CIBC Investor’s Edge is the latest brokerage to offer US dollar RRSP accounts. This is good news for cost-conscious ETF investors, as it allows them to save even more money each year by holding US-listed foreign equity ETFs in their RRSP accounts. Opting for this ETF structure in an RRSP account can generally save investors about 0.30% per year in product fees and foreign withholding taxes.

This is all well and good if you already have US dollars available for investment, but what if you only have Canadian dollars?

One of the cheapest ways to convert your unwanted loonies is called Norbert’s gambit. As this strategy can be intimidating for newbie investors, I’ve put together a video tutorial that will make your first gambit a successful one. In the example, I convert about 10,000 Canadian dollars into US dollars within my RRSP account (I’ve also included step-by-step instructions below the video).

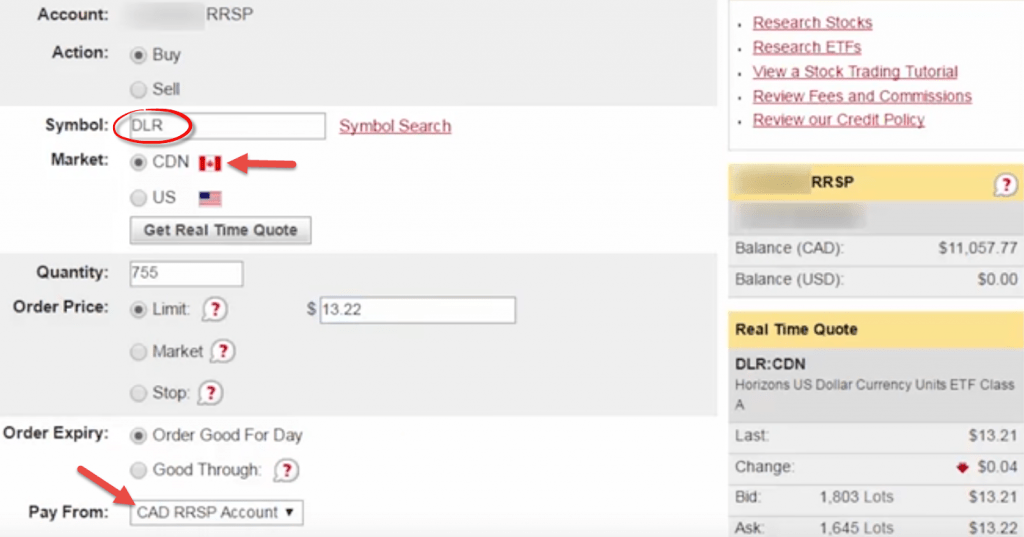

Step 1: Buy DLR on the Canadian stock market in your Canadian dollar RRSP account at the current ask price.

The first step is to purchase shares of the Horizons US Dollar Currency ETF (DLR). The fund invests in US dollar cash equivalents, but can be purchased with your Canadian dollars.

In order to determine the number of shares of DLR that you would like to purchase, just take the $10,000 CAD that you would like to convert, subtract the $6.95 trading commission, and divide by the current ask price, which is $13.22 in our example – this equals 755 shares (just round down to the nearest whole share).

Trading Screen: CIBC Investor’s Edge

Source: CIBC Investor’s Edge as of March 31, 2017

Step 2: Call CIBC Investor’s Edge at 1-800-567-3343 and ask them to transfer 755 shares of DLR from the Canadian dollar RRSP account to the US dollar RRSP account.

When I called CIBC, I explained to the trader what I was trying to do, and there were no issues at all. After they had entered the instructions into their system, they offered to take care of the third step for me on the same phone call.

Step 3: Ask the CIBC trader to sell 755 shares of the Horizons US Dollar Currency ETF (DLR.U) in the US dollar RRSP account on the Canadian stock market at the current bid price.

DLR.U is the exact same security as DLR. The only difference is that DLR.U is transacted in US dollars, while DLR is transacted in Canadian dollars.

