Our ongoing series on ETF investing may not be quite as thrilling as you manage to catch “Game of Thrones” in real time this season, but I hope we’re at least helping you dominate your own ETF empire. Currently, we’re about to take on Part II in this three-part battle among global equity ETFs:

• Part I: Two Canadian-listed and U.S.-listed global equity ETFs from iShares that track the MSCI World Index (XWD and URTH) (found here)

• Part II: Two iShares global equity ETFs that include both developed and emerging market stocks (ACWI and XAW)

• Part III: Two Vanguard global equity ETFs tracking FTSE indices (VT and VXC) (up next!)

Let’s set out on today’s iShares quest.

Conquering the World (ACWI)

BlackRock released the iShares MSCI ACWI ETF (ACWI) in 2008 to track the MSCI ACWI Index. While ACWI may sound like a mythical realm, it’s really just an acronym for “All Country World Index”. It includes all the developed companies in the MSCI World Index, plus all the large- and mid-cap companies included in the MSCI Emerging Markets Index.

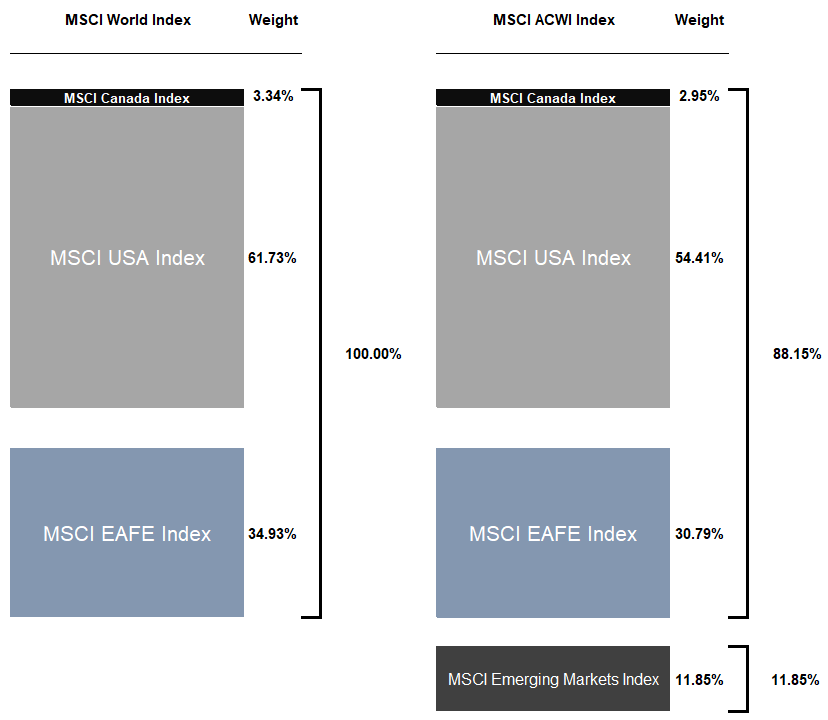

The MSCI ACWI Index allocates about 12% to emerging markets companies, reducing its developed stock market exposure to around 88% relative to the MSCI World Index, which invests only in developed markets.

Sources: MSCI Index Fact Sheets as of December 31, 2018

Since ACWI is a U.S.-listed ETF, it also avoids the 15% U.S. withholding tax on foreign dividends when held in a tax-deferred account such as an RRSP, LIRA, RRIF, or LIF. I’ve included ACWI’s estimated foreign withholding tax impact across various account types in a chart near the end of this piece.

Seeking Global Domination (XAW)

The iShares Core MSCI All Country World ex Canada Index ETF (XAW) is a favourite among ETF investors seeking global stock market exposure. You may have already noticed, to build in global stock market exposure, we’ve included XAW in both the Canadian Couch Potato and the Canadian Portfolio Manager model ETF portfolios.

XAW tracks the performance of the MSCI ACWI ex Canada IMI Index, which allocates about 56% to U.S. equities, 32% to international equities and 12% to emerging markets equities.

Sources: MSCI Index Fact Sheets as of December 31, 2018

This index is similar to the MSCI ACWI Index, with two notable differences:

1. The “ex Canada” in the name indicates that Canadian stocks are excluded from the index, so XAW excludes Canadian companies, while ACWI includes them. This exclusion is a nice feature for Canadian investors who may already have an extreme home bias to domestic stocks.

2. The “IMI” in the name (which happens to stand for “Investable Market Index”) indicates that the index tracks large-, mid-, and small-cap stocks, while ACWI tracks just large- and mid-cap stocks. So XAW includes small-cap stocks, while ACWI does not.

