So far in our tax-loss selling blog post series, we’ve taken a pretty deep dive into how to engage in tax-loss selling in your non-registered accounts.

To review, tax-loss selling means selling an existing ETF at a capital loss, and then repurchasing a similar, but not identical holding to maintain similar asset class exposure in your portfolio.

Again, the new ETF must NOT be deemed identical to the one you just sold, or you’ll violate the CRA’s superficial loss rules. If you do, you’ll lose the tax savings you were hoping to gain.

To Err Is Human, To Pair Is Divine

To that end, it helps to have a list of ETF pairs that offer you similar, but different exposure to the same asset class. That’s what today’s post is all about. Here, we’ll suggest ETF pairs we believe would be good candidates. Fortunately, due to the seemingly endless supply of new ETFs being launched, tax-loss selling for Canadians has never been easier.

Actually, before we continue, we pause for an important public service announcement! The rest of this post is going to go deep into the weeds of tax-loss selling pairs. If your curiosity is itching, I am confident it will be deeply scratched by the end.

Are you ready? Let’s pair off! We’ll start with the most broadly diversified asset class ETFs for global (ex Canada), Canadian, U.S., international and emerging markets stocks. We then suggest a replacement ETF that will provide similar market exposure without being deemed identical property. Oh, and as always, you should speak with your accountant or other tax-planning specialist before engaging in any tax strategy.

Global (ex Canada) Equities Pairing: XAW Pairs with VXC (and a Surprise)

The iShares Core MSCI All Country World ex Canada Index ETF (XAW) is familiar fund among DIY investors, featured in the Canadian Couch Potato and Canadian Portfolio Manager model portfolios. XAW follows the MSCI All Country World ex Canada Investable Market Index. This index tracks the performance of large-, mid- and small-cap companies in the U.S., emerging markets, and developed markets outside of North America.

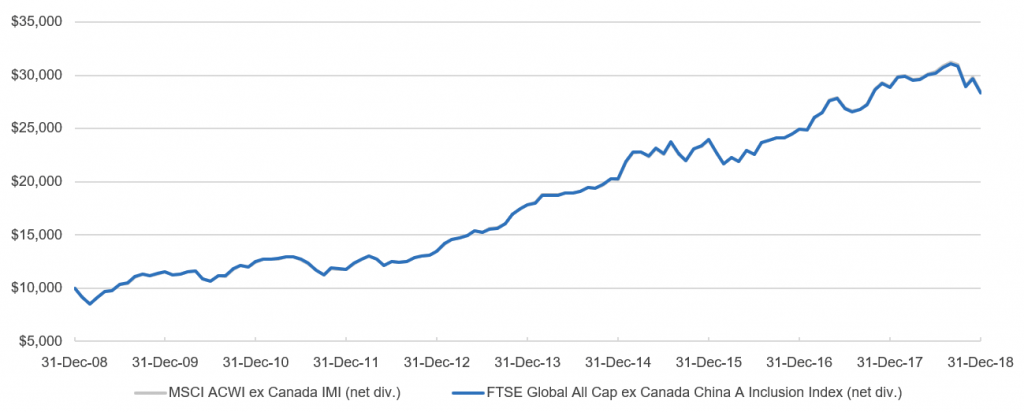

The Vanguard FTSE Global All Cap ex Canada Index ETF (VXC) is the best XAW replacement for tax-loss selling purposes, as it also tracks large-, mid- and small-cap companies across the world, excluding Canada. From 2009–2018, the ETFs’ underlying indexes had a low monthly tracking error of 0.065%, indicating similar expected performance going forward. Over the same period, performance for both indexes was nearly identical – so similar, in fact, you can barely make out the grey line of the MSCI ACWI ex Canada IMI in a graph charting both of them.

By the way, tracking error is often commonly used to describe the size of a fund’s outperformance or shortfall. Without getting too technical, I’m using a more technical application of the term here, based on the standard deviation of the differences in their monthly returns. As used in this post, the lower the tracking error, the more closely two indexes track one another.

Growth of $10,000: MSCI ACWI ex Canada IMI (net div.) (in CAD) vs. FTSE Global All Cap ex Canada China A Inclusion Index (net div.) (in CAD)

Sources: FTSE Russell Indices, MSCI, Morningstar Direct, Dimensional Returns 2.0 (2009 to 2018)

Now for the surprise. Until very recently, VXC had a higher management expense ratio than XAW (0.27% vs. 0.22%) and higher expected foreign withholding taxes in a taxable account (0.13% vs. 0.04%). This meant that most tax-loss selling investors would have preferred to switch back to XAW once the 30-day holding period had been satisfied. Plus, we would have encouraged investors to only realize a loss on XAW if it was at least $10,000 and 10% of the book value. By increasing the tax-loss selling threshold, you’d have been less likely to switch your VXC holdings back at a gain if markets recovered during the 30-day period, thus offsetting the benefit from your initial tax-loss selling trades.

But, then, just as we were preparing this post, Vanguard announced it was fixing VXC’s tax inefficiencies and lowering its fee. With this update, we can now change the loss threshold to $5,000 and 5% of book value, with no need to switch back to XAW. Way to go, Vanguard!

Canadian Equities: VCN Pairs with FLCD (which also pairs with XIC and ZCN)

If you’re currently holding the Vanguard FTSE Canada All Cap Index ETF (VCN), a suitable tax-loss selling alternative would be the Franklin FTSE Canada All Cap Index ETF (FLCD). Although both fund names suggest they track the same index, a closer inspection reveals they track slightly different ones. VCN follows the FTSE Canada All Cap Index, which tracks the performance of 200 large-, mid- and small-cap Canadian companies. FLCD tracks the FTSE Canada All Cap Domestic Index, which also tracks the same 200 large-, mid- and small-cap companies as VCN, but in slightly different proportions.

The term “Domestic” in the name indicates that this index does not adjust any company weights based on foreign ownership restrictions. In contrast, the FTSE Canada All Cap Index does adjust the weights of certain companies in the index, based on these restrictions. Governments impose limits to the foreign ownership of companies within certain industries when they feel it would not be in the public interest, such as in the aviation or telecommunications sectors.

