Whether you prefer podcasts, videos, or blog posts, we’ve got you covered in our most recent series on a subject that’s still foreign to many investors: foreign withholding taxes. If you’re a blog reader, just keep reading. Or, you’ll find the podcast and YouTube versions below:

The truth is, I’ve been a bit obsessed with foreign withholding taxes ever since I read a Dimensional Fund Advisors article on the topic in 2012. So inspired, I spent countless nights and weekends poring over the annual financial statements of my favourite ETFs, determined to create a methodology for estimating this mysterious, and usually hidden tax drag.

In 2013, Dan Bortolotti and I published the first edition of our Foreign Withholding Tax white paper (which we intend to update in 2020). Shortly after publication, ETF providers seemed to notice the spotlight our report cast on their foreign withholding tax distributions. Many of them started creating more tax-efficient fund structures, aimed at reducing the withholding tax drag on their existing products. Today, we’ll cover the gamut of options available.

Key Factors: Structure, Account Types, and Withholding Tax Levels

Before we dive in too deep, let’s review what I’m talking about here. Many countries impose a tax on dividends paid to foreign investors. For example, the U.S. government levies a 15% tax on dividends paid to Canadians. Because these taxes are sometimes withheld before dividends are paid in cash, they often go unnoticed. But their impact can be far greater than that of management fees, which get much more attention.

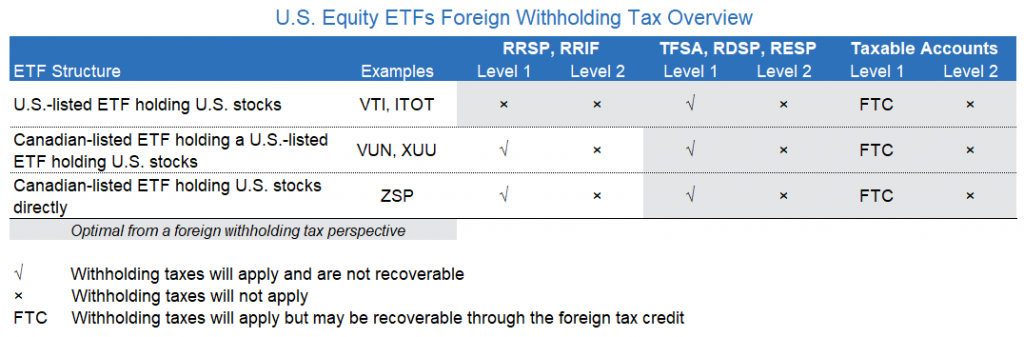

The amount of foreign withholding tax payable depends on two important factors. The first is the structure of the ETF that holds the stocks. The second is the account type used to hold the ETF. Both can be managed to minimize two layers of withholding tax levels.

Structure – Canadian ETF investors can gain exposure to U.S., international, and emerging markets stocks in three ways:

- A U.S.-listed ETF that holds the foreign stocks

- A Canadian-listed ETF that holds a U.S.-listed ETF that holds the foreign stocks

- A Canadian-listed ETF that holds the foreign stocks directly

Withholding tax levels – In all three cases, investors are potentially subject to two layers of withholding tax levels:

- Level I withholding taxes are those levied by the countries where the stocks are domiciled, whether in the U.S. or overseas.

- Level II withholding taxes are incurred when international or emerging markets stocks are held indirectly via a Canadian-listed ETF that holds a U.S.-listed ETF. Specifically, there’s an additional 15% U.S. tax on the foreign dividends, before the U.S.-listed ETF pays the net dividends to Canada.

To visualize how this double-layer of withholding tax works, think of your Canadian investment portfolio as a movie theatre seat, with a U.S. concession stand found between the theatre entrance and your seat. The cost of your movie ticket is like your Level I withholding tax. The additional cost of your popcorn, soft drink, and bag of Twizzlers is your Level II tax.

Fortunately, as most frugal moviegoers know, you can avoid the extra expenses by sneaking in your own snacks. Similarly – but lawfully – there are ways to sidestep the Level II withholding taxes on your foreign dividends. In some cases, you may also be able to avoid Level I taxes.

Account Types – Different account types in which you’re holding the ETF (such as an RRSP, RRIF, TFSA, RESP, RDSP, or a taxable or non-registered account) are vulnerable to foreign withholding taxes in different ways. For example:

- When U.S.-listed ETFs are held directly in an RRSP, or other registered retirement account, such as a RRIF or locked-in RRSP, investors are exempt from withholding tax from the U.S. (but not from overseas countries).

- This exemption unfortunately does not apply to TFSAs, RESPs, or RDSPs. But it does hold for several other registered retirement accounts, such as a RRIF, locked-in RRSP (LIRA), or life income fund (LIF).

- If you hold foreign equity ETFs in a personal taxable account, you will receive an annual T3 or T5 slip indicating the amount of foreign tax paid. This amount can generally be recovered by claiming the foreign tax credit on your return. But what if your international or emerging markets equity ETF is subject to both Level I and Level II withholding taxes in a taxable account? Here, only the second layer of U.S. withholding tax is generally recoverable.

- Since no tax slips are issued for dividends received in a registered account, any foreign withholding taxes incurred in an RRSP, RRIF, TFSA, RESP, or RDSP are not recoverable.

Now that we’ve set the stage, let’s walk through some steps you might be able to take, to mitigate your tax drag without running afoul on CRA tax codes. In this post, we’ll cover the three main foreign equity asset classes: U.S., international, and emerging markets. For each, I’ll suggest which ETF structures are the most tax-efficient for the account type, as well as when it might make sense to make an exception to the rules of thumb.

U.S. Equity ETFs in an RRSP or RRIF Account

Remember, there are three ETF structures to choose from for this asset class:

- A U.S.-listed ETF that holds U.S. stocks

- A Canadian-listed ETF that holds a U.S.-listed ETF that holds U.S. stocks

- A Canadian-listed ETF that holds U.S. stocks directly

In an RRSP or RRIF account, the first structure – a U.S.-listed ETF that holds U.S. stocks – is the winning one from a withholding tax perspective. Holding a U.S.-based U.S. equity ETF in your RRSP or RRIF exempts all dividends from the 15% U.S. withholding tax. Based on the current U.S. equity dividend yield of 1.8%, this should save you around 0.3% per year.

Some popular examples of this structure include the Vanguard Total Stock Market ETF (VTI) and the iShares Core S&P Total U.S. Stock Market ETF (ITOT). Both funds also have lower expense ratios than their Canadian-based counterparts.