Sources: MSCI Index Fact Sheets as of December 31, 2018

XAW’s Fearsome U.S. Foursome

XAW uses a “fund-of-funds”, or “wrap” structure, to gain exposure to the index’s asset classes – but with some interesting nuances.

First, for U.S. equity exposure, iShares picked not just one, but four of its existing U.S.-listed ETFs: IVV, IJH, IJR, and ITOT. Since none of their existing ETFs precisely track the MSCI USA IMI Index, the interesting combination is iShares’ attempt to mimic the index’s specific returns anyway.

In addition, iShares claims their proprietary Aladdin equity risk model possesses special powers to minimize tracking error between the combined performance of the four ETFs and the MSCI USA IMI Index. (Trivia: “Aladdin” also is an acronym, standing for “Asset, Liability, Debt and Derivative Investment Network.” Don’t worry; this won’t be on the test.)

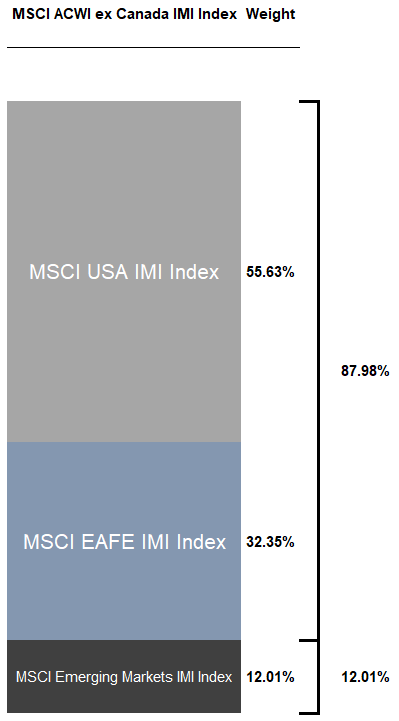

The verdict is out on whether this is just wishful thinking, or if they should have simply held the iShares Core S&P Total U.S. Stock Market ETF (ITOT). The argument against holding only ITOT is that it includes a tiny allocation to micro-cap stocks, while the MSCI USA IMI Index only includes large-, mid- and small-cap stocks.

Practically speaking, the returns of both indices have been nearly identical over the past 10 years, so investors would have likely been comfortable if XAW had held just ITOT from the onset.

Sources: MSCI, Morningstar Direct as of December 31, 2018

XAW’s International and Emerging Markets Appeal

For international equity exposure, iShares has opted to hold the iShares Core MSCI EAFE IMI Index ETF (XEF). As the ETF is Canadian-listed and holds the underlying international stocks directly, this choice has resulted in greater tax efficiency across all account types, relative to holding its US-listed counterpart, the iShares Core MSCI EAFE ETF (IEFA). Holding IEFA would have resulted in an additional layer of unrecoverable foreign withholding taxes (Note: If XAW had chosen to hold IEFA, the foreign withholding tax impact to the investor would differ in tax-deferred accounts, relative to the individual investor holding IEFA directly – confusing, right?).

For emerging markets exposure, the most tax-efficient fund would have been a Canadian-listed ETF that holds the underlying emerging markets stocks directly. This would have mitigated the cost drag from foreign withholding taxes. Too bad there are currently no Canadian-listed ETFs available that follow the MSCI Emerging Markets IMI Index, and hold the underlying stocks directly. To make do, iShares chose to hold the U.S.-listed iShares Core MSCI Emerging Markets ETF (IEMG).

War of the Worlds: XAW vs. ACWI

Although ACWI and XAW are imperfect substitutes for one another, I’ve compared their foreign withholding tax drag across various accounts in this chart. XAW has been more tax-efficient than ACWI across all accounts except tax-deferred accounts such as RRSPs, LIRAs, RRIFs, and LIFs.

Estimated Unrecoverable Foreign Withholding Taxes: ACWI vs. XAW

| Account Type | ACWI | XAW |

|---|---|---|

| Registered Retirement Savings Plan (RRSP) | 0.15% | 0.36% |

| Registered Retirement Income Fund (RRIF) | 0.15% | 0.36% |

| Locked-in Retirement Account (LIRA) | 0.15% | 0.36% |

| Life Income Fund (LIF) | 0.15% | 0.36% |

| Tax-Free Savings Account (TFSA) | 0.50% | 0.36% |

| Registered Education Savings Plan (RESP) | 0.50% | 0.36% |

| Registered Disability Savings Plan (RDSP) | 0.50% | 0.36% |

| Taxable Accounts | 0.15% | 0.04% |

Sources: BlackRock Asset Management Canada Limited, BlackRock Inc., MSCI as of December 31, 2018

From a product cost standpoint, holding XAW (instead of purchasing all of its underlying ETF holdings), will cost you about 0.22%, or roughly twice the weighted-average cost of the underlying ETFs. However, most investors with modest-sized portfolios and limited time to spend managing them would likely agree: The simplicity of XAW seems worth the additional cost.

