In our last blog/video, we introduced the all-equity ETFs from iShares and Vanguard. These ETFs make it easy to gain and maintain exposure to global stock markets with the click of a mouse, eliminating the hassle of juggling several ETFs in your all-equity portfolio.

Vanguard and iShares don’t offer their services for free though.

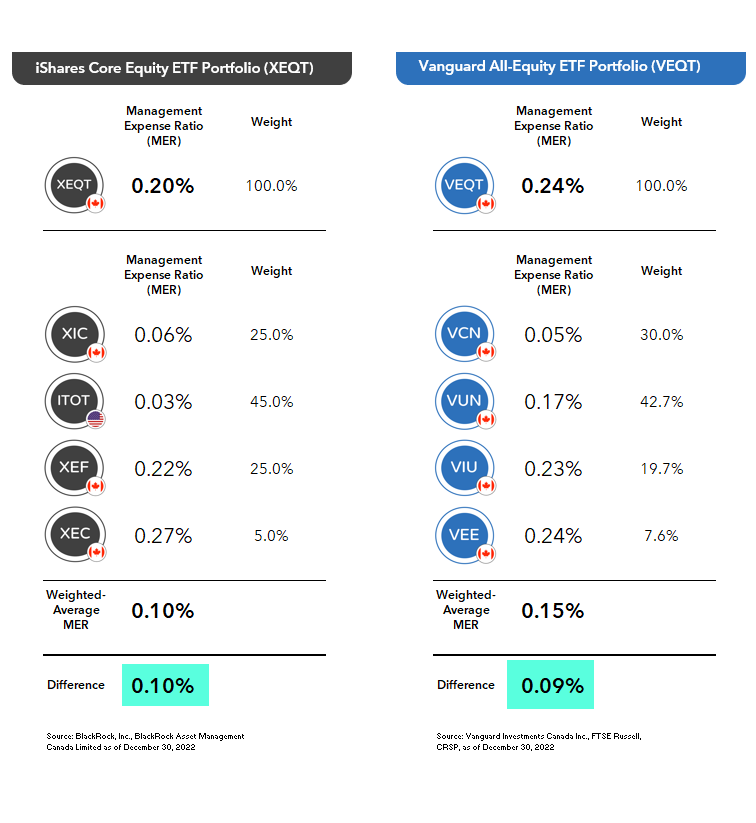

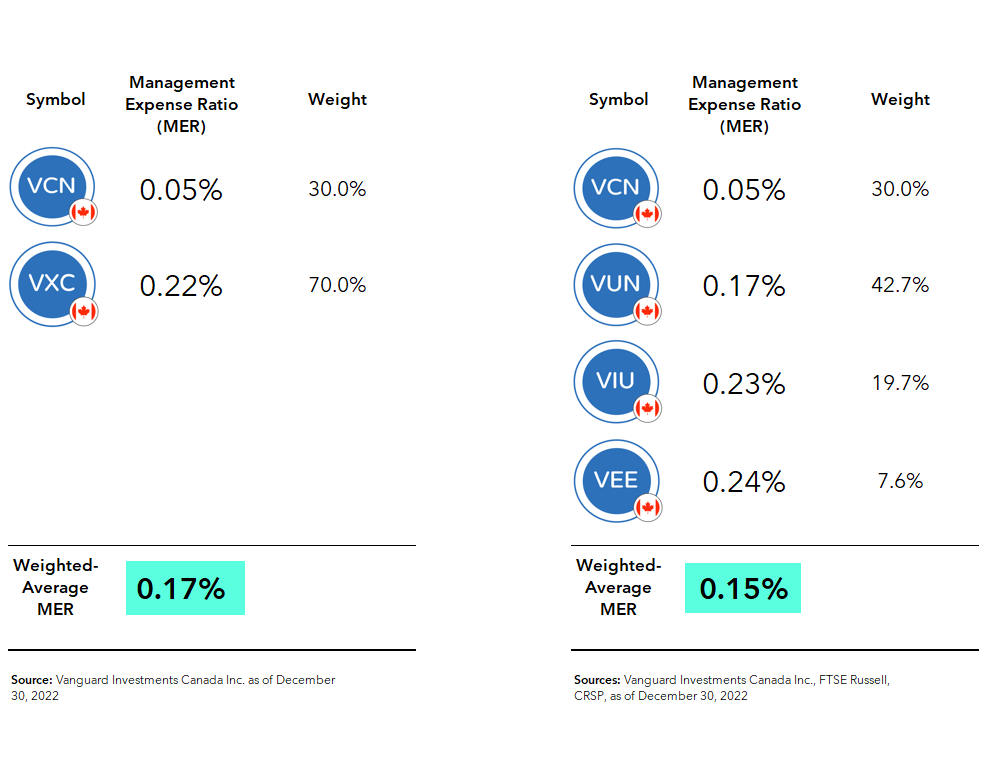

The MERs for their all-equity ETFs are slightly higher than the weighted-average MERs of their underlying holdings. Consider this modest surcharge as the price of admission for their professional asset allocation and rebalancing services. In my opinion, that’s a bargain for most investors.

Then again, there are those who might prefer to squeeze every last penny out of their portfolio costs. If that’s you, you may want to try skipping the value-add of an all-equity ETF, and simply purchase the underlying ETFs directly, in similar weights. If you take on the task of rebalancing back to your targets each month when you add new money to your portfolio, you should be able to mimic an all-equity ETF for a lower overall MER.

That’s the goal anyway. But it’s still going to take time, money, or both to keep your asset allocations on track each month. Let’s look at three potential strikes against trying to reinvent an all-equity ETF on your own, as well as one potential play that may serve as a suitable compromise.

