Welcome back! We’ve now pressed our Spaceballs-inspired accelerator past Light and Ridiculous, and have reached a Ludicrous level of model portfolio complexity (check out our Vanguard and iShares Ludicrous Model ETF Portfolio Examples here).

Our Ludicrous portfolios include the same ETFs with the same allocations as our Ridiculous portfolios. But they also build in traditional asset location strategies, aimed at increasing your expected after-tax return. In other words, they make sure each ETF is located in its proper account, with “proper” dictated by the asset class each holding represents. By locating relatively tax-inefficient assets in tax-preferred accounts and tax-efficient assets in taxable accounts, the goal is to achieve warp-speed tax-efficiency across your entire portfolio.

That is, if you’re not “chicken”. (If this reference flew past you, please revisit this clip.)

How To Locate Your Assets in Five “Easy” Steps

Since our Ludicrous portfolios’ make-up is identical to their Ridiculous portfolio counterparts, it’s not technically a separate model. It’s really more a different process for managing your holdings across your accounts. The basic process goes something like this:

- Plan out your asset allocations. First, determine the dollar amounts to purchase in each asset class. For example, if you have a $1 million portfolio with an 18% target Canadian equity allocation, you would want to purchase $180,000 of Canadian equities.

- Fill your TFSA with equities. Next, locate as many of your equity ETFs as you can in your TFSA … with two variations on that theme. I prefer to hold a mix of Canadian, U.S. international and emerging markets ETFs in the TFSA. But some investors prefer to prioritize holding their Canadian equity ETFs in their TFSA, to reduce the portfolio’s overall unrecoverable foreign withholding taxes. I personally don’t have an issue with this approach either, and have implemented both with my clients.

- Try to locate the rest of your equities in a taxable account. If you can, locate the rest of your equity ETFs in your taxable account, based on which are expected to have the lowest – or at least lower – taxable distributions. So you would purchase relatively tax-efficient U.S. or Canadian equity ETFs first (with the order depending on your taxable income and where you live in Canada). Next up are emerging markets equity ETFs. Relatively tax-inefficient international equity ETFs come last.

- Make your RRSP your last stop for locating any left-over equities. If you still need to purchase more equities after your TFSA and taxable accounts have been filled up, make your RRSP your last stop; locate these equity ETFs in the opposite order of how you did it in your taxable account. So, you’d purchase international equities first, then emerging markets equities, and then either Canadian or U.S. equities. If you’re comfortable with Norbert’s gambit, you could purchase U.S.-based foreign equity ETFs in your RRSP to reduce your overall product costs and foreign withholding taxes.

- Round out your taxable account (and RRSP) with bonds. If your equities have now all been purchased and you still have dollars left to invest in your taxable account, you could purchase a tax-efficient bond ETF with your remaining cash, like the BMO Discount Bond Index ETF (ZDB). You could then purchase a traditional (less tax-efficient) bond ETF in your RRSP to round off your fixed income allocation.

Trading Places: Is Ludicrous Asset Location Worth It?

Now for the million-dollar question: Does this old-school asset location strategy actually work?

As we now have a full year of actual (not back-tested) performance and tax data for our Light balanced portfolios, we can compare their 2019 after-tax returns to those of our Ridiculous and Ludicrous balanced portfolios.

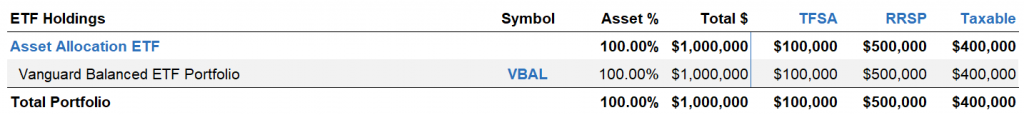

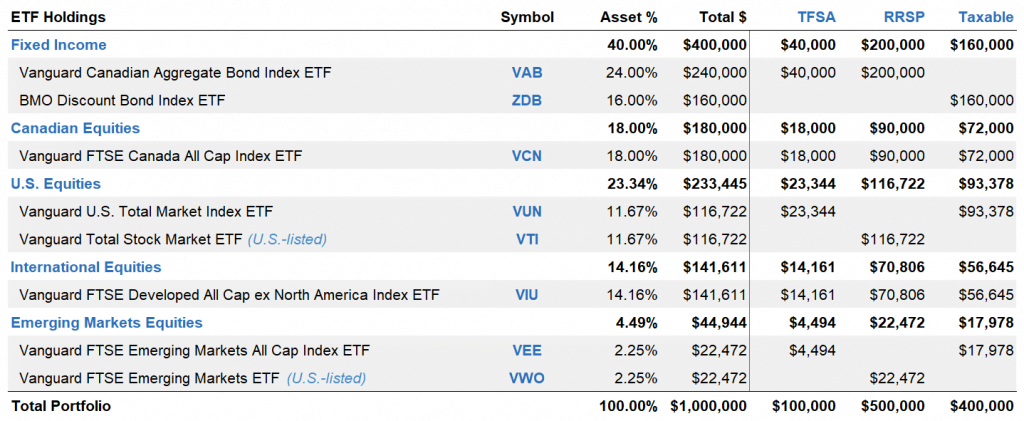

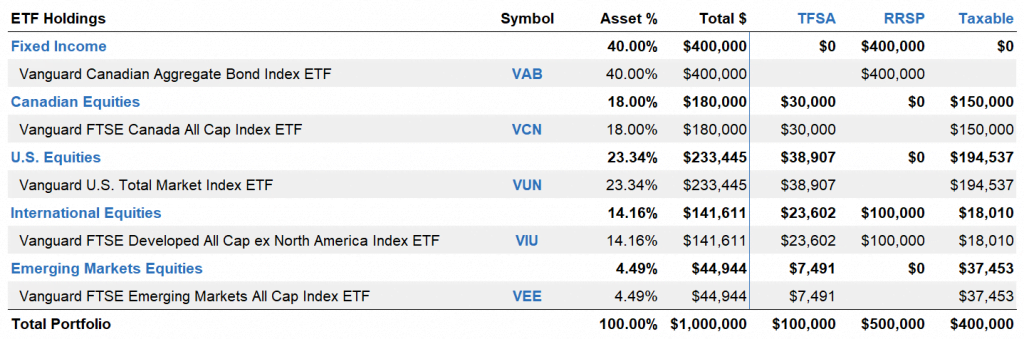

For our example, we’ll assume an Ontario top-rate taxpayer and multimillionaire “Pat” invests $1 million in each of our Vanguard Light, Ridiculous and Ludicrous 40% bond / 60% stock model portfolios at year-end 2018. Being the adventurous type, Pat invests $100,000 in each TFSA, $500,000 in each RRSP, and $400,000 in each taxable account. Pat continues to hold these investments until year-end 2019, and then sells everything and deregisters the RRSP assets. (Obviously, Pat’s behavior is more than a little ludicrous, but for the sake of our experiment, we’ll cut our friend some slack.)

2019 is a decent period to analyze, as all asset classes had positive performance, but stocks still handily beat bonds. This is what most investors would expect from these asset classes over the long-term, so it makes for a good microcosm, if you will.

I’ve included examples below showing how Pat located each ETF in each account type at the beginning of the experiment. Keep in mind, since Vanguard’s foreign equity allocations are market-cap weighted, the percentage values in our examples will be slightly different than those seen in our current model portfolios.

