If you’ve stuck with me through my last three asset location blogs, congratulations. Don’t ever let some sissy Iron Man Triathlon champion tell you they’ve got more endurance than you do.

The good news is, we’re nearing the end. This post will hopefully be my last word on the matter, as we explore how to build your tax-efficient ETF portfolio across multiple accounts using optimal asset location. But fair warning: There’s one more hurdle separating you from your ideal asset location. Here’s the equipment you’ll require to reach the finish line:

- A DeLorean time machine with a functional flux capacitor (just like the kind Marty McFly used in “Back to the Future”)

- 1.21 gigawatts of electricity (generated by plutonium, a bolt of lightning, or a yet-to-be-fabricated Mr. Fusion charger)

In other words, the only thing standing between you and sure-fire asset location is the ability to time travel. Since anything else is largely guesswork about what the future holds, it’s the only way to readily define what “optimal” will actually turn out to be, according to these steps:

- Once you’ve reached the future, you’ll want to review your (future) past tax returns to calculate your effective tax rate on all registered withdrawals.

- Do the same for any taxable capital gains you’ve realized over the (upcoming) years.

- Next, once you’ve returned to good old 2018, you may find that your present life also needs a few adjustments to improve your future situation, now that you know what it will be.

- Finally, remember that any financial changes in the present could alter your future tax rates, which means you may have to travel back to the future several times until you get it right.

Great Scott. Without that time machine, you may need to accept your inability to predict future effective tax rates, expected returns or asset class investment income distributions. What then?

Let’s face it. Most DIY investors may be better off simply holding the same asset mix in each account type. Then again, with the stamina you’ve exhibited so far, you may not be “most DIY investors.” You may still yearn to know what it would look like to go the distance in pursuit of optimal asset location.

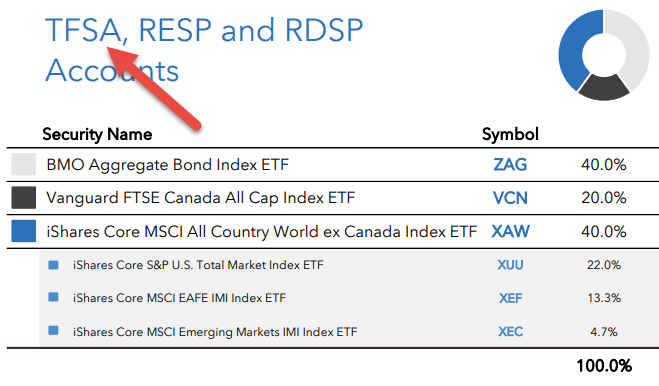

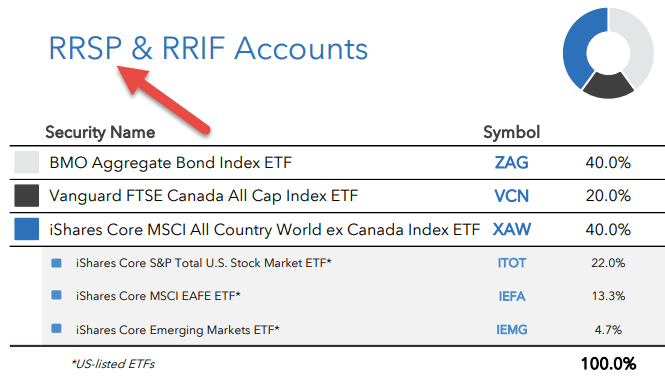

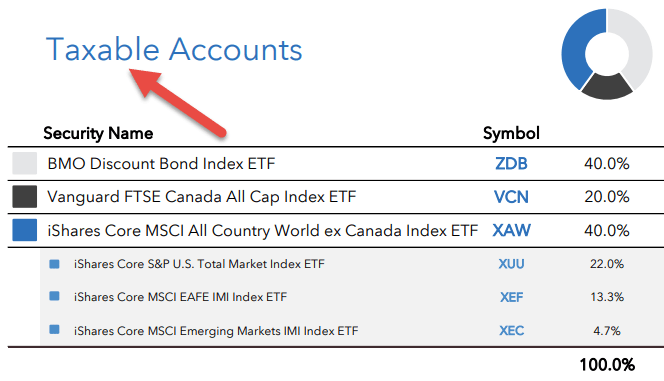

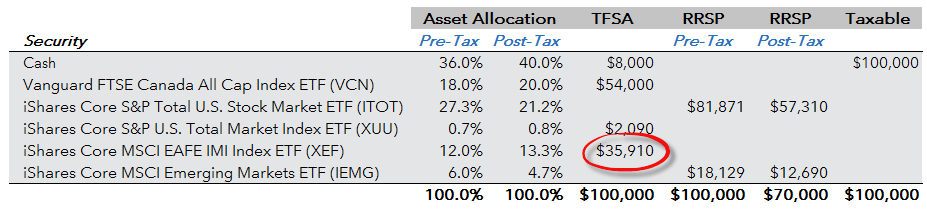

Here’s what’s involved. Let’s assume that you’ve decided to implement the Canadian Portfolio Manager 40% bonds / 60% stocks model ETF portfolio. For that, I’ve included the balanced model portfolios below for each account type as of June 30, 2018. We’ll assume you’ve got enough clairvoyance to determine you’re expecting to incur a 30% effective tax rate moving forward.

