Welcome back! In Part I of our series on Foreign Withholding Taxes on Foreign ETF Distributions, we took on foreign withholding taxes for equity ETFs. Today, we’ll cover the same for global equity, global bond, and asset allocation ETFs. Or again, if you’d prefer, you can tune into the full-length podcast version here.

Global Equity (ex Canada) ETFs

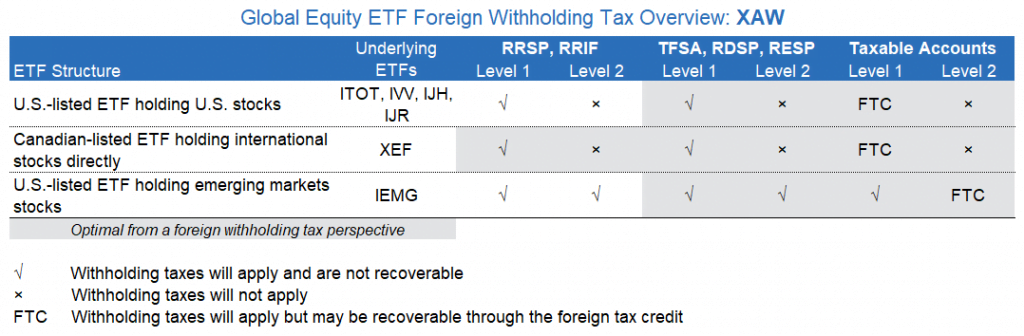

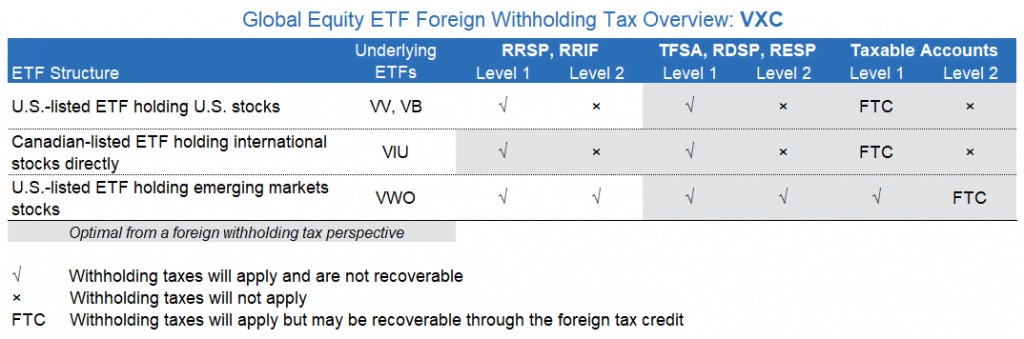

Before we press forward, remember, a global equity ETF is just a roll-up into a single global fund of the three foreign equity asset classes we covered in Part I: U.S., international, and emerging markets. Two popular examples are the iShares Core MSCI All Country World ex Canada Index ETF (XAW) and the Vanguard FTSE Global All Cap ex Canada Index ETF (VXC).

Until recently, Vanguard Canada used a tax-inefficient wrap structure in VXC. The fund gained its exposure to companies in Europe and the Asia-Pacific by holding two U.S.-listed international equity ETFs: the Vanguard FTSE Europe ETF (VGK) and the Vanguard FTSE Pacific ETF (VPL). This structure added an extra layer of foreign withholding tax on the international equity portion of the fund.

But that was then. As Scott Johnson from Vanguard Investments Canada covers in more detail in our companion podcast, Vanguard has since made some improvements to VXC. First, they sought to improve withholding tax efficiency by having VXC’s Europe and Asia-Pacific exposure come directly through a Canadian product, rather than by way of the U.S. They’ve also lowered the management fee from 25 basis points to 20 basis points.

After these recent changes, the foreign withholding tax implications for both VXC and XAW are now the same as for their individual underlying ETFs … with a noteworthy exception: If you hold VXC or XAW in an RRSP or RRIF – and the fund holds an underlying U.S.-listed U.S. equity ETF or a U.S.-listed emerging markets equity ETF – you do not avoid the 15% withholding tax on U.S. dividends.