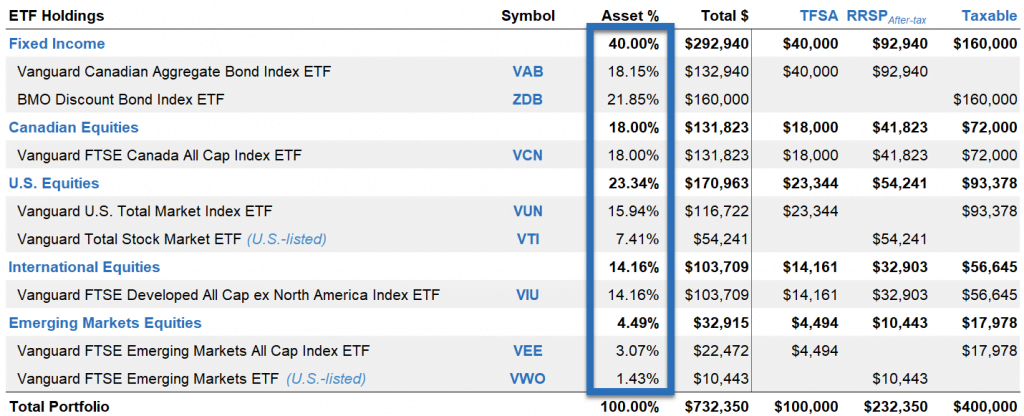

Light Model ETF Portfolio

Sources: Vanguard Investment Canada Inc., As of December 31, 2018

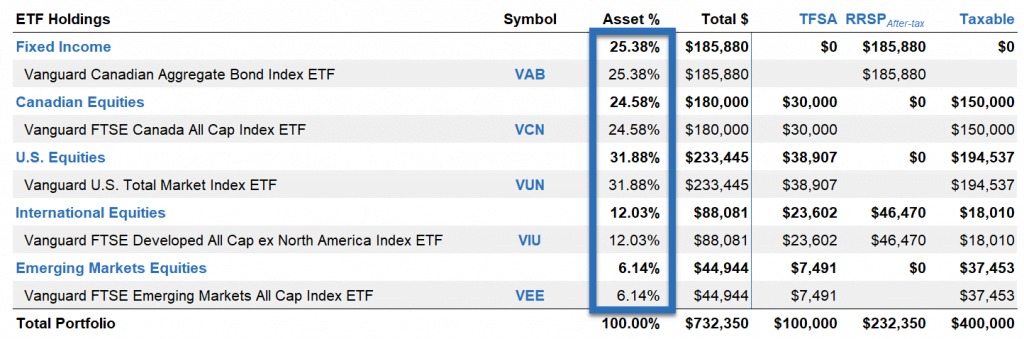

Ridiculous Model ETF Portfolio

Sources: Vanguard Investment Canada Inc., CRSP, FTSE Russell Indices, as of December 31, 2018

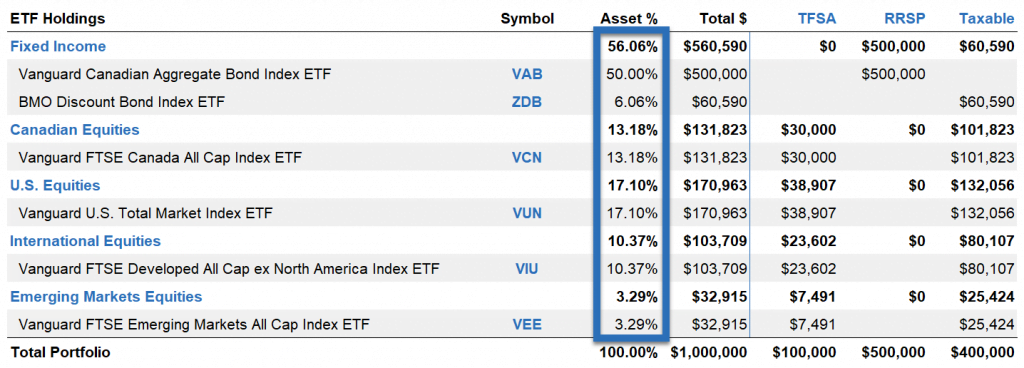

Ludicrous Model ETF Portfolio

Sources: Vanguard Investment Canada Inc., CRSP, FTSE Russell Indices, as of December 31, 2018

The Light and Ridiculous portfolio arrangements should look familiar from our past discussions. However, the Ludicrous portfolio is set up very differently.

First, you can see that the TFSA is now 100% equities, with 30% in a Canadian equity ETF (VCN), and 70% in three market-cap weighted foreign equity ETFs (VUN, VIU and VEE) (Quick tip: As the Vanguard All-Equity ETF Portfolio (VEQT) is now available to investors, you could also consider simplifying your TFSA investment by replacing VCN/VUN/VIU/VEE with VEQT).

In the taxable account, there is almost enough room for the remaining equities, except for the most tax-inefficient international equity ETF, VIU, with its highest taxable distribution). Only $18,010 will fit into the taxable account, so the remaining $100,000 allocation has spilt over into the RRSP account.

Finally, VAB rounds out the entire bond allocation with the remaining RRSP balance.

The Right Place at the Right Time

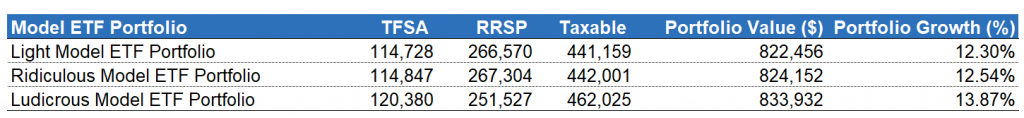

So how did Pat do? At the end of 2019, after all securities have been sold and RRSPs deregistered, we find that the Ridiculous portfolio had a slightly higher after-tax portfolio value and after-tax return than the Light portfolio. The numbers were $824,152 vs. $822,456, and 12.54% vs. 12.30%, respectively.

This makes sense, since we already knew that the Ridiculous portfolios are cheaper and more tax-efficient than the Light portfolios. Unsurprisingly, the Ridiculous portfolio offered lower product costs and foreign withholding taxes from its U.S.-based ETF holdings, and higher tax-efficiency from the taxable account ZDB holding.

The more interesting result is the relatively high after-tax performance found in the Ludicrous portfolio. It has a much larger after-tax portfolio value and after-tax return of $833,932 and 13.87%, respectively. So, what’s causing the Ludicrous portfolio’s huge performance advantage?

After-Tax Portfolio Values and Returns: Light, Ridiculous and Ludicrous Model ETF Portfolios

Sources: taxtips.ca (2019), cds.ca (2019), Bank of Canada (2019), Vanguard Investment Canada Inc. (2018-2019), CRSP, FTSE Russell Indices, as of December 31, 2018

Comparing Apples-to-Apples, ATAAs-to-ATAAs

The Ludicrous edge all comes down to differences between the portfolios’ after-tax asset allocations (ATAAs). In all portfolios, the RRSP is worth $500,000 before the government gets its cut. But once we factor in future taxes at the top Ontario tax rate, the RRSP is really only worth $232,350 [$500,000 × (1 – 53.53%)]. As the Light and Ridiculous portfolios hold the same asset mix across all accounts (including the RRSP), their initial after-tax asset allocation is still 40% bonds and 60% stocks. Sure, each security held in the RRSP is worth less from an after-tax perspective, but the overall portfolio’s asset mix stays the same, before- and after-tax.

