When I first watched Star Wars, I thought it would be impossible to improve on its perfection. What a blast it was! But that was before I became a huge fan of the Spaceballs spoof of the same. Likewise, as fond as we are of the original Canadian Portfolio Manager (CPM) model ETF portfolios, you may have noticed we’ve made some big changes lately. Most notably, there are now four CPM portfolio levels of complexity to choose from: Light, Ridiculous, Ludicrous, or Plaid.

If you’ve never seen Spaceballs, go ahead. Take a five-minute break to get a feel for these new names.

Now, back to the serious matter of CPM portfolio construction. As you might guess, each of our models’ four levels is more difficult to manage than the last … and arguably, more powerful. By the time you get to Plaid, you may find yourself wanting to sport a Dark Helmet for protection. (And don’t hesitate. Somewhere out on the Interwebs, I’m pretty sure there’s an embarrassing picture of me wearing one.)

In this series of posts – and related podcasts and videos – I’ll discuss each of our four model ETF portfolio levels in painstaking detail. Even with proper gear, you’ll want as much knowledge as possible to make an informed decision, before hurtling head first into a complicated portfolio you may regret.

Today, we’ll introduce you to the Light model portfolios (also known as “The Price is Light Models“). We’ll also talk about the pros and cons of asset allocation ETFs in general. Finally, we’ll help you decide which ETF provider is right for you: Vanguard or iShares. Spoiler alert: It actually doesn’t matter much.

By the way, I’ve decided to exclude the BMO asset allocation ETFs in these discussions, mainly because they don’t have U.S.-listed versions of their products. This will be important when reviewing the other three, more complicated models. So, if you do decide to go with our Light portfolios, you can also consider the BMO asset allocation ETFs.

Shedding Light on the Light Portfolios Report

Raise your hand if this sounds like you: You have very little investment experience, a small-ish portfolio, and/or too many other things you’d rather be doing in your free time.

If any combination of these traits applies to you, our Light model ETF portfolios might be just the ticket for you and your investment adventures. Using single-fund Vanguard or iShares asset allocation ETFs, you’ll get diversified exposure to global equity and fixed income markets, at a fraction of the fees charged by most Canadian-based mutual funds.

The Light portfolios are available for download in the Model ETF Portfolios section of the CPM Blog. Clicking on either the Vanguard or iShares Asset Allocation ETF buttons in Step 2 will generate the report in a separate tab.

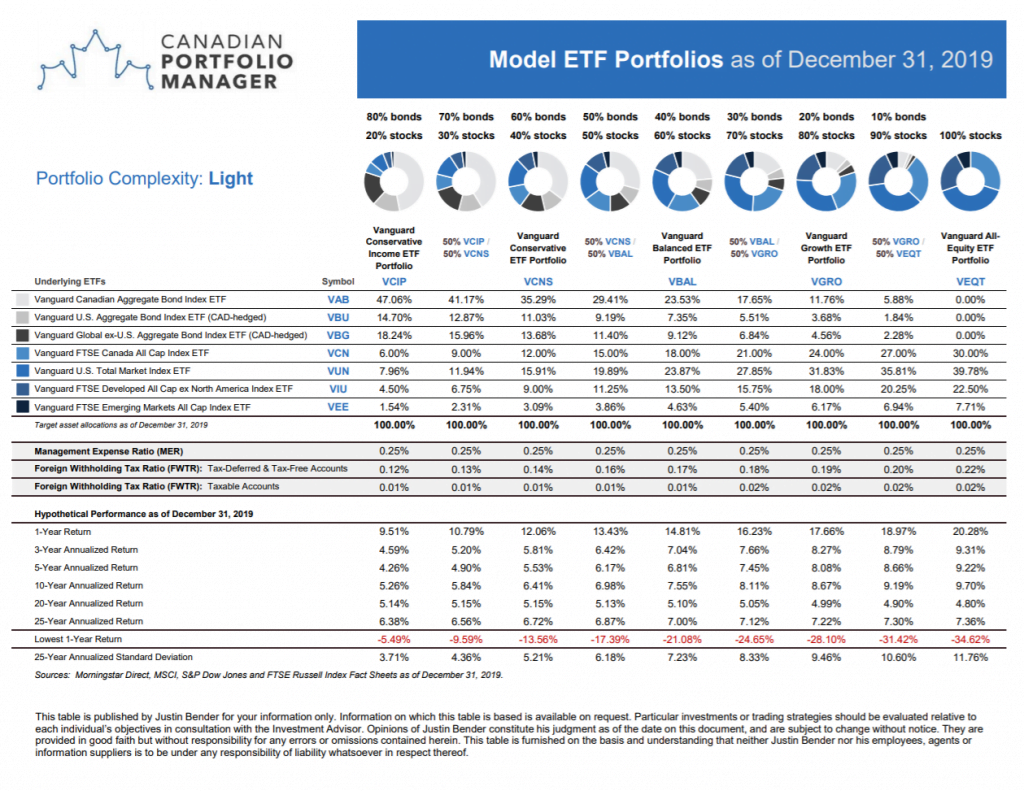

The Vanguard or iShares portfolios are displayed from left to right, ranging from a very conservative 80% bond, 20% stock portfolio, all the way to a very aggressive 100% stock portfolio. For either fund company, their five asset allocation ETF names and tickers are listed below the blue and grey donuts.

