Since they began offering commission-free ETF trades, National Bank Direct Brokerage (NBDB) has become the cheapest big bank to invest with (as long as you are buying or selling at least 100 shares of a Canadian-listed ETF).

This is welcome news for seasoned DIY investors who have mastered the Norbert’s gambit strategy to cheaply convert their Canadian dollars into US dollars (as they can now generally avoid the two additional trading commissions required for the transaction).

For the rest of you newbie Couch Potato investors, I’ve put together a video tutorial that will make your first gambit a successful one. In the example, I convert about 8,000 Canadian dollars into US dollars within my RRSP account (I’ve also included step-by-step instructions below the video).

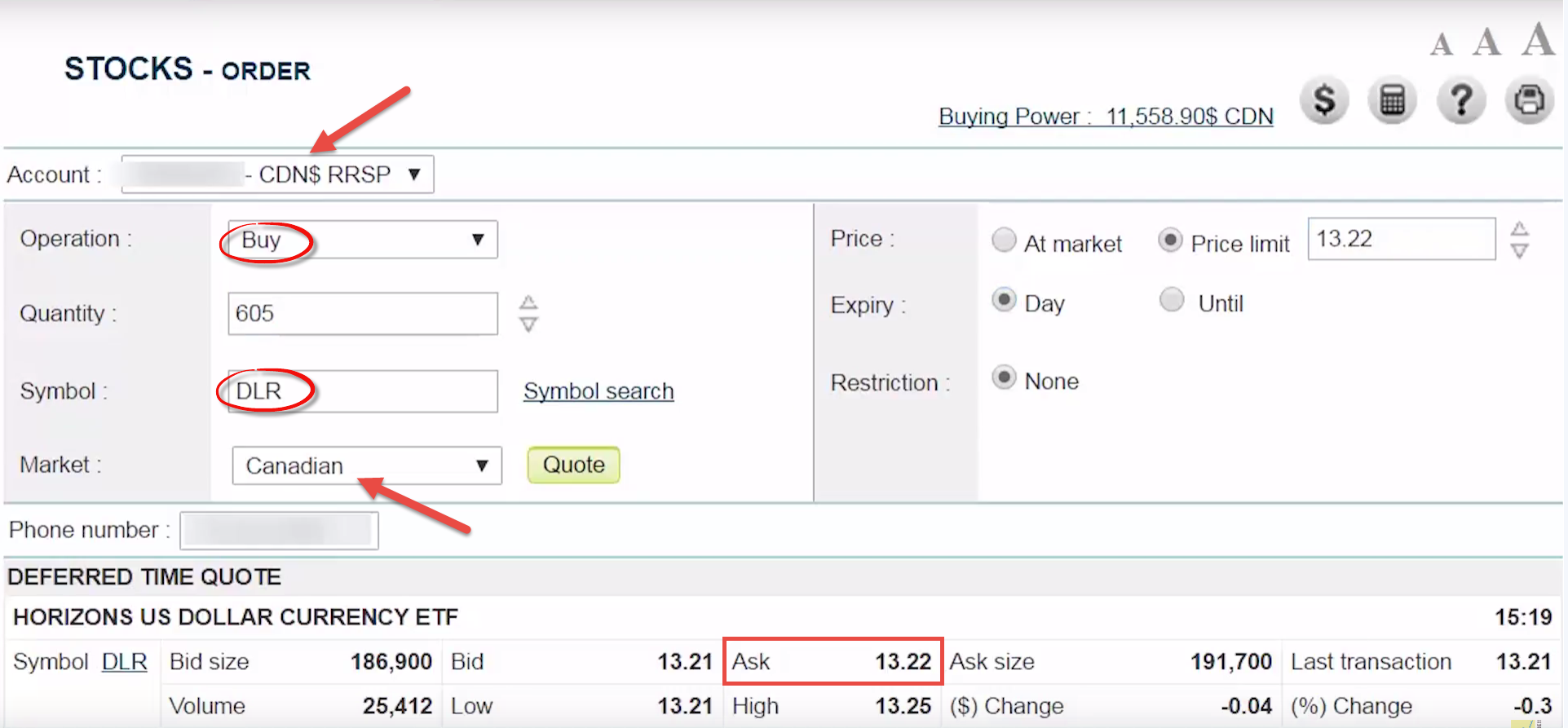

Step 1: Buy DLR on the Canadian stock market in your Canadian dollar RRSP account at the current ask price.