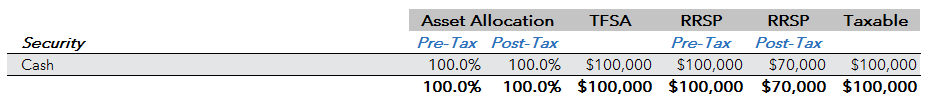

Your initial portfolio is reasonably straightforward: $300,000 of cash split evenly across a TFSA, RRSP and taxable account. If your future effective tax rate on RRSP withdrawals is 30%, the post-tax value of the RRSP is actually worth $70,000 [$100,000 × (1 – 30%)].

Next, we’ll plan to invest the cash in the most “optimal” way possible, by holding equities in the TFSA or RRSP account first, while ensuring that we are managing the asset allocation from a post-tax perspective (i.e. we’ll ignore the $30,000 portion of the RRSP account that is owed to the government).

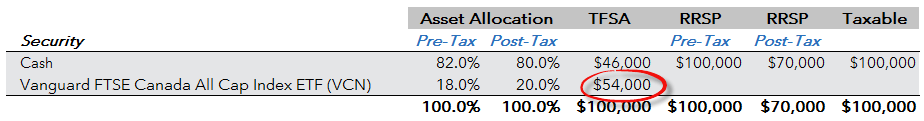

Step 1: Buy $54,000 of VCN in the TFSA

Let’s start by purchasing the Vanguard FTSE Canada All Cap Index ETF (VCN) in the TFSA account.

In my blog post, Asset Location in a Post-Tax World: TFSAs vs RRSPs, I showed that, as long as you manage your portfolio’s asset allocation from a post-tax perspective, it’s largely irrelevant which asset class you hold in your TFSA versus your RRSP. However, foreign withholding taxes can complicate the decision, since withholding taxes on foreign dividends will apply in a TFSA. As Canadian investors don’t incur withholding tax on dividends received from Canadian equity ETFs, holding VCN in the TFSA first will be slightly more tax-efficient than holding foreign equity ETFs.

To determine how much VCN to buy, we’ll multiply our post-tax portfolio value of $270,000 by VCN’s target asset allocation in our model portfolios of 20%, which equals $54,000.

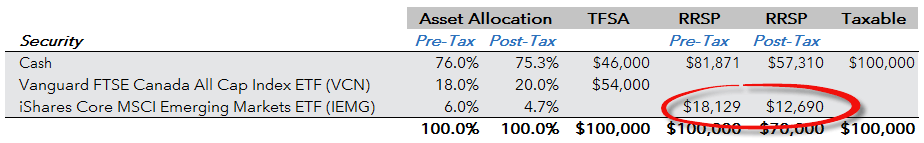

Step 2: Buy $18,129 CAD ($13,767 USD) of IEMG in the US dollar RRSP

When holding a Canadian-listed emerging markets equity ETF in an RRSP or TFSA, two layers of unrecoverable withholding taxes are generally levied on foreign dividends. You can avoid one of these taxable layers in your RRSP by instead holding a US-listed emerging markets equity ETF, like the iShares Core MSCI Emerging Markets ETF (IEMG). (Unfortunately, doing the same thing in your TFSA does nothing to reduce this tax drag.)

It’s a bit trickier to calculate how much IEMG to buy. We first need to calculate how much to purchase in post-tax Canadian dollars by multiplying our post-tax portfolio value of $270,000 by IEMG’s 4.7% target asset allocation in our model portfolios. This equals $12,690 CAD post-tax. We then need to gross up this figure by dividing it by 0.70 (or 1 minus our 30% tax rate). This equals $18,129 CAD pre-tax.

Also, since IEMG trades in US dollars, you’ll need to convert the $18,129 CAD figure to USD before calculating the number of shares to purchase. Using the June 29, 2018 Bank of Canada exchange rate of 0.7594 (1 CAD = 0.7594 USD), you could purchase $13,767 USD of IEMG ($18,129 × 0.7594).

If you don’t have enough US dollars available in your RRSP account, consider using the Norbert’s gambit strategy to convert your Canadian dollars to US dollars before purchasing IEMG.

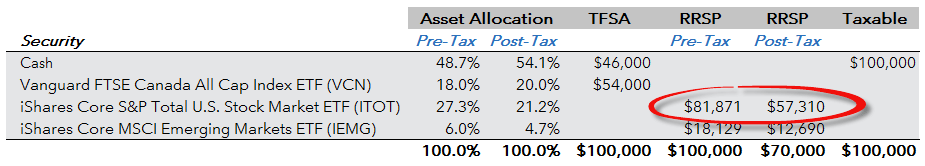

Step 3: Buy $81,871 CAD ($62,173 USD) of ITOT in the US dollar RRSP

Withholding taxes of 15% are also levied on dividends paid from Canadian-listed US equity ETFs. But you can avoid these taxes in an RRSP by holding a US-listed US equity ETF, like the iShares Core S&P Total U.S. Stock Market ETF (ITOT). (These taxes are still applicable in a TFSA.)

