If ever there were a contest held for “Canada’s Most Boring Investment Ever,” I’ll bet that bond ETFs and guaranteed investment certificates (GICs) would duke it out in the final round. We buy them to offset our more glamorous (and more risky) stock funds with some sensible dependability. Then, thankless crowd that we are, we cringe at their related paltry returns.

So in the boring battle between them, which should you use? Laugh at the humble GIC if you must, but even though they’ve been around before many of you were born, GICs may just help save the day in today’s fixed income markets … and will probably outlive you while they’re at it.

Consider this. Between September 30, 2016 and September 29, 2017, the 10-year Government of Canada benchmark bond yield rose from 1% to 2.1%. As the yield increased, prices dropped; Canadian bonds suffered their worst 1-year performance in over 20 years, losing nearly 3% of their value.

Now, relative to the gut-wrenching double-digit drops we periodically see in the stock markets (50% during the last severe bear market), 3% doesn’t sound so bad. But many index investors just can’t stomach seeing their “safe” bond ETF holdings show up in bright red when they view their accounts. If fixed income is going to be so boring, they reason, the least it can do is keep its head above water.

If this sounds like you, GICs may be worth a second look.

Bond ETFs vs. GICs

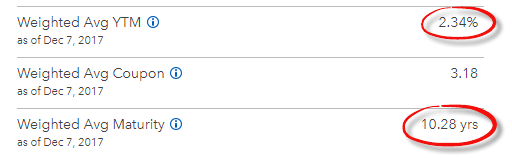

With a bond ETF, the best estimate we have of its future return is its weighted average yield-to-maturity (YTM). These days, the YTM on Canadian bond ETFs is about 2.34% (see image below). At 10.28 years, the weighted average maturity of the underlying bonds is also higher than you may prefer. This seems like a long time to expose your cash to a little more risk, while receiving so little extra in return.

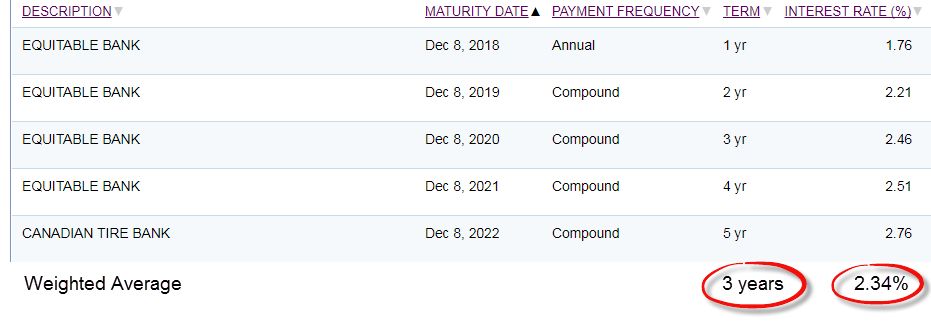

Enter the good old GIC. Not only does the Canada Deposit Insurance Corporation (CDIC) insure GICs within specified limits, many GICs have yields that rival those of your favourite bond ETFs, with a much lower average maturity. In fact, a 1–5 year GIC ladder at RBC Direct Investing currently boasts an identical average yield of 2.34%, with an average maturity of just 3 years (see image below).

So with the GIC ladder, you could currently get the same expected return with far less term risk.

Portfolio Characteristics of the iShares Core Canadian Universe Bond Index ETF (XBB)

Source: BlackRock Canada as of December 7, 2017

Top GIC Rates: RBC Direct Investing

Source: RBC Direct Investing as of December 8, 2017

Striking a balance

The downside of GICs is that you generally can’t sell or liquidate them until they’re due. This can be an issue if you are trying to rebalance your portfolio back to its target asset mix after your equities tank.

