On March 13, 2023, BlackRock announced an investment strategy update for the iShares Core MSCI Emerging Markets IMI Index ETF (XEC).

Prior to these changes, XEC gained its equity exposure by investing in its U.S.-based counterpart, the iShares Core MSCI Emerging Markets ETF (IEMG). Going forward, XEC will invest primarily in thousands of individual emerging markets stocks. This should be welcome news to XEC unitholders, as these changes should significantly reduce the negative effect of foreign withholding taxes on the fund.

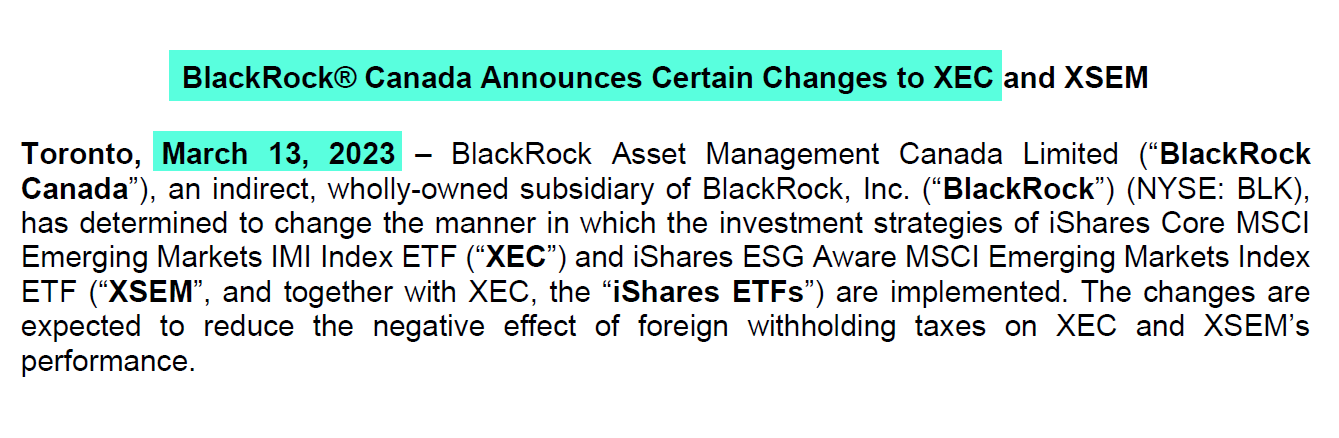

Until now, XEC was subject to two layers of withholding taxes when held in an RRSP, LIRA, RRIF, LIF, or similar account type, while IEMG was only subject to one layer.

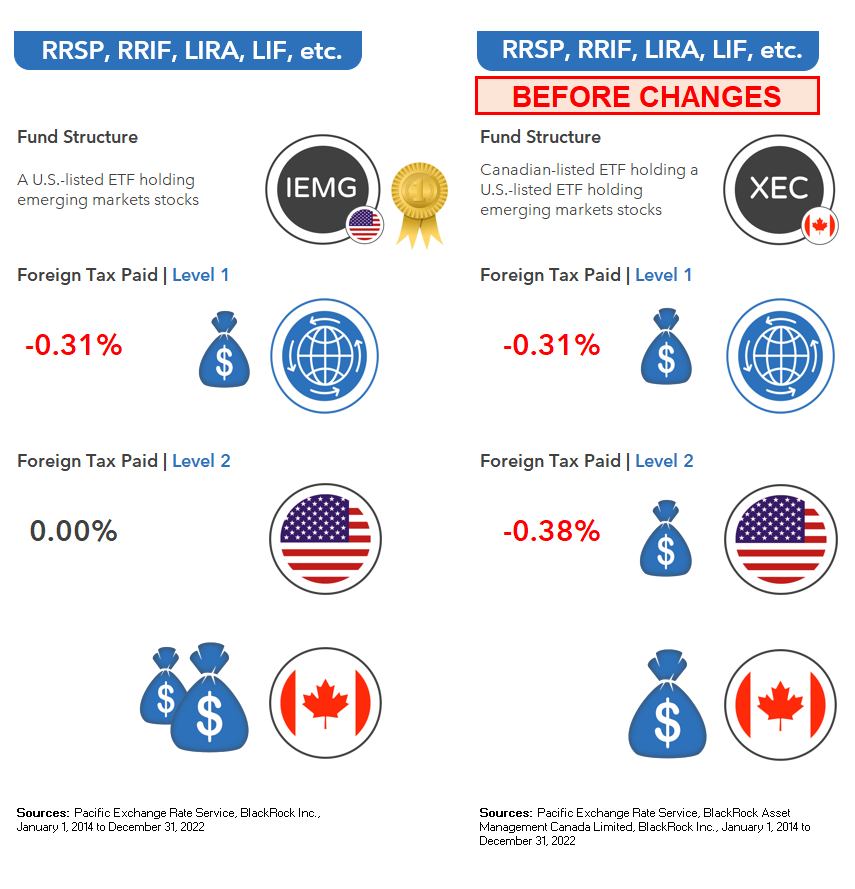

Now, foreign dividends paid from the emerging markets countries to XEC will bypass the U.S. and head directly to Canada. That’s one less layer of foreign withholding taxes for XEC. At least on that count, XEC and IEMG are now on a level playing field, as long as you’re holding them in the account types just mentioned.

