In 2020, all you had to do to earn decent returns was stay invested. It didn’t really matter what asset classes you were invested in. Both stock and bond markets performed well, so even conservative investors with a bond-heavy portfolio weren’t complaining.

2021 was a bit different. All-equity portfolios returned around 20%, while conservative investors got the short end of the return stick. Safer bonds were a drag on returns, but investors with a balanced mix of stocks and bonds still saw double-digit returns in 2021.

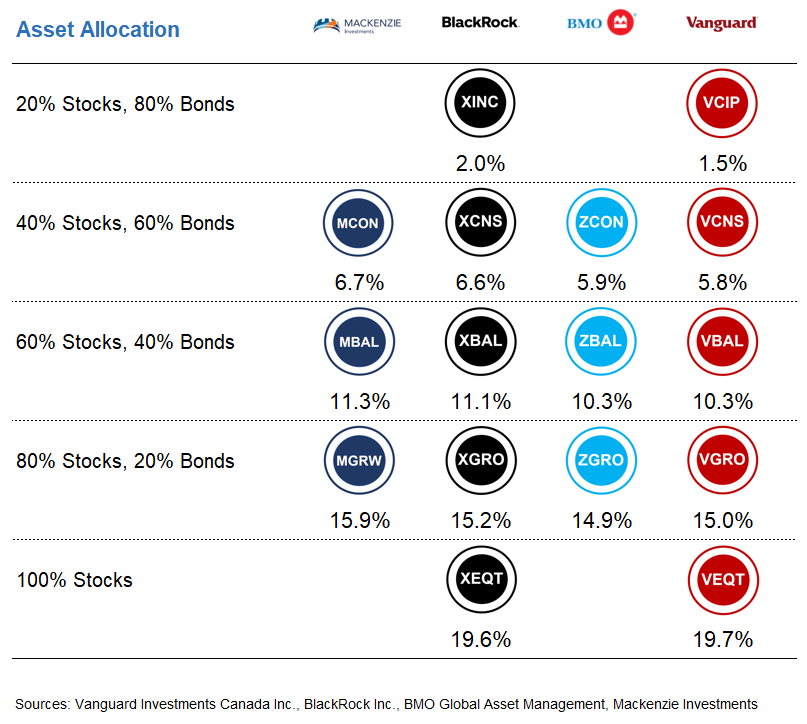

In this post, we’ll review 2021 performance for Vanguard, iShares, BMO, and Mackenzie asset allocation ETFs, as well as for their underlying holdings.

If you’d like to skip straight to the compelling conclusion, you could have thrown a dart at these asset allocation ETF providers, and come out about the same. As usual, the takeaway is as follows: First have a sturdy investment plan to guide your investment allocations to begin with. Then look for a fund provider that lets you implement your plan cleanly and cost-effectively. After that, you may find it interesting to compare the annual nuances between appropriate providers, but it’s largely an optional, if not detrimental exercise.