The first step is to purchase shares of the Horizons US Dollar Currency ETF (DLR). The fund invests in US dollar cash equivalents, but can be purchased with your Canadian dollars.

In order to determine the number of shares of DLR that you would like to purchase, just take the $8,000 CAD that you would like to convert and divide by the current ask price, which is $13.22 in our example – this equals 605 shares (just round down to the nearest whole share).

As you are purchasing at least 100 shares of a Canadian-listed ETF, the trading commission will be $0.

Stock Order Screen: National Bank Direct Brokerage

![]()

Source: National Bank Direct Brokerage

Before proceeding to the second step, you’ll need to wait four business days after purchasing DLR. As we purchased DLR on March 31, 2017, we will need to wait until April 6, 2017 in order to proceed to the next step (Note: The investment industry is scheduled to implement a T+2 settlement cycle beginning September 5, 2017, so you will soon be able to complete the gambit in one less business day).

Step 2: Call National Bank Direct Brokerage at 1-800-363-3511 and ask them to transfer 605 shares of DLR from the Canadian dollar RRSP account to the US dollar RRSP account.

When I called National Bank, I explained to the trader what I was trying to do, and there were no issues at all. After the trader has completed the request, as them to include a note on the account that will allow you to sell 605 shares of the Horizons US Dollar Currency ETF (DLR.U) today (the trader also told me to wait two minutes before placing my trade).