On the other hand, the Ludicrous portfolio has a significantly more aggressive after-tax asset allocation of around 25% bonds and 75% stocks. This is because the portfolio holds its entire $400,000 bond allocation in the RRSP. From an after-tax perspective, this $400,000 bond allocation is only worth $185,880 [$400,000 × (1 – 53.53%)]. If we divide this after-tax fixed income value by the after-tax value of the entire portfolio – voila – we end up with only a 25.38% after-tax bond allocation.

Light Model ETF Portfolio (After-Tax)

Sources: taxtips.ca, Vanguard Investment Canada Inc., as of December 31, 2018

Ridiculous Model ETF Portfolio (After-Tax)

Sources: taxtips.ca, Vanguard Investment Canada Inc., CRSP, FTSE Russell Indices, as of December 31, 2018

Ludicrous Model ETF Portfolio (After-Tax)

Sources: taxtips.ca, Vanguard Investment Canada Inc., CRSP, FTSE Russell Indices, as of December 31, 2018

Are the Ludicrous Portfolios Really More Tax-Efficient?

To determine whether the Ludicrous portfolios are actually more tax-efficient than the Light or Ridiculous portfolios, we have to make sure we’re comparing portfolios with the same after-tax asset allocations. If we adjust the before-tax asset allocation of the Ludicrous portfolio in our prior example so its after-tax asset allocation matches the Light and Ridiculous portfolios (i.e. 40% bonds, 60% stocks), we would need to start with approximately 56% in bonds and 44% in stocks.

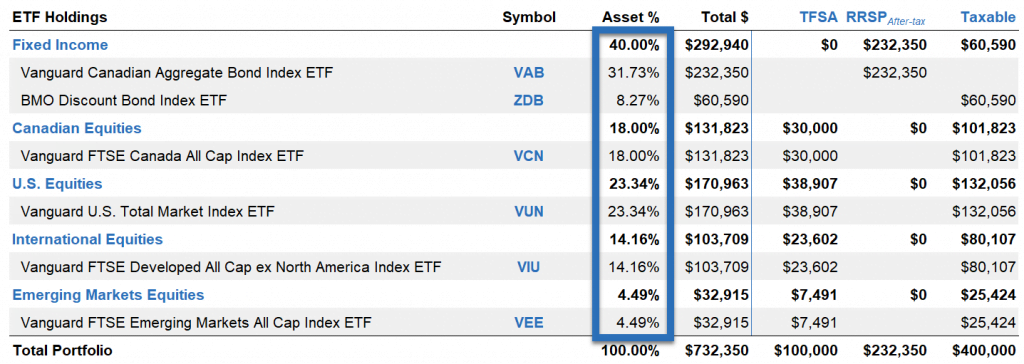

Ludicrous Model ETF Portfolio (Before-Tax Asset Allocation): 56.06% bonds / 43.94% stocks

Sources: taxtips.ca, Vanguard Investment Canada Inc., CRSP, FTSE Russell Indices, as of December 31, 2018

Ludicrous Model ETF Portfolio (After-Tax Asset Allocation): 40% bonds / 60% stocks

Sources: taxtips.ca, Vanguard Investment Canada Inc., CRSP, FTSE Russell Indices, as of December 31, 2018

If we run the same after-tax return analysis using this new portfolio, we find that the adjusted Ludicrous portfolio actually ends up with a lower after-tax portfolio value and return than any of our other portfolios – $819,840 and 11.95%, respectively. This would indicate that it’s not the tax-efficiency of the original Ludicrous portfolio that made it superior. It was because Pat was perhaps unwittingly taking on more after-tax equity investment risk.

As I’ll cover next in more detail, if you can live with this technically tax-inefficient portfolio to increase your expected after-tax portfolio value, Ludicrous investing can still be a viable strategy. But it’s best if you go in knowing the facts.

After-Tax Portfolio Values and Returns: Light, Ridiculous, Ludicrous and Ludicrous (ATAA) Model ETF Portfolios

Sources: taxtips.ca (2019), cds.ca (2019), Bank of Canada (2019), Vanguard Investment Canada Inc. (2018-2019), CRSP, FTSE Russell Indices, as of December 31, 2018

Advantages of the Ludicrous Portfolios

Okay, so maybe we haven’t found the holy grail of tax-efficient investing with our Ludicrous portfolios. But there are still several great reasons to consider using them for your own investments.

- Higher expected after-tax returns. Even though the after-tax benefits of your before-tax asset allocation may be a bit of a mirage, the higher expected portfolio value is very real. Your product fees and unrecoverable withholding taxes will also be lower than with the Light portfolios.

- Behavioural benefits. As far as Pat was concerned, the portfolio was a 60/40 stock/bond portfolio. All of Pat’s statements and performance reports would indicate the same, as they are all reported on a before-tax basis. The Ludicrous portfolios can be a great way to trick your brain into thinking you’re taking the same amount of risk as the other portfolios, while increasing your expected return. There are so few opportunities in investing where irrational behaviour can work to your benefit, why not take advantage of this one?

- Forecasting future tax rates is not required. At no point will you need to predict future tax rates in order to successfully manage your Ludicrous portfolio.

- Lower expected minimum RRIF withdrawals. The Ludicrous portfolios invest more of your lower-yielding bonds in the RRSP, so this account isn’t expected to grow as quickly as your TFSA or taxable account. This can reduce the amount of mandatory minimum RRIF withdrawals at age 72, which could also lead to fewer Old Age Security (OAS) clawbacks in retirement.

- Norbert’s gambit may not be required. Depending on your asset mix and account values, you may not need to hold U.S.-based ETFs in your RRSP to reduce the withholding tax drag. If you can hold your entire equity allocation in your TFSA and taxable account, you’ll only need to purchase bond ETFs in your RRSP with your Canadian dollars.

- Fewer holdings than the Ridiculous portfolios. The Ludicrous portfolios tend to have fewer holdings to manage than the Ridiculous portfolios. This is especially true if you decide to simply hold a 100% equity ETF, like VEQT or XEQT, in your TFSA and taxable accounts.

- More opportunities for tax-loss selling. Investors with larger taxable accounts could hold most of their equities there, which could present more tax-loss selling opportunities over time.

Now, to the potential disadvantages to managing a Ludicrous portfolio.

Disadvantages of the Ludicrous Portfolio

- It’s more complicated. Nothing beats the Light portfolios in terms of DIY simplicity. I list this as the primary disadvantage for good reason. Time = money!

- You will be taking more after-tax equity risk. Even though it may not feel like it, know that you’re sharing less of the portfolio risk load with the government, relative to holding the same asset mix across all accounts.

- Your rebalancing spreadsheet will get a workout. Any time you add new money to the portfolio, or withdraw funds from it, you will need to review all accounts in your spreadsheet, and determine which trades need to be placed. You’ll do so on a consolidated-portfolio rather than an account-by-account basis.

- You’ll need to track more ACBs. At least relative to the Light portfolios, you’ll need to track the adjusted cost bases on multiple ETFs held in your taxable accounts.

- Your accounts will perform differently from one another. During bull markets, you might be asking yourself why your bond-heavy RRSP is doing so poorly. During bear markets, you’ll be wondering why your TFSA and taxable accounts are underperforming your RRSP. Calculating your portfolio’s performance on a consolidated basis can help with this issue.

- Unexpected capital gains. If you require a large, lump-sum amount from your taxable account (such as for a down-payment on a home), you may find yourself realizing more capital gains than the other portfolios. This is because your taxable account will have a higher allocation to equities, which could be trading at a significant gain.