What if you’re not satisfied with the single-fund model portfolios? This might detract from the simplicity of a one-fund solution, but you could split your cash between two of the five one-fund solutions. For example, you could invest half your money in the Vanguard Balanced ETF Portfolio (VBAL) and the other half in the Vanguard Conservative ETF Portfolio (VCNS). You’d then have a custom, 50/50 stock/bond mix. But be forewarned: You will now be responsible for keeping roughly equal amounts invested in each fund.

Below the ETF tickers, you’ll find the percentage weights allocated to each of the underlying ETFs. The individual ETF names can also be found on the far left of the report.

Near the center of the report, you’ll find the estimated management expense ratio (MER) for each asset allocation ETF. This is the annual percentage cost to invest in the fund. New this year, we’ve added my foreign withholding tax ratio (FWTR), which estimates the unrecoverable foreign withholding taxes in tax-deferred accounts (like RRSPs and RRIFs), tax-free accounts, and taxable accounts.

Further down, the report displays hypothetical past returns of each model portfolio. Just remember, this doesn’t tell you much about future returns. New for 2020, we now have 25 years of semi-fictional performance. If you’d like to read up on the performance methodology, you can check out more details on page 2 of the report. (Although, honestly, I’ve never been asked a single question about it.)

More importantly, in bright red near the bottom of the report, you’ll find each fund’s worst 1-year return over the 25-year period. Pay close attention to these figures. Ask yourself: Are you really comfortable with these types of losses? Because you will eventually experience similar, or likely worse short-term returns in your actual portfolio.

The Pros and Cons of Keeping It Simple

Now that you’re familiar with the Light model portfolio reports, let’s discuss some of the advantages and disadvantages of using all-in-one asset allocation ETFs. First, the benefits:

Less Effort – It doesn’t get much easier than this. As I mentioned earlier, you only need to place a single trade to gain access to thousands of Canadian and foreign stocks and bonds. Also, you won’t need to rebalance your portfolio to maintain its asset mix; iShares or Vanguard will take care of that for you.

Potential Cost Savings – The funds can save you money on trading commissions when you add new money to your accounts, as you only have to buy a single ETF to invest your cash. Many of the big bank discount brokerages still charge investors around $10 per trade. Also, management expenses are extremely low, at around 0.20% for the iShares portfolios and 0.25% for the Vanguard portfolios.

Less Angst – Since you can’t readily see the underlying funds in a single-fund structure (and how each is doing relative to the others), you should be less tempted to “tinker” with the portfolio, which is usually to the detriment of your end returns.

Simplified Tax Management – Tracking your adjusted cost base (ACB) in taxable accounts will take less time. You’ll only need to track the ACB of a single ETF, instead of for numerous funds.

Easier Portfolio Management – A couple of the asset allocation ETFs allow you to arrange pre-authorized cash contributions (PACCs), for automatically purchasing more fund shares each month. PACCs offer the ultimate “set-it-and-forget-it” investing experience.

Now, to the inevitable trade-offs for all this convenience:

What You See Is What You Get – Since you can’t adjust the underlying holding weights to suit your preferences, if you want a lower allocation to Canadian stocks, you’re out of luck.

Less Flexibility – Although the iShares and Vanguard asset allocation ETFs come in five flavours of risk, you may still prefer a different asset mix for your portfolio. In this case, you’ll need to combine at least two ETFs together, as I described earlier. This can defeat the products’ simplicity.

The Prices Paid – The MERs are slightly higher than if you had just purchased the underlying ETFs directly. Foreign withholding taxes may also be higher.

Tax Inefficiencies – When held in a taxable or non-registered account, the underlying bond ETFs can be slightly less tax-efficient than other fixed income options. This is due to tax-inefficient premium bond holdings, which I’ll explain in a future post. Also, since you hold the same ETF in every account, you can’t engage in tax-wise asset location strategies, and tax-loss selling opportunities may not pop up as often.

If you’ve made it this far, you’re probably realizing, while asset allocation ETFs are imperfect, they may still be the best option for most DIY investors. Next, let’s check out the main differences between the iShares and Vanguard asset allocation ETFs. We’ll also review how, or if, these differences have impacted the historical risk and returns over the past two decades. (Here’s another spoiler: They mostly have not.)

Equity Home Bias

Investors and ETF providers alike tend to overweight their home country’s stocks. In fact, the tendency is so common, it has a name: home bias. The Vanguard and iShares portfolios are no exception to this rule. They also are overweighted in Canadian stocks relative to foreign stocks.

Canadian stocks only make up around 3% of the global stock market, but Vanguard and iShares have both provided a higher weight to domestic stocks in their portfolios. In all five of their funds, Vanguard has allocated 30% of their equity mix to Canadian stocks, and 70% to foreign stocks. iShares has split their equity allocation 25%/75% between Canadian and foreign stocks.