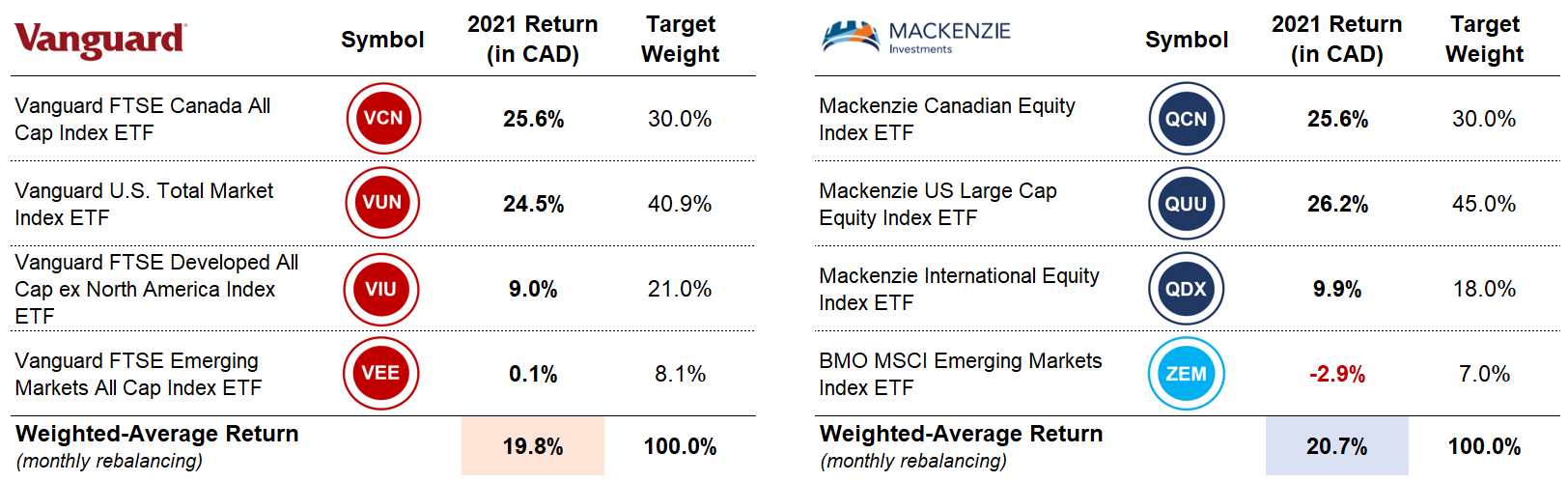

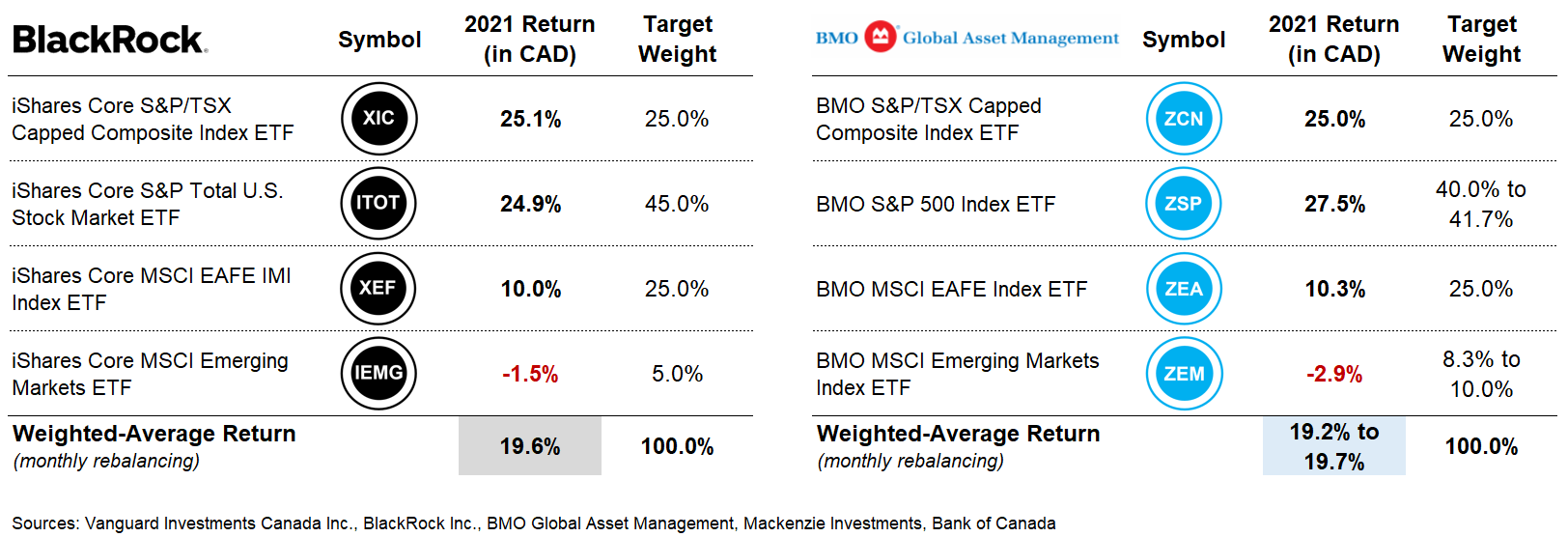

2021 Equity Returns

Before we look at 2021 returns for the asset allocation ETFs, let’s check out the year-end results for their underlying holdings, starting with the equity ETFs in our Canadian Portfolio Manager model portfolios.

While Canadian equities performed adequately in 2020, they really outdid themselves in 2021, returning a net of around 25% across all portfolios. That was enough to squeak past the net returns in Canadian dollars for the broad U.S. stock market ETFs.

U.S. equities also ended 2021 on a high note. The U.S. equity ETFs in our model portfolios returned between 24.5%–27.5% in Canadian dollars, net of withholding tax. The BMO and Mackenzie ETFs had slightly higher U.S. equity returns, due to the large-cap bias in their funds. It’s interesting to note that BMO decided to include a small allocation to mid- and small-cap U.S. equities in 2021, so we may see their large-cap bias diminish over time.

International developed equities ended the year on a positive note as well, with net returns between 9.0%–10.3%. We can largely explain the return differences across issuers based on whether or not they included South Korean companies, which returned –6.5% in Canadian dollars in 2021.

This explains the lower relative performance for the Vanguard FTSE Developed All Cap ex North America Index ETF fund (VIU), which tracks a FTSE index that includes Korea as a developed country. In contrast, the iShares Core MSCI EAFE IMI Index ETF (XEF), BMO MSCI EAFE Index ETF (ZEA), and Mackenzie International Equity Index ETF (QDX) follow developed markets indexes that exclude Korea, classifying the country as an emerging market instead.

Compared to developed markets, emerging markets equities were a disappointment in 2021, with returns ranging from +0.1% to –2.9%. This time, VEE had the slight return advantage, due to the exclusion of the underperforming Korean companies in their emerging markets fund.

All together now: If we combine these equity asset classes according to their target asset allocation ETF weights (rebalancing monthly and adjusting for additional asset allocation ETFs fees), we find their overall equity returns are similar across the board. Mackenzie did manage to slightly outperform the others, with estimated equity returns of 20.7%. This outperformance was mainly due to Mackenzie’s higher allocation to Canadian and U.S. equities, which were the top-performing equity regions in 2021.