You can mitigate this liquidity risk by holding a combination of GICs and bond ETFs. As a rule of thumb, I tend to hold enough of the portfolio in bond ETFs to be able to rebalance back to my target asset mix even if there’s a 50% stock market meltdown. This rule is a bit confusing, so my cheat sheet below provides the suggested portfolio allocation between liquid bond ETFs and illiquid GICs.

| Model ETF Portfolio | Portfolio Allocation to Bond ETFs (%) | Portfolio Allocation to 1–5 Year Laddered GICs (%) |

|---|---|---|

| 20% stocks / 80% bonds | 8.0% | 72.0% |

| 30% stocks / 70% bonds | 10.5% | 59.5% |

| 40% stocks / 60% bonds | 12.0% | 48.0% |

| 50% stocks / 50% bonds | 12.5% | 37.5% |

| 60% stocks / 40% bonds | 12.0% | 28.0% |

| 70% stocks / 30% bonds | 10.5% | 19.5% |

| 80% stocks / 20% bonds | 8.0% | 12.0% |

Rebalancing act

Let’s work through an example together, adapting my model ETF portfolios to include GICs. Suppose you have a $100,000 portfolio, with a target asset mix of 60% equities and 40% fixed income. (So you would initially have $60,000 in equities and $40,000 in fixed income.) If your equities dropped by 50%, they would be worth $30,000 while your fixed income would still be at $40,000, for a total portfolio value of $70,000. To rebalance the portfolio back to its 60/40 target asset mix, you would need to sell $12,000 of bonds and purchase $12,000 of equities ($70,000 new portfolio value × 60% target equity asset mix = $42,000 minus $30,000 of existing equities = $12,000 of additional equities required).

So for an initial portfolio value of $100,000, you would allocate $12,000 to bond ETFs (or 12%); the remaining $28,000 (or 28%) could be invested in GICs, with $5,600, or 5.6%, invested in each GIC rung.

Example: Portfolio rebalancing using GICs and bond ETFs

| Security | Before the 50% stock market downturn | After the 50% stock market downturn (pre-rebalance) | After the 50% stock market downturn (post-rebalance) |

|---|---|---|---|

| BMO Aggregate Bond Index ETF (ZAG) | $12,000 | $12,000 | $0 |

| 1-Year GIC | $5,600 | $5,600 | $5,600 |

| 2-Year GIC | $5,600 | $5,600 | $5,600 |

| 3-Year GIC | $5,600 | $5,600 | $5,600 |

| 4-Year GIC | $5,600 | $5,600 | $5,600 |

| 5-Year GIC | $5,600 | $5,600 | $5,600 |

| Vanguard FTSE Canada All Cap Index ETF (VCN) | $20,000 | $10,000 | $14,000 |

| iShares Core (XUU) | $20,000 | $10,000 | $14,000 |

| iShares Core MSCI EAFE IMI Index ETF (XEF) | $15,000 | $7,500 | $10,500 |

| iShares Core MSCI Emerging Markets IMI Index ETF (XEC) | $5,000 | $2,500 | $3,500 |

| Total Portfolio Value | $100,000 | $70,000 | $70,000 |

This illustration also happens to facilitate another important point about the fixed income holdings we so often love to hate. When stock markets do periodically plummet, those “boring” bonds or GICs can suddenly become your best friends. Imagine if your $100,000 portfolio were all-equity, and had plummeted to $50,000 instead of $70,000. You’d probably rue the day you ruled out tempering your stock market risks with some sturdier (if less stellar) GICs or bonds.

So, will you opt for simpler, single bond ETFs, or mix in some GICs as well? Let me know what you think. Either way, in markets fair and foul, give your fixed income investments a little more love. They’ve earned it.

Great post. Curious how this discussion changes from an advisor standpoint? Do bond ETF’s make any sense when there’s 1%+HST coming off the top? (Whereas GIC issuers pay a smaller commission)

What about discount bond ETF’s which you’ve advocated in the past?

Thanks.

@Rob: If you’re a discretionary portfolio manager, you can choose to hold either bond ETFs or GICs in managed client accounts. As you would be charging management fees on these accounts, all GIC commissions would be rebated back to the client.

The average fee for our client base is around 0.65% plus tax (the median fee is around 0.75% plus tax).

I use both bond ETFs (for liquidity) and GICs in my client accounts. Adding GICs has definitely led to better client returns over the past few years (relative to holding only bond ETFs).

Hi, I am confused about where to place my GICs for tax efficiency.

You have stated more than once that GICs are tax-efficient and that they should be in a taxable account.

