In our last article, we learned how to combine international and emerging markets equity ETFs in a madcap, market cap global adventure (by way of Korea). If the entire exercise brought back unpleasant memories of elementary school math drills, you might prefer our next three pieces. In them, we’ll review six global equity ETFs that still allow you to invest globally, but eliminate the need to calculate market-cap weightings along the way. We’ll take them two at a time:

• Part I: Two Canadian-listed and U.S.-listed global equity ETFs from iShares that track the MSCI World Index (XWD and URTH)

• Part II: Two iShares global equity ETFs that include emerging markets (ACWI and XAW)

• Part III: Two Vanguard global equity ETFs tracking FTSE indices (VT and VXC)

Going Global with XWD

Our first ETF on today’s tour is the iShares MSCI World Index ETF (XWD). It was released in 2009 and trades on the Canadian stock market. It was a favourite among Couch Potato investors, until cheaper and more tax-efficient options came along.

As its name suggests, XWD follows the MSCI World Index. But it’s not quite as worldly as you might think. First, it only tracks companies in developed, not emerging markets. And, since “IMI” (Investable Market Index) is missing from the name, we also know it tracks only large- and mid-cap companies; it excludes small-caps.

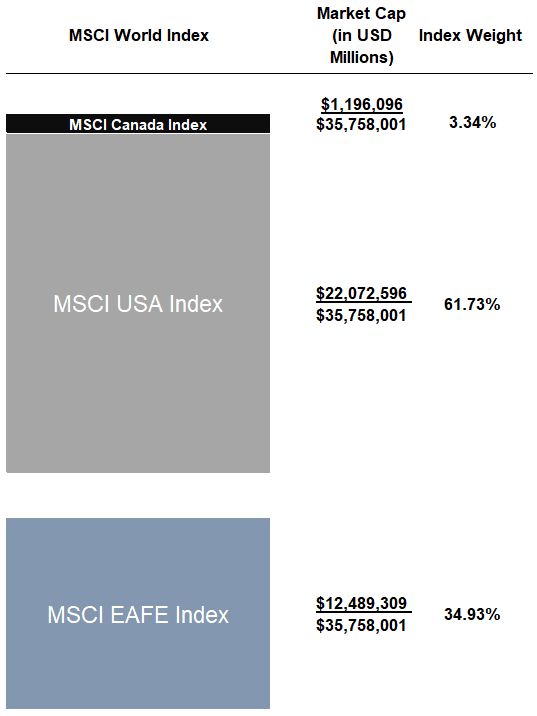

Basically, you can think of the MSCI World Index as the MSCI Canada Index + MSCI USA Index + MSCI EAFE Index, in the following proportions:

Sources: MSCI Index Fact Sheets (in USD) as of December 31, 2018

Do you still want to calculate market-cap weights (even though the XWD fund has done the math for you)? You can determine the weights of each region by dividing the market cap of each index (taken from the MSCI index fact sheets) by the total market cap of the MSCI World Index. For a step-by-step guide, please refer to my last piece, Combining International and Emerging Markets Equity ETFs.

By doing this, we find that Canadian stocks are 3.34% of the MSCI World Index, and U.S. and international stocks are 61.73% and 34.93%, respectively, as of December 31, 2018.

Finding Middle Ground

To gain exposure to these developed markets, XWD uses a “fund-of-funds” approach, meaning it holds existing ETFs, instead of purchasing the underlying stocks directly.

But, there’s a wrinkle: There are no iShares ETFs that track the MSCI Canada or MSCI USA indexes. Instead, iShares substituted similar ETFs from its product line-up:

• iShares uses its S&P/TSX 60 Index ETF (XIU) as its underlying large-cap Canadian ETF.

• iShares uses its Core S&P 500 ETF (IVV) as its underlying large-cap U.S. ETF.

Similar, yes. But the indices XIU and IVV track exclude many of the mid-cap companies that are included in the MSCI Canada and MSCI USA indexes.

