Welcome back to our Spaceballs-inspired exploration of the Canadian Portfolio Manager’s (CPM’s) latest four model ETF portfolios. Our models now range from our simple (but not simplistic!) Light portfolios, to our bordering-on-insanely complicated Plaid portfolios. Today, we’ll introduce our moderately complicated Ridiculous portfolios.

To be honest, most of you can probably begin and end your adventures with a Light portfolio; you’ll still be light years ahead of most DIY investors. But I know some of you may prefer to boldly go where no DIYers have gone before. That’s fine, as long as you’re up for the challenge, and you know all the facts. Most importantly, managing a more complex portfolio is, unsurprisingly, more troublesome. Is it worth it? Usually not. But for the uncommonly intrepid, there may be rewards worth reaping.

After you’ve considered today’s Ridiculous model portfolios, it’s your call: Will you continue onward, or hit the emergency stop button and head toward the Light? You decide; but first, read on.

A Really, Really, Ridiculously Good-Looking Model

The Ridiculous portfolio reports are available for download in the Model ETF Portfolios section of the Canadian Portfolio Manager blog. Clicking on either the Vanguard or iShares ETF buttons in Step 2 will generate the report in a separate tab.

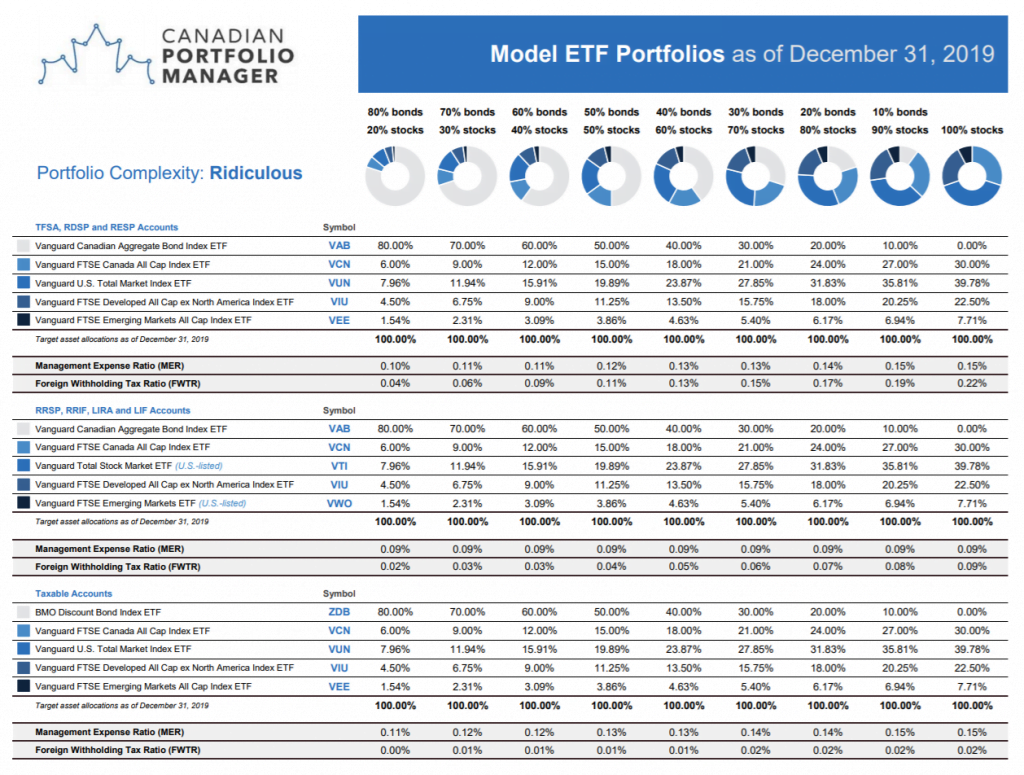

Similar to their Light portfolio counterparts, the Vanguard or iShares Ridiculous portfolios are displayed from left to right, ranging from a very conservative 80% bond, 20% stock portfolio, all the way to a very aggressive 100% stock portfolio. Below the blue and grey donuts, you’ll find the percentage weights allocated to each ETF. To allow for cost comparisons and other portfolio management conveniences, I’ve used the same Canadian, U.S., international, and emerging markets equity ETF weightings in both the Ridiculous and Light portfolios.

The report is further divided horizontally into three account-type sections:

- TFSA, RESP, and RDSP Accounts

- RRSP, RRIF, LIRA, and LIF Accounts

- Taxable Accounts

In each section, we’ve adjusted the specific holdings to reduce product costs and increase tax efficiency within the overall portfolio. For each asset mix, you’ll also find the weighted-average management expense ratio (MER), as well as the foreign withholding tax ratio (FWTR).

You can directly compare these figures to those found in the Light portfolio reports. For example, in an RRSP, the Vanguard 40% bond / 60% stock Ridiculous portfolio would have a combined MER and FWTR of 0.14%. In comparison, the Vanguard Balanced ETF Portfolio (VBAL) from the Light portfolio report would cost 0.42% in an RRSP, for a total cost difference of 0.28% per year.

Although the report looks intimidating, there are only a handful of differences between the Ridiculous and the Light portfolios. I’ll take you through them now.

Fixed Income Differences: Light vs. Ridiculous

Foreign bonds. I’ve dropped the Vanguard U.S. Aggregate Bond Index ETF (CAD-hedged) (VBU) and the Vanguard Global ex-U.S. Aggregate Bond Index ETF (CAD-hedged) (VBG) from the Vanguard Ridiculous portfolios, due to their higher product costs and foreign withholding taxes. I’ve instead opted for the Vanguard Canadian Aggregate Bond Index ETF (VAB) in all account types except taxable accounts. This change also reduces the holdings in an already-complex portfolio.

As iShares doesn’t yet provide CAD-hedged versions of their U.S.-based bond funds, it was an easy decision to stick with the iShares Core Canadian Universe Bond Index ETF (XBB) in most account types.

Short-term corporate bonds. I’ve also excluded the iShares Core Canadian Short Term Corporate + Maple Bond Index ETF (XSH) from the iShares Ridiculous portfolios. This decision (along with excluding U.S. bonds) increases the duration risk from 7 years for the iShares Light portfolios to 8 years for the iShares Ridiculous portfolios.

Tax-efficient bonds. In taxable accounts, I’ve swapped out VAB and XBB in favour of the BMO Discount Bond Index ETF (ZDB). Because it invests in lower-coupon bonds, with less taxable annual interest, ZDB is expected to be slightly more tax-efficient than the other two.

Equity Differences: Light vs. Ridiculous

U.S.-listed foreign equity ETFs. In tax-deferred accounts (like RRSPs, RRIFs, LIRAs, and LIFs), I’ve replaced the Vanguard U.S. Total Market Index ETF (VUN) with the U.S.-based Vanguard Total Stock Market ETF (VTI). I’ve also replaced the Vanguard FTSE Emerging Markets All Cap Index ETF (VEE) with the U.S.-based Vanguard FTSE Emerging Markets ETF (VWO). These changes reduce product costs and foreign withholding taxes in tax-deferred accounts.

