By now, you should be more familiar with the equity ETF offerings from Vanguard and iShares. But you may still feel uncomfortable building and managing a portfolio of ETFs on your own.

For example, how much of your portfolio should you allocate to Canadian vs. foreign equity ETFs? And when should you rebalance these allocations?

Not to worry. If you’re comfortable dialing up your portfolio risk to 11 with an all-equity risk exposure, Vanguard and iShares have you covered, with the Vanguard All-Equity ETF Portfolio (VEQT) and the iShares Core Equity ETF Portfolio (XEQT).

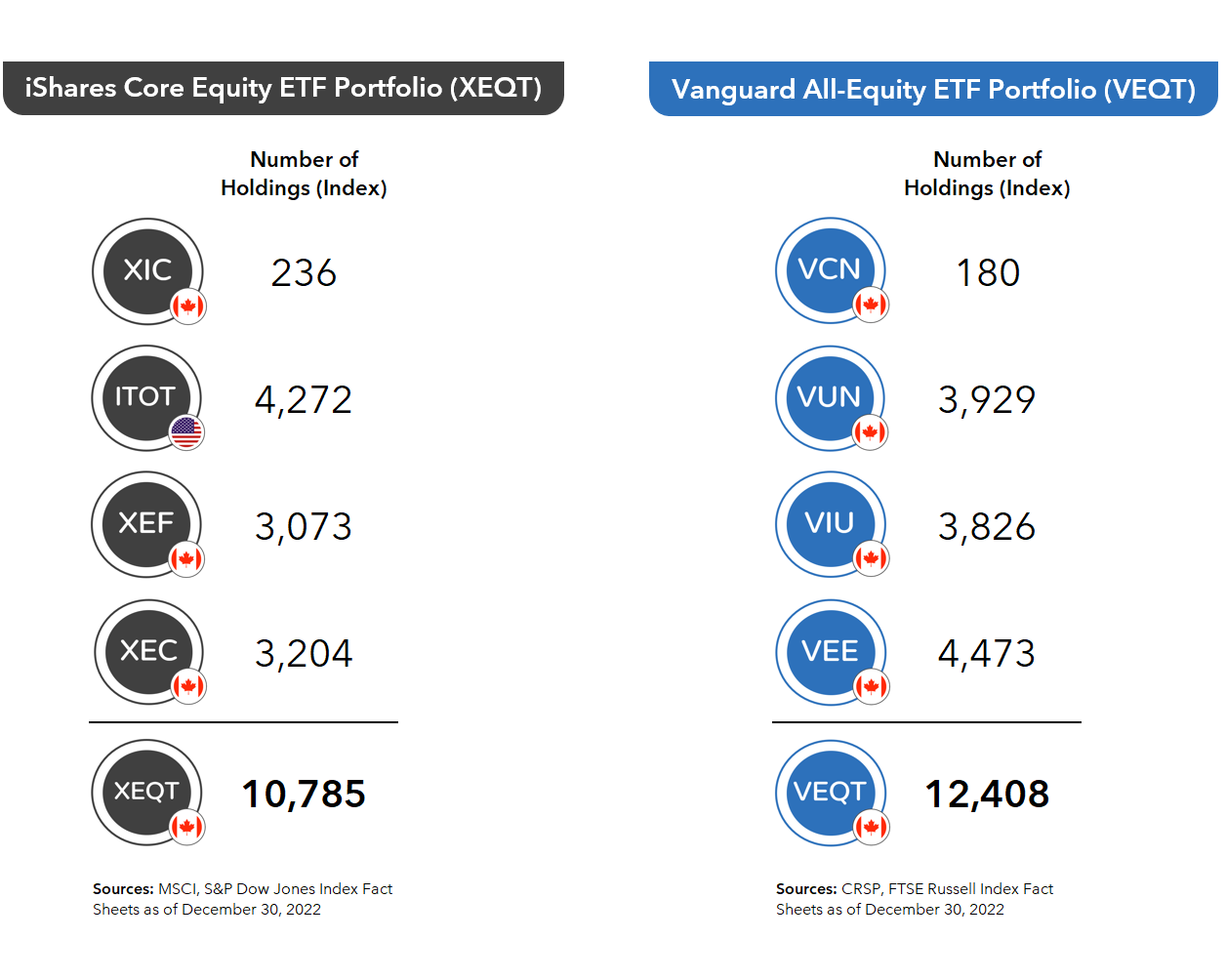

Each of these funds include several underlying equity ETFs you’ll recognize from our past blogs/videos. And each tracks the performance of thousands of individual companies, providing bold Canadian investors with extensive global equity diversification through a single trade.

There are a few minor variations between XEQT and VEQT, which we’ll cover next. If any of these differences tilt your scale, go for it. Otherwise, a coin flip may be fine.