But, GICs produce interest income.To my understanding interest income (without dividend tax credit and preferential cap gains treatment), attracts the highest level of tax, Doesn’t it?

Please help clarify my confusion. Thanks for all that you do.

@sarah: I have stated that if you’re holding fixed income in a taxable account, GICs do not suffer from the premium bond issue that many bond ETFs and mutual funds do. You can also hold GICs in registered accounts.

I would encourage you to read my latest asset location posts for more information on the subject (as the topic is too complicated to explain in a single blog comment):

https://canadianportfoliomanagerblog.com/asset-location-in-a-post-tax-world-tfsas-vs-rrsps/

https://canadianportfoliomanagerblog.com/asset-location-in-a-post-tax-world-rrsps-vs-taxable-accounts/

https://canadianportfoliomanagerblog.com/asset-location-in-a-post-tax-world-tfsas-vs-taxable-accounts/

https://canadianportfoliomanagerblog.com/optimal-asset-location-applied/

Ok, so it’s about GICs vs Bond ETFs vs Cash accounts. I am beginning to understand.

I will read the articles you’ve linked to.

Thank you so much for this valuable info.

In the past model portfolios, I think I recall a mention to the Vanguard Canadian Short-Term Bond Index ETF (VSB) as an alternative to the Vanguard Canadian Aggregate Bond Index ETF (VAB), which is now replaced with BMO Aggregate Bond Index ETF (ZAG) or

BMO Discount Bond Index ETF (ZDB).

As I don’t think I can a GIC in my RESP account, would a short term bond index ever be an attractive alternative over an aggregate bond index? For instance, could VSB be a better alternative to VAB?

@Mark: A short-term bond ETF can lower the volatility significantly for more conservative portfolios:

https://www.pwlcapital.com/en/Advisor/Toronto/Toronto-Team/Blog/Justin-Bender/July-2012/Should-you-avoid-long-term-bonds

Good article, justin. Thank you. I was wondering if you have had any experience with a U.S. account for Canadians? Is there anything equivalent in the US market that we could use instead of etf’s?

thanks g

Jack Bogle noted that since 1926, the entry yield on the 10-year Treasury explained 92% of the annualized return an investor would have earned over the following decade if they held that Treasury to maturity and reinvested the income at prevailing rates. “The entry yield on the Barclays U.S. Aggregate Bond index (of investment-grade U.S. bonds) explains 90% of its 10-year returns for the years 1976 to 2012, says Tony Crescenzi, a portfolio manager and strategist at Pacific Investment Management Co.”

One advantage of GICs is that they are truly fixed income. If you buy a GIC that reinvests its return, you are certain as to the income and return of principal. The only bonds that do that are zero coupon bonds. And when you invest in bond ETFs, you lose certainty of income and also certainty of return of principal.

But what is written in the first paragraph makes question how important the certainty of GICs is. If you invest in a 5 year investment grade bonds, that 92% may be an underestimate. Similarly, if you invest in a short term investment grade bond ETF, that 90% will also likely be an underestimate.

@Park: The current advantages of GICs over bond ETFs are as follows:

– 1-5 year GIC ladder currently has a higher yield than a bond ETF (2.9% vs. 2.7%)

– 1-5 year GIC ladder currently has lower term risk than a bond ETF (3 years vs. 10 years)

– 1-5 year GIC ladder is generally more tax-efficient than most bond ETFs

– 1-5 year GIC ladder does not fluctuate in value (whereas a bond ETF does), so this helps investors stay the course.

Please feel free to invest in whatever fixed income security you prefer.

Justin, what’s your though on holding a corporate class bond fund in a taxable account if you dont want to buy ETFs or individual bonds? at least the income will be deferred and turned into capital gains when cashed in.

@marc: I’m assuming the corporate class bond fund has high enough fees to offset any tax benefit of the structure.

Hi Justin,

If you always have cash around for rebalancing your equity position. Do you even need to have a bond ETF?

@Miwo: As long as you have sufficient cash to rebalance your equity allocation in the event of a downturn (that is not required for emergencies), you could hold all GICs and no bond ETFs if you prefer.

But if you don’t need the cash for anything, shouldn’t it be invested into your overall portfolio? (equities and fixed income)?