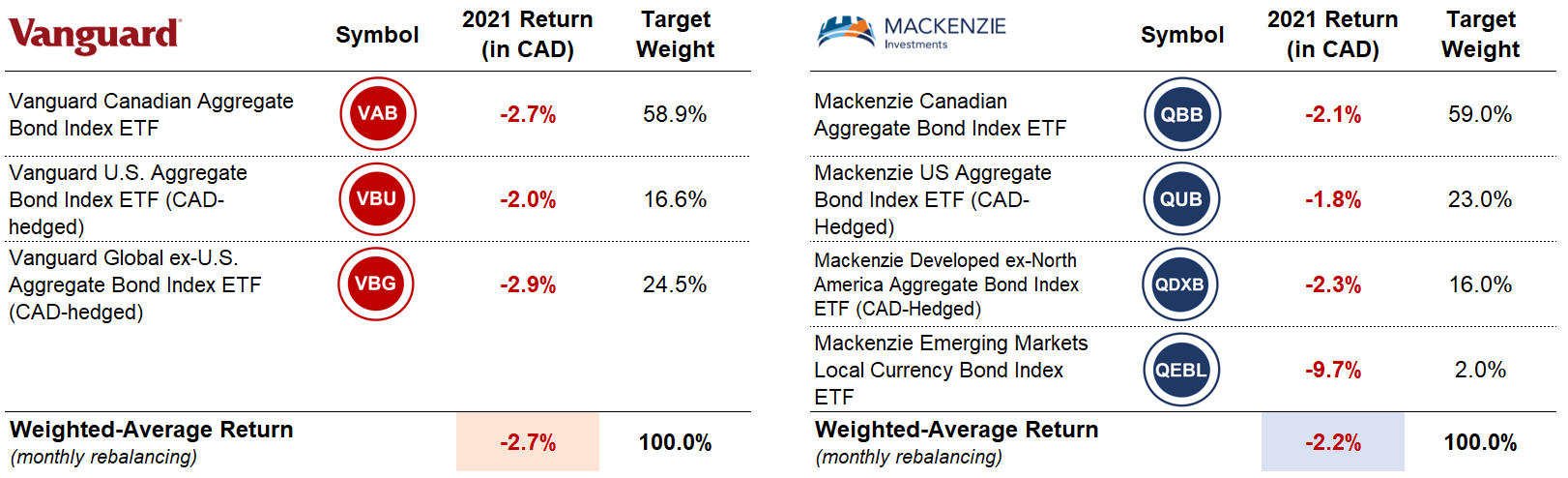

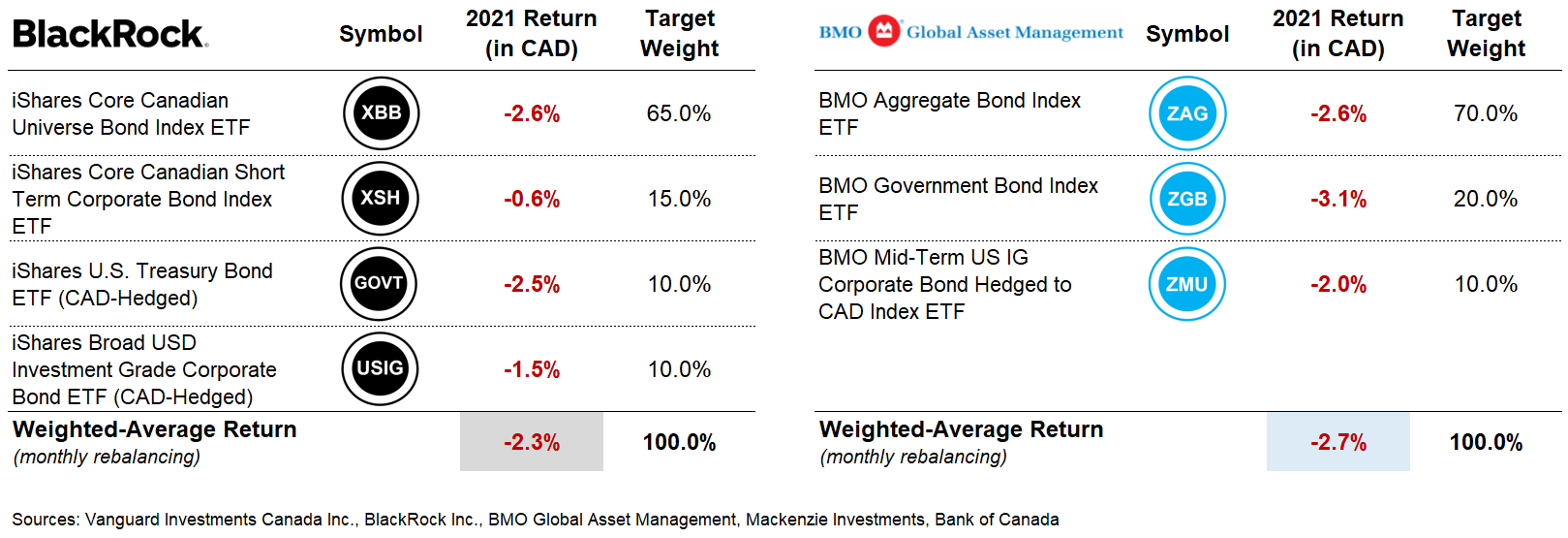

Next, let’s check out fixed income returns, since your asset allocation ETF portfolio likely holds some bonds too.