Multiplying the post-tax portfolio value of $270,000 by ITOT’s target asset allocation of 22% gives us $59,400 CAD post-tax. We again need to gross up this figure by dividing it by 0.70 (1 minus our 30% tax rate), which equals $84,857 CAD.

You may already have noticed, after our purchase of IEMG in Step 2, we only had $81,871 CAD left in our RRSP ($100,000 CAD minus $18,129 CAD). We can purchase this amount for now. In Step 4 below, we’ll purchase the rest in the TFSA. Purchasing $81,871 CAD pre-tax is equivalent to purchasing $57,310 CAD post-tax [$81,871 × (1 – 30%)].

As ITOT also trades in US dollars, we’ll need to convert our Canadian dollars to US dollars before purchasing the fund. As we currently have $81,871 CAD, this is equivalent to $62,173 USD ($81,871 × 0.7594).

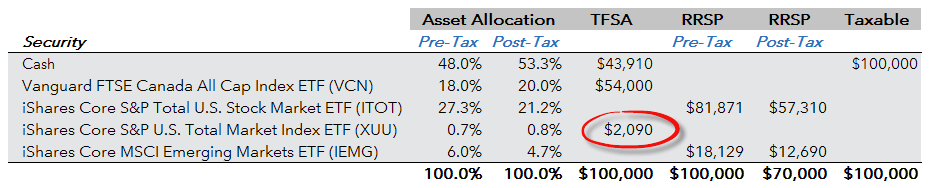

Step 4: Buy $2,090 of XUU in the TFSA

In Step 3, we calculated that we required $59,400 CAD post-tax US equity ETFs. We were only able to purchase $57,310 CAD post-tax of ITOT, so we still need another $2,090 CAD in another US equity ETF. Since holding US-listed US equity ETFs in a TFSA does not avoid the 15% foreign withholding taxes, we’ll instead purchase $2,090 CAD of the Canadian-listed iShares Core S&P U.S. Total Market Index ETF (XUU) in the TFSA. This also avoids the complication and cost of currency conversions.

Step 5: Buy $35,910 of XEF in the TFSA

Holding Canadian-listed international equity ETFs (which hold the underlying stocks directly) eliminates one of the layers of foreign withholding taxes. So it’s more tax-efficient to hold something like the iShares Core MSCI EAFE IMI Index ETF (XEF) in a TFSA than holding a US-listed international equity ETF. To determine the amount of XEF to buy, we’ll multiply our post-tax portfolio value of $270,000 by the 13.3% target asset allocation of XEF in the model portfolios, which equals $35,910 CAD.

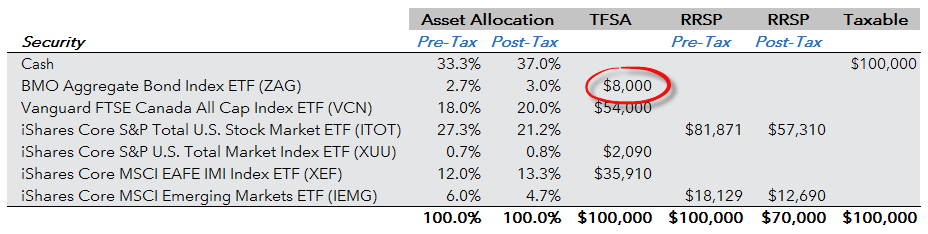

Step 6: Buy $8,000 of ZAG in the TFSA

Now that all the equity ETFs have been purchased, we can tend to our fixed income ETFs. We still have $8,000 CAD of cash available in the TFSA account, so we can use it to buy the BMO Aggregate Bond Index ETF (ZAG).

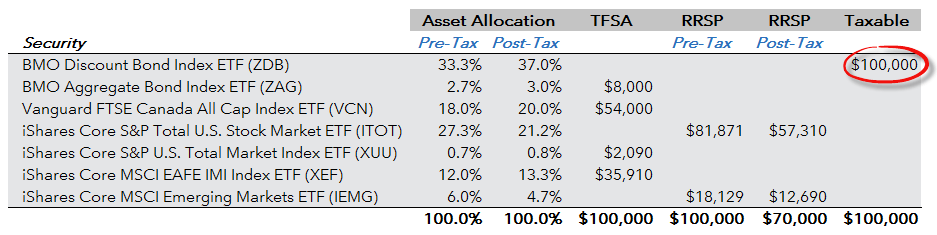

Step 7: Buy $100,000 of ZDB in the taxable account

Finally, we have $100,000 CAD cash sitting in the taxable account, and we still need to purchase $100,000 of fixed income ETFs. You can probably reduce your annual tax bill a bit by choosing a more tax-efficient ETF, like the BMO Discount Bond Index ETF (ZDB).