A perfectionist may quibble, but excluding Canadian and U.S. mid-cap stocks hasn’t hurt XWD’s performance – at least not yet. Since July 2009 (near XWD’s inception date), the S&P/TSX 60 Index returns have been slightly better than the MSCI Canada Index returns, and the the S&P 500 Index returns have been nearly identical to the MSCI USA Index returns:

| Index | Annualized Returns Since July 2009 |

|---|---|

| S&P/TSX 60 Index | 6.40% |

| MSCI Canada Index | 6.04% |

| S&P 500 Index | 15.41% |

| MSCI USA Index | 15.38% |

Sources: MSCI, S&P Dow Jones Indices, DFA Returns, as of December 31, 2018

For XWD’s international exposure, the fund holds the iShares MSCI EAFE ETF (EFA), chosen because it follows the correct MSCI EAFE Index.

Unbundling for Fun and Profit

If you wanted to replicate XWD’s exposure without investing in it, you could instead purchase the three underlying ETFs directly in similar weights. Your portfolio’s complexity would increase, but in exchange, your MER would decrease – from 0.47% for XWD to about 0.14% for the ETF trio.

By holding the underlying U.S.-listed international and U.S. equity ETFs directly, you’d also reduce foreign withholding taxes in your tax-deferred accounts. Surprised? Remember, if a Canadian-listed ETF holds U.S.-listed foreign equity ETFs, the 15% U.S. withholding taxes on foreign dividends still applies. But as an individual investor, you can avoid this tax drag by purchasing IVV and EFA directly in your tax-deferred account.

Down to URTH

Even with potential tax savings and cost benefits, you may not want the hassle of holding three funds, when one might do. Enter the iShares MSCI World ETF (with the clever ticker symbol, ‘URTH’). URTH gives you exposure to the MSCI World Index, lets you reduce costs and foreign withholding taxes, and is a single fund. It trades on the U.S. stock market in U.S. dollars, and its 0.24% cost is nearly half of XWD’s 0.47% MER.

When URTH is held in a tax-deferred account (such as an RRSP, LIRA, RRIF or LIF), the 15% U.S. foreign withholding tax on dividends does not apply, which saves you an additional 0.33% per year, relative to XWD. So, by holding URTH instead of XWD in your RRSP, you could potentially save a total of 0.56% per year in product costs and foreign withholding taxes.

Estimated Unrecoverable Foreign Withholding Taxes: XWD vs. URTH

| Account Type | XWD | URTH |

|---|---|---|

| Registered Retirement Savings Plan (RRSP) | 0.46% | 0.13% |

| Registered Retirement Income Fund (RRIF) | 0.46% | 0.13% |

| Locked-in Retirement Account (LIRA) | 0.46% | 0.13% |

| Life Income Fund (LIF) | 0.46% | 0.13% |

| Tax-Free Savings Account (TFSA) | 0.46% | 0.47% |

| Registered Education Savings Plan (RESP) | 0.46% | 0.47% |

| Registered Disability Savings Plan (RDSP) | 0.46% | 0.47% |

| Taxable Accounts | 0.10% | 0.13% |

Sources: BlackRock Asset Management Canada Limited, BlackRock Inc., MSCI as of December 31, 2018

Next Up: Adding Emerging Markets

We’re up and running in our (mostly) math-free global market tour. Next up, we’ll take a look at two more global equity ETFs that include emerging markets.

Hello Justin,

How can I determine the tax implications of selling xwd in my non-registered account? Do you have any documentation or links that could point me in the right direction?

@Kevin: To determine the tax implications, you would have to first calculate the adjusted cost base of your XWD units. Here’s some helpful links:

https://www.pwlcapital.com/resources/as-easy-as-acb-understanding-and-tracking-your-adjusted-cost-base-with-etfs/

https://www.pwlcapital.com/easier-than-acb/

Thank you for your quick reply and explanation Justin.