- More unexpected capital gains. Also, if you can’t keep your portfolio in balance by injecting new cash into it when needed, you may need to instead rebalance periodically by selling equities in your taxable account, realizing capital gains in the process. In contrast, the Ridiculous portfolios hold substantial equities in the RRSP account, which you can sell to rebalance the portfolio with no tax consequences.

Next Up – CPM Goes Plaid

We’re nearing the end of our model portfolio adventures. But before we leave you to chart a Light, Ridiculous or Ludicrous course, we have one last model to show you. The Plaid!

What if you wanted your portfolio to incorporate the after-tax asset location concepts just discussed? For example, what if you wanted to start out with appropriate before-tax allocations to shoot for a truly tax-efficient, after-tax 60/40 portfolio? Good news – our Plaid model portfolios will take you there.

Justin, can Passiv be used to rebalance the Ludicrous and Plaid portfolios? The difference in fees and the tax drag you estimate compared with the Light portfolios ends up being fairly significant on an $800K investment.

@Philip – I haven’t tested Passiv, but from what I understand, it would not be able to assist DIY investors with asset location management.

Hi Justin,

I wonder where can I find the PDF portfolio to download. The link doesn’t work anymore, and I can’t find a Ludicrous, Ridiculous or Plaid portfolio to download on the website.

Hi Justin,

Thank you for the work that you do!

My investments are currently actively managed and I am in the research phase of transitioning to one of your outlined portfolios. For me, the benefits of simplicity and time savings in the light portfolio are worth the cost of higher MERs and taxes – especially since it is already significantly more cost efficient than my actively managed portfolio.

Example 4 (60% VEQT and 40% VAB) from the ludicrous portfolio appealed to me for its simplicity. Could you please elaborate on what the differences between Example 4 and the light portfolio are in terms of expected rates of return and risk?

Thank you!

Hi Justin,

First off, thank you so much for all the work you do. I have learned so much from your blog the past couple weeks, reading and re-reading, watching and re-watching. Please don’t ever take this site down as I have a feeling I will be referring back to this for years to come.

I’m a little confused however by this section: “Make your RRSP your last stop for locating any left-over equities. If you still need to purchase more equities after your TFSA and taxable accounts have been filled up, make your RRSP your last stop”

How does one fill up a taxable account? There is no limit on taxable accounts, is there? Am I missing something? If there is no limit on taxable accounts, then I’ll never fill it and therefore never get to my RRSP, which is why I am confused by your recommendation here.

Thanks again!

@Nelson: If you have $100,000 in a TFSA, $100,000 in an RRSP and $100,000 in a taxable account (and no other cash to invest), your taxable account is “filled up” once you’ve purchased $100,000 of equity ETFs.

Since my account has just cracked 100000 I haven’t bothered to Norberts my nonCAD funds. I did it once with Questrade for a large portion to get it in VTI.

I realized then that it would be a real painful task when adding my monthly deposits to have to login buy a stock. Then call/chat Questrade then wait 3 days then sell, then buy the funds I want.

Too much work to have to login multiple times and perform multiple moves. But then I just thought of something.

Why not buy XEF, XEC or XUU every month for a year or so and then sell it all, perform the NGambit once and then buy the US equivalents at the cheaper cost. You pay the slightly higher tax and pay the FWT for one year but the rest of your investment career you save.

As a DIY corner cutting, time saving strategy I think it’s a great idea.

@Martin Sandbach – This is certainly an option. The main risk is that you’ll be out of the market for a number of days while processing the gambit (which may end up costing you more in opportunity costs than the tax and fee savings, if markets were to increase over this processing period).

Hi Justin,

Thanks for the great info. If I were to look to simplify and locate all my equities in the TFSA, would it make sense if I bought VXC and VCN instead if I wanted to lower my CAN target? Or is VXC less efficient.

Given Foreign Withholding Tax is unrecoverable in the TFSA, is it preferable to avoid foreign investment or is this a case of it shouldn’t matter since the key is to grow your TFSA as high as possible given the income tax is likely to take the biggest chunk of your investments.

@Jason – VXC is going to have unrecoverable foreign withholding taxes (whereas VCN would have none), but since we don’t know which asset class will outperform over the long-term, I don’t see any issues with holding both in your TFSA.

@Justin: You have 10 examples in your Ludicrous portfolio, can you please give a brief description of each one? I can see what you doing with some, but a couple of them I just can’t figure out. As always, thanks for your amazing blog, Quentin.

Hi Justin,

Thanks for the great analysis. It’s perfect timing and I think I’m ready to switch from TD index to the world of ETF with multiple accounts now.

Just a couple of questions if you don’t mind:

1. Am I correct that another disadvantage in using Light is that as we are getting older, to increase the bond ratio will require sell VABL and buy something else. That’ll cost large capital gain for the taxable account. Or do you have another way to change the allocation while still using Light?

2. Another question is that for people who have defined benefit pension, could or should we treat that as fixed income, so additional saving (RRSP/TFSA/taxable account) can be all in equity.

@Helen: I don’t mind at all :)

1. That is one disadvantage of the Light portfolios, but as you approach retirement, you can simply add new contributions and ETF distributions to a bond ETF (like VAB or ZDB), 1-5 year laddered GICs, and cash equivalents. I discuss this process on the CPM podcast when I answer this exact listener question:

https://canadianportfoliomanagerblog.com/podcast-4-shedding-light-on-the-light-model-etf-portfolios/

2. Although it makes sense (in theory) to have a higher equity allocation if you have a defined benefit pension plan, in reality, you should stick with an asset mix you can stomach. Your willingness to take risk should be driving the majority of your asset allocation decision, not your ability to take risk:

https://canadianportfoliomanagerblog.com/choosing-your-ideal-vanguard-asset-allocation-etf/

Hello Justin,

Thank you for this blog. I have been looking high and low for discussions on this topic for a long time especially where to allocate funds across accounts (tfsa/rrsp/non reg) within my asset allocation parameters.

In your examples you describe 40% bonds and 60% stocks asset allocation.

What about 60% bonds and 40% stocks? Would you put 600k VAB to RRSP?

Would you put stocks in same ratios as in your ludicrous example?

@Mike: In the same example, if the portfolio’s asset mix was 60% bonds and 40% stocks, you would purchase $500,000 of VAB in the RRSP (the RRSP is only worth $500,000, so you can’t buy $600,000 of VAB), and $100,000 of ZDB in the taxable account. You can refer to the “Ridiculous” model portfolios for the current equity weights across various asset mixes:

https://canadianportfoliomanagerblog.com/model-etf-portfolios/

Hi Justin,

I hold all my investments in RRSP and TFSA accounts as I am invested in a pension plan, I feel I do not the need to make further contributions to a taxable account. Correct me if I am wrong please but for this type of situation would it make sense for me to hold all Canadian ETF’s in my TFSA as well as as much international and emerging market ETF’s as possible.and putting all US and Bond ETF’s in my RRSP. rounding off my RRSP with international and emerging market ETF asset mix room left over from TFSA. this would make sense to me or would it make more sense to split US, International, and Emerging ETF’s in both TFSA or RRSP. Any comments or opinions would be greatly appreciated.

Thank you in advance :)

@Jared: If you are managing a “Ludicrous” portfolio, your asset location strategy would be to hold equities in your TFSA first, and RRSP second. The choice of equities in your TFSA is not as important. I tend to hold a mix of Canadian, U.S., international and emerging markets in the TFSA. But you could also hold Canadian only, a mix of Canadian and international, etc. And if you’re trying to reduce foreign withholding taxes, it’s best to hold U.S.-based U.S. equity and emerging markets equities in your RRSP.