What about high interest savings accounts or money market funds for fixed income options?

@Sarah: I’ve already answered your question in the comments below.

Justin, do you have any comments on the use of ZCS as opposed to some of your more recent recommendations such as XBB and ZAG? Thanks!

@Lynn: ZCS has a lower average maturity and duration than broad-market bond ETFs, like XBB and ZAG (but with a similar yield-to-maturity), so this could also be used by investors who prefer less term risk but more credit risk.

Why bond ETFs vs GICs, why not bond ETFs vs GICs vs bonds? If you are a buy and hold investor then why use bond ETFs at all, why not buy a bond directly? You get screwed a bit by the bid-ask spread charged by your broker but if you are buying a bond to hold for the long term then you aren’t paying any fees on an annual basis. So why not just directly buy a GoC bond or provincial bond or corporate bond in your brokerage account? You don’t have to worry about diversification with bonds, especially if you are buying GoCs or provincials.

@wayner: Most GICs pay more than federal Government of Canada bonds of the same maturity (I believe this is still likely the case for provincial bonds as well).

Hi Justin, what about money market funds or high interest savings accounts for fixed income? Where would you find the best rates for these and would you recommend these as an alternative to GIC’s? Thanks

@Sarah: This would also be an option (especially for the lower yielding 1-year and 2-year GICs in your ladder). EQ Bank is currently offering 2.3% on its cash deposits: https://www.eqbank.ca/

Hi Justin, compelling model you showed in your post using GICs and Bonds to combat a market downturn.

However, considering I am a young investor in an accumulation phase, my portfolio is small, I have a long-term time horizon, and I make monthly deposits. Does make sense to keep any bonds in my portfolio? Would not be more straightforward to invest just in laddered GICs? Considering the monthly deposits I mentioned, I would keep my bond allocation intact even in a market downturn, instead of moving bonds to zero as you did at your post-re balance column.

@Paul: I would tend to argue the opposite. If you are young and your portfolio is small, I probably wouldn’t even bother investing anything in GICs (adding to a single broad-market bond ETF, like ZAG or XBB, will be much easier to manage).

GICs also tend to have minimum purchase amounts at most discount brokerages (like $3,000 per GIC), so it may not even be possible to incorporate GICs into a small portfolio.

Hi Justin thanks for the great posts. I have a question about how gics are liquidated in the event of death. I’ve set a very similar version of this portfolio for my grandfather (low equity) with RBC DI? He’s 89. I’ve been staying away from the 4 and 5 year issues as “you never know when you re going to go” also rates have been rising shorter issues allow for reinvestment at higher rates. Also I generally choose annual payments. How is the interest calculated in the event of a early exit? Should I still be comfortable with longer terms?

An aside, now we have some clarity with the corporate passive investments will you again pursue the white paper on passive portfolio construction in a ccpc?

@Phil: The issuers should pay any accrued interest to the date of death (I would check with RBC DI just to be certain).

Any white papers are being put on the back-burner for now (just too busy at the moment). Most of the concepts can be pieced together from my existing blog posts though.

I rather like the idea of augmenting my fixed income portion with a GIC ladder, but I’m not clear on where they sit in terms of tax optimization, especially relative to Canadian equities.

Suppose I have a $500K couch potato portfolio with 60% equities and 40% fixed income. RRSP and TFSA are maxed, with the RRSP containing $180K in bonds, and $150K in US and international equities (all index mutuals). Meanwhile, the TFSA contains $55K in emerging markets and US equities (XEC and VUN). Finally, due to their tax efficiency, this portfolio has $100K of VCN in a taxable account, with $15K in ZDB rounding out the fixed income portion. (The priorities of the portfolio are to keep non-Canadian equities sheltered, with Canadian equities being the first to land in the taxable account, while using a discount bond in the taxable account to keep the fixed income portion balanced.)

Confounding factors: the RRSP account is a group plan without a GIC option, and selling the Canadian equities would realize a 4.5% gain.

