In an upcoming Canadian Portfolio Manager (CPM) podcast about our new Ridiculous Model Portfolios, we also took the time to address an important Frequently Asked Question from one of our listeners. There are variations on the theme, but the query goes something like this:

Hey, Justin: A couple months ago, I was following the recommendations from the June chart of CPM’s model ETF asset allocation. Today, as I was rebalancing my account, I noticed there were some updates to the model. Some of the funds and some of their asset allocations had changed. So, I was wondering, do you recommend I update my ETF allocations to match the latest model, or should I stick with what I’ve already got?

Old vs. New CPM Portfolios: Should You Stay or Should You Go?

First of all, I do apologize for my year-end model portfolio surprise update. I never set out to confuse my readers, but occasionally the portfolios do need a few tweaks. When improvements are truly warranted, (at least moving forward), I figure ignorance is NOT bliss.

It’s also important to note: While we may sometimes change the CPM model portfolios (including the funds used and their specific weights), please rest assured: Our overall investment philosophy hasn’t changed, and won’t.

In particular, the Vanguard Ridiculous portfolios include a handful of new ETFs with slightly different asset allocations, but they still provide almost identical market exposure compared to our old CPM portfolios.

For example, the old CPM portfolios were comprised of a Canadian bond ETF (ZAG), a Canadian equity ETF (VCN), and a foreign equity ETF (XAW). For investors who wanted to reduce product costs or foreign withholding taxes in their RRSP, XAW was broken down further into its underlying U.S., international, and emerging markets ETFs (either XUU, XEF, and XEC, or their U.S.-based counterparts, ITOT, IEFA, and IEMG).

Within XAW, the foreign equity ETFs were weighted relative to their current market caps. If this sounds familiar, it’s because the Vanguard Ridiculous portfolios also weight their foreign equities based on their current market caps. They also include the same Canadian equity ETF (VCN) and a nearly identical Canadian bond ETF (VAB).

The CPM portfolios did include a slightly higher weighting to Canadian stocks compared to the Vanguard Ridiculous portfolios, at around 33% vs. 30%. However, this small difference isn’t expected to impact returns over the long term.

If we compare the underlying asset class weights of a typical balanced 60% stock, 40% bond portfolio for the old CPM vs. the new Vanguard Ridiculous portfolios, we find minimal difference between their market exposures.

Asset Class Weightings: Vanguard Ridiculous Balanced Index Portfolio vs. CPM Balanced Index Portfolio

| Asset Class | Vanguard Ridiculous Balanced Index Portfolio | CPM Balanced Index Portfolio | Difference |