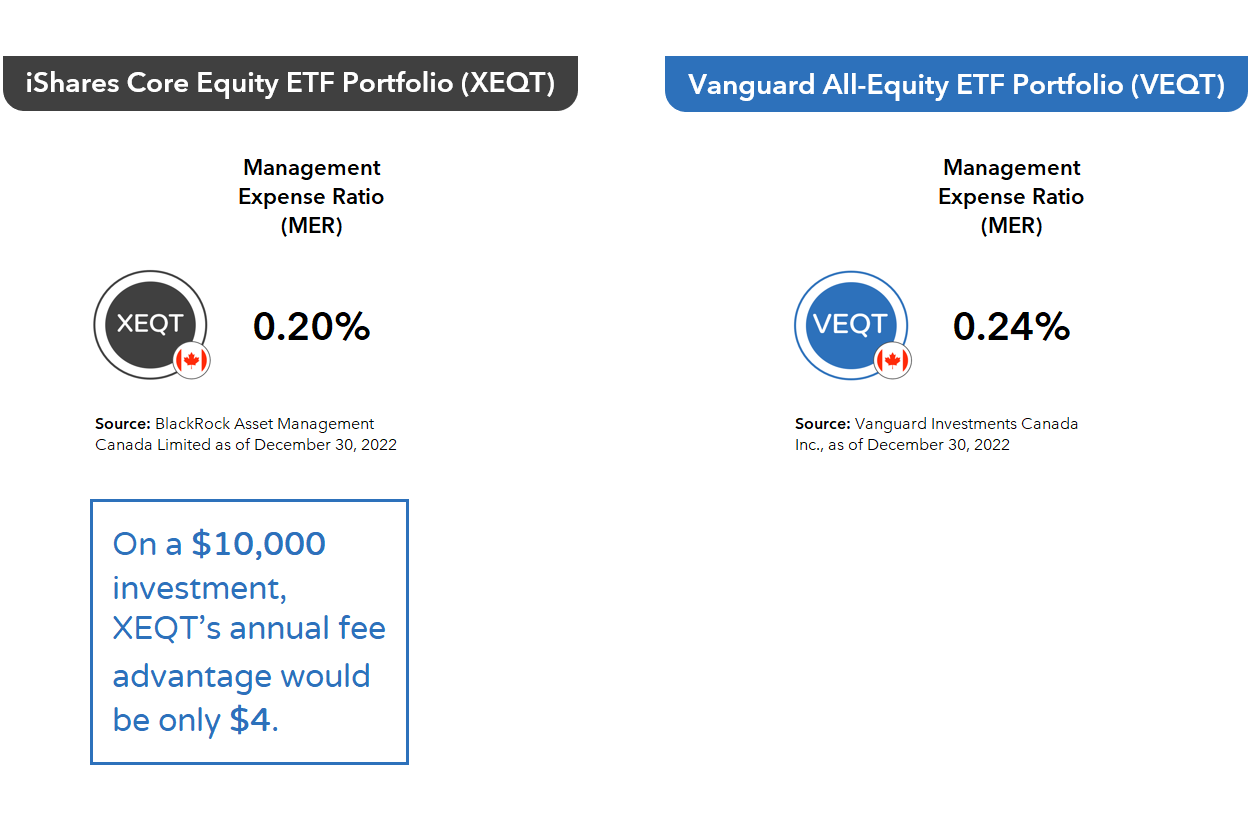

First, there are the annual fees. XEQT has a slightly lower management expense ratio (or MER), compared with VEQT. But it’s so slight, it’s hardly a sufficient reason to prefer one fund over the other, especially in a smaller portfolio. For example, for a $10,000 investment, XEQT’s annual fee advantage would be modest.