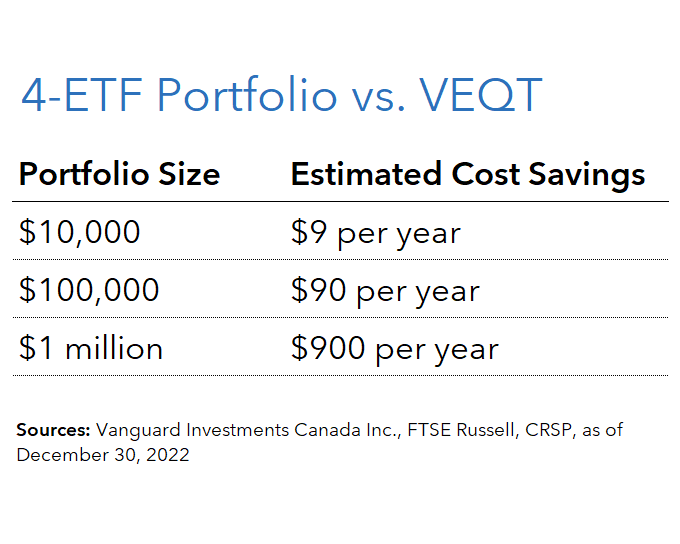

Strike One: The potential cost savings are minimal.

For example, let’s say you’ve got $10,000 to invest. Instead of investing it in the Vanguard All-Equity ETF Portfolio, or VEQT, you could divide it up among VEQT’s component funds. The estimated cost savings might let you rent an extra movie each year, but are the savings really worth it? The extra time you’ll need to spend on rebalancing may not leave you much time to even enjoy your movie.

For larger amounts, the fee savings start adding up, but only if you can buy and sell ETF shares at zero commission as you rebalance. If not, you can forget about it.

Strike Two: Managing a portfolio of four ETFs (instead of just one) will be more difficult.

Sticking with our VEQT example, a DIY investor would either need to visit Vanguard’s website monthly to collect the individual ETF weights within VEQT, or use the market cap data from the FTSE and CRSP index fact sheets to determine how to allocate each of the underlying ETFs. They would then need to calculate how many ETF units to buy or sell across various accounts to get their portfolio back on target, and place multiple trades to get the job done.