But, as usual, there’s a catch: To purchase VTI or ITOT in your RRSP, you’ll first need to convert your loonies to U.S. dollars. And even if you use Norbert’s gambit to reduce the cost of buying U.S. dollars, there will be transaction costs.

As an example, suppose we’re converting $20,000 Canadian dollars to U.S. dollars. At most brokerages, you’ll pay two $10 commissions to buy and sell these ETFs for the gambit. These are DLR and DLR.U, respectively. There also will be the hidden trading cost of the bid-ask spreads. If properly executed, the total percentage cost will be roughly 0.3%. Given an annual withholding tax savings of 0.3%, you should be able to offset this cost in about a year.

But what if you’re converting a smaller amount, such as $2,000 CAD? The overall percentage cost of the conversion will be around 1.3%, which will take nearly 5 years to offset with your annual withholding tax savings of 0.3%. And remember, if and when you eventually convert your U.S. dollars back to Canadian dollars, you’ll be hit again with more transaction costs.

So, as an exception to these rules: If you have a smallish portfolio, you might want to stick with Canadian-listed U.S. equity ETFs for now.

U.S. Equity ETFs in TFSA, RDSP, or RESP Accounts

If you’re holding U.S. equity ETFs in a TFSA, RDSP or RESP, there’s nothing you can do about the withholding tax drag. U.S.-listed U.S. equity ETFs receive no preferential tax treatment in these account types, so they’re effectively the same as the other two ETF structures.

For this reason, we would recommend holding either a Canadian-listed ETF that holds a U.S.-listed ETF that holds U.S. stocks, or a Canadian-listed ETF that holds U.S. stocks directly. The Vanguard U.S. Total Market Index ETF (VUN) is one such fund with a U.S.-wrap structure. It simply holds the U.S.-listed ETF, VTI. Another example would be the iShares Core S&P U.S. Total Market Index ETF (XUU), which holds ITOT (as well as a few other ETFs). The BMO S&P 500 Index ETF (ZSP) is an example of a fund that holds the underlying U.S. stocks directly. Its structure is very similar to that of VUN or XUU from a withholding tax perspective.

As an exception to these rules: If you already hold U.S. dollars in one of these account types, you could consider purchasing a U.S.-listed U.S. equity ETF to slightly reduce your product costs. Just keep in mind that the foreign dividends will still be subject to the 15% U.S. withholding tax.

U.S. Equity ETFs in Taxable Accounts

U.S. withholding tax also applies here no matter which ETF structure you choose. You can generally claim a foreign tax credit to offset this tax drag, but you will still pay income tax on the full dividend.

As mentioned earlier, a slightly lower product cost is the main benefit of holding U.S.-listed U.S. equity ETFs like VTI and ITOT. But, since it would take many years for these product cost savings to offset the currency conversion costs to buy U.S. dollars, we still recommend holding Canadian-listed U.S. equity ETFs like VUN or XUU in your taxable account.

As exceptions to these rules:

- If you already have U.S. dollars available in your taxable account, you could consider purchasing U.S.-listed ETFs. Keep in mind, there may be additional CRA reporting requirements, such as completing a T1135 form each year. If you want to avoid the T1135 reporting, you could purchase a U.S. dollar version of a Canadian-listed U.S. equity ETF, like XUU.U. Either way, you would be required to track the cost base of your U.S. dollar-denominated ETF in Canadian dollars, which can be a bit of a pain.

- If you’re a Canadian-U.S. dual citizen, you can potentially reduce your “passive foreign investment company” or PFIC reporting costs by holding U.S.-listed instead of Canadian-listed ETFs in your taxable accounts.

Enough said about U.S. foreign tax withholdings. Next, let’s look at tax-efficient international equity ETFs for your accounts.

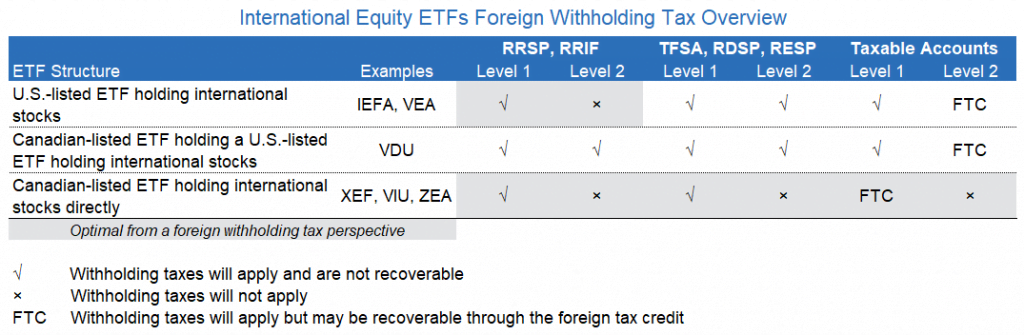

International Equity ETFs in RRSP or RRIF Accounts

When choosing between the three international equity ETF structures for your RRSP or RRIF, you can immediately scratch one of them off your list: a Canadian-listed ETF that holds a U.S.-listed ETF that holds international stocks.

This U.S. wrap structure was originally how companies like Vanguard Canada and BlackRock Canada structured their international equity ETFs. And it’s how they still structure their U.S. and emerging markets equity ETFs.

When this fund type is held in an RRSP or RRIF, foreign dividends are first paid to the U.S.-based fund, generating a layer of withholding taxes in the process. The net dividends are then paid from the U.S.-based to the Canadian-based fund, creating another layer of withholding taxes in the process. The end result is a tax drag of around 0.7% per year. This fund structure can still be seen – although probably best avoided – in ETFs like the Vanguard FTSE Developed All Cap ex U.S. Index ETF (VDU).

The remaining two fund structures avoid the second layer of U.S. withholding tax in RRSPs and RRIFs, but for different reasons.

A Canadian-listed ETF that holds international stocks directly allows the foreign dividends to bypass the U.S. on their way to Canada. The second layer of withholding tax is thus avoided, although the first layer still applies, based on foreign companies paying dividends to the Canadian fund. The result is a tax drag of around 0.3% per year.

Examples of funds with this structure include the iShares Core MSCI EAFE IMI Index ETF (XEF), the Vanguard FTSE Developed All Cap ex North America Index ETF (VIU), and the BMO MSCI EAFE Index ETF (ZEA).

A side note: In February 2014, when BMO launched ZEA they held its underlying stocks directly, making it the most tax-efficient ETF on the block. Interestingly, BMO didn’t even set out to create a more tax-efficient fund. It just worked out that way. If you’d like, you can listen to the podcast version of this post (at minute 11:31), to hear BMO’s Managing Director and Head of ETF and Managed Accounts Kevin Prins share his perspective on how the fund has evolved.