I love the FWT calculator – it’s so handy – and as WS was mentioning VEQT has a lower FWT vs other global ETF’s .

Can’t want for Part 2 & 3.

@Ale: I’m glad you like the calculator – it certainly helps to address many questions that I typically receive from readers.

Keep in mind that VEQT has a 30% allocation to Canadian stocks (which do not have FWT), so its lower FWT figure (relative to global equity ETFs that have a 0-3% allocation to Canadian stocks) is a bit misleading.

Just finishing up Part 2 today (hopefully it will be released by next Monday/Tuesday.

Hi Justin,

I’m following closely your blog and as usual a very informative post.

I was under impression that you need to have a US address to open an account with Vanguard US and buy VT ETF.

What are the tax implications for a Canadian resident to have this ETF in TFSA? I think I read somewhere if you hold a direct US stock and the amount is higher than a certain threshold there might be some additional tax/issues from Uncle Sam?

For my equities (in TFSA), I was narrowing to VCN & VXC, but I came across XAW which has a lower MER, lower price (more units to be bought for the same amount of $), and if I’m not mistaken has lower withholding tax.

Please let me know your thoughts if these 2 equity ETF’s (VCN & XAW) are the “best” for diversification, withholding tax, & lower fees.

Thanks

Ale

@Ale: You can buy U.S.-listed Vanguard ETFs (like VT) at most Canadian discount brokerages (such as Questrade, RBC and TD Direct Investing, Scotia iTRADE, CIBC Investor’s Edge, BMO InvestorLine, etc.). There’s no requirement to have a U.S. address.

Holding a U.S.-listed foreign equity ETF (like VT) in your TFSA is technically fine, but all layers of foreign withholding taxes (FWT) are unrecoverable. For an estimate of the tax drag in a TFSA, please download my Foreign Withholding Tax calculator (~0.49% per year): https://canadianportfoliomanagerblog.com/calculators/

Using the calculator, you’ll also notice that VXC would have similar foreign withholding tax implications to VT (~0.48% per year).

As you already stumbled on, XAW is cheaper and more tax-efficient than VXC. It is actually expected to have a total cost that is nearly identical to VT. All of the ETFs have comparable diversification.

Total Cost of VXC = 0.27% MER + 0.48% FWT = 0.75%

Total Cost of XAW = 0.22% MER + 0.36% FWT = 0.58%

Total Cost of VT = 0.10% MER + 0.49% FWT = 0.59%

How about VEQT compare to XWD though it has lower MER?

@WS: Great idea! In a future post, I will also be comparing the Vanguard/BMO/iShares asset allocation ETFs (so that’s where I plan to review VEQT, as it is a slightly different breed than other global equity ETFs, with a 30% weighting to Canadian stocks).

Hello,

I currently own xwd in my internaxx account as well as xic as based around Andrew Hallam’s advice for a Canadian expat investor. However, this is the first blog that I have read that even mentions xwd. Most people recommend xaw. In your opinion would it be better to replace xwd with xaw since I already have Canadian exposure with xic? I guess I would be saving a lot in MER fees by making a switch and I could purchase more units for the same amount of money.

@Kevin: XAW is definitely cheaper, more tax efficient, and more diversified than XWD. It includes emerging markets, small cap stocks, and excludes Canadian stocks. If this is the type of exposure you’re looking for, XAW could be a good fit.

You’ll have to determine if there’s any tax consequences of making the switch as well (only if you hold XWD in a non-registered account).

Hi Justin,

Informative post, can’t wait for Parts 2 and 3!

Does URTH also leave out small-cap companies, mid-cap Canadian companies, mid-cap US companies, and Emerging Markets?

@Mark: Glad to hear you enjoyed the post!

Good question – unlike XWD, URTH includes the mid-cap Canadian and U.S. companies (as it holds the underlying stocks directly, instead of through a fund-of-funds approach), but it still excludes small cap companies. It also excludes emerging markets companies of all sizes.