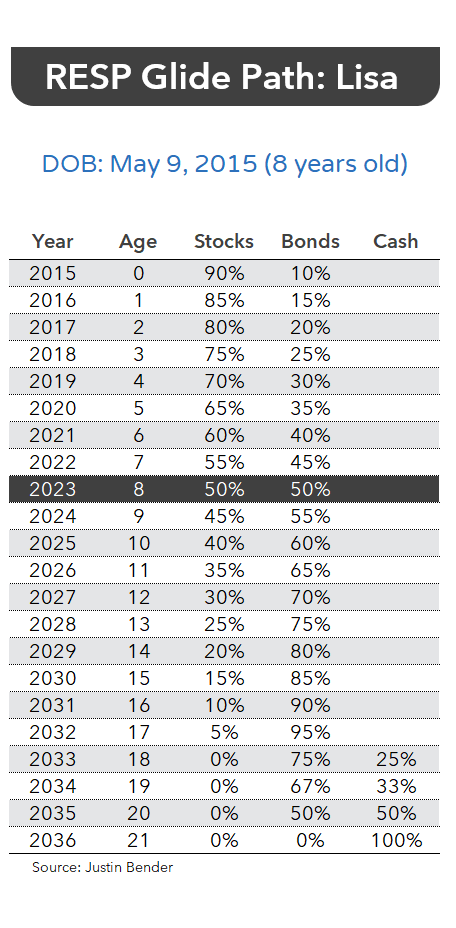

Let’s now assume Bart has a little sister named Lisa, who is 8 years old, or two years younger than him. Based on our RESP Glide Path strategy, her portion of the account should be invested in 50% stocks and 50% bonds this year … while, as you may recall, Bart’s portion should be 40% stocks and 60% bonds.

So how do we resolve the dilemma? We could try allocating her RESP portion to the Vanguard ETFs from our previous example. But that gets pretty confusing, pretty fast. So instead, we’ll invest Lisa’s allocation in similar, but not identical ETFs.

For the 50% equity portion, we’ll purchase the iShares Core Equity ETF Portfolio (XEQT). For the bond portion, we’ll invest in the iShares Core Canadian Short Term Bond Index ETF (XSB). And once Lisa approaches university age, we’ll also add a new HISA ETF to the mix.