Finally, there’s the U.S.-listed ETF that holds international stocks. This structure also avoids the additional tax drag when held in an RRSP or RRIF, where it is exempt from U.S. withholding tax.

An example is the iShares Core MSCI EAFE ETF (IEFA), which offers two additional benefits. First, IEFA has lower product fees. Its annual cost is 0.07%, compared to XEF’s cost of 0.22%. Second, IEFA is expected to have a lower tracking error relative to its index. It’s currently around 26 times bigger than XEF, and can arguably track its index more closely with this level of scale.

International Equity ETFs in TFSA, RDSP, RESP, or Taxable Accounts

When holding international equity ETFs in TFSA, RDSP, and RESP accounts, the preferred fund structure is a Canadian-listed ETF that holds international stocks directly. This structure results in only one layer of foreign withholding taxes, while the others have two layers. So, if you’re holding international equity ETFs in your TFSA, we’d suggest opting for XEF, VIU, or ZEA.

We prefer the same for taxable accounts. When you hold a Canadian-listed ETF that holds international stocks directly, only one layer of withholding taxes will apply – and even that one may be recoverable.

Compare that to the other two structures: (1) U.S.-listed ETFs like IEFA that hold international stocks, or (2) Canadian-listed ETFs like VDU that hold a U.S.-listed ETF that hold international stocks. Both of these are subject to two layers of withholding taxes, and only the second layer of U.S. withholding tax may be recoverable. So again, our vote for taxable account holdings goes to ETFs such as XEF, VIU, or ZEA.

The takeaway? If you don’t feel like messing around with Norbert’s gambit to convert your Canadian dollars to U.S. dollars, you may want to just hold XEF, VIU, or ZEA in ANY account type, as relatively tax-efficient choices.

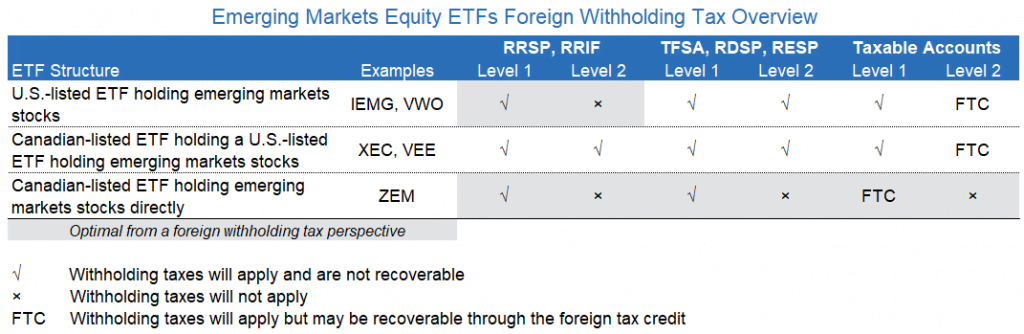

Emerging Markets Equity ETFs in RRSP or RRIF Accounts

Before we dive into our take on emerging markets ETFs, we again direct you to the companion podcast to this post, if you’d like to hear from Steven Leong, Director and Head of Canada iShares Product at BlackRock. There (at minute 18:40), Steven discusses XEF’s transition away from the traditional U.S. wrap structure, as well as why BlackRock still uses the U.S. wrap structure on some of their other asset classes, like emerging markets equities.

Here, we note that BlackRock Canada’s emerging markets equity ETFs do not hold the emerging markets stocks directly. The same can be said of Vanguard Canada’s emerging markets equity ETFs. So, although the main ETF providers have all taken action to improve the tax efficiency of their international equity ETFs, so far only BMO has taken the leap into creating a more tax-efficient emerging markets equity ETF.

Even so, in RRSPs and RRIFs, the rules work the same for emerging markets as they do for international equity ETFs. The most tax-efficient structure would either be a U.S.-listed ETF that holds emerging markets stocks, or a Canadian-listed ETF that holds the emerging markets stocks directly. In both cases, you avoid the second layer of U.S. withholding tax, so your overall tax drag is around 0.3% per year.

Examples of U.S.-listed ETFs include the iShares Core MSCI Emerging Markets ETF (IEMG) and the Vanguard FTSE Emerging Markets ETF (VWO). Both of these invest in large-, mid-, and small-cap emerging markets stocks. The BMO MSCI Emerging Markets Index ETF (ZEM) is a Canadian-listed ETF that holds the emerging markets stocks directly. ZEM only invests in large- and mid-cap emerging markets stocks, so it is not as diversified as IEMG or VWO.

What if you choose to hold a Canadian-listed ETF that holds a U.S.-listed ETF that holds the emerging markets stocks? For that, there’s the iShares Core MSCI Emerging Markets IMI Index ETF (XEC), which holds IEMG, or the Vanguard FTSE Emerging Markets All Cap Index ETF (VEE), which holds VWO. With either, your withholding tax drag will increase from 0.3% to around 0.7% annually.

Emerging Markets Equity ETFs in TFSA, RDSP, or RESP Accounts

In TFSA, RDSP, and RESP accounts, the most tax-efficient fund structure is a Canadian-listed ETF like ZEM, which holds the emerging markets stocks directly. It will result in only one layer of foreign withholding taxes, while the other structures will have two layers of tax drag.

However, along the theme of Steven’s comments, it’s worth noting that this structure generates other, indirect costs to consider. As such, while ZEM’s structure is arguably the most tax-efficient from a withholding tax perspective, that doesn’t mean it’s the optimal structure when all costs are considered (I’ll be posting a separate blog post shortly which compares ZEM and XEC).

Emerging Markets Equity ETFs in Taxable Accounts

Last up, in taxable accounts, only one layer of withholding taxes will apply – and may be recoverable – if you hold a Canadian-listed ETF like ZEM, which holds emerging markets stocks directly. There are U.S.-listed ETFs like IEMG or VWO that hold emerging markets stocks, or Canadian-listed ETFs like XEC or VEE that hold a U.S.-listed ETF that holds emerging markets stocks. Both of these types will be subject to two layers of withholding taxes, and only the second layer of U.S. withholding tax may be recoverable. Even so, I’ve still chosen to hold XEC or VEE in my clients’ taxable accounts … at least for the time being.

Up Next in Part II: Global Equity, Global Bond, and Asset Allocation ETFs

Wow. We’ve now covered three kinds of fund structures for U.S., international, and emerging markets stock ETFs, across a range of investment account types available. That’s a lot of ground covered! In Part II in this series, we’ll take on global equity, global bond, and asset allocation ETFs in similar fashion. Hang onto your hat. We’ll be back with that soon.