Fancy steps, but where will they lead?

Well, that was a blast wasn’t it? In the end, we needed to increase our pre-tax stock asset allocation to 64% (compared to 60% post-tax). If the RRSP account was relatively larger than the other accounts (or the tax rate was higher), the pre-tax allocation to stocks could have been much higher (although this may have made the additional pre-tax risk hard to stomach during market swings).

Again, there’s a big catch to all this fancy footwork: Without the foresight a time-machine would afford us, we cannot accurately predict future effective tax rates. It’s equally as challenging to forecast expected returns or income distributions for the asset classes in which we’re invested. On top of that, acting on our assumptions is a complicated process, which we’ll need to revisit periodically to keep the portfolio on track.

So, again, I encourage most DIY investors to simply hold the same asset mix in each account type. If you must go the extra mile, you can still do so by choosing the most tax-efficient ETFs for each account type (as presented in my TFSA, RRSP and taxable model ETF portfolios). That’s likely to earn you a few more post-tax dollars along the way, without exhausting the precious energy you’ll need to go the distance with your efficient portfolio management.

Asset Class Pre-Tax Asset Allocation Post-Tax Asset Allocation

Canadian Bonds 36.0% 40.0%

Canadian Stocks 18.0% 20.0%

US Stocks 28.0% 22.0%

International Stocks 12.0% 13.3%

Emerging Markets Stocks 6.0% 4.7%

Hi Justin,

You said that you “encourage most DIY investors to simply hold the same asset mix in each account type”, would this statement still hold true if dealing with RRSP, TFSA and a CCPC account instead of a regular non-registered personal account?

Also, much of my reading has said that filling TFSA and RRSP first over a corporate account is the best thing to do, but all the articles assume the highest personal marginal tax rate. If I pay myself a salary that is much lower (75000-90000) and my personal tax rate is lower, would RRSP or corporate investing be better after maxing out TFSA?

Thanks for your work and your response!

Stephanie

Hi Justin,

A huge thank you for all your hard work. After many years of trying to make sense of various investment options, I finally feel like I’ve found some clarity. Who knows what the markets will do in the next few years, but I implemented the RRSP, TFSA and non-registered options you covered here and I can now concentrate on other things in life!

Thanks again for this gem of a blog.

@Oz: You’re most welcome – thanks for reading! :)

Hi Justin, I was wondering if the benefit of asset location with a corporate account may have easier rules of thumb to apply, and show greater ROI for some added complexity.

Specifically, wouldn’t intentionally holding all of one’s portfolio’s Canadian equities in a corporate account lead to a significant benefit from the favourable eligible dividend distribution to make this a useful long term strategy? Especially with larger portfolios, I’d imagine the benefit is significant?

@Steve: Canadian dividends received in a corporate or personal account would have similar tax benefits (although the same can’t be said for foreign dividends, which are generally more tax-efficient in a personal non-registered account).

Remember that the active business income in a corporation hasn’t been fully taxed, so it is actually worth less (similar to how the RRSP works). So if you were managing your asset allocation from an after-tax perspective, you would need to hold more Canadian equities in your corporate account (relative to if you were holding Canadian equities in your personal account).

Hello Justin,

Firstly, thank you for the valuable information that you provide and for all the work that you put in.

Curious on what your thoughts may be on leveraging the new asset allocation etfs for asset “location” techniques across account types. For example, if an investor wants a 60/40 portfolio allocation and has a 50/50 split between maxed out registered accounts and taxable accounts, they could hold VCIP (20/80) in the registered accounts and VEQT (100% equity) in the taxable accounts. The weighted average of this configurationis 60/40 and you may save a few nickels in taxes and foreign withholding taxes. In this simplistic example balancing 2 ETFs @ 50/50 asset location while having the asset allocation done for you is not that onerous in my opinion.

Let me know your thoughts….thx

@Jeff: I’ve had a number of investors bring this idea up, but I can’t visualize how this would work in practice. As you contribute differing amounts to the various account types (and the performance of each ETF differs), your actual asset mix will start to shift from your target (without any rebalancing strategy to bring it back in line).

Thanks for the reply Justin.

You have confirmed one of my thoughts as well about asset location. If we had no limits on new contributions into registered accounts or someone had very much room to add new funds it may work for a while. But once your registered accounts are topped out it really constrains how the balancing process works. Add to that if you go the other way to subtract from registered into taxable, you pay tax on the registered withdrawal. It may look good on your first try for a year or so but eventually it will drift and there is not a lot you can do about it. Way to go Government !!! Good job !!!

I think I will continue on with matching my asset allocation in all accounts for now. Thank you for your answer. Cheers

@Jeff: Sounds like a plan – good luck!

Thanks Justin.

In the portfolios that you personally oversee in PWL, do you hold the same asset mix in each account type like you described?

Merci beaucoup!