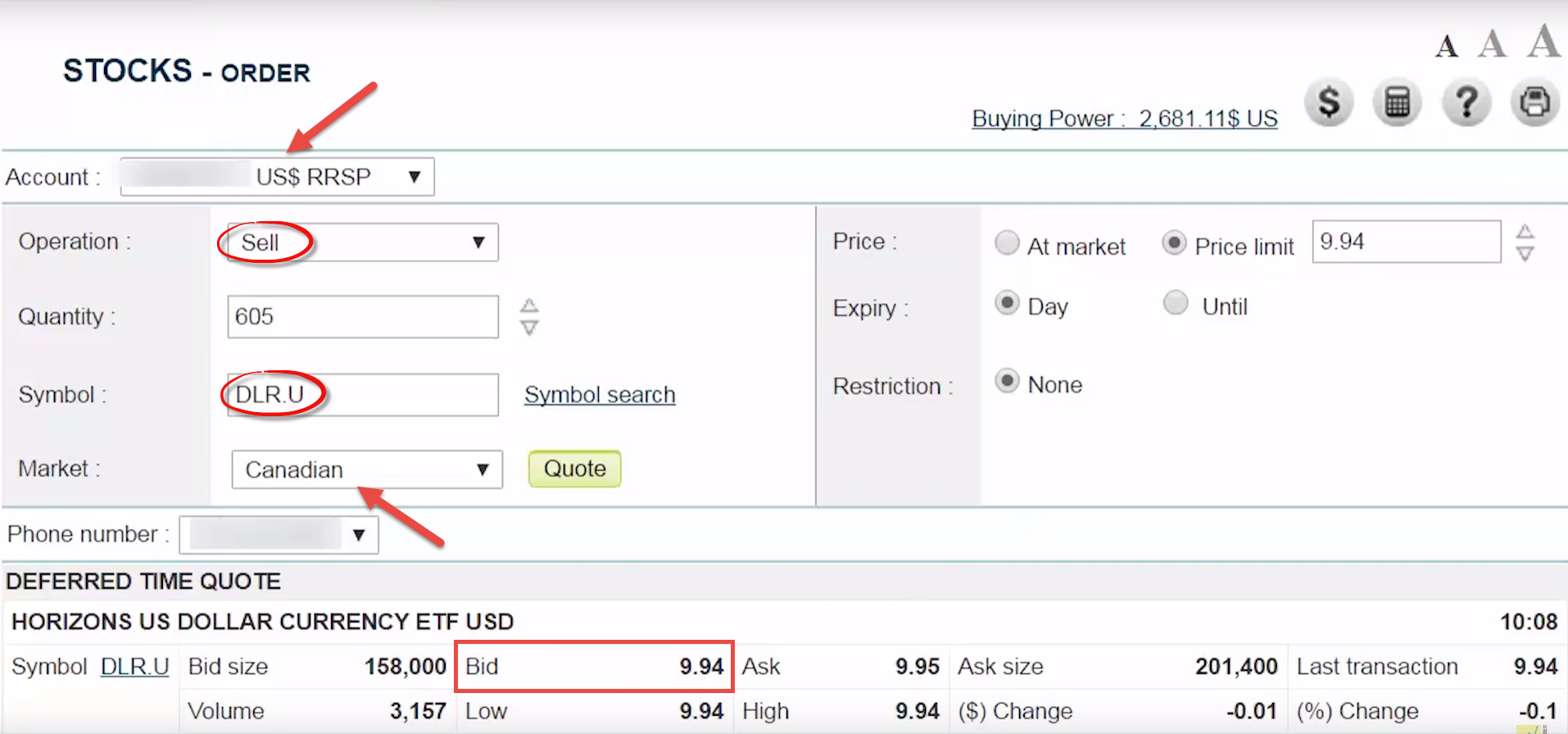

Step 3: Sell 605 shares of DLR.U in the US dollar RRSP account on the Canadian stock market at the current bid price.

DLR.U is the exact same security as DLR. The only difference is that DLR.U is transacted in US dollars, while DLR is transacted in Canadian dollars.