What about CAD-hedged versions of a Canada-listed international equities ETF – like ZDM (which holds ZEA), or VI (which holds VIU)? If it’s a Canada-listed ETF holding another Canada-listed ETF for currency hedging reasons (versus holding the international stocks directly), are foreign witholding taxes still recoverable in a Canadian taxable account?

Hi Justin – how should investors factor in currency value?

Today USD is worth 20% more CAD than 10 years ago. A win if you deposited in 2012 and withdraw today.

If CAD rises then doesn’t this potentially offset not just any tax benefit but reduce the gain down to nothing?

Thanks

@Norbit – Currency fluctuations are a risk when investing in foreign equity ETFs. Over the long-term (i.e., 20 years), currency fluctuations tend to have minimal impact. However, if this risk concerns you, you can always opt for currency-hedged ETFs.

Should You Invest in Currency-Hedged ETFs: https://www.youtube.com/watch?v=5VmgejOxkkw

Thanks Justin.

Sorry I should have provided more context. I am trying to determine if I can buy a broad based US market ETF and avoid the 15% non-resident tax.

Am I right in saying, using a CAD hedge ETF wouldn’t allow me to avoid the tax as these trade in CAD?

Thanks

Does FWT apply to the new FHSA? Is it treated as a TFSA, or is it exempt like a RRSP?

@Jen – I would expect the new FHSA to be treated similar to TFSAs from a foreign withholding tax perspective.

Hi Justin, Thank you for this great article.

Regarding the “CAD Based ETF that holds US equities in a RRSP account” scenario:

Say I use my RRSP account (which is far from being 6 digits ;) ) to hold exclusively a US preferred share index ETF like ticker symbol ZUP with currently 6% per year dividend yield…Would you suggest changing towards something like PFF,a US Based ETF that has an equivalent purpose, with US Dollars? According to my math, the account’s FWT would reach close to 1% in my scenario… Thanks for your advice.

@Guillaume – I’ve never researched either ETF, so unfortunately I can’t comment on their similarities. But if U.S. foreign withholding taxes are a concern, then theoretically buying a U.S.-listed ETF in your RRSP could mitigate this issue.

Keep in mind that if you get gouged on currency conversion fees by your brokerage on the purchase of PFF, and the eventually sale (typically in the 2-3% range each way), this could offset any benefit from the withholding tax reduction.

I’ve read from other blogs that FWTs from international stocks/ ETFs are not recoverable, but US FWTs are. Thus for an ETF like ZEM, is the FWT recoverable? Since all dividend income is generated internationally.

Similarly, For an ETF like XEQT, is there a way to recover the US portion of FWTs in a non-registered account? The tax breakdown sheet for XEQT from the CDS website clumps all foreign non-business income together.

nvm, I look through my income tax forms for the 2021 tax year and realized that they are indeed recoverable.

Thank you for this amazing blog!

Question about U.S listed ETFs held in an RRSP/LIRA for Canadians. Do we need to complete form W-8BEN (for individuals) not to pay FWT?

@Mike – You’re very welcome!

You don’t need to complete a W-8BEN form for your RRSP/LIRA accounts (only for TFSA and non-registered accounts).

If I buy a Canadian listed ETF in my tfsa and that ETF holds us stocks in it, am I taxed anything on it?

@Jer – Yes, the U.S. dividends will be subject to a 15% unrecoverable withholding tax.

Thanks for the reply, I just want to ask one more thing to make sure I understand correctly. Are the capital gains from the investment taxed as well in my tfsa or just the dividends? For example if I bought an ETF let’s say XEI and 3.53 percent of the etf is in US holdings I would be just charged a 15% withholding tax on the dividends from the 3.53 that is In US holdings?And there is no tax information I would have to keep record of? the tax is automatically deducted and I don’t have to file anything?

@Jer: Capital gains are not taxed in your TFSA. There are only unrecoverable foreign withholding taxes which may apply on foreign dividends:

https://www.youtube.com/watch?v=NSkub4OqkuM

Your example of XEI would be correct. There is no tax information you need to keep track of (the tax is automatically deducted and simply reduces your net return).

I have a related question for FWT. I verified my statements in my TFSA, non registered and RRSP accounts and noticed for example XUU, VFV and XEF did not appear to have FWT. I multiplied my number of shares by what was declared as a dividend on Vanguard/Ishares sites for these ETFs and it equalled what was paid as a dividend to me in my statements (as opose to a lower amount net of FWT). There was no other line on my statement that showed any FWT. This was true for both my brokers accross all these accounts. Does Ishares/Vanguard list the dividends on their site net of FWT? For my non registered account I receive the amount on my T3 of FWT paid but was suprised to see my units*dividend declared on Ishares/Vanguard site equal to what was paid to me with no other fees on my statements. Is there more to consider?

@Mike – You’re correct – iShares and Vanguard list the “net” dividends on their websites, so these figures are after the foreign withholding taxes have been applied.

Hi,

I’ve read your PWL Foreign Withholding Tax PDF and I have a few questions:

1) You calculate FWT as: 15% * (Div. Yield – Expense Ratio). I’m not quite understanding why we subtract the expense ratio from the dividend yield? Do we need to add the expense ratio back on top of the FWT to get the real net expense ratio of an ETF?

In your first example in the PDF with VTI you calculated FWT as: 15% * (2.07% – 0.05%) = 0.30%. Do we need to add 0.05% back on the FWT calculation to get the real estimated ETF net expense ratio of 0.35%?

2) The dividend yield differs every day as the market fluctuates in pricing. I see the common method is to add up the last four quarterly dividend distributions per share and divide by the current price of the ETF to get the “current” dividend yield at a specific moment of time. Would it not be better or more accurate to take the average dividend yield of the fund in the last 5 or 10+ years before calculating the approximate FWT on an ETF?

3) I love your FWT calculator spreadsheet, and am trying to learn about the various formulas/calculations you’ve created so that I can create my own similar calculator spreadsheet that is more frequently updated and has additional ETFs. I’m trying to understand some of the calculations in the hidden columns. Especially the Level I and II columns. You have some formulas such as “=9408000/(1233622000+9408000)”. I’m curious where these numbers are coming from?

Thanks for all your great work on your Blog/YouTube/Podcasts.

@Adam:

1) The US-based ETF deducts their expense ratio before the US FWT is applied, so it must be deducted. The calculation is for the foreign withholding tax ratio (not the MER, which can be found elsewhere). You can add the two figures together if you’d like to determine a more complete “total cost”.

2) This is incorrect. I currently use the gross dividend yield at the end of the proceeding year. I don’t see how calculating the past 5 or 10 years of past data would be more accurate than a more current calculation based on more current dividend yields and tax treaties/region allocations.