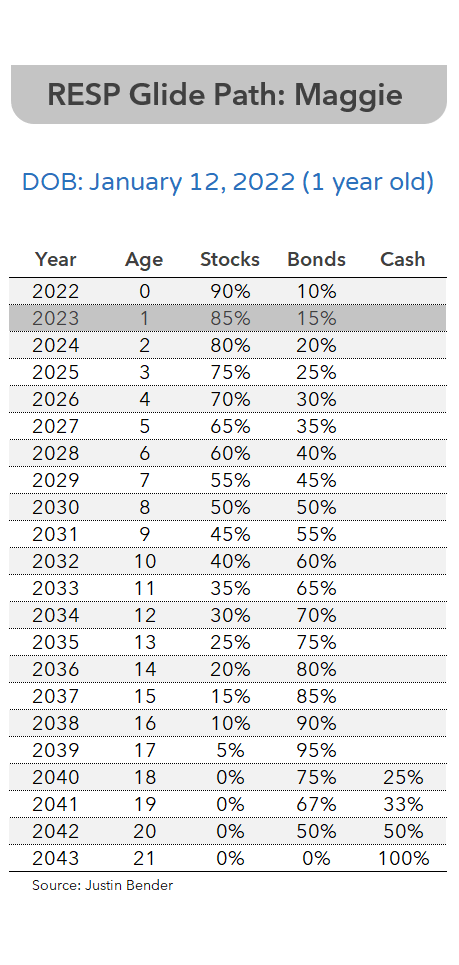

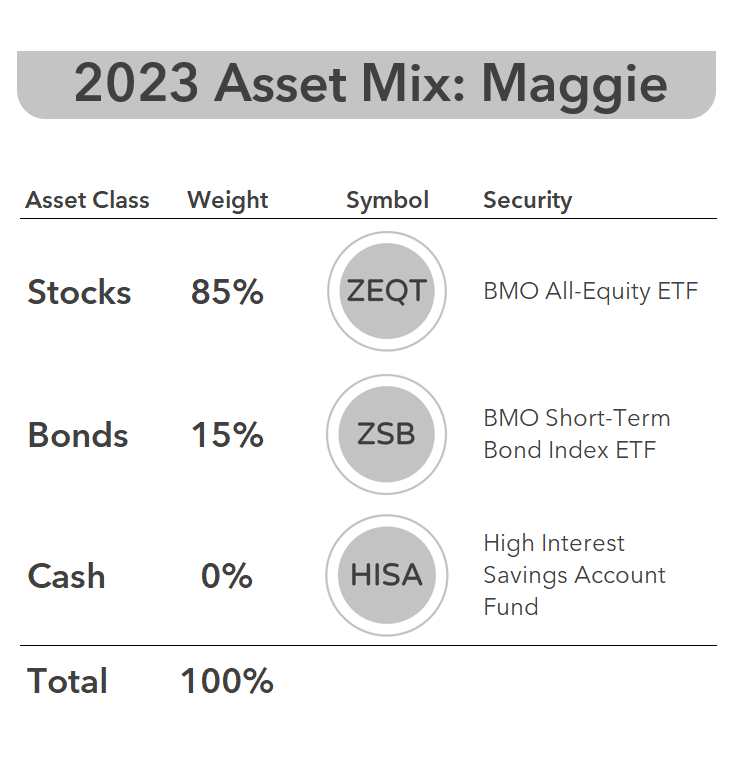

Now, let’s also assume Bart and Lisa have a baby sister named Maggie, who just turned one this year. Since Maggie is still so young, her portion of the RESP can be invested more aggressively than her siblings’ portions. Based on our RESP Glide Path strategy, Maggie’s portion would be invested into 85% stocks and 15% bonds this year.

We’ll once again invest in different ETFs for Maggie’s contributions and grant. For her equity allocation, we’ll purchase the BMO All-Equity ETF (ZEQT). For the bonds, we’ll buy the BMO Short-Term Bond Index ETF (ZSB). And when Maggie eventually reaches university age, we’ll throw another HISA ETF into the mix.

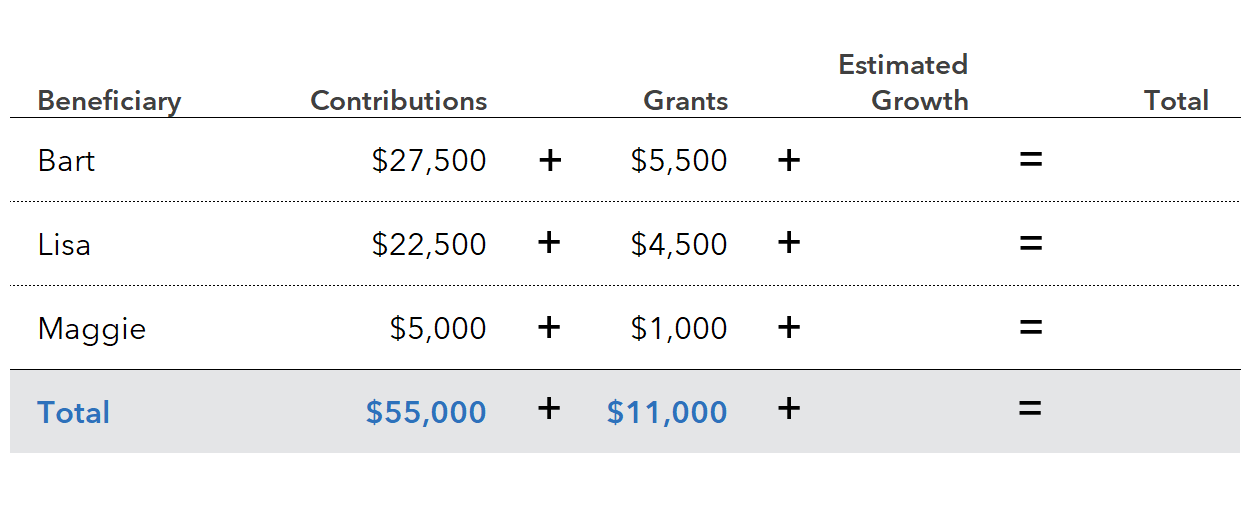

Okay, so we’ve now chosen the current target asset mixes for the three beneficiaries, but we still need to determine what portion of the RESP account to allocate to each of them. To do this, we’ll need to add up all contributions made and government grant received by each beneficiary.

