As mentioned in our initial foreign withholding tax lesson, the amount of foreign dividend withholding taxes you incur as an ETF investor depends on two important factors. The first is the structure of the ETF that holds the foreign stocks. And the second is the account type in which you hold the fund—such as an RRSP, TFSA, or non-registered account.

Depending on these two factors, your foreign dividends could be subject to one, or even two layers, or levels, of withholding tax.

Level I withholding taxes are those levied by the developed countries where the international stocks are domiciled, such us Japan, France, Switzerland, and so on.

Level II withholding taxes are incurred when the international stocks are held indirectly via a U.S.-listed ETF. Specifically, there’s an additional 15% U.S. withholding tax on the foreign dividends in certain account types before the U.S.-listed ETF pays the net dividends to Canada.

With this in mind, let’s look at the foreign withholding tax implications for the three international equity ETFs from our last video. To review, these include:

- The Vanguard FTSE Developed All Cap ex North America Index ETF (VIU)

- The iShares Core MSCI EAFE IMI Index ETF (XEF), and

- The iShares Core MSCI EAFE ETF (IEFA)

In terms of fund structure, IEFA is a U.S.-listed ETF that holds international stocks, while XEF and VIU are Canadian-listed ETFs that hold international stocks.

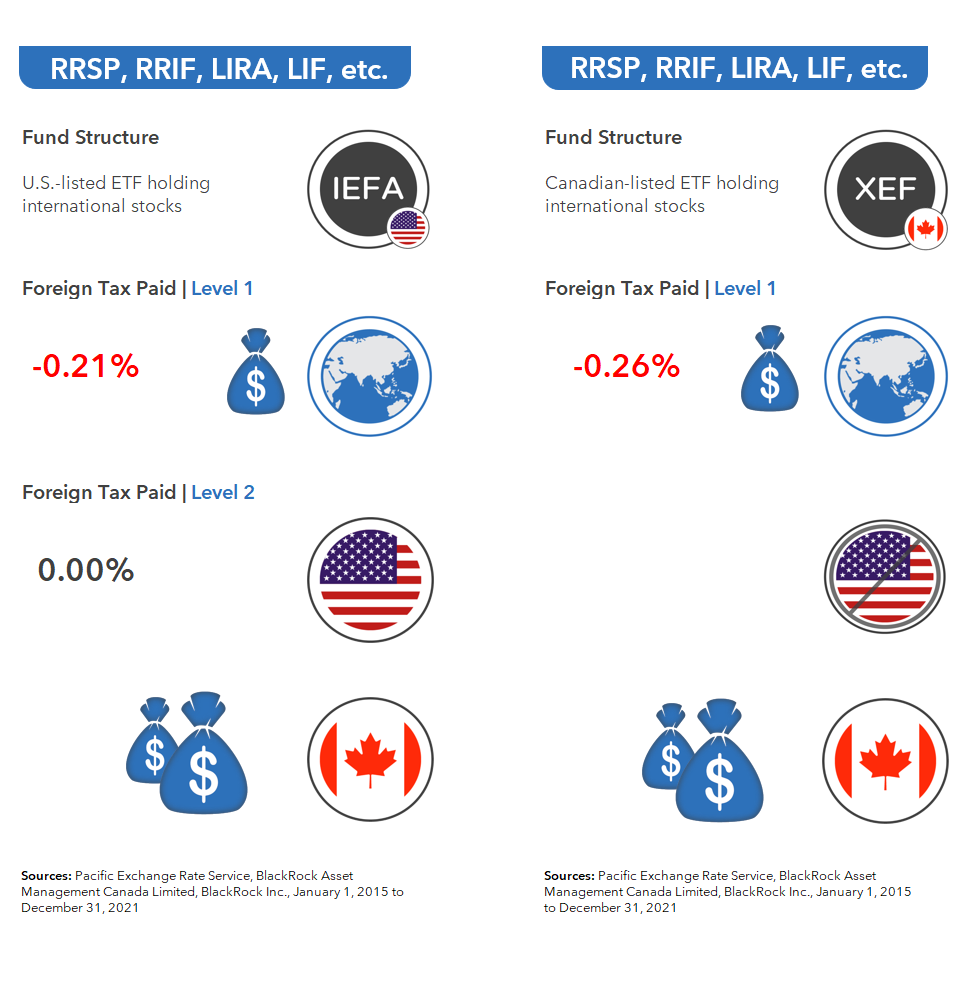

Both fund structures help you avoid the second layer of U.S. withholding tax if you hold them in RRSPs or RRIFs … but for different reasons.

