In the last installment of my “Understanding ETFs” series, we toured the U.S. equity ETF landscape, covering solutions you can use to diversify your portfolio’s domestic stock allocation. Of course, when it comes to investing, you don’t have to limit yourself to North America. Today, let’s head overseas, to explore how to further diversify your global portfolio by adding ETFs from other developed markets around the globe.

Before we get going: When I refer to “international” investing in this piece, I’m talking about investing in developed stock markets outside of North America. Since it would get pretty tedious if we used that entire phrase every time, this is the common short-hand for them in Canadian financial-speak.

The Developed World at Our Financial Fingertips

In 2001, BlackRock released the iShares MSCI EAFE ETF (EFA). MSCI is an acronym for “Morgan Stanley Capital International,” while EAFE stands for “Europe, Australasia and the Far East”. EFA tracks the performance of over 900 large and mid-size companies located in 21 developed countries around the world, excluding Canada and the U.S.

EFA’s largest holdings include a number of familiar names most Canadians will instantly recognize.

Top 10 Holdings by EFA Weight

| Company | Symbol | Weight |

|---|---|---|

| Nestle SA | NESN | 2.0% |

| Novartis AG | NOVN | 1.5% |

| Roche Holding AG | ROG | 1.4% |

| HSBC Holdings plc | HSBA | 1.3% |

| Royal Dutch Shell plc Class A | RDSA | 1.1% |

| Toyota Motor Corp. | 7203 | 1.1% |

| TOTAL SA | FP | 1.0% |

| BP plc | BP. | 1.0% |

| Royal Dutch Shell plc Class B | RDSB | 0.9% |

| AIA Group Ltd. | 1299 | 0.8% |

Source: BlackRock Inc., as of December 31, 2018

As EFA trades in U.S. dollars on the U.S. stock exchange, Canadian investors may find it more convenient to purchase the BMO MSCI EAFE Index ETF (ZEA) instead. ZEA follows the same index, but trades in Canadian dollars on the Canadian stock exchange

| U.S.-listed | Canadian-listed |

|---|---|

| iShares MSCI EAFE ETF (EFA) | BMO MSCI EAFE Index ETF (ZEA) |

Each company in the MSCI EAFE Index is weighted according to its “float-adjusted” market capitalization. For more information on float-adjusted market caps, please watch my video, Understanding Canadian Equity ETFs.

It’s a Small World, After All

In 2007, BlackRock also launched the iShares MSCI EAFE Small-Cap ETF (SCZ). SCZ complements EFA by following the MSCI EAFE Small Cap Index, which tracks the performance of over 2,300 smaller companies located outside of North America.

| Tracking ETF | Symbol | MER | Underlying Index | Number of Stocks | Dividend Yield |

|---|---|---|---|---|---|

| iShares MSCI EAFE ETF | EFA | 0.32% | MSCI EAFE Index | 920 | 3.7% |

| iShares MSCI EAFE Small-Cap ETF | SCZ | 0.40% | MSCI EAFE Small Cap Index | 2,348 | 2.9% |

Sources: BlackRock Inc., MSCI, as of December 31, 2018

By allocating about 85% of your international investment dollars to EFA, and the remaining 15% to SCZ, you gain float-adjusted market-cap exposure to most of the developed stocks outside of North America, at an annual MER of about 0.33%.

Everybody, Come Together

True to form for our clever index providers, there also is a single index that follows a combination of the MSCI EAFE Index and the MSCI EAFE Small Cap Index. It’s called the MSCI EAFE IMI Index.

“IMI” stands for “Investable Market Index”, which includes large, mid-size and small-size companies. This index follows the performance of over 3,200 international companies, providing broad stock market exposure.

You may now be thinking, “Say, I’ll bet there are ETFs available to invest in those MSCI EAFE IMI Index companies. That way, I can invest in one fund instead of two, and achieve the same goal.”

If you leaped to this conclusion ahead of me, congratulations! You’re not only correct, you’re clearly getting into the swing of my “Understanding ETFs” series.