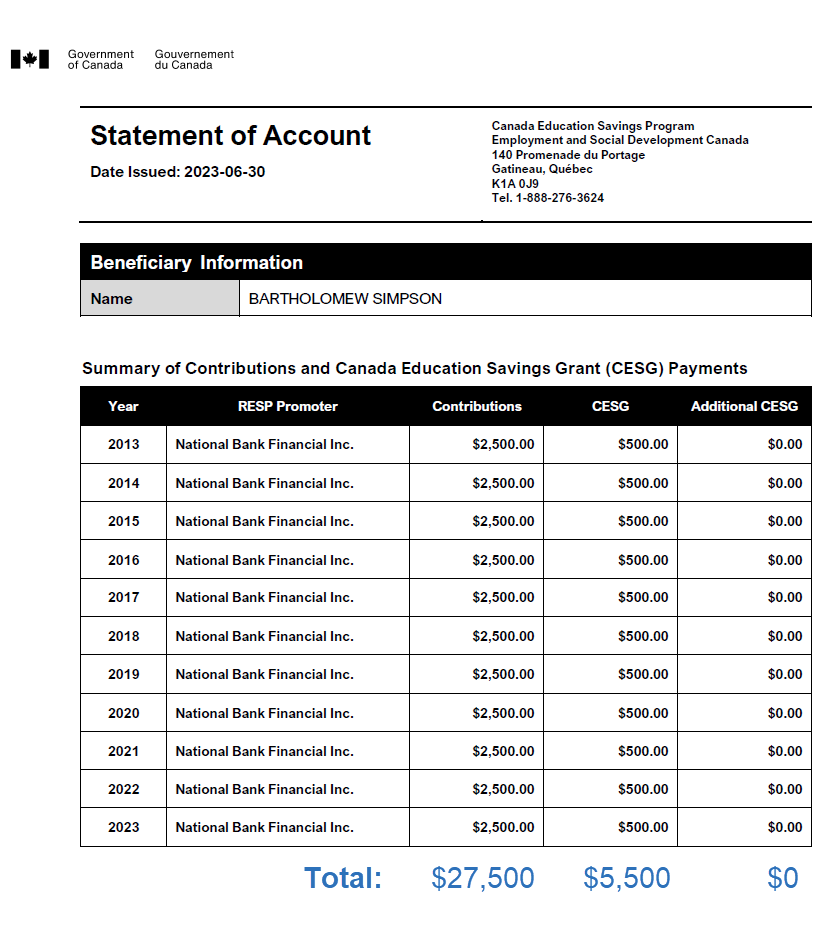

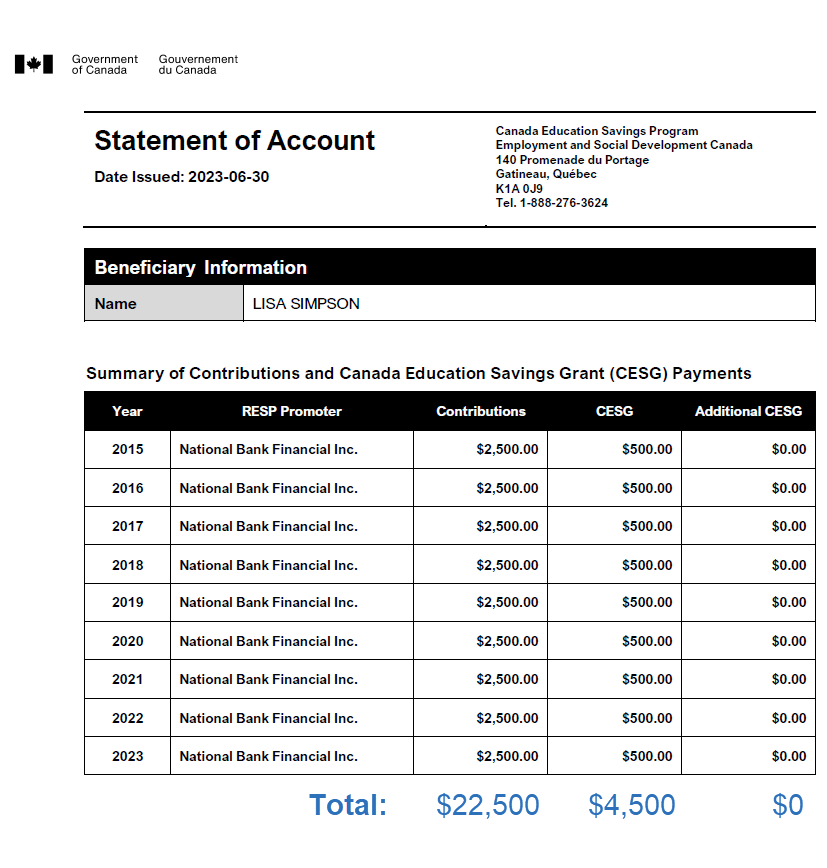

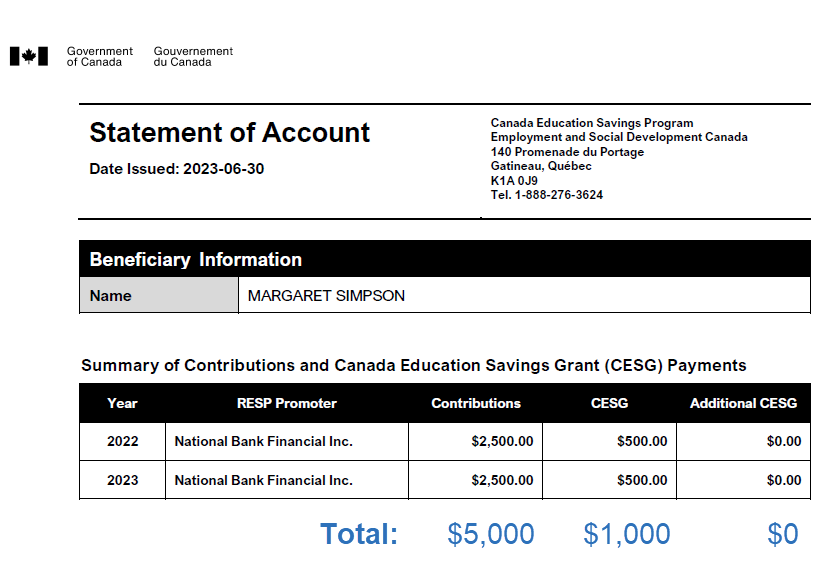

If you haven’t kept a detailed record of this information, not to worry. You can obtain these figures by calling the Canada Education Savings Program hotline at 1-888-276-3624 and requesting a Statement of Account for each beneficiary. You’ll need to provide each beneficiary’s social insurance number and date of birth, so have these ready when you call. The government representative will then email you a copy of each beneficiary’s Statement of Account, which will include all contributions made on behalf of the beneficiary, all Canada Education Savings Grant (or CESG) received, as well as any additional CESG assets paid into the RESP. Also, if the beneficiaries received any Canada Learning Bond (CLB) or provincial grant payments, this information will also be provided.

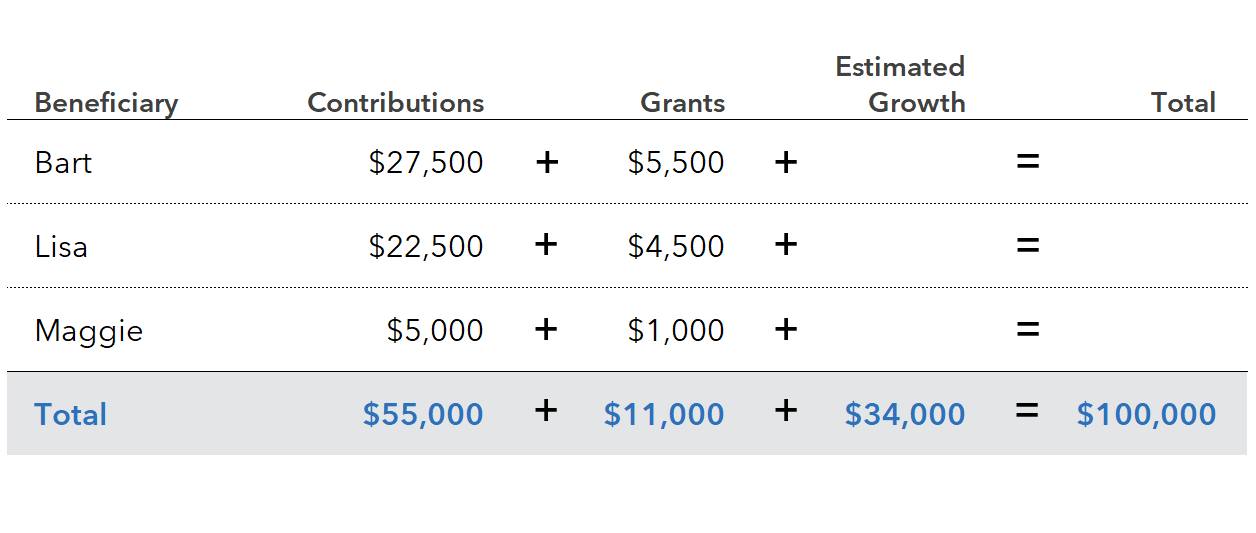

On the Statement of Account, you’ll find a summary of all contributions and grant payments to date—although any transactions from the most recent month may not be included. You can total up the contributions, CESG and additional CESG columns, and allocate these amounts to the appropriate beneficiary. For example, we’ll assume Bart has $27,500 of contributions, and $5,500 of grant received on these contributions. Lisa has $22,500 of contributions and $4,500 of grant, while Maggie has $5,000 of contributions and $1,000 of grant.

We now know the total contributions made to the RESP were $55,000, and the total grant received on these contributions was $11,000, for a combined total of $66,000.

Now, let’s assume the RESP’s current market value is $100,000. The difference between this market value and the total contributions and grant provides us with the account’s investment growth (or loss) to date. In this case, the RESP has investment growth of $34,000.