@M.Raymond: No, I tend to hold equities in the TFSA first, taxable next, and RRSPs last (so the traditional approach to asset location). Keep in mind that this asset location strategy is technically taking on more equity risk from an after-tax perspective (relative to holding the same asset mix in each account), which is why it has higher expected after-tax returns.

Hi Justin. When invested funds get large enough is it more efficient to hold IEMG (in a non-reg account) than the CDN wrapped version XEC? The foreign withholding taxes are equal (I believe) but the MER is less with direct US ownership, correct? As long as someone has already maxed their RRSP and TFSA, want’s more EM exposure, and is competent with Norbert’s Gambit and the additional accounting, is IEMG the way to go? Thanks. -Tom

@Tom: You’re correct – IEMG would be cheaper than XEC in a taxable account (with similar foreign withholding tax implications). The main downsides of holding IEMG over XEC in a taxable account include:

– Investors must be competent with Norbert’s gambit (as you mentioned)

– Investors need to track their adjusted cost base in Canadian dollars (discount brokerages are terrible at this task)

– Investors may need to prepare the T1135 report for Canadian tax filing purposes

– At death, if the value of your worldwide estate exceeds $11.4 million USD (2019), you may be subject to U.S. estate tax (this threshold could also be low in the future)

– Even if the value of your worldwide estate at death does not exceed $11.4 million USD, if the value of U.S. property you own exceeds $60,000 USD, your estate is still required to file a U.S. estate tax return

Well that was a fun one too. In your opinion, in addition to taking into account (or at least considering) post-tax costs for asset allocation, do you also think people should calculate their net worth using post-tax calculations for their tax deferred accounts?

@Erin: Calculating your net worth post-tax would be a more accurate depiction of your finances, but it’s a lot to expect investors to do this. Probably a better use of time would be to ensure you have an updated financial plan that accounts for the future taxes.

Thanks for the fantastic post, Justin!

I have one question, though. In your example, you were able to put only bonds in the taxable account. What if your situation forced you to put equities in the taxable account? Does it matter which equities (Canadian, US, international) go to taxable vs RRSP/TFSA?

Thanks!

@Karl Robin: If you’re using U.S.-listed foreign equity ETFs in your RRSP and Canadian equities in your TFSA, you could consider starting with U.S. equity ETFs in your taxable account (as they have a very low dividend yield).

@Justin: I am actually surprised by your answer. After posting, I did some investigation and thought the answer would be to put Canadian equity in the taxable account, due to the fact that Canadian equities are eligible for the dividend tax credit. Would the lower yield compensate for the unfavorable taxation?

@Karl Robin: Here’s an old post that can help you decide what’s best for you (the short answer is, it depends):

https://canadianportfoliomanagerblog.com/asset-location-across-canada-some-rules-are-made-to-be-broken/

So mention a few that mes DIY investors would be better off holding the same asset allocation across different plans. What if you’re working with an advisor? Short of hold US listed ETF’s in RRSP and discount bond ETF’s in taxable plan, should my advisor implement an asset location strategy?

This may be a stupid question — or perhaps I’m missing something — but doesn’t XAW always contain the same funds regardless of which account it’s in? I don’t understand why XAW’s constituents change in the RRSP.

Also, if you look up XAW on BlackRock’s site, the top three holdings are IVV, XEF, IEMG (not XUU, XEF, XEC).

Hello Justin, I am wondering if you can comment on investing in a Whole life insurance policy, as a tax planning strategy, and how that compares to just keeping the money invested in the taxable portfolio. I have been quoted a whole life insurance policy which has an annual premium of $72,000.00 for 8 years. Thanks, Joan

@Joan: I personally feel that whole life insurance is generally oversold to Canadians. Depending on your personal situation, it may be appropriate for tax-efficient estate planning purposes (but this would be very specific to the individual).

Thanks Justin for this awesome series!

I have written a very messy spreadsheet to calculate all of this for my family so I can plan how to rebalance and move away from a 3-fund portfolio. I haven’t been able to write an automated rebalance calculation and do it by hand, it’s pretty complicated accross accounts. I might still have errors but I’ll share what it gives me for my particular situation.

120k after-tax with 20% tax rate planned on withdrawal, still room in both TFSA and RRSP.

The cost of opportunity for what you describe here vs a 80/20 3-fund XAW/ZAG/VCN portfolio is 193$ of extra costs and FWT: ie, 380$ for 3-fund, 190$ for optimal portfolio. I don’t think most people would find it worth it if it’s just for the costs, but like you said, it might have other benefits. So about 150-180$ per 100k without including transaction costs.

I’m now wondering what would be the strategy for rebalancing when for instance RRSP is 100% in USD equities. Reading your GIC ladder article, you recommend preparing for a 50% drop. So what happens if it’s a 100k account in an RRSP and there’s a 50% drop and my bonds are let’s say all in Taxable with no room in neither TFSA or RRSP to add money. The only option I see is to sell bonds in Taxable and buy equities in Taxable. That could potentially leave a registered account very low after rebalancing in case of a bad sequence of return for someone near retirement and lose much of the benefits of tax-free growth. Should we leave some bonds in registered accounts then? That would diminish yet again the advantage of optimal asset location.