For example, Bell Canada (BCE) is subject to the Telecommunications Act, which governs the ownership and control of Canadian telecommunications carriers. The Act restricts foreign investment in voting shares of BCE to a maximum of 33 1/3%. If we view FLCD’s holdings, Bell Canada has a weight of around 2.4% as of September 30, 2019. VCN has a weight of only 0.8%. That’s a third of FLCD’s weight, which is the maximum foreign ownership of the company allowed.

Another way to think about the difference between these two ETFs is that FLCD’s index is a better gauge of what Canadian investors would consider to be the “available Canadian stock market”, while VCN’s index is what foreign investors would consider as their “available Canadian stock market”. Knowing this, it’s a bit surprising that Vanguard Canada hasn’t shifted VCN to the domestic version of this index yet.

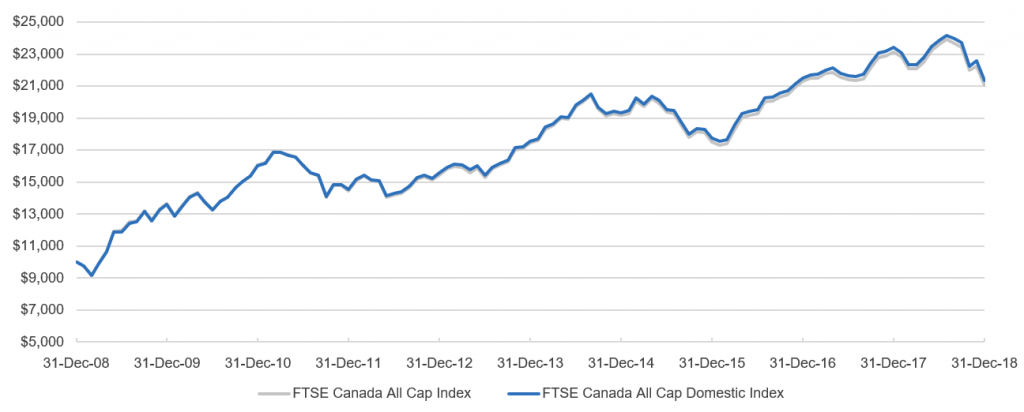

From 2009–2018, these two indices had a monthly tracking error of 0.106%. This is a relatively small tracking error, which indicates they can be interchanged with little expected impact on future market performance. By comparison, the monthly tracking error over the same period between the FTSE Canada All Cap Index and the S&P/TSX Capped Composite Index was slightly higher, at 0.177%.

If you’re considering a switch from VCN to FLCD to realize a capital loss, there’s little reason to switch FLCD back to VCN after 30 days, unless another tax-loss selling opportunity presents itself at the end of the required holding period. Both ETFs are expected to have similar returns going forward. Without knowing which ETF will slightly outperform over your future investment horizon, we would recommend saving yourself the extra cost and hassle, and hang onto the replacement ETF.

The graph below shows the growth of $10,000 in the FTSE Canada All Cap Index (grey line) and the FTSE Canada All Cap Domestic Index (blue line) between 2009–2018. This time, the very similar tracking produces a modest “shadow effect.”

Growth of $10,000: FTSE Canada All Cap Index vs. FTSE Canada All Cap Domestic Index

Sources: FTSE Russell Indices, Morningstar Direct, Dimensional Returns 2.0 (2009 to 2018)

FLCD is also the best available tax-loss selling replacement for either the iShares Core S&P/TSX Capped Composite Index ETF (XIC) or the BMO S&P/TSX Capped Composite Index ETF (ZCN). Both XIC and ZCN follow the S&P/TSX Capped Composite Index, which tracks 233 large-, mid- and small-cap companies in the Canadian stock market.

As the name suggests, index weights are capped at 10% (avoiding a future Nortel-like meltdown due to a single company dominating the index). If a single company were to one day become larger than 10% of the FTSE Canada All Cap Domestic Index, we might see significantly higher tracking error between the two indices. The S&P/TSX Capped Composite would cap the security at 10%, but the FTSE Canada All Cap Domestic Index would continue to allow the stock’s weight within its index to increase above 10%.

Another notable difference is FLCD excludes a number of Brookfield Limited Partnerships, while XIC and ZCN include them. This is because FTSE indexes exclude limited partnerships, while S&P Dow Jones indexes do not.

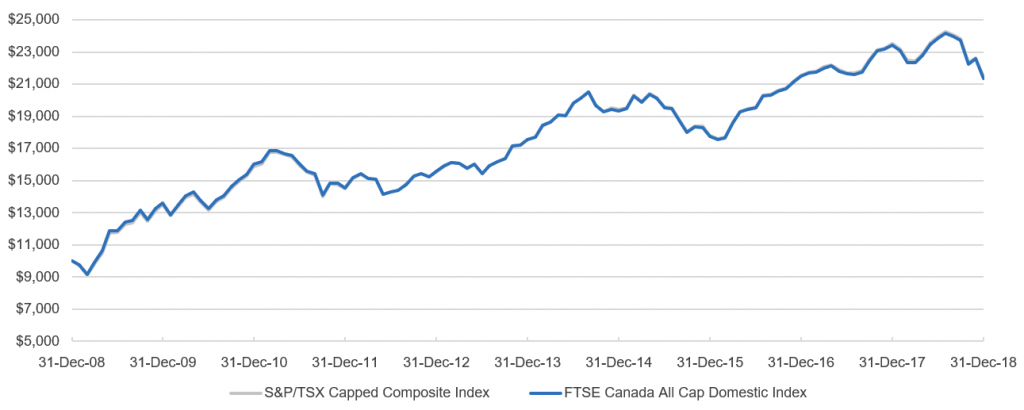

In terms of similarities, the S&P/TSX Capped Composite Index does not adjust company weights with regards to foreign ownership restrictions. This makes it more similar to the FTSE Canada All Cap Domestic Index than to the FTSE Canada All Cap Index. We can see in the graph below how this single difference has led to nearly identical performance from January 2009–2018. The grey S&P/TSX Capped Composite Index line is mostly indistinguishable from the blue FTSE Canada All Cap Domestic Index line.

