In an earlier blog/video, we compared four different ETFs for capturing the U.S. total stock market. These included:

- The Vanguard Total Stock Market ETF (VTI)

- The Vanguard U.S. Total Market Index ETF (VUN)

- The iShares Core S&P Total U.S. Stock Market ETF (ITOT), and

- The iShares Core S&P U.S. Total Market Index ETF (XUU)

We now need to include some caveats to the conversation in the form of tax ramifications. The U.S. government levies a 15% tax on U.S. dividends paid to Canadian investors. And because these taxes are sometimes withheld before you receive your cash dividends, you may never notice they’re there. But they are. And their impact can be far greater than a fund’s more obvious MER or expense ratio.

The amount of foreign withholding taxes you end up paying depends on two important factors. The first is the structure of the ETF that holds the stocks. The second is the account type used to hold the ETF.

In terms of fund structure, VTI and ITOT are U.S.-listed ETFs, holding U.S. stocks. In contrast, VUN and XUU are Canadian-listed ETFs that hold U.S.-listed ETFs that hold U.S. stocks.

In terms of account types, we’ve got various registered and non-registered accounts, which will also determine the level of withholding taxes applied to your U.S. stock dividends.

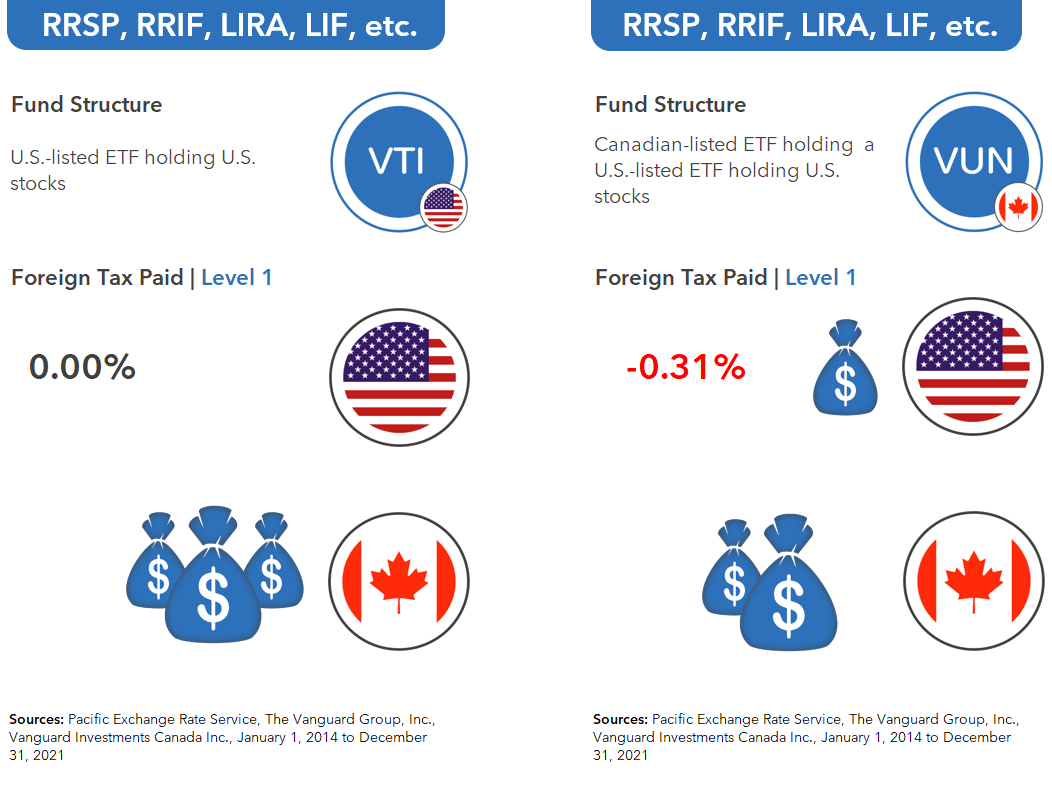

Foreign Withholding Taxes in RRSPs

First, let’s look at your RRSP, or similar registered accounts such as a RRIF, LIRA or LIF. For these, the winning choice from a withholding tax perspective is a U.S.-listed ETF that holds U.S. stocks, like VTI or ITOT. That’s because holding a U.S.-listed U.S. equity ETF in your RRSP exempts all dividends from the 15% U.S. withholding tax, due to a tax treaty between Canada and the U.S.

