Selecting the right asset allocation ETF for your portfolio can be intimidating — especially if you ask your friends or family for their opinion. They’ll probably give you conflicting recommendations, each of them confident they’re right, and they might suggest a much riskier asset mix than you’d select on your own.

Remember: it’s not their money at risk. My advice on seeking advice is to ignore what your peers are doing. This is your money, so you should decide how much risk makes sense for your portfolio.

When determining your willingness, ability and need to take risk, a good place to start is by completing a risk profile questionnaire. Vanguard Canada has provided a decent online form, which we’ve linked to in Step 1 of the model ETF portfolios section of the Canadian Portfolio Manager blog. It includes 11 questions to help you consider your personal risk profile, as well as your investment circumstances.

Let’s look at the factors that should influence the amount of risk you take in your portfolio.

Your Ability to Take Risk

Your ability to take risk depends on your time horizon and the stability of your income. If you have many years to invest and a stable income, you should be able to take more risk.

For example, if you’re 30 years from retirement, or a tenured professor with a pension, you have the ability to invest in an asset allocation ETF with a higher stock allocation (which has more risk). On the other hand, if you’re a few years from retirement, or working less-reliable freelance jobs, you may want to consider a higher bond allocation (which means less risk).

Although Vanguard’s questionnaire is a good starting point, it’s not without its issues. For example, the first few questions relate to when you’ll need your money back. If you indicate that you plan to withdraw your money in 2 years or less, but you answer the remaining questions as aggressively as possible, the suggested asset mix will be 50% stocks and 50% bonds. We think this portfolio is way too risky for an investment horizon of under 2 years.