Over the same period, these two indices had a monthly tracking error of 0.118%. As mentioned above, the monthly tracking error between the S&P/TSX Capped Composite Index and the FTSE Canada All Cap Index was slightly higher, at 0.177%.

What happens if Vanguard ever changes the underlying index for VCN to the Domestic version at some point in the future? All else equal, we’d then prefer pairing XIC or ZCN with VCN for tax-loss selling, so FLCD would no longer be needed.

Growth of $10,000: S&P/TSX Capped Composite Index vs. FTSE Canada All Cap Domestic Index

Sources: FTSE Russell Indices, S&P Dow Jones Indices, Morningstar Direct, Dimensional Returns 2.0 (2009 to 2018)

U.S. Equities: XUU Pairs with VUN

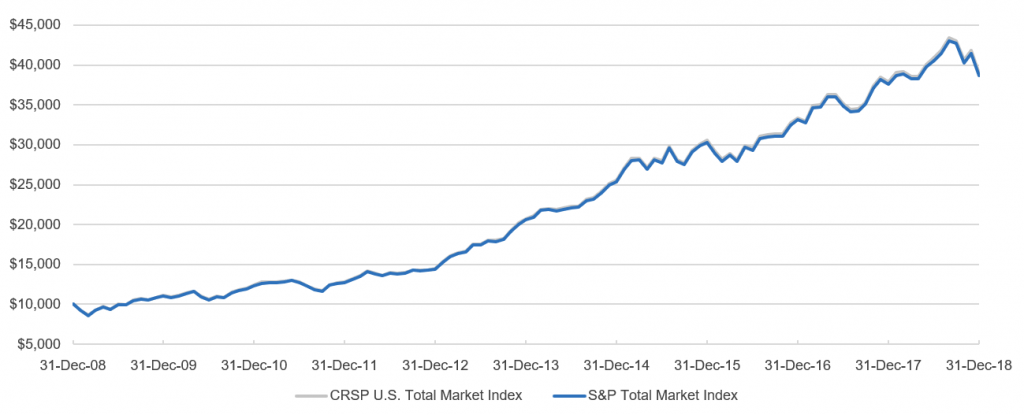

If you’ve decided on the iShares Core S&P U.S. Total Market Index ETF (XUU) for your U.S. equity exposure, we would recommend the Vanguard U.S. Total Market Index ETF (VUN) as the most suitable tax-loss selling replacement. XUU follows the S&P Total Market Index, which tracks the performance of around 3,800 large-, mid-, small- and micro-cap companies, making it one of the most diversified U.S. equity indexes. VUN follows an equally impressive index, the CRSP U.S. Total Market Index, which includes over 3,500 large-, mid-, small- and micro-cap companies.

After switching from XUU to VUN, cost-conscious investors may prefer to switch back, as XUU has an annual management expense ratio (MER) of 0.07%, while VUN has an MER of 0.16%. We don’t feel this is entirely necessary, but if you’re planning to switch back after the 30-day period has ended, consider only selling XUU if it has a loss of $10,000 and 10% of the book value. This will increase the odds you’ll still have an overall capital loss when you switch VUN back to XUU.

From 2009–2018, the underlying indices had a monthly tracking error of 0.065%. As with our last example, the blue and grey lines in the graph below mostly overlap.

Growth of $10,000: CRSP U.S. Total Market Index (in CAD) vs. S&P Total Market Index (in CAD)

Sources: CRSP, S&P Dow Jones Indices, Morningstar Direct, Dimensional Returns 2.0 (2009 to 2018)

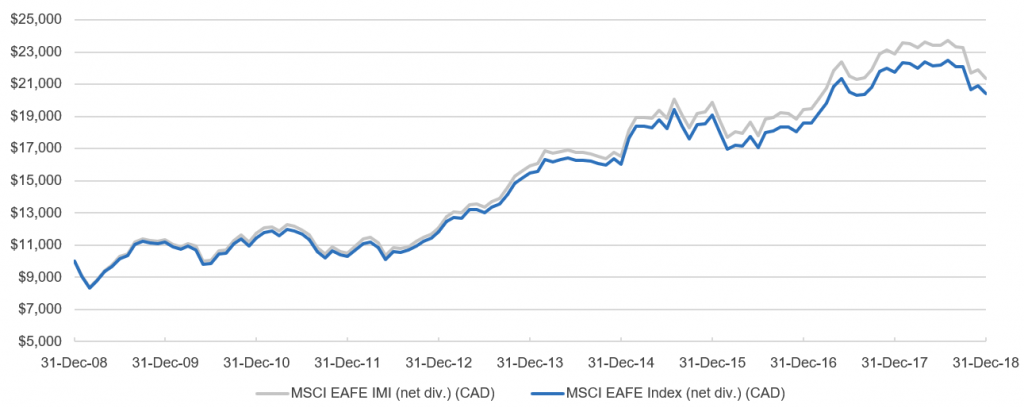

International Equities: XEF Pairs with ZEA

Suitable tax-loss selling pairs for international equity ETFs are harder to come by than for Canadian or U.S. equity ETFs. Many investors may consider the iShares Core MSCI EAFE IMI Index ETF (XEF) and the Vanguard FTSE Developed All Cap ex North America Index ETF (VIU) to pair well with one another, as they both track over 3,000 large-, mid- and small-cap companies in developed countries outside of North America. However, index providers FTSE and MSCI differ in which countries they consider to be “developed”. The most obvious example is South Korea, which is classified as a developed market by FTSE, but an emerging market by MSCI. As VIU follows a FTSE index, it allocates more than 4% of its portfolio to over 400 Korean companies, while XEF (which follows an MSCI index) has no Korean companies in its fund. This difference has led to a higher monthly tracking error than our previous tax-loss selling pairs, at 0.226%.