Equity Home Bias: Vanguard vs. iShares

| Asset Class | Vanguard | iShares |

|---|---|---|

| Canadian stocks | 30% | 25% |

| Foreign stocks | 70% | 75% |

| Total | 100% | 100% |

Sources: Vanguard Investments Canada Inc., BlackRock, Inc., as of December 31, 2019

You may be tempted to favour the iShares ETFs, and their higher allocation to foreign stocks. After all, over the past decade, foreign stocks have outperformed Canadian stocks by around 4.6 percentage points per year. Before you decide, check out how dramatically fortunes were reversed in the decade just prior. From 2000–2009, Canadian stocks crushed foreign stocks by an average of 8.2 percentage points per year. Besides, remember that past performance tells us little about what to expect next.

Canadian vs. Foreign Equity Performance: January 1, 2000 to December 31, 2019

| Asset Class | Annualized Return 2000 - 2009 | Annualized Return 2010 - 2019 | Annualized Return 2020 – 2029 |

|---|---|---|---|

| Canadian stocks | 5.6% | 6.9% | ? |

| Foreign stocks | -2.6% | 11.5% | ? |

| Difference | +8.2% | -4.6% | ? |

Sources: Morningstar Direct, MSCI, S&P Dow Jones Indices as of December 31, 2019

If you had been invested over the past two decades, it would have made little difference whether you had selected a 30%/70% or 25%/75% Canadian/foreign stock split. Vanguard’s 30%/70% weights would have slightly outperformed the iShares’ 25%/75% allocation, but only by an average of 0.1% per year. And both portfolios would have had similar risk, with standard deviations at around 11.5%. So, if you’re still torn on which company to invest with, know that a 5% difference in Canadian stocks isn’t likely to have a noticeable long-term impact on risk or returns.

All-Equity Index Portfolio Performance: January 1, 2000 to December 31, 2019

| All-Equity Index Portfolio | Annualized Return 2000 - 2019 | Annualized Standard Deviation 2000 - 2019 |

|---|---|---|

| 30% Canadian stocks / 70% Foreign stocks | 4.9% | 11.5% |

| 25% Canadian stocks / 75% Foreign stocks | 4.8% | 11.5% |

| Difference | 0.1% | 0.0% |

Sources: Morningstar Direct, MSCI, S&P Dow Jones Indices as of December 31, 2019

Market-Cap vs. Target Weights

Beyond essentially insignificant equity home bias differences, there is a notable difference in how each company manages the foreign equity allocation within the portfolio.

Vanguard weights their U.S., international, and emerging markets equity allocations based on their current market cap. This lets these asset classes fluctuate freely within the constraints of the overall 70% foreign equity allocation, based on the relative stock market values in each region.

iShares has instead chosen specific target weights for their U.S., international, and emerging markets allocations. They stick to these target weights no matter what daily stock markets do.

Think of Vanguard’s strategy as being like the diet someone might take if they were not obsessed with their body weight. They might put on an extra five pounds during the winter, figuring they’ll lose the flab during beach season. The iShares’ strategy would appeal more to a disciplined health fanatic who weighs themselves daily and diets accordingly, lest they shed or gain an unwanted pound.

Given their current target weights, the iShares foreign equity allocation underweights emerging markets and overweights developed markets by around 5.8%, relative to Vanguard. So, if you prefer more emerging markets stocks in your portfolio, the Vanguard asset allocation ETFs may be the way to go.

Foreign Equity Breakdown: Vanguard vs. iShares

| Asset Class | Vanguard | iShares | Difference |

|---|---|---|---|

| U.S. stocks | 56.8% | 60.0% | -3.2% |

| International stocks | 30.7% | 33.3% | -2.6% |

| Emerging markets stocks | 12.5% | 6.7% | +5.8% |

| Total | 100.0% | 100.0% |

Sources: CRSP, MSCI and FTSE Russell Index Fact Sheets as of December 31, 2019

Note: The market cap of Korean stocks has been included in the emerging markets stock allocation for both companies.

If we adjust the foreign equity weights in our 25% Canadian stocks / 75% Foreign stocks index portfolio, we find this change resulted in slightly higher performance than our 30% Canadian stocks / 70% Foreign stocks index portfolio (5.1% vs. 4.9%), but with similar risk. In the charts below, I’ve referred to these two portfolios as the Vanguard All-Equity Index Portfolio and the iShares Core Equity Index Portfolio, which would be similar to VEQT and XEQT, before fees.

All-Equity Index Portfolio Performance: January 1, 2000 to December 31, 2019

| All-Equity Index Portfolio | Annualized Return 2000 - 2019 | Annualized Standard Deviation 2000 - 2019 |

|---|---|---|

| Vanguard All-Equity Index Portfolio | 4.9% | 11.5% |

| iShares Core Equity Index Portfolio | 5.1% | 11.5% |

| Difference | -0.2% | 0.0% |

Sources: Morningstar Direct, S&P Dow Jones, MSCI, FTSE Russell Indices as of December 31, 2019

Fixed Income Home Bias

Within the portfolios’ fixed income allocations, Vanguard targets 60% Canadian and 40% foreign bonds. They also hedge away the foreign bonds’ currency risk, which makes them behave more like Canadian bonds. U.S., international, and emerging markets bonds are all included in this foreign bond allocation.