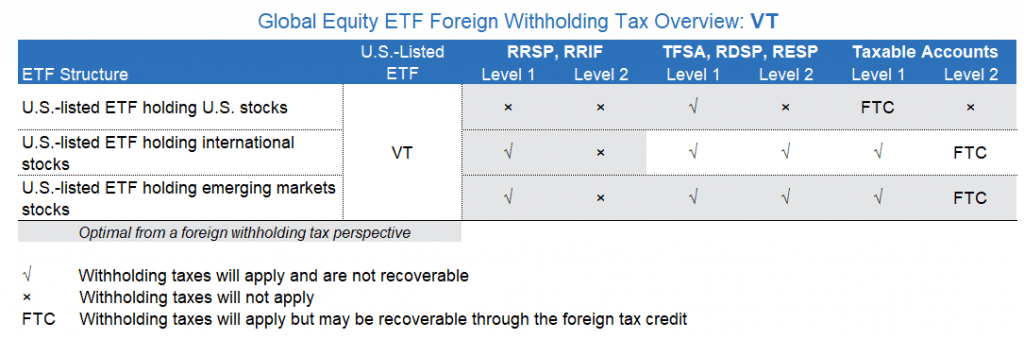

Because of the additional tax drag in RRSPs and RRIFs, some investors prefer to hold a U.S.-listed global equity ETF instead, like the Vanguard Total World Stock ETF (VT). This ETF has similar exposure to XAW or VXC, but includes a 3% allocation to Canadian stocks. Keep in mind that VT is only more tax-efficient in an RRSP or RRIF account. VXC or XAW would likely be better choices for TFSA, RDSP, RESP, or taxable accounts.

In the charts below, the most optimal ETFs from a foreign withholding tax perspective for each account type will have all its cells shaded grey. For example, VXC and XAW are the most tax-efficient ETFs when held in TFSA, RDSP, RESP and taxable accounts, while VT is the most tax-efficient ETF for RRSPs and RRIFs.

Currency-Hedged Global Fixed Income ETFs

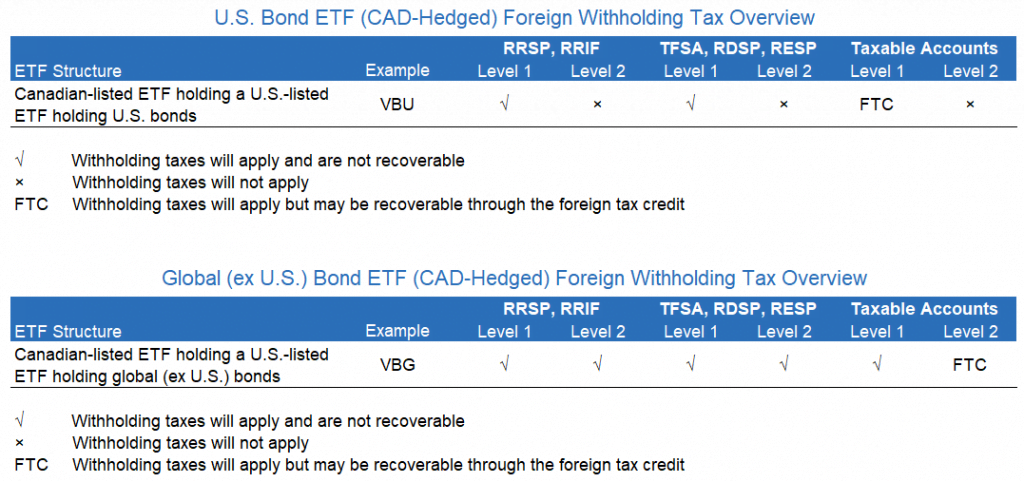

Onward into the realm of fixed income. Global fixed income ETFs are also subject to foreign withholding taxes on the coupon interest paid to foreign investors. The most common ETF structure for this asset class is a Canadian-listed ETF that holds a U.S.-listed ETF that holds the global bonds.