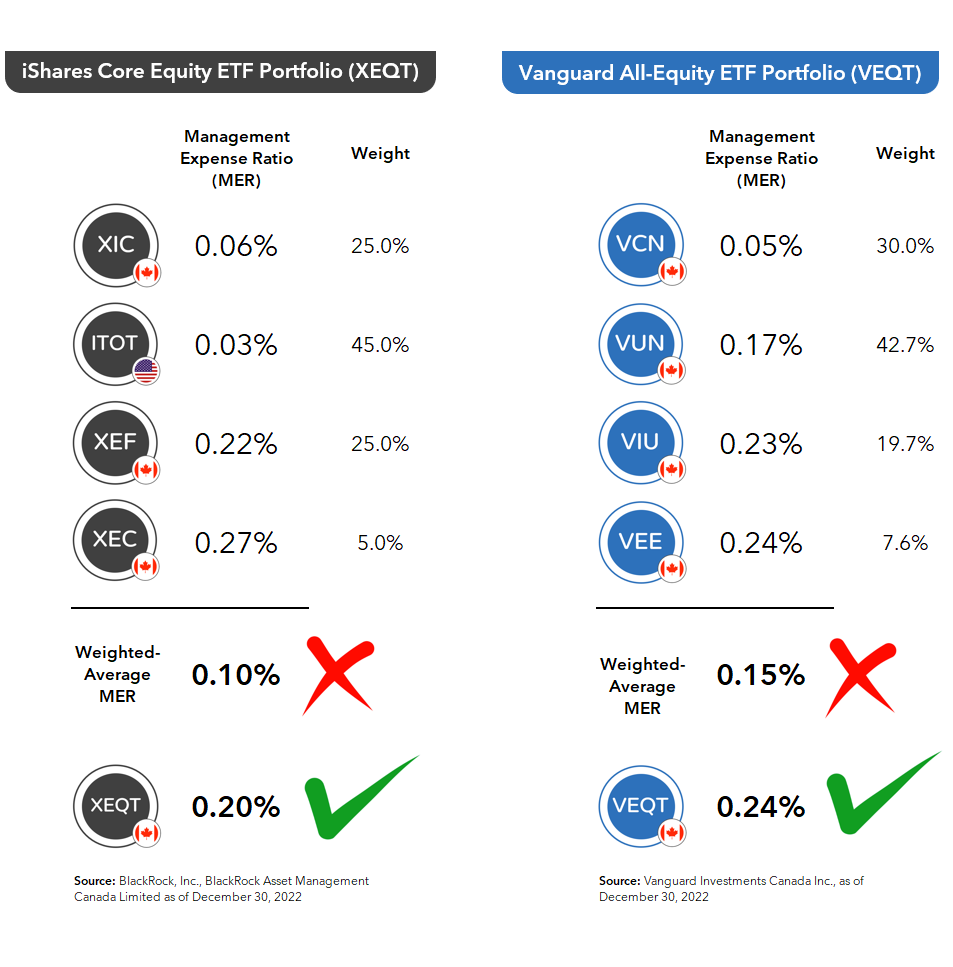

I also want to ensure investors understand that these MERs are not in addition to the MERs of the underlying individual ETFs – you do not pay both. So there are no double-dipping fee shenanigans going on with XEQT or VEQT.