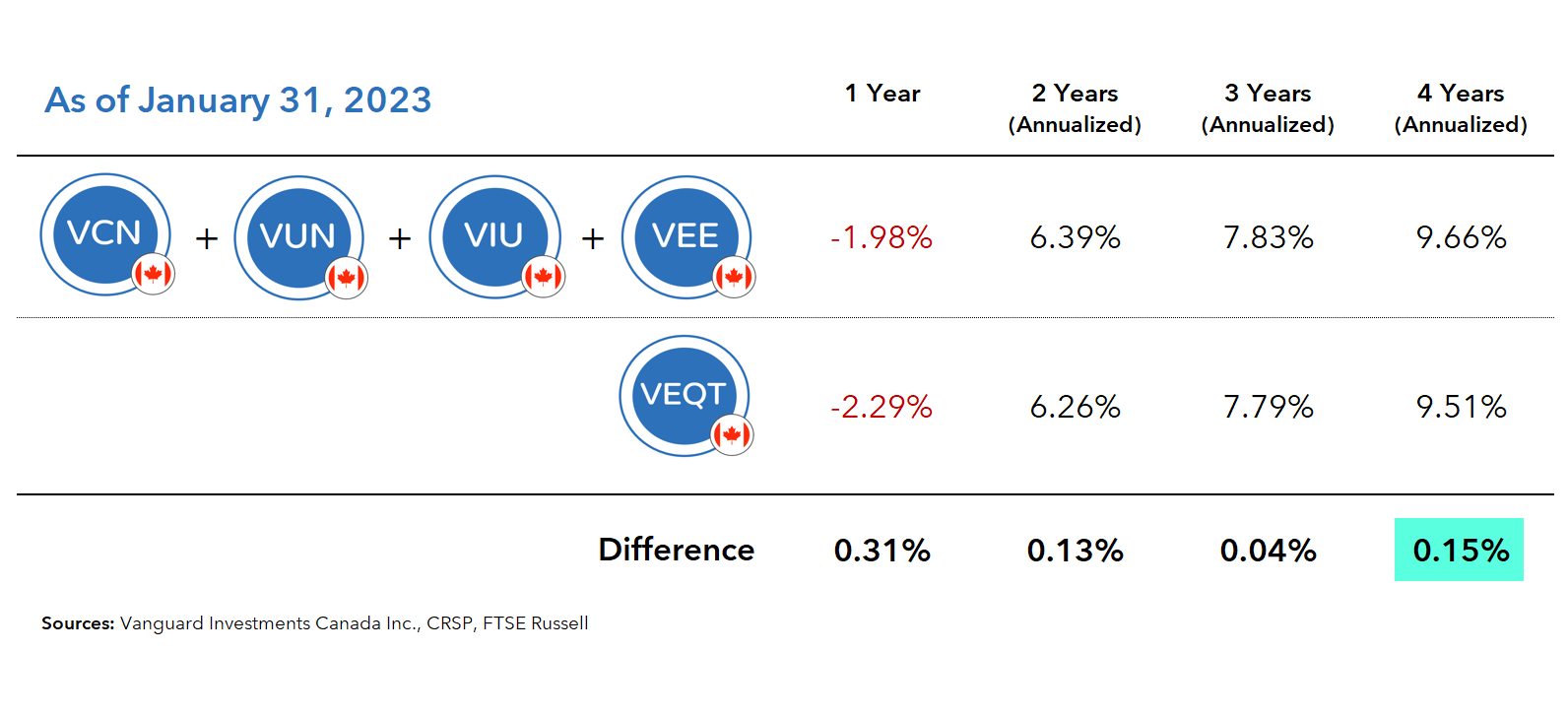

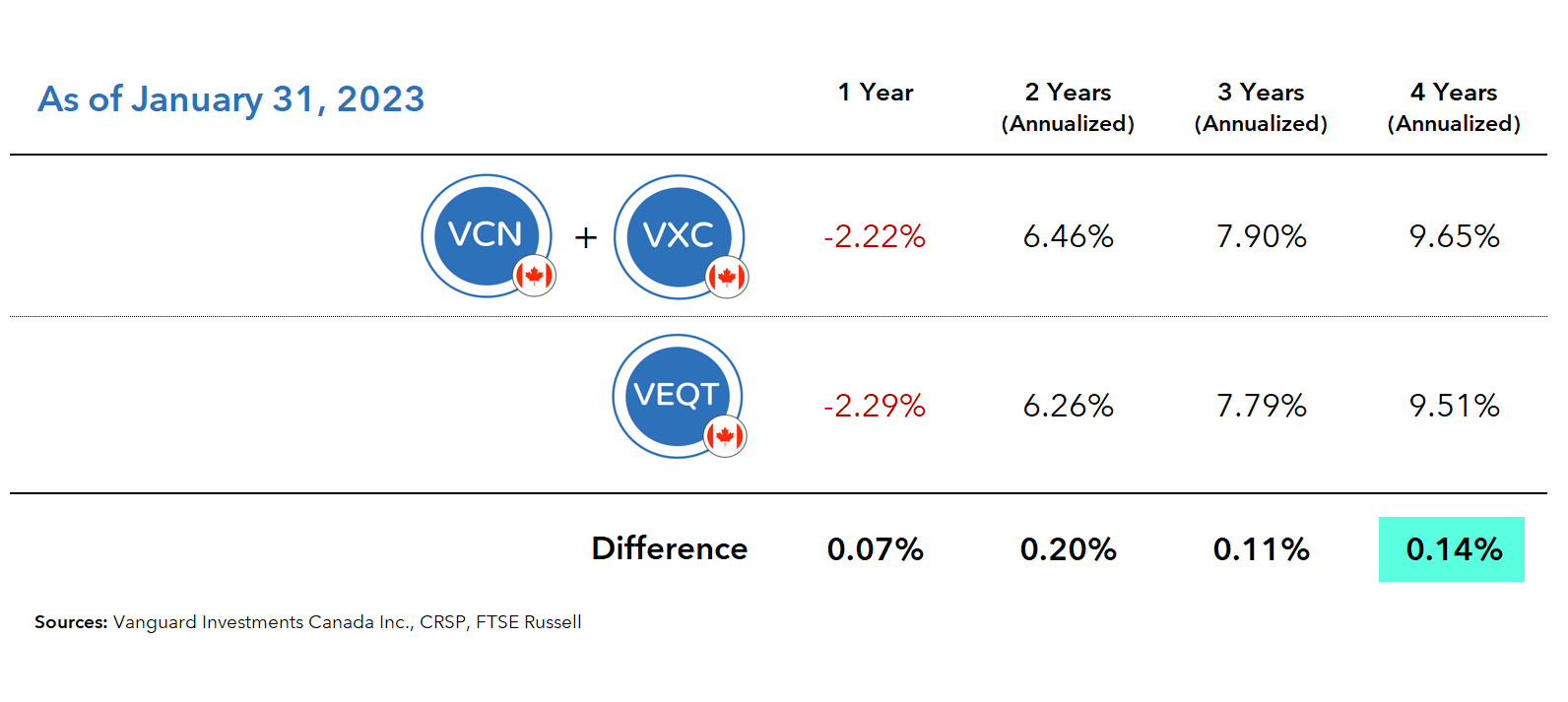

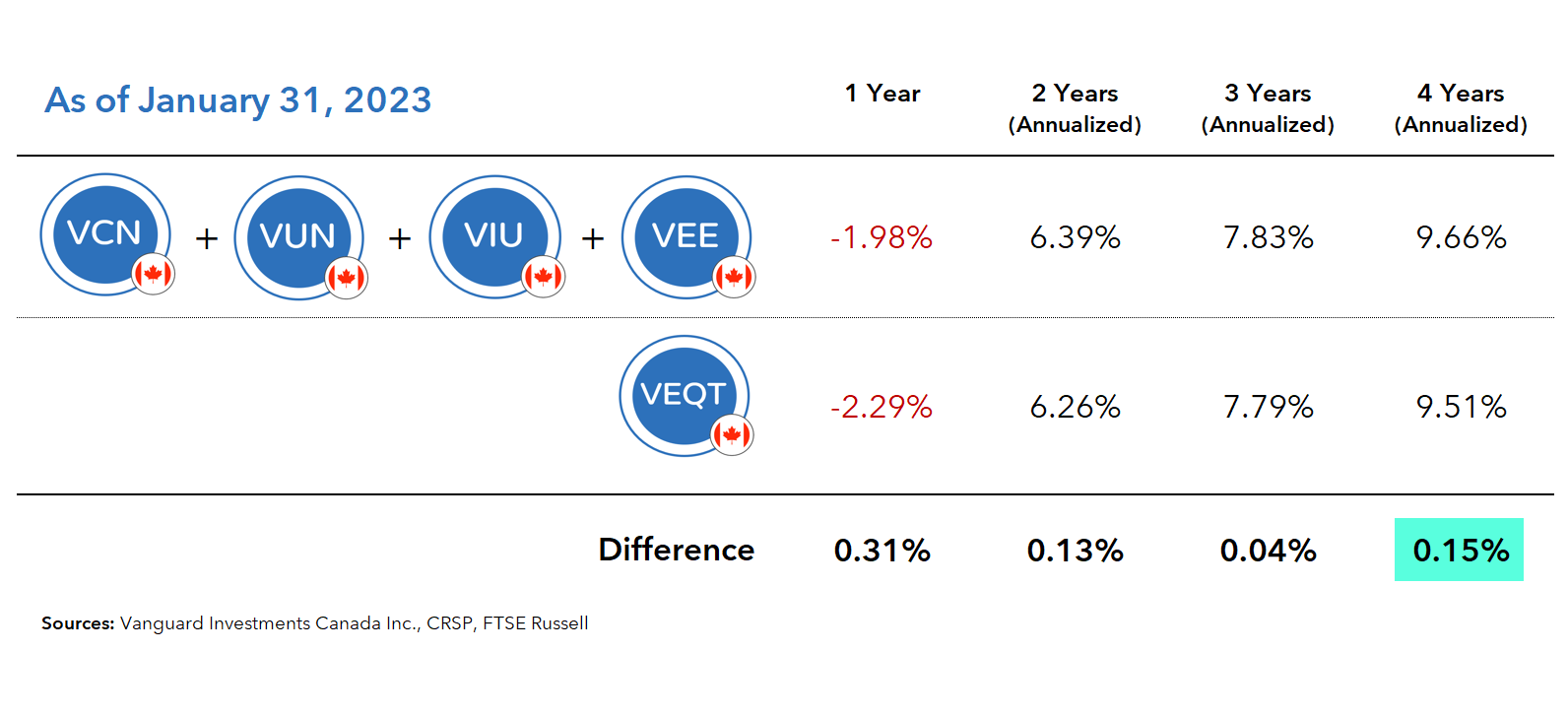

If you were to perfectly execute this strategy each month, you may be able to eke out slightly higher returns than VEQT. If we compare VEQT’s past returns to the aggregate performance of its four underlying ETFs since February 2019, we see our component strategy did outperform VEQT during this time – which is good news.

But again, this assumed you made no mistakes along the way, rebalancing your portfolio like clockwork each month. With a busy schedule and constant distractions, could you honestly say you’d never miss a beat?

Strike Three: You’ll be working with stale data.

Let’s discuss whether we mere mortals really could flawlessly replicate VEQT’s returns by buying and rebalancing its underlying funds. While you can probably come close, perfection seems out of reach.

Consider, for example, Vanguard’s resources versus your own. Vanguard has constant daily inflows and outflows from thousands of investors, and they can use these flows to continuously fine-tune their target asset mix. They also have up-to-the-minute market cap index information to improve their aim.

You’ve got you, rebalancing monthly, based on more limited index information. It usually takes a couple weeks before Vanguard updates their website with VEQT’s asset class weightings from the previous month-end. The FTSE index data is also only publicly available several days after month-end, and the CRSP index data is only available several days after the end of each quarter. This means DIY investors will never be working with the most current ETF target weightings when rebalancing their portfolios each month.

Again, you can still probably come close. But there will be random differences, which will lead to positive or negative tracking error. In other words, if you’re unlucky, through no fault of your own, negative tracking error could potentially cost you more than the reduced MER may save you.

Bottom line, even if you perfectly execute your own buy-and-rebalance-monthly strategy, there’s still a risk you might underperform an all-equity ETF anyway, even after fee savings.

So does this mean we’ve struck out on building a cheaper all-equity ETF portfolio? Actually, there is one more play to consider.