I decided to leave the Vanguard FTSE Developed All Cap ex North America Index ETF (VIU) alone for now. It’s nearly as tax-efficient as other comparable U.S.-based ETFs, and there is no perfect U.S.-based substitute for it. If you’d rather squeeze every last basis point out of your international equity ETFs, I’ve provided some ideas in my blog post, More Alternatives to Vanguard’s Asset Allocation ETFs.

The iShares Light portfolios already hold the U.S.-based iShares Core S&P Total U.S. Stock Market ETF (ITOT) and iShares Core MSCI Emerging Markets ETF (IEMG). But, as asset allocation ETFs with a fund-of-funds wrap structure, these funds don’t benefit from the usual tax advantages. Instead, a Canadian investor can hold ITOT or IEMG directly in their RRSP, and eliminate the 15% U.S. withholding tax on foreign dividends. To reap this tax benefit, I’ve placed these U.S.-based ETFs in the iShares Ridiculous portfolios as direct buys. To further reduce product costs I’ve also swapped out the Canadian-based iShares Core MSCI EAFE IMI Index ETF (XEF) for the U.S.-based iShares Core MSCI EAFE ETF (IEFA). If you’d rather stick with XEF, that’s fine too.

In TFSAs and taxable accounts, I’ve included only Canadian-based iShares foreign equity ETFs. In terms of foreign withholding tax, there is no advantage to using U.S.-based ETFs in these account types, so why bother? In fact, doing so can sometimes lead to even higher withholding taxes.

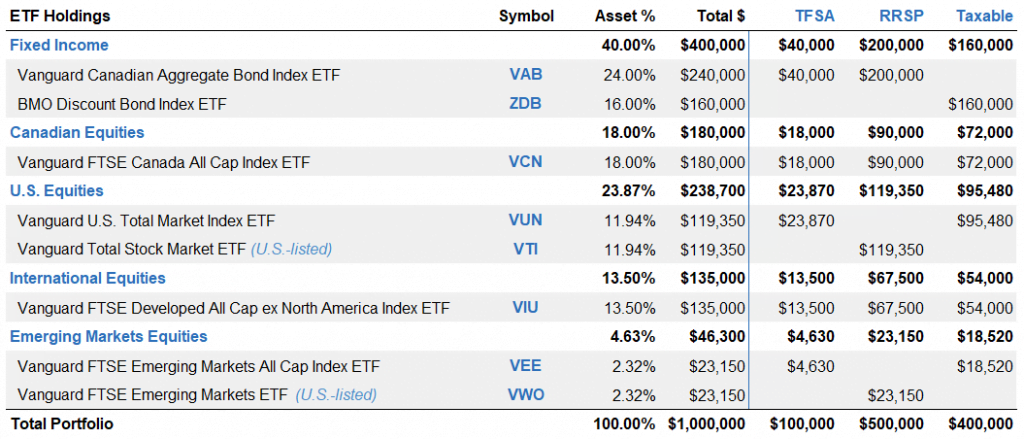

With all these confusing details to track, a Ridiculous example seems appropriate. In the chart below, I’ve illustrated a balanced Vanguard 60% equity, 40% fixed income portfolio worth $1 million, with $100,000 in a TFSA, $500,000 in an RRSP, and $400,000 in a taxable account.

Example: Ridiculous Balanced ETF Portfolio

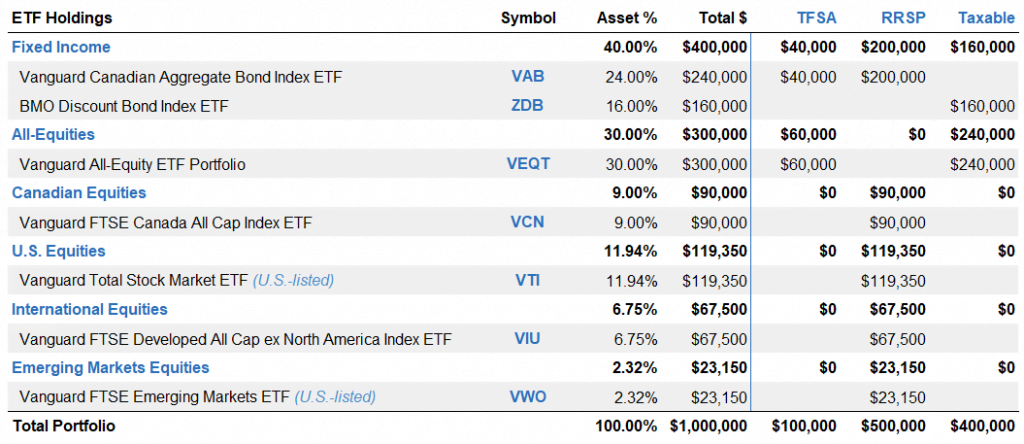

Using VEQT and XEQT in TFSA and Taxable Accounts

If you’re overwhelmed by the number of holdings above, we may be able to tone it down for you. Instead of holding four equity ETFs in your TFSA or taxable accounts, you could swap your VCN/VUN/VIU/VEE holdings for the Vanguard All-Equity ETF Portfolio (VEQT), or your XIC/XUU/XEF/XEC holdings for the iShares Core Equity ETF Portfolio (XEQT). The Ridiculous portfolios’ equity region weights are identical to the 100% Vanguard and iShares asset allocation ETFs, so you can think of them as interchangeable. Your product costs will increase slightly, but you’ll still maintain most of your cost savings, with slightly less ridiculous portfolio management.

Example: (Slightly Less) Ridiculous Balanced ETF Portfolio

Advantages of the Ridiculous Portfolios

Now that you’re familiar with the Ridiculous portfolios, let’s discuss some of their potential benefits.

Lower product costs. By ditching some of the higher-cost foreign bond ETFs, adding a dose of lower-cost U.S.-based foreign equity ETFs, and performing your own portfolio rebalancing, you can further reduce your already rock-bottom product costs.

Lower foreign withholding taxes. By opting for U.S.-listed foreign equity ETFs in your RRSP, you can reduce the unrecoverable withholding taxes on your foreign dividends.

Lower income taxes. Holding lower-coupon bond ETFs like ZDB in your taxable accounts can increase your after-tax return – at least relative to holding traditional bond ETFs, like VAB or XBB. It’s coupon clipping at its finest.

Increased ability to customize. What if you don’t like the equity weights or specific ETF holdings in the Ridiculous portfolios? No problem. You can mix and match them to your liking.

More tax-loss selling opportunities in your taxable account. If you’re investing in multiple ETFs in a taxable account, one or more of them may be in the red more often than a one-fund balanced ETF portfolio. A disciplined tax-loss selling strategy could come in handy, especially if you’ve just realized big gains by switching to a new portfolio.

Disadvantages of the Ridiculous Portfolios

By seeking to improve on the Light portfolios, we’re bound to add some relative downsides as well.