2021 Fixed Income Returns

The weighted average yield to maturity of Canadian bond ETFs started the year at 1.2%, but had increased to around 1.9% by year-end. Remember, an increase in yield decreases bond prices, so this resulted in modest losses across all fixed income securities included in our model portfolios.

Broad market Canadian bond ETFs returned between –2.1% and –2.7% in 2021, with Canadian government bonds performing even worse, at –3.1%.

Currency-hedged foreign bonds performed similarly to their Canadian counterparts, with returns ranging from –1.5% to –2.9%.

Local currency emerging markets bonds weren’t even that lucky in 2021, with nearly double-digit losses of –9.7%. Fortunately, this asset class only makes up a small portion of the Mackenzie Asset Allocation ETFs, so it had little impact on their total performance.

Short-term Canadian corporate bonds, which make up 15% of the fixed income allocation of the iShares portfolios, fared slightly better, with a 2021 return of –0.6%. Their inclusion helped reduce the iShares portfolios’ fixed income losses in 2021.

To estimate a ballpark return for each portfolio’s fixed income allocation, we can once again take the weighted average of each ETF’s return and rebalance monthly, adjusting for the additional fees charged on the asset allocation ETFs. Doing so provides us with an estimated –2.7% for the Vanguard and BMO portfolios, –2.3% for the iShares portfolios, and –2.2% for the Mackenzie portfolios.

2021 Portfolio Returns

Again, it didn’t much matter which asset allocation ETF provider you invested with in 2021. For any given risk level, their returns were within 1% of one another. Since our estimates gave Mackenzie the edge in both equity and fixed income portfolios, it’s no surprise they outperformed the others across their conservative, balanced, and growth allocations. Because iShares portfolios included better-performing short-term Canadian corporate bonds, they landed in second place at every risk level, except (unsurprisingly) the all-equity group.

Here’s a visual overview for the year:

As we suggested at the outset, don’t read too much into these short-term variations. Mackenzie may have gained the edge over the others in 2021, but that does not foretell what to expect going forward. Over the long-term, we would continue to expect similar returns for comparable asset mixes, so why mess with it? In the wise words of financial legend Charles Ellis:

“Benign neglect is the secret to long-term investing success. If you change your investment policy, you are likely to be wrong; if you change it with a sense of urgency, you’re guaranteed to be wrong.”

— Charles Ellis, in “Wall Street’s Wisest Man”

Besides, leaving your portfolio alone gives you more time to watch for our latest Canadian Portfolio Manager insights throughout 2022 and beyond. Happy New Year!

Hi Justin,

I have been a DIY invester for some years. Lately, I have been reading your articles and your book on ETF investing.

My question today: All in One Global Equity ETFs like VEQT and XEQT contain 20-25% Cdn equity, whereas true World Index types like XWD have only about 4% Cdn equity. Why this large difference? Is one type better than the other?

@Khalil – This article should answer your question: https://canadianportfoliomanagerblog.com/home-bias-in-the-vanguard-asset-allocation-etfs/

Hi Justin,

I hope 2022 has been kind to you and all your loved ones. Thank you for your previous feedback – it has furthered our knowledge base and given confidence that single ETF’s are the way to go.

We opened a non-tax sheltered account with Questrade this year and have been investing in VBAL on a weekly basis – have around 70K invested with a long term horizon. Based on recent conversations and a better understanding of how defined benefit pension income fits into the bigger picture, we would like to assume a more aggressive strategy with these savings and move to VGRO for future weekly investing. Should we leave the 70K in VBAL or sell and reinvest in VGRO at the same time? Doing so would leave us with a single ETF again – or should we maintain both, knowing we will not be buying any more XBAL.

I look forward to your reply and the new knowledge I may be able to gain. Thank you.

@Karim – If there are no consequences to selling VBAL/XBAL, then it would likely make sense to sell the holding and switch to your new target asset allocation ETF, VGRO.

Thank you Justin. I am going to find out what consequences may arise. I had a typo in the initial message “… not buying any mroe VBAL” (not XBAL). Sorry for any confusion. Thank you once again. Karim.

Thank you very much Justin. Just wanted to let you know that I was able to sell all VBAL holdings and purchase the equivalent amount in VGRO. The total cost was around $25. Will continue to invest weekly on a dollar cost average basis for the long term. Really appreciate your timely response. Wishing you every success in your endeavors.

@Karim – Excellent news! Thanks for the update, Karim :)

Best of luck with your investment (and life) success!

Hi,

Wanted some advice.

Should I be concerned that people are moving more towards stocks than bonds? I have VGRO and XGRO right now. Wondering if I should move all to VEQT and XEQT?

Hi Justin,

I think I messed up with this post earlier as it got deleted, Trying again.