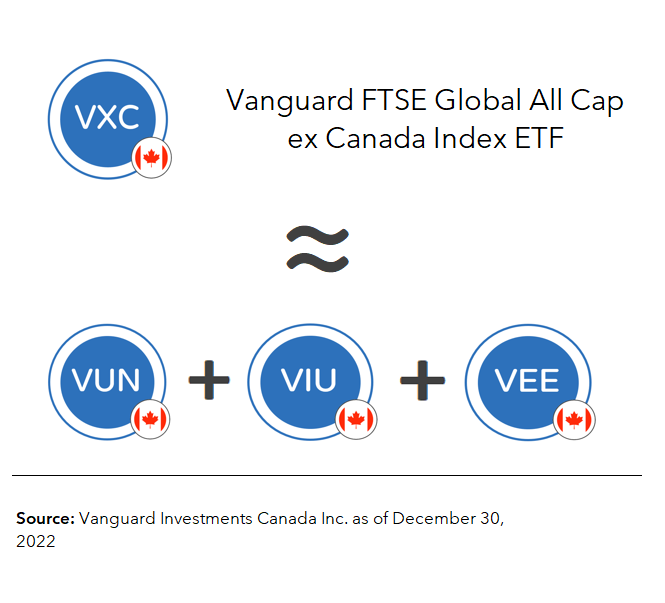

You could ditch your three foreign equity ETFs for a single fund. Just like VEQT, the Vanguard FTSE Global All Cap ex Canada Index ETF (VXC) also weights its underlying U.S., international, and emerging markets equity regions by market capitalization. This makes it a decent substitute for the VUN, VIU, VEE combination.

The main difference is that VXC’s U.S. equity allocation excludes micro-cap stocks, while VUN includes them. However, this small difference is not expected to have a material impact on VXC’s returns.

To use this approach, you would invest 30% in VCN and 70% in VXC, rebalancing the portfolio back to these target weights each month. The weighted-average MER of a VCN/VXC combo is also similar to the fees of our four-fund approach.

A back-test of this strategy also yielded similar results, but with tighter tracking and much less effort.

All things considered, I still prefer the simplicity of an all-equity ETF. But if you just can’t stand the thought of potentially leaving some cash on the table, a two-fund approach might be an appropriate compromise for you and your portfolio.

Interesting. Would you pay more in capital gain taxes if you rebalanced VXC/VCN yourself as opposed to buying an all in one etf like VEQT that does automatic rebalancing?

@Ken K – Unfortunately, it’s impossible to know. However, if you’re adding new money to VCN/VXC on a regular basis, that should reduce the amount of portfolio rebalancing necessary (although VCN and VXC could still distribute capital gains distributions).

Is that how MER is calculated on an all-in-one fund? I thought the 0.20% fee was on top of the fee captured by assets within it. Especially as some funds have 3 layers, I would not have expected for the top level MER to be all inclusive.

In other words, my thought was that XEQT makes you pay 0.20% for convenience, and the underlying assets also include an average of 0.10% for a total of 0.30%.

@Seb – The MER on the asset allocation ETFs is an all-inclusive fee (you do not also pay the additional MERs/ERs of the underlying ETFs).

I’ve been wondering if the constant rebalancing of the single fund could lead to better performance and so be worth paying the extra for, all else equal.

I rebalance by adding money to a 4 fund portfolio (one of your old model ones), but I do that a couple times a month max, so I’d probably miss out on many days of volatility, where the rebalancing could lead to buying low and selling high.

I’ve read before that the frequency of rebalancing doesn’t impact results. So maybe this thinking is just market timing and we could sometimes benefit and sometimes not, so there’s no reason to expect more frequent rebalancing to give better performance?

Is there really any point to invest in international/emerging ETFs, and bond ETFs, based on their historical performance compared to US ETFs?

@Tony – No one knows which asset classes will outperform going forward, so it’s prudent to diversify your portfolio (and not just hold U.S. equities).

For an ETF, when selling large quantities in a single limit transaction does the sell trade affect the price? As a retail investor, should one sell the investment over a few days in smaller batches or perhaps is such a trade placed via a different channel? Example, 25K shares of XEQT with a FMV of 0.8 million CAD. It would be great to hear your thoughts.

Great article. I was thinking about this exact same strategy. I think you make a compelling case for the all – in – one approach in a subversive way.

If you have a margin, tfsa, rrsp accounts, would you replicate VEQT in each account? Or would you take the component ETFs and hold them in each account? For eg, RRSP acct would have US and Cdn equity, TFSA would have international equities and so on to minimize costs even further?

Buy VEQT in all accounts for simplicity.

Great question and excellent points regarding equity.

Excellent article!