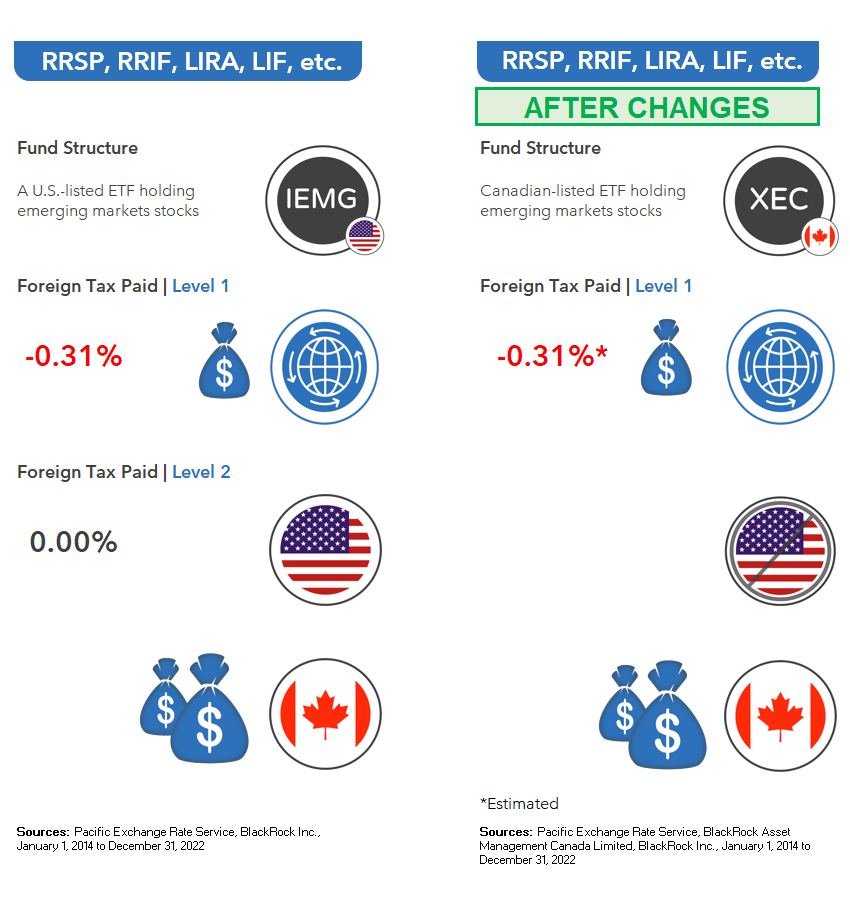

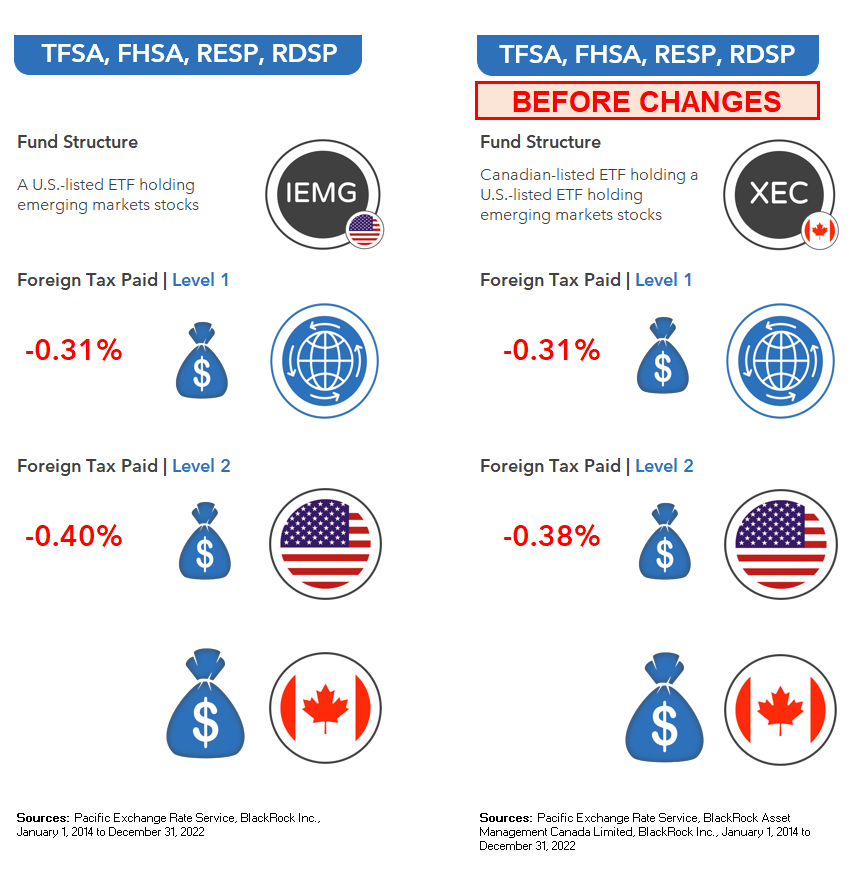

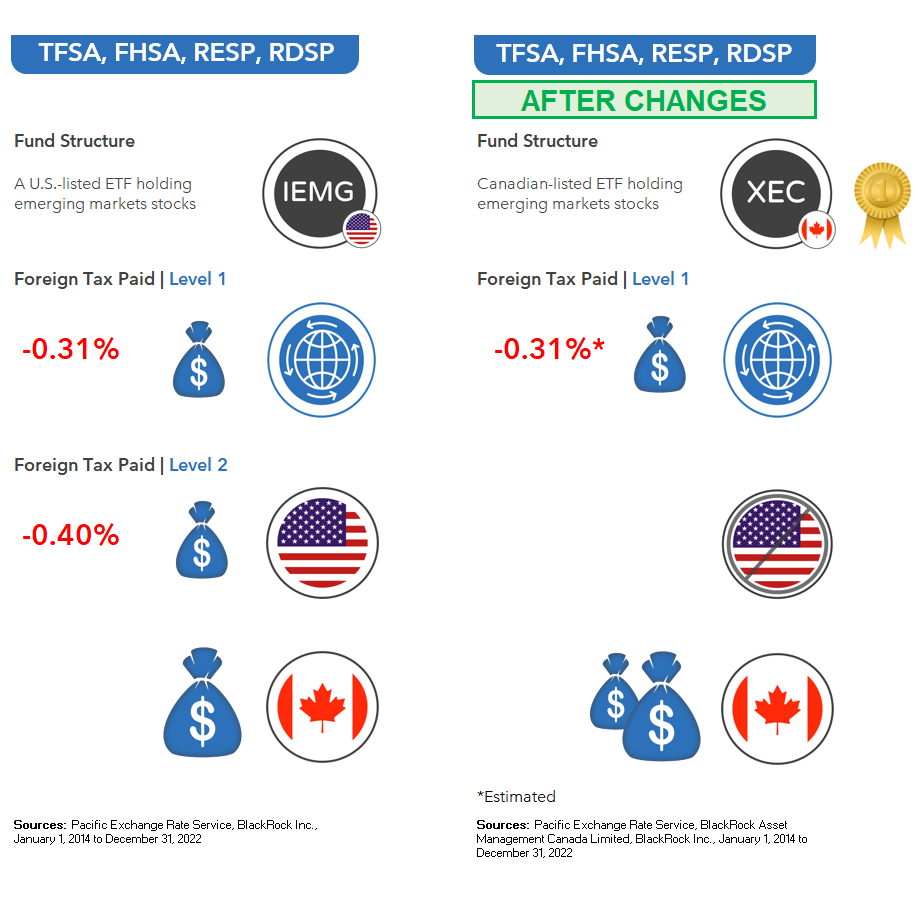

It gets even better. Before, in TFSAs, FHSAs, RESPs, and RDSPs, both XEC and IEMG were subject to two layers of foreign withholding taxes.

Now, XEC will be subject to only one layer, while IEMG is still subject to two. All else equal, this will give XEC a foreign-withholding-tax edge over IEMG.