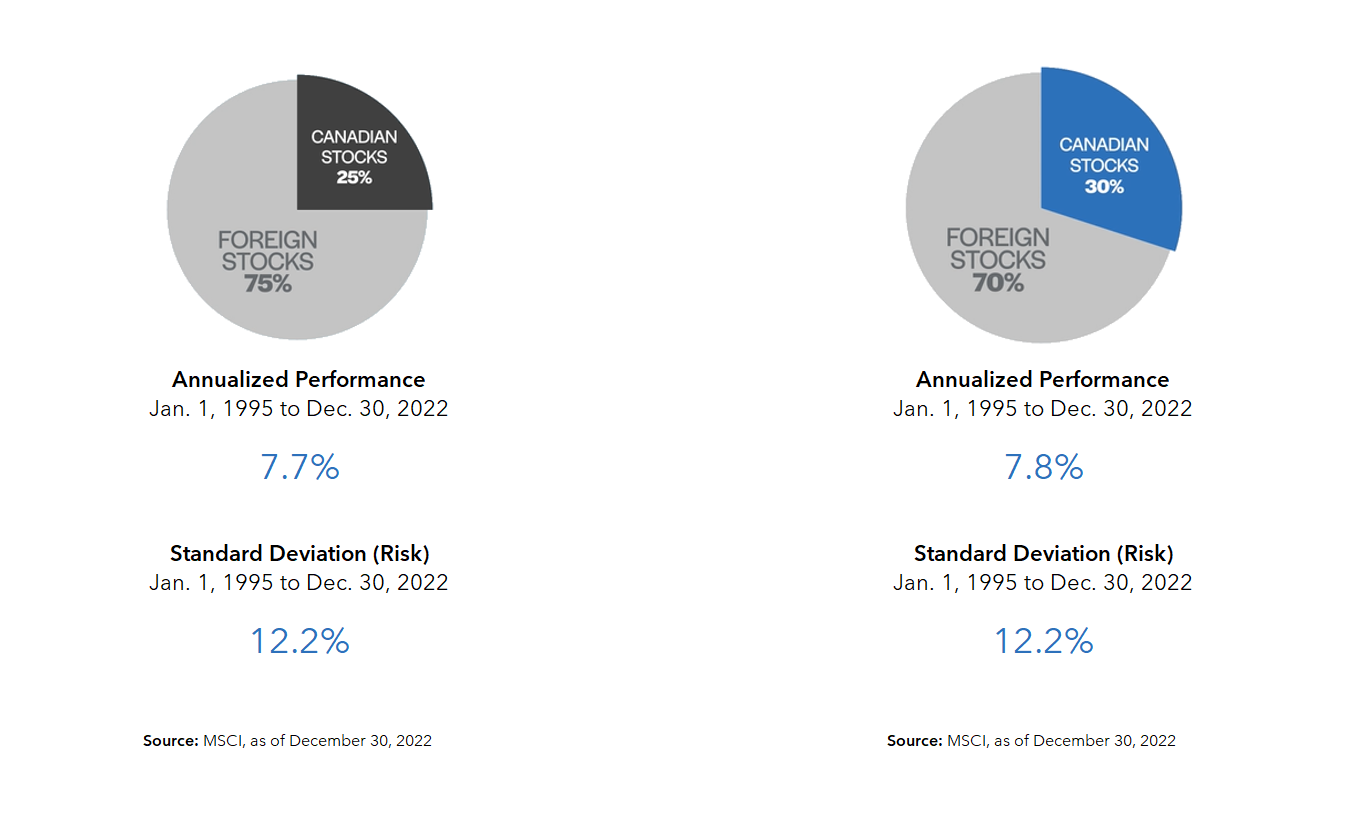

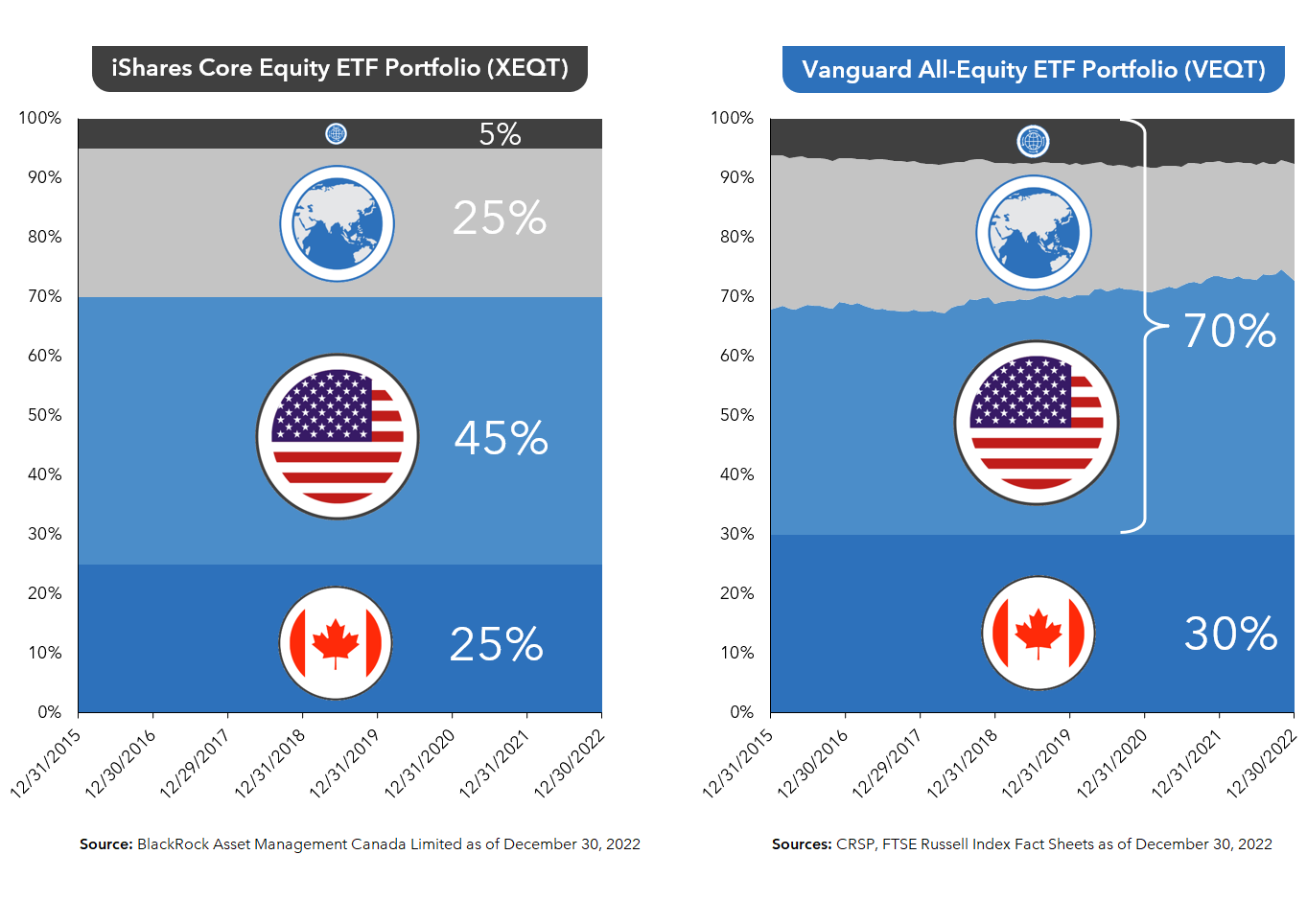

Next, there is each fund’s Canadian equity allocation. Canadian stocks make up only around 3% of the global stock market, but both funds have a higher weight to them in their portfolios. iShares has allocated 25% to Canadian stocks in its all-equity ETF, while Vanguard’s has a 30% allocation.

Either way, a 5% difference in Canadian stocks isn’t likely to have a noticeable long-term impact on your portfolio’s risk or returns. For example, if you had invested in either a 25% or 30% Canadian stock allocation since 1995, it would have made little difference to your portfolio’s risk or returns. In other words, this difference probably isn’t worth agonizing over.

And how about how each fund manages its foreign equity allocations?