You need big accounts. If your RRSP is worth $10,000, you’re only saving about $28 per year on your Ridiculous balanced portfolio, relative to a Light balanced portfolio. And that’s before factoring in your additional trading commissions and currency conversion costs. Make sure your portfolio value is well into 6 digits or higher before considering a switch.

You’ll be placing more trades. More ETF holdings to manage across each account creates more trading costs and complexities. If you’re regularly contributing to your portfolio, the commissions can start to offset some or even all of your cost savings.

You need to rebalance your portfolio. In place of an elegant one-fund solution, your accounts now resemble a crudely constructed Frankenstein’s monster. Good luck manually keeping this beast in balance over time.

You’ll need to track more adjusted cost bases (ACBs) in your taxable account. With more ETFs at play, you’ve got more ACBs to track. Tracking the book value for a single ETF is a whole lot easier.

You’ll need U.S. dollars. To cheaply convert your Canadian dollars to U.S. dollars in your RRSP, you’ll need to master Norbert’s gambit. As described in my bonus section below, this strategy has a cost, so you’ll also need to ensure you’re only converting larger amounts. I’d say at least $10,000 a pop.

A Ridiculous Waste of Time?

Are you ready to replace your nearly perfect asset allocation ETF for a slightly cheaper Ridiculous portfolio? Before you go, know that I’m not a big fan of them in their current form. I don’t even typically manage my client portfolios like this. That’s right, just like Dark Helmet in Spaceballs, I too prefer to skip over Ridiculous and head straight to Ludicrous with my portfolio complexity.

So why bother with the Ridiculous portfolios in the first place? Great question. As we continue on our quest for portfolio perfection, we’ll be using the same ETFs from the Ridiculous portfolios, but adjusting their weights in each account type to maximize overall tax efficiency.

Bonus: Estimating the Cost of Norbert’s Gambit

As I mentioned earlier, if you plan to use the Norbert’s gambit strategy to convert Canadian dollars (CAD) to U.S. dollars (USD) in your RRSP, $10,000 would be a good minimum starting point per transaction. But how much does each conversion really cost? Good news: I’ve got a process for figuring that out.

For our example, we’ll assume you want to convert $10,000 CAD to USD, and buying and selling DLR and DLR.U costs $9.95 per trade. Adjust accordingly if your commissions are different, or you also are subject to Electronic Communication Network (ECN) fees.

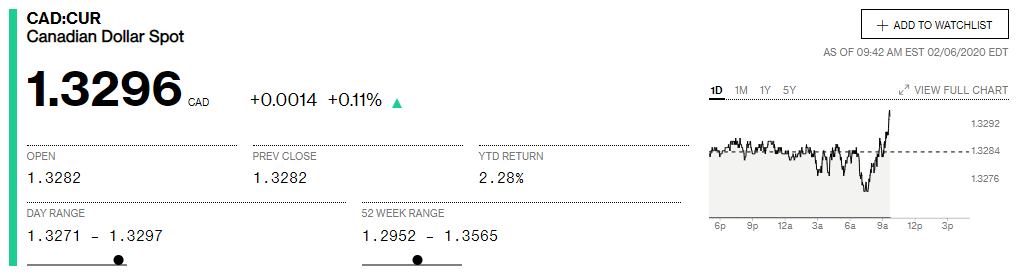

Step 1: Calculate the U.S. dollars you’d receive based on the current spot rate.

We first need to determine a fair conversion price, so we can compare it to our Norbert’s gambit outcome. For this, we need to know the spot (or benchmark) rate for converting CAD to USD. Bloomberg publishes a Canadian dollar spot rate we can use. Simply divide the CAD amount you’d like to convert by the quoted spot rate on their website. In our example, dividing $10,000 CAD by 1.3296 CAD/USD gives us $7,521.06 USD.

Source: Bloomberg, as of February 6, 2020 (9:45 am ET)

Step 2: Determine the current ask price for DLR and bid price for DLR.U.

When we obtained the spot rate from Bloomberg, DLR had a current per-share ask price of $13.45 CAD; DLR.U had a current per-share bid price of $10.11 USD.

| Security | Symbol | Bid Price | Ask Price |

|---|---|---|---|

| Horizons U.S. Dollar Currency ETF | DLR | $13.44 CAD | $13.45 CAD |

| Horizons U.S. Dollar Currency ETF | DLR.U | $10.11 USD | $10.12 USD |

Source: Quotestream, as of February 6, 2020 (9:45 am ET)

Step 3: Calculate the U.S. dollars you’d receive from the Norbert’s gambit.

- Subtract trading commissions (and ECN fees) from your Canadian dollars. This will provide you with your net CAD after trading costs:

$10,000 CAD – $9.95 CAD = $9,990.05 CAD

- Divide this figure by the DLR ask price. This will provide you with the number of DLR shares you can purchase with your Canadian dollars. Don’t worry about using partial shares for the calculation; just remember that you can only purchase whole shares when placing your trades:

$9,990.05 CAD ÷ $13.45 CAD = 742.75464684 shares

- Multiply this figure by the DLR.U bid price. This will provide you with your gambit’s U.S. dollar proceeds, before trading commissions:

742.75464684 shares × $10.11 USD = $7,509.25 USD

- Subtract your trading commissions (and ECN fees) from your U.S. dollars. This will provide you with your net U.S. dollars, after trading costs:

$7,509.25 USD – $9.95 USD = $7,499.30 USD

Step 4: Compare the USD proceeds from Step 3 with the USD proceeds from Step 1.

- Subtract the USD calculated in Step 3 from the USD calculated in Step 1. This will provide you with the Norbert’s gambit strategy’s estimated dollar cost in U.S. dollars:

$7,521.06 USD – $7,499.30 USD = $21.76 USD

- Multiply this figure by the spot rate from Step 1. This will put your U.S. dollar cost into Canadian dollar terms:

$21.76 USD × 1.3296 CAD/USD = $28.93 CAD

- Divide this figure by your initial $10,000 CAD conversion amount. This will provide you with the estimated percentage cost of the Norbert’s gambit strategy.

$28.93 CAD ÷ $10,000 CAD = 0.29%

Norbert’s Gambit Results

In this example, the total cost of Norbert’s gambit relative to our benchmark spot rate conversion was around 0.29%. It would take roughly a year for your product cost and foreign withholding tax savings to offset this initial currency conversion cost. That’s not too bad. If your cost exceeds 0.3%, you might want to stick with Canadian-based ETFs instead.

If you’d like to see some gambits in action, feel free to check out my YouTube video tutorials for various brokerages.

A Ludicrously Long Wait

Again, our Ridiculous model portfolios are a bit of a gambit themselves. You might think of them as a stepping stone toward creating even more complex model portfolios. Next up, we’ll take you on a tour through our Ludicrous portfolios, which may arguably be more worth your while.