We are maxed out on our RRSPs and TFSAs and have been with an investment firm for almost two decades – our AA is 40% bonds/60% equities – most recent breakdown was Cash & Equivalents (0.69%), Fixed Income (40.25%), Canadian Equities (21.19%), U.S. Equities (18.95%), International Equities (18.92%). The weighted average MER of our mutual funds is 0.96%.

One of our new year’s resolutions was to become more independent with our investments – we have been reading materials on the Canadian Couch Potato and recently purchased and read Dan’s book. We started investing in the e-series this year (40% bonds, 60% stocks) at TD where we bank and have invested around $10K so far in this effort. The goal is to save between 80-100K this year in an investment account (non-tax sheltered). We had started off with the TD e-series before Dan’s 2022 portfolio update and the release of his book advocating the merits of the single AA ETF – something that we find very appealing.

Having read Dan’s book and watching and reading what you have shared on this site, we are reconsidering our approach to investing in the e-series and thinking of going with VBAL instead. We are planning to save at this rate (80-100K) for the next 5-7 years before I retire (I was the stay at home spouse and began work in my late 30’s). There is a possibility (50-75%) that my partner will continue to work until age 67, or even 70 as their work is very meaningful personally. We are in our late 50’s (age 57 and 58). Although both of us have defined benefit plans, we are risk averse and have settled with VBAL as an allocation that we feel comfortable with even though we have the ability to tolerate more risk. Your video made the choice between VBAL or XBAL easier. We would like to draw down from my RRSP (retire at 63) in the early years and start CPP and OAS at age 70. The drawn down funds would also be invested into VBAL or an appropriate tax friendly alternative in light of OAS thresholds.

Questions:

1) Move to VBAL instead of e-series starting February? We have only been invested for a month (January 2022; 10K) and will be investing for the next several years. If we can gain enough confidence, we are considering moving our RRSPs and TFSA into VBAL within a couple of years.

2) We will be making weekly contributions and are thinking of signing up for and using Wealth Simple to avoid transaction fees. Quest Trade is another option we need to investigate further. With e-series, we are using the weekly contributions to rebalance the portfolio to maintain the 40%bonds/60% stocks ratio. There are no fees at the present time for TD DI clients. Is there any way to automate VBAL purchases that you are aware of or that may be on the horizon?

3) If we self manage our RRSP and TFSAs, will we have to do the ACB calculation annually? This is something new we learnt from your shared knowledge (thank you). We understand it is something we will need to do in our investment account for VBAL. Is this something we will also need to do with the TD e-series?

4) From a tax perspective, are there steps we should take now as DIY investors so as to not be penalized in later years when decumulation becomes necessary.

Sorry for the long email and multiple questions. Your generosity in sharing knowledge and resources through this site has been very helpful to our efforts at learning and gaining some confidence as we venture into the DIY investment space. The amount of information is mind boggling but you have (and Dan on his site and his book) have made it easier to understand. Thank you very much.

@Karim:

1) With TD e-Series, you’ll need to occasionally rebalance your portfolio, whereas with VBAL, you can avoid this task (which is very appealing).

2) There’s no way to automate VBAL purchases, but you can automate XBAL purchases at Questrade. Also, National Bank Direct Brokerage doesn’t charge for ETF purchases or sales, so they may be a good option to consider.

3) You do not need to track the ACB for any securities held in RRSPs and TFSAs (just in non-registered accounts).

4) I can’t answer this question, as there are too many unknowns.

Thank you Justin. This is helpful – we did not know about the XBAL purchase automation option.

We have invested 10K in e-series this year – the actual value today is around $300-$400 less than when we started. We have started the process to open a Quest Trade account and will start investing in VBAL or XBAL shortly.

Question – in this situation, would you leave the funds ($10K) in e-series or withdraw and move them to the all in one ETF? Is there any benefit to leaving them there? We understand that when markets are down, the same will be true across the board so we will be buying the all in one ETF at a lower cost as well.

Thank you again.

@Karim – I don’t see much benefit in keeping just $10K in e-Series if you’re moving to an asset allocation ETF approach (as the exposure would be similar).

Hi Justin,

Further to the earliest post from this morning, I looked at the composition of the funds in our 40/60 portfolio and the proportions this morning were as follows overall: Cash & Equivalents (0.71%), Fixed Income (41.19%), Canadian Equities (21.37%), U.S. Equities (20.66%), International Equities (16.08%). The funds are actively managed – we have annual meetings with the advisor to review performance and although taking weekly views to see how we are doing, we do not intervene to seek changes.

Hope this extra information helps provide any context that may have been missing earlier. Thank you once again.

Generally when stocks are down, you want to buy more of them; does the same apply to bonds because they have been falling in price?

@Noob – Yes, but you should first have a target asset mix and rebalancing thresholds for your portfolio, so this should be a very systematic process (which takes the emotion out of your decisions).

Hi Justin,

This was an excellent post. Just finished Dan’s book and trying to absorb it all.

What is you take on using VCNS when one in in the “decumulation” phase especially in a non-registered account. Is there any growth there or is the payout, just over 2%, what we can expect?

@NormL – I don’t see any major issues using VCNS in the decumulation phase of retirement in a non-registered account. Over the long-term term (10-15 years), I would expect total returns of around 3.5% (after MER and foreign withholding taxes), although these are not guaranteed. If you needed additional cash for expenses above the fund distributions, you would need to sell a portion of the fund each year (or monthly).