Hi Justin,

another strike against complex ETFs for Canadians is the US withholding tax on dividends. If the US part of VEQT is held in US traded ETF, then this tax can be avoided, at least within RRSP, imho. Is my reasoning correct?

I believe it would make it more tax-efficient in RRSP or non-reg accounts if that were the case – but I’m not an expert. But to that point, one thing Justin left out is the better tax-efficiency of using VCN/VXC over VEQT. This is because VXC uses VV/VB (US ETFs) to cover the US market instead of the Canadian wrapper for VTI, so only 1-layer of WHT. Plus, it also holds VWO directly to cover Emerging markets while VEQT holds VEE which is a wrapper for VWO, so again, 1 layer. I’m personally a big fan of the VCN/VXC combo.

what about rebalancing tax cost? won’t multiple funds force you to realize capital gain as you rebalancr which is more likely than capital lost as you age forcing you to pay taxes on returns? does all in one ETF shield you from rebalancing taxation?

Hey Justin, great article. Do you know if a US domiciled All-Equity fund such as AOA would work within a RRSP or LIRA to eliminate the withholding tax drag? Thank you,

I think it would be much more efficient to buy Ishares MSCI World Index (XWD) and a bond etf based on the equity/bond split you want. For example a 60/40 model would result in a 10 year average return of 10% with a low standard deviation of .08. This beats all the all-in-one etf’s and virtually all 60/40 mutual funds.

Super informative. Thanks for the detailed analysis and clear comparisons.

What are your thoughts on using a portfolio rebalancing softwear like Passiv to buy the underlying ETFs of VEQT or XEQT with the respective weights? Seems like a very easy way to save the 9 or 10 basis points as you mention without really any hassle to rebalance in the accumulation phase. Any unseen issues here?

@T.J. – As I mentioned in this blog/video, the foreign equity weights for VEQT are constantly changing, so you can’t simply include a static allocation in a portfolio rebalancing software, like Passiv (unless you opt for a 30% VCN, 70% VXC asset mix).

You could use Passiv to replicate BlackRock’s XEQT (perhaps using XIC, XUU, XEF, and XEC), but it’s likely not worth the effort for most investors, and not guaranteed to outperform the simple one-fund solution.

Folks really looking to save on fees should just use Interactive Brokers, convert to USD, pick up Vanguard VOO and VEU and call it a day. Especially in a RRSP. Arguably a better balanced portfolio as well.

Sorry to bring up an old thread. But do we know how often does VEQT/XEQT rebalances? Do they rebalance after a set period(daily/monthly/quaterly)? or when the % deviates too much from the target % (in that case, what’s the target %?) Is it documented anywhere? I tried looking through the documents and didn’t find an answer.

Hi Justin, always enjoy your posts & videos!

Regarding utilizing stale data, I have a potential solution that I’d like your opinion on. iShares publishes XAW’s holding weightings at the end of each trading day (see “Holdings” on the XAW page on iShares’ website). I typically take these values (US, EAFE, and Emerging), exclude the cash (0.12% as of this writing), and utilize those as my foreign equity allocations. As of today (June 15) I end up with 61.8% US, 27.1% EAFE, 11.1% Emerging. It does not take long to pull these values when I go to rebalance or add cash (monthly or so).

Is there a flaw in this methodology that I’m missing that would make this worse than using stale data?

@Alan – Thanks for reading/watching!

I think your process makes perfect sense (I assume BlackRock would be ensuring their asset class weightings are relatively on target each day) – thanks for the tip! :)

Hi Justin

I have about 500k to invest. With today’s turbulent market I’m hesitant to invest the 500k all at once. Right now I just have everything in a ISA. What do you think is an appropriate strategy to shift at least 80% to veqt? Thanks

@Pete – If you’re uncomfortable with investing everything all at once into an 80% equity allocation, perhaps you should start by revisiting whether this asset mix is appropriate for you in the first place (stock markets will always be turbulent).

If you’d just like a strategy for reducing regret, you could consider investing 40% of the $500K into VEQT now, and then invest the remaining 40% (or $200,000) into 12 equal monthly tranches.