Hi Justin,

I’m planning to set up an RRSP investment with your model portfolio shown above – including the US listed VTI and VWO. These will be my only holdings in USD. When it comes to rebalancing the portfolio, I suppose I’ll need to be moving amounts back and forth between CAD and USD. The total portfolio is well into the 6 figures, so I believe there may be enough benefit to holding the lower cost US listed ETFs, in addition to the lower withholding tax. I’m just not sure how efficient it will be to keep balance across the whole portfolio, if the balancing will require smallish currency conversions.

What happened to the Ridiculous, ludicrous, etc. portfolio PDF’s? They seem to have disappeared from the website… Thanks.

@Derek & @JMT – I’ve decided to simplify the blog a bit, but I’ll be releasing asset location videos describing the tax concepts at some point this year.

I’ve just discovered DIY investing, the blog, and the CMP Podcast. I’m finding Justin’s insight to be invaluable. And, FWIW, the Light, Ridiculous, Ludicrous, and Plaid options as of 30 September 2020 are available if you access the website using the Internet Archive Wayback Machine found here: https://archive.org/web/ . If you look at the 25 June 2021 version of the site, you should be able to access the old portfolios.

Thanks for sharing this Lawrence: I have been using the 5 ETFs portfolio for many years so I was happy to record the last version of it. I guess this website/blog revamp is encouraging me to start my very own ETF model portfolio tracker.

Hello Justin,

I love your blog and it has taught me so much about DIY investing when I used to be afraid to learn about it.

What happened to your ridiculous portfolios on your website?

Thank you,

JMT

Hey Justin.

I love reading your blog! It has helped me a ton to learn how to be a DIY investor and switching out of my expensive bank mutual funds.

What happened to the ridiculous model portfolios on your website?

Thanks!

Hi Justin,

I’ve read differing information on whether or not Canadian Vanguard funds such as VEE, VFV, and VUN are still wrap funds or if they now own the stocks directly rather then investing in its U.S.-listed counterparts (e.g. whether or not VEE simply owns VWO). Can you comment on whether or not these funds are still wrap funds?

If this is the case, how does one find the information on whether or not that is the case. I know that when you go on Vanguard Canada’s site, they show the holdings for these funds as the actual stocks, whereas VEQT, for example, shows the holdings as simply 4 underlying Canadian ETFs. I would have expected wrap funds to show the U.S.-listed counterpart ETFs as their only holdings.

Thank you!

Darren

@Darren M – VEE, VFV, and VUN still hold U.S.-based ETFs. You can determine this by reviewing the Annual Financial Statements for the ETFs (in the “Schedule of Investment Portfolio” section).

Hi Justin and CPM fellows. Thank so much for all the information provided on the website, I finally feel that I am learning lots and I am close to stop the paralysis analysis that I have had. That being said I need a little final push.

For someone who is almost 40 years old, makes just above 6 figures salary in BC ( 110k) , Canada, who has been really good at saving, does not have any debt but it is just now starting to put her investment portfolio together. I have almost 200k to invest ( this does not include a 3 month emergency fund) I would be maxing out my TFSA and RRSP (around 50k) My work is pretty secured. I

I am going back and forth between a all in one portfolio (VGRO) and the ridiculous portfolio ( i have created my portfolio but I just need to actually implemented ) that would reflect still a 20%bond and 80%stocks

I have read a lot the comments and post on this blog and I see that yes that Ridiculous portfolio has the potential and most likely better returns and less fees than a all in one portfolio. My indecision comes as to would I really be saving $$$ with this type of portfolio when I have to re balance, how many times a year do people typically re-balance this type of portfolio, the ridiculous one?

I am just trying to decide if knowing the above facts about my situation what would potential give me better return (taking into accounts Questrade trading fees) as I know I am a bit late for the investment party but I feel I still doing pretty good knowing that I have a good amount to start this now.

Thoughts on what would make more sense?

@Juliet – Unfortunately, I can’t determine which portfolio option would be best for you specifically. An asset allocation ETF makes more sense for the majority of investors.

The Ridiculous portfolio is more advantageous for investors with large RRSPs (>$200,000) who are very comfortable using the Norbert’s gambit strategy to convert their CAD to USD (and back again). If this doesn’t sound like you, perhaps the asset allocation ETFs are a more suitable option.

Thanks Justin! Thats good point to know about the RRSP’s amount and what makes sense for the Ridiculous portfolio.

I decided I am going to go with the 1 ETF Light Portfolio to star :)

@Juliet – Excellent choice! :)

One more question, so I started putting VGRO on a TFSA, does it make sense to also put VGRO on RRSP or should I maybe put XGRO on RRSP? Wondering if there is pro/cons or I just get a complete different 1 ETF for the RRPS acc? Also I will have some non-register cash, I guess same question….. do all my account register not register go to the same chosen ETF or each could have different one? I just rather not have to rebalance or complicated my life much more.

@Juliet: The iShares, Vanguard and BMO asset allocation ETFs are all very similar. I tend to just use the same ETF across all accounts, but some investors have chosen to hold an iShares ETF in one account type and a Vanguard ETF in another (it really doesn’t matter).

If you want to keep things as simple as possible, just choose a single ETF provider.

Justin, as always thank you for the excellent post. Question for you, why not use US-listed VT as opposed to VTI, VIU and VWO in the RRSP? Are the foreign withholding tax advantages lost when using VT compared to the three separately?

Second separate question. Given I invest in my RRSP monthly, using the norbert’s gambit is a pain. I have a long horizon and anticipate maximizing RRSP contribution, is it still worth it to invest in VT (vs say VXC) even if 2% foreign exchange fee is paid per transaction if time horizon is 20+ years?

Really appreciate any feedback.

@Salman: VT is also an excellent option, in place of VTI, VIU and VWO. As it includes Canadian stocks, some adjustments would be necessary. I left it out of the discussion so that comparisons could be made to the asset allocation ETFs.

https://canadianportfoliomanagerblog.com/more-alternatives-to-vanguards-asset-allocation-etfs/

It would likely make more sense to contribute to VXC until it’s relatively large (maybe $25,000), sell it, gambit the proceeds, and then buy VT. This assumes you can process the gambit at your brokerage on the same day (like at RBC or BMO).

Sorry if this has been covered in a different post, but I didn’t see it in these comments yet: The old portfolios used to have a mix-and-match of Vanguards and iShares rather than keeping to a single provider family. Are you only showing these for demonstration purposes to compare Light/Ridiculous/etc. to the one-fund solutions? Is there a hybrid model portfolio that would result in even lower fees/taxes by mixing-and-matching ETFs from different families?

@Gavin: Once you’ve reached the rock bottom product costs of the CPM portfolios, there’s not much more fine-tuning you can due to reduce costs further. Some investors prefer XUU over VUN, as the MER is 0.07% vs. 0.16%, but that’s about it.

You can feel confident moving forward with ETFs from either fund family (I use all of these in my client portfolios).