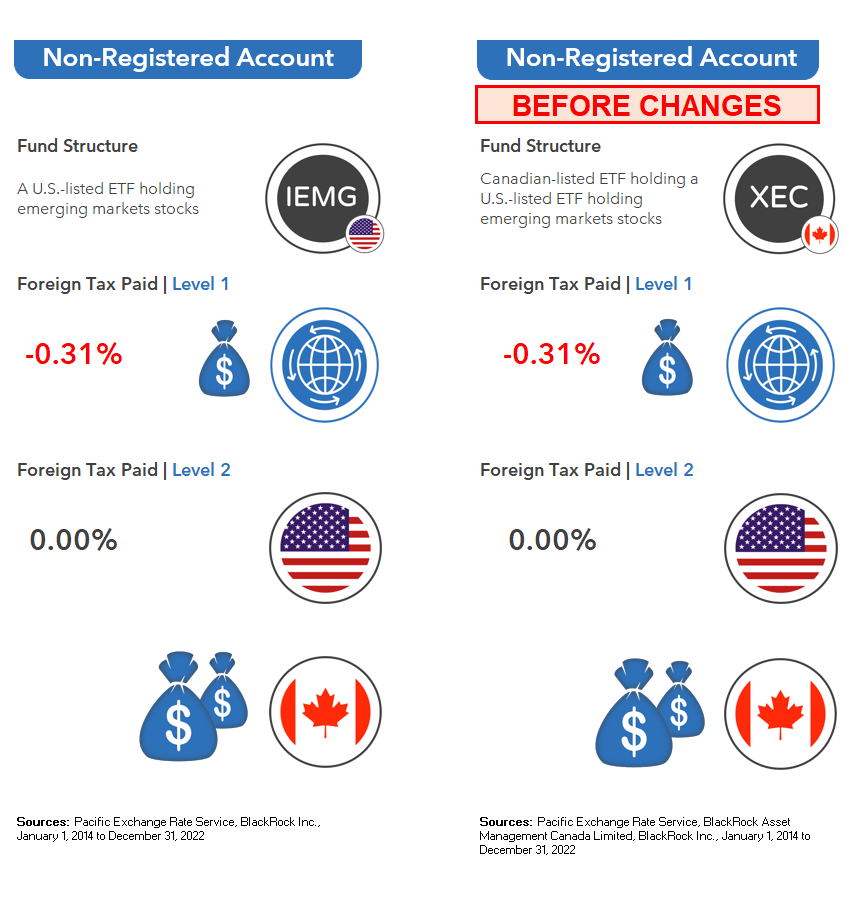

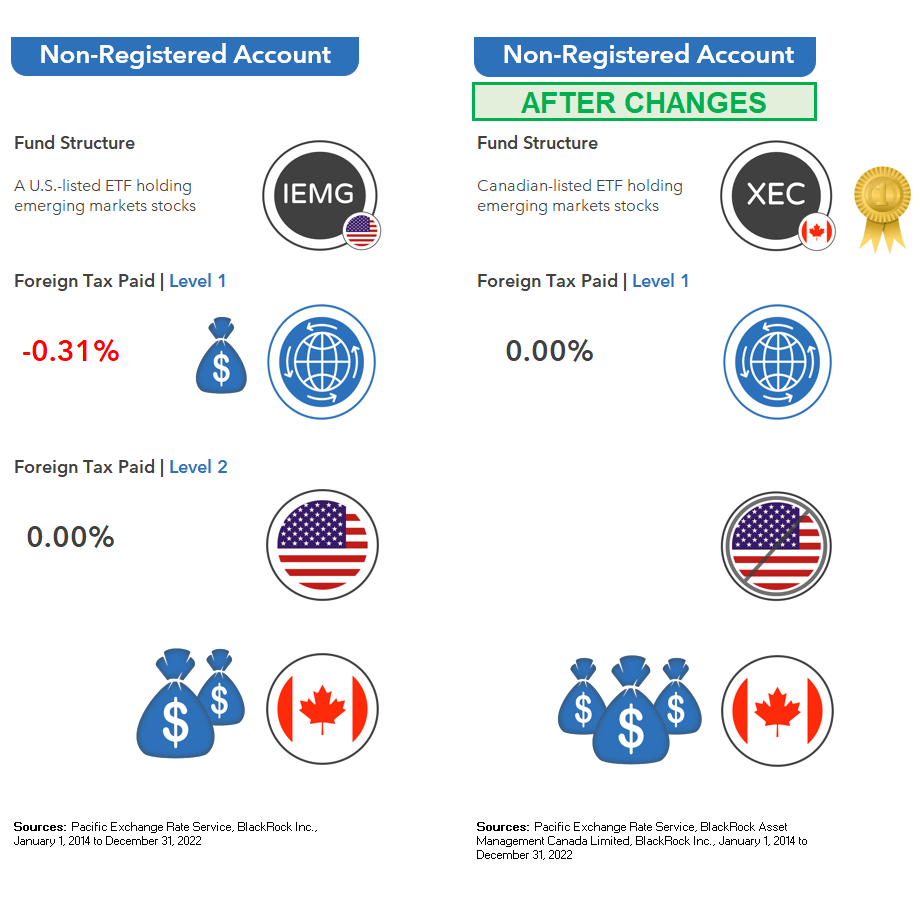

The same holds true in non-registered accounts. Prior to the changes, XEC and IEMG were both subject to two layers of foreign withholding tax drag, and only the second layer was generally recoverable at tax time.