If I wanted to move $100K from bonds to GICs, in terms of tax efficiency would it be better to a) sell the Canadian equities in the taxable account (which would consequently realize the gains and incur a ~$1k tax hit next year), buy a GIC ladder in the taxable account, and transfer $100K from bonds to Canadian equities in the RRSP account, or b) open a new direct investing RRSP account, do an inter-institution transfer of $100K from the $180K currently in bonds, and setup a GIC ladder in the new RRSP account? Or someting else? :)

It seems like a) would be the clear winner were it not for the capital gains tax.

Thanks!

@Jason: Your questions are bit too specific, but perhaps these articles will help:

https://www.canadianportfoliomanagerblog.com/asset-location-across-canada-some-rules-are-made-to-be-broken/

https://www.canadianportfoliomanagerblog.com/asset-location-tax-savings-through-more-organized-living/

Hi Justin,

I have studied how to build a ladder GIC as you suggested. I organize monthly deposits for my investments, and I noticed there are minimum deposits for GICs. In this case, is it better to buy a 5-year GIC first, then 4-year GIC and so on until I build the ladder?

Second question: Is it possible to invest in GICs inside a TFSA first, and move them to registered account when my TFSA is full, and I need to start to consider Asset Location?

@Bruno Alves: That would work too.

You can’t move GICs from your TFSA account to your RRSP account, but as each GIC matures, you could buy equities with the proceeds in your TFSA account (and then sell some equities in your RRSP account and purchase a GIC).

@Justin,

My question referred moving GICs from a TFSA to a Non-Reg account. I forgot to make it clear :)

I have an additional question, and I will give you A better context now: I have a 7 years investment goal, and I am using my TFSA to build it. I use a portfolio with 60% bonds and 40% stocks. I started to invest in 2017 with a large lump sum, and I bought XSB instead of ZAG to reduce the interest rate exposure. After the 2017 interest rate rises, my XSB is down 2.1%. Does make sense to sell part of my XSB and buy GICs at this stage to build the 48% allocation you have recommended in your article? Or is it better to hold the XSBs and start to build the GIC allocation using my new deposits?

Thank you!

@Bruno: XSB has a yield-to-maturity after fees of about 1.97%. If you can obtain a higher expected return on a ladder of GICs (with a similar average maturity of 3 years), you may want to consider switching XSB to GICs (if you don’t require the liquidity).

(Correction)

@Justin

When you say “after fees”, it means yield minus CRA taxes? How do you calculate it?

@Bruno: When I say “after fees”, I mean, yield to maturity minus fees (the fund’s management expense ratio).

@Justin, thank you for your fast feedback.

According to iShares, the distribution yield is 2.36%, and the MER is 0.09%. The after fees, in this case, is 2.27% (not 1.97% you mentioned). What am I missing here?

Source: https://www.blackrock.com/ca/individual/en/products/239491/ishares-canadian-short-term-bond-index-etf

PS: Sorry for messing up the comments above.

@Bruno: The weighted average yield to maturity is currently 2.11% (if you subtract the expected MER of 0.10%, you end up with 2.01% after fees). The distribution yield is not the expected return (as it does not factor in the capital loss portion on the underlying premium bonds).

@Justin, thank you very much for your clarification. You da man!

Hi @Justin,

I have a remaining question. If I have a 7-year goal, does make sense to keep XSB (short-term) as my bond exposure? Or make sense to replace it with ZAG ETF (aggregate)?

Thank you!

@Bruno: Since XSB and ZAG reinvest their maturing bonds, they’re not ideal for liability/goal matching. You could always consider buying a 5-year GIC, and then buying a 2-year GIC when that one matures.

@Justin

Just put in a context, my goal with 7 years is a reference in this case. My wife and I rent a small apartment and had an agreement to save some money in parallel as we would “virtually” buy a house. However, there no time obligation, because we are happy renting at this stage.

Our allocation for this goal at the moment is 48% GICs, 12% VSB, 13% VCN, 27% XAW invested on our TFSAs. I am keeping VSB to work in a negative correlation with our stock allocation.

Based on your comment above, does make more sense sell the VSB and work only with laddered GICs? I would not lose the negative correlation aspect in case the market tanks?

Thank you for your time and patience. I am learning how to invest reading your blog.

@Bruno: Unfortunately, I can’t provide advice on your specific situation.