Stock Order Screen: National Bank Direct Brokerage

Source: National Bank Direct Brokerage

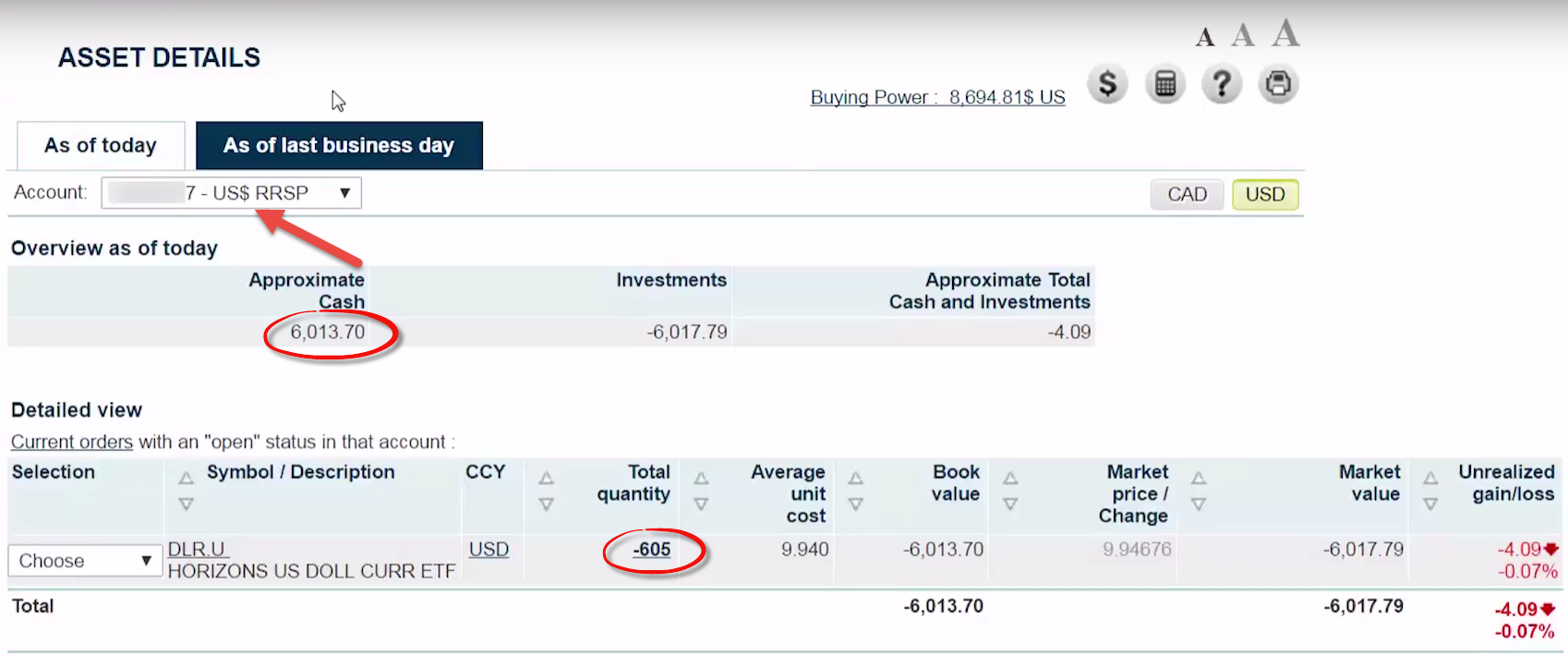

To verify that the trade has been completed successfully, hover over the Accounts tab at the top left of the page and click on Asset Details.

You should now see a positive US dollar cash balance, as well as a negative quantity of DLR.U shares (these will disappear once National Bank processes your transfer request). You are now free to purchase US-listed ETFs with the cash available in your US dollar RRSP account.

Asset Details: National Bank Direct Brokerage

Source: National Bank Direct Brokerage

Norbert’s Gambit no longer allowed at RBC (got written confirmation of this today).

Possible at BMO Investorline if you call (no longer allowed online).

Possible at TD with online title transfers to/from US/CAD accounts (must wait until titles have settled before journaling).

Possible at Questrade? Anyone knows?

@C. Baron: Thanks for the heads up – would you mind providing me with a copy of the written confirmation you received from RBC?

Update: Free Buy/Sell on all US listed ETFs as well at NBDB. Same 100 unit minimum.

Can I also do this with HXS/HXS.U ? The price is higher so the bid/ask spread has less impact and I would follow the market while I wait to be able to transfer the funds. It looks like a better option to me, but I always see with DLR so I might be missing something.

@Philippe Chartrand: I’ve never tried Norbert’s gambit with HXS/HXS.U, but the funds appear to have the same ISIN number (CA44051U2083), so it should work. I would test it out with a small amount of shares first.

Justin, would you be able to explain how to do Norbert’s Gambit at Qtrade? I’ve found a couple of explanations on the web but they’re never as clear as yours and I feel uneasy about following them (they seem to assume you know certain things already)

Thanks in advance!

@Juliana: Unfortunately, I do not have a Qtrade account, so I’ve never tried out the gambit there. However, these instructions seem very straight-forward and concise (just change the T+3 settlement instruction to T+2, as this recently changed):

http://financialuproar.com/2015/04/29/how-to-cheaply-exchange-canadian-dollars-for-u-s-dollars-using-qtrade/

I did it with a Canadian stock I happened to own. I wanted to eventually trade in the US market. I did what they call journalling. Its right on their website. It was done right away as I recall. You may have to wait a day or so for it to complete before you are able to do anything with the money. Many bank stocks are traded on both exchanges. CP and CNI as well. They’re all non-volatile equities you can do this with.

But doing it with an ETF is better if you’re not in the market already as there is no fee as long as you do at least 100 shares. So as long as you need at least $1000 it should work I suppose. I wonder how many ETF’s are priced way less than $10 each? I never trade in ETF’s so I have no idea. That would be great though because then you could convert smaller amounts of money, like for online purchases.

I assume this can be done to convert USD to CAD as well

@Neil Kleckner: You are correct – you would buy DLR.U in the USD account instead, and sell DLR in the CAD account.

There’s no reason this couldn’t be done in a non-registered cash account, assuming the holder has both a USD and a CAD account, correct? Potentially, a miniscule capital gain or loss could result, but no issue other than that? I’ll have to check if this is possible with HSBC InvestDirect. Thank you for all the useful material you put out there!

@Bjorn: Norbert’s gambit can also be completed in a non-registered account (with CAD and USD sides). The process would be similar to the registered account process.

In IB Interactive brokers…that would cost me about a dollar.

@Steve: Have you tried converting CAD to USD in an Interactive Brokers RRSP account? Does IB offer US dollar RRSP accounts?