Hi Justin, Do you have any suggestion on how to balance a Ridiculous Taxable Portfolio (ishares) that has some VCN and some XIC as well as some VUN and some XUU. I understand if I am going for a 100% stocks portfolio that total Canadian and US should be 70% but unsure how to calculate the proper balance when mixing VCN/XIC and VUN/XUU to get the proper weightings. Thank you!

@Brad: You can just consider VCN/XIC and VUN/XUU as “close enough”. There’s no need to rebalance between them:

https://www.youtube.com/watch?v=pmJTlGJefoE

https://www.youtube.com/watch?v=vSJL8C5rT7M

Some of the Vanguard Ridiculous Portfolios total do not add up to 100%.

Is that due to rounding off numbers?

E.g.

TFSA

100% stocks

VAB 0.00%

VCN 30.00%

VUN 39.78%

VIU 22.50%

VEE 7.71%

Total 99.99%

@TC: You’ve got to be kidding me right now…

Haha I laughed so hard here. I can only imagine you after doing all this work for us all coming across this comment and being just stunned and shaking your head (rightfully so). Thank you for all the help….i’d even pitch in the “missing” 0.01 for that alone haha

Thanks Justin. Love the blog. Two related questions.

Question about retirement: Does the Ridiculous Strategy mean you have to consider USD/CAD exchange rates when bringing the money home in retirement? For example, if I bought when the FX rate was 1.4, do I have to liquidate US funds and convert back to CAD when the FX is 1.5 or higher to avoid a currency conversion loss?

Question about changing strategies: If I want to abandon Ridiculous and go Light, can I ignore the FX rates? So if I bought VTI/VIU/VWO when the spot rate was 1.4, and sell when it’s 1.3, I’m not really taking a hit because I am also buying the US-listed shares underlying VEQT at 1.3?

Hi Justin,

I have a huge loss in my VGRO in my Corporate account. It might be time to tax loss sell. I wonder if you think moving to VEQT would be deemed tax loss sell eligible. Since it follows the same index.

@Cam: I would speak with your accountant before tax-loss selling in your corporate account. Switching VGRO to VEQT would generally not be considered a superficial loss (as they are not identical securities – i.e. an investor would not be indifferent between holding one or the other).

Hi Justin,

Wondering about making the choice between buying US or Canadian listed ETF’s in my RRSP. With the global economy in its current state the Canadian dollar has dropped aprox. 6-8 cents +/- (8-10%). Does a change like this get taken care of within US listed ETF’s or is it favorable to buy CAD listed ETF’s instead of converting CAD to USD to buy US listed ETF’s while the CAD is so low and vice versa. (I’ve always been told buy low/sell high but buying USD right now seems to go against this) Maybe I am over complicating things just worried this could possibly outweigh the benefits of owning US listed ETF’s, as well as the need to re balance more frequently. If you could clear this up for me it would be greatly appreciated.

Thank you in advance this blog/ website has been a great help in becoming a DIY investor.

Jareet, I’m just a fellow reader/fan of the blog. But since I assume Justin is swamped supporting his current clients during the market turmoil, I thought I would share my understanding (and Justin can let us know what he thinks when he has time).

The short story is that I don’t think the actual exchange rate (either, say 6 cents higher or lower than it was a week ago) affects which type of ETF you use (US-listed of CAD-listed). (It MIGHT effect if you want a hedged fund or not but that is a different issue.)

For example, let’s say you buy a Canadian listed ETF that holds either US stocks directly or a US-listed ETF. You give Canadian dollars to, say, Vanguard Canada, to buy the Canadian listed ETF. They then convert those funds into USD at the current exchange rate, and then buy US stocks in US$ for you. Let’s say instead you convert your Canadian dollars to USD first, and then you use them to buy the US-listed ETF from Vanguard US. In both scenarios, your CAD has been converted to USD at the current rate, and you now own the US stocks. So I don’t think the actual rate today effects the pros/cons on whether to own US-listed ETFs directly (which, as Justin has listed, is driven by other factors such as the cost of you converting the CAD to USD vs the higher expense ratios in Canada).

The hedging issue is tougher and Justin and friends have written about that. In both scenarios above, you now own US stocks. So let’s say the stocks don’t change in value but the Canadian dollars changes value. You would then make or lose money on your investment from the currency rate. If you want, you could hedge this by buying the Vanguard Canada US stock fund that is hedged. That means that while you own the US stocks, they basically lock in the Canadian dollar exchange at today’s rate. So if US stocks stay the same in value, you won’t lose or make money due to the exchange rate.

For example, the Canadian dollar is weaker now than it was a week ago. So you need to spend more CAD to buy the US stocks. If the CAD strengthens from today to when you sell, then when you sell, you would get less CAD back (for any given rise or decline of the US stocks). So you might be more tempted this week than last to buy the hedged Vanguard Canada US stock fund, since then when you sell you are basically getting today’s weak CAD.

But, if you ask me, it is really hard to try to time the foreign exchange market in making hedging decisions. You probably want an overall philosophy and stick with it. (My personal experience is that my dad insisted that I buy the hedged CAD fund a few years ago when the CAD seemed very weak and he thought it could only strengthen. Well now it has weakened more so we have lost more money with the hedged fund than we would have without the hedge.)

But please take all this with a grain of salt as I’m not a professional and we need Justin to weigh in.

Jeremy, thanks for you response and explanation clears things up for me greatly appreciated

@jarett: Whether you buy Canadian-listed foreign equity ETFs or U.S.-listed foreign equity ETFs makes ZERO difference to your currency exposure.

Hi Justin,

Considering norbits for new corp

RRSP VGRO

TFSA VGRO

Taxable VEQT

New Corp Account (Canadian) being set up. Would like to consider 80-90%VGRO and the other 10-20% US blue chip speculation. If thinking some US stocks like APPL or TSLA for example, is norbits suggested to do this? Or keep the Corp clean with 100% all in one and do speculation in the taxable account with VEQT? Norbits seems intimidating but very helpful exercise you went through. Do I have to convert to US to purchase these type of blue chips?

@Lou: I don’t recommend any investor speculate on individual stocks.

You don’t have to use Norbert’s gambit to purchase USD securities, but it can save you money on larger currency conversions.

Wow! I feel like I’ve been learning so much reading this blog and others like CCP. My challenge has been to process all the different options and boil it down to something that best suits me. My goal is to set up a portfolio that won’t need too much tinkering over the years as I really appreciate your bar of soap analogy. I’m trying to keep it simple…ish so an all-in-one is obviously a good choice but also considering a 3 (ex: XIC, XAW and XBB) or one of your 5 fund options above. Partial to keeping it CAD and in TFSA as well as RRSP. I like your suggestion of mixing in XEQT or VEQT to simplify the ‘ridiculous’. I’m assuming the TFSA ‘ridiculous’ option would work the same in terms of FWT in an RRSP? More expensive MER than the us listed options but no more FWT?

What are your thoughts on adding in a REIT to the mix? Something like VRE in a TFSA? Would 10% of equity bring more diversification and stability over the long term?

I appreciate any insights. Thanks!