@Justin, no problem. Thank you ;)

Thanks so much for this very timely post. I will be doing a major re-vamp of my portfolio in January and this information will be a big help.

@LauraH: You’re very welcome – good luck! :)

Thanks Justin! I am already doing CCP investing and have been wondering what to do with my fixed income portion (All bonds, all gics, maybe 50/50 of each). This article has definitely given me a better understanding of what to do with my fixed income part of my portfolio.

@Brian: Glad to hear the article helped :)

Very interesting topic. Thank you very much for sharing all your knowledge!!

Have you run regression tests to compare the performance of a portfolio with GIC and one without? Are the performance the same?

@Guillaume: Unfortunately, there’s no historical data that shows the performance of a 1-5 year GIC ladder using the highest available issuer rates.

Are there any seasonality issues with GIC purchases? Do providers tend to offer better rates during RRSP season or are they in fact lower because demand is higher then? Does it even matter?

@Dave: I’ve never noticed any seasonality trends with GIC purchases – you could always spread your 1-5 year ladder out over the entire year if this is a concern.

Good article Justin

@John Tittel: Thanks for reading! :)

Hi Justin,

Is there any risk associated with the fact that the highest yielding GIC’s are from somewhat sketchy looking companies (Equitable Bank, Homequity Bank, etc.)?

Does CDIC guarantee only principal? Or both principal and earned interest?

I’m wondering if one of these shady companies goes belly up 4 years from now you’d lose 4 years of accrued interest.

Thanks!

@Scott: As long as you stay within the CDIC limits, there is no default risk (other than some opportunity cost for the few months while CDIC is arranging for the reimbursements).

CDIC insures eligible deposits at each member institution up to a maximum of $100,000 (principal and interest combined) per depositor per insured category: http://www.cdic.ca/en/about-di/what-we-cover/Pages/default.aspx

Nice to see that it looks like CDIC pays now and asks questions later. From their web site:

“CDIC would aim to reimburse chequing and savings accounts, joint accounts and mortgage tax accounts within three business days from the date of failure.”

@Grant: For certain accounts types, CDIC will attempt to reimburse the accounts fairly quickly (although this doesn’t include all account types, such as registered accounts).

I would expect that this process could take a few months (but we’ll have to wait until the next bank default before we find out exactly how smooth and efficient the process is).

I was thinking an alternative way to transition into GIC’s for a portion of fixed income exposure would be to incrementally do it over 5 years. For example:

Year 1: 60% equities, 35% bonds, 5% GIC

Year 2: 60% equities, 30% bonds, 10% GIC

Year 3: 60% equities, 25% bonds, 15% GIC

Year 4: 60% equities, 20% bonds, 20% GIC

Year 5: 60% equities, 15% bonds, 25% GIC

It’d be a slow transition, but the upside is you don’t have to commit to a bunch of low yield (1-3 year) GIC’s right off the start. Each 5% increment you buy would be a 5 Year GIC.

Justin – I think a fascinating blog post would be a comparison of a long term laddered GIC strategy vs. an aggregate bond strategy over the long term (say 20 or 30 years). I always wonder if the marginally better 5 Year GIC ladder is a strategy that is sustainable over the long term.

Keep up the blog posts! Loving reading and thinking about these ideas.

@Scott: This would be another option as well. Remember that in 4 years, you’ll still end up with a 1-5 year GIC ladder. Depending on what interest rates do during that period will determine whether this was a superior strategy compared to just setting up a GIC ladder in year 1.

One question – just to verify. There is no change in expected return, just a decrease in volatility. Correct?

@Joey: I wouldn’t say for certain that the volatility of the portfolio will be lower (if you swap out bonds for GICs). As bonds generally have a lower correlation with equity markets, they help to reduce the volatility (i.e. during market downturns, they tend to go up in value, which reduces the portfolio’s volatility).

The GICs, on the other hand, will not increase more in a market downturn (they’ll just keep ticking along as expected).

So you could maybe say, similar expected return with similar expected portfolio volatility.