Alternatively, investors could consider switching from XEF to the BMO MSCI EAFE Index ETF (ZEA). Both ETFs track an MSCI index, which avoids the South Korea country classification issue just discussed. But ZEA does not invest in small-cap stocks, which will result in return differences, relative to XEF.

From 2009–2018, the underlying indices had a monthly tracking error of 0.171%, which is lower than our last example (indicating a more optimal tax-loss selling pair). However, the index performance during this 10-year period was noticeably different. So, if you go this route, you may want to consider switching back to XEF after the 30-day period has passed, if you intend to maintain broad-market exposure. If you plan to switch ZEA back to XEF after thirty days, a $10,000 and 10% tax-loss selling threshold is recommended.

Growth of $10,000: MSCI EAFE IMI (net div.) (CAD) vs. MSCI EAFE Index (net div.) (CAD)

Sources: MSCI, Morningstar Direct, Dimensional Returns 2.0 (2009 to 2018)

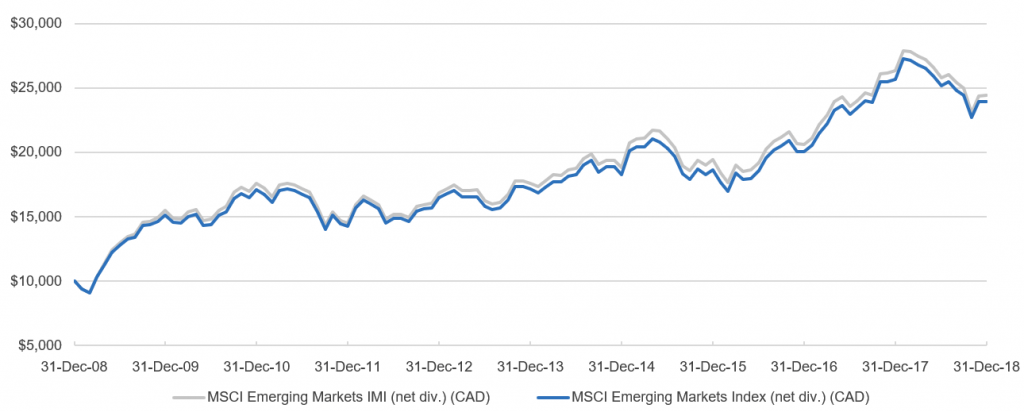

Emerging Markets Equities: XEC Pairs with ZEM

The same country classification issue arises with emerging markets indexes as well. At first glance, you might think you could replace the iShares Core MSCI Emerging Markets IMI Index ETF (XEC) with the Vanguard FTSE Emerging Markets All Cap Index ETF (VEE).

Both underlying indexes follow thousands of large-, mid- and small-cap companies in developing markets across the globe. However, as XEC follows an MSCI index (which considers South Korea to be an emerging market), it allocates more than 12% of its fund to over 400 Korean companies. On the other hand, VEE (which follows a FTSE index) considers South Korea to be a developed country, and allocates these stocks to its developed markets ETF, VIU. This difference has led to a relatively high monthly tracking error from 2009–2018 of 0.544%.

Long story short? We believe a better tax-loss selling pairing for XEC would be the BMO MSCI Emerging Markets Index ETF (ZEM). ZEM follows the MSCI Emerging Markets Index, and includes large- and mid-sized companies from developing markets around the world. As both ETFs follow MSCI indexes, they both include South Korean companies in their funds. The monthly tracking error from 2009–2018 for their underlying indexes was 0.213%, which would indicate they make a better couple than VEE and XEC.

Growth of $10,000: MSCI Emerging Markets IMI (net div.) (in CAD) vs. MSCI Emerging Markets Index (net div.) (in CAD)

Sources: MSCI, Morningstar Direct, Dimensional Returns 2.0 (2009 to 2018)

Best of Both Worlds, with a PWL Twist

We’re the first to admit, our tax-loss selling pairs for international and emerging markets equity ETFs are not ideal. The replacement BMO ETFs exclude smaller companies, while the original iShares ETFs include large-, mid- and small-cap stocks. As such, we expect more tracking error among them than we’d like to see.

If MSCI upgraded South Korea to developed markets status, we wouldn’t have this problem. We could switch XEF to VIU, or XEC to VEE, knowing that the future performance of our replacement fund would likely closely track our original ETF. Until that happens, it would appear we’re stuck with these “next best” tax-loss selling pairs for international and emerging markets ETFs.

As we’re not fans of “good enough” at PWL, we’ve come up with a better (albeit, more complicated) solution. For tax-loss selling purposes, we have adjusted our rules slightly to treat XEF and XEC as if they were a single holding. If the net unrealized dollar losses on the combined holdings of XEF and XEC are greater than $5,000, and the total percentage loss of both holdings is greater than 5%, we consider the threshold met. We would consider selling all units of both XEF and XEC and repurchasing VIU and VEE with the proceeds – even if the loss on one of the two ETFs is not above our tax-loss selling threshold, and even if one of the ETFs has an unrealized capital gain.

This relaxed rule allows us to realize the overall capital loss for our clients, maintain similar broad equity market exposure, and keep the CRA from crying foul. The tradeoff: It involves more number crunching … and another example!

Switching XEF and XEC to VIU and VEE

Suppose you bought $80,088 of XEF and $28,315 of XEC in September 2018, for a total book value of $108,403. At year-end, the value of XEF and XEC fell to $72,924 and $27,076, respectively. You’d have a total market value of $100,000, and a total unrealized capital loss of $8,403.

XEF’s unrealized dollar loss is $7,164, and its percentage loss is 8.9%. It is now a potential tax-loss selling candidate; it could be switched to ZEA to realize the loss.

On the other hand, XEC’s dollar loss is only $1,239, and its percentage loss is only 4.4%, both of which are under our $5,000 and 5% tax-loss selling thresholds.