It is extremely important that the trader sells DLR.U in your US dollar RRSP account, not DLR, so have them confirm the order back to you before proceeding with the trade. Also confirm that you will be paying the $6.95 online trading commission for this trade.

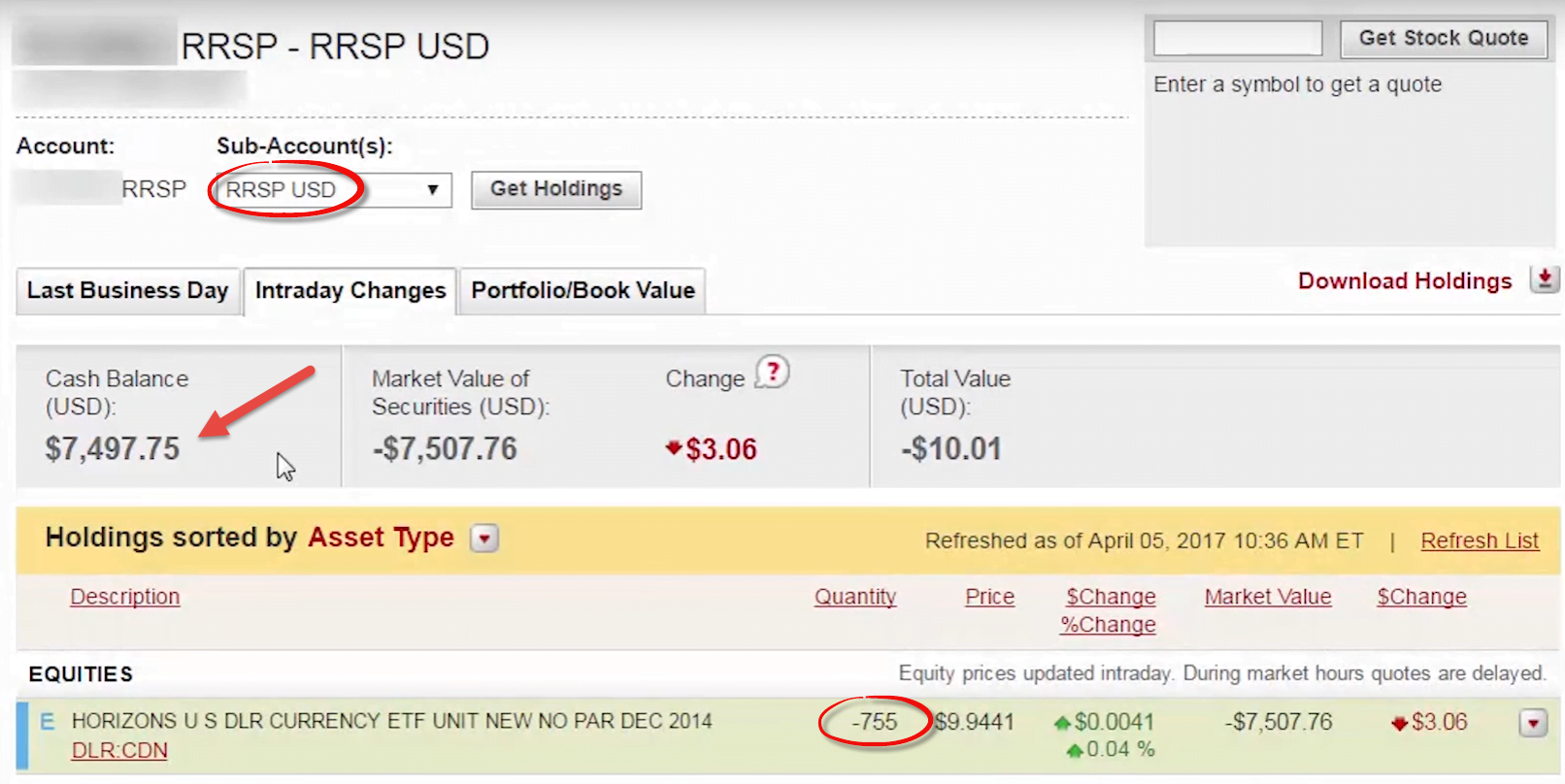

To verify that the trade has been completed successfully, go to the Account Holdings page and click on the Intraday Changes tab. Select the US dollar RRSP account from the drop-down menu and then click on Get Holdings.