Justin, could you expand a bit on your comment that bonds/stocks portfolios and GIC/stocks portfolios would have similar expected volatility and returns? As bonds tend to go down when stocks go up (reducing volatility) and tend to go up when stocks go down (reducing volatility), wouldn’t you expect stock/bond portfolios to be less volatile than stocks/GIC portfolios? With regard to returns there is the illiquidity premium of GICs, but the rebalancing bonus of bonds, so maybe they cancel each other out leading to similar returns?

@Grant: The expected volatility and returns would be similar (I would expect the portfolio that contains GICs to have a slightly higher volatility). The main takeaway is that adding fixed income to a portfolio (whether its in the form of bonds or GICs) will substantially reduce the volatility of a portfolio.

As long as you keep some bond ETFs in your portfolio, you can still rebalance the portfolio when markets drop (so there’s not really a significant downside to including GICs in the portfolio, it terms of liquidity).

Thanks Justin for demonstrating the math behind your idea. I have a different take on the laddering of GIC’s that might be of interest to readers.

Because the GIC rates are lower for the 1-4 year GIC, I build my ladder with 5 yr GIC’s only, thus maximizing return, and so that each year, only one GIC matures, and I therefore maintain similar amounts each year. With your ladder, you will have more than one maturing GIC in some years, thereby having to purchase a larger amount of GIC’s in a given year that may be a good or bad year. My purpose in laddering is to average out the changing rates of interest over the years, but still get the higher rate of the 5 year term.

I purchase the 5 year GIC rates offered by Achieva Financial and Oaken Financial (to spread the guarantee limit) with emergency funds in a daily interest account at EQ bank. presently at 2.35 % to cover me if I need access to immediate cash.

Because GIC’s attract the highest level of taxation, I put them in a TFSA or RSP as much as possible.

I’ve stayed away from bonds because of the risk versus reward compared to GIC’s, but then I take my risks on the roller coaster stock market!

@Bruce: I’m not sure I understand your comments. If I build a 1-5 year GIC ladder (with proceeds from the sale of an existing bond ETF), I would invest equal amounts in each rung. After a year, a single 1-year GIC would mature (not multiple GICs), and this would be invested in another GIC that matures in 5 years. The same thing would occur in each future year.

I believe what you’re saying is that for someone just starting out, you would use your first amount of cash to purchase a single 5-year GIC. The following year, you would use your additional savings to purchase another 5-year GIC (and so on). Is this what you’re doing in practice?

There are a couple other factors that one could consider:

1. This might apply to an RRSP which is just for accumulation, but if there’s a possibility of spending any of that money, then an ETF would be preferable for liquidity purposes.

2. If interest rates rise, the ETF would fall in value, but the YTM would increase on new bonds, so it wouldn’t hurt as much and might even be better in the longer term.

3. It’s simpler to use just one bond ETF than laddering GICs plus an ETF. I know you and Dan quite often recommend DIY investors take a simpler approach – that might be the case here since I don’t think the yield difference would affect your ability to meet your financial goals.

4. In stock market declines, interest rates tend to drop to encourage more spending which will make bonds do better. Bonds have inverse correlation with stocks while GICs are just constant.

5. ZDB, HBB and BXF can increase your tax-efficiency. It might be still better with a GIC ladder, but this is also a factor to consider.

Because of this, I think I’m staying with one simple bond ETF, but I’m really glad to know the best way to optimize the fixed income part of the portfolio.

Thanks for this post.

@Joey: Thanks for including your comments :) It’s true that if a DIYer wants to keep things as simple as possible, a bond ETF is easier than managing a ladder of GICs. With our managed clients, we tend to include GICs within the overall portfolio (increasing its complexity)…but this is our full time job ;)

For a DIY investor who only has minimal experience managing their own portfolio, a single bond ETF may be more appropriate.

If, for whatever reason, someone wanted to switch brokerages in the future, can GICs be transferred in kind, as can be easily done with a bond ETF? I ask, since my understanding is that the GIC providers available can differ between brokerages.

Thanks

@Tyler: It shouldn’t be an issue transferring your GICs from one discount brokerage to another (but you may want to check with the specific brokerages to confirm).

The only GICs that generally can’t be transferred are those held with the big bank branches.

Do you regularly use ZAG instead of something like VSB? The YTM is higher but so is the risk if rates rise? Isn’t this what you are trying to avoid with the GIC’s? What would the GIC ladder look like after several years of rebalancing? Initially each rung has an equal weighting but I imagine it would be quite different over time?