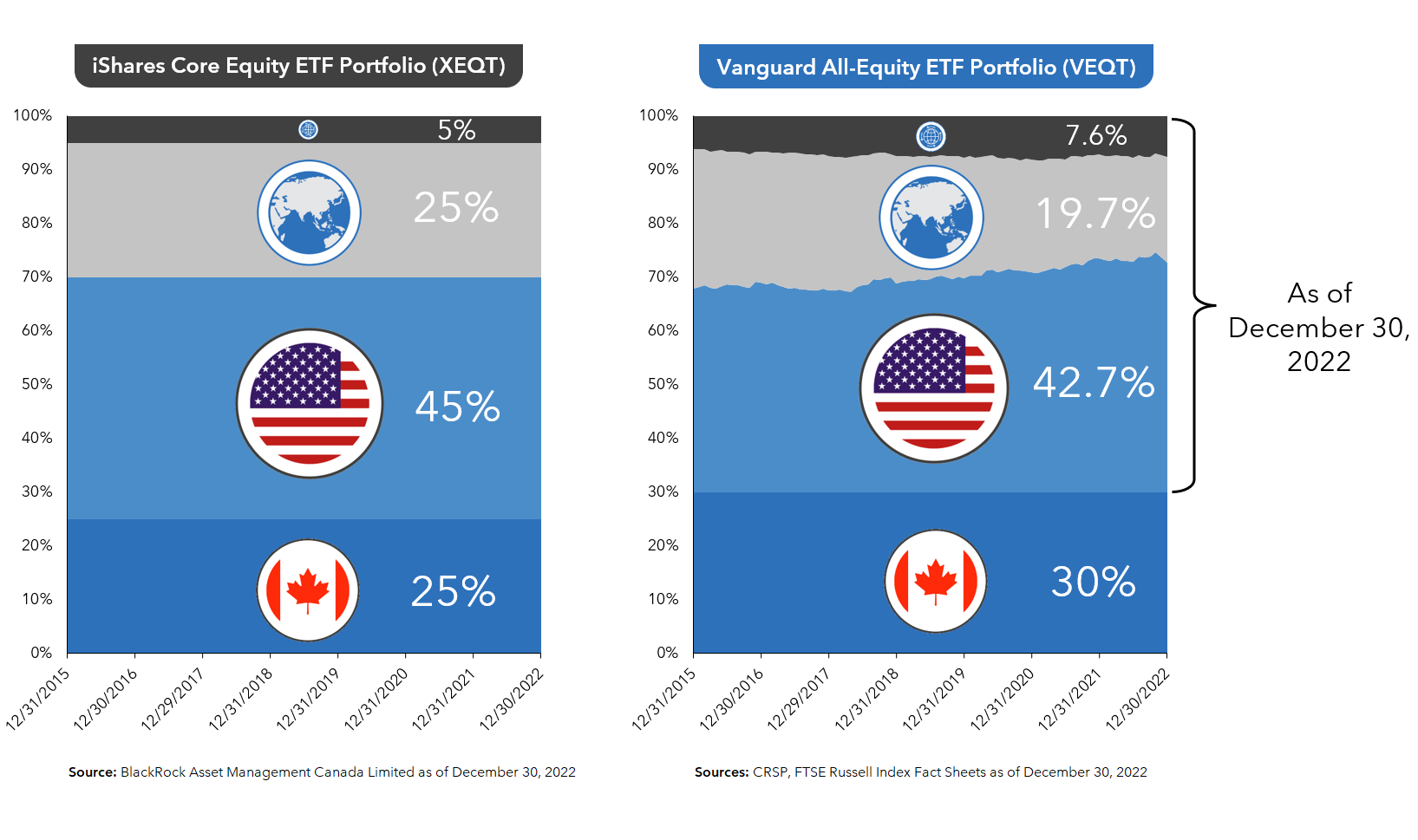

Like its 25% Canadian equity allocation, iShares has also chosen specific target weights for its U.S., international, and emerging markets stock allocations.

U.S. equities receive a 45% share, with another 25% allocated to international equities. The remaining 5% is allocated to emerging stock markets. iShares rebalances back to these target weights, regardless of what global stock markets are up to on any given day.

Similar to iShares, Vanguard’s 30% Canadian stock allocation is also static, so its weight within VEQT is essentially set in stone.