You should now see a positive US dollar cash balance, as well as a negative quantity of DLR shares (these will disappear once CIBC processes your transfer request). You are now free to purchase US-listed ETFs with the cash available in your US dollar RRSP account.

Account Holdings: CIBC Investor’s Edge

Source: CIBC Investor’s Edge as of March 31, 2017.

Hi there I have 5K in cibc investors edge TFSA CAD account and I am planning to buy ETF listed in USD only. CIBC told me than there will be no fee other than $6.97 trading commission to buy the ETF listed in USD using the CAD in TFSA. Intraday fx rate will be applied. Do I get much benefit from applying norbert’s gambit in this case?

@Tan: First off, there’s no tax benefit from holding a U.S.-listed ETF in a TFSA (so you may want to consider just holding a Canadian-listed version of the ETF).

CIBC definitely has cheaper currency exchange rates than most brokerages, so it may be cheaper (or at least similar and less hassle) to just accept their FX rate for more modest conversions.

Hi Justin, I did the Gambit at CIBC INVESTORS EDGE. 1) I bought DLR IN CAN$ (T+2). 2) Called them, asked them to journal to us side of my rrsp. 3) Asked them to sell DLR.U in US$ . (T+2). I did this all on the same day, had the cash in the account. Worked as you had indicated. Trader said there might be an interest charge, and if there is, he would reverse it.

A few weeks later when my statement showed up, there was a $15.00 interest charge. I asked about this, they said to avoid the interest charge I would have to wait until the first DLR trade settles before journaling and selling DLR.U.

Have you heard of this before? If both trades are T+2, why the interest? They said it was because it was foreign currency trading, I didn’t get an good explanation that makes sense to me. Let me know your thoughts.

@TJ: Their system could automatically charge debit interest on the transaction, but they should reimburse you (as you were not in a debit position). I’ve had this occur at RBC Direct Investing, and they always reimburse it when I request it by phone.

I would call back and request a reimbursement of the charge. If they give you any issues, consider switching to RBC Direct Investing.

Hi Justin,

Thanks for the reply. I did call them, and the trader said he would reverse the charge. He said to avoid the interest charge in the future, best to wait until the first trade settles before calling them to journal it over to the U.S. side of the account and selling DLR.U. The explanation was not clear. Did not make sense to me.

Your explanation makes sense, I was not in a debit position. I will call them back to clarify this before we decide to do this on my wifes rrsp account.

Thanks again.

Hi Justin,

Thanks for the instructions, I have a couple questions based on your steps:

1) By you using the $10,000 amount in the example is that what you would consider the minimum amount to make this worth doing? If I were to only have let’s say $8,000 in my TFSA to use should I still use this method?

2) In your 2nd and 3rd steps when you called the CIBC trader didn’t they charge you for those calls to make the transactions?

Thanks again

@Dave: The minimum amount (depending on the brokerage) is generally around $3,000 (but $10,000 is arguably a better trade amount). The CIBC trader should not charge you for those calls.

You would need to call the brokerage to ask for a quote (i.e. ask them how many U.S. dollars you would receive). Then determine how many U.S. dollars you would receive (after commissions) by using the gambit.

Does this have to be done within a retirement account, the RRSP? Thanks!

@Sean: It can be done in any account type, but most ETF investors use the gambit to convert their CAD to USD to purchase U.S.-listed foreign equity ETFs in their RRSP (to reduce the foreign withholding tax drag).

Hi Justin,

Sorry, I think my previous question was confusing. What I meant to say was.

Is it possible to time the currency conversion from Can to US dollars? Or is this futile? For instance, trying to convert the Can dollars to US dollars at a point in time during the year when the Can dollar has a high value relative to the US dollar. Or is this the same as timing the stock markets and is unpredictable. Right now compared to historical data, is the Can dollar at an average price relative to the US dollar, or high or low?