@rich: I think you might be overthinking the asset location process (which was not my intention when I wrote the blog ;)

Justin, would you be willing to tweak this for people with corporate accounts (USD & CAD)?

Thanks for considering.

@ACL$: I likely won’t be tweaking this for a corporate account soon – I’m not certain how I would even illustrate the examples to be of any practical use.

Thanks for a great post. Hopefully you’ve scared everyone off going post tax asset allocation! It can be a bit confusing, especially so when it comes time to rebalance. Having the same asset allocation in each account is a good solution, although I prefer the traditional bonds in RRSP/ignore post tax considerations approach which permits a riskier portfolio without the incremental increase in volatility.

To add another wrinkle to this topic, I like your earlier advice to hold equal amounts of Canadian/US/international equities in a TFSA because we cannot know in advance which of the 3 markets will do better. I think that consideration trumps tax efficiency.

@Grant: I thought this post would scare most investors into keeping things simple, but I’ve received more comments from investors who want an even more detailed and complicated optimization analysis (so it would appear that I’ve failed ;)

Grant makes a good point.

Hi Justin,

Silly question, but is not the maximum I can hold in my TFSA 56k as of now?

@Beginner: The maximum historical TFSA contribution room in 2018 is $57,500 (however, there can also be growth or loss on the portfolio investments, so an individual’s TFSA market value may be above or below $57,500 – even if they’ve maxed out their contributions each year).

Hi Justin,

What would you recommend to an investor who wants to diversify currency as well (hold USD investments) but with a small RRSP room (about 10% of the available cash USD)?

Thank you,

Cristian

P.S. Thank you for taking time to write all these great posts and for answering to all our questions.

@Cristian: Once you’re invested in foreign equity ETFs (non currency-hedged), you’re already diversified across many different currencies. For example, in my 40% bond / 60% stock model ETF portfolio, 40% of your portfolio is also exposed to the underlying foreign currencies.

So even if you’re holding a Canadian-listed foreign equity ETF in your TFSA or taxable accounts (i.e. XUU) you still have US dollar exposure through XUU.

Thanks Justin, this is a great detailed guide on how to apply optimal asset location.

I do have a few questions:

1.) I noticed that you elected in this case to put equities in your registered accounts first (rather than fixed income), in your example here. Notwithstanding duplicating your AA across all accounts, would you generally recommend this approach over fixed income in registered accounts first?

2.) The rule of thumb that I’ve read is that slower growing assets should be put in RRSP over TFSA, if it must go in a registered account. In your example, you elected to use the remaining balance of your TFSA on fixed income, rather than use RRSP room for it. Was this deliberate, or perhaps I am just over-interpreting things here?

3.) This might be a silly question…you recommend using ZAG in the registered account and ZDB in the non-registered. Is there any reason why one shouldn’t just use ZDB in registered accounts over ZAG?

Thanks again!

@Jon:

1) If you weren’t going to hold the same asset allocation across accounts, I would tend to hold fixed income in RRSPs first (and ignore the fact that my portfolio is more aggressive from a post tax perspective).

2) Your rule of thumb ignores the management of a portfolio’s asset allocation from a post-tax perspective. Once you do this, the decision of whether to hold your fixed income in an RRSP or TFSA is irrelevant:

https://canadianportfoliomanagerblog.com/asset-location-in-a-post-tax-world-tfsas-vs-rrsps/

3) ZDB will not track the FTSE TMX Canada Universe Bond Index as closely as ZAG will, so there is a behavioural benefit of holding ZAG instead of ZDB in the TFSA account in this example.

Thanks for your replies, your answers make a lot of sense.

In general, is there a certain portfolio size in which you would start recommending to go through the trouble to optimize asset location? Or does it make sense to keep same asset allocation across all account types regardless of the total portfolio size?

@Jon: Asset location is not something you can really optimize (due to the many unknown variables). However, asset location generally matters less as your taxable accounts grow (as the majority of your equity allocation will need to be held in the relatively larger taxable account anyways).

Take the example of a portfolio with $100,000 in the TFSA, $100,000 in the RRSP and $1,000,000 in the taxable account. If you took the traditional approach to asset location (and held equities in your TFSA first and your taxable account second), your post-tax asset mix would be about 61.54% equities and 38.46% fixed income (assuming a 30% tax rate) – which is very close to the “optimized” post-tax asset mix of 60% equities and 40% fixed income (obtained by holding equities in the TFSA/RRSP accounts first).

Hi Justin, excellent post! Thanks for the clear and practical breakdown. Any chance you might be writing a future post involving some of the choices that would occur when adding a ccpc into the mix?

@Phil: Likely not – such a post would stray too far away from being practical (this current post has arguably already taken the subject too far in that direction).

Thank you very much for the informations. I have a last question. When I do the math for CGR and REET, I get some weird results. CGR holds 52.57% of US REIT and 1.17% of Canadian REIT on December 31th, but the withholding taxes of the fund is only 7% (418768 / 5981134). I was expecting at least 7,89% (52.57% x 15%).