Although global bonds have not yet caught on with Canadian ETF investors, it’s still worth mentioning them, as many of the popular asset allocation ETFs include them.

For example, the Vanguard U.S. Aggregate Bond Index ETF (VBU) is a currency-hedged U.S. bond ETF that is included in all of Vanguard’s asset allocation ETFs. VBU holds the Vanguard Total Bond Market ETF (BND), which is a U.S.-listed ETF that holds U.S. government and corporate bonds. Although most U.S. coupon interest is exempt from withholding tax, there is a small portion that is unrecoverable in all account types except taxable accounts, where a foreign tax credit is available. At my last review, this tax drag was around 0.1% in registered and tax-free accounts, and fully recoverable in a taxable account.

The Vanguard Global ex-U.S. Aggregate Bond Index ETF (VBG) is another currency-hedged fixed income ETF, but it invests in global bonds outside of the U.S. VBG holds the Vanguard International Bond ETF (BNDX), which is a U.S.-listed ETF that holds global bonds, excluding U.S. bonds.

Similar to international and emerging markets equities, coupon interest from VBG is subject to two layers of foreign withholding taxes. The second layer from the U.S. to Canada is the most punitive.

In RRSPs and TFSAs, both layers of foreign withholding taxes are unrecoverable. So, at my last review, the tax drag was around 0.3%. In taxable accounts, the second layer of U.S. withholding taxes may be recoverable, so the expected drag is closer to around 2 basis points. Perhaps as a result of this additional tax drag, BMO and iShares have opted to exclude currency-hedged global (ex U.S.) bonds from their asset allocation ETFs, while Vanguard has included them.

Relative to Canadian bond ETFs, both currency-hedged global bond ETFs have higher MERs. With that, and the additional foreign withholding tax drag, I tend to exclude both from my clients’ portfolios … although that could change with future product improvements.

Asset Allocation ETFs

Finally, we have one-fund solutions, or asset allocation ETFs. The estimated tag drag for these ETFs would be similar to the weighted-average tax drags of Canadian-listed global (ex Canada ETFs) and currency-hedged global bond ETFs. That drag in RRSPs and TFSAs ranges between 0.04%–0.22%, depending on the product provider and whether the asset allocation ETF is conservative or aggressive. In taxable accounts, the annual unrecoverable withholding tax is expected to be a modest 1–2 basis points. Feel free to download my Foreign Withholding Tax Ratio (FWTR) Calculator for the most current figures.

The only way to reduce the foreign tax drag in your RRSP account is by breaking up with your asset allocation ETF. This would increase the complexity of your portfolio. But depending on your asset mix, it could reduce your annual costs by between 0.15%–0.30%.

If you go this route, remember you’ll need to purchase some ETFs with U.S. dollars, so you’ll need to be comfortable with the Norbert’s gambit strategy. You’ll also want your portfolio to be large enough to warrant the extra effort. If you’re interested in increasing your portfolio complexity from “light” to “ridiculous”, I’ve posted model ETF portfolios on my blog, to help you reduce the foreign withholding tax drag in your RRSP.

Coming Up on the Podcast: Asset Location Strategies

Congratulations, you’re nearing the end of our blog post/podcast series on managing foreign withholding taxes. In an upcoming Canadian Portfolio Manager podcast, we’ll take on another powerful investment technique worth mastering. If you liked thinking about foreign withholding taxes, you’re going to love diving into optimal asset location. See you then!

Thanks @Justin.

What are your thoughts on buying and holding accumulating UCITS ETFs. Some of the broad market ETFs trade in USD on London Exchanges and I believe a resident Canadian can buy them through a broker like Interactive.

Yes, there will be 15% withholding (and possibly unrecoverable) tax by the US government when dividends are paid. But the ETF itself will not distribute, so there shouldn’t be any additional taxes until deciding to sell at which time it will be taxed as capital gains. For people in the highest tax bracket, shouldn’t this save money over time on non-registered accounts – paying 15% on US dividends ( non-recoverable) vs. paying 68.5% (though 15% of it is recoverable)?