However, if we consider XEF and XEC to be a single position, their total dollar losses of $8,403 and percentage losses of 7.8% would meet our tax-loss selling requirements.

| Security | Book Value | Market Value (as of December 31, 2018) | Unrealized Capital Loss ($) | Unrealized Capital Loss (%) |

|---|---|---|---|---|

| iShares Core MSCI EAFE IMI Index ETF (XEF) | $80,088 | $72,924 | ($7,164) | (8.9%) |

| iShares Core MSCI Emerging Markets IMI Index ETF (XEC) | $28,315 | $27,076 | ($1,239) | (4.4%) |

| Total | $108,403 | $100,000 | ($8,403) | (7.8%) |

Sources: BlackRock Canada Inc., MSCI Index Fact Sheets as of December 31, 2018

After selling XEF and XEC, VIU and VEE will immediately need to be purchased, but in slightly different proportions. To determine the appropriate market-cap weights, you’ll need to use the most recent month-end index fact sheets from MSCI and FTSE Russell Indices. Currently, the approximate splits are 73/27 for XEF/XEC, and 75/25 for VIU/VEE. For more information on this process, please refer to the blog post and video, Combining International and Emerging Markets Equity ETFs.

In this example, $75,909 of VIU and $24,091 of VEE would need to be purchased with the sale proceeds of $100,000 from XEF and XEC. These investment amounts provide market-cap-weighted exposure to international and emerging markets, as of December 31, 2018. The relative index weights fluctuate daily, but using the latest month-end index fact sheets should be close enough for our purposes.

MSCI Index Weights as of December 31, 2018

| Tracking ETF | Underlying Index | Market Cap (in USD) | Allocation (%) | Sale Amount ($) |

|---|---|---|---|---|

| iShares Core MSCI EAFE IMI Index ETF (XEF) | MSCI EAFE IMI | 14,590,688 | 72.92% | $72,924 |

| iShares Core MSCI Emerging Markets IMI Index ETF (XEC) | MSCI Emerging Markets IMI | 5,417,489 | 27.08% | $27,076 |

| Total | MSCI EAFE + EM IMI | 20,008,177 | 100.00% | $100,000 |

Sources: BlackRock Canada Inc., MSCI Index Fact Sheets as of December 31, 2018

FTSE Russell Index Weights as of December 31, 2018

| Tracking ETF | Underlying Index | Market Cap (in USD) | Allocation (%) | Purchase Amount ($) |

|---|---|---|---|---|

| Vanguard FTSE Developed All Cap ex North America Index ETF (VIU) | FTSE Developed All Cap ex North America Index | 15,219,418 | 75.91% | $75,909 |

| Vanguard FTSE Emerging Markets All Cap Index ETF (VEE) | FTSE Emerging Markets All Cap China A Inclusion Index | 4,830,248 | 24.09% | $24,091 |

| Total | FTSE Global All Cap ex North America China A Inclusion Index | 20,049,666 | 100.00% | $100,000 |

Sources: Vanguard Investments Canada Inc., FTSE Russell Index Fact Sheets as of December 31, 2018

What About Asset Allocation ETFs?

Vanguard’s Asset Allocation ETFs were launched in January 2018, and have become a popular choice for DIY investors. One of the downsides of these products (and there aren’t many) is that they’re not ideal for tax-loss selling.

Take the Vanguard Balanced ETF Portfolio (VBAL) for example. Let’s say you had purchased $1 million of the fund at the end of January 2018 (shortly after its launch). There would have only been 3 days in 2018 when the fund showed a loss of at least $5,000 and 5% of its book value. These days were December 20, December 21 and December 24. There were no days where the loss was at least $10,000 and 10% of the book value.

On those December days, you could have switched to a similar fund, like the iShares Core Balanced ETF Portfolio (XBAL), keeping in mind the “wet paint” was still drying on this fund too, at around the same time.

Unfortunately, had you switched XBAL back to VBAL after 30 days, you would have realized substantial capital gains due to the stock market recovery in January 2019. This would have offset the majority of the capital losses from your initial tax-loss selling trades. Also, the trading costs due to the ETF’s bid-ask spreads would generally be larger when trading an asset allocation ETF, relative to trading the individual underlying ETFs. You’re technically forced to sell and buy all of VBAL/ XBAL’s underlying ETF holdings behind the scenes, including the bond ETFs, which would not have been trading at large losses.

If you had instead purchased VBAL’s underlying ETFs in similar proportions, there would have been many more tax-loss selling opportunities to take advantage of throughout the year (and no need to switch back to the original ETFs). There were 33 days during 2018 where VCN would have been trading at a loss that breached our tax-loss selling thresholds. VUN also had a few days when it qualified for tax-loss selling. Combined, VIU and VEE spent an impressive 84 days in the proverbial danger zone.

2018 Tax-Loss Selling Opportunities (Number of Days)

| Month | VBAL | VCN | VUN | VIU+VEE |

|---|---|---|---|---|

| February 2018 | 0 | 2 | 1 | 1 |

| March 2018 | 0 | 1 | 0 | 0 |

| April 2018 | 0 | 1 | 0 | 0 |

| May 2018 | 0 | 0 | 0 | 0 |

| June 2018 | 0 | 0 | 0 | 0 |

| July 2018 | 0 | 0 | 0 | 0 |

| August 2018 | 0 | 0 | 0 | 8 |

| September 2018 | 0 | 0 | 0 | 12 |

| October 2018 | 0 | 6 | 0 | 22 |

| November 2018 | 0 | 6 | 0 | 22 |

| December 2018 | 3 | 17 | 2 | 19 |

Source: Vanguard Investments Canada Inc. (2018), FTSE Russell Indices as of December 31, 2018

On any of these days, you could have taken action to realize some capital losses. This would have been especially useful if you had already realized substantial capital gains when transitioning your $1 million portfolio to low-cost ETFs.

So, if you happen to be in a similar situation, and you don’t mind the added complexity, it could make sense to consider purchasing a handful of ETFs instead of an asset allocation ETF in your taxable account. It would increase your chances of stumbling across tax-loss selling opportunities to offset the capital gains realized in your portfolio transition.

That said, the hassle factor is worth calculating into your costs. For many, a simple asset allocation ETF may still be your preferred route.

Hey Justin,

Great post and so very thorough. Love it!