Similar to the equity allocation, the split between these foreign bond regions are determined by their current market caps, not by a specific target weight. Again, other than the 60%/40% split between Canadian and foreign bonds, there’s very little active decision-making going on here. This is ideal for those of you who prefer a more hands-off approach to indexing.

In comparison, iShares targets 80% Canadian and 20% foreign bonds in their portfolios. Like Vanguard, they also hedge the currency risk of their foreign bonds. Unlike Vanguard, their foreign bond allocation is entirely U.S. bonds, split evenly between government and corporate investment grade bonds.

Fixed Income Breakdown: Vanguard vs. iShares

| Asset Class | Vanguard | iShares |

|---|---|---|

| Canadian short-term corporate bonds | - | 15.0% |

| Canadian bonds | 60.0% | 65.0% |

| U.S. bonds (CAD-hedged) | 18.4% | 20.0% |

| International and emerging markets bonds (CAD-hedged) | 21.6% | - |

| Total | 100.0% | 100.0% |

Sources: BlackRock Inc., Vanguard Investments Canada Inc., Bloomberg as of December 31, 2019

Fixed Income Duration

The iShares portfolios have also swapped out a portion of the broad-market Canadian bonds for shorter-term corporate bonds, which has reduced the average duration of their bond portfolio. (Duration is a measure of a bond price’s sensitivity to interest rate changes.) So, the iShares portfolios may be right up your alley if you’d prefer more corporate bonds in your portfolio, with less duration risk.

Weighted-Average Bond Duration: Vanguard

| Fixed Income Securities | Allocation | Average Duration (Years) |

|---|---|---|

| Vanguard Canadian Aggregate Bond Index ETF (VAB) | 58.8% | 8.0 |

| Vanguard U.S. Aggregate Bond Index ETF (CAD-hedged) (VBU) | 18.4% | 8.3 |

| Vanguard Global ex-U.S. Aggregate Bond Index ETF (CAD-hedged) (VBG) | 22.8% | 8.1 |

| Weighted-Average Duration | 8.1 |

Source: Vanguard Investments Canada Inc. as of December 31, 2019

Weighted-Average Bond Duration: iShares

| Fixed Income Securities | Allocation | Average Duration (Years) |

|---|---|---|

| iShares Core Canadian Short Term Corporate + Maple Bond Index ETF (XSH) | 15.0% | 2.8 |

| iShares Core Canadian Universe Bond Index ETF (XBB) | 65.0% | 8.0 |

| iShares U.S. Treasury Bond ETF (GOVT) | 10.0% | 6.4 |

| iShares Broad USD Investment Grade Corporate Bond ETF (USIG) | 10.0% | 7.5 |

| Weighted-Average Duration | 7.0 |

Source: BlackRock Inc. as of December 31, 2019

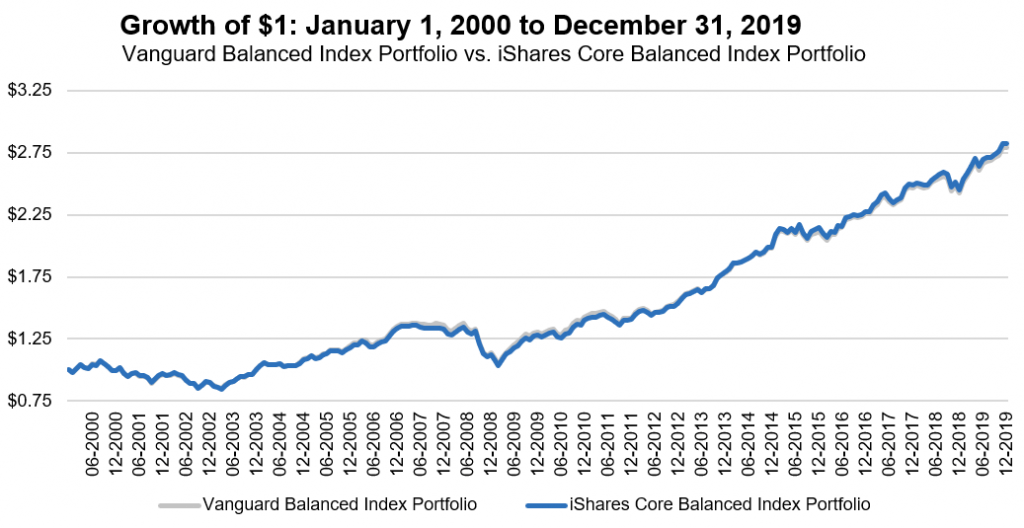

Striking a Balance

As most Canadians allocate a portion of their portfolio to bonds, I’ve run the historical performance over the past two decades on a typical balanced 60%/40% stock/bond index portfolio, which incorporates most of the equity and fixed income differences just discussed. In the charts below, I’ve referred to these two portfolios as the Vanguard Balanced Index Portfolio and the iShares Core Balanced Index Portfolio, which would be similar to VBAL and XBAL, before fees.

For both portfolios, we find identical performance and risk. In other words, even with all the slight differences between how Vanguard and iShares construct their asset allocation ETFs, we wouldn’t expect there to be much long-term difference in risk and returns. Bottom line? Investors should feel comfortable no matter which option they choose.