The World Is Your ETF Oyster

If you’re an investor with relatively large RRSPs or other tax-deferred accounts, you may want to consider replacing XAW with three U.S.-listed ETFs, to reduce your product costs and foreign withholding tax drag. For your larger tax-deferred accounts, I suggest a mix of ITOT, IEFA and IEMG in my CPM Model ETF Portfolios (instead of XAW).

I estimate the switch-out could produce around 0.39% in annual cost- and tax-savings. On a $10,000 global equity allocation, you’d only save around $39, so investors with smaller portfolios may be better off just holding XAW. But on a $100,000 allocation, estimated annual savings increases to $390. That’s probably money worth keeping in your pocket by breaking up your XAW allocation.

As purchasing U.S.-listed ETFs requires U.S. dollars, please refer to my Norbert’s gambit video tutorials, which will show you how to cost-effectively convert your Canadian dollars to U.S. dollars at various Canadian discount brokerages. If you’re also interested in comparing the MER and foreign withholding tax differences between various broad-market ETFs, please try out my Foreign Withholding Tax Calculator, available as a free download in the Calculators section of the Canadian Portfolio Manager blog.

Next up, in Part III of our “Under the Hood: Global Equity ETFs” series, we’ll check out two global equity ETFs from Vanguard. Stick around, and I’ll release that gripping episode soon.

Hi Justin,

Great stuff. Curious as to your thoughts about the recent tracking error in XAW. I have a lot of my holdings in XAW, is the tracking error a cause for concern?

@A: I’ll discuss XAW’s tracking error in a future video :)

Thanks for all the valuable input. I’m looking for a single ex Canada USD index to mimic XAW in an RRSP to reduce tax drag. Any easier suggestions other than what you mentioned to Bob above which uses 3 funds?

@Schlepper – A similar U.S.-based ETF to XAW would be VT (but this includes a ~3% allocation to Canadian stocks).

I started with Canadian Couch Potato philosophy around 8 years ago when reading MoneySense magazine. First with RBC e-series funds, then TD-Bank. After that i went to Questrade and switched to ETFs. There I evolved from simple VCN+XAW set to your more sophisticated portfolio :)

Quick question about LIRA. I read your white papers on foreign withholding tax structure and for some reason (I don’t remember exactly why) I assumed that LIRA should follow TFSA-RESP route, so I have VCN+XAW there. But from comments here I noticed that LIRA should be treated as RRSP…

So now I will definitely be switching to appropriate structure :) I have around 90.000 (32% VCN and 68% XAW) so I think it’s worth the switch, right?

Thanks for keeping us educated!

@Oleksiy Gryshchenko: If you moved to a combo of something like VCN+VT (a U.S.-listed global equity ETF), you would be expected to save just under $200 per year (before any other costs).

I would encourage you to read my articles about making a switch to U.S.-listed global equity ETFs, and all the additional costs/issues to consider (many investors regret making the switch, as it has complicated their investment management):

https://canadianportfoliomanagerblog.com/when-should-i-dump-veqt-or-should-i/

Thanks for your article Justin, I found this very informative, particularly from a tax perspective. I’m just starting to try to wrap my head around low cost investing and tax-efficient investing.

You mentioned that “XAW uses a “fund-of-funds”, or “wrap” structure to gain exposure to the index’s asset classes”. However, when I look on Morningstar at the Portfolio tab, it shows the holdings as individual companies (Microsoft, Apple, Amazon, etc). A few questions:

** First off – In your table of taxes, is there a typo in the percentages (eg 0.04% should be 4%)?

1. Is there a good source/website (eg some section on Morningstar or TD marketresearch) for seeing the tax structure of XAW (and other funds) and its direct holdings? Ie if XAW holds IVV, IJH, IJR, and ITOT, where can I see that?

2. Similarly, do you know a source for identifying how much withholding tax there is WITHIN an ETF? Eg, for XAW I’ve searched and see the Annual Report on Black Rock’s website. For 2018, Dividend income is shown as $16.478 mil and Withholding taxes is $1.536 mil (As a percentage, that’s 9.3%). Is this recoverable? (You mention that the unrecoverable withholding tax is only 4%, in a taxable account)

3. Lastly, why does ACWI have an unrecoverable tax of 15%?

3a) If it’s US listed, can’t the 15% be recovered as a tax credit against Canadian taxes owing?