3) This is all explained in my white paper: https://www.pwlcapital.com/wp-content/uploads/2018/06/2016-06-17_-Bender-Bortolotti_Foreign_Withholding_Taxes_Hyperlinked.pdf

Thanks for the reply. I re-read the white paper and understand more now that these calculations are coming from the Annual Reports. I’m looking to calculate the most recent figures on some of the ETFs.

For example in the latest 2021 Annual Report for iShares IEFA, under the Statement of Operations section it has the following relevant values:

Dividends Unaffiliated – 2,203,421,788

Dividends Affiliated – 6,067

Foreign Taxes Withheld – (195,842,561)

Foreign Withholding Tax Claims – 60,786,570

Would the correct calculation be:

(195,842,561 – 60,786,570) / (2,203,421,788 + 6,067) = 6.1%

Or do you have to leave the Tax Claims figure out of the calculation?

Thanks again!

Hi Justin!

I am in my 40’s, new to investing but I don’t want some cash sitting in my savings. I would like to buy ETF that holds international stocks & keep it in my TFSA. Would ZSP, ZAG or ZQQ a good pick? I am looking for a growth stock etf that isn’t so complicated and I can just hold & keep. Please advise!

Thanks so much!

@JM – Hey there! If you’re new to investing, check out the asset allocation ETFs found in the model portfolio section of the blog (they range from very conservative to very aggressive). Also check out these videos to help you choose between them:

How to Choose Your Asset Allocation ETF: https://www.youtube.com/watch?v=JyOqqtq12jQ

Asset Allocation ETFs – Vanguard vs. iShares: https://www.youtube.com/watch?v=jehooxCWU1k

Hi Justin,

Quick question about something you may have looked into. If you have not, it’s not a quick question, but I would like to hear your response nonetheless (even on the basis of “is this a possibility?”)

Is the percentage of foreign withholding tax incurred on foreign dividend income earned by a Canadian-resident vs US-resident ETFs higher or lower (based on similar index holdings) depending on the respective ETFs’ home countries’ respective treaties with the countries of the companies whose stocks the ETFs hold?

As on data point, I have discovered that certain developed countries have more advantageous/lower dividend withholding taxes in treaties with the US vs Canada (UK is one example).

As an exemplification of my question, when comparing IEMG and ZEM (assuming same holdings for argument’s sake), is it possible that IEMG incurs a lower foreign withholding rate of taxation within the fund (and before it distributes the dividend income to unit holders) on the dividends it receives (because it is US domiciled) when compared to ZEM (which is Canadian domiciled)? Or the other way around, if Canadian ETFs had the upper hand based on tax treaties? Food for thought. Have you encountered any literature on this?

@Baba Novac – You are correct! The tax treaties between foreign countries and the U.S. vs. foreign countries and Canada will be different, but this is accounted for in the estimated foreign withholding tax ratio (FWTR).

Hi Justin, thanks for your great content. I’m wondering, what about stocks that are cross listed? For instance, ENB is available in both NYSE and TSX listings. Does a Canadian have to pay foreign withholding tax on dividends if they purchase NYSE:ENB?

@K – You shouldn’t have withholding tax applied on inter-listed Canadian stocks (like ENB), even if you purchase it on the NYSE.

So, if structure 1 (US listed/ US stocks) wasn’t an option but one could choose between the other 2 structures and from either RRSP, TFSA or unregistered accounts, than my take-away is your unregistered accounts is actually best for US allocation, correct? Because of the FTC. Did I miss something?

In this scenario the investor has maxed TFSA and RRSP, thus also has an un-registered account. I’m thinking for an account that size maybe they would want to look into a USD account to hold “structure 1 ETFs” but that is another matter.

Hi Justin, for a US-listed ETF holding US stocks, if my RRSP is maxed out, the next most efficient account to invest in a US-listed ETF holding US-listed stocks if deciding between a TFSA, RDSP, or taxable account, would be the taxable account because level 1 FWT would be recoverable, correct?

@Jon: From an income tax perspective, it would generally be more tax-efficient to hold a U.S.-listed ETF holding U.S. stocks (like VTI or ITOT) in a TFSA or RDSP (before a taxable account). From a foreign withholding tax perspective, it would generally be more tax-efficient to hold VTI/ITOT in a taxable account (before a TFSA or RDSP). And from an asset location perspective … it depends.

Be careful not to base your investment decisions on just foreign withholding tax implications – they are just one piece of the total taxes you will pay.

Justin, I’m am still confused with your answer here in terms of direction…

If you have maxed your rrsp with vti, iefa, and iemg w norbert’s gambit. The next best place to purchase US and international ETFs would be a taxable account as vti and Zea since most of the foreign tax will be recovered no?

This would keep the tfsa space for zcn.

Or is it more tax efficient to hold vti and zea in the tfsa and move zcn over to taxable account since canadian eligible dividends are taxed favourably?

Hello Justin!

I have a high 6 figure portfolio, and I am trying to setup my portfolio in the most tax efficient manner, I’ve read your blog

posts, saw your youtube video and listened to the podcasts. Thanks for putting out such important and helpful information!

I am in british columbia, and I am in the 28.20% combined federal and BC income tax bracket ($49,020 up to $84,369 yearly income)

Currently my total portfolio allocation is:

47% XUU

24% VIU

24% XIC

5% VEE

The way I have located my holdings is:

Maxed out my wife’s and my TFSA with as much XUU as possible (0.26% unrecoverable FWT), and the rest of the holding are in taxable account (still includes some XUU as well as the other ETFs). I will ignore my RRSP for this example, since the balance is small relative to my total portfolio (only about 5% of my total portfolio), and in that account specifically I chose to hold only VEQT for simplicity.

I have read a comment on your blog where you say to someone “Or you could hold the least tax-efficient asset class in your TFSA, which would be international equities (like VIU).” Using your withholding tax calculator spreadsheet, it seems like an ETF such as XUU (which I use to hold my US exposure) is more tax efficient (less unrecoverable FWT) in a TFSA (0.26%) vs VIU (0.29%). Could you please clarify?

In your “asset location strategies with the plaid model etf portfolios” podcast, you say that “canadian equities are a natural fit there (TFSA), since dividends from canadian sources are not subject to foreign withholding taxes”.

While acknowledging that in your example, the tax payer is in a much higher tax bracket than mine (and maybe that’s where the recommendation difference could come from) doesn’t it make sense to put foreign equities in the TFSA (and pay minimal FWT, such as 0.26% on XUU, while saving on dividends and capital gains taxes), while on the other hand seize the “eligible dividends tax credit” by placing canadian equities in my taxable account ?