@Yachae Namja: Holding Canadian-based U.S. and emerging markets equity ETFs will increase the foreign withholding tax drag in an RRSP, relative to holding U.S.-based U.S. and emerging markets equity ETFs

If you’re trying to keep your portfolio simple, adding REITs would be complicating it (there’s also no guarantee it will result in lower risk going forward).

If your portfolio size is modest (i.e. under $100,000), you should really consider sticking to a one-fund solution for now.

Yeah the one fund solution does seem like a great option. Where I start to suffer from the paradox of choice is that my portfolio is around $100,000 hence my hesitation with the all-in-one. I don’t want to feel like I need to change it in a year or two.

I realize that US products held in USD accounts have lower fees and less tax drag in an RRSP compared to a CAD RRSP. My question is if I wanted to keep everything in CAD would an RRSP have more tax drag relative to a TFSA if I put equal contributors in each? I suppose my other option Is to keep equity in the TFSA and Fixed Income in the RRSP?

I don’t think I’m willing to convert to USD to save extra money yet but I figure I can still save a bit on fees by avoiding the all in one option in favour of a 2 (XBB, XEQT) or 3 (XBB, XIC XAW) CAD ETF that is still pretty simple to set up and rebalance.

@Yachae Namja: Canadian-based foreign equity or CAD-hedged foreign bond ETFs would have the same FWTR in an RRSP or TFSA:

https://canadianportfoliomanagerblog.com/part-i-foreign-withholding-taxes-for-equity-etfs/

https://canadianportfoliomanagerblog.com/part-ii-foreign-withholding-taxes-for-global-equity-global-bond-and-asset-allocation-etfs/

If you put equities in your TFSA and fixed income in your RRSP, you are following the Ludicrous asset location process. Keep in mind that although this is expected to yield higher after-tax portfolio values, it is due to the higher after-tax equity risk in your portfolio.

https://canadianportfoliomanagerblog.com/canadian-portfolio-manager-introducing-the-ludicrous-etf-portfolios/

Would it be a good idea to use 2 different balancing strategies for TFSA and RRSP? For example, 0% bonds/100% stocks in TFSA, and 40% bonds/60% stocks in RRSP if the target allocation is 20%/80% (assuming the same annual contribution in each).

@Julien: I will be discussing a similar strategy in this week’s “Ludicrous” blog post ;)

Why do you use the same asset allocation in all account types? Within the allocation limits, why wouldn’t I put all my US equities in the RSP, Canadian equities in TFSA, rather than have both in each account?

@Paul: I’ll be answering that question in great detail when I discuss the Ludicrous and Plaid portfolios (which use asset location strategies).

When are the Ludicrous & Plaid portfolios gonna be up? Not sure if it’s a joke or they are actual things at this point haha.

Really curious to see what they’ll look like.

@Elias: The Ludicrous and Plaid portfolios use the same ETFs found in the Ridiculous portfolios. I’ve just posted examples of the Ludicrous portfolios in the model ETF portfolios section of the blog, and will follow-up next week with an explanatory blog post.

Hey Justin,

Do you have any articles on the tradeoffs/reasoning for portfolio allocation in an ETF such as VAB, compared to a bank issuing you a GIC or bond?

I assume they both accomplish similar risk management goals, but the advantages of VAB are increased liquidity, ease of purchase, and a bit of volatility on the dividend returns. Is this correct, and is there anything big that I am missing?

@Greg: Please see the link below.

https://canadianportfoliomanagerblog.com/gics-vs-bond-etfs-a-case-study-and-bold-adventure/

Justin,

While I understand the motivation to present the Ridiculous portfolios as unwrapped versions of the Light models, I fail to understand why one should stick to a single ETF provider. Yes, they classify some countries differently as international or emerging markets, so for those classes it makes sense to stick to the same provider. However, why not mix and match for Canadian and US? For example, XUU and VUN both follow US Total Market indexes (albeit different ones), but XUU’s MER is 0.07%, while VUN’s is 0.16%, so it seems natural to me that I should pick always XUU.

@Jorge: These are just model portfolios. Please feel free to swap out VUN for XUU, or XIC for ZCN, or VCN for ZCN, or VAB for ZAG, or XBB for ZAG, or VIU/VEE for XEF/XEC, etc.

I should also add that over the past 3 years (ending January 31, 2020), XUU returned 13.68%, while VUN returned 13.95% (so the lower cost ETF doesn’t necessarily outperform the ETF with the slightly higher cost).

HI Justin, I hope all is well. Do you have any thoughts on VFV? Thanks so much!

@Vanessa: VFV follows the S&P 500 Index (a U.S. large-cap equity index). XUU includes the same companies in the S&P 500 Index, plus mid, small and micro-cap companies (so it’s more diversified):

https://canadianportfoliomanagerblog.com/understanding-us-equity-etfs/

Good day,

I have been a Couch Potato investor for a number of years. I currently have four Action Direct accounts (RRSP ($450K), LIRA ($40K), TFSA ($70K), and Investment ($55K)) with a total market value of just over $600K. I am still using the older model in the fully aggressive mode with holdings in VCN (30%), XAW (60%), ZAG (10%). I plan to continue to be “all in”. Should I be switching to the latest version of the Couch Potato” model?

I am 60 years old and plan on partial-retirement at the end of 2021.

Thanks.

@Jean Lavigne: It would appear that you are approaching a point in your life when some financial planning advice would be beneficial. I would encourage you to discuss your specific situation with a fee-only planner to determine if you have the right asset mix and portfolio for this stage in your life.

I’ll be releasing a blog shortly that discusses the new vs. old CPM model portfolios, and whether it makes sense to make a switch (but this will be a very generic discussion, and not applicable to everyone’s situation).

When you get to increasingly complex portfolios with multiple accounts, maintaining the re-balancing spreadsheet can be a real pain. That’s why the Passiv 3rd party app for Questrade was a godsend for me. It’s $40 a year, which isn’t bad, and it lets you purchase the right amount of each security in each account at the click of a button.

What used to take me half an hour now takes 1 minute. No more copy pasting values into a spreadsheet. I looked into automating it myself using Questrade’s API, but I’m not a programming whiz so this was a much simpler solution.

The only thing is that it’s hard to implement an asset location strategy, but those strategies are arduous and impossible to get right because you can’t predict future tax rates. You’re better off using the same asset allocation across all accounts.

@Julien: Thank you for sharing your experience with Passiv. I haven’t tried them out yet, but it sounds like an interesting service.

When I release the “Ludicrous” blog, you’ll find that investors can create a portfolio with a higher expected after-tax portfolio value (relative to holding the same asset mix across all accounts), without needing to make any future tax rate predictions.

Looking forward to the Ludicrous portfolios! When are you expecting to release those? Hopefully lines up nicely with RRSP contributions/rebalancing time in March :)

@Amit: I’ve finished the Ludicrous draft blog (it’s just in the editing phase right now) – I’ll possibly release it by the end of this week or early next. As you can probably imagine, each CPM blog post takes a substantial amount of preparation and time – I wish I could release them at a faster pace, but then I would need to sacrifice the quality and accuracy of the content.