Hi Justin,

I just was wondering if it is wise to build a portfolio for TFSA, that is for a 20-year investment horizon, following either VBAL or ZBAL but with some modifications as:

1. For the bond portion use blend of aggregate (ZAG, VAB, XBB) and short-term (VSB, ZPS, XSB).

2. Replace “the emerging markets” with VRE. I put VRE here for income purposes because based on my understanding, it behaves to some extent different from stocks as well as concerning interest rates correlations.

I have TFSA, RRSP, and non-registered accounts. Is it wise if I build a balanced portfolio (60/40) with income/dividend Equity ETFs such as XDV, VDY, XEI, ZDV, ZDY, XHU, and Bonds? Only for one of these accounts.

Thank you very much.

@Sara: It seems like your plan is a form of market-timing (I don’t think it’s a coincidence that you’re considering getting rid of 2021’s worst performing fixed income and equity asset classes (broad-market bonds and emerging markets), and buying more of the better performing fixed income and equity asset classes (short-term bonds and Canadian dividend-focused ETFs).

I wouldn’t overthink your investment plan – asset allocation ETFs are a gift to DIY investors. Choose your target asset mix, choose your ETF product provider, and then focus on your savings strategy.

Hi Justin,

Crypto was obviously a big story in 2021. Can you explain why couch potatoes don’t need to allocate to other asset classes beyond fixed income and equities, like gold, real estate or now, crypto?

Thanks for the amazing work you do!

@John: Crypto, gold, etc., are not productive asset classes (i.e., they don’t have a positive expected return above inflation). You are really just hoping that someone will buy it off of you for more than you pay for it. There will always be new speculative asset classes that entice investors to abandon their prudent long-term plan, but they can safely be ignored.

Many broad-market equity ETFs include real estate investment trusts (REITs), so investors have exposure to this asset class.

thanks Justin also reply to Lawrence

I never think of build XIC XUU XEF XEC, I as individual can do better than XEQT, by allocate a better asset allocation.

only because I have a large portfolio, so save couple thousands management fee per year is good for me.

and 4 funds etf is still something I can manage.

but if i only have <500K I will go XEQT.

my 4 funds will waiving the percetnage different than XQET, but I don;t see a 1% more difference than XEQT. so it won;t matter a lot for the total return.

Hi Justin,

I am also wondering how these Asset Allocation ETFs, specifically the “All Equity” ones will work in the long term. 100% of these new ETFs, whether All Equity or Equity/Bond allocation have all only started in the last 3-5 years or so. In the last 3-5 years, we have been in a Bull Market mostly, with US market leading the way. Therefore, an allocation of 40% to 50% in the US Market, 20% to 30% in Canada, and remaining in International/Emerging makes sense and the funds have performed well. What if the US market goes into a bear market and Canada and International markets outperform for say the next 5-10 years. This happened between year 2000 and 2010 after the dotcom crash. Will Vanguard/Blackrock reallocate their targets to increase International allocation and decrease US allocation? I am worried that past performance of the indices are not necessarily the indicators of the future. One shouldn’t be invested in these asset allocation funds, only to find out that the funds fall along with US market because of the higher allocation percentage to US Stocks and based on market cap weighting. If US stock market continues to outperform in the future, only then these funds will remain the winners.

Alternatively, wouldn’t it be prudent to copy the allocation percentages for now, for example from VEQT, and individually invest in VUN, VCN, VIU and VEE separately? Which means, in the future, if necessary, we could adjust the percentages based on which market gains momentum? For example, there could be a time in the future where the meaningful ranking should be VCN: 50%, VIU: 20%, VEE:20%, VUN: 10%!! Or will VEQT prudently do that reshuffle if and when required so we don’t have to worry? The way these funds are set up, it looks like they won’t adjust the target allocations much, no matter what happens. Also, there is no history of anything like that happening, again it’s been a short while since these came into existence, so it is difficult to know how they will behave in the future.

Hi Lawrence,

Although what you say is true, there is no guarantee that the US will continue to hold such weight in global markets, the question you pose is a fundamentally unanswerable question. No one in the world knows what the correct allocation to US/Canada/International is. (If someone knew, they would be making millions on Wall Street, not telling people for free online on a blog post) Only people know can predict the future can know for certain.

Even though past returns do not guarantee future returns, we can use historical data to make an educated guess, and correct our path as we go, which is what these companies are doing with the asset allocated ETFs. Vanguard and Blackrock are the two biggest asset managers in the world. They have 1000s of research staff, probably pondering this exact question. I seriously doubt that if there were a fundamental shift in market allocation, that they would not 1. publish multiple papers of their findings and 2. adjust these AA ETFs accordingly.

Alternatively, let’s say you truly do not trust the two biggest asset managers in the world and want to hold the underlying ETFs. What percent are you going to allocate for US/Canada/Internaltional? What makes your allocation more or less wrong than what Vanguard/Blackrock chose? At what point would you adjust your allocations? How would you ever figure out if your allocation is more correct than others? All these questions are unanswerable unless you are answering them in hindsight or you can predict the future.