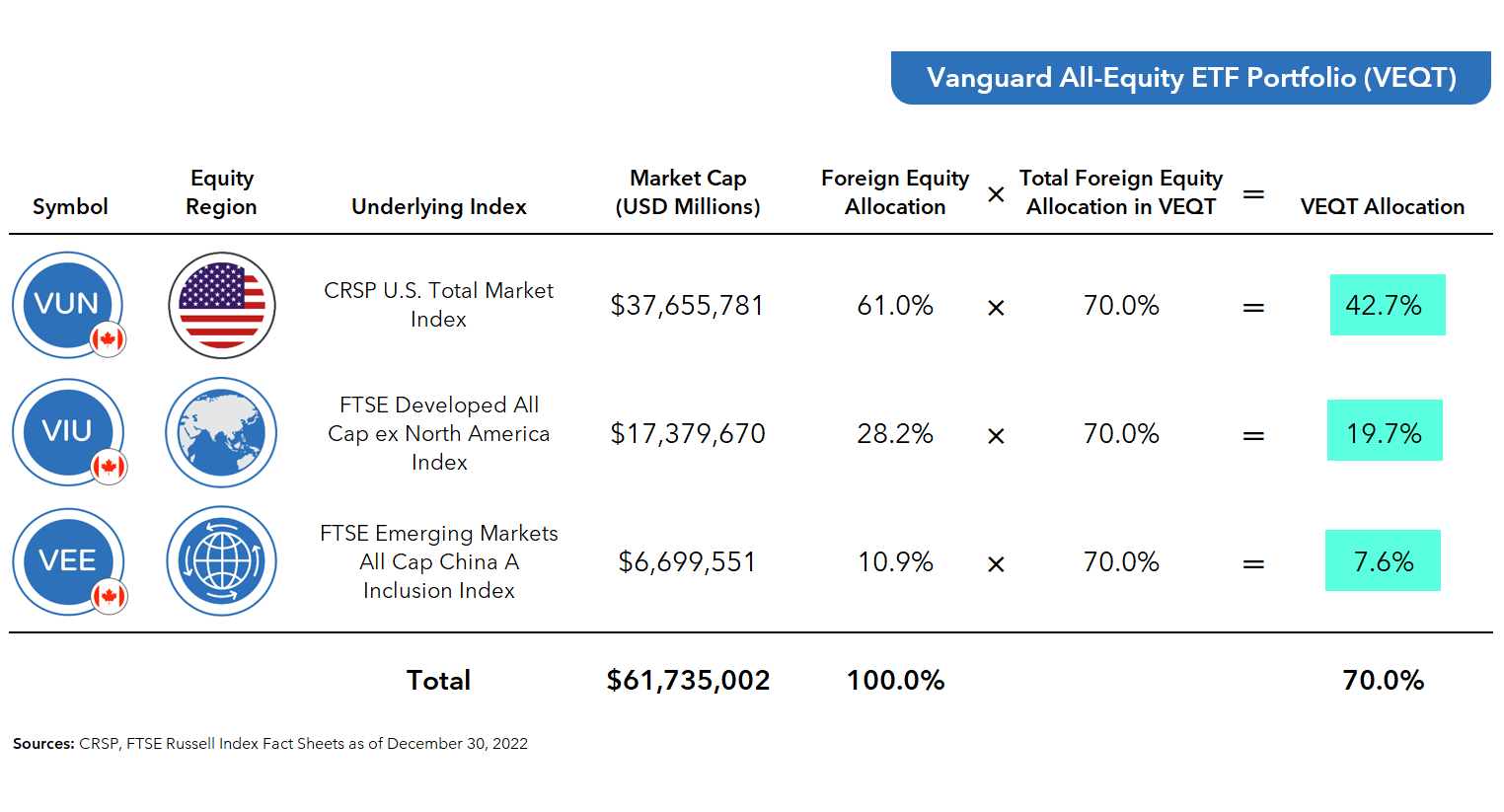

However, VEQT’s U.S., international, and emerging markets equity allocations are more fluid, as they are based on each region’s current stock market value, or market cap. This means that each asset class is free to fluctuate within the constraints of the overall 70% foreign equity allocation, based on the relative stock market values of each region at any point in time.

For example, if we wanted to calculate VEQT’s target foreign equity allocations at the end of last year, we would start by collecting the market caps of the indexes tracked by their underlying U.S., international, and emerging stock market ETFs. These figures can be found on each fund’s monthly or quarterly index fact sheets. Then, we would divide each region’s individual market cap by the total of all three, and multiply each result by VEQT’s 70% total foreign equity allocation. The results would provide us with the year-end target weights within the fund.

You’ll notice, relative to Vanguard, most of iShares’ 5% underweight to Canadian stocks has been reallocated to international stock markets. There are also some small differences in the U.S. and emerging markets equity weights. But again, nothing to lose sleep over.