I will also be releasing podcasts and videos on each, which should help with the more complicated concepts.

Hi Justin,

Thanks for another great analysis! I wonder why ACB tracking is a disadvantage of a more complicated portfolio. It seems that most brokerages are doing a great job in tracking ACB for investors nowadays. I know for one tracks everything from ROC to phantom distributions in its ACB calculations. Therefore, am I missing something?

Some people like me also have corporate accounts in their portfolio. Would it be possible for you to include comments on corporate tax efficiency in the comparisons as well? Thanks.

@Joe: Although brokerages have gotten better at tracking ACBs for Canadian-based ETFs over the past few years, investors are ultimately responsible for their accuracy (and should verify them independently). Canadian brokerages are still downright awful at tracking the the ACBs for U.S.-based ETFs though.

I’ll certainly try to include corporate accounts in my future discussions (once I have tackled basic personal accounts).

Justin,

Thanks for continuing educating us :) I started with CCP and slowly moved to your model.

Quick question – why is percentages differ for iShares and Vanguard allocations?

i.e. for 100% stocks VCN is 30% but XIC is 25%?

It just happened that I have combination of both :) – VCN, ITOT, IEFA and VWO… I know, I know…

And another quick question: would you recommend to use 1CAD=1USD exchange rate for rebalancing purposes?

Thanks again!

@Oleksiy Gryshchenko: You’re very welcome! I’ve used the same split between Canadian and foreign stocks as seen in the iShares and Vanguard Asset Allocation ETFs (from the Light portfolios):

https://canadianportfoliomanagerblog.com/canadian-portfolio-manager-introducing-the-light-etf-portfolios/

Definitely would not recommend using 1CAD = 1USD exchange rate for rebalancing purposes. Use the current exchange rate.

@Justin: is there a difference between the one fund option versus the multi fund option in regards to the buy low/sell high rebalancing benefits? You would have to research how the one fund company does its own rebalancing and see how often it happens, and then compare it to other typical rebalancing methods an investor would do with the multi fund portfolio. Have you given much thought as to which method would provide the best benefit?

Que: I would argue that the one-fund option has the superior rebalancing strategy, because the ETF companies will actually rebalance their portfolios. The same can’t be said for the average investor.

In terms of rebalancing frequency, it doesn’t really matter much, as long as you occasionally rebalance the portfolio:

https://personal.vanguard.com/pdf/ISGGBOT.pdf

Hi Justin, thanks so much for all of this information; I really appreciate it! I make less than $50,000 per year, so haven’t contributed to an RRSP. I have a small amount of room left in my TFSA for this year. I would like to start investing in US and international stocks and/or ETFs, so I’m wondering what would be my most tax efficient allocation? Should I save up +$10,000 and buy US stocks and/or ETFs in my RRSP to save on the withholding taxes? Is it worth it for me to do that given my tax bracket? Or, if I go with XAW, should fill up the remaining room in my TFSA and then keep buying shares in my non-registered account? Thanks again for all if your help!

@Vanessa: Unless your RRSP is very large (i.e. well into the 6 digits), it’s not really worth buying U.S.-listed ETFs to reduce your product costs and foreign withholding taxes. The $10,000 figure is the minimum CAD amount to convert using Norbert’s gambit for any additional U.S.-listed ETF purchases in your RRSP (you should still start with a larger amount in your RRSP to make it worthwhile – well over $100,000 in foreign equity ETFs in my opinion).

In terms of RRSP vs. taxable account, this will depend on your specific situation. If you’re not expected to be in a higher tax bracket than you currently are in during retirement, it could make sense to contribute to your RRSP before your taxable account (but make sure you save and invest your tax refund!).

Justin

Nice review of the ridiculous! I glad you did this and added the reasoning of why change. Like TJ looking for an after tax approach of the Ludicrous portfolios. I have a large US currency account and see you have US listed stocks in the RRSP portion but did not do the same for the taxable account. Since i have a large US$ and do not want to convert to C$. I used your RRSP recommendation of ITOT and IEMG in my taxable. But would love to get your advice on how to balance large sum of US$ on a cost and tax efficiency. Thanks again. and Great job!. Pat

@Pat M: Glad you liked it! Buying ITOT and IEMG in your taxable account (instead of XUU and XEC) is also fine (especially if you already have U.S. dollars), as long as you don’t mind the additional ACB tracking complexity and potential T1135 reporting requirements.

Hey Justin,

what do you think of wealthsimple as a brokerage as it charges no fees?

@Pete: That doesn’t sound like a very sustainable business model ;)

I’ve never tried them out (I tend to recommend Questrade for those investors looking for low ETF trading commissions).

Great post! Thanks, Justin!

Very naive question: I have been using Dan’s Couch Potato portfolio for a number of years now. Could you briefly compare your portfolios to the CCP and whether it would be worth switching over, please?

@Helmut: Not a naive question at all! If you’re holding ZAG/VCN/XAW (the last version of the CCP and CPM model portfolios), this would be nearly identical to holding VAB/VCN/VUN/VIU/VEE (which is the Ridiculous portfolio) – the main difference would be the split between Canadian and foreign stocks (but it’s a trivial difference).

I’ll be discussing this question on an upcoming podcast (and hopefully a blog), where I’ll go into more detail.

Will you be publishing detailed return rate tables for your updated model portfolios?

@Gail Bebee: The hypothetical returns are included on the Light model portfolio report. As the other portfolios are nearly identical (other than lower fees, lower withholding taxes, no foreign bonds), the returns for the Ridiculous portfolios are expected to be similar to the Light.

Would you consider putting all the fixed income etf VAB only into a RRSP account as it’s more tax efficient. Any remaining balance over the fixed income allocation will then be in the other equity etfs. The taxable account will be fully invested in equity etfs. And would it be simpler to use XAW for all non Canadian equity allocation instead of using the three etfs of VUN VIU and VEE.

@George: Please see my response to TJ regarding asset location (and my other earlier responses to other readers regarding VUN/VIU/VEE vs. XAW).

Any reasons none of your portfolio consider long term bonds like XLB?

@Jean: The VAB, XBB and ZDB holdings all include long-term bonds, as well as short-term and mid-term.

Ray Dalio All Weather Portfolio ?

I’m curious to have your impression on Ray Dalio All Weather Portfolio.

Deep analysis might be very intersting for Canadian investors in futur blog or podcast.

Thank you, Jean

@jean: I might consider a podcast episode where I discuss other popular investment strategies, and their issues.

You should, it will bring lots of traffic$ to this UNIQUE blogs.

;-)

If I only want to invest in CAD, example in a RESP, this portfolio is hard to implement for the commodities portion in CAD.

You publish lots of great stuff. Hard to find quality contents on the web when it come to Canadian investing.

Thumbs UP!

Keep up the good work.