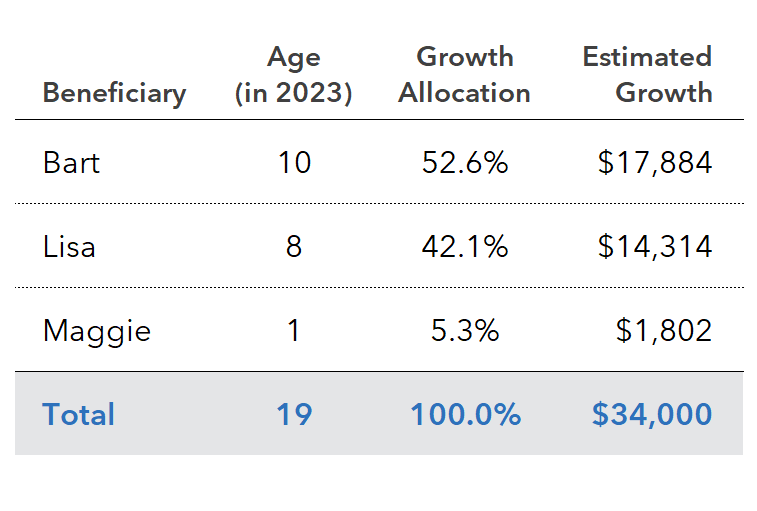

It’s a bit trickier to allocate this growth component to the three RESP beneficiaries, as there’s no way to really know how much income each beneficiary’s specific contributions or grant earned while invested. As a rough estimate, we’ll simply weight the $34,000 of growth by the proportional age of each beneficiary in the current year.

For example, since Bart is 10 years old, and the total age of the beneficiaries is 19 years, his allocation of growth will be 52.6%, or 10 divided by 19. Bart will therefore receive 52.6% of the total $34,000 of growth in the RESP, which is $17,884. Following the same process, Lisa would receive $14,314 of the RESP growth and Maggie would receive $1,802.

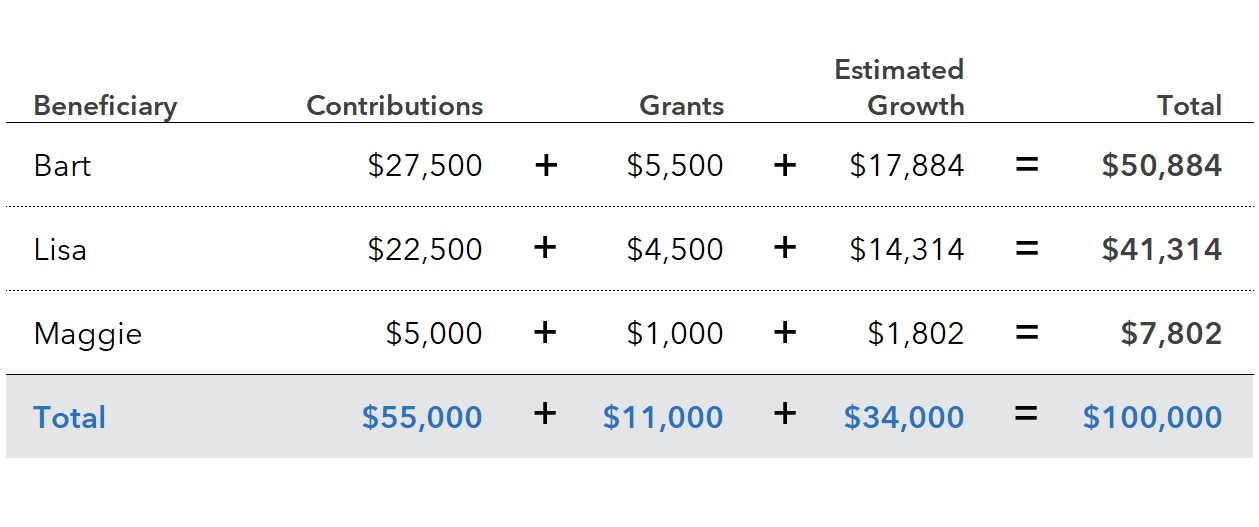

Okay, we’ve now allocated the existing RESP assets across all three beneficiaries. Of the total RESP value of $100,000, we’ll invest $50,884 into Bart’s target asset mix, $41,314 into Lisa’s asset mix, and $7,802 into Maggie’s.