Sources: Morningstar Direct, S&P Dow Jones, MSCI, FTSE Russell Indices as of December 31, 2019

Balanced Index Portfolio Performance: January 1, 2000 to December 31, 2019

| Balanced Index Portfolio | Annualized Return 2000 - 2019 | Annualized Standard Deviation 2000 - 2019 |

|---|---|---|

| Vanguard Balanced Index Portfolio | 5.3% | 7.0% |

| iShares Core Balanced Index Portfolio | 5.3% | 7.0% |

| Difference | 0.0% | 0.0% |

Sources: Morningstar Direct, S&P Dow Jones, MSCI, FTSE Russell Indices as of December 31, 2019

Management Expense Ratio (MER)

If there’s one rather obvious difference between iShares and Vanguard, it’s their annual fees. The iShares portfolios are slightly less expensive than Vanguard’s, at around 0.21% vs. 0.25%, respectively. However, a five basis point difference is hardly a sufficient reason to prefer one company’s funds over the other, especially in a smaller portfolio. For example, the fee advantage is only worth about $5 per year on a $10,000 investment.

Rebalancing Strategies

In terms of portfolio rebalancing, both Vanguard and iShares will take care of this for you.

iShares plans to occasionally rebalance their portfolios at their discretion. They do not expect to allow any asset class to deviate by more or less than 10% of its target weight. For example, the iShares Core Balanced ETF Portfolio (XBAL) has a Canadian equities target weight of 15%, invested in the iShares Core S&P/TSX Capped Composite Index ETF (XIC).

- If XIC became more than 16.5% of the portfolio [15% + (15% × 10%)], BlackRock would likely sell a portion to bring the asset class back in line with its target.

- Likewise, if XIC became less than 13.5% of the portfolio [15% – (15% × 10%)], BlackRock would likely sell a portion of any overweight ETFs, and use the proceeds to buy more shares of XIC.

- In reality, BlackRock will typically use investors’ new cash flows to top-up any underweight asset classes. This should reduce the need to rebalance by selling securities at a gain.

Vanguard also plans to periodically rebalance their portfolios at their discretion. They do not expect to allow any specific fund to deviate by more or less than an absolute 2% of its target weight. For example, VBAL has a Canadian equities target weight of 18%, invested in the Vanguard FTSE Canada All Cap Index ETF (VCN). If VCN were to become more than 20% of the portfolio (18% + 2%), or less than 16% (18% – 2%), Vanguard would likely spring into rebalancing action. Again, they would try to use investors’ new cash flows to top-up any underweight asset classes, reducing the need to sell existing securities.

Pre-Authorized Cash Contributions (PACCs)

Two of the iShares asset allocation ETFs – XBAL, and the iShares Core Growth ETF Portfolio (XGRO) – are still eligible for PACC programs at select brokerages. This is because, instead of launching new ETFs back in December 2018, iShares simply changed the names, tickers, fees, and investment objectives of two existing balanced ETFs (which were themselves relics from the Claymore days, where the PACC program originated). Thanks to this grandfathering provision, investors in these two specific ETFs can still participate in the PACC program … for now.

If that’s of interest, here’s how it works:

- Fill out the iShares PACC enrollment form, attach a voided cheque, and mail the documents to a participating discount brokerage you invest with, like Questrade.

- Questrade will then complete their portion of the form and provide it to State Street Trust Company Canada (SSTCC) for processing.

- Once set-up is complete (after about 10 days), SSTCC will start to debit your bank account near the end of each month for the amount you specified on the form (it must be at least $50/month). The actual purchase occurs at the beginning of the following month, and the shares are deposited into your brokerage account mid-month.

- Only whole shares can be purchased, so any leftover cash is refunded to your bank account around the 5th of each month. If you’re targeting a specific monthly savings amount, you can occasionally move the leftover cash from your bank account to your brokerage account and invest it yourself.

Don’t trust yourself to buy more shares of your ETF through thick and thin? Or maybe you’d rather spend your spare time doing something more exhilarating than placing ETF trades. (Like watching or rewatching Spaceballs!) If so, the convenient PACC program may be just the thrust you need to accelerate your XBAL or XGRO investments.

So, Vanguard or iShares?

By now, I hope you’ve realized: An asset allocation ETF from either Vanguard or iShares would be a pretty good choice for most investors. If you prefer one based on the discussion above, great. If not, flip a coin. Heads or tails, you win. This is especially true if you compare either strategy to the hyper-active floundering most DIY investors engage in as they make their way across the ETF universe.

That said, for those of you who think Light speed is too slow, we can crank up the complexity level, and squeeze even more power out of your investment engines. Next up, we’ll introduce you to our Ridiculous model portfolios. Until then, may the investment force be with you.