Strangely, I could only find minimal literature or discussion of this strategy on the Internet

@Ram – Unfortunately, I haven’t conducted any research on UCITs and their tax implications.

Hi Justin, thanks so much for the amazing analysis and resources on your blog/podcast!

As a Canadian planning to re-establish tax residence in Canada after living in Singapore the past several years, I’ve been reading everything I can to decide whether I should switch up my ETF holdings. The bulk of my investments are in a taxable account with Interactive Brokers which holds just one global ETF – VWRA (FTSE All-World UCITS ETF (USD).

I like that this fund accumulates dividends so I will only be taxed on capital gains at the time of sale, but I’m not clear on the level 1 & 2 taxes being applied. Not sure whether you have looked at Vanguard’s other international offerings to see how they stack up. Might this ETF be worth considering for other readers too?

@Gillian – I’m glad you’ve been enjoying the blog/podcast! Unfortunately, I haven’t completed an analysis of foreign withholding taxes from the perspective of a non-resident of Canada. Perhaps Andrew Hallam has tackled this topic on his blog though:

https://andrewhallam.com/

Does anyone know if registered pension funds are treated the same as RRSPs for foreign withholding tax (level 2)? I haven’t been able to find the answer to this online.

Thanks!

Hi Justin,

First up, your website is by far the best I have seen in terms of Canadian personal finance so HUGE thanks for that.

Secondly, this particular post is SUPER helpful, at least for my current situation. My question is this:

I’m currently moving my 6 figure portfolio (currently in GBP) from UK to Canada. I want to invest in a global equity ETF and can’t decide between VT (USD) vs VXC (CAD). Both would be in a taxable account.

I understand that VT has lower fees (and includes Canada), but VXC has lower WHT. The additional consideration is that I haven’t yet converted from GBP into CAD or USD.

What would you recommend – VT or VXC?

Perhaps it just comes down to what currency I want my portfolio to be in? as we’re investing for the long term and not sure how long we’ll be in Canada for.

Thanks!

John

@John – Thank you for your kind words! For taxable accounts, Canadian investors typically opt for either VXC or XAW for their non-Canadian equity exposure:

https://www.youtube.com/watch?v=hzj-CZ38NKM

Awesome, thank you Justin. That Youtube video is excellent, was it a coincidence that you posted it the day after my question?

Either way, i’d love to buy you a beer next time you’re in Ottawa :)

John

@John – I’m glad you liked it! (it was just a happy coincidence ;)

A beer sounds great! (although I don’t get to Ottawa very often :)

Hi Justin. I bought 4 ETFs in my portfolio: XIC, XUU, XEF and XEC. I did try to “optimize” my portfolio for tax efficiency by buying XIC+XUU in my non-registered account, XEF+XEC in my RRSP and XIC+XEF in my TFSA so I can rebalance yearly between my accounts. I keep a ratio of 33.33% XIC, 33.33% XUU, 22.22% XEF and 11.12% XEC and I live in Québec (for tax purpose).

Here comes my question. Could I simplify this portfolio at low cost? I would like to know what would be the cost of having XEQT in each of my 3 accounts instead of trying to save on taxes by buying multiple ETF. I know the allocation would be different from my current one. Let pretend I want to invest $350,000 in my 3 accounts: $250,000 in the non-registered account, $100,000 in the TFSA and $100,000 in the RRSP. Here is what this portfolio could look like:

Non-registered:

XIC: $100,000

XUU: $150,000

RRSP:

XEF: $50,000

XEC: $50,000

TFSA:

XIC: $50,000

XEF: $50,000

Would that cost me a lot more to fill these accounts with XEQT instead? An average is OK. Will this add me $10, $100, $1,000 a year in cost for switching to the easy one-fund solution?

Thank you for all the information you share with us.

