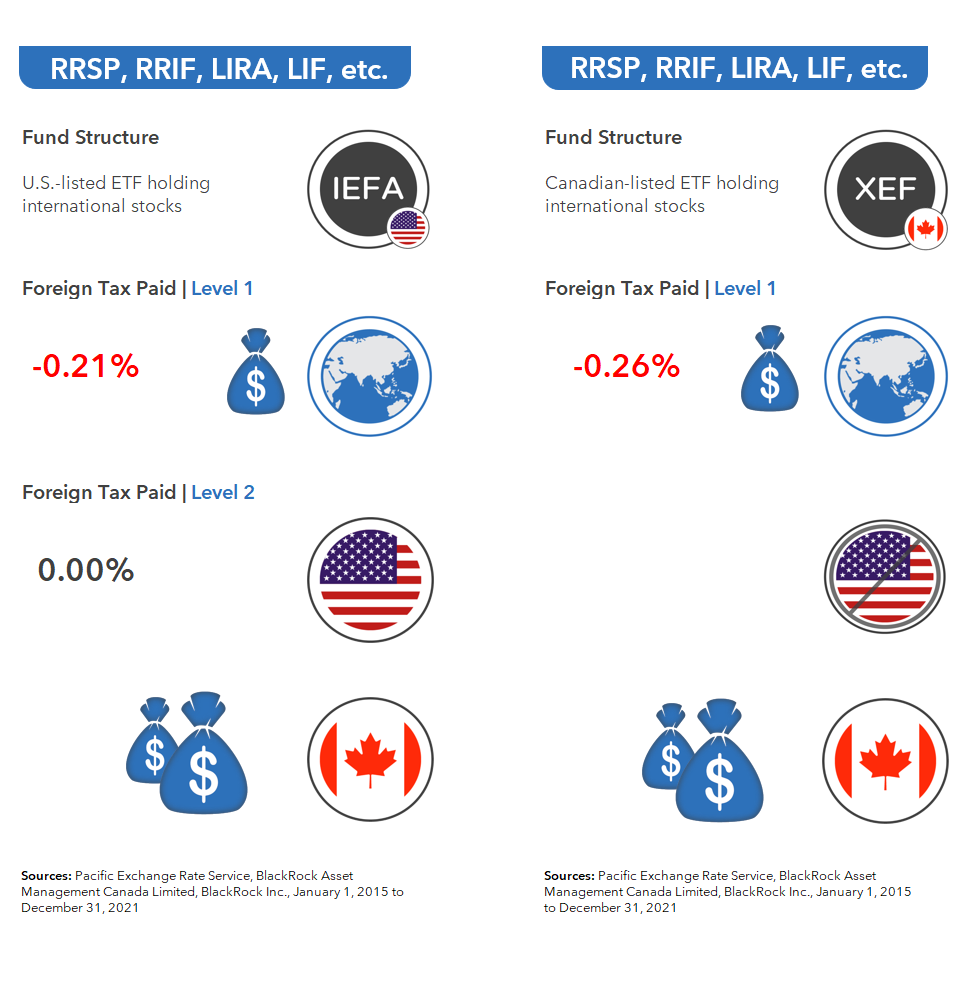

In our last blog/video, we learned, when holding an international equity ETF in an RRSP, you can expect a similar foreign withholding tax drag whether you hold a U.S.-listed ETF like IEFA, or a Canadian-listed ETF that holds the stocks directly, like XEF or VIU. We also pointed out, there’s more to know before you just throw a dart to decide which fund type to prefer. Today, we’ll take a closer look at what we mean by that.