Hey Justin,

Thanks for all the info with the Blog and on YouTube. With the new FHSA available I’d imagine either of these options might be on the riskier side with most people wanting to use the funds a bit earlier so what do you think would be a recommendation for an ETF with say a 2-3 year timeline? Appreciate the feedback!

@Brad – For shorter-time frames (i.e., less than 5 years), appropriate investment options include:

– Investment savings accounts (ISAs)

– High Interest Savings Account ETFs (HISA ETFs)

– Cashable GICs (or non-cashable, if you are certain on when you will require the funds)

– Short-term bond ETFs (i.e., VSB, ZSB, XSB)

MER difference is only one component to performance. Timing is another. Beside unavoidable tracking error there is also frequency. Your calculations are based on unspoken assumption that individual and Vanguard would rebalance with the same frequency and, therefore, the same accuracy. This is a pretty strong assumption.

Is there a publicly available research comparing performance of investments rebalanced daily vs monthly vs quarterly?

@Anatoli – My calculations for the back-testing assumed monthly rebalancing. I’m not sure if you read this article / watched the video, but one of my main arguments for sticking with an all-equity ETF was that an individual investor does not have the index data available to rebalance on a daily basis (so this is a strike against trying to outsmart an all-equity ETF).

Justin, I read your article. could you read my question: do you know how often ETFs like VEQT are rebalanced?

H Justin, thanks a lot for this. In the owning multiple ETF’s instead of a single asset allocation ETF option, what do you think about owning the US market ETF component directly (VTI or ITOT). This would lower the combined weighted MER further, do you think this is worth the trouble, even if Norberts Gambit is used for currency conversion?

@Simon – You’re very welcome. In my opinion, this would only be worthwhile for larger RRSP portfolios (where the investor would also benefit from the reduced foreign withholding tax drag on dividends received by VTI or ITOT in this account type).

What are the optimal component weights for an all equity portfolio? There is a discrepancy between the component weights of VEQT and XEQT, and lately my XEQT has been outperforming my VEQT (although that could reverse at some point). The Canadian economy, being at most 3% of the world’s economy, suggests a much lower weighting of VCN or XIC would be appropriate.

By the way, I really appreciate your work. When I don’t have time to immediately read an email, I make sure I flag it for reading later. None of your posts are ignored. Thanks.

@Herman – An investor would first need to define what “optimal” means to them (i.e., lowest risk?, highest after-tax returns?, highest risk-adjusted returns?, highest risk-adjusted after-tax returns?, etc.). Even after doing so, many of these outcomes can’t be determined in advance.

Historically, the lowest risk asset mix has differed, depending on the specific time period. Since 1970, it’s been around 24% Canadian stocks, 76% foreign stocks. Over the past 20 years or so, it’s been around 1/3 Canadian stocks. Both VEQT and XEQT have similar allocations to these “optimal” weights, so they seem reasonable to me (I wouldn’t argue with an investor if their allocation to Canadian stocks was anywhere between around 10% to 40%).

A 3% Canadian equity weighting is likely not optimal for most Canadian investors though. It’s never been the lowest risk portfolio over rolling 20-year time periods since 1970, and it is less tax efficient than portfolios with a higher allocation to Canadian stocks (for most investors).

My goal would be to maximize risk-adjusted after-tax returns. But as you indicate, it’s not possible to determine what portfolio compositions would achieve such a goal, in advance. I suppose one could always augment XEQT or VEQT with more of one of their component ETFs to tilt the portfolio towards the US, ex-NA developed, or emerging markets. Thank you for your feedback.

The difference between VCN+VXC vs. VCN+VUN+VIU+VEE is a lot smaller than the difference between the iShares equivalents. I wonder if Vanguard Canada will ever drop the MER on VUN to compete better with XUU, and perhaps optimize VEE’s foreign withholding tax drag to directly compete with XEC to boot.

@Bill – I expect Vanguard will eventually lower VUN’s MER and update the structure of VEE to compete with BlackRock.

Hi Justin,

Thanks for the video and blog.

I am happy with my XAW+VCN portfolio with a reduced MER.

I just need to add money to the ETF that is underperforming (would be VCN at the moment), doesn’t take much time.

And I usually only invest when I have about $5k in cash to reduce trading costs.

I m glad you mentioned this option as well!

@Jacky – It sounds like you have a very disciplined process in place – keep up the great work! :)