@Sebastian: From a product fee and foreign withholding tax perspective, please feel free to use my online FWT calculator to help you estimate how much you would save in cost for your various scenarios:

https://canadianportfoliomanagerblog.com/calculators/

In fact, I would like a tax perspective (not only withholding taxes). I just want to know if it would cost me a lot more to simplify the portfolio in my example. I think the difference is less than $100 a month (about $50), but I want to be sure that my calculations are correct.

Sorry I wrote $100 a month but I meant a year.

Hi Justin,

On the issue of VXC vs VT in a taxable account, how would being a non-resident Canadian affect this decision? The funds would be coming from a Canadian brokerage account holding Canadian dollars.

Hi Justin,

I have BND, BNDX and TIP in various accounts. The distributions I’m getting are being subjected to a 15% foreign withholding tax when the ETFs are in TFSA or taxable accounts, and not in RRSP.

I thought that the distributions from bond ETFs had a different treatment to those from stocks, which is what I’m reading in your article as well. Is this an error from my brokerage (NBDB)?

Thank you

Eric

Hi Justin,

Thank you so much for the FWTR calculator, it really does the heavy lifting for us!

I assume that the data in “sheet 2” of the calculator will become outdated at some point, correct? I am not really sure how to proceed if I need to update this sheet manually periodically, so I would appreciate some guidance.

@Gui: You’re very welcome! Sheet 2 is just a background calculation I was using for one of the data entries – you can ignore this sheet.

There’s no need to update anything periodically (I do this each year).

Another great article! FWT aside, is VGAB tax-efficient in taxable accounts? Are the returns likely to be higher compared to a universal CA bond like VAB?

@melwin: VGAB would be expected to have similar tax-efficiency as other plain-vanilla ETFs (like VAB), but less tax-efficiency than a fund like ZDB.

I would expect the returns on VGAB to be lower than a Canadian bond ETF like VAB, after fees and foreign withholding taxes are considered (but comparable expected returns before these additional costs).

https://canadianportfoliomanagerblog.com/expected-returns-of-currency-hedged-global-bond-etfs/

Thanks for giving valuable insight!

@melwin: You’re very welcome – thanks for following the blog :)

Hi Justin,

I’m looking for a Bond ETF with international exposure and I’m interested in the XGGB from Blackrock. I would prefer XGGB to VBU because of the variety of countries covered but I wanted to know if it was interested in a taxation standpoint. It is not very clear to me what are the holdings of the XGGB.

Thank you for your time and this amazing website. That’s gold!

Take Care,

Loïc

@Loïc: XGGB could be appropriate if you’re looking for currency-hedged global government bond exposure. It would appear that XGGB holds the underlying international bonds directly, so this may have beneficial foreign withholding tax implications, relative to something like VGAB (although I haven’t looked into this in any detail).

Thank you very much!

Well done! Thanks for making a complicated matter into something approachable. Personally, I like the blog format !

Your blog is by far the best source I’ve found.

Hi Justin,

Quick question: I haven’t heard anything about this, but please tell me if my understanding is correct. For a Canadian investor who wants to take advantage of asset location while also not having to worry about rebalancing (hello simplicity), could holding a US-listed asset allocation ETF such as AOR or AOA in a RRSP account be a goo doption? My understanding is that witholding taxes wouldn’t apply on US stocks dividends and interest payments. It that right?

Thanks

@Sebastien Desforges: That is an option, but there are some issues:

– Your U.S. and international bonds would not be hedged back to the Canadian dollar, causing more portfolio volatility

– You would have more exposure to foreign equities than in the iShares or Vanguard AA ETFs

I get the first issue.

Regarding the second one, why is that an issue? AOR/AOA have around 3% Canadian equities, wouldn’t that simply be not having a home bias for a Canadian investor? Also, by “iShares or Vanguard AA ETFs”, I suppose you are referring to the Canadian AA ETFs?

@Sebastien Desforges: Most Canadians prefer more home bias in their portfolios. If an investor went with a market cap weighted approach, and were disappointed with the results during periods when Canadian stocks outperformed foreign stocks, this could cause them to abandon their investment strategy.