Performance Methodology

Canadian stocks

01/2000-12/2019: Monthly returns of the S&P/TSX Composite Index

U.S. stocks

01/2000-12/2019: Monthly returns of the MSCI USA IMI (net div.) (in CAD)

International stocks

01/2000-12/2019: Monthly returns of the MSCI EAFE IMI (net div.) (CAD)

Emerging markets stocks

01/2000-12/2019: Monthly returns of the MSCI Emerging Markets IMI (net div.) (CAD)

Foreign stocks

01/2000-12/2019: Monthly returns of the MSCI ACWI ex Canada IMI (net div.) (CAD)

Foreign stocks²

01/2000-12/2019: 60% U.S. stocks + 33.33% International stocks + 6.67% Emerging markets stocks, rebalanced monthly

Canadian short-term bonds

01/2000-12/2019: Monthly returns of the FTSE Canada Short-Term Bond Index

Canadian bonds

01/2000-12/2019: Monthly returns of the FTSE Canada Universe Bond Index

U.S. bonds (CAD-hedged)

01/2000-12/2019: Monthly returns of the Bloomberg Barclays US Aggregate Bond Index (CAD Hedged)

Global bonds (CAD-hedged)

01/2000-12/2019: Monthly returns of the Bloomberg Barclays Global Aggregate Bond Index (CAD Hedged)

Vanguard All-Equity Index Portfolio

01/2000-12/2019: 30% Canadian stocks + 70% Foreign stocks, rebalanced monthly

iShares Core Equity Index Portfolio

01/2000-12/2019: 25% Canadian stocks + 75% Foreign stocks², rebalanced monthly

Vanguard Balanced Index Portfolio

01/2000-12/2019: 23.53% Canadian bonds + 16.47% Global bonds (CAD-hedged) + 18% Canadian stocks + 42% Foreign stocks, rebalanced monthly

iShares Core Balanced Index Portfolio

01/2000-12/2019: 6% Canadian short-term bonds + 26% Canadian bonds + 8% U.S. bonds (CAD-hedged) + 15% Canadian stocks + 27% U.S. stocks + 15% International stocks + 3% Emerging markets stocks, rebalanced monthly

People need to talk more about iShares PACC, this is the real deal (sadly not many brokerages, besides Questrade and Qtrade, are willing to do it). It also seems that iShares is committed in the near term to continue this program: you could update your article now that every single all-in-one ETF portfolios are supported, including their ESG ones (XCNS, XBAL, XGRO, XEQT, GCNS, GBAL, GGRO, GEQT)

@Hyacinthe – It’s a very cool service! I signed up for it at Questrade, and I do find it’s great for behaviour (i.e., Since you need to send in another form to cancel your savings plan, most investors can’t be bothered, so they just continue saving ;)

When VEQT is held in a taxable account would it ever be necessary to fill out a T1135 form when filing income taxes? Is it the same for XEQT?

@Darby – VEQT, XEQT, or any Canadian-listed ETF are not considered foreign property for the purposes of completing a T1135 form.

U.S.-listed ETFs (like VTI, ITOT, IFA, IEMG, and VWO) are considered foreign property, so if you held U.S.-listed ETFs with a cost base above $100,000 in your taxable account, you would need to complete a T1135 form.

Hello Justin, have you heard of vanguard canada being under investigation by the AMF due to their patented system for taxes. My financial advisor warned me to withdraw.

Should I listen to it? What can happen? I own VEQT…

Thanks

Hey Justin,

Not sure if you get to read the comments on these older posts, but I thought my question belonged here.

There have been a lot of other companies jump onto the “asset allocation ETF bandwagon”. TD recently launched their “one click” lineup, and I recently saw that Mackenzie Investments launched some asset allocation ETFs as well with a reasonable MER. Are either of these products worth taking a closer look?

Do you have any plans to cover these in future blog posts or podcasts? You’ve done the best job at “deep diving” into specific ETFs in the past in a way that os easy to understand.

Thanks!

@Mark H: I am planning to review these asset allocations ETFs in more detail at the beginning of next year, but I plan to recommend that investors avoid them, and stick to the passively managed ETFs from Vanguard, iShares and BMO.

In the meantime, I will be releasing a video next Thursday comparing the Vanguard and iShares Asset Allocation ETFs. Two weeks later, I plan to release a video for the BMO Asset Allocation ETFs.

Awesome, I look forward to seeing what your findings are in the new year!

It has always struck me that in the whole “Passive vs. Active” debate, the reason to avoid Active has always been the higher fees. As we see fees on active ETF’s approach those of their passive equivalents, I have to wonder if we will start to see the pendulum swing a bit back to the active side in the coming years.

That said, once one decides to pursue an active strategy, the number of choices increases tenfold

@Mark H: Active management can also be an issue, as you may not hold the specific securities that are generating the market returns (so it’s not just a losing strategy because of fees, but fees are certainly a big reason for the underperformance of active strategies).

Hi Justin,

Thanks for all the work that you do. This along with all the other portfolios are super helpful for a beginner like me. I’m still new to investing and your website in general and I know you’ve talked about foreign witholding taxes in your YouTube videos and otherwise but I had the following question – when handpicking individual ETFs over one asset allocation model, I understand which ETFs should be preferred in RRSP vs TFSA due to the FWT regardless of how small the difference in dollar amount might be. I was hoping to get your opinion on holding one of these products (VGRO/VEQT/XGRO/XEQT etc. ) in TFSA vs RRSP as the underlying funds are typically a mix of both of Canadian and US. If you’ve already talked/written about it somewhere else, please feel free to link me to that.