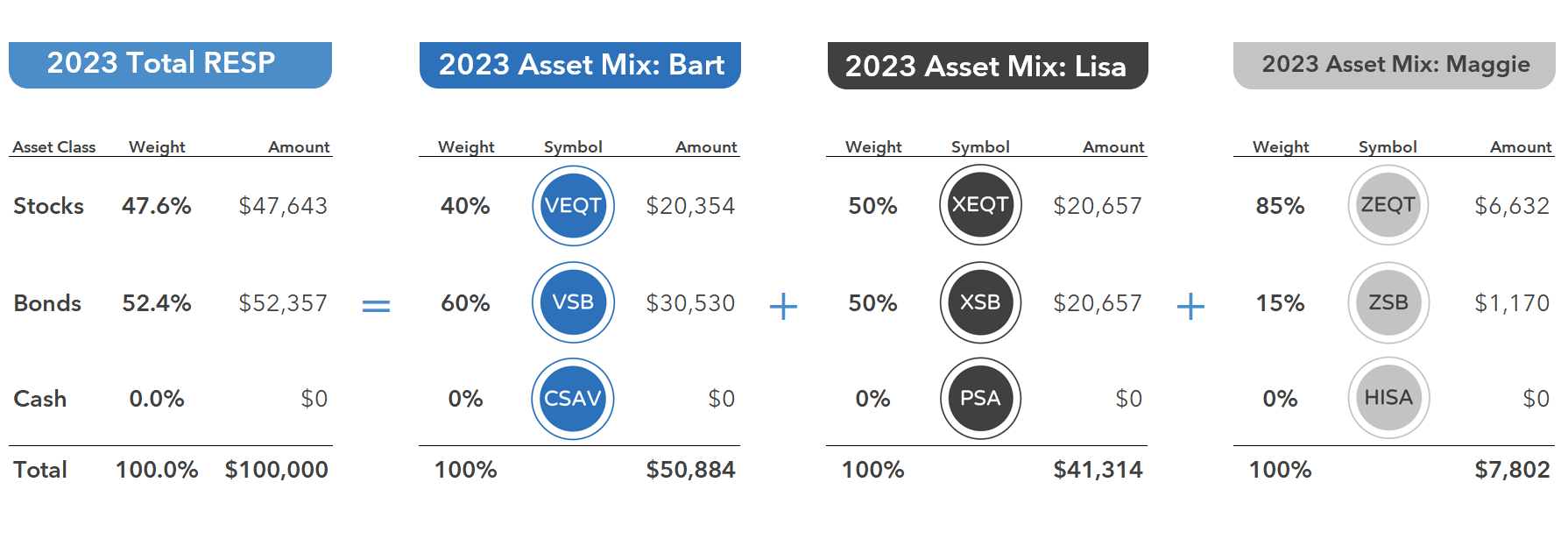

If we assume the RESP assets are currently uninvested, we’d start by purchasing $20,354 of VEQT and $30,530 of VSB for Bart, providing him with a 40% stock, 60% bond allocation for his RESP portion.

For Lisa, we would buy $20,657 of both XEQT and XSB, resulting in a 50/50 stock/bond allocation for her RESP portion.

And for Maggie’s portion, we would purchase $6,632 of ZEQT and $1,170 of ZSB, giving her a more aggressive 85% stock, 15% bond asset mix.

And none of the beneficiaries are old enough to warrant investing in a HISA ETF just yet.

Each year, we’ll adjust the asset mix for each child, reducing the stock allocation and increasing the bond allocation according to our schedule. As a tip, try to contribute annually to your RESP, as this will simplify the exercise. For example, you could place your ETF trades each January, after making your annual contributions for each beneficiary, and place additional trades a month or two later once the government grants are paid into the account.

At the beginning of each year, you can also reinvest any dividends paid into the account. If you don’t feel like combing through the prior year’s transactions to determine the exact amounts to allocate to each beneficiary, just divvy it up like we did earlier in the video. Simply weight the extra cash by the proportional age of each beneficiary and call it a day.

Managing Your RESP Annually

So, to recap: Once a year, adjust the asset mix for each beneficiary, invest your contributions, invest the government grants, and reinvest the dividends—all according to our handy glide paths and a little math to divvy up the assets. After completing these tasks, you can then set the account back on autopilot and get on with your busy life until next year.

In fact, the less you fuss with your RESP, the better. That’s in large part because you’ve wisely invested in low-cost, globally diversified ETFs, instead of trying to mess with selecting individual securities. And by the way, don’t even think about trying to jump in and out of markets based on fluctuating conditions. When you’ve got time on your side, it’s best to let capital markets do the heavy lifting for you.

Hi Justin, great article! In your examples do you recommend setting up a dividend reinvestment plan (DRIP) within a RESP? Thanks for your help.

-Mike

Thanks so much for this helpful information.

The bond ETF we are currently using in our daughter’s RESP (she is 12 years old) is ZAG. I’m wondering if you would recommend that we switch this to VSB? I would love if you were able to clarify the benefit of VSB over other bond ETFs.

Thanks again!

Hi Justin,

I see others have asked about shifting from their current one fund ETF, to two ETFs (one all equity, one bond). I currently have a family RESP with only XGRO – kids are 3 and 5. Is it worth switching to an all-equity ETF and a bond ETF right now, or can I just add on a bond ETF to gradually change the asset mix.

@Leah – As long as the additional math doesn’t bother you, you could just start adding a bond ETF to the account.

This post helped me feel less overwhelmed about the process of managing my kids’ RESP. Just a couple of questions, my kids are 5, 8 and 11 and I have only made 2 years worth of contributions equally. Given the age gap do you think it’s better to switch to 3 individual RESP so I have to do less calculations each year? And if 3 individual ones are a good option, would you invest according the plan set out for Bart, Lisa and Maggie respectively or use Bart’s plan for all 3?

Hi Justin. Thanks for all your content. You and Dan’s blogs have been pivotal in my journey into investing, so thank you!

I am making the switch from Questrade to BMO Investorline shortly and am trying to find a short-term bond etf to use that is part of their “No Commission Fee ETFs”. I was hoping V/XSB would be there but they are not. Do you have any thoughts on CLF.TO (iShares 1-5 Year Laddered Government Bond Index ETF) as a decent substitute?