This might be slightly unrelated but still a tax loss scenarios question. I read somewhere that you could somehow manage to get a tax break on losses in registered accounts if you moved your loss performing registered account asset out of the registered account in kind and then sell outside. In my opinion it does not matter since any movement of asset between different account types is considered a deemed disposition and you are essentially selling and buying the stocks during the transfers. Also superficial loss rules technically follow you between accounts and furthermore between partners. I wanted to know your take if there are some other nuanced scenarios which I am missing. I am not considering any life event changes during this period like dissolution of marriage or deceased partner. Just a single user scenario.

@Anuraag – I’m glad you liked the post!

Unfortunately, transferring a security in-kind from a registered account to a non-registered account will not preserve the loss (although technically, you will be paying less tax on the withdrawal, since the value is down, so I guess that’s sort of a benefit).

The security’s book value will become its market value on the date of transfer to the non-registered account, so no losses can be realized.

Thanks for confirming my suspicions. I was using more riskier asset classes in my RRSP thinking the upwards trend might generate more revenue and hence not be a tax liability right away. I overlooked that what goes up can also go down. In retrospect, I think its smarter to use safer bets which will rise steadily over years in the RRSP and stick with the risker stuff in non-registered as it will allow tax loss harvesting in case the market takes a downturn. Thank you for your posts and keeping it simple for all Canadians. Your blogs have been a beacon of reason in all the chaos of buy and sell.

Say I bought both VEQT and XEQT in early 2022 and then decide to sell them at a significant loss one year later to buy a larger total amount of four ETFs as follows: XIC (33%), VUN (33%), XEF (22%) and ZEM (11%). Since for example XEQT includes XIC and XEF, is this a problem?

@Brian – Although CRA might feel differently, I don’t view VEQT as the same security as VUN, or XEQT as the same security as either XIC or XEF.

If you’d rather play it safe, you could do the following:

1. Sell VEQT and XEQT

2. Buy ZEQT (and hold it for 30 days)

3. Sell ZEQT

4. Buy XIC, VUN, XEF, ZEM (if ZEQT is trading at a loss, you could buy XEC instead of ZEM)

Thank you for the quick response to an old blog that is probably more relevant than when it was published. Good idea too. Probably should have asked you first haha. If nothing else, the CRA might find it too complicated for a $70k capital loss, especially if “Canada Revenue Agency Commissioner Bob Hamilton says it is not worth the effort to conduct a full review of more than $15-billion in pandemic wage benefits the Auditor-General has said may have been sent to ineligible recipients”.

@Brian – Haha – yeah, I doubt CRA will be reviewing the annual financial statements of VEQT and XEQT to determine their underlying ETF holdings during your next audit ;)

Thanks for all you do ! I will have a large capital gain from the sale of a rental property and would like to take advantage of this down market. Would selling VSB, VSC and VAB to purchase ZDB work for tax loss selling ? VCN and XAW for XEQT ? I’m worried about partial superficial losses. Thanks for your help

@Donna – You’re very welcome! :)

Selling VSB, VSC and, VAB, and purchasing ZDB, would not trigger any partial superficial losses. Neither would selling VCN and XAW, and purchasing XEQT. Good luck!

Hi Justin!

Say one is using an all-in-one asset allocation ETF like, VEQT (comprising of 4 underlying ETFs—one of which is VCN). Compared to say, FLCD.

Both VCN and FLCD track the same index (FTSE Canada All Cap Domestic Total Return Index).

However VCN is only roughly 30% of VEQT. How would that affect the calculations for superficial losses?

Also, is there a singular site to easily compare various ETFs and verify if they track the same index (and thus are subject to superficial loss rule)?

Hey skube! I would view VEQT as a single security (not a combination of various ETFs). So if you sold VEQT at a loss and purchased VCN, I would assume that would be fine (although CRA may disagree). Generally though, you would want to sell a security like VEQT and repurchase something similar, like XEQT.

The best approach for determining whether an ETF tracks the same index as another is to visit the ETF website directly (the company will always include the name of the underlying index on their site).

Hi Justin! I just happen to be the guy in your example: I switched a 1 million$ portfolio in my corp from actively managed funds to VEQT. Capital gains of $160 000 in september. I am looking to offset these gains with a tax-loss selling.

1- Is this strategy a sort of speculation? Speculating that the market will collapse enough for me to trigger some losses?

2- I dont want to sell some of my VEQT for this tax-loss selling. I would rather buy a pairing ETF with new money, and wish this new ETF will eventually collapse enough to sell it. What would you suggest as a pair for VEQT? I am afraid XEQT would be considered to be the same ETF (superficial loss). I dont mind buying a different asset allocation ETF with this new money, for the tax loss selling (for instance, XGRO, or an ETF tracking a narrower/less diversified index than VEQT).

3- What do I do with my new ETF if the market doesnt fall down as expected in the next 3 years? I keep it for the long term?

4- How much money do you suggest I put in this new ETF to harvest a $10-20 000 loss?

Thanks for your wisdom!

@Antoine:

1. The strategy is not speculative. You are not market-timing in any way, as you immediately replace your existing holding for a similar ETF. If you’re fortunate, you won’t have any tax-loss selling opportunities (but this is sort of a “when life gives you lemons, you make lemonade” strategy).

2. That is not tax-loss selling. If you have just purchased VEQT, and it goes down in value, you would want to sell it and replace it with something like XEQT. If XEQT has not recovered in 30 days, you could consider selling it and repurchasing VEQT at that time.