Now, XEC will only be subject to one layer of withholding tax, and even this layer will generally be recoverable when you file your tax return.

After BlackRock’s announcement, we received several questions from our subscribers about the changes. Fortunately, I was able to sit down with BlackRock’s representatives Hail Yang and Jacqueline Tung, who shared a few additional insights with me.

First, we asked them whether there will be any negative tax consequences for XEC unitholders.

The short answer is, probably not.

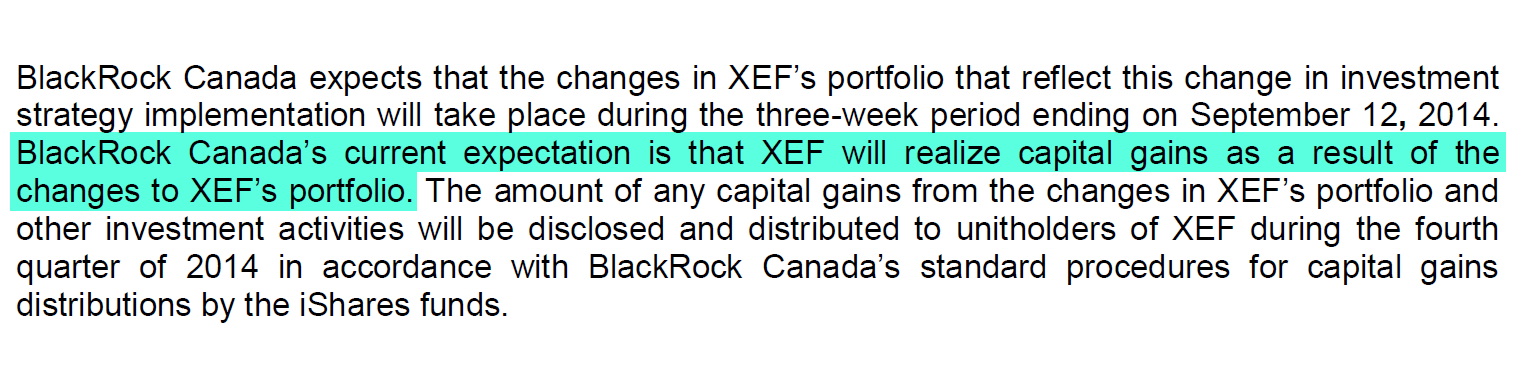

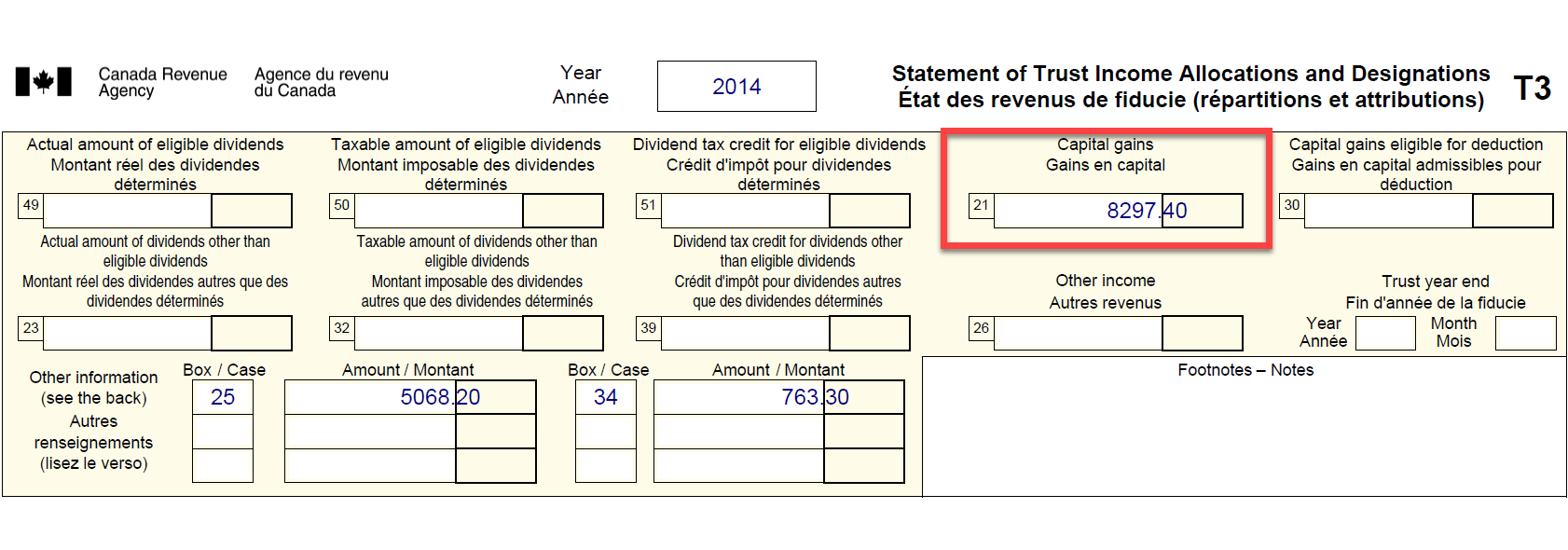

On September 12, 2014, BlackRock completed a similar change to the iShares Core MSCI EAFE IMI Index ETF (XEF). Specifically, they sold the underlying U.S.-based iShares Core MSCI EAFE ETF (IEFA) and replaced it with thousands of individual international stocks. In August 2014, BlackRock warned shareholders to expect XEF to realize capital gains as a result of the changes.