@Tyler – We’re so happy to hear you’ve found our blogs useful :)

CLF would be a decent substitute for the other short-term bond ETFs (main difference is that CLF doesn’t include corporate bonds).

Hi Justin,

Great topic and presentation, and very timely too.

One question that arose, though: is there any brokerage that has commission free trade for the ETFs used in this article? Questrade is free for buy only and Qtrade only has XEQT in their list of commission free ETFs.

Thanks!

@Mike – National Bank Direct Brokerage is one example :)

Just came across this information. Helpful. Thank you.

I have 2 kids 3 and 5. Opened questrade and started each with 1k in Xgro and 1k in vgro

1. How do I switch to the 2 etf model? Sell all xgro and vgro ?

2. Also I plan to contribute monthly and buy ETFs every 3 months. Will that complicate my life or should I just save the money and buy ETFs in January. I worry about money sitting there for almost a year not doing anything.

3.if I have the 2 etf portfolio- will I need to rebalance or simply buy each time based n allocation amount. Ie. 1 k to invest in a 60 stock/40 bond- $600 stocks, $400 bonds?

Thank you

@Diana Amankwah:

1. Yes

2. You will need to place more trades and crunch more numbers, but if you’re fine with that, you can contribute monthly to the RESP.

3. You may need to rebalance occasionally, so you’ll need review your portfolio prior to each purchase (which is why annually investing in an RESP is less work).

Hello, I am investing in VEQT for last 3 years for my son RESP. I want to know if compound interest really works on ETFs and stock ? Since I am not selling etf, how compound interest return works. ?

Hi Justin,

this is very timely as I’ve just added money into the RESP! I’m at RBC DI, currently hold e-Series MFs in the account (I’ve used Dan’s info as my guide for a few years now), with two beneficiaries age 2 and 4 for 2023. Looking to switch all holdings to ETFs, now that the 1% commission is in effect for MFs. It’ll cost me $10 per ETF trade at RBC, so looking to minimize that cost for the small size of the account. Planning to use GICs for the fixed income portion rather than bonds to minimize transaction costs. What are your thoughts on the equity holding: do I purchase two separate ETFs to mimick the glide path, or buy one and choose the eldest child’s equity percentage for that holding, average their percentages, or use the youngest child’s percentage?

Not planning on moving the RESP to another provider at this time. I have a feeling I may be inside my own head too much and overcomplicating things!

Thanks in advance for your thoughts!

@Sebastian – If you don’t want to place as many equity ETF trades, you could just go through the exercise in the video and only purchase VEQT (based on the Total RESP figures – see example on the far left at time 11:36 in the video).

Hi Justin. Great resource and thank you for making this available. Just to follow up on this question, I’m looking to minimize the number of different ETFs to buy and sell (as I’m with TD and not looking to move brokers at this time), but have 3 children of different ages. It seems straightforward enough to determine the initial purchase of VEQT and VSB, based on the total RESP figures at 11:36 in the video. Going forward, for future years and figuring out what the right mix between VEQT and VSB should be, is it reasonable to use the cumulative contributions+grants for each child as a proxy for how much of the RESP they should ‘own’?

For example, to determine the equity portion for a given year:

Portfolio equity percentage = ((Equity % target Child 1) x (child 1 cumulative contributions/grants / all cumulative contributions/grants)) + ((Equity % target Child 2) x (child 2 cumulative contributions/grants / all cumulative contributions/grants)) + ((Equity % target Child 3) x (child 3 cumulative contributions/grants / all cumulative contributions/grants))

Is there a benefit to having a single family RESP with three beneficiaries, rather than three individual RESPs for each of Bart, Lisa and Maggie? Administration of separate RESPs would appear to be simpler than in the example provided, and I believe the individual RESPs can later be combined into a family plan, at least in certain circumstances.

@Doug – Setting up multiple RESP accounts is another option (and then the parents could follow a separate guide path for each child in each account, which would be slightly easier from a math perspective). However, if I suggested this option to investors, most would not complete the paperwork (so from a behavioural perspective, managing a single RESP is likely the better advice).

Thanks for always sharing Justin. My kid was born in 2020 and I invested in VGRO right away. So far he is down lol due to the turbulent market. Hopefully he see a change soon

@Pete – I think your son still has plenty of time to make up for his initial RESP losses :)

Hi Justin,

Thanks very much for the thoughtful approach to a family RESP. I use RBC Direct Investing for my family RESP and make a lump sum contribution once a year in January. I know the contributions are correctly registered to each of my two kids (indicated in the transaction records). However the portfolio breakdown and overview does not show any allocation by child…it’s just provides a straight up total – eg VGRO and cash. This means that I don’t seem to have the ability to trade against individual asset allocations by child. Has not been too concerning, as my children are only 2 years apart, so not a big risk profile difference, but definitely would prefer to manage them separately. Not sure if this is a specific problem to RBC. I assume other online platforms this is pretty clear?