This potential behavioural issue should not be ignored. I witnessed it first-hand with nearly every investor when Canadian stocks outperformed foreign stocks by more than 8% per year (in the decade running from 2000 – 2009):

https://canadianportfoliomanagerblog.com/canadian-portfolio-manager-introducing-the-light-etf-portfolios/

Justin,

Thank you very much for pointing to your calculators’ page. I am shocked at such a high withholding tax drag on VEA. I just realized that I have to review my allocations. Thank you again for all the info you provide.

I would like to point at a bug on your website. If you visit your “calculators” page on the phone or desktop with a very small browser page, then “Foreign Withholding Tax Calculator” is NOT Visible, instead you see “Money Weighted Rate of Return Calculator”!

@Vi: Yeah – it’s relatively high on U.S.-listed international equity ETFs held in TFSAs (generally best to hold a Canadian-listed international equity ETF that holds the underlying stocks directly).

Thank you for the heads up regarding the calculators – I’ll have to speak to my website designer about that bug.

Hi Justin,

I have VEA ETF in my TFSA. When dividends are paid, I can see 15% withholding tax removed and I know that this amount is not recoverable. Based on your explanation, my understanding is this is Level 2 witholding tax on dividends. How can I find out how much is Level 1 tax for this VEA (Vanguard FTSE Developed Markets) ETF? I looked for the info on Vanguard website, but I could not find anything there.

TIA!

@VI: It’s a confusing process to estimate the foreign withholding tax drag, which is why I’ve done the heavy-lifting for you!

Check out VEA’s FWTR in my Foreign Withholding Tax Ratio Calculator: https://canadianportfoliomanagerblog.com/calculators/

It’s roughly 0.63% in a TFSA.

Justin, thank you for these two posts on foreign withholding tax. Very helpful!

Could you kindly say more about BND & BNDX? I currently hold both these USD-denominated ETFs in a taxable account, having reasoned myself a year ago that this was the most efficient route to own US and non-US fixed income. I am not clear why you wouldn’t also find this to be best.

I don’t understand your reply to Simon either, about these not being equivalent offerings.

Thanks.

@JPG: BND & BNDX do not hedge away their U.S. dollar currency exposure (so for a Canadian investor, you’re investing in both U.S. bonds and the U.S. dollar). This will make your portfolio more volatile than using currency-hedged bond ETFs, like VBU and VBG.

Thanks Justin.

Putting aside the volatility due to currency (for me this is desirable, as I want the USD exposure), can you confirm that BND & BNDX efficient from a foreign withholding tax perspective in a taxable account?

Really appreciate your posts here. Making some changes elsewhere in my portfolio (such as selling VXUS in my taxable account) based on what you’ve laid out. Thank you again.

@JPG: BND and BNDX would have similar foreign withholding tax implications in a taxable account as VBU and VBG.

Depending on the capital gains tax implications, selling VXUS in a taxable account to switch to more tax-efficient ETFs may not always be the best option. You also must consider the product fee differences as well.

Hi Justin,

Do you see any benefit to buying VGRO bimonthly (when I get paid) versus quarterly before the ex-dividend date?

My brokerage charges 10/ trade. I invest large amounts but it seems to be random the prices I buy at anyhow.

Would it be more efficient to just buy quarterly instead?

Last year I made 24 trades and I doubt this makes sense.

@Emily: It’s impossible to know which option will yield better results. Perhaps buying monthly might be a reasonable compromise?

Thanks for the quick reply!

My worry is when I buy monthly, isn’t that similar to the adage to not DRIP in taxable accounts?

Wouldn’t that just increase the bookkeeping and ACB complexity?

@Emily: Once you’re dealing with taxable accounts, unfortunately the complexity is going to increase regardless. 12 buy transactions in a taxable account should only take you around 10 minutes each year to input into adjustedcostbase.ca. If you have more than one ETF holding, it may take you longer.