@John – You’re very welcome! I’ve written about asset location strategies a number of times (here are the links to the latest articles):

https://canadianportfoliomanagerblog.com/canadian-portfolio-manager-introducing-the-ludicrous-etf-portfolios/

https://canadianportfoliomanagerblog.com/canadian-portfolio-manager-introducing-the-plaid-etf-portfolios/

Excellent information as always, very detailed and well laid out. Thanks for sharing!

Hi Justin,

I like the idea of 1 ETF as it makes things a lot easier and simple for me. Right now I am using your 3 ETF model. When I sell my 3 ETFs should I put the money back in VGRO on the same day or should I use a dollar cost averaging strategy for the next 12 months? Thanks

@Pete Danza: Any strategy other than immediately putting the money back into a similar asset mix is market-timing.

Could you recommend which portfolio you would suggest for retirees who use the 4% withdraw rate, or would you suggest using possibly one of the one fund core holdings plus a few covered call etfs to increase yield a bit?

@Brian: I would suggest working with a financial planner to determine a suitable asset mix and withdrawal strategy for your own portfolio. Adding niche ETFs (like covered call ETFs) to an already prudent portfolio is not a solution (but perhaps including investment savings accounts and GICs could be suitable, depending on your specific situation and cash flow requirements).

Hi Justin – thanks for putting this analysis together – just in time for bonus and tax return season!

Apologies if this sounds like a novice question – I’ve gone through your posts but couldn’t find an answer to this (except for your home bias comments) – in addition to investing in VEQT, is there any benefit of adding XAW/VEF to boost exposure to other markets that VEQT provides (~30%)? Meaning that the portfolio would look like: VEQT + VEF or does this unnecessarily increase complexity without much return?

Thanks!

Ack, never find, found your Canadian vs. Global stocks posts! Do you have any thoughts about being too overweight in the US (or NA in general)?

@Stephanie: I would stick with similar weightings as the asset allocation ETFs (there’s really no benefit to complicating your portfolio for an unknown benefit).

Thanks Justin, appreciate the input!

Hi Justin, thanks for the great info. I am new to investing. I love the simplicity offered with buying a one ETF fund such as VGRO or VEQT. However, does it make sense to start with your ridiculous or ludicrous model if I anticipate that I could save my income effectively and grow my portfolio >$100,000 in a couple of years? or simply use the light model and then switch?

Thanks

@john: The majority of DIY investors should just use the Light portfolios (and never switch). You can always decide at a later time whether it makes sense to complicate your portfolio.

Do you know of an all in one vanguard US ETF that I can buy?

Hey Justin, i have some US funds that I want to put in an all in one fund. What do you think of VASGX (80% stocks, and 20% bonds) as I am 36? Would it be best to put in a rrsp account? Thanks

@Pete: VASGX is a U.S.-based mutual fund (not a U.S.-based ETF), so Canadian investors can’t buy it.

When Vanguard/iShares rebalances their portfolio (e.g., vgro/xgro), do the gains/losses affect your taxes?

@Lester: If Vanguard or iShares realize capital gains in their portfolios when rebalancing/trading (to the extent they don’t have any capital losses to offset them with), they would distribute these gains to their unitholders (so it would affect your taxes).

They can’t distribute capital losses to unitholders, but these can be used to offset gains within the portfolio (which would result in lower capital gains distributions to unitholders).

Great comparison! I am leaning towards XBAL for less home bias, the PACC option and 0.05% less fee. As of 2/7/2020 the MER for XBAL is 0.20% not 0.21% in the PDF analysis. Looking to invest a pension lump sum, so the difference for me is hundreds. The only other one I might consider is ZBAL with the same 0.20% MER. It would be great to see a PDF on that one too. Nicely done with the tax hit and 25-year Hypothetical Performance.

Hi Justin

Outside of questrade, do you know which other brokerage participant in the PACC?

@Azul: I’ve only set it up at Questrade so far. I’ve heard from other investors that the PACC program is also available at Qtrade.

If anyone has tried it out at other brokerages, please feel free to provide your experiences in the comments section.

Your blog/podcast (along with a few other resources) has taught me so much about passive investing over the last several years! My long-time investing sister was unfamiliar with ETFs until I introduced her to your blog not too long ago, and has since decided to shift her investment strategy, so these new model portfolios are perfectly timed!

@Simon Edwards: I’m so happy to hear these resources have helped you (and now, your investing sister!). Thanks for following the blog and podcast!

Hi Justin,

I hold VGRO in my CCPC. Is it still about 0.11 difference between the Light and Ridiculous portfolios? I used your taxable as the proxy.

I calculated that that would be an extra 1100/ year for every million invested if one used the light portfolio method.

That seems to be a fair trade for me.

I am afraid to see if your Ludicrous and Plaid will convince me to abandon my current strategy.

@Emily: From a product cost perspective, you would only save around 0.11% per year (by using the Ridiculous portfolio over the Light portfolio).

Hopefully Ludicrous and Plaid will remind you of all the benefits to keeping your portfolio simple :)

Does this 0.11% difference take into account the rebalancing costs? There appear to be two costs, the commissions incurred when doing the trades required to rebalance, and the cost of the rebalancing frequency that is employed. Here I have in mind recent research from Morningstar: https://www.morningstar.com/articles/962396/heres-why-you-should-rebalance

From my understanding of that article’s implications rebalancing on a monthly basis, as opposed to a yearly or even continual basis like in these all in one ETFs, might see that 0.11% differences vanish altogether.