Sure enough, an investor holding 10,000 units of XEF at the end of 2014 discovered around $8,300 in capital gains on their annual T3 slip, increasing their overall tax bill for the year.

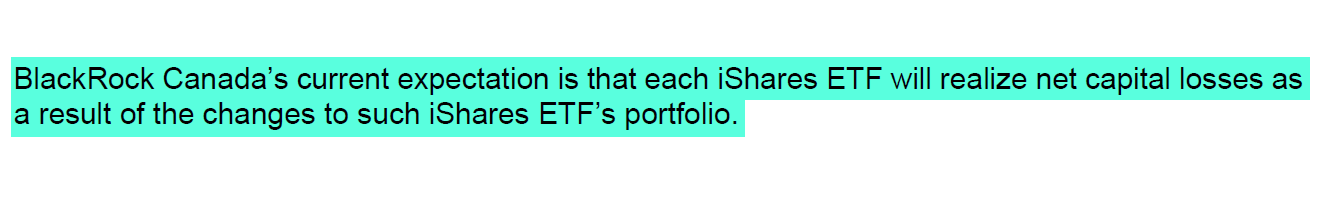

However, in their latest announcement for XEC, BlackRock indicated they expect to realize net capital losses as a result of the changes to its portfolio.

So, investors should not anticipate a significant capital gains distribution from the fund at year-end, at least not based on this specific activity.

Next, we asked whether XEC’s management expense ratio (MER) will increase.

The short answer here is, possibly, but only slightly.

When I asked Hail whether the MER would increase as a result of the changes, he indicated BlackRock had no plans to adjust the management fee, which is currently at 0.25%. However, while they are not permitted to estimate future fund MERs, we would foresee a modest increase moving forward.