REET on the other side have withholding taxes of about 11.09% from my calculations: 1181493 / (1181493 + 23045360) * (100% – 61,35%) + 61,35% * 15%.

I think there is something I misunderstand because I would expect the withholding taxes to be similar for both ETFs.

Ok, I understand now. So I have some questions about annual reports.

1st question: In annual reports from BMO, iShares and Vanguard in Canada, when I divide withholding taxes from dividend income, I get 14,27%, 15,00% and 14,98% respectively. What explain the BMO result as about 99,15% of the portfolio is US equity ?

2nd question : How can I find the L1 US withholding taxes in the US-Listed ETFs annual reports? Is there a way to find it out more accurately than dividend yield x 15% ?

3rd question: I found out that L1 withholding taxes is 15.00% for XEC ETF. The result for IEMG ETF is 10,63%%. How can I find the right value (~15%) for the US-Listed fund ? My formula is $80,593,821/($80,593,821+677,585,642)

4th question: Are the L1 withholding taxes calculated the same way for REITs?

Thank you for your time.

@Sebastien:

1. Not sure why there’s a discrepancy – you could reach out to BMO to find out. It may have to do with foreign exchange adjustments for accounting purposes.

2. US-listed ETFs or US stocks paying dividends to Canada will generally withhold 15%. Best way to test this out is to buy a US-listed ETF in a taxable account and watch them do it.

3. The 10.63% figure is the right value for the withholding tax from the emerging market countries to the US (it will be an odd number, as they are multiple countries withholding with different withholding tax rates and different dividend yields – it will likely never be 15%). The 15% withholding of XEC is from the US to Canada (which is to be expected).

4. Withholding tax rates on dividends from REITs work the same way (although for US REITs, the government will also generally withhold 15% on any return of capital that the fund distributes).

Hi, I really like your blog. Could you please explain how to calculate the withholding taxes paid for global equity funds (US-listed) and balanced funds? I would really like to know how to find all the informations to be able to calculate the withholding taxes for any kind of ETFs.

I like this document (https://www.pwlcapital.com/pwl/media/pwl-media/PDF-files/White-Papers/2016-06-17_-Bender-Bortolotti_Foreign_Withholding_Taxes_Hyperlinked.pdf?ext=.pdf), but it doesn’t explain how to do the math for a fund with multiple asset classes.

Thank you.

@Sebastien: The process for global equity funds (US-listed, like VT) would be the same as a US-listed international or emerging markets equity ETF (the process is included in the white paper you linked to).

For a Canadian-listed global equity ETF (like VXC or XAW), I’ve illustrated the process here: https://canadianportfoliomanagerblog.com/war-of-the-worlds-ex-canada/

Great article. Even if we don’t search for the optimal asset allocation, I think it’s the best approach to consider the post-tax asset allocation. In a taxable account, considering the unrealized capital gain, how should we calculate our exposure? In a sense, it’s a little bit like a RRSP, part of our investment belongs to the government. With the raw numbers, in the case of unrealized gain, we then overestimate our exposure to the assets we have in our taxable account. But it is not all the placement that will be taxed, only the gain unlike the RRSP…

Example: 150k$ in HXT of which 50k$ unrealized gains in a taxable account, and future effective tax rate is 30% (therefore 15% on the capital gain considering the inclusion rate)

I consider for my post-tax asset exposure is 127.5k$ in canadian market and a 15k$ in cash (because I don’t a have to pay tax on my acquisition cost, and it is equivalent to consider that this part is taxable but that I already have the cash to pay it). Finally I consider that the (virtual) cash part is equivalent to bonds. Is this a correct way of seeing things? We can not simply remove the latent taxes: just take the case where the acquisition cost is zero, the situation is then identical to a RRSP (with a tax rate / 2) and the model must then join the RRSP model also.

I took the HXT as an example because there are no dividends, which simplifies the model.

NB: What you describe for the allocation is almost identical to what I do. I am aware that it is a lot of calculation for a low gain, but I have a certain pleasure to do it!

Hi Justin, I’m sure everyone is thinking the same thing, but is there a calculator for this?

I also wanted to inquire about your rebalancing tool. i downloaded it and was wondering if i could get an unprotected version.

Thanks and amazing work!

@Marc: Unfortunately not (although I doubt most readers are itching to implement this asset location strategy after reading through this blog post).

I’ll email you an unlocked version of the rebalancing calculator (please verify the formulas if you make any changes).

Hi Justin,

Thanks for the post.

Any reason for splitting XAW in a taxable account into XUU/XEF/XEC besides the slightly cheaper MER?

@Andrei: The slightly cheaper MER of XUU/XEF/XEC would be the main benefit over XAW in a taxable account. There could also be increased tax loss selling opportunities of holding the separate ETFs.

Hello Justin,

Did I just read you correctly that you believe the government might disallow the HBB swap structure?! I just bought some in my CCPC this morning. Uh oh.