HI Justin, thanks as always for your knowledge and sharing it with us all.

I have a CCPC and investments spread among RRSP, TFSA, Non-reg, and corp accounts.

I was thinking that if we added on an additional layer of tax efficiency of eligible dividend distributions out of a CCPC, that additional wrinkle would make asset location of Canadian Equities in a Corp highly desirable.

I know that’s different than a purely investment return analysis but was wondering if you had insights into that part of the overall taxation calculations?

@Steve: From a personal/corporate tax integration perspective, Canadian eligible dividends in a CCPC are more desirable than foreign dividend income:

https://canadianportfoliomanagerblog.com/taxation-of-foreign-income-in-a-corporate-account/

Hi Justin,

Based on my reading, it seems that the “Ludicrous” profile may be best for use with a CCPC investing account, TFSA (and if I need the room, RRSP contributions) – Would you agree? (I am not interested in taking the additional step of US-listed equities in the RRSP)

Can you comment on deciding asset allocation percentages – for your 60/40 examples, why did you not use 20% CDN equities, 20% US equities, 20% International (developed and emerging markets) equities? What tips would you give when trying to decide which percentages make the most sense? How do you decide how much (%) developed vs. Emerging market you want to invest in?

Lastly, Is there a good single ETF option that captures both developed and emerging international market equities that would be a good option for both a TFSA and a CCPC investing account?

Thank you! All your work is so incredibly helpful. It is much appreciated!

Stephanie

@Stephanie: It depends on your definition of “best”. Using a Ludicrous asset location strategy is expected to result in higher after-tax portfolio values, but this is due to the increased after-tax equity risk. I personally use this asset location strategy in client accounts, mainly because the Plaid asset location strategy is not practical.

The exact asset allocation choice is not as important as sticking to whichever asset allocation you choose over the long term. For the new CPM model ETF portfolios, I’ve used the same asset allocations as those found in the Vanguard and iShares asset allocation ETFs. In my client portfolios, I use a 1/3, 1/3, 1/3 (Canadian, U.S., international/emerging markets) equity breakdown. The results have been very similar, so I wouldn’t overthink this decision.

There are no decent ETF options for combining international and emerging markets equities. The closest would be VXUS or IXUS (but they include Canadian stocks as well, and trade in U.S. dollars.

Thanks Justin.

As a follow up, I started my DIY investing about 3 years ago with TD e-series funds. I am due to rebalance now/I have extra funds to invest and I think I’m comfortable with ETFs as I have had a lot of time over the past few weeks to read about them. When starting with ETFs, should I sell all my e-series funds and buy the diversified asset classes (CDN bond/CDN equity/US equity/International equity) in ETFs? This seems like it may be an ok thing to do in my TFSA, but I understand that there would be tax consequences in the CCPC. The CCPC only has about $15,000 across the common 4 TD e-series funds. Or should I just hang on to what I have for e-series in the accounts and add the ETFs and use them moving forward?

With e-series, I used just the “international” TD fund and never broke it up into developed and emerging markets. I would like my ETF portfolio to have 1/3 of equities be international, but what amount of that 1/3 should be developed and what amount should be emerging markets?

Thanks! After this, I think my “analysis paralysis” may be over and I can implement my plan. I’m quite looking forward to that.

@Stephanie: This decision would depend on your specific tax situation. I would recommend speaking with your accountant to determine the best approach to take in your CCPC.

Hi Justin,

I really like your ludicrous strategy of using veqt, vab. Now I try my best to put all vab in my rrsp. However I have a lot of rrsp contribution room. Is it better to use this contribution room get a tax refund and also buy veqt in my rrsp to keep it at 80/20 or only buy veqt in a taxable account?

@Pete: It’s totally fine to buy a portion of VEQT in your RRSP to keep your portfolio in balance (you lose a bit to foreign withholding taxes, but that’s the main downside).

Hi Justin,

What’s the ETA on Plaid portfolios?

@Ryan: I’ll be posting the Plaid blog tomorrow (the example Plaid portfolios will take longer though, as I’m a bit preoccupied with tax season).

@Justin: oh man, it’s feel like I missed something in the explanation, why are there so many example of different combinations?

@Justin: you lost me on #3. Why would you put equites in a taxable account before you would put bonds there?

@Que: I would recommend ignoring these more complicated portfolios and sticking with the Light portfolios.

@Justin: I already have some understanding of with holding taxes where your US ETFs are good in RSP, and benefit of faster growth potential in TFSA versus RRSP, and the tax advantage of capital gains over distributions in a taxable account where ZDB would work well.

It just sounded conflicting, and I was wondering what your thoughts were.

Hey Justin,

First, thank you for all you do, and the rest of the PWL team as well. Very inspiring and educational.

Second, a question, Horizons has a newly launched HULC (US Large Cap Swap ETF):, it appears to have no swap fee or any FWT, as there is no planned distributions. Seems too good to be true, we could hold this HULC and supplement with IWS and IJS (value factor tilt) for additional US market cap exposure… What do you make of these new Corp class ETFs and could you see these as a potential replacement for a US holding? (HULC).

I know….. I spun this a few directions… but my question is solely focused on your feedback on HULC, and while we’re on the same page, let’s add HXCN too.

Thanks for the read.

Btw, love the podcasts :)

@Max: I’m glad you’ve been enjoying the podcast (I have another two episodes ready to launch – just waiting on our compliance department to give the green light).

As for the corporate class Horizons family of ETFs, at the present time, I’m not comfortable commenting on these products until they’ve had a few years of after-tax performance that I can analyze. There’s also rumblings that the government is going to shut-down corporate class funds in the near future, so I wouldn’t get too excited about these ETFs as a viable long-term tax-efficient solution.

Hi Justin,

For those of us with Corporate accounts. Isn’t our corporate accounts similar to an RRSP taxation wise since we also do not own a good percentage of it either.

I look at my corporate accounts like an RRSP without RMD.

How does that change the calculations for a Ludicrous portfolio. I guess you might not see the behavioural benefit as the tax treatment is similar between the RRSP where you place the bonds and one’s CCPC.

@Emily: Although a corporate scenario would not be comparable to these specific examples (as they include personal accounts with no embedded tax liability on day 1), the asset location process would be the same for a Ludicrous portfolio (with personal non-registered accounts) and a Ludicrous portfolio (with corporate non-registered accounts). Holding equities in your TFSA first, corporate account second, and RRSP last will have a higher expected after-tax portfolio value than other asset location options (the main reason in this case is the ability to pay out 50% of realized capital gains tax-free from the corporate account through the capital dividend account mechanism – no such mechanism exists in the RRSP).

However, if you’re managing your portfolio’s asset mix from an after-tax perspective (very few investors do this), the asset location rules could change.

Hi Justin,

I have been using a modified Ludricrous portfolio with VGRO in my TFSA and corporate accounts and VAB in my RRSP.

I have been using this for almost two years now.

Even with the recent volatility, I find it embarrassingly easy to just add money to each account without needing to balance.

So far it is working like a charm!

All your information is invaluable. It is truly a goldmine for DIY investors. Thank you very much for doing this!

@Emily: Sounds like a very reasonable portfolio set-up. I’m glad you’ve been enjoying the blog – I have a lot of fun with it :)

Hi Justin,

Thanks for another great article! I can’t wait to see how you prioritize allocation of Canadian equities to TFSA in your next Plaid portfolio (reference your response to Amit). In the meantime, can you please comment on the following choices of ETFs:

1. Is XUU not better than VUN due to its lower MER?

2. You did not mention much about the BMO ETFs. How do you compare ZEA with VIU and XEF? All three have very close MERs. I am holding ZEA now, and wonder if there is any compelling reason to switch.