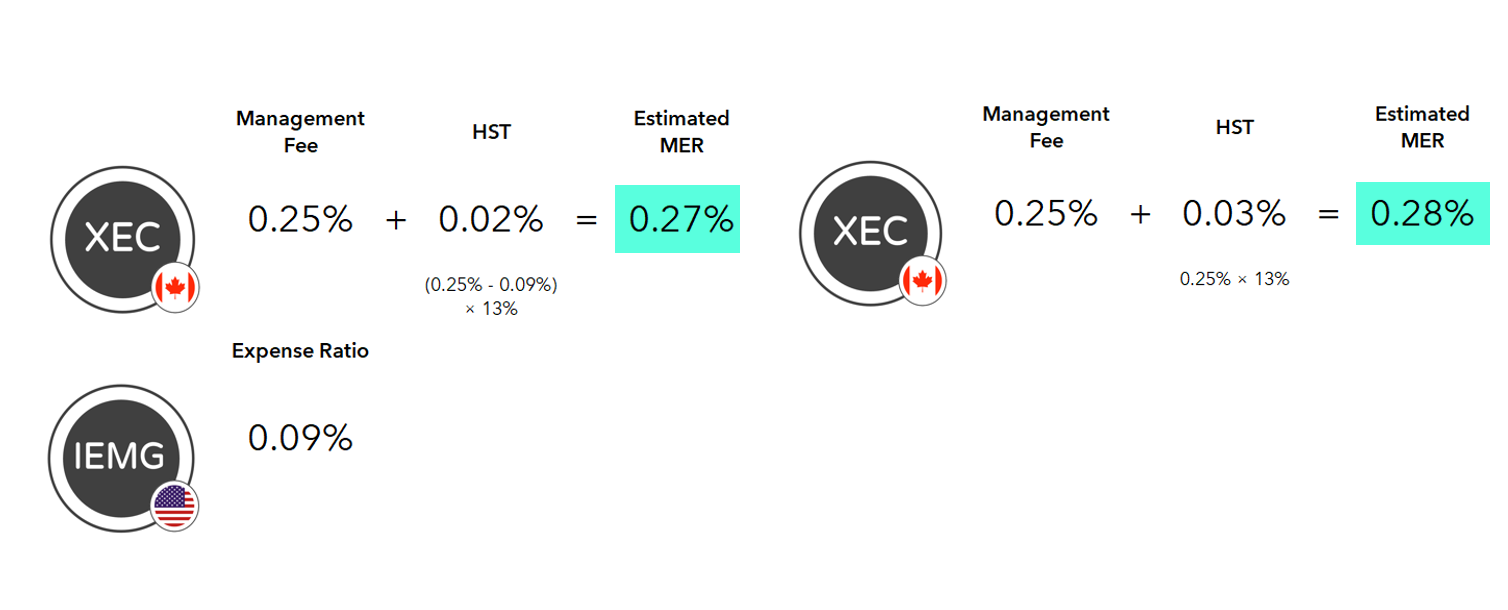

Let’s explain why. For reference, the current MER of XEC is 0.27%.

As some of you may already know: For a typical broad-market ETF, you can estimate the MER by simply adding HST to the management fee. So, if a fund’s management fee is 0.25%, you multiply 0.25% by 13% to determine the HST, and then add that to the management fee. That should be its estimated MER.

However, if we crunch the numbers for XEC, the results total 0.28% rather than its current 0.27% MER.

Hail explained that Canadian-based ETFs holding U.S.-based ETFs for their exposure must first deduct the expense ratio of the underlying U.S.-based ETF from the management fee of the Canadian-based fund before calculating the HST amount.

So, prior to the changes, XEC wasn’t charging HST on the portion of its 0.25% management fee attributable to IEMG’s 0.09% expense ratio. This could have resulted in XEC’s slightly lower 0.27% MER.

After the changes, HST will now be applicable on XEC’s entire management fee. Long story short, it wouldn’t come as a surprise if the MER were to increase slightly to 0.28% in future years.

Now, you might also be wondering about XEC’s trading expense ratio (or TER).

As a result of the changes, BlackRock does expect a higher trading expense ratio. While they would not estimate the amount, we believe we can make some educated guesses about what to expect.

Between 2014–2021, XEC’s trading expense ratio was a modest 0.02%, on average. We could compare that to the BMO MSCI Emerging Markets Index ETF (ZEM), since ZEM has directly held its underlying emerging markets stocks between 2014–2021. ZEM’s trading expense ratio over the same period averaged around 0.07%. This is higher than XEC’s historical trading expense ratio, but not by enough to offset the expected benefits of its new, more tax-efficient structure.

Another popular question: Will BlackRock replace IEMG with XEC in its iShares Core ETF Portfolios?

Once again, my BlackRock contacts were tight-lipped when it came to disclosing any future changes to their funds, but they did say the company is always looking for ways to improve their existing product line-up.

Reading between the lines, the next logical step would be to swap out IEMG for XEC in the iShares Core ETF Portfolios. This would eliminate a layer of withholding tax on their emerging markets equity allocation across all account types. And when BlackRock launched its Core ETF portfolios, they already used XEF instead of IEFA, given XEF’s tax-efficient edge.

So, a similar exchange of XEC for IEMG would be fair game. No promises, but we’ll be looking for that shift moving forward, and we won’t be too surprised if it happens.

We’ll end things off with perhaps the biggest question for anyone using other ETFs for their emerging markets exposure:

If you hold another emerging markets equity ETF, should you switch to XEC?

Here, our short answer is: It depends.

It’s not as if BlackRock invented the idea of holding underlying stocks directly in its Canadian-listed emerging markets equity ETF. But one holdout has been the Vanguard FTSE Emerging Markets All Cap Index ETF (VEE).

It still has an outdated fund structure that, frankly, seems to be on the verge of extinction.

So, if you currently hold VEE, you may want to sit tight and wait for Vanguard to play catch-up. But how long you may need to wait is anyone’s guess. Hail and Jacqueline mentioned that BlackRock had been working on XEC’s transition plan since 2021, so don’t expect Vanguard to flip a switch tomorrow.

If patience is not your strong suit, you may want to switch from VEE to XEC, provided there are no big tax hits from selling VEE in a taxable account.

You’ll also want to determine whether the switch will leave you with a double dose of South Korean and Polish companies across your overall international and emerging stock market allocations, which can occur if you pair XEC with the Vanguard FTSE Developed All Cap ex North America Index ETF (VIU).

Overall, we’re pleased with BlackRock’s recent changes to XEC. Since the fund should provide similar or superior tax-efficiency to IEMG moving forward, Canadian investors now have even fewer reasons to complicate their portfolios with a U.S-based emerging markets equity ETF.