3b) Aren’t there still underlying withholding taxes being held by the foreign countries that ACWI invests in? (Eg in the ACWI Annual Report for 2018, it looks like there were foreign taxes withheld of $11.409mil relative to Dividends of $211.475mil = 5.4%)

Again, many thanks for your article! Your website is a great resource for myself and others.

@Andrew: **No error in the table of taxes. The unrecoverable foreign withholding tax drag for XAW in a taxable account would be around 0.04% (this figure should be thought of like an additional MER, not as “4%”).

1. Annual financial statements (there will be a section on the actual fund holdings).

2. Please refer to my white paper for a step-by-step guide on the process: https://www.pwlcapital.com/resources/foreign-withholding-taxes-estimate-hidden-tax-us-international-equity-etfs/

3. ACWI’s 0.15% unrecoverable foreign withholding tax in an RRSP/taxable account is due to the first layer of unrecoverable tax on the dividends from international and emerging markets stocks (to the U.S. ETF). The 0.15% figure is just a coincidence, and has nothing to do with the U.S. foreign withholding tax rate of 15% (again, think of it like an MER, not 15% withholding tax).

Hi Justin, what about ZEM from BMO for EM exposure? I think it holds the underlying directly.

@George: ZEM’s structure is more tax-efficient than a fund-of-funds, like XEC, but ZEM’s sampling strategy has been less than stellar over the past five years (and has completely offset its more tax-efficient structure). Perhaps going forward, BMO will have more success with their sampling strategy, but I think it’s too soon to declare it a clear winner.

Hi Justin, I’ve really loved your entire “Under the hood” series and over the past year or so have migrated all of our accounts over to ETFs from Mutual Funds and have found this series extremely valuable. We are now fully invested in accordance with your model portfolio recommendations. This includes a good portion of XAW. I’m pretty competent at re balancing our various holdings and have done so now for many years on a regular basis. Given the importance of minimizing costs to maximize our returns, I’m wondering if you can suggest an ex North America ETF that I could use to combine with the cheaper US and Canadian only ETFs in lieu of XAW.

Cheers

@Bob Clark: I’m so glad you’ve been enjoying the “Under the Hood” series. Two suitable ex North America ETF options for Canadians are XEF and VIU, which are discussed in my “Understanding International Equity ETFs” series:

https://canadianportfoliomanagerblog.com/understanding-international-equity-etfs/

You would also need to combine this with an emerging markets equity ETF (as well as a Canadian and U.S. equity ETF) to mirror the exposure of XAW:

https://canadianportfoliomanagerblog.com/understanding-emerging-markets-equity-etfs/

I’ve already included ETF breakdowns in my CPM model ETF portfolios:

https://canadianportfoliomanagerblog.com/model-etf-portfolios/

Hi Justin thanks for the nice look at the world of funds:) ok not too funny, but, do you prefer I shares over vanguard? It seems I’ve made a bit extra work for myself by combining the 2 companies which I’m ok with. Back 8 years ago I felt vanguard would be most likely to lead the way in low fees and diversification… but now it seems both have good options. Still no directly held em funds for either and bit by bit their improving the type of ownership to suit Canadians. Going forward I’ve been choosing I shares, with motivation spurred by xef and its companions and am no longer adding to rrsp so Canadian domiciled funds are the preference. If you do have a preference, if so, why?

@Phil: I use both iShares and Vanguard ETFs. In terms of Canadian-listed global equity ETFs, I tend to favour XAW over VXC, as it’s cheaper and has a more tax-efficient structure (I’ll compare these two in more detail in Part III) of the series.

I always wondered why XAW held IVV, IJH, and IJR. Now I know! Thanks Justin.

@Steve Patterson: You’re welcome, Steve! Seems like a bit of overkill…but I guess they know what they’re doing ;)

I don’t understand why the “Unrecoverable Foreign Withholding Taxes” are consistently lower in taxable accounts than in the other types of account … It seems these ETFs would then be better held in taxable accounts? Thx.

@E: That would only be looking at one piece of the tax puzzle. For example, if you held a U.S. equity ETF in a taxable account, all foreign withholding taxes would generally be recoverable. However, you would pay annual tax on the ~2% dividend (at a 50% marginal tax rate, you would pay 1% in taxes). When you later sell the ETF, you would also pay taxes on the taxable portion of any capital gain.

If you held the same U.S. equity ETF in a TFSA account, you would lose ~0.30% per year in foreign withholding taxes (2% dividend yield x 15% withholding tax), but pay no other taxes ever.