Also, I have been digging around your sight and am having difficulty finding an article related to whether or not to do tax loss harvesting when I buy VCN and XAW in my CCPC investments.

I see the benefit of using CDA account for the gains but the losses confuse me.

Can you direct me to your articles about this or if you haven’t addressed these I can stop rifling through your site for this. Thanks!

@Miwo: The government has disallowed products with similar tax benefits in the past, so it wouldn’t surprise me if they took action on swap-based ETFs at some time in the future.

This is the only article I’ve written about Tax Gain Harvesting in a corporation (tax loss harvesting could still make sense in a corporation, but this would be very dependent on your particular situation):

https://canadianportfoliomanagerblog.com/corporate-taxation-tax-gain-harvesting-crazy-like-a-fox-tax-planning/

It would be indeed interesting to see if there is any significant difference in terms of tax efficiency between a multi-ETF portfolio distributed over various accounts and a one-stop ETF such as Vanguard’s Balanced ETF Portfolio (VBAL) bought in all accounts.

Would it be possible to compare?

@Cristian: Based on my estimates, this would be the tax/fee benefit of using my CPM 60EQ/40FI model portfolio over VBAL (this assumes you use the cheaper 5-ETF portfolio, and hold US-listed ETFs in the RRSP account):

Taxable = 0.28% per year

RRSP = 0.29% per year

TFSA = 0.19% per year

Justin, would have the comparable figures for the 3 fund vs the 5 fund portfolio? Thanks!

@Grant: They’re essentially the same portfolios, so the returns would be similar (the 5-ETF portfolio weights for the foreign equities are just the MSCI ACWI ex Canada IMI Index market cap weights).

Hi Justin,

I’m not sure if this is answered somewhere, but for a TFSA, is there any lean towards using the 3 ETF (XAW) over the 5 ETF (XUU, XEF, XEC) construction? As far as I can tell, the 5 ETF would have a lower overall MER but would incur extra trading fees, so they seem pretty similar to me.

Thanks!

@Nicholas: You’re correct! There’s no tax benefit of breaking XAW up into XUU/XEF/XEC in a TFSA account (only a slight product cost reduction, but that assumes no additional trading costs).

So since there is no tax benefit, it is purely a question of doing a break-even on the two portfolios, to see if the slight reduction in MER offsets the extra trades you would have to make.

@Nicholas: That would be a purely quantitative view on the decision – most investors would find it much simpler to just buy XAW in their TFSA.

Justin,

You mention above “There’s no tax benefit of breaking XAW up into XUU/XEF/XEC in a TFSA account.” What’s the tax benefit of breaking XAW up into XUU/XEF/XEC in a taxable/corporate account (aside from lower MER)?

@Lily: There’s no tax benefit of breaking up XAW into XUU/XEF/XEC in a taxable/corporate account either (only a product fee reduction).

What do you think of using the Horizon total return HXS in a TFSA for US exposure without the withholding tax issue? Or, for the same reason, buying HXX for European exposure in a TFSA? Also, could you provide your thoughts on use of this type of ETF for taxable accounts.

@Gail Bebee: Holding HXS in a TFSA account for your US exposure in order to avoid foreign withholding taxes is simply swapping (no pun intended) one cost for another (so it solves the foreign withholding tax drag issue, but adds a swap fee issue).

The dividend yield on the S&P 500 Index is around 2.0% (as of June 29, 2018), so the 15% US withholding tax would result in a tax drag of 0.30%.

The additional swap fee on HXS is 0.30% – so they are identical costs.

In regards to swap-based ETFs:

– From September 14, 2010 (inception if HXT) to December 31, 2017, HXT outperformed a comparable plain-vanilla ETF (XIU) by 0.47% per year on an after-tax basis (for an Ontario taxpayer in the highest marginal tax bracket).

– From April 1, 2013 (inception of non currency-hedged HXS) to December 31, 2017, HXS outperformed a comparable plain-vanilla ETF (VFV) by 0.32% per year on an after-tax basis (for an Ontario taxpayer in the highest marginal tax bracket).

– I haven’t crunched the numbers for their other swap-based ETFs, but I think it’s safe to say that they are expected to be more tax-efficient than plain-vanilla ETFs (as long as the government does not disallow their structure, which in my opinion is very likely).

Thanks Justin

If an investor were considering the complexity of the “optimal” asset location such as this, wouldn’t it make sense to also put in the effort to estimate what the savings might be for his/her own portfolio? Of course there would be many assumptions (you touched on that) but you could get a ballpark, right? Could you touch on how you might do that?

For example, if one were to choose between your model portfolio of 5 ETFs, vs. the CCP model portfolio of 3 ETFs, or Vanguard’s all-in-one ETF, you could easily compare the costs of each to determine if it is worth the effort to save time.

@Chris: Unfortunately, it would be impossible to compare the costs, as you would need to know the future investment income, returns, portfolio contributions, rebalancing tax consequences, tax rates, etc.

The main point I’m trying to hit home is that this would be a futile exercise.