Jean, I am a fan of The All Weather Approach (or often called Risk Parity). I implement this using an account at Interactive Brokers where you can purchase equity and/or bond futures contracts in order to access the leverage needed. I do not think these futures products can be purchased in a RRSP or TFSA account. For commodity exposure, I purchase one of Pimco’s commodity fund (PCRAX) which is a USD fund.

(Risk Parity is basically an approach where you can end up with, say, similar returns as a 80% equity/20% bond portfolio but with less risk by purchasing a lot more bonds, using leverage, and much less stocks. While leverage – borrowing money to invest – can increase risk in other cases, here it is reducing the risk significantly since you are buying much fewer equities.)

Is there an All In One ETF available that is denominated is US currency. The reason I ask this is because I currently have individual US$ holdings, and would prefer a simple ETF holding with both equity and bonds across Canada, US, and international.

@Mustafa:

iShares in the U.S. have some asset allocation ETFs you could check out (AOR, AOM, AOA, AOK):

https://www.blackrock.com/us/financial-professionals/products/239756/ishares-growth-allocation-etf

https://www.blackrock.com/us/financial-professionals/products/239765/ishares-moderate-allocation-etf

https://www.blackrock.com/us/financial-professionals/products/239729/ishares-aggressive-allocation-etf

https://www.blackrock.com/us/financial-professionals/products/239733/ishares-conservative-allocation-etf

Hi Justin, thanks so much for your series of informative posts and podcasts, they’ve been so helpful.

I’m weary of converting to US dollars in my RRSP. I was thinking of just using the same ETFs that you recommend for the TFSA in my RRSP. If I were to do that, and follow the ishares 80stocks/20bonds portfolio, can you tell me the MER and foreign tax percentages? I’d like to see how much savings I’m missing out on by not converting.

Or if there were any Canadian dollar ETF alternatives that would be better in the RRSP than the ones recommended for the TFSA I’d like to hear about those too.

Thanks again!

@Kris: If you’re not comfortable with Norbert’s gambit and U.S.-based ETFs, why not just stick with a one-fund solution, like in the Light portfolios:

https://canadianportfoliomanagerblog.com/canadian-portfolio-manager-introducing-the-light-etf-portfolios/

If you held the TFSA securities in your RRSP, the MER + FWTR would be the same in the RRSP as it would be in the TFSA.

Hello Justin,

In the examples of the ridiculous portfolios used above, could they be further optimized with the traditional asset location approach? For example, shifting more of the bonds to the rrsp’s first, shifting more equities to tfsa first and then to the taxable accounts second?

The portfolios above have 40% bonds – 60% equities allocation in each of the accounts. With such a large 1M dollar portfolio, using asset location could improve the long term result and reduce taxes also….

Your thoughts? Will this asset location (traditional approach vs after tax approach) be covered in your next podcast?

Thanks a bunch.

TJ

@TJ: You’re right on the money! The Ludicrous portfolios will use the same ETFs as the Ridiculous models, but will hold equities in the TFSA first, taxable second, and RRSP last.

My rebalancing spreadsheets are ready. Bring on the Ludicrous :D

@Brenda: Okay, but don’t say I didn’t warn you ;)

I guess this is an ETF analysis, but I can’t help wondering why you would recommend ZDB in a non-registered account with a YTM of 1.93%. You could use the Motive Financial high-interest savings account with CDIC protection and a standard 2.8% yield.

@GregJP: These are stock and bond model ETF portfolios, not cash accounts.

@Justin

When estimating the cost of norbert’s gambit, I’m curious to why you use the Bloomberg spot rate as a benchmark …

Asking because it seems as though its not a fair comparison – bank fees/commissions are not included in the spot rate, however, they are included on the DLR side.

As someone who is trying to convert 10k cad to usd, is it wrong to compare the amount of usd I would get using Norberts Gambit, to the amount of usd I would get using bank or retail foreign exchange place ?

Thanks!

@Nav: I’ve assumed that the big ETF providers (like iShares and Vanguard) can convert currencies at very close to the spot rate, so this is a better comparison (when deciding whether to use Norbert’s gambit and purchase U.S.-based ETFs in your RRSP, or just stick with Canadian-listed ETFs and accept the foreign withholding tax drag).

If you’re just comparing Norbert’s gambit to a bank rate for the purposes of converting CAD to USD (but not for purchasing U.S.-listed foreign equity ETFs in an RRSP), then this comparison would be fine.

Hi Justin,

Any reason you’re not using more BMO ETFs and instead concentrate on Vanguard and iShares?

Thanks,

Cristian

@Cristian: I discussed this in my last blog post (basically because BMO does not have U.S.-based foreign equity ETFs):

https://canadianportfoliomanagerblog.com/canadian-portfolio-manager-introducing-the-light-etf-portfolios/

“By the way, I’ve decided to exclude the BMO asset allocation ETFs in these discussions, mainly because they don’t have U.S.-listed versions of their products. This will be important when reviewing the other three, more complicated models. So, if you do decide to go with our Light portfolios, you can also consider the BMO asset allocation ETFs.”

These are too simple. I’m holding out for Plaid

What happened to the 33% VCN 67% XAW recommended portfolio for 100% equities in your taxable account? Any reason this has been switched out (I didn’t see any reasoning noted) I’ve been doing that and I was wondering if there was any reason I shouldn’t now? It seemed to strike the balance to me between lower MER and being more flexible for when I’d like to add bonds in the future.

Thanks.

@Andrew: The 100% stock Vanguard Ridiculous portfolio is very similar (so I took the old CPM models down, as they don’t add anything different). The combination of VUN/VIU/VEE is the same as XAW (or VXC for that matter). This is because I have weighted VUN/VIU/VEE based on their relative market caps (which is also how XAW or VXC weights U.S., international and emerging markets).

The difference in splits between Canadian equities and foreign equities (i.e. 33%/67% for the old models vs. 30%/70% for the Vanguard models) isn’t expected to make much difference.

As mentioned in this article, you can customize the model portfolios however you’d like.

Not even an honorary mention for XAW? The reduced fee and improved tax structure of VXC not enough to hook you either? Just curious why you decided to skip over these options for the TFSA and taxable portfolios?

Ah well. Can’t wait to see what the next two model portfolios have in store!

@Mark H: XAW is nearly identical to VUN/VIU/VEE, which is nearly identical to VXC. However, for my future asset location discussions, it’s easier to have investors familiar with the individual pieces. Please feel free to use XAW or VXC in place of VUN/VIU/VEE.

How come you advise VUN with a 0.16 MER over VTI, with a 0.03 MER within the TFSA account? Would it be better to go with VTI if your TFSA is maxed and you do not mind doing the Norbert’s Gambit to be able to buy VTI? And same question with regards to VEE vs VWO.

I assume it’s because of the ease of transaction, but maybe you could clarify.

@Greg: Most investors’ TFSAs are still not very large, so the dollar cost savings of holding slightly cheaper U.S-based U.S. equity and emerging market equity ETFs would over-complicate the portfolio management. If you don’t like VUN’s MER, you could consider using XUU instead (with an MER of 0.07%).