Thanks again for all the work on your blog, podcast and youtube channel!

Eduardo

Justin,

This is an incredible article. I wished I had read it earlier.

Would dividends paid by ETFs be eligible for the dividend tax credit? The dividend tax credit is available on dividends paid on Canadian stocks held outside of an RRSP, RRIF or TFSA. Is it dependent on whether the ETFs are domiciled in Canada or the underlining securities must be Canadian?

Would there be foreign tax withholding on capital gains on US-domiciled ETFs?

Have you written about how we can be tax-efficient on larger ETF portfolios?

Thank you again.

Hi Justin,

My name is Adi and I have recently starting to research more about ETFs and want to thank you immensely for your content

(particularly calculators and youtube tutorials)

I’m looking at holding ETF’s in my RRSP and TFSA accounts and looking at a long term (“buy and hold”) strategy to save for my retirement. Specifically, I’m interested in CAD listed ETF’s which invest in US stocks-specifically-VFV, VUN, XUU. I was hoping to clarify some questions around taxation

1. I know you mentioned that if we invest in CAD listed ETF’s investing in US stocks, then we are subjected to withholding taxes. I’m planning to go with a DRIP for the above ETF’s I mentioned. In this case, will I still be paying withholding taxes if I choose DRIP

2. If I were to buy the US-listed ETF’s, I would be getting fewer units given that CAD currency has a lower value than US $ and the NAV of the US ETF’s is higher–> So, would this be a good strategy to hold fewer units of a US-listed ETF than owning more units of a CAD equivalent like VFV?

3. Let’s say, I retire 30 years from now and I plan to sell my CAD listed ETFs (e.g. VFV) to withdraw money for retirement–> In this scenario, will I be paying any tax on the US side?. I’m really concerned about this as paying US taxes on a huge amount at the end of 30 years will dent by retirement savings.

Thanks again for your help

@Adhithya:

1. A DRIP is simply an administrative tool (so that dividends are automatically used to purchase more shares). Arranging a DRIP on an ETF does not get rid of the foreign withholding tax implications.

2. The number of ETF units held is mostly irrelevant (some ETFs have higher unit values just because they’ve been around longer).

3. Although I can’t predict what tax rules will be in place in 30 years, selling VFV currently would not result in any U.S. tax implications for a Canadian investor (with no U.S. ties).

Hi Justin,

Thank you so much for your crisp and insightful response. I was hoping to ask you a quick follow up question around this point

1. Are withholding taxes applicable to index funds? For e.g. Will witholding taxes apply to TD E-series index funds which are listed in Canada but invest in US-based companies?

2. I understand that index funds have higher MER than ETFs. So, if index funds are not subject to withholding taxes like ETFs…then in the long run (let’s say in 30 years), which one would yield better returns, for eg. TD E-series index funds (high MER, no withholding tax )vs Vanguard S&P 500 ETF (low MER, withholding tax?

Essentially, I wanted to know between a higher MER and withholding taxes, which can impact long term returns

3. When we invest in ETFs every month/bi-weekly, would we get the compounding benefit (which we get when investing regularly in Mutual Funds )

@Adhithya:

1. Yes, withholding taxes are applicable to index funds/mutual funds which invest in foreign securities.

2. An ETF that has a lower fee, similar fund structure, and tracks the same index, would be expected to outperform a higher cost index fund.

3. If you have more units invested in an ETF whenever it increases in value, yes, you would make more money (the opposite is also true).

Hi Justin,

I’m wondering when Part 2 will be available. Also, if an ETF contains both U.S. and international stocks, such as in many Global ETFs, how is the FWT calculated?

@Chantal Moore – Part 2 is already available :)

https://canadianportfoliomanagerblog.com/part-ii-foreign-withholding-taxes-for-global-equity-global-bond-and-asset-allocation-etfs/

If an ETF contains both U.S. and international stocks, the FWT calculation would be a weighted-average of the FWT of each equity region.

Hey Justin, suppose I wanted to estimate foreign withholding taxes on an ETF that is not a total market ETF / not an ETF found in your Calculator spreadsheet. Is there a whitepaper or a link describing how I may do this myself?

I am interested in IJS and IUSV inside an RRSP, which are US-listed ETFs that hold US listed stocks, from Ben Felix’s old model portfolios.

I also may wish to investigate other factor ETFs, such as the new ones from Avantis or Dimensional. These are US-listed ETFs for US, international, or emerging markets segments. Thoughts on how to go about this?

@Mark Hermann – Here you go!

https://www.pwlcapital.com/resources/foreign-withholding-taxes-estimate-hidden-tax-us-international-equity-etfs/

@Justin: I was wondering about foreign withholding taxes, and how they are paid and not paid.

For example, if I have a TFSA and a RRSP account at Questrade and hold for example VTI in both, how can I tell I need to pay the taxes for the TFSA but not the RRSP? Is it automatically done behind that scene? Does Questrade have a part in it?

Thanks, Que

This is great materiel and worths a lot. the best i found in internet in term of quality, details and clarity. You really broke it down.

I just want to thank you so much.

from a CFA holder.

@SE – Thanks! I appreciate you reaching out :)

Hi Justin,

I don’t have a company pension and make a moderate salary so my portfolio is small-ish. I’m not interested in converting US funds held in a Canadian ETF to USD in my RRSP, is it still preferential to hold my US equities in my RRSP? This is still more tax friendly than holding them in my TFSA, correct?

Thanks in advance,

Paul

@Paul: From a foreign withholding tax perspective, there is no difference between holding Canadian-based U.S. equity ETFs in your TFSA or RRSP.

Are there any Canadian mutual fund trusts that have only RRSP and RRIF accounts owning units, so that the mutual fund trust can apply for withholding tax exemption? That way, investors can invest in a Canadian mutual fund trust that invests in US stocks, and not be subject to the 15% withholding tax.

@Aada: I believe some employer group Registered Pension Plans are set-up in this manner, but I’m unaware of any retail products available (but it would be a cool development).

There was talk of DFA mutual funds releasing a version of their U.S. equity fund with this feature, but it never materialized to my knowledge.

Hi Justin! Thanks for all your work which you put into this homepage. I hope you can help me with my question.

Lets say I have VEQT in my TFSA. I had an annual growth of 10%. My $10.000 are now worth $11.000. Do I have to pay tax on the captial gains which I made, or is the capital gain tax-free?

Another question: Do I have to report anything regarding my TFSA + VEQT in my tax return, eg that I payed FWT on VEQT?