For starters, the iShares Core MSCI EAFE ETF (IEFA) trades on the U.S. stock exchange in U.S. dollars. IEFA tracks over 3,200 international stocks and has a cost of 0.08% per year. In addition, its sister ETF, the iShares Core MSCI EAFE IMI Index ETF (XEF), trades on the Canadian stock exchange in Canadian dollars. XEF also tracks over 3,200 international stocks and has a cost of 0.22% per year.

| Tracking ETF | Symbol | MER | Underlying Index | Number of Stocks | Dividend Yield |

|---|---|---|---|---|---|

| iShares Core MSCI EAFE ETF | IEFA | 0.08% | MSCI EAFE IMI Index | 3,268 | 3.6% |

| iShares Core MSCI EAFE IMI Index ETF | XEF | 0.22% | MSCI EAFE IMI Index | 3,268 | 3.6% |

Sources: BlackRock Asset Management Canada Limited, BlackRock Inc., MSCI as of December 31, 2018

IEFA is generally less tax-efficient than XEF when held in a TFSA, RESP, RDSP or taxable account. In most of these account types, the tax drag is due to the extra 15% U.S. withholding taxes that apply on foreign dividends paid to Canadian investors from this U.S. fund.

XEF, on the other hand, holds most of its underlying stocks directly in a Canadian-domiciled fund structure, so it avoids this second layer of U.S. foreign withholding taxes. For more information on foreign withholding taxes, please refer to our white paper on the subject, but here’s a quick view of their expected impact.

Estimated Unrecoverable Foreign Withholding Taxes: IEFA vs. XEF

| Account Type | iShares Core MSCI EAFE ETF (IEFA) | iShares Core MSCI EAFE IMI Index ETF (XEF) |

|---|---|---|

| Registered Retirement Savings Plan (RRSP) | 0.28% | 0.30% |

| Registered Retirement Income Fund (RRIF) | 0.28% | 0.30% |

| Locked-in Retirement Account (LIRA) | 0.28% | 0.30% |

| Life Income Fund (LIF) | 0.28% | 0.30% |

| Tax-Free Savings Account (TFSA) | 0.76% | 0.30% |

| Registered Education Savings Plan (RESP) | 0.76% | 0.30% |

| Registered Disability Savings Plan (RDSP) | 0.76% | 0.30% |

| Taxable Accounts | 0.28% | 0.00% |

Sources: BlackRock Asset Management Canada Limited, BlackRock Inc., MSCI as of December 31, 2018

Room with a VIU

Unsurprisingly, where there’s success, there are copycats, which is all well and good for you, the consumer. In 2015, Vanguard Canada released the Vanguard FTSE Developed All Cap ex North America Index ETF (VIU), to compete with the tax-efficiency of XEF. VIU follows the FTSE Developed All Cap ex North America Index, which tracks the performance of over 3,600 companies located in 23 developed countries outside of North America, making it similar to IEFA and XEF. As discussed in earlier installments, “FTSE” stands for “Financial Times Stock Exchange,” and “All Cap” indicates that the index tracks large, mid-cap, and small-cap companies.

| Tracking ETF | Symbol | MER | Underlying Index | Number of Stocks | Dividend Yield |

|---|---|---|---|---|---|

| Vanguard FTSE Developed All Cap ex North America Index ETF | VIU | 0.23% | FTSE Developed All Cap ex North America Index | 3,675 | 3.5% |

Sources: Vanguard Investments Canada Inc., FTSE Russell Indices as of December 31, 2018

Vanguard’s VIU fund has an MER of 0.23%, and holds most of the underlying stocks directly in a Canadian-domiciled fund structure. This structure makes VIU similar to XEF in tax-efficiency.