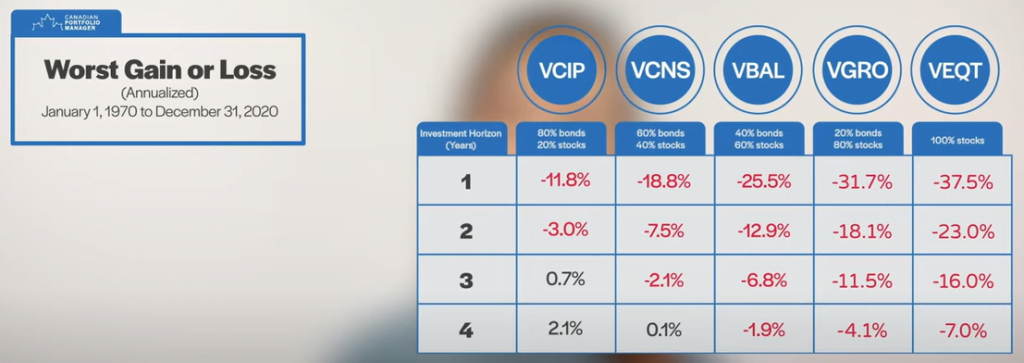

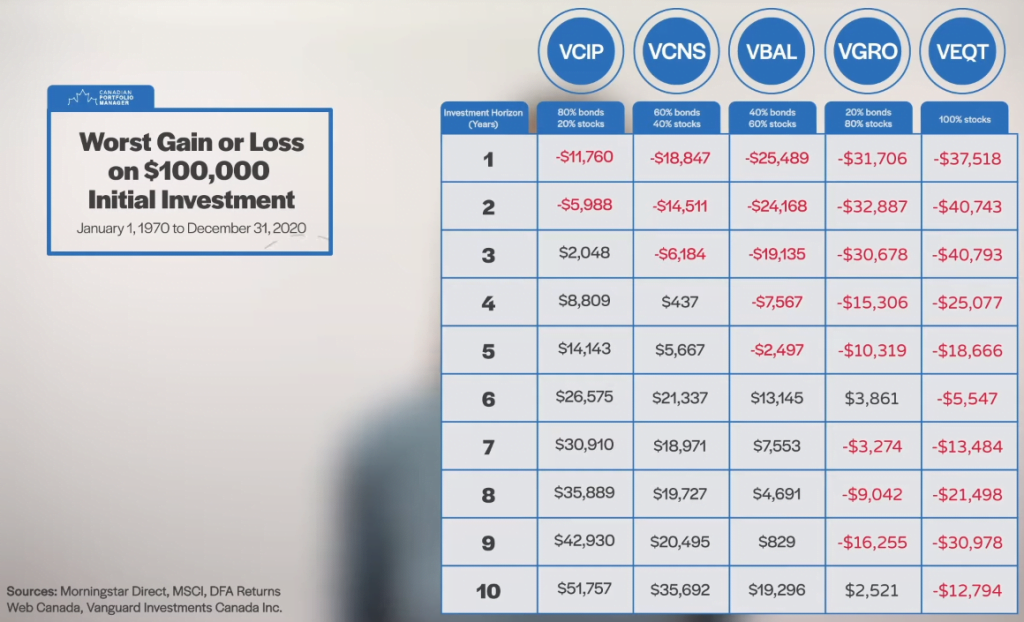

As a rule of thumb, you shouldn’t invest in any asset allocation ETF if you require the cash in less than 5 years. We’ve analyzed the hypothetical performance for the Vanguard asset allocation ETFs over the past 50-plus years ending December 2020, and here’s what we found:

- The worst 1- and 2-year periods were negative for all Vanguard asset allocation ETFs.

- The worst 3-year period was negative for all ETFs except the Vanguard Conservative Income ETF Portfolio (with ticker symbol VCIP), which holds 80% in bonds. Even still, VCIP only returned 0.7% over its worst 3-year period.

- The worst 4-year period was negative for all ETFs except VCIP and the Vanguard Conservative ETF Portfolio (with ticker symbol VCNS). But they only returned 2.1% and 0.1%, respectively, over their worst 4-year periods.

Sources: Morningstar Direct, MSCI, DFA Returns Web Canada, Vanguard Investments Canada Inc.

So, looking further out:

- If you need the cash in 5 to 9 years, VCIP and VCNS should be the only asset allocation ETFs on your radar. Even the Vanguard Balanced ETF Portfolio (with ticker symbol VBAL), which allocates 60% to stocks, returned only 0.1% over its worst 9-year period.

Sources: Morningstar Direct, MSCI, DFA Returns Web Canada, Vanguard Investments Canada Inc.

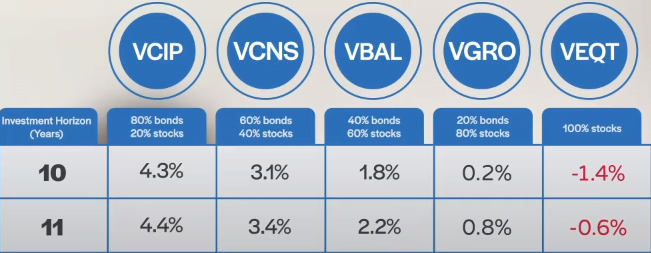

- If you won’t need the cash for 10 to 11 years, VBAL could be an appropriate choice, as even its worst 10-year return during this period was 1.8%.

Sources: Morningstar Direct, MSCI, DFA Returns Web Canada, Vanguard Investments Canada Inc.

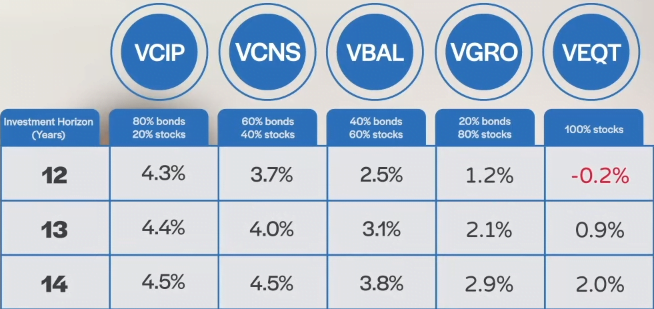

- If you don’t need the cash for 12 to 14 years, you could look at a more aggressive ETF, like the Vanguard Growth ETF Portfolio (with ticker symbol VGRO).

Sources: Morningstar Direct, MSCI, DFA Returns Web Canada, Vanguard Investments Canada Inc.

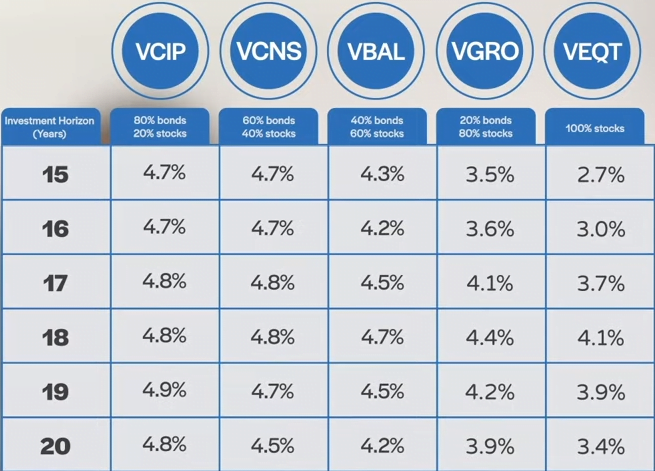

- And if you’re investing for 15 years or more (and you’re comfortable dialing up your portfolio risk to eleven), the Vanguard All-Equity ETF Portfolio (with ticker symbol VEQT) might be right up your alley.