Thanks a lot,

Mario

@Mario: You’re very welcome! In regards to your questions:

1. You are not required to pay taxes on capital gains realized in a tax-free account ever.

2. You are not required to report anything concerning your TFSA income on your tax return (i.e. such as how much you lost in unrecoverable FWT on VEQT)

Hi Justin, thanks for all your work on helping explain FWT. I am working on implementing the process you published in the PWL white paper to try to estimate FWT for various ETFs and ran into a couple of areas I wasn’t sure about:

1) Do FWTs apply to all distributions (including those from foreign income, capital gains, and/or return of capital) in addition to foreign dividends? E.g. in the ZEM 2019 annual report, distributions from dividends, capital gains, and return of capital are all listed, but it is unclear to which the foreign withholding taxes applied.

2) When estimating level 1 and/or level 2 FWT on a wrap structure international ETF (e.g., XEC holding IEMG), is it most accurate to obtain the relevant data (net dividends, FWT, distribution yield) from the XEC annual report, or to do so from the IEMG annual report?

3) Finally, some ETFs (e.g. XUU) have both CAD and USD units. Does this have an effect on FWT (and its calculation)?

Thanks again!

Hi Justin, Thanks for all your great work on these posts – it is a wealth of fantastic information! Quick question, I assume that the rules for FWT for registered pension plans follow the same rules as RRSP/RRIF? I could not seem to find any information on the web to confirm this. Thanks again!

@Randall: You would need to check with your specific RPP provider (I have heard of situations where the pension plan has achieved foreign withholding tax relief from the U.S. government for these types of plans).

Can you comment on if/how the foreign tax credit can be carried forward? I know I will not be able to claim it fully if I hold my ETFs in a taxable account and I’m trying to figure out if it still makes sense to use a taxable account.

@Julien: Foreign tax credits that arise from foreign non-business income cannot be carried forward. I would recommend speaking with an accountant to determine the best course of action for your situation.

Hi Justin,

I am following your blog since a while now. I am very thankful for all the informations and details, you have now idea how much value that gives to me- big thanks!

I am a complete newbie into investment and I am right now at the point where I setup everything. I have some basic questions, I tried to find more in your blogs, but I guess I was not able to find everything.

Some details:

– I am 25 and preparing everything for retirement (with 60)

– I am a newcomer to Canada

– I have 40k CAD savings to invest as a one shoot and then 500 CAD / month for the next 35 years

– Forget my RRSP for now, there is not really room to put money into it

– My TFSA only has 12k CAD contribution room

– The rest of my saving I want to put into a non-registered account

– I am looking for a very simple and passiv strategy

My asset allocation looks like this:

25% Vanguard FTSE Developed All Cap ex U.S. ETF

45% Vanguard S&P 500 ETF

30% FTSE Emerging Markets All Cap

My questions:

– My head does not understand how do I distribute the assets between non-registered and registered accounts. My goal is to have the most tax efficiency when I reach the age of 60. My idea is to put most of the Vanguard S&P 500 ETF into my TFSA until I reach the max contribution room, the rest of it I put into a non-registered account and the other ETFs too. The reason is, I expect the S&P 500 ETF to grow the most and the witholding tax only applies to the dividends in my TFSA, which is on the end not a lot

– Lets assume I have the Vanguard S&P 500 ETF in my TFSA. Once I sell the ETF, there will be no capital gain tax on it, right?

– From your personal perspective and experience, is there something wrong with my calculation?

Thank you very much, kindly appriciate your perspective!

Amelie

@Amelie: Asset location is not a big concern if your portfolio is 100% equities. It also does not deserve much attention until your portfolio value is well into the six digits.

Without knowing which equity region (U.S., international or emerging markets) will outperform over your investment horizon, it’s impossible to know which would be best held in your TFSA. I generally just hold all of them in the TFSA (you could consider a 100% equity asset allocation ETF, like VEQT, to keep things simple). Or you could hold the least tax-efficient asset class in your TFSA, which would be international equities (like VIU).

That was a very good question!

I am in a similar situation and I am doing DIY with VEQT and Questrade. I am a newcomer too. I do have 100k savings and I plan to put the max into my RRSP,TFSA and the rest in a non-registered account.

Every year I plan to save up to 10k and distribute it between RRSP, TFSA and non-registered. Since I only have one ETF, does it make any difference in which account I buy first/last the ETF? I am trying to smartly distribute between the accounts, but you said that should not a big concern, right?

@Yamuna: Deciding on the amount to contribute to each account is a different decision than what to purchase in each account (it would be based on your specific financial and personal situation).

@Justin: Thanks for answering my question. My goal is to leave RRSP, TFSA and non-registered account untouched until I retire (25 years left). I can contribute each month between $200-600$.

I do not want to overcomplicated things- do I just put money randomly in thoose 3 account types and thats it? I figured that this topic can make you crazy if you think very deeply about it…millions of questions :-)

@Yamuna Kamischrm: The choice of which accounts to contribute to would depend on your personal tax rates to a large extent. If you’re in a high tax bracket, you may want to consider contributing to your RRSP first, TFSA second and non-registered last. If you’re in a low tax-bracket, you may want to focus on your TFSA first.

@Justin: I checked out VEQT. I really like it! Cheap and global! I think that is the one which I choose, way more simple than the other ones. Thanks for this really valueable information.

I have a similar question than Yamuna, I did not fully understand how to proceed. I have 3 accounts too where I can put money in, I do not know which tax-bracket I will be in later, right now I am on a very low tax bracket.

I like things simple and I dont want to think about 1 year on how to put money into each account. Is it OK to just start with TFSA, then RRSP (I have very little room here) and the rest in my non-regeistered?

Thank you!

@Amelie: If you have TFSA room, that’s a great place to start. Once your TFSA room has been maxed out, you may need to seek personalized advice on whether the RRSP or taxable account should be prioritized next.

If you’re in a very low tax bracket, it’s probably not the worst thing to contribute to your taxable account after the TFSA (at least until you figure things out).

Nice article, good resource, thank you! A quick question, you write that for a smallish portfolio in the RRSP, holding the Canadian ETFs is sufficient. By when is a portfolio large enough and if you have build the portfolio with the Canadian products, do you sell them and buy the US ETFs? Just talking about the RRSP with US listed ETF purchased with the Gambit or what to do when a Portfolio is large enough?

@Mike: There’s no need to ever switch to U.S.-listed foreign equity ETFs in an RRSP if you prefer simplicity. Dealing with the Norbert’s gambit strategy and rebalancing with U.S. dollars is enough to kill the confidence of most DIY investors. I’ll discuss more about this when I release my next blog about the “Ridiculous” portfolios (the name says it all).