Thanks.

@Joe:

1. XUU is cheaper than VUN. But is it better? Very hard to say – I don’t like how it holds multiple U.S.-based U.S. equity ETFs (IVV, IJH, IJR and ITOT), instead of simply holding 100% ITOT (in comparison, VUN just holds 100% VTI). VUN and XUU have also nearly identical annualized performance over the past 5 years, ending February 29, 2020 (9.88% for XUU and 9.83% for VUN), so I don’t think it’s a decision to agonize over. I’m certain Vanguard Canada will lower their MER on VUN shortly.

2. ZEA is similar to XEF, but it has no small cap stock exposure (so I personally prefer XEF for a more diversified fund). Other than that “small” difference, ZEA is still a great option for large and mid-cap international equity exposure:

https://canadianportfoliomanagerblog.com/understanding-international-equity-etfs/

Hey Justin,

So I have put together a spreadsheet of what my Ludicrous portfolio might look like across our families’ multiple accounts (TFSAs, RRSPs, SRRSPs, LIRAs, Taxable). What I enjoy about my current ZAG/VCN/XAW style allocation is that every 3 months with dividends/distributions, it is easy to “buy the laggard,” and also rebalance with new funds, thus I rarely (so far never) have to sell equities to rebalance. With the Ludicrous portfolio, I think I would have to buy whatever security is in the account, then sell to rebalance whatever account holds both bonds and equities (RRSP).

Still, the fewer holdings overall is tempting.

Do you have a calculator where I can enter my own tax rate & information to compare my “before” results from 2019 with the hypothetical “ludicrous” results? Similar to your example above, but with my own numbers. I might need to really math this one out.

@Mark H: Unfortunately not, but I might consider creating a user-friendly calculator for asset location decisions.

@Justin:

Hi Justin, In Marks description “I would have to buy whatever security is in the account, then sell to rebalance whatever account holds both bonds and equities (RRSP).” It made me wonder, did you take re-balancing into the equation of figuring out your returns? I am thinking in the situation of when equities crash, and you want to use your bonds to re-balance, which would be in your RRSP account. Now in comparison to the TFSA account where there would only be equities. The TFSA would not benefit from re-balancing like the RRSP would. Is this something worth to consider?

@Roger – In the one year return comparisons of the various portfolios, there was no rebalancing.

There will certainly be times when it would have been nice to have bonds in the TFSA for rebalancing purposes, but without knowing when those times are, it’s more tax-efficient to keep all equities in the TFSA.

When you calculated the after-tax return for the year, did you assume that the only taxes paid where those that would be assessed in 2019 if Pat didn’t sell his shares (so dividends basically)?

I’m not clear in my mind on this so I could be off-base here but if we want to see whether the asset location strategy has real financial advantages through tax efficiency, might you want to analyze the situation if Pat sold all of Pat’s shares, and distributed all the funds from the RRSP and took it as income?

Obviously Pat wouldn’t do this all at one time but at some point this would happen (let’s say at death at the latest) and we would want to know if the asset allocation strategy led to higher performance (for example, because the higher capital gains in the taxable account are taxed at capital gain rates rather than turning into ordinary income through the RRSP).

@Jeremy: My assumptions were included in the blog:

For our example, we’ll assume an Ontario top-rate taxpayer and multimillionaire “Pat” invests $1 million in each of our Vanguard Light, Ridiculous and Ludicrous 40% bond / 60% stock model portfolios at year-end 2018. Being the adventurous type, Pat invests $100,000 in each TFSA, $500,000 in each RRSP, and $400,000 in each taxable account. Pat continues to hold these investments until year-end 2019, and then sells everything and deregisters the RRSP assets. (Obviously, Pat’s behavior is more than a little ludicrous, but for the sake of our experiment, we’ll cut our friend some slack.)

Apologies for missing this and taking up your time!

I have read it more closely now. I will wait to see your Plaid portfolio and perhaps then will better understand why the after-tax return (for the same asset allocation) is actually lower in the ludicrous model than the ridiculous one – even though the approach is meant to bring more, rather than less, tax efficiency

@Jeremy: No worries at all!

The Ludicrous portfolio had a higher after-tax return and after-tax portfolio value than either the Ridiculous or Light portfolios. But this is due to it taking more after-tax equity risk (keep in mind that it was still had a 60% equity, 40% fixed income asset mix before-tax).

So you can still say that the Ludicrous portfolio is expected to have a higher after-tax return and after-tax portfolio value than either the Ridiculous or Light portfolios, but you can’t say that its expected outperformance is due to its superior tax efficiency.

Thanks – If I understand correctly now, we can we say that – for any given after tax adjusted asset allocation – the Ludicrous portfolio has a lower return than even the light portfolio?

I understand the potential behavioral benefits (of thinking you have less equity exposure than you do) but otherwise Pat could do better by using a light portfolio with the actual after tax asset allocation she has (roughly 75% equities not 60%)?

So the ludicrous portfolio has a tax cost rather than benefit, as you point out.

Jeremy: You got it! The Ludicrous portfolio is the winner from a behavioural perspective, but a loser from a tax-efficiency perspective. The Plaid portfolio (which I will discuss in my next blog) is the winner from a tax-efficiency perspective, but a loser from a behavioural perspective. The Light and Ridiculous portfolios are somewhere in-between these two extremes.

I personally feel behavioural arguments have more weight than tax-efficiency arguments (this is most likely due to my constant interaction with clients and DIY investors, which provides me with a very unique perspective). This is why I prefer the Ludicrous portfolios over the Plaid (that, and because you can’t predict future tax rates with accuracy). It’s also why I feel most DIY investors should probably opt for a Light portfolio.

Hi Justin, this is awesome, thanks you so much for the work you put into this!

I am wondering if the ordering of your steps for this would be altered in those of us whose taxable accounts are corporately held vs. personally.

My understanding based on your PWL White Paper was that we are generally better off in the long run putting assets preferentially into TFSA/RRSP rather than corp taxable. Also, why not preferentially put XUU into an RSP to at least be protected from one layer of FWT?

To boil it down, here are my questions:

1. For those with prof corps, would you advise we fill up TFSA/RRSP accounts preferentially before leaving anything in the corp taxable account?

2. Is there a tax-efficiency gain by holding ZAG/XBB in RRSP compared to holding ZDB in taxable?

3. If there’s room in the RRSP, wouldn’t XUU be the preferred equity ETF to go in there?

3. Finally, would you recommend REITs to go into a) RRSP or b) TFSA? Presumably these would be tax inefficient, thus not in a taxable account? My understanding is that it doesn’t really matter, but I’m not confident about this.

@Dan: You’re very welcome – to answer your questions…

First, the Ludicrous asset location process uses the same equity order for assets held corporately (i.e. TFSA first, corporate account second, RRSP last).

1. I could be wrong, but it sounds as though you’re mixing up the decision on whether to withdraw from the corporation to fund your TFSA/RRSP, with our asset location discussion.

2. As we’ll see in our Plaid portfolios, there is an actual tax-efficiency advantage to holding ZDB in a taxable account (and your equities in an RRSP), if you manage your asset allocation from an after-tax perspective.

3. XUU would lose a layer of withholding taxes in an RRSP. It would be better to hold ITOT. Whether this makes sense from an asset location perspective depends on how you’re managing your portfolio.