Sources: Morningstar Direct, MSCI, DFA Returns Web Canada, Vanguard Investments Canada Inc.

Your Willingness to Take Risk

Now, even if you have the ability to take risk, you might not be willing to endure the gut-wrenching stress of a severe market downturn. Even if you have 20-plus years before you require the funds, can you keep your cool when your ETF’s value plummets — which it certainly will from time to time?

There are five questions in Vanguard’s questionnaire that address this concern. But when I completed them to be as conservative as possible (while still indicating a high ability to take risk), the suggested asset mix was 60% stocks and 40% bonds. This is probably too aggressive if you get anxious during stock market declines. For example, even a balanced portfolio with 60% stocks lost more than 25% during its worst 1-year period between 1970 and 2020.

To estimate your willingness to take risk, I suggest imagining what you’d do if the stock allocation in your portfolio dropped by 50%. This is a reasonable worst-case scenario.

If you’re considering VGRO, with an 80% stock allocation, assume the fund’s total value could drop by 40% in a severe downturn. So if you’re planning to invest $10,000, imagine that dropping to $6,000. And if you have $100,000, ask yourself how you would react if it fell to $60,000.

Would you truly be willing to ride out that roller coaster, or (more likely), would you feel like you’d just made a huge mistake?

Be honest with yourself: are temporary setbacks going to completely freak you out? Go through the same process with other asset allocation ETFs until you’ve identified one you can stomach. By going more conservative, you might leave some extra returns on the table over time. But in our opinion, that’s a fair trade-off for avoiding the incredibly expensive mistake of selling your holdings at a deep loss in a panic and fleeing to a more conservative ETF — or, worse, to cash.

If the only bear market you’ve lived through was the brief crash of March 2020, you might be under the impression that market downturns don’t last long. Here’s a reality check. We looked at worst back-tested losses on the Vanguard asset allocation ETFs over rolling time periods. For example, a $100,000 investment in VGRO, which is 80% stocks, was still showing a loss of over $16,000 at the end of its worst 9-year period. And VEQT, which is 100% stocks, was still down by nearly $13,000 at the end of its worst 10-year period. While it’s true these types of longer-term losses were rare during the last 50 years, you still need to be comfortable with the possibility of this occurring again.

For these reasons, we believe your willingness to take risk should always take priority over your ability to take risk.

Your Need to Take Risk

And the final consideration — often forgotten in all the excitement — is how much risk you need to take. If you’re a young investor — and you’re not the offspring of the rich and famous — you probably need to take some market risk to grow your portfolio over the next few decades.

But what if you’ve been a diligent saver all your life, and you’ve already built a substantial portfolio? Could you meet your financial goals by simply investing in GICs? If so, you may not need to put your savings at risk by allocating any of it to stocks.

As you get closer to retirement, you can work with a financial planner to determine whether you can afford to take less risk over time.

Risky Business

Before I let you go complete your questionnaire, I’d like to reemphasize the relationship between your willingness and ability to take on risk. Your willingness should be the one driving the bus, especially when you’re still gaining investment experience.

As a young investor, you’ll often hear that time is on your side, so you can be aggressive with your investments. If we’re talking about ability to take on risk, this is true. But if you only have a modest amount to invest, think about how excruciating it will be when the markets head south on their periodic “vacations,” taking your seed money along for the ride.

Until you’ve personally had the chance to ride out a long bear market or two, we suggest opting for a more conservative or balanced ETF, rather than a growth-oriented or 100% equity ETF.