For a Canadian-listed international equity ETFs like XEF or VIU, the first layer of foreign withholding tax still applies, based on foreign companies paying dividends to the Canadian fund. But because foreign dividends bypass the U.S. on their way to Canada, you get to avoid the second layer of U.S. withholding tax, regardless of the account type in which it’s held. It’s interesting to note, since January 1, 2015 (which is the first full calendar year XEF held their international stocks directly), the annualized tax drag has been similar to the fund’s MER.

Then there’s the U.S.-listed international equity ETFs like IEFA. They also still incur the first layer of withholding tax when the foreign companies pay dividends to the U.S. This structure also avoids the second layer of tax drag, as long as you hold it in an RRSP or RRIF. This time, the tax break is due to a treaty between Canada and the United States, which exempts these account types from the 15% U.S. withholding tax otherwise incurred.

So, bottom line, when holding an international equity fund in an RRSP, RRIF, or similar account, you can expect a similar overall tax drag whether you hold the U.S.-listed ETF that holds international stocks (like IEFA), or a Canadian-listed ETF that holds international stocks (like XEF or VIU).

Does that mean it doesn’t matter whether you prefer U.S. or Canadian-listed international equity funds for these account types? Before you reach that conclusion, please wait for our next blog/video, where we’ve got some additional points to cover.