Estimated Unrecoverable Foreign Withholding Taxes: XEF vs. VIU

| Account Type | iShares Core MSCI EAFE IMI Index ETF (XEF) | Vanguard FTSE Developed All Cap ex North America Index ETF (VIU) |

|---|---|---|

| Registered Retirement Savings Plan (RRSP) | 0.30% | 0.31% |

| Registered Retirement Income Fund (RRIF) | 0.30% | 0.31% |

| Locked-in Retirement Account (LIRA) | 0.30% | 0.31% |

| Life Income Fund (LIF) | 0.30% | 0.31% |

| Tax-Free Savings Account (TFSA | 0.30% | 0.31% |

| Registered Education Savings Plan (RESP) | 0.30% | 0.31% |

| Registered Disability Savings Plan (RDSP) | 0.30% | 0.31% |

| Taxable Accounts | 0.00% | 0.00% |

Sources: BlackRock Asset Management Canada Limited, BlackRock Inc., FTSE Russell Indices, MSCI, Vanguard Investments Canada Inc. as of December 31, 2018

Where in the World Is Korea?

The main difference between the FTSE Developed All Cap ex North America Index and the MSCI EAFE IMI Index, is that FTSE considers Korea to be a developed country, while MSCI considers it to still be an emerging market (the same is true of Poland, but it has much less of an impact due to its smaller world market capitalization). This means that VIU (which follows the FTSE index) tracks more than 400 additional Korean companies than XEF (which follows the MSCI index).

Developed Markets Classification

| Country | MSCI | FTSE |

|---|---|---|

| Korea | Emerging | Developed |

| Poland | Emerging | Developed |

Thus, the large difference in the number of companies each index tracks. In fact, VIU currently allocates approximately 5% of its holdings to Korean stocks, while in turn underweighting many of its other top country holdings.

Top Country Weights: VIU vs. XEF

| Country | VIU | XEF | Difference |

|---|---|---|---|

| Japan | 24.7% | 25.3% | -0.6% |

| United Kingdom | 16.3% | 17.4% | -1.1% |

| France | 9.0% | 9.9% | -0.9% |

| Germany | 7.9% | 8.3% | -0.4% |

| Switzerland | 7.6% | 8.0% | -0.4% |

| Australia | 6.7% | 6.9% | -0.2% |

| Korea | 5.0% | - | +5.0% |

| Hong Kong | 3.7% | 3.6% | +0.1% |

| Netherlands | 3.1% | 3.3% | -0.2% |

| Spain | 2.8% | 3.0% | -0.2% |

| Sweden | 2.7% | 3.1% | -0.4% |

Sources: BlackRock Asset Management Canada Limited, Vanguard Investments Canada Inc.as of December 31, 2018

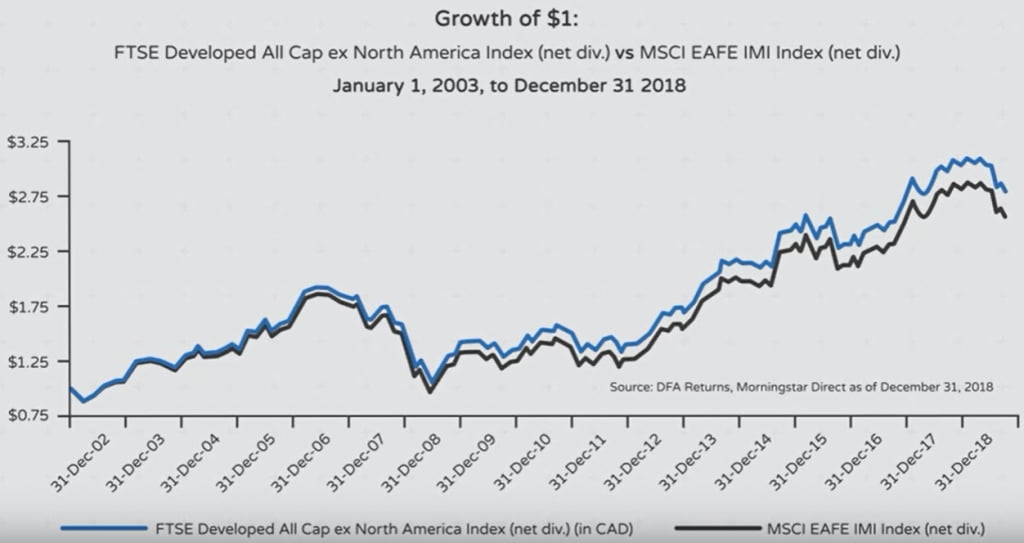

Since 2003, the FTSE Developed All Cap ex North America Index has returned 6.6% in Canadian dollars on an annualized basis, while the MSCI EAFE IMI Index returned 6.1%.