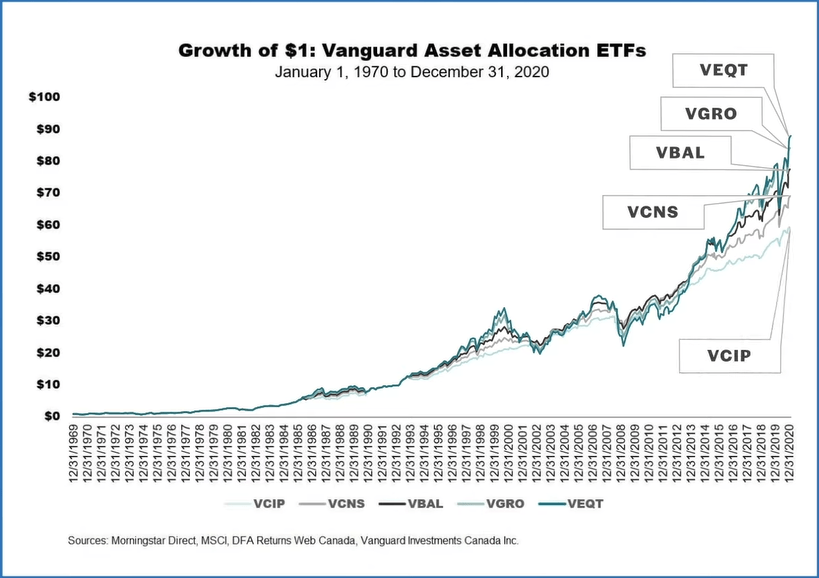

During the entire period we back-tested — between 1970 and 2020 — the Vanguard asset allocation ETFs with higher stock allocations (like VEQT) outperformed those with lower stocks allocations (like VCIP). However, it’s important to understand that taking more risk, even over periods of 20 years or more, does not guarantee a better outcome.

For example, VEQT underperformed VGRO during 61% of the 373 monthly rolling 20-year periods we measured. And over those same periods, VGRO underperformed VBAL around 49% of the time — basically a coin flip. That’s the other side of taking more risk that investors sometimes forget: it doesn’t always lead to higher returns, even over the long term.

There’s nothing wrong with starting off with a more conservative asset allocation ETF, even if you’re very young, have a long-term time horizon, and a stable income. I’ve yet to meet an investor who failed to meet their financial goals because they invested in a balanced asset allocation, rather than a more aggressive one. So, don’t feel like you need to fake a high risk tolerance to fit in. You can go with a more conservative or balanced asset allocation ETF to start, and use all your youthful energy to embark on an aggressive savings plan.

As you gain more experience, you can always decide to sell VBAL and switch to a more aggressive ETF, like VGRO or VEQT.

Hopefully you’re now feeling more confident about choosing the right asset allocation ETF. Before you run off to place your trades, do a quick reality check on what returns you can expect from these Vanguard Asset Allocation ETFs. Spoiler alert: It’s not anywhere near 10%.

How did you back-test these ETFs given that they are all very recent? For instance, VBAL’s inception date is 25 jan 2018.

@Alexandre – We simply used the historical gross returns of similar indexes that the underlying ETFs follow, and deducted the asset allocation ETF’s MER from the returns.

Hi Justin,

Thank you for this amazing and super clear post.

You said that if the investment horizon is 15 years or more, then VEQT is the recommendation. Any thoughts on VFV though? I think it’s also a solid choice for a 15 year (or beyond) horizon?

Would you recommend 50% VEQT + 50% VFV? 60% VEQT + 40% VFV? 70% VEQT + 30% VFV? Or…?

Hi Justin,

If I chose to go with Vanguard’s VGRO and in 10 years, i decide to change to VBAL, which is the best way to do so?

Is it only by selling VGRO and then buying VBAL? Are there any consequences by doing so?

Thank you,

@Olivier Leclerc – It depends. If your investments are in RRSPs/TFSA (so you don’t need to worry about capital gains tax implications), so you could either sell VGRO and immediately buy VBAL, or gradually add a bond ETF to VGRO with new contributions (like VAB) and once your overall allocation is 40% bonds, you could sell VGRO and VAB, and buy VBAL.

In taxable accounts (where you may not want to trigger a gain), you could gradually buy a bond ETF with new contributions (like VAB) to reach a 60% stock/40% bond allocation.

Love the videos and blogs!! Keep it up! What would you recommend for when we are ready to start reducing our risk in our portfolios of asset allocation ETFs. Currently I am 50/50 of VGRO and VBAL. As I near my retirement, would it be wise to sell my VGRO and invest all into VBAL or VCNS? (Depending on my risk at that time) My thoughts were at 5 years to retirement, I would start investing any new funds to VBAL only and then as I neared closer buy into VCNS but unsure what to do with the VGRO in either of those scenarios at that time.

@Corey B – Thanks! :)

It would depend on the asset allocation that you’re targeting, and your tax situation. If you’re investing in just a TFSA and RRSP, you don’t need to worry about the tax implications of switching (but you may need to manage the tax impact in your non-registered accounts as you transition to a more conservative asset mix).