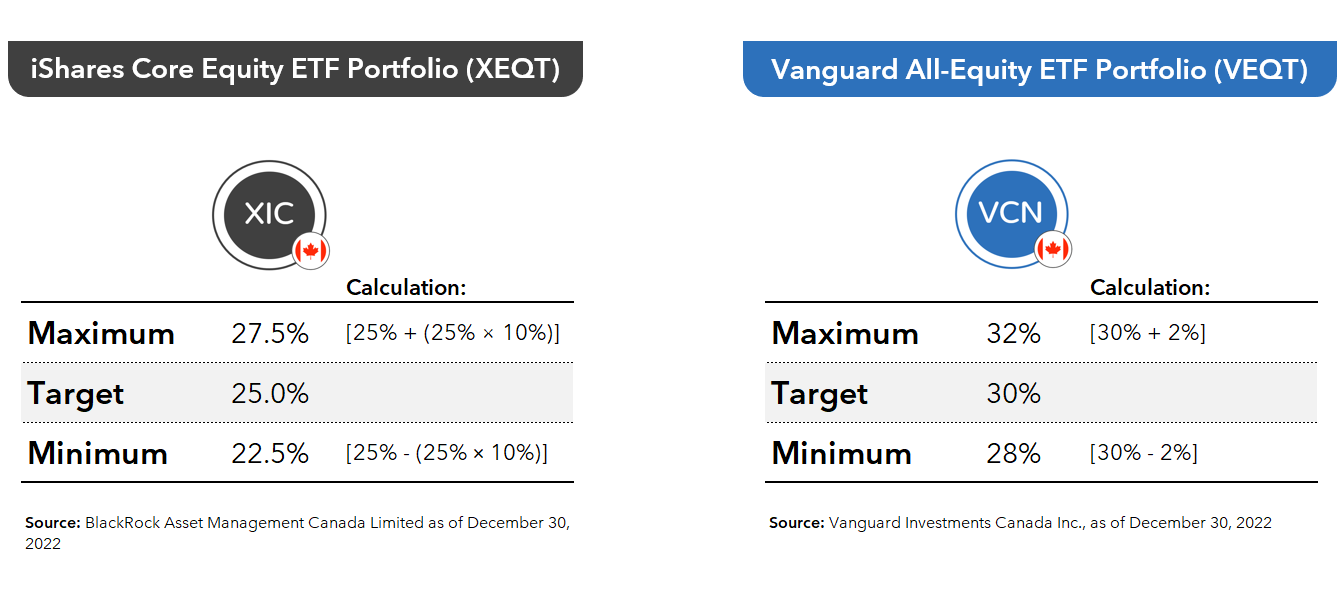

Last up, let’s look at the minor differences between Vanguard’s vs. iShares’ rebalancing thresholds.

iShares plans to rebalance anytime an asset class drifts more or less than 10% of its target weight in either direction. For example, XEQT has a Canadian equities target of 25%, invested in the iShares Core S&P/TSX Capped Composite Index ETF (XIC).

If XIC becomes more than 27.5% of the portfolio [which is calculated as 25% + (25% × 10%)], the managers will likely sell a portion to bring the asset class back in line with its target.

Likewise, if XIC becomes less than 22.5% of the portfolio [which is calculated as 25% – (25% × 10%)], iShares will likely sell a portion of any overweight ETFs, and use the proceeds to buy more XIC.

In practice, iShares will typically prioritize using new cash flows to top-up any underweight asset classes. This should reduce the need to rebalance by selling appreciated securities, which could be taxable to the ETF’s unitholders.

Vanguard’s rebalancing plan is a little different. They won’t allow any specific fund to deviate by more or less than 2 percentage points from its target weight. For example, VEQT has a Canadian equities target weight of 30%, invested in the Vanguard FTSE Canada All Cap Index ETF (VCN). If VCN becomes more than 32% of the portfolio (30% + 2%), or less than 28% (30% – 2%), Vanguard will likely spring into rebalancing action. Again, they’re more likely to use new cash flows to top-up any underweight asset classes, reducing the need to sell existing securities.

So, which is right for you: XEQT or VEQT? By now, I hope you’ve realized, if an all-equity ETF makes sense for you to begin with, either offering would be an acceptable choice. None of the minor variations in their annual fees, Canadian and foreign equity allocations, and rebalancing protocols create a clear edge either way. If you prefer one over the other based on the factors I’ve discussed here, great. If not, flip a coin. Heads or tails, you win.

I chose VEQT in registered accounts because of the once a year distribution. It pays in January at the same time I make annual contributions. I add the residual cash after DRIP to the contributed cash and make just one paid transaction a year. If there is a little cash left, I add it to a TD index fund that I keep for that purpose, and then I’m 100% invested (no cash) … which is where I want to be. For years I have not entered a sell order and hopefully won’t need to for another 15 years.

@Kevin – Thanks for sharing! It sounds like your strategy is working really well for you :)

Salut Justin, excellentes contributions financières qui nous enrichissent chaque jour. Pour ma

part, je compte investir dans un compte non enregistré une coquette somme d’argent issu de mon fonds communs de placement que je viens de liquider car négatif! ; merci de me proposer un FNB ou deux fiscalement avantageux. J’avoue que je suis perdu. je compte investir une partie dans le HXS-C mais il ne couvre pas toute la planète boursière. merci d’avance.

Are these good for the FHSA? I’d rather not have dividends to remember to reinvest but it’s not a deal breaker either.

@Justin:

Are there any other alternatives to VEQT, ZEQT, or XEQT? Like the VGRO or XGRO.

I am looking for something similar but that also has option.

For example VCN doesn’t have options, whereas XIC does.

As always, thanks for the amazing educational posts and answering our questions!

Hi Justin,

I’ve heard a lot about this idea of ETFs being able to tax-efficiently rebalance with new cash flows. What I’m confused about is where these cash flows are coming from.

I understand that in a mutual fund structure, new money is exactly that, new money. However, ETFs expand by issuing new creation units, and exchanging them in-kind for a basket of securities with the authorized participant, in the proportion that they currently exist within the ETF. This process is often used to illustrate the tax efficient structure of ETFs since there is no taxable event to existing ETF unitholders arising from unit creation.