In comparison, the 15% withholding tax will apply if you hold a Canadian-listed ETF that holds a U.S.-listed ETF that holds U.S. stocks … like VUN or XUU. Since January 1st, 2014, the annualized return drag for VUN from foreign withholding taxes has been noticeably more than its management expense ratio.

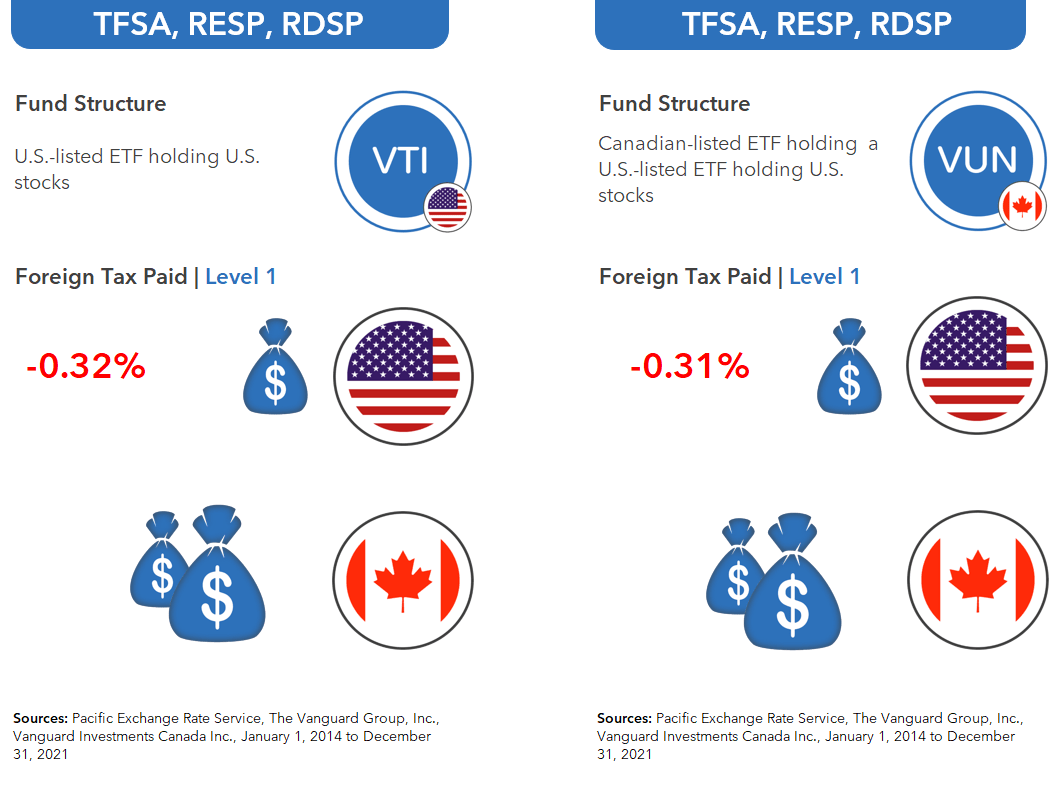

Foreign Withholding Taxes in TFSAs

And what if you’re holding U.S. equity ETFs in a TFSA, RESP, or RDSP? Unfortunately, there’s nothing you can do about the withholding tax drag within these account types. U.S.-listed U.S. equity ETFs (like VTI or ITOT) receive no preferential tax treatment here, so they’re effectively the same as Canadian-listed ETFs that hold U.S.-listed U.S. equity ETFs (like VUN or XUU) and are subject to a similar foreign withholding tax drag.

For this reason, I would recommend opting for VUN or XUU in your TFSA, RESP, and RDSP accounts. You don’t get the tax break no matter what, but these fund structures help you avoid costly currency conversion fees (which we’ll discuss in our next blog/video), as well as a host of other issues.