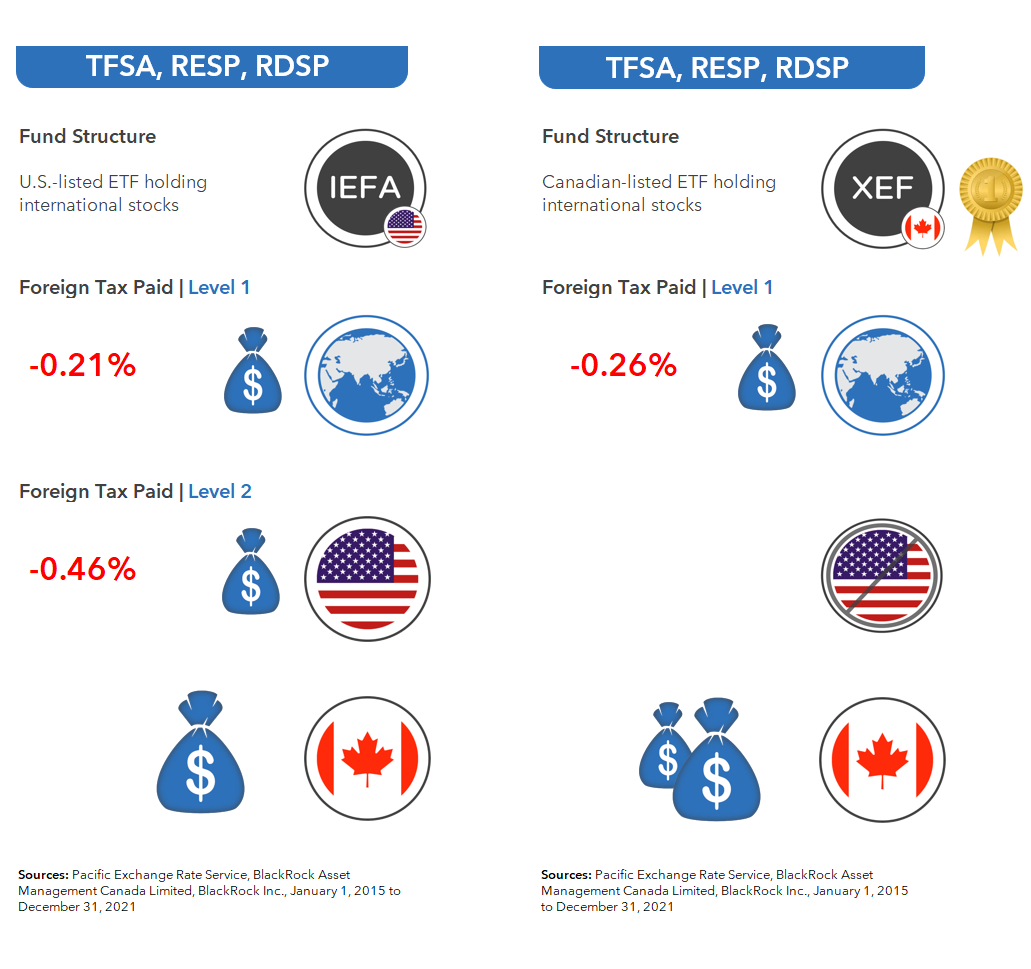

What about holding international equity ETFs in TFSA, RESP, and RDSP accounts? For these, the preferred fund structure is a Canadian-based ETF like XEF or VIU, which holds the international stocks directly. This structure results in only one layer of foreign withholding taxes, while a U.S.-listed ETF like IEFA will be subject to two layers of foreign withholding tax on its international stock dividends. That’s because that U.S./Canadian tax treaty to exempt the 15% U.S. withholding tax does not exempt these account types. Plus, since January 1st, 2015, this second layer of taxes has been even more punitive than the first.

So, if you’re holding international equity ETFs in your TFSA, I’d suggest opting for the Canadian-listed ones like XEF or VIU.

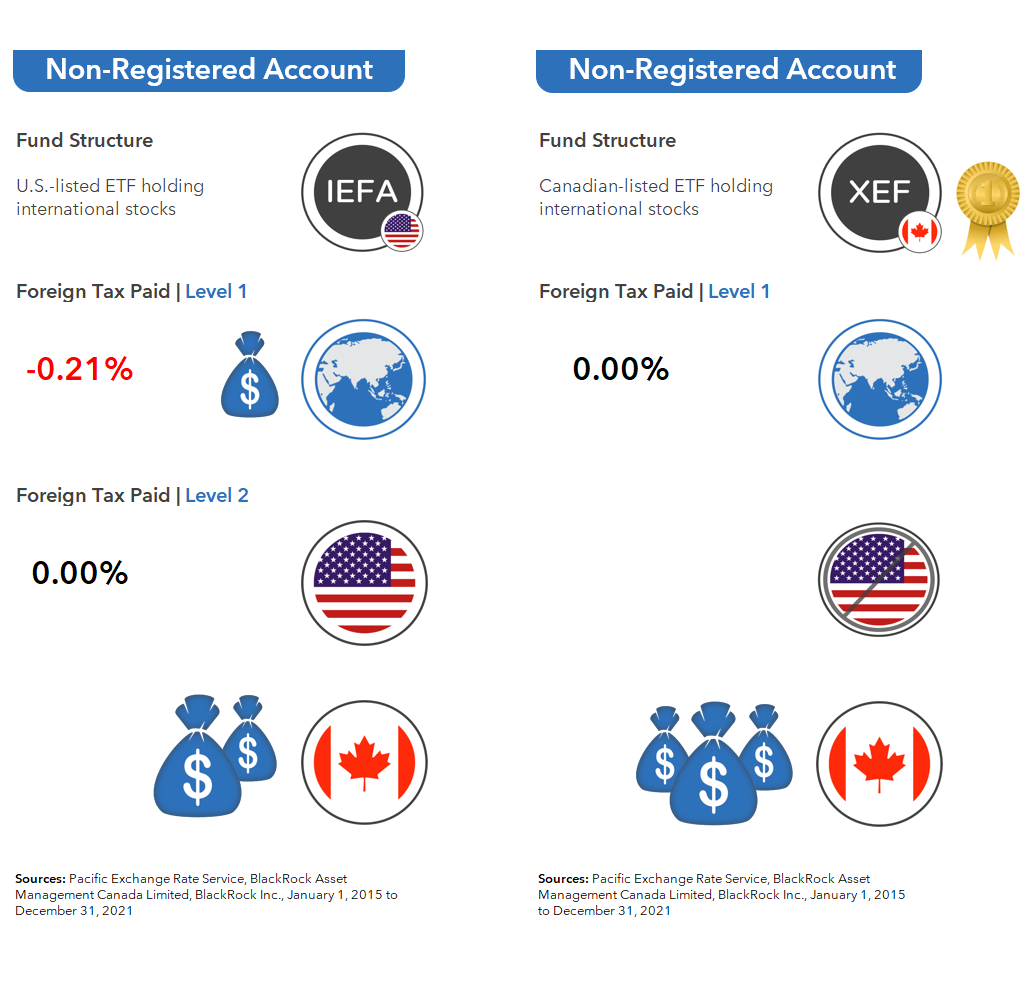

I also prefer the same Canadian-listed ETF structure for non-registered accounts. Here too, only one layer of withholding taxes will apply – and even that layer is generally recoverable each year when you file your tax return.