Source: DFA Returns, Morningstar Direct as of December 31, 2018

The difference in returns can largely be attributed to the exclusion of Korean stocks in the MSCI EAFE IMI Index. Over the same time period, Korean stocks returned 8.8%, which was higher than the returns of all the international countries with larger market caps (Note: FTSE reclassified Korea to developed markets status in 2009, but Korean stocks also outperformed most larger developed country stock markets between 2009 and 2018).

Annualized Country Returns: January 1, 2003 to December 31, 2018

| Country | Annualized Return (in CAD) |

|---|---|

| Japanese Stocks | 5.0% |

| U.K. Stocks | 5.3% |

| France Stocks | 5.9% |

| German Stocks | 7.7% |

| Swiss Stocks | 7.5% |

| Australian Stocks | 8.6% |

| Korean Stocks | 8.8% |

Sources: MSCI, DFA Returns as of December 31, 2018

To Be Continued …

If you prefer XEF to VIU, but want to ensure that your portfolio includes Korean stocks within your emerging markets allocation, please subscribe and tune into our next video, “Understanding Emerging Markets Equity ETFs,” to learn more.

| Tracking ETF | Symbol | MER | Underlying Index | Number of Stocks | Dividend Yield |

|---|---|---|---|---|---|

| iShares Core MSCI EAFE ETF | IEFA | 0.08% | MSCI EAFE IMI Index | 3,268 | 3.6% |

| iShares Core MSCI EAFE IMI Index ETF | XEF | 0.22% | MSCI EAFE IMI Index | 3,268 | 3.6% |

| Vanguard FTSE Developed All Cap ex North America Index ETF | VIU | 0.23% | FTSE Developed All Cap ex North America Index | 3,675 | 3.5% |

Sources: BlackRock Asset Management Canada Limited, BlackRock Inc., FTSE Russell Indices, MSCI, Vanguard Investments Canada Inc.as of December 31, 2018

Thanks for this excellent article. I’m thinking of purchasing VEA in my RRSP due to it being the lowest MER and low foreign withholding tax.

One thing I noticed though was compared to IEFA (iShares equivalent), it carries a Canadian position (about 9%) vs. IEFA excludes Canada.

Would I end up paying foreign withholding tax (level 2) on the Canadian portion within VEA since it’s going through the US?

Since it’s my RRSP, I thought the best combination to get a FTSE world all cap index with the lowest MER and foreign withholding would be to hold VTI, VWO, and VEA. In this case, I wouldn’t own VCN since the Canadian portion is within VEA I believe.

@Matt – There would be one level of withholding tax on the Canadian portion of the dividends (from Canada to the U.S.). The 15% U.S. withholding tax (from the U.S. to Canada) wouldn’t apply.

VT may also be an option to look at, if you’re interested in global stock market exposure for your RRSP (in a single ETF).

A quick question/correction to your table “Estimated Unrecoverable Foreign Withholding Taxes: IEFA vs. XEF”: isn’t the US portion of the tax withholding of IEFA in an RRSP lower due to US/CA tax treaty?

@Simon: When IEFA is held within an RRSP, the 15% US withholding tax does not apply (but the unrecoverable international withholding taxes to the US still apply, resulting in a tax drag of around 0.28% – almost identical to the unrecoverable international withholding taxes to Canada of 0.30% for XEF when held in an RRSP). The table does not require any corrections.

Thanks for the clarification Justin.

An separate question: will you have a future blog post that covers XAW and VXUS/IXUS and the estimated Unrecoverable Foreign Withholding Taxes of those ETFs?

@Simon: I have no plans to include VXUS/IXUS in future videos, but XAW will definitely make an appearance.

Have you downloaded my new foreign withholding tax calculator? https://canadianportfoliomanagerblog.com/calculators/

Thanks Justin, the new calculator looks useful. My US-listed positions are VTI and VXUS/IXUS and the calculator only has VTI, so unfortunately I can’t make full use of it.