4. I’m not dealing with REITs in this asset location discussion. But they kick out a lot of annual taxable income, so you would generally want to protect them from annual taxation by holding them in a TFSA/RRSP.

Justin, it’s very interesting that the behavioural advantage of holding bonds in your RRSP and not adjusting for after tax asset allocation, overwhelms the post tax inefficiency of the after tax asset allocation Ludicrous portfolio. I assume that is because of the “second TFSA within the RRSP” having bonds instead of equities in it is the reason? Is there any other contributing factor? We used to think that asset location was a good idea because of tax efficiency considerations, when it is, in fact, behavioural, assuming post tax allocation is not done, which is likely the case for the vast majority of DIY investor. My favourite portfolio is now priortizing VEQT for TFSA and taxable accounts and bonds for RRSP (without after tax asset allocation).

@Grant: You’re bang on with your reasoning. Most investors won’t argue that they should hold equities in their TFSA first. So if you adjust your RRSP for what it’s actually worth to you after-tax, your “leftover” portion effectively becomes another TFSA. So from an after-tax perspective, you should also hold equities in your RRSP first.

I like the behavioural argument for implementing a traditional Ludicrous portfolio as well (as you suggested, VEQT in the TFSA and taxable account and bonds in the RRSP would be an easy set-up, similar to my Ludicrous Example #4 in the model ETF portfolios section of the blog).

Hi Justin,

I see where you are coming from with equities in TFSA and RRSP.

But for those of us with corporations would it not be better to keep equities mainly in our corporation. Then we do not run into the RMD issues and OAS clawbacks. We have more flexibility with our CCPC.

Or do you suggest your clients with large portfolios put equities into TFSA and RRSP first?

I am using VGRO currently.

Thank you for this series. I am learning a lot!

@Cameron: If you’re not managing a Ludicrous portfolio to an after-tax asset allocation (which you shouldn’t be), then holding equities in your corporation second (after the TFSA) is expected to lead to a higher after-tax portfolio value than holding equities in your RRSP second (again, because you are taking more after-tax equity risk).

I don’t manage client portfolios from an after-tax asset allocation perspective – I’ll get into the disadvantages of this approach when I discuss the Plaid model portfolios.

Hi,

First off, thank you for all the great information you and your colleagues at PWL provide- very insightful and most importantly evidence based!

My question is twofold:

1) I’m not sure I quite understand why the ludicrous ATAA did not perform as well or better than the light portfolio given that:

A)it has lower MER and FWT, and

B) Capital gains are taxed favorably in a taxable account compared to an RRSP (where capital gains are taxed as interest received).

Could you shed some light as to why it is the case? Is it random?

2) Given that equities would likely provide more tax deferral than bonds (as equities have a higher expected capital gains – which can be deferred and lower dividend (interest) which get taxed in the year issued when compared to bonds) in a taxable account, wouldn’t this favor a positive performance return of the ludicrous ATAA portfolio versus the light portfolio in a passive(buy and hold) strategy in a multiyear scenario? I.e. Wouldn’t this strategy take advantage of the time value of money (keeping the money owed for taxes invested for a longer period)?

Thanks

@Mike: You’re very welcome!

1. The Ludicrous portfolio (after adjusting it’s before-tax asset mix to match an after-tax 60EQ-40FI portfolio) did not perform as well, because once you’re managing a portfolio’s asset mix from an after-tax perspective, the asset location rules change to “hold equities in your TFSA and RRSP first, and your taxable account last”. Both the Light and Ridiculous portfolios were holding a portion of their equities in their RRSP, so they were on their way to managing a more tax-efficient portfolio, whereas the Ludicrous Portfolio (ATAA) was breaking these asset location rules. This will make more sense once I release the Plaid portfolios.

2. This question really is based on the same complex asset location topic. I would encourage you to read my past posts on this topic, which should help:

https://canadianportfoliomanagerblog.com/asset-location-in-a-post-tax-world-tfsas-vs-rrsps/

https://canadianportfoliomanagerblog.com/asset-location-in-a-post-tax-world-rrsps-vs-taxable-accounts/

https://canadianportfoliomanagerblog.com/asset-location-in-a-post-tax-world-tfsas-vs-taxable-accounts/

https://canadianportfoliomanagerblog.com/optimal-asset-location-applied/

Thanks for the quick response – very helpful past posts..

Based on this – I will likely hold the same proportion across accounts. But I am curious of the upcoming plaid portfolio…!

Hi Justin,

Very valuable information. It answered several questions I had, but also raised new ones ;)

1. Compared to emerging markets equity, what makes international equities so unfavorable in a TFSA or taxable account? Is that expected to continue in the future?

2. If I’m not an Ontario top-rate taxpayer, how does that affect your conclusions? In my case, I’m a mid-rate Alberta taxpayer.

Thanks!

@Pete:

1. International equities are not unfavourable in a TFSA (there is one layer of unrecoverable foreign withholding taxes, but this is better than paying tax on its juicy dividend yield in a taxable account). Emerging markets equity ETFs (at least those that hold a U.S.-based emerging markets equity ETF for its exposure) are more tax-inefficient than international equity ETFs (that hold the underlying stocks directly) in a TFSA.

https://canadianportfoliomanagerblog.com/part-i-foreign-withholding-taxes-for-equity-etfs/

2. The only small conclusion it might change is if you’re in a situation where you need to hold either Canadian or U.S. equities in your taxable account (Example #9 and #10 in the Ludicrous Model ETF Portfolio Examples, available in the model ETF portfolios section of the blog). You’ll need to crunch the data based on your current tax rate, and current dividend yields on your Canadian and U.S. equity ETFs:

https://canadianportfoliomanagerblog.com/asset-location-across-canada-some-rules-are-made-to-be-broken/

Hi Justin,

Just out of curiosity – how come you prefer to hold a mix of all equities in the TFSA rather than splitting it up?

I currently only have a TFSA and RRSP with a portfolio allocation of 80% equity and 20% FI. Right now, I have the full FI allocation in the RRSP, and the same exposure to Canadian/US/International/Emerging in both accounts (using US listed ETFs in the RRSP).

I was debating doing something like the following but not sure if it’s worth it for the small savings in FWT and MER:

1) All bonds in RRSP

2) All US equity in RRSP

3) All Canadian equity in TFSA

4) As much international equity in TFSA as I can (since XEFs FWT in a TFSA is similar to holding IEFA in an RRSP), and then the remainder in RRSP

5) Emerging markets equity in RRSP

Just wondering what your pros and cons would be to each of these approaches? Based on my portfolio value and using your FWT calc, I’d currently save $200/year in MER and FWT vs my current approach. Note that I already use norberts gambit to convert money, and wouldn’t have to convert too too much to implement this

Thanks!

@Amit: It sounds like you’re starting to push past Ludicrous asset location into Plaid :)

I’ll discuss this type of portfolio set-up in the next blog post.

Look forward to it!

Will the plaid model portfolios potentially apply to this type of setup even if I didn’t want to manage things from an after-tax perspective? Not looking to get quite that complex! Either way I’m sure I’ll be able to get some tips :)

@Amit: Unlike the Ludicrous portfolios, the Plaid portfolios will require you to manage your asset allocation from an after-tax perspective (which is one of the biggest disadvantages of the Plaid portfolios).

Hi Justin,

I always though it was better to hold Canadian stocks in non-registered accounts first since their dividends are taxed favourably.