There’s no need to have a DRIP running in your taxable account if you’re buying ETFs monthly, as you can just pick up the extra cash at that time.

You could also consider a brokerage that doesn’t charge you $10 trading commissions (like Questrade).

Justin:

As always,I enjoy your blogs and podcasts. Your analysis/observations are very clear.

But I do have a product questions. I’m a fan of Vanguard and am pleased with enhancements to VXC. However, If not mistaken, I recall Its management expense used to be .25% and MER used to be .27%. But now while its Management expense is .20%, the MER is .26%. How come its MER hasn’t meaningfully dropped? I apologize if I’m asking something you may have already covered elsewhere.

Thank you!

@Babak: I’m glad you’ve been enjoying the blogs and podcasts – thank you for reading/listening.

It’s typical for ETF providers to continue posting their old MER. They usually have to wait until they publish their financial statements with the updated MER figure before adjusting their website. So there’s no need to worry about VXC – it should have comparable fees to XAW.

Thanks for this. I love your podcast but this particular issue (ugh taxes) is so complicated it’s great to have it laid out in all it’s glory so you can pick out the relevant details more easily. Keep up the great work!

@Lise: I definitely would agree. It’s a complicated topic that you need to use all your senses to wrap your head around (not just your ears :)

Hi Justin,

You are a clearly a leading expert on this stuff. This is probably a question for the lawyers, but I wonder how it came about historically that RRSPs are exempt from US foreign witholding taxes, and what it would take to get this tax-exempt status for TFSAs in the future. Many Canadians invest for retirement inside their TFSA; have you ever considered petitioning the government about working with the US to get TFSAs exempt from foreign witholding taxes as well? What a win that would be for Canadian investors!

For your next podcast on Asset Location, I suspect I know what your conclusion might be. However it would be interesting to hear you talk about draw-down strategies and how the account type that a retiree might draw down first vs. last would impact asset location.

Keep up the great work Justin!

@Mark H: I’m not much of a tax historian, so unfortunately I don’t have much to add to the reasoning behind the tax treaties. I’m also not really the petitioning type (sounds too time consuming!), but feel free to pick up the baton on this one ;)

Drawdown strategies do not typically have a large impact on asset location strategies. If certain asset classes need to be sold in one account during retirement (such as a taxable), the same asset class can be repurchased in another account to keep the portfolio on target.

Hi Justin,

The Vanguard website gives no indication that VXC is a wrap structure. It lists VXC as having 10,731 holdings, and does not mention VIU, etc. as being the underlying ETFs. (In contrast, XAW clearly lists which ETFs it is composed of.)

How can the average investor discover the underlying structures of Vanguard ETFs, so we have some idea of their tax efficiency?

Thanks!

@pjb: You can download the fund’s latest annual financial statements and review the holdings (they will list a handful of ETFs if they are a wrap, or hundreds/thousands of individual securities if they hold them directly).

You can also just skip that step and take my word for it ;)

Thanks! I was curious about the funds I hold – VXUS and VCN. The financial statements aren’t light reading.

@pjb: There’s no need to read the financial statements from cover to cover. Just look up your fund and flip ahead to the list of its holdings.

VXUS is a U.S.-listed international/emerging markets equity ETF that is like a 76/24 split between VEA and VWO (so you can punch these percentages into the foreign withholding tax calculator to determine the expected foreign withholding tax drag, or you can just look up VXUS, which is also included in the spreadsheet).

VCN is a Canadian equity ETF, so it isn’t expected to have a noticeable foreign withholding tax drag (but it has been included in the FWTR calculator for reference):

https://canadianportfoliomanagerblog.com/calculators/

Thanks Justin!

Is it possible to expand the tables to include BND and BNDX in relation to how withholding is applied in each type of account?

@Simon: I haven’t included the unhedged U.S.-listed bond ETFs (BND and BNDX) as I didn’t want investors to think these are equivalent offerings. BND and BNDX would appear to be more tax-efficient than VBU and VBG in RRSPs, but they are not comparable on a risk level, whereas my other examples are nearly identical.