I have been buying Vanguard ESGV and VSGX in my RRSP account. I was looking at XSUS or ESGY as possible replacements but it seems like Vanguard’s lower MER and withholding taxes might still be worth it despite the currency conversion costs?

If I am investing in my TFSA does it make sense to switch to the Canadian listed ETFs despite the higher MERs?

@Jeremy: It would depend on how much you’re paying for your currency conversions. Are you using Norbert’s gambit to convert your Canadian dollars to U.S. dollars in your RRSP? If so, have you determined your approximate cost of the gambit each time you convert your currency? If you’re not diligent with these conversions, you might be offsetting all the tax benefits from holding U.S.-based ETFs in your RRSP.

In TFSA accounts, U.S.-based U.S. equity ETFs (like ESGV) receive no preferential tax treatment (so it’s probably best to just stick with Canadian-based U.S. equity ETFs in your TFSA).

International equity ETFs (like VSGX) will lose two layers of withholding tax in a TFSA, so it may be better to find a Canadian-based international equity ETF that holds the underlying stocks directly for your TFSA.

Well, I like that the difficult question that you wrote in reading is very accessible and understandable!

Personally, I like the format of your blog. Thanks!

Thank you for putting out these excellent and detailed blog posts. They make the concepts really easy to understand and apply. I like the blog posts for ease of referencing back. The podcasts are good for listening to while multitasking with chores. Looking forward to the updated Foreign Withholding Tax white paper! Also I’m so curious as to what the Ludicrous and Plaid model portfolios are going to be :D

@Brenda: I’m glad you’ve found the multiple platforms useful.

Everyone is very interested in the mysterious Ludicrous and Plaid model portfolios. Spoiler alert: They use the same ETFs as the Ridiculous portfolios. I will just be showing investors how to optimize their portfolios for asset location purposes, using these ETFs :)

Well done! Thanks for making a complicated matter into something approachable.

Personally, I like the blog format

@Leon: Thanks! I’ll definitely continue to release the accompanying blogs (and shortly, videos) as well as the podcast.

Is there a list or easy way to find which Canadian-listed ETFs hold international stocks directly?

@Mark: The best way to determine this is to look up the holdings in the official annual financial statements for the ETF.

I do like the blog format. Thanks for keeping these up.

Any chance that vee and xec may change to a similar structure as bmo down the road?

@Phil: Judging by Steven Leong’s response, changing XEC’s structure to holding the emerging markets stocks directly doesn’t appear to be a priority (the same likely applies to Vanguard and VEE). As I discussed on the podcast (during the ETF Kombat – ZEM vs. XEC), the wrap structure has actually been about as efficient as holding the underlying stocks directly, once all costs are considered (i.e. MERs, FWTRs, TERs and tracking error to the index from the fund’s sampling strategies).

Ok thanks, sorry for asking something you’ve already covered. I’ll ease my way into the podcast for the rest of the goods.

@Phil: No apologies necessary – I can honestly say I don’t listen to many podcasts either (I prefer to read ;)

Love your articles and white papers!

I have a question about international equities ETFs if one wants to hold investments in USD.

It seems to me that especially for large invested amounts it would be advantageous to switch from IEFA to XEF.U.

XEF.U has a MER of 0.22% while IEFA has a MER of only 0.07%, so for a 0.15% increase in MER one could save the 15% withholding taxes after the FTC, for a total amount of 15% – 0.15% = 14.85% savings.

Am I correct in my interpretation?

Thanks,

Cristian

@Cristian: From a foreign withholding tax and MER perspective in a taxable account, IEFA would have a cost of 0.32% (0.07% MER +0.25% FWTR) while XEF or XEF.U would have a cost of 0.22% (0.22% MER + 0.00% FWTR).

Please feel free to play around with the Foreign Withholding Tax Ratio Calculator on the blog:

https://canadianportfoliomanagerblog.com/calculators/

Hey Justin,

I noticed you recently updated your Foreign Witholding Tax Calculator. If I may make a request, I think it would be great to also see it include the BMO Asset Allocation ETFs, as well as the two factor ETFs that Ben Felix includes in his model portfolios (IJS and IUSV).

@Mark H: I’ve decided to only include ETFs I would recommend to investors in my Foreign Withholding Tax Ratio (FWTR) Calculator.

The BMO Asset Allocation ETFs will have similar tax implications as the iShares or Vanguard ETFs.

IJS and IUSV would have a drag in a TFSA of around 0.28% and 0.38% respectively.

This is amazing work Justin.

I think withholding taxes are the next wave of hidden expenses to be exposed and perhaps avoided. Retail mutual fund fees were the first wave.

I’ve always bought my foreign equity ETFs (RRSP) on the US exchange, so it hasn’t affected me. But it’s good to know about the taxes, so I can let people know that converting to US$ with Norbert’s Gambit is probably worthwhile if they have a decent amount of money.

@Mike Holman: It could be worthwhile using U.S.-listed foreign equity ETFs in larger RRSPs from a foreign withholding tax perspective. But I’ve met many DIY investors who have regrets about complicating their portfolio to save on taxes, and now want to switch to a simple asset allocation ETF solution (so if an investor has an aversion to math and complexity, it’s probably best for them to just take on the additional foreign withholding tax cost).

Thanks for another amazing article!

When you talk about foreign withholding taxes in taxable accounts and that they *may* be recoverable, under what circumstances would they not be recoverable?

@JR: I tend to see portions of unrecoverable withholding taxes in taxable accounts when either the taxpayer has a relatively low income, or when they’ve made significant donations to charity.

Thank you for the article!

I have a couple of questions:

When are the Foreign Withholding Taxes deducted from the ETF? at the time of receiving the dividends?

How does the dividends and FWT work for mutual funds?

@Erika: Usually the foreign withholding taxes are deducted before the dividends are received (but I do notice U.S.-listed ETF distributions typically show the gross dividend amount, as well as the 15% withholding tax on account statements).

Canadian-based mutual funds have similar withholding tax implications as ETFs (as they are both trusts).

thanks!

When Canadian ETF providers report performance: do they include dividends, and subtract MERs and WTF?

What about the US ETF providers? I presume they don’t need to subtract any withholding tax from their published rate of return.

@Erika: Great question. The performance of Canadian ETF providers is reported after foreign withholding taxes and MERs. If a portion of the foreign withholding taxes are recoverable (such as in a taxable account), this process is technically understating the fund’s performance.

U.S. ETF providers would report gross returns before U.S. withholding taxes (for U.S. equity ETFs) and net returns after the first layer of foreign withholding taxes (for international and emerging markets equity ETFs), but before they are subject to the second layer of U.S. withholding taxes.