In summary, no one can predict the future. No one knows the perfect asset allocation. The reason why people recommend these AA ETFs is to force people to not play around with their portfolio. At the end of the day, it does not matter if US under performs, or if Canada out performs because the two most factors affecting your portfolio returns are 1. minimizing fees and 2. time IN the market.

Hi Viktor,

Thank you for your response. I am not saying I don’t trust Vanguard/Blackrock. They are the biggest and the best and majority of the market assets are highly influenced by them. Just that these new products will perform well only in the current allocation scenario. No one will ever know what the correct allocation should be, but there is a chance to reduce downside risk to some extent when something terrible may happen, over a long period of time. Imagine VEQT/XEQT between 2000 and 2010 (10 years)! If that scenario occurs, the asset managers will either have to do portfolio reallocation, or come up with new products to suit conditions at that time. These funds will only go up or down with the US Stock market as of now. Even Vanguard/Blackrock have people trying to figure out, like you mentioned, and will and could make bad decisions or change their mind on how these funds should work.

What I have in mind is highly risky, but may decrease the downside/draw down if there will be a protracted bear market. By Momentum strategy, what I would do is look for broad market asset classes (in this case, the underlying 4 funds) that have a higher momentum (performance) in the last 6 to 12 months. Clearly Bonds and Emerging Markets have had the weakest performance in the trailing 12 months as noticed every month for the last 1 year, followed by Developed Markets. But these ETFs’ allocation has remained constant and not adjusted since their inception. I would readjust my allocation at least quarterly based on the performance of the individual asset classes in the trailing 12 months. What percentage allocation to be used, that I myself am not sure, but higher allocation to the best performing assets. That way more money will be invested in the best performing (best momentum) assets at all times. If all equities (all markets) were to fall at the same time, similar to 2008 recession (based on trailing 12 months performance), then money would be moved to bonds until equities performance / momentum picks up again. You might call this market timing, but I would call this reducing downside risk by staying awake at least every quarter and reevaluating rather than “buy and forget”. This will be a bit more cumbersome for the “buy and forget” group. Momentum has always worked and irrational behavior in the publicly traded securities only makes momentum concept stronger.

Asset allocation funds, these new products, all look good in the current market, and even in the last 10 years or so. Remember we have been in the longest bull market in history (since 2011-12), and 100% of these Asset Allocation ETFs were created in this bull market. Every fund looks great in a bull market, but if a scenario such as 2000-2010 or that great recession of the 80s happen, then there will be a paradigm shift in the investments industry.

Lawrence, what you are alluding to is an attempt to “TIME THE MARKET”, which is the number 1 no no for personal investing.

Don’t do it, people who do are more likely to lose more than someone who didn’t. They’ve done studies, it doesn’t work.

I suggest you read a great book called A Random Walk Down Wall Street. Once done that one read Winning the Losers Game.

Try to get the most up to date copy as there have been numerous revisions of the books, and that’s because they are so great.

Martin, I don’t want to time the market as well. I like the concept of Asset Allocation ETFs. All I want to know (which I am not sure anyone does), is whether these ETFs will adjust to the changing environment or stick to their target allocation as they are set up now. For example, if S&P500 is doomed for the next 10 years in a protracted bear market, and Emerging Markets have better returns during that time, then I hope these Asset Allocation ETFs will gradually adjust their target allocations accordingly and based on the momentum. You can’t deny the momentum factor which plays a major role and for extended periods of time. Also, what we saw in the last 10 – 15 years may never happen in the next 10 to 20 years. Remember US market was the worst performing from 2000 to 2010!

Where the LIKE button for this post?

Dang can’t edit post. My like was referring to Viktor.

I was looking for an international ETF for my TFSA and was pleased with what I read about VIU. I’m second guessing myself now because VIU seems to be getting outperformed by VEF in both its growth and dividend—am I reading that correctly? Is VIU still the better choice between the two?

@John – VEF is not directly comparable to VIU. VEF is currency-hedged, while VIU is not. And VEF also includes an allocation to Canadian stocks, whereas VIU does not.

However, VEF has a less tax-efficient structure than VIU, as it does not hold the underlying international stocks directly (resulting in an additional layer of unrecoverable foreign withholding taxes across all account types).

Hi Justin,

Thank you for your helpful insights as always. I have a question specific to making a decision between XEQT and VEQT for my investments. XEQT has quarterly distribution, whereas, VEQT has annual distribution. Doesn’t it help if one chooses a fund with quarterly distribution as there will be better Dollar Cost Averaging because of more frequent reinvestments per year, than obtaining distributions (additional shares) only once per year?

@Lawrence: The distribution frequency is largely irrelevant. Technically, the less distributions you have, the more days your cash will be invested in the stock market. Once the ex-dividend date arrives, the price of the ETF drops by the amount of the dividend (and you don’t get access to this cash until the payment date, which could be more than a week away).

Thank you Justin. While I was focused on DCA and interest compounding for quarterly dividends, I forgot to realize that money saved in the fund would grow rather than being distributed and reinvested. Appreciate your response!