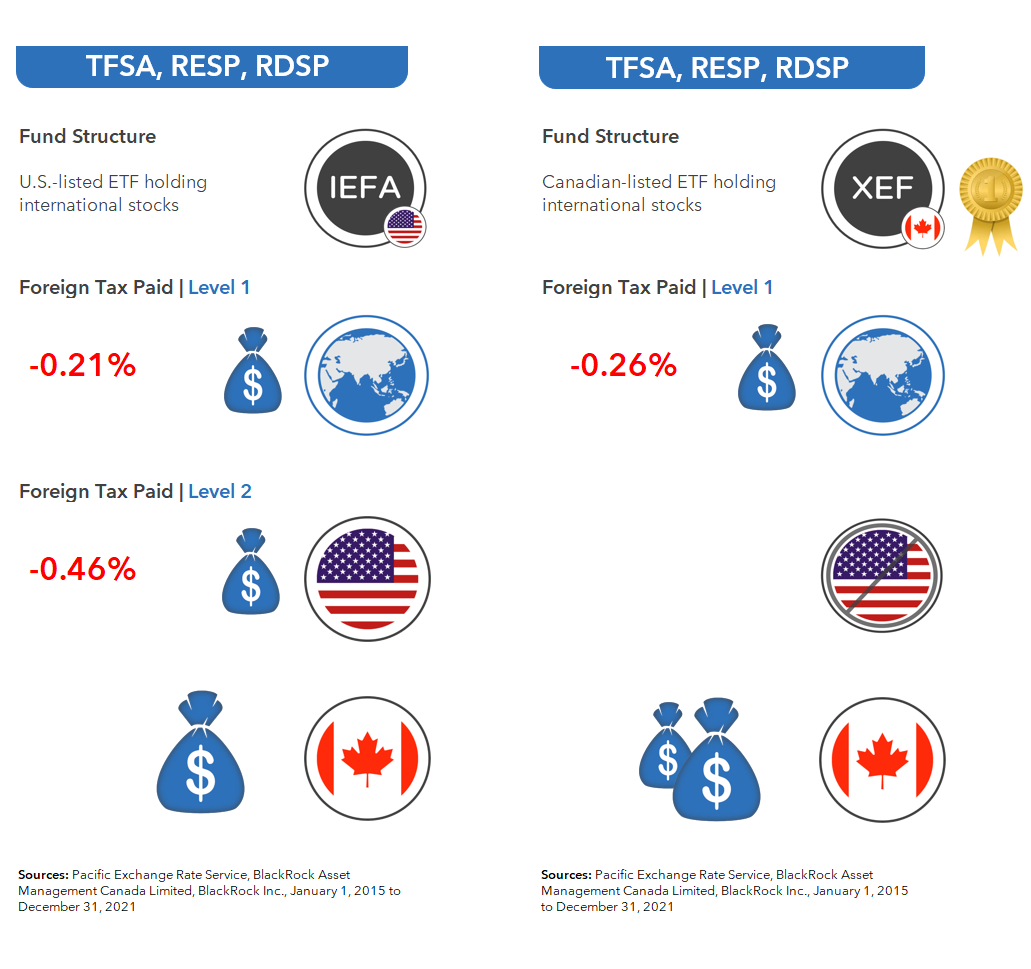

To review, in TFSAs, RESPs, and RDSPs, our Canadian-listed international equity ETFs already had the advantage, as they were only subject to one layer of withholding taxes, while our U.S.-listed ETFs were subject to two layers.