@Adonis: The 0.11% difference is the MER. Rebalancing differences would vary for each investor, relative to an asset allocation ETF (this difference could be positive or negative, so it could eliminate the 0.11% figure or increase it).

Other differences could also have an impact (such as the exclusion of foreign bonds in the Ridiculous portfolios, as well as the inclusion of ZDB in taxable accounts).

Thanks for the response. I look forward to the rest of the series. Maybe if I am lucky and if it fits in with the planned content, rebalancing strategies relative to the model ETF portfolios will be considered, e.g. what is the optimal rebalancing frequency for the ridiculous/ludicrous portfolio for either an investor in the accumulation or withdrawal phase?

As context for my curiosity, I happen to have a fairly significant portfolio, in the withdrawal phase, where from an MER perspective it makes sense to steer away from the light portfolio model outlined here (my current portfolio looks very close to the ridiculous one, it just has little more asset location optimizations), but the Morningstar article I noted has me seriously considering just going with the all in one since the monthly rebalancing costs might well be canceling out the MER reduction the more complex portfolio achieves. So I’d be very curious to hear your thoughts on the topic rebalancing frequency.

Either way I am grateful for the excellent content you provide, it is a tremendous service to all Canadians who take the time to read (or now even listen) to your thoughts.

PS: The frugality bit in the podcasts is hilarious.

@Adonis: I wouldn’t get too bogged down with optimizing rebalancing frequency – it’s impossible to do. I would just top up any underweight asset classes whenever you add new money to the portfolio. If equities or fixed income become overweight by around 5%, you could also consider rebalancing at that time to keep your portfolio risk in check. If you’re withdrawing from your portfolio, perhaps just sell a portion of whatever asset classes are overweight at the beginning of each year to provide enough cash for the year (so calendar year rebalancing).

I’m glad you were able to pick out the “Frugality” line in the ETF Kombat – I’ve tried to think of another word that would beat it, but so far…nothing.

First class!

@Lyla: Thanks for reading the post :)

Great post.

Quick question why is your light model portfolio different than this one from CCP https://cdn.canadiancouchpotato.com/wp-content/uploads/2020/01/CCP-Model-Portfolios-Vanguard-ETFs-2019.pdf

Where there it’s a balancing act between just VEQT & VAB only – it seems like an easier way to do it to me – and the MER’s seems less when VAB is involved.

I feel like I’m missing something here.

@Elias: The CCP “2-ETF” portfolios are very similar to the CPM “2-ETF” portfolios, but they do not include foreign bonds (so this makes them a bit cheaper).

I’ve included the CPM 2-ETF portfolios mostly for reference (so that investors have a more complete asset allocation view). The moment you switch from a one-fund solution to multiple ETFs, you give up the biggest advantage of these “light” portfolios. If you’re going to already complicate your portfolio, there’s more efficient ways to do so (which I’ll get into in my upcoming posts).

Some investors may have already realized the CPM “Ridiculous” Portfolios for Vanguard ETFs are really just a cheaper combination of VAB and VEQT (as the weights in VCN, VUN/VTI, VIU, VEE/VWO are the exact same as in VEQT).

Excellent information as always, very detailed and well laid out. I enjoy the podcast as well, especially the ‘ETF Kombat’ section, haha.

@Marco: I’m glad you’ve been enjoying the blog and podcast. If you have any ETF Kombats you’d like to see happen on the podcast, let me know :)

I use the Vanguard asset allocation ETF in my TFSA and iShares in my RRSP, adding to each over time. If one ends up being the better choice, I have them both. Problem solved :-).

@Marco: You work smart, not hard ;)

Great post. Thanks Justin. Will be tuning in for more.

@Martin: Thanks for reading – looking forward to having you back.

This is fantastic, Justin – so detailed, well thought out, and clear! It is incredibly informative and helpful. Looking forward to reading all the installments in this series. Thanks so much!

@Rod Martin: I’m glad you enjoyed it! It is my hope that this series will be the definitive model ETF portfolio guides for Canadian investors (I will also be releasing videos and blog on the concepts for investors who prefer to watch/listen).

Immensely helpful, thanks Justin! My parents are retired and I’m planning to setup a super simple portfolio for them; I think the ‘light’ approach is best, and leaning towards VCNS or XCNS across all accounts (RRIF, TFSA, taxable). It seems the differences are more pronounced at this end of the spectrum. There are 9 basis points difference in fees (MER + FWTR) for tax deferred/free accounts. XCNS is cheaper but lacks international bond exposure, which seems important in a bond heavy portfolio. Could VCNS be preferable despite being more expensive? I’m probably overthinking it, but curious to know your thoughts.

@Chris: You’re very welcome, Chris. Both VCNS or XCNS could be reasonable options (depending on your parents’ specific situation). Historically, having more currency-hedged foreign bonds in a conservative asset mix has further reduced the portfolio’s risk (so this could be another reason to prefer VCNS to XCNS).