This is a great video. Thanks. Do you think there is any merit in choosing GICs within the RESP portfolio rather than a bond ETF? Maybe in the short term with where current GICs are? The historical rates for for VSB seem fairly low (understanding that is a trade off for increased security), and in some cases lower than current GIC rates. Thanks!

@Craig – Historical returns for VSB were very low, but so were GIC returns (they both now have higher expected returns because bond yields have increased). However, GICs tend to still outperform short-term bond ETFs over time (as they generally have higher yields), so if you don’t require the liquidity, a 1-5 year GIC ladder would be a good substitute for a short-term bond ETF in an RESP.

Thanks Justin – super informative as always. Glide path absolutely makes sense. Thoughts on transitioning to an all GIC ladder as your child approaches post secondary age? Meaning setting up a ladder with a set amount coming due at the beginning of each university year. For example if you had a $100k fund – ladder in four $25k GICs with the first one coming due at the start of year 1 university. Alternatively over two years i.e. $50k In Year 1 and $50k in Year 2 (if a two year college degree might be an option, or you might want more funding up front for a four year degree) Mitigates all risk of equity or bond downturn, and might get a better return vs bonds.

Bart, Lisa, and Maggie. love it!

@L Lau – Thanks! :)

Ha! my youngest goes to uni this fall so this is a bit late for us but what a great detailed breakdown this is. I had a hard time even trying to find out the contribution breakdown from the govt. I could have used this 20 years ago!

Thanks as always for your excellent work.

(my only criticism, and this goes for many web pages and apps, is that my old but well-funded eyes can no longer read gray font on white :))

@Lise – Oh good, I thought it was just me that was having issues reading the grey text in the video/blog! ;)

Hey Justin,

Thanks for the post. What’s the advantage to using bonds for the fixed income portion vs GICs? GICs seem to have a better rate of return lately.

@Derek:

Advantages: Bond ETFs are liquid, and easier to manage than a GIC portfolio. They can also be purchased in small increments – GICs oftentimes have minimum purchase limits.

Disadvantages: Bond ETFs are not CDIC-protected (GIC deposits are, up to $100,000 per beneficiary in an RESP). Bond ETFs also currently have lower yields than a GIC ladder, and their price fluctuates.

Hi Justin. Thanks for the breakdown and explanation! Could you provide more detail on what a ‘gradual shift from VAB to VSB’ would look like? At what point would someone start the shift & how quickly?

@Michelle – There’s no optimal solution to your question (which is why it may just be easier to stick with short-term bond ETFs or 1-5 year GICs for the entire investment period), but here’s an example:

Age 10: 60% broad market bonds / 0% short-term bonds

Age 11: 50% broad market bonds / 15% short-term bonds

Age 12: 40% broad market bonds / 30% short-term bonds

Age 13: 30% broad market bonds / 45% short-term bonds

Age 14: 20% broad market bonds / 60% short-term bonds

Age 15: 10% broad market bonds / 75% short-term bonds

Age 16: 0% broad market bonds / 90% short-term bonds

Thanks Justin! That sounds like a plan, I will re-visit in Jan 2025. And Congrats Alex!

Same here with a little girl born in August last year and as soon as her SIN was received, we opened her RESP and went with VEQT.

Although I understand the thought process behind the shifting allocation inside the RESP in time, my thinking was to keep a full equity allocation inside this accout for far longer. This might come into the “asset location” part, but I thought it would make more sens in our situation to manage the RESP account as part of a global portfolio strategy, rather than seing it as a separate part. In that sens, could it make sense to keep an asset allocation on a total portfolio basis ? As it is already part of my plan to fund my daughter’s education, am I wrong in thinking that the source of the fund (which account type) doesn’t really matter ? In that sense, I don’t see why I wouldn’t use the tax sheltering offerd by the RESP structure to maximize expected returns (or rather minimizing tax drag).

I’m curious to know the “flaws” in this strategy.

@Alex – Of course, there’s no one right strategy for everyone!

I know another investor that makes sufficient salary income each year to pay for all education expenses from this cash. In their case, they treat the RESP as part of their retirement portfolio, and when they withdraw from it each year, they simply invest the funds back into their non-registered account.

Thanks for posting this. Great timing as we just had a son in July 2022. I opened an RESP with Questrade as soon as he was born, and put $2500 into XGRO, and did the same with the $500 grant. Then earlier this month I put another $2500 into XGRO. I am wondering if I should sell the XGRO and buy a total equity fund and a bond fund, as the glide chart you posted makes a lot of sense.

@Paul – I don’t think it’s necessary to make any changes to your RESP at this time. Based on the video’s strategy, you should be around 85% equities (and you’re at 80% – close enough in my opinion). And in 2024, you’ll be right on track. Perhaps consider making your adjustments in January 2025.