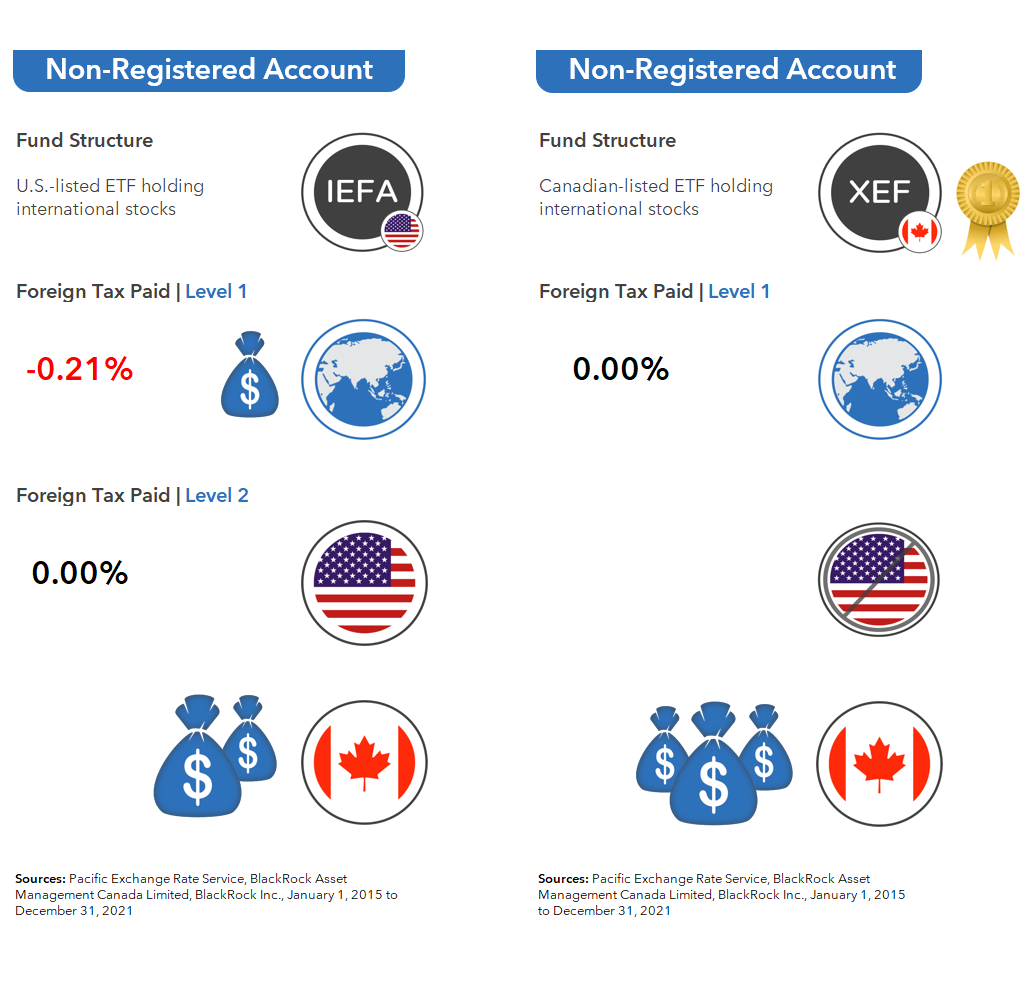

The story is the same in non-registered accounts, where Canadian-listed international equity ETFs still came out ahead. Once again, they are only subject to one layer of withholding tax, and this layer is generally recoverable at tax time. On the other hand, U.S.-listed ETFs are subject to two layers of withholding tax, and only the second layer is generally recoverable.

Tack on the fact that you can avoid your brokerage’s steep currency conversion fees by opting for Canadian-, rather than U.S.-listed ETFs, and it seems clear that Canadian investors should probably avoid U.S.-listed international equity ETFs altogether.

However, it’s hard to ignore the significantly lower expense ratio on IEFA, relative to XEF or VIU.

And as we mentioned earlier, IEFA also has far more assets under management – and this level of scale could provide an advantage when attempting to tightly track the returns of a broad market index.

So where does that leave us? Instead of debating the theoretical pros and cons of both structures, let’s review how our international equity ETFs have actually performed in each account type, after accounting for all costs. These numbers should speak louder than words.

Currency Conversion Fees in RRSPs

We’ll start by comparing an initial 10,000 Canadian dollar investment in IEFA and XEF within an RRSP, purchased and held since January 1, 2015. We’ve chosen that date because 2015 was the first full year XEF held its international stocks directly, instead of through a U.S.-listed ETF.

As both ETFs had similar foreign withholding tax costs (and because IEFA had the advantage of lower products costs and economies of scale), it’s no surprise IEFA grew at a slightly faster rate than XEF.

However, once we tack on a 2% currency conversion fee to buy and sell IEFA, the net outcomes reverse, with XEF outperforming IEFA. So, after considering all costs, a Canadian-listed international equity ETF like XEF or VIU is still likely the better choice within your RRSP.

Currency Conversion Fees in TFSAs

And what about in TFSAs? Even if we assume no currency conversion fees when purchasing U.S.-listed ETFs in TFSAs, IEFA has still lagged behind XEF, due to the second layer of U.S. withholding taxes applied to its foreign dividends. Even though IEFA is bigger and cheaper, it’s no match for XEF’s more tax-efficient structure.

And of course, if we assume a 2% currency conversion fee when buying and selling IEFA, this just puts the fund deeper into the red compared to XEF. Based on this comparison, investors should once again opt for a Canadian-listed international equity ETF like XEF or VIU for their TFSA accounts.

Currency Conversion Fees in Non-Registered Accounts

Last but not least, there’s our non-registered account comparison. Here, we’ll assume all units of each ETF are sold at the end of the measurement period, and the investor pays taxes at the top Ontario tax rate. If we first assume no currency conversion fees, we find IEFA and XEF had similar returns over the measurement period. But once we tack on a 2% currency conversion fee to the purchase and sale of IEFA, we find XEF to again be the superior choice for non-registered accounts.

Now that we’ve considered all the costs—including foreign withholding taxes, fund fees, and currency conversion fees—I think it’s safe to say that Canadian-listed international equity ETFs like XEF or VIU are the best choice for most investors across all account types. This also illustrates why the supposedly cheapest fund as measured by its MER alone, isn’t always the most cost-effective one in the end.

In our next video, we’ll pop the hoods on the emerging markets equity ETFs found in the Vanguard and iShares asset allocation products. See you then!

Would Canadian/US FX rate not be a consideration when comparing whether to own US vs Canadian domiciled international. ETFs, in for example , a RRSP/RRIF? For example XEF and VEA.

What about holding the US aspect of the portfolio in USD (such as VTI instead of VUN) to prevent the withholding tax?

VTI MER: 0.03

VUN MER: 0.16

VTI Withholding Tax Savings: 15% of 1.47%= .2205%

Total savings: 0.3505%/year

Combined with Norbert’s Gambit this is a no-brainer, but even with traditional forex fees, the break-even point seems much closer. Main issue I see is that re-balancing is slightly harder, but it’s not a big deal to me, within certain limits. 30% canadian exposure is already slightly arbitrary (any round number is!), so semi-annual re-balancing through new money and dividend (whatever didn’t get DRIPed) is enough for me.

Shouldn’t the solution in the RSP/RIF be Norbert’s Gambit? Even at 9.99/trade, it looks like you’re better off than holding the Canadian-listed fund or paying 2% to convert currencies.

@Gavin – Norbert’s gambit is a great approach for more experienced investors, but this series is for investors who are just getting started.