Thanks TJ

@TJ: The fair value for the Canadian dollar is around $0.80 USD, so it’s close to fair value now. Unless you can predict the future, I wouldn’t concern yourself with timing any markets.

Hi Justin, If one is converting large amounts in his and her rrsp’s from Canadian listed etf’s to us listed etf’s via Norberts Gambit, is there some way to do this to reduce the currency risk? Timing the currency markets?

To explain further. We have large amounts in our rrsp’s invested in Canadian listed etfs. We need to sell the Canadian listed etf’, use Norberts Gambit to convert CAN to US dollars. Then purchase the US listed etf’s. All within the RRSP’s accounts.

Do we time the currency market? I don’t think this is possible. What is the historical average exchange rate b/w Can and US dollars? Or is this futile? Or is it best to slowly convert the Can to US dollars over a 1 to 2 yr time period?

Thanks

TJ

@TJ: If you’re switching from Canadian-listed foreign equity ETFs (unhedged) to U.S.-listed foreign equity ETFs, your currency exposures will be the same either way. Don’t be fooled by the specific currency the ETF transacts in – if you purchase VUN (Canadian-listed U.S. equity ETF that trades in Canadian dollars) or VTI (U.S.-listed U.S. equity ETF that trades in U.S. dollars), you are equally exposed to the U.S. dollar. When you buy VUN with your Canadian dollars, Vanguard converts them to U.S. dollars and buys VTI. This is no different from converting your Canadian dollars to U.S. dollars and buying VTI directly (other than the foreign withholding tax implications in an RRSP).

Hi Justin,

Great video.

CIBC investors edge allows Canadian dollars and US dollars in rrsp accounts now, which makes this Norberts Gambit easier I think.

2 Questions:

1) to convert USD to Can dollars, is it just the exact opposite?

2) What is settlement date for DLR AND DLR.U?

thanks in advance

@TJ: Thanks!

Answer #1: Yes, just do the opposite to convert USD to CAD (i.e. buy DLR.U, sell DLR).

Answer #2: Trade date + 2 (it used to be trade date + 3). Watch out for U.S. holidays during the settlement period that don’t match Canadian holidays.

Hi Justin, I have heard that CIBC is exchanging Can to US dollars close to the spot rate now. So is it still advantageous to do Norbert’s Gambit like you describe above? Is it still the cheapest way to convert CAn $ to US $ and vice versa. Are there any risks in doing so? I am just asking because we have large amounts in our RRSP’s and would like to invest in US listed ETF’s to avoid the foreign US withholding taxes. Just seems a little daunting trading such large amounts to get US dollars. thank you.

@TJ: CIBC seems to have better FX conversion rates than many of the other banks. Norbert’s gambit would still be slightly cheaper for larger amounts at CIBC IE (i.e. ~$64 USD of savings on $10,000 CAD conversion), but it’s not as significant.

You could consider converting the larger amounts using Norbert’s gambit, and just accepting the CIBC rates for any new conversions.

Is there a video/instructions for doing the opposite? ie converting USD to CAD using this system on Investors Edge?

@Stuart: You would just do the opposite (i.e. buy DLR.U and sell DLR).

Did they change the rules now that you have to wait for the first leg (buying DLR) to settle (t+2) before you can do the second leg (sell DLR.U)?

@Mike: Not that I know of (the rep you spoke with may be new).

Justin, you have given very clear instructions on how to perform NG with Canada’s big banks. But are you planning to do the same for independent discount brokerages such as Questrade?

@D Munday: I will be releasing Norbert’s gambit videos for National Bank Direct Brokerage and Questrade in the next month or so.

Hmmm, when converting from USD to CAD in my IE non-registered account using Norbert’s Gambit, I didn’t have to wait 3 days between buying DLR.U and journaling&selling DLR. I was able to do so immediately (with the assistance of a trader). Not sure why there’s that difference with the above example.

@Jim R: I’ve heard the same thing from other investors (I’m not sure why my experience was different). I’ll update the post and look at updating the video as well.