Compare that to the other structure: a U.S.-listed international equity ETF like IEFA. Its foreign dividends are subject to the two layers of withholding taxes, and only the second layer of U.S. withholding tax is generally recoverable. So, for non-registered accounts, a Canadian-listed international equity ETF like XEF or VIU, is the preferred fund structure for reducing the foreign withholding tax drag.

Alright, that’s a lot to digest, so feel free to review the material again. Coming up in our next blog/video, we’ll determine whether it makes sense to hold IEFA in an RRSP to reduce your product costs. See you then!

Could you provide an estimate of FWT on XEQT held in an RSP (For example based on $1000 invested for 1yr).

I have read the total FWT combined is about 0.22% but is that on the total gained from a year of cumulative distributions derived from those applicable etfs?

For example 4 of the etfs were subject to FWT and their distributions were total of $100 for the tax year. The tax applied on $100 would be 0.22%?

Can’t you claim reimbursement of tour US withholding taxes when you file your income tax return with the information supplied on RL-15 or T3?

To what extent is the FWT recoverable in a non registered account for the Canadian listed international ETFs? Will it only be recovered if one has taxable income to offset? Do you recommend the HXDM and HXEM ETFs for tax simplicity?

@Claude – In personal non-registered accounts, it is generally 100% recoverable (but you do need sufficient taxable income). In corporate non-registered accounts, the foreign withholding taxes impact the refundable corporate tax mechanism, so foreign dividends received in a corporation are tax in-efficient (i.e., ~64% combined corporate/personal tax rate for a top rate Ontario taxpayer).

I don’t generally recommend HXDM or HXEM for investors, as there are other risks (like regulatory and counterparty) that I am not comfortable with.

Thanks for the great posts. I’ve learned a lot over the last few months thanks to you guys. I’m wondering about the withholding tax bps on ZGRO in both a TFSA and RRSP. I’ve use your Excel calculator for VGRO and XGRO but it doesn’t include ZGRO. Thanks in advance!

@Andrew – I haven’t specifically calculated the FWT for ZGRO, but it would be similar to VGRO and XGRO.

Even though ZEM is more tax-efficient?

@Andrew – Emerging markets is a small portion of the asset allocations ETFs, so any potential tax-efficiency of BMO’s EM ETFs will only result in a modest difference.

Happy I found your website via your YouTube channel!

Would holding the Vanguard ETF VEE make more sense in an RRSP vs. a TFSA from a tax perspective? Thank you

@Fernando – Welcome to the blog! When held in an RRSP or TFSA, VEE would have the same foreign withholding tax drag (i.e., it would lose two levels of withholding tax). I’ll be releasing videos on this topic shortly.

In a corporate account, XEF should be more tax efficient than IEFA, right? There would be a similar 0.21% tax drag like in the personal tax example (once recoverable taxes were recovered), right? The MER discrepancy (0.22% for XEF vs 0.07 for IEFA) would shrink that discrepancy slightly though, right?

@Diego Revere – I haven’t crunched the numbers recently for a corporate account. But the refundable dividend tax credit in corporate accounts doesn’t work well for foreign dividend income – Canadians typically end up paying more in total taxes (i.e., corporate + personal).

Thanks for the great blog post Justin! It was clear and easy to understand.

From what I’ve been able to tell, the new TFFHSA (Tax Free First Home Savings Account) coming later this year will follow the TFSA rules with respect to the treatment of foreign withholding tax. Will you be covering this in a future post?

@Brenda – I’m glad you enjoyed it! :)

The new FHSA will follow the TFSA rules with respect to the treatment foreign withholding tax (as it is not considered a retirement account). I may cover the new FHSA in a future post.