Also, compared to its competitors, BlackRock now has the only tax-efficient emerging markets equity ETF covering the broad market, which includes around 3,000 large-, mid-, and small-cap emerging markets companies.

If XEC’s managers can keep a lid on the fund’s tracking error and trading expenses, its new tax-efficient structure should be a net positive for its investors.

ZEM from BMO has 783 stocks, with an AUM of about $1.1 billion. MER of 0.28 and TER of 0.04

XEC from iShares has 3335 stocks with an AUM of about $1.7 billion. MER of 0.27 and TER of 0.07.

VEE from Vanguard has about 5000 stocks with an AUM of about $1.9 billion. MER of 0.25% with a TER of 0%.

Assume 2.5% yield with 15% foreign withholding tax and a 50% tax bracket. If the ETF holds the stock directly (ZEM, XEC), as opposed to holding via a US listed EF (VEE), this will result in aftertax yield having an absolute increase of 0.1875%.

The main change is that XEC will now be able to directly receive dividends from emerging markets companies rather than going through a U.S. intermediary. This will reduce the amount of foreign withholding tax that XEC’s shareholders have to pay.

Hi Justin,

Are there any plans to update the FTWR calculator with the new changes to the iShares ETFs that switched from IEMG to XEC? e.g. XAW, XEQT, XGRO, etc.

Hi Justin,

Any word about them doing the same for XUU? Seems to me like that would be way easier from a implementation point of view than XEC/XEF as there is only a single country to deal with. I currently hold ITOT/IEMG/IEFA on my RRSP and would consider to replace with XUU/XEC/XEF but I don’t want to pay FWT on XUU.

Is there a “good” Canadian-listed ETF that holds US equities directly?

@Avia Abessa – XUU is already subject to just one layer of foreign withholding taxes (just like XEF and XEC), so there’s no improvement that can made (holding the underlying U.S. stocks directly won’t fix the issue). The only option would be to hold its US-based counterpart (ITOT) in an RRSP.

Hey Justin,

I love your content. Now that XEC is held in XAW, would you recommend holding XAW instead of VXC in all accounts because of the tax efficiency? I’ve read your other blog post and video where you recommended VXC because of its more passive ETF approach, and because XAW was more of an actively managed fund. If you had to recommend between either the two now, which would recommend now?

Thanks,

Dan

@Dan – I’m glad you’ve been enjoying the content! The increased tax-efficiency of XAW is not a significant benefit overall (since emerging markets don’t make up a large portion of the fund).

I think you can stick with either fund (Vanguard will catch up with iShares in the next couple years, at which point I would likely recommend VXC over XAW).

Thanks!

Of the major ETF providers, BMO was the first to try to deal with the FTC issue for its emerging markets ETF. Now, BlackRock is going to do it. Unless, the BlackRock experience turns out poorly, Vanguard will be forced to follow.

I consider Vanguard to be the most individual investor friendly of the major ETF providers. But it’s interesting that Vanguard is the follower on this issue.

I’m a bit confused. At the end you say XEC is the only tax efficient broad market EM ETF in Canada, but earlier you mentioned that ZEM directly holds its stocks. it’s also a broad market EM ETF. What am I missing?

@Kevin – “Broad market” = Large-cap + mid-cap + small-cap

ZEM only tracks large-cap + mid-cap EM stocks (it doesn’t include small-cap stocks)

Gotcha thanks!

Hi Justin, that’s great news for Canadian ETF investors. Will you be updating the foreign withholding tax calculator? I found the calculator to be really helpful when I was deciding my initial ETF allocations. Thanks again for being a trusted source of information!

@Brenda – At this point in my life, I need to pick and choose which resources I allocate my time to update (the FWT calculator is not too high on my list, as the amounts do not change much). Perhaps when Vanguard makes VEE more tax-efficient, I’ll update the spreadsheet :)

Interesting! Do you think Vanguard will follow suit? If so, would that also change for their all in one ETFs?

@Jane – I think Vanguard must follow suit to remain competitive (it just might take some time). Hail (BlackRock) informed me that it can take months for an ETF provider to just open a custodian account in an emerging country.

Hi Justin,

You mention that with this change, Canadian investors have fewer reasons to complicate their portfolios with a U.S-based emerging markets equity ETF. Are there some cases where you would still recommend holding VWO or IEMG in a RRSP, if only to benefit from the lower management fee?

@Alexandre – If an investor had already made the decision to use Norbert’s gambit to invest in a U.S.-based U.S. equity ETF in their RRSP (like ITOT or VTI), it would make sense to also use U.S.-based international and emerging markets equity ETFs (like IEFA, IEMG, VWO) to reduce the product fees, as it wouldn’t really increase the portfolio complexity at this point.