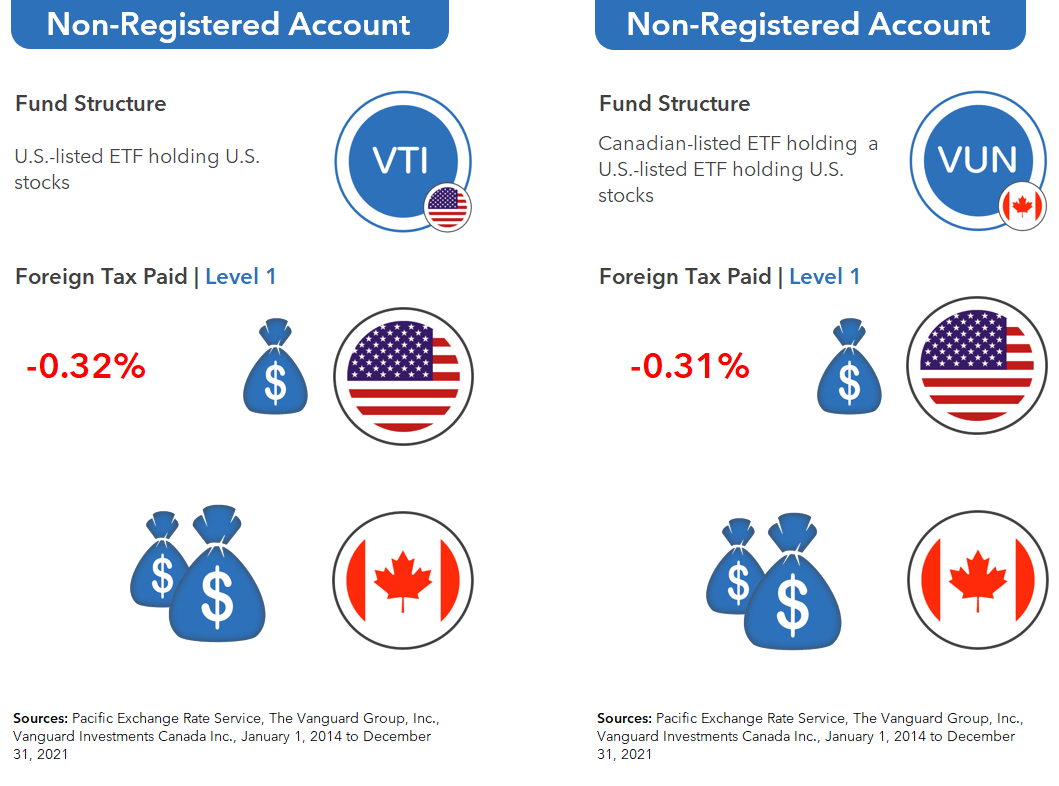

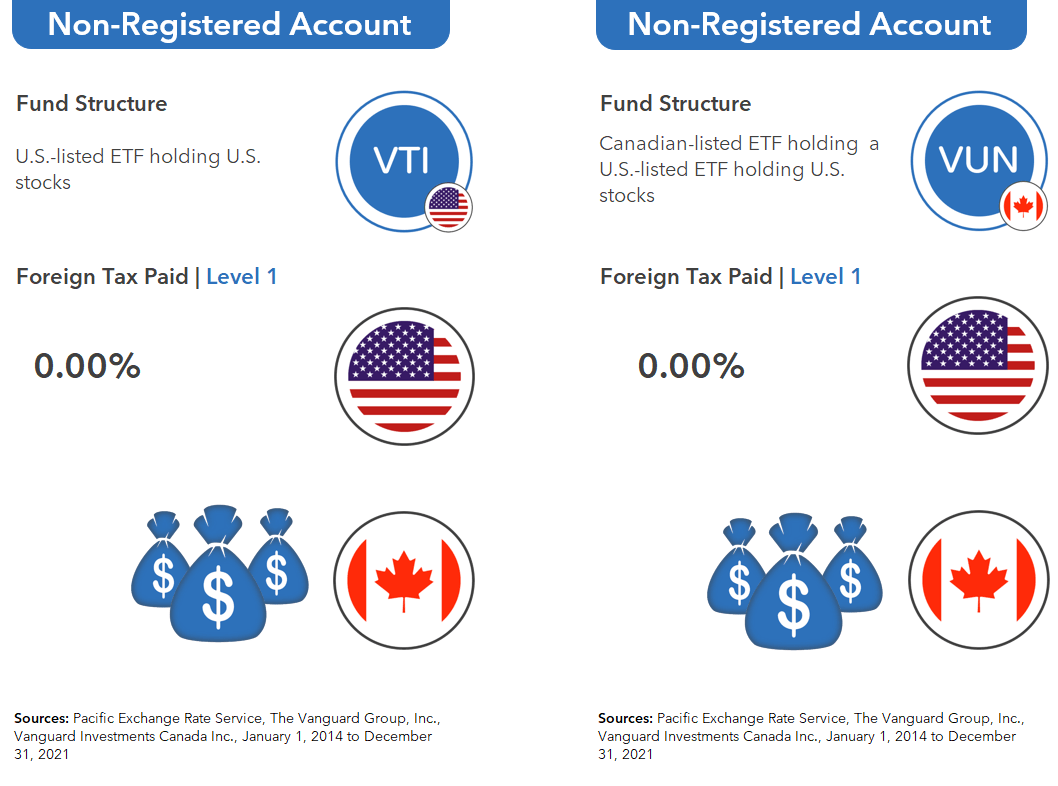

Foreign Withholding Taxes in Non-Registered Accounts

Now onto your non-registered accounts. U.S. withholding tax also applies here, no matter which ETF structure you choose.

At tax time, you can generally claim a foreign tax credit to recover the foreign taxes paid, but you will still pay Canadian income tax on the full dividend.

Since the foreign withholding tax implications are the same for both structures in your non-registered accounts, I would generally recommend sticking with Canadian-listed ETFs that hold U.S.-listed U.S. equity ETFs, like VUN and XUU.

In our next blog/video, we’ll show you why you may still want to avoid investing in VTI or ITOT, even in accounts where the foreign withholding taxes are eliminated. See you soon!

Hello,

I have a Vanguard Windsor Fund Investor Shares account, through Vanguard.com

I made a withdrawal of $9,000 US, but was charged 30% tax withholding,

I’m a Canadian citizen & filled out the W-8 form for tax exemption.

Is this correct or was I overcharged ?

Thank you for your time,

Joanne

P.S. I love your video !

My RRSP has been maxed out, but I still have some US$. What is the best strategy to invest the US dollars without converting to Canadian dollars?

Thanks

Good stuff THX

Justin, I think I read a piece of yours where you mention that this “withholding tax thing” is negligible unless your portfolio is at least a certain size. Would you know where you may have said that? Would love to re-read.

Could you use a total return ETF from another provider to avoid the withholding issues if they don’t pay distributions?

@Mike , @Eric Davis – Many total return ETFs use a swap structure, which includes a swap fee that offsets the benefits from eliminating the foreign withholding tax drag in RRSPs and TFSAs (the FWT is generally recoverable in non-registered accounts).

Your posts & videos are awesome, keep it up!