3. If you buy VEQT and markets don’t fall, there will not be any tax-loss selling “opportunities”.

4. This is not relevant – I would re-watch the videos to ensure you’re understanding the process.

Justin

I love the Tax loss selling Blog. Being a New Ludicrous Ishare asset Allocator i think Loss selling would be my next step in the investment journey. My initial thought was to move between Ishare to vanguard asset allocations and hold till next tax loss opportunity as they both seem to track different indexes (adjusting for the % mix by class like XEF/XEC). however you recommended an ETF ” FLCD” as the best pairing with no need to swap, Wondering the logic incase i missed something??. Or possibly you have another list of Independent ETF for a third Asset Allocation offering ( Vanguard, Ishare, Mix bag). Also Now that my Equity in the Ludicrous portfolio is ticking along nice, I am looking for how to improve the Fixed Asset class with other options ( ETF Bonds, Bonds, GIC, High interest saving accounts, Low risk Dividend ETF…) the low interest environment is killing me now that i am entering retirement years

@Pat M – I’m so glad you liked the blog (I will also be following up with two tax-loss selling videos in November! :)

FLCD’s index has historically had the least amount of tracking error to both XIC’s and VCN’s index (so it is technically the best substitute for each). But practically, there are no big issues with using XIC and VCN as your tax-loss selling Canadian equity pairs (I actually used all three ETFs during my March 2020 tax-loss selling). I sold XIC and purchased FLCD with the proceeds. Then, when Canadian stocks dropped further, I sold FLCD and purchased VCN with the proceeds.

The low-interest rate environment is certainly a drag. I’ve been buying a lot of laddered GICs lately, but the yields are still pretty pathetic. Wish I had a better solution for you (without taking more risk).

Hi Justin,

Was wondering

1—if XEQT might be a pair for VEQT?

2—about tax efficiency between VEQT and VCN. In other words, by investing in a non-registered account in VEQT rather than VCN, there are foreign withholding taxes and the dividend tax credit for eligible dividend is lost.

Thanks

@Ale:

1. XEQT would be a decent tax-loss selling pair for VEQT.

2. The tax-efficiency of VEQT and VCN are not directly comparable. You would need to compare the tax-efficiency of holding VEQT across all accounts (like an RRSP, TFSA and taxable account) with a more tax-efficient asset location strategy using the underlying VEQT holdings (VCN, VUN or VTI, VIU, VEE or VWO). These are extremely complex tax concepts (and it’s very dependent on many factors that are investor-specific), so there’s not a single definitive answer. I’ve discussed the underlying tax concepts in great detail in numerous blogs and podcasts:

https://canadianportfoliomanagerblog.com/podcast-4-shedding-light-on-the-light-model-etf-portfolios/

https://canadianportfoliomanagerblog.com/podcast-5-wrapping-your-head-around-the-ridiculous-model-etf-portfolios/

https://canadianportfoliomanagerblog.com/podcast-6-asset-location-strategies-with-the-ludicrous-etf-portfolios/

https://canadianportfoliomanagerblog.com/podcast-7-asset-location-strategies-with-the-plaid-model-etf-portfolios/

https://canadianportfoliomanagerblog.com/canadian-portfolio-manager-introducing-the-light-etf-portfolios/

https://canadianportfoliomanagerblog.com/canadian-portfolio-manager-introducing-the-ridiculous-etf-portfolios/

https://canadianportfoliomanagerblog.com/canadian-portfolio-manager-introducing-the-ludicrous-etf-portfolios/

https://canadianportfoliomanagerblog.com/canadian-portfolio-manager-introducing-the-plaid-etf-portfolios/

Was looking to harvest a sizeable loss on VCN by switching to FLCD, but was abruptly derailed when I noticed the quote from my brokerage (RBC DI) showed a trading volume of 0, and a corresponding NAV delta of 0.00. Google and Yahoo likewise show a volume of 0 for FLCD. They show the last trade date being yesterday at 15:22.

The bid/ask prices look sane (based on FLCD’s closing price yesterday and the growth of VCN since opening), but I’m obviously apprehensive about pulling the trigger on such a nontrivial transaction without being certain about it.

Is this zero volume being reported for FLCD an actual issue, or an artifact of something else?

@Jason: This can happen if the trading volume is low (the prices should still reflect the accurate cost of the security though). If trading FLCD makes you uncomfortable, ZCN or XIC are suitable tax-loss selling pairs for VCN as well.

Thanks for confirming that, Justin. I did end up moving to ZCN and was able to crystallize a $26k capital loss, which is no small potatoes. The fact that the market has headed back up after doing that is a serendipitous icing on the cake. :)

Hi Justin,

A few questions for you:

1. Are US-listed ETFs that track the same index considered “identical property” for tax loss selling purposes?

2. If so, do you have any tax loss selling pair recommendations for ITOT, IEFA, and IEMG?

For instance, using your 2019 model portfolios as an example, if an individual sold XUU in their NREG account, would they also have to sell their US-listed ITOT in their RRSP?

From my understanding, to crystallize the capital loss in their NREG account, one has to sell ALL identical holdings throughout their NREG and registered accounts. Thus, it seems that one would also have to sell ITOT in their RRSP.

Thanks

Corey

@Corey:

1. Not certain – I probably wouldn’t test my luck with this one.

2. ITOT, IEFA, IEMG ~ VTI, VEA, VWO

You do not need to sell all identical holdings – just any shares of the identical ETF that were purchased in the last 30 days prior to sale.

Hi Justin,

thanks so much for your very informative tax-loss blogs. Apologies in advance for the long post.

Along the lines of @ferd: for long-term ETF investors who tax-loss harvest and buy a similar ETF immediately (eg. VCN for XIC) the gains will have been washed out upon selling (assuming the value goes up, which is hopefully will in the long-term.)

What are the ways then that capital losses can be used? Reading your posts, so far I understand that losses can be used for:

1. offsetting capital gains for others securities which you have previously sold (going back up to 3 years)

2. offsetting capital gains distributions given by a company at year end (or whenever they choose to distribute)

3. offsetting capital gains when rebalancing

(For #3 however, if one has ongoing contributions and no plans on selling in the near future, therefore not needing to sell to rebalance, then there would be no advantage.)

Are there other uses to the tax-loss harvest?

And are there any differences in corporate vs. personal non-registered accounts?

Thanks again for your time!

@Leslie: By deferring capital gains, you may also be able to realize them during retirement (when you may be in a lower tax bracket).