This would seem to indicate that the ETF doesn’t receive new cash as part of the creation process. The only new cash flows would seem to come from dividends/distributions of the holdings within the ETF.

Am I missing something here? Do ETF providers have some other source of new funds that can help avoid needing to sell as part of rebalancing?

Answering my own question:

ETF managers have access (at least, in the US) to a tool called custom in-kind baskets for creation and redemption.

https://www.investopedia.com/custom-basket-exchange-traded-fund-etf-definition-5224219

This allows the ETF manager, in partnership with the authorized participant, to create/redeem shares using baskets that do not reflect a pro-rata slice of the existing portfolio (e.g. containing mostly cash), but only when it is in the best interests of the ETF shareholders, like tax-efficiently rebalancing the portfolio.

I am not sure whether this mechanism exists in Canada as well, although CIBC states in https://www.cibcmellon.com/en/what-we-do/solutions/index.jsp#!/canada/etf-servicing/exchangetraded-fund-services-719781 that they support custom basket creation, which seems to indicate that such a mechanism exists for Canadian ETFs as well.

Hi Justin, thank you for your updates.

Which one of these 2 ETFs would be your preferred choice for RRSP investment?

@Sigal – I don’t really have a favourite – some investors may prefer XEQT if their brokerage account is with Questrade, as they can set-up and automatic investment plan on the fund (i.e., a PACC plan).

Thank you for your outstanding analysis, Justin! I’m wondering, if for the equity portion of my investments held in a taxable account there is any TAX disadvantage to holding VEQT* as opposed to holding it’s constituent funds, or similar, in the same proportions? I ask this is because I know dividends from Canadian corporations receive favorable tax treatment, and when holding VEQT, you can’t show CRA what portion of the VEQT dividends are from Canadian corporations. (Does this question make sense?) [resubmitted to correct typo]

@Mark – There are no expected tax benefits from holding VEQT’s constituent funds (rather than VEQT) in a non-registered account, other than more potential tax-loss selling opportunities.

When you receive your T3 tax slip for VEQT, it will include a separate box line item for eligible Canadian dividends (which were received by its underlying VCN holding).

Justin, I just started following your blog and it’s been very educational. Thank you! I love the XEQT/ VEQT global diversification but was also considering VFV… would this be redundant since VEQT/ XEQT already has the SP500 in there? Or a ways to increase US exposure, but looks like VEQT / XEQT already has 45% exposure to US. Thank you!

@Rac – Thanks for stopping by the blog :)

Adding VFV would be redundant, as its underlying U.S. stocks are already included in VEQT or XEQT.

@Ernest , @Justin

I want to start self-investing. Is it possible to have the link to see his advice?

Thank you Justin for all your content.

Sincerely

I love this it is awesome. I have been slowly switching my portfolio (4 accounts) to VGRO. I wanted VEQT but their payout is once a year, something I have not quite figured out why.

Thanks for the great work.

Sean

@sean – You’re very welcome – good luck! :)

Wonderful explanation. Couple questions if I may. Does it make sense to sell one and buy the other when we are at a market dip to lower our tax liability? Since either will work wondering if moving between them will trigger superficial loss rule? Also, what would be the advice of using this vs combining an ex-Canada ETF and add XIC or VCN at the global market cap of 3%? Is the over exposure to Canadian markets just a way to get favourable dividend tax benefits or is there a more nuanced deeper reasoning for the choices?

@Anuraag Mishra – In my opinion, XEQT and VEQT would be acceptable tax loss selling pairs (they would not be expected to trigger CRA’s superficial loss rules, as they are not identical securities).

I will be discussing your second question in detail in my next couple videos :)

“If you prefer one over the other based on the factors I’ve discussed here, great. If not, flip a coin. Heads or tails, you win.”

Thank you. I will not sell the VEQT and purchase XEQT, I do not want to generate a capital gain. I took your advice many moons ago and bought Vanguard. I appreciate your advice on this ETF and others that you have suggested in the past. .

@Ernest – Excellent news – glad to hear you’re still staying the course with your thoughtful index investing :)

Hi Justin, great content as always. As a teacher, I appreciate how well written and succinct your posts are. I teach a grade 12 business course in Ottawa, is there any chance that you’d be open to a virtual guest speech if our school board pays you? Would love for our students to hear from a professional like yourself. I know you’re busy so if not that’s totally fair. Thank you!

In addition, do you think it’s adventitious to have the foreign equity as a floating weight? For the long term values in your vanguard page, VEQT performed worse than XEQT and ZEQT. Thank you!

@Leo – Thank you so much – that’s a huge compliment! :) I’m unfortunately a bit bogged down for the foreseeable future, but thank you for the offer anyway.

I don’t think there’s a clear winner in the “static vs. market cap-weighted” foreign equity allocation debate. While it’s true overweighting U.S. equities historically led to outperformance (relative to a market cap-weighted approach), BlackRock would likely not have chosen this asset mix 50 years ago (so the past performance is not very helpful in making a decision going forward).