Hi Justin,

Thank you for posting your incredible analysis. A question about Adjusted Cost Base (ACB). Does it make sense to track it even if I have only one non-registered account and I’m only buying investments to build my portfolio (young investor profile)? Thank you and I wish you a happy new year!

@Bruno: You’re very welcome! To answer your question, yes, you should update your ACB each year (usually around March). If you wait 20 years, you’ll have one heckuva job to do when you finally sell units of your ETF. I’ve laid out the step-by-step process in this video | How to Track the Adjusted Cost Base (ACB) of Your Asset Allocation ETF: https://www.youtube.com/watch?v=84qCOhMuA8g

Hi Justin,

Great article! I’ve been using some of the earlier model portfolios and i was wondering if it would make sense to move to the asset allocation etfs instead. Also, if i don’t use these etfs, for fixed asset allocation, does it make sense to move from ZAG to another recommendation in the latest model portfolios?

@Alex – If there are no tax implications of making a switch, asset allocation ETFs would be simpler to manage. If you’re aiming for broad-market Canadian bond exposure, ZAG is still a suitable fixed income ETF.

Great article Justin. After a discouraging 2021 for the Bond market, have your thoughts changed regarding the use of bonds to dampen a portfolios volatility?

@Mike Sullivan: Thanks! I haven’t changed my thoughts at all. Retired investors will need bonds or GICs in their portfolio for their withdrawals (in case equities are down in value), and most accumulating investors would not be comfortable with a 100% all-equity portfolio (so having a core bond allocation may help them stay the course and not abandon their investment plan if stocks underperform bonds for an extended period of time).

Great summary Justin. I think you made it abundantly clear, it really does not matter which ETF provider you go with, it is more important to create a plan and stick to it; sticking to the plan is easy on paper, but difficult in practice.

All you guys at PWL are truly empowering the average Canadian investor with valuable, insightful and unbiased personal finance knowledge.

I wish you and Mrs. Bender all the best in 2022. Looking forward to all blogs, youtube videos and podcasts you guys have in store for 2022.

@Viktor: Thank you so much for stopping by the blog – we have a lot of great content planned for 2022, so we’re looking forward to releasing it shortly! :)

Is there a blog post that explains the September 30, 2021 model portfolios? They no longer show the difference between portfolios for TFSA, RESP, Margin, etc. and I was wondering why.

@Tyrell: I decided to take them down, as they were confusing most readers. For more advanced investors, they are already aware of how to use U.S.-based versions of the foreign equity ETFs in RRSPs, and more tax-efficient bond ETFs or GICs in non-registered accounts. I’ve also been releasing a series of foreign withholding tax and asset location videos, which are meant to explain some of the core tax concepts.

The Ultimate Guide to Foreign Withholding Taxes on ETFs: https://www.youtube.com/watch?v=NSkub4OqkuM

Asset Location – Part 1: Key Concepts: https://www.youtube.com/watch?v=lQBpRLlEmGg

Asset Location – Part 2: The Ludicrous Strategy: https://www.youtube.com/watch?v=ScoLiJOeL6A

Asset Location – Part 3: The Plaid Strategy: https://www.youtube.com/watch?v=ezDWpZ6HNyk

Hello and Happy New Year

I would like to know how these Portfolios would compare to the all in one etfs?

@Jagdish: Happy New Year! These portfolios are all-in-one ETFs :)

Are you going to be updating the Benchmark Your Portfolio calculator?

@Chris: It’s currently not at the top of my to-do list.

Hi so are TD e series portfolio’s off your radar now?

@Mr – The TD e-Series portfolios are still great options for investors that don’t want to pay commissions to purchase ETFs (or want to set-up a systematic investment plan). However, there are now many brokerages that provide commission-free asset allocation ETF purchases (i.e., Questrade, BMO InvestorLine, National Bank Direct Brokerage, etc.), and Questrade even allows for systematic ETF investing in XBAL and XGRO. Asset allocation ETFs also have the added benefit of automatic rebalancing (which the TD e-Series do not have).

I have a question:

for a 100% stock portfolio.

for Energing Market the range is from 5%-8% that is a too wide swing;

what you prefer if you build from scrach? which number will you choose from 5% to 8%?

@Boss – If I was building a 100% stock portfolio from scratch, I would generally take the following steps:

1. Choose your split between Canadian and foreign equities (let’s assume you decide on a 30% Canadian, 70% foreign equity split).

2. For the foreign equity allocation, you could opt for a market-cap weighted approach for your US, international developed, and emerging markets allocation. As of November 30, 2021 (for the MSCI indexes), this would be 62.23%, 26.08% and 11.69% respectively (Note: The split would be slightly different if you were using FTSE indexes)

3. You would then multiply your 70% total foreign equity weight by the foreign market-cap weight of each equity region:

Foreign equity portfolio weights:

US = 70% x 62.23% = 43.56%

Intl = 70% x 26.08% = 18.26%

EM = 70% x 11.69% = 8.18%

Total = 70%

You can make any adjustments based on your own preferences. However, Vanguard already takes a similar approach with their 100% asset allocation ETF (VEQT), so it would just be easier to buy a one-fund solution, as long as you are fine with the 30% Canadian, 70% foreign equity split in their fund.