@Dave: If you’re using a short-term bond ETF (like VSB) for your fixed income, there would be an even bigger incentive to swap out a portion of the bond ETF for a ladder of GICs (as the YTM on a short-term bond ETF is about 1.92% before fees).

In the rebalancing scenario, as equities recover, a portion of them would be sold again and used to buyback the holding in ZAG.

If you continued to add cash to your portfolio over time, you could add more to each GIC rung as it matures.

@Justin,

Fantastic post. Thanks for sharing your knowledge.

I have a question: I am following the 3 ETF Portfolio using VSB as fixed income. If I need to sell part of VSB and buy GICs following the recommended allocation above, how do I figure out a good trading day to do it? I am thinking to wait when the NAV price of VSB is similar to the trading price. Does it make sense?

PS: Yeaaaahhhh! We have an option now to notify when there is an answer to my comment. Super feature!

@Bruno: As long as the bid-ask spread on VSB is relatively tight (i.e. 1-2 cents), I wouldn’t be too concerned with the specific day that you choose to sell the ETF. Just remember that your VSB sale will settle on T+2, and your GIC purchase will settle either same day or T+1 (depending on the brokerage), so you should wait about 2 trading days after the sale of VSB before purchasing your GICs.

Very clear article Justin. An additional option might be to shorten the GIC ladder to three or four years. That would result is some reduction in return on the fixed income versus a bond fund, but could eliminate the need to hold a bond fund at all, due to the higher value in each GIC. The worst case would be that you would have to wait 1 year to rebalance, but likely less than that in reality. It might also provide some insulation from the impact of interest rate increases to a bond fund in the shorter term.

Excellent food for thought, thanks.

@Rob: That would be another option (especially if you really want to keep your GIC ladder very short term). You may miss out on a rebalancing opportunity though, if equities recover before your 1-year GIC matures (I’m sure most investors wouldn’t be too upset with this scenario ;)

I have never bought GICs before, I have a TD web broker account, how do I go about purchasing laddered GICs?

I combine the value of my TFSA and taxable account for balancing, were is best to keep the bonds/GICs portion of it

@Steve: TD Direct Investing has a GIC list you can review first: TRADING > Fixed Income > GIC rates

Once you’ve decided which GICs you would like to purchase and the amounts, call a TD representative at 1-888-983-2663 to place the GIC purchases (make sure you have already sold your bond ETFs two business days earlier, so that the account does not go into a debit position).

I tend to fill the TFSA account with all equity ETFs, so if you hold some fixed income in your portfolio, it should generally be in your taxable account. GICs are tax-efficient, but bond ETFs (like ZAG) are not when held in a taxable account (so if you hold ZAG in your taxable account, you may want to consider replacing it with ZDB).

@Steve @Justin: Just to point out that as ETFs settle in T+2 whereas GICs are same-day settled, an ETF would have to be sold two business days before one intends to buy a GIC.

@Russ: I believe that is correct with GICs purchased through TD Direct Investing (thanks for pointing it out). Best to check with your specific brokerage to see when their GIC purchases settle.

I have done just that with my fixed income after you mentioned it in the comment section of one of your posts some time back. I though about it for a while first as initially I was a bit reluctant to give up bump up in price of bonds that occurs during a crash with the “flight to safety”. However, that 5% or so price rise probably wouldn’t make you feel much better anyway after a 50% equity drop, so I made the change last September – albeit at probably the worst time in the year to do it, just as bond yields peaked for the year, and GIC rates remain stable, but c’est la vie. The reduction of risk is worth it.

@Grant: Thank you for your comments. Did you keep any of your bond ETFs for rebalancing purposes (or did you switch everything to GICs)?

I kept 12% of the portfolio in bonds (60/40 portfolio) as you suggested. I should have said I was reluctant to give up most of the bounce of bonds in a crash, but will still have some with the 12% I have for rebalancing.

What about using Stripped Bonds instead of GIC’s so that you retain the liquidity.

@Tim Dengate: Guaranteed federal government strip bonds would have a much lower yield-to-maturity than guaranteed 1-5 year GICs.