@Dan – Thanks! There are plenty of videos/blogs in production, so I likely won’t run out of steam for the foreseeable future :)

Hi Justin,

What is your opinion about Horizon swap-based ETFs, like HULC or HGRO, for TFSA and Non-Registered Accounts considering the withholding tax, knowing their underlying holdings may differ?

@Vincent – Based on their financial statements, HULC (and therefore, a portion of HGRO) are subject to U.S. withholding taxes:

(Page 22): https://horizonsetfs.com/wp-content/uploads/2022/06/HULC-EN-AR2021.pdf?ver=1669115280

What about HXS this seems a great alternative as it avoids all withholding taxes and effectively converts the dividend to capital gains

Thoughts ?

Hi Justin,

What are the FWT implications for using asset allocation funds such as XGRO which contains ITOT?

@David Scott – XGRO is a Canadian-listed ETF that holds (among other ETFs) a U.S.-listed U.S. equity ETF (ITOT). So the FWT implications for the U.S. equity portion of the ETF would be similar to VUN or XUU.

Hi Justin. You suggest holding US listed ETF (such as VTI) in RRSP. Wouldn’t the currency exchange cost far exceed the 0.31% tax cost of using Cdn listed ETF such as VUN? Or am I missing something.

@Khalil – In the video, I note that the most tax-efficient U.S. equity ETF structure in an RRSP from a foreign withholding tax perspective would be a U.S.-listed U.S. equity ETF (like VTI or ITOT).

Currency conversion fees would be expected to offset most, if not all of this FWT benefit over the long-term – I’ll be discussing this exact topic in my next video/blog, so stay tuned! :)

You have not commented on another group of ETFs. Canadian Listed ETFs holding US securities directly. Eg. ZNQ, ZSP. I hold these in my RSP. How does withholding tax affect these ETFs?

@Bruce – They have the same foreign withholding tax implications as VUN or XUU (i.e., Canadian-listed ETFs that hold U.S.-listed U.S. equity ETFs).