If taxes are an issue, you could also consider holding on to VGRO and VBAL, and adding new money to bonds and GICs as you approach retirement.

Hi Justin.

I noticed your model portfolios don’t have the different complexity levels. Is there a blog post to explain this change?

@Ryan – I decided to take them down, as they were causing more confusion than they were worth. I’ll be releasing a few videos instead which discuss the asset location strategies.

Hi Justin,

Thanks for this post! It has helped me to decide which ETF allocation I will use.

However, I do have a question:

I am planning to go with the VGRO portfolio. I have a TFSA account with no more contribution room, so part of my savings will be invested in a non-registered account. Is it convenient to get the VGRO for both accounts (TFSA+non-registered) or do you recommend buying the underlying ETFs in the portfolio 1 by 1 and try to distribute them in a more tax-efficient manner? I gues bonds in the TFSA and stocks in the non-registered?

Thanks,

Edmund

@Edmund: I’m glad you liked the post :)

I recommend that most DIY investors simply buy a single asset allocation ETF in all account types. However, there are a number of asset location strategies that I plan to discuss in upcoming blogs/videos (so you can check these out as well). Generally though, in both strategies, stocks would be held in the TFSA first.

hi Justin,

I’m 30 years old and planning to retire at 55 years old. should I currently buy 50 percent VGRO and 50 percent veqt in my rrsps?

what do you recommend for my age and growth time frame.

thanks!

Hello,

Thanks for the article and all the information you are providing in this blog.

I am starting with these DIY investments and I have maybe a basic question that I haven’t been able to answer by just reading your posts.

I am planning to use one of your model portfolios to select the asset allocation I feel more comfortable with. My question is the following if, for example, I decide to use the Vanguard portfolio 80% Bonds 20%Stocks, should I buy the “VCIP ETF”, or am I supposed to buy all the underlying ETFs one by one myself. According to my understanding, the VCIP portfolio already contains those assets with the same distribution as it is shown there.

Are there any benefits/advantages of buying only the VCIP rather than the underlying ETFs one by one?

Thanks,

Franco

@Franco – Investors would generally want to purchase a single asset allocation ETF (like VCIP) instead of the individual underlying holdings. Benefits of asset allocation ETFs include:

– Improved investor behaviour (you won’t agonize as much about how each underlying ETF is performing)

– Simplicity (just buy a single ETF and add money to it)

– Automatic rebalancing (the ETF provider takes care of this for you)

– Broad global diversification

– Low-cost

This was very useful information as we have RESPs for grandkids who are in Grades 8 and 11 this year. I’ve been doing some reading about dialing down risk so your piece was very timely. Thanks.

@Brian – Good point! These guidelines (if adjusted for the age of the beneficiaries) could be used to create a reasonable RESP asset allocation strategy.

Hi Justin. One aspect of risk and asset mix selection that doesn’t commonly get a lot of discussion is capacity to sustain losses and what percentage of your portfolio and more importantly, net worth and or cashflow, can you afford to lose. As a retiree, I’ve learned this is a key if not most important parameter in determining my risk tolerance and therefor my ideal asset mix.

“As a rule of thumb, you shouldn’t invest in any asset allocation ETF if you require the cash in less than 5 years.” This doesn’t make sense.

Even if you need cash in 5 years time, you don’t need all of your cash in 5 years. Even at 55, my investment horizon is 20 years plus. In fact, the prevailing wisdom in FIRE circles is to increase the percentage of equities after the initial 5-10 year period of retirement (reduce sequence of returns risk.) Whether VEQT and a bond tent yields the same as VBAL over a 20 year investment horizon would be a useful comparison.

@Bill G – To clarify, if you need 100% of the value of your asset allocation ETF in less than 5 years, you shouldn’t invest in an asset allocation ETF.

Ok, thanks, Justin. I think it’s important to be clear because you could see, as I did, that people might interpret their retirement date as the date “they need their cash.”

Just to add another comment: It’s not really the fault of Vanguard or any other ETF brand for these results. They are just representative, literally, of the market over those periods of time.

Of course, if they are advertising “10% returns” then that’s a problem.

Justin, an extremely well-reasoned and data-driven look at risk. The “ability, willingness and need” factors apply to any form of investing, and this article lays them out beautifully. Very useful reading, whether interested in asset allocation ETFs or a different vehicle. Thanks!

@Rob Steele – We’re so glad you liked the article! It was our most popular video on the YouTube channel, so it made sense to (finally) post the updated blog to go along with it (with the help of our new colleague, Rebecca :)