I want to get “90% of the way there”. I’m planning to have a TFSA (75k XAW), RRSP (75k ZAG), and taxable account (50k VCN, 25k XAW, 25k ZDB).

Are there any tweaks you’d make?

@Drew: That looks more than 90% of the way there to me ;)

VEQT will have similar withholding tax implications to VCN/XAW in TFSA and taxable accounts, if you’re looking for less holdings (although it has a slightly lower allocation to Canadian equities than your sample – 30% vs. 33.33%).

So there’s little difference between between the above portfolio and one that would be TFSA (75k VEQT), RRSP (75k ZAG), and taxable account (75k VEQT, 25k ZDB)?

If that’s the case, it doesn’t seem like the simplicity gained in the latter portfolio (4 funds rather than 5) would be worth the slightly higher MER for VEQT.

@Drew: Correct – the asset allocation ETFs are simple solutions if you hold the same one across all accounts.

Do you have any insight into how much drag there will be for VGRO and VEQT in taxable accounts?

@Drew: What do you mean by “tax drag”? Foreign withholding tax drag?

I’ll be covering these ETFs in a future episode/blog.

Justin, I was first introduced to your work through the Foreign Withholding Taxes white paper and was thoroughly impressed with the detailed information provided, which was presented in such a way that even a layman such as myself could grasp and apply the concepts it detailed. I can’t believe it’s taken me such a long time to discover this blog. As a DIY investor with a world market cap-weighted ETF portfolio consisting of VSB, XUU, XEF, VCN and VEE, I was dismayed to find out that I apparently don’t own any Korean stocks. Thanks for sharing your expertise and I look forward to your Emerging Markets Equity ETF piece!

@Dave M: It sounds like you’re doing just fine (even without Korean stocks ;)

Justin, firstly and again I want to express my appreciation to you for great articles. I look forward to your next installment and any planned to follow. Will you be eventually offering us a compilation in print?

I read, digest, and then share each article with my daughter as important independent sources of information for her development as an informed millennial investor.

@Curt: Glad to hear you’ve been enjoying the articles. I have no plans for any “print” articles, but I’ll speak to my web designer to see if he can improve the print function on my blog (which is non-existent at that time).

Thanks again Justin for a very informative article with an ideal level of detail. As a related aside, am I correct in understanding that BMO has recently introduced its family of ETFs to compete with iShares and Vanguard, and if so, do you have any opinions on them yet?

@Bob Clark: I’ll be creating videos in the future for the Vanguard, iShares and BMO asset allocation ETFs (they’re all decent product solutions though).

Oh, and another point worth clarifying, but the underlying stocks would all be held in the various currencies of the countries that they trade in, correct? Are the “market caps” and therefore holdings percentages all adjusted for the various fluctuations among the currencies with respect to one-another, or are they all “normalized” to CAD (or USD) currency?

@Mark: None of the international equity ETFs mentioned in the video/blog use currency hedging, so investors would also have exposure to the various underlying international currencies by investing in these ETFs. From an investing viewpoint, Canadians would want the Canadian dollar to depreciate, relative to the underlying international currencies.

The market caps are taken at a point in time (using the same currency – usually USD is the easiest to find online for illustration purposes). As of December 31, 2018, the MSCI EAFE IMI Index had a market cap (in USD millions) of $14,590,687.64. Japan is the largest country in the MSCI EAFE IMI Index, with a market cap of $3,734,462.32 (in USD millions). So Japan would receive a weight of 25.59% in the MSCI EAFE IMI Index ($3,734,462.32 / $14,590,687.64).

Thanks for the informative article as usual, Justin. I rarely get my advice from videos (and admittedly haven’t yet watched any of yours), so I appreciate the “stand-alone” article as well.

After you are done covering Equity ETF’s, can we expect to see similar coverage to the Bond ETF’s out there?

@Mark: I plan to tackle a number of popular broad Canadian and foreign bond ETFs in future installments of my Understanding ETFs series.