Isn’t the tax advantage on Canadian stocks’ dividends greater than the unrecoverable withholding taxes of international or US stocks when held in a TFSA account?

Thanks

@Seb: The traditional advice of holding Canadian stocks in non-registered accounts is a generalization:

https://canadianportfoliomanagerblog.com/asset-location-across-canada-some-rules-are-made-to-be-broken/

Holding Canadian stocks in your taxable account can be more tax-efficient than holding U.S. equities (at least from an annual income taxation perspective), but this would depend on your income and the province or territory you live in.

With TFSAs, again, it would depend on your personal tax situation.

Thanks Justin for a well thought out and detailed analysis.

Regarding Canadian Equities and it’s preferential tax treatment for dividends. Assuming someone is retired in Ontario, and they have no other income, therefore not in the highest marginal tax bracket, I would assume that putting all Canadian equities in their taxable account first is preferred as they can earn almost 55K in eligible Canadian Dividend tax free. Would you agree?

@Ken: If you’ve decided to manage your asset location using the Ludicrous portfolio strategy (and are in a low tax bracket), holding Canadian equities in the taxable account next (after equities have filled up your TFSA) would make sense. If you have little income, the withholding taxes on foreign dividends received in a taxable account may not be fully recoverable.

Hi Ken,

Asset allocation choices need to be made based on lifetime taxes and income. By age 72, you’ll be getting CPP, OAS, and RRIF withdrawals (if you have an RRSP now). When these amounts kick in, you may need to adjust your portfolio to optimize taxes because dividend income will no longer be your only income. Adjustments could lead to capital gains. It could be that sticking to $55k in Canadian dividends right now is the best long-term strategy, but the analysis to confirm this isn’t easy. The answer will likely also depend on the sizes of your pensions and RRSP.

Thanks for the great analysis Justin and for helping me so much with DIY investing over the years.

There are two points of confusion for me and they may be a bit tangential to your main focus here.

Because of limited space in my RRSP, I have been trying to move Canadian equities to my taxable account because of taxation on Canadian dividends. Are Canadian equities the first thing to move to a taxable account ( even before US equities)?

Second, you’ve indicated a few times about using special bond funds in a taxable account given their tax advantages. Do these funds, such as the BMO Discount Bond Index fund, perform better than GICs or high interest savings after taxes? I’m a bit concerned about that part of my portfolio given such low interest and then taxes on that income.

Thx

@David: You’re very welcome – glad I could help :)

Whether to move Canadian or U.S. equities first to your taxable account would depend on your marginal tax rate (which would depend on your other taxable income and where you live in Canada). If you’re in the highest tax bracket (and live in Ontario), U.S. equities might be slightly more tax efficient. If you’re in a mid-tier tax rate and live in Alberta, Canadian equities could be more tax efficient.

https://canadianportfoliomanagerblog.com/asset-location-across-canada-some-rules-are-made-to-be-broken/

ZDB, a GIC ladder and ISAs are not directly comparable (as they have different risks, like maturity risk and liquidity risk), but they could all be appropriate options for a taxable account (depending on your specific situation). Here’s an article that might be useful:

https://canadianportfoliomanagerblog.com/gics-vs-bond-etfs-a-case-study-and-bold-adventure/

Great article!

I’m sort of half doing this. I’m doing a 100% stocks portfolio, so my RRSP holds mostly VTI & my TFSA holds VCN/XEF/XEC – both accounts pretty much topped off.

I’m thinking I’ll keep it simple when I finally dive into a taxable account and buy something like HBAL or HGRO to keep it easy to manage. My portfolio isn’t huge, so while I went a little complicated between RRSP/TFSA it hasn’t been a hassle at all. But juggling a 3 account portfolio at around 100k-200k size, probably ain’t worth the trouble I think for me, at least for now.

Would be nice if you could provide some insight on a ludicrous 100% equities portfolio :)

@LawrenceW: What insight are you looking for exactly?

I think what LawrenceW means and what I also want to know is if the Ludicrous portfolio gets higher after-tax returns compared to Light and Ridiculous because of an aggressive asset allocation, what kind of returns or differences in returns are expected if the Light, Ridiculous, and Ludicrous all had aggressive asset allocations (100% equities)?

@Raymond: The expected return differences for the Light and Ridiculous portfolios would be whatever fee and tax savings you obtain after your costs to implement the more complex portfolio (you can compare the expected MER and FWTR differences in the model portfolio reports).

The Ludicrous portfolios are meant to increase the expected after-tax portfolio value by taking more after-tax equity risk (i.e. by reducing your after-tax bond exposure). If you’re taking 100% pre-tax equity risk, you’re not going to be able to increase this with a Ludicrous portfolio. This is why I’ve used a balanced 60% equity / 40% fixed income asset mix in my examples.

To add to this interesting line of thinking of a 100% equity portfolio across personal, corp, tfsa, rrsp accounts would the guiding principles of asset location be:

RRSP – International ETFs 1st

Corp – Canadian ETFs 1st

Personal – US ETFs 1st

TFSA – asset allocation mix

With the Ridiculous portfolios ETFs?

@Steve W: If you were following the Ludicrous asset location rules, your would hold equities in your TFSA first, personal taxable account second, corporate account third, and RRSP account last.

Hi Justin,

I already use your example 5 ludicrous portfolio. I use VGRO instead of VEQT to have more automation. And my taxable account is actually my Canadian Corporate Account.

Does this look reasonable to you?

@Cameron: If you’re following the Ludicrous portfolio process, holding equity ETFs in your TFSA first, corporate account second, and RRSP last would still be the process.

Hi Justin,

I agree with your logic regarding the higher expected after-tax returns of the Ludicrous portfolios; however, the Ludicrous (ATAA) portfolio ended up under-performing the other two portfolios in your 2019 back-tested analysis. Do you think this was due to the small (1-year) sample size of this back-test? Can you shed some light onto why the Ludicrous (ATAA) portfolio may have under-performed the other two portfolios despite reduced foreign withholding taxes and product fees? Do you think that the Ludicrous (ATAA) portfolio would out-perform the others in the long run if more data was available?

@Braden: After we assume the after-tax value of Pat’s RRSP is lower, the remaining amount of the RRSP that Pat owns is really like an additional TFSA. So if you’re controlling for after-tax asset allocation, you would never want to hold equities in your taxable account first – you would want to hold them in your “TFSAs” (where you never pay any tax…other than a small amount of withholding taxes).

https://canadianportfoliomanagerblog.com/asset-location-in-a-post-tax-world-tfsas-vs-taxable-accounts/

The one-year period is adequate for showing how these tax concepts work. However, I wouldn’t put any emphasis on the absolute after-tax return differences between these portfolios over this one-year period (I would expect these differences would be much lower).

Thanks Justin! My takeaway from this is that the primary benefit to the Ludicrous model is the higher expected returns due to the behavioral benefit of holding a more aggressive after-tax portfolio, and the lower withholding taxes and product costs are fairly negligible if managing your portfolio from an after-tax perspective. Looking forward to the plaid model!

Hi Justin,

With the Ludicrous (ATAA) portfolio, have you tried putting the fixed income in the taxable account? For the tax rates my wife and I expect to pay along with the return assumptions I chose, it worked out better for us.

@Michael James: I have, and will be doing so for the Plaid portfolios (which use after-tax asset allocation, but hold equities in the TFSAs/RRSPs first).

Hi Justin,

I can’t find any other portfolio as a pdf in the website. Will you please share links for ridiculous and for Ludicrous or/and plaid?

Thank you