There are differences between tax-loss selling in corporate vs. personal non-registered accounts. Basically, you may want to consider tax-gain harvesting in corporate accounts (rather than tax-loss selling), but this decision is complex, and each investor should work with their accountant/advisor to determine the best approach for their situation.

I know that there is unlikely to be a “pair” for SWAP/corp-structure funds like HXT/HXS, but if one is seeing a large loss in these, could you sell all the holdings and move the money to VCN/VUN for 30 days to capture the loss, then reverse? Obviously you would lose the “benefits” of the swap for that period, but with large losses to harvest, could this make sense?

@sleepydoc: Sure, that would work (although there could be some tracking error between the pairs of ETFs during the 30 day period).

Thank you for this comprehensive article and podcast episode. I have a basic question:

– I am a buy an hold investor who purchases the same ETFs year after year. When calculating the amount of capital loss, should I use the adjusted cost base (ACB) value of an ETF, or can I use the value of the ETF on a single transaction?

If I have to use the ACB, it seems like I will rarely get an opportunity to harvest tax losses.

Thanks again for all the good content.

@Jean-Francois: You should be using your adjusted cost base and proceeds of disposition to determine your capital loss.

Some lucky taxable investors may never have a tax-loss selling opportunity (which is not the worst situation to be in ;)

Hi Justin, happy new year.

I was wondering what is your take on how the superficial loss rule applies to a US-listed ETF and its canadian domiciled equivalent (for example, VTI with VUN)? While they are tracking the same index, they are not technically identical (VUN is just a wrapper ETF of VTI, I believe).

So for instance, if I sell VUN in a taxable account and purchase VTI in an RRSP account within the 61 day window, will the superficial loss rule still apply?

@Jon: I personally don’t feel that they are identical securities. Although they follow the same index, they have different fund structures and fees which would generally make an investor prefer one over the other.

However, since we only have a vague response from CRA stating that index funds that track the same index would generally be considered identical property, I would play it safe and just consider that it would be a superficial loss.

I have a question about superficial loss.

If holding ZCN in one account that is taxable and XIC in another account that is registered, and you do a tax loss harvest replacing ZCN With FLCD but continue to buy XIC in the registered accounts, would that be considered a superficial loss since ZCN and XIC track the same index?

@Kosta: CRA would generally consider any purchases of XIC within the 61-day period to be a partial superficial loss (if it is not sold by the end of the period), as XIC tracks the same index as ZCN.

Good article, as usual. I have one question though. What about bonds? Given the pattern above is it fair to assume VAB pairs with ZAG?

@Adonis: I use the BMO Discount Bond Index ETF (ZDB) in taxable accounts. If a tax-loss selling opportunity arises on ZDB (i.e. a loss of more than $10,000 and 10% of the book value), I sell it and buy-back ZAG (XBB would also work). After 30 days, I sell ZAG and repurchase ZDB (as ZDB is more tax-efficient).

Hi Justin,

Have you had a chance to look at the new ETFs ZSDB and ZCDB? They are supposed to be tax efficient for non registered corporate accounts like ZDB is? Are we able to use these as a replacement etf for ZDB that wouldn’t trigger a superficial loss in our corporate account? We are at 9% loss but not $10,000 yet so maybe not time yet but just want to know what to do if that time does come.

@Nicole – For my clients, I just sell ZDB and buy XBB. After 30 days, I switch back to ZDB.

Rather than selling ZDB, then purchasing XBB and then switching back to ZDB, is there another bond etf other than ZDB that we can purchase and keep in a taxable corporate account that is just as tax efficient? That’s why I was curious about the new ETFs that came out ZSDB and ZCDB? I’m assuming they are too identical to ZDB and would trigger the superficial loss, but are those another option that can now be used in taxable corporate accounts that you would recommend or no?

@Nicole – ZSDB is a short-term bond ETF, and ZCDB is a corporate bond ETF (while ZDB is a broad-market bond ETF with a ~70/30 split between government and corporate bonds). So although the switches would not result in a superficial loss, the asset class exposure would be different.

For my clients, I switch from ZDB to XBB, and then switch back to ZDB after 30 days.

So a tax-loss selling opportunity doesn’t arise for anyone who doesn’t have at least $100,000 in ZDB? So just continue to hold if it’s a 10% loss but only $6000? I understand this considers the impact a strong market recovery during the 30 day holding period could have on the results of the strategy, but this is a consideration even for a bond etf like ZDB?

@Nicole – You don’t need to have a $100,000 position in ZDB for it to lose more than $10,000 (but it would be more likely) – Even a $50,000 position could potentially lose $10,000.

However, my rules of thumb are just guidelines (you can feel free to adjust them to your personal situation). $5,000 and 5% is another appropriate rule of thumb to follow (you just want to ensure you’re not racking up large bid-ask spreads for a small tax benefit).

Hi Justin,

In Part 1, tax-loss harvesting is said to be useful “(…) so they can be used to offset taxable capital gains”. Is there any analysis on your part to make sure that assets with potential capital gains are owned by the client (other than ETFs)?

Because for regular “buy-and-hold” ETF investor, my comprehension is that there isn’t much value in tax-loss harvesting, especially if you are far away from retirement since most of those realized losses will have been regained by the time you sell (retire), thus washing out any benefit. Thus one would need to own other capital property (real estate, business, individual stocks from a time before enlightenment) with potential gains for it to be useful to harvest losses to be used in future years.

Actually, my real question is, do you use capital-gains harvesting in conjunction with your capital-loss harvesting in order to increase the ACB of other asset classes, either in the same year (probably unlikely) or in other years. If so, can you expand on the strategies used?

Many thanks for all your work which I follow diligently

@Ferd: We use capital gains harvesting often in corporate accounts:

https://canadianportfoliomanagerblog.com/corporate-taxation-tax-gain-harvesting-crazy-like-a-fox-tax-planning/

We will also realize gains in personal taxable accounts if we’re trying to smooth out the tax bill (often during retirement), but this strategy is different for each client. We need to use out financial planning software (Naviplan) to determine if this is an appropriate strategy.

However, if we have net capital losses carrying forward, we won’t just realize gains if it’s not required.