|---|---|---|---|

| Canadian Bonds | 40.0% | 40.0% | 0.0% |

| Canadian Stocks | 18.0% | 20.0% | -2.0% |

| U.S. Stocks | 23.9% | 22.7% | 1.2% |

| International Stocks (incl. Korea) | 13.5% | 12.4% | 1.1% |

| Emerging Markets Stocks (excl. Korea) | 4.6% | 4.9% | -0.3% |

| Total | 100.0% | 100.0% |

Sources: CRSP, FTSE Russell and MSCI Index Fact Sheets as of December 31, 2019

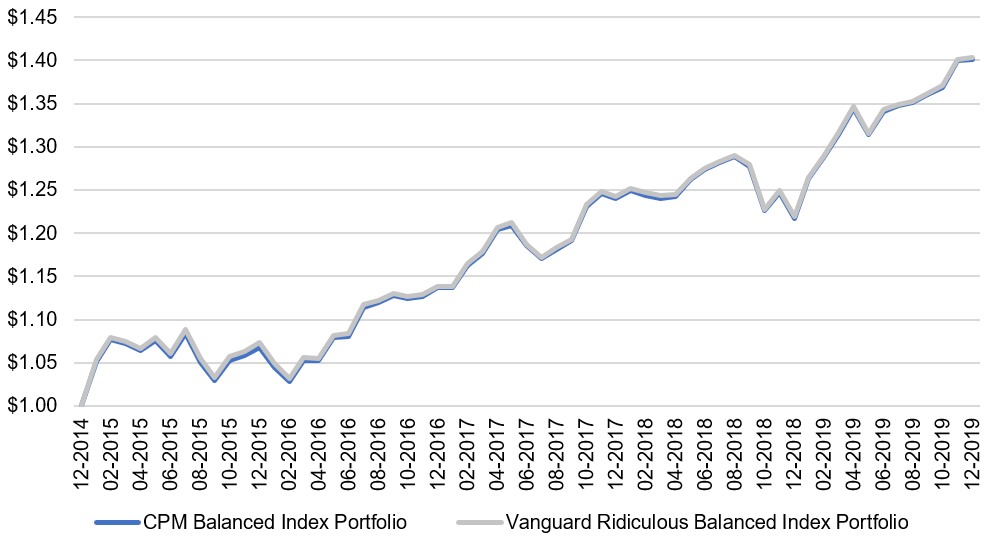

Using each of the funds’ underlying index performance, I’ve also determined that both portfolios would have experienced an identical 7% annualized return over the past 5 years ending December 31, 2019. That’s before fees.

Growth of $1: Vanguard Ridiculous Balanced Index Portfolio vs. CPM Balanced Index Portfolio

Sources: Morningstar Direct, MSCI, Vanguard Investments Canada Inc. as of December 31, 2019

Annualized Returns: Vanguard Ridiculous Balanced Index Portfolio vs. CPM Balanced Index Portfolio

| Index Portfolio | 1-Year Return | 3-Year Return (Annualized) | 5-Year Return (Annualized) |

|---|---|---|---|

| Vanguard Ridiculous Balanced Index Portfolio | 15.1% | 7.2% | 7.0% |

| CPM Balanced Index Portfolio | 15.1% | 7.2% | 7.0% |

| Difference | 0.0% | 0.0% | 0.0% |

Sources: Morningstar Direct, MSCI, Vanguard Investments Canada Inc., as of December 31, 2019

Multiple Choices, Common Approach

In other words, your current portfolio is not all that different from the new Vanguard Ridiculous portfolios. If there are no tax implications, and you like the idea of simplified, essentially single-fund portfolio management, you could consider a switch to the new Light portfolios. But it’s really not necessary.

If your current portfolio includes XAW, think of it as interchangeable with the VUN, VIU, and VEE combo in the Vanguard Ridiculous portfolios. And if you hold ZAG instead of VAB, don’t even bother switching it, as both funds have similar fees and similar Canadian bond exposure.

Bottom line, whether you use our old CPM model, or our new Simple, Ridiculous, Ludicrous or Plaid Portfolios, the important thing is to adhere to the same underlying investment strategy they very much share in common: Build a globally diversified portfolio that reflects your goals and risk tolerances, minimize unnecessary costs, and stay the course through our wonky markets. If you can do all that, you should do just fine.

Performance Methodology

Vanguard Ridiculous Balanced Index Portfolio

01/2015-12/2019: 40% Bloomberg Barclays Global Aggregate Canadian Float Adjusted Bond Index + 18% FTSE Canada All Cap Index + 42% FTSE Global All Cap ex Canada China A Inclusion Index (net div.) (CAD), rebalanced monthly

CPM Balanced Index Portfolio

01/2015-12/2019: 40% FTSE Canada Universe Bond Index + 20% FTSE Canada All Cap Index + 40% MSCI ACWI ex Canada IMI (net div.) (CAD), rebalanced monthly

Hi Justin,

Big fan of the blog and YouTube, thanks.

Seem to be hearing a lot more of this chatter recently, what do you think?

https://www.theglobeandmail.com/investing/markets/etfs/article-theres-a-downside-to-passive-etf-investing/

@Ak11: Glad you’ve been enjoying the blog/videos!

I’ve had a few investors send me this link. Just another sad attempt by an active manager to justify their high fees (with zero evidence provided).

I currently have a 3 ETF portfolio in my account. I’d like to buy more during this downturn but I don’t want to invest too much at once. So instead of paying a $10 fee for each transaction that might be only a few thousand dollars each, what do you think of buying TD e-series instead, and then changing it back to ETF’s once there’s enough money to justify paying a $10 fee?

Sounds complicated. You may want to consider switching to a low-cost brokerage (like Questrade) so you don’t need to make these types of decisions.

Hey Justin, thanks for the great Canadian content! I just recently started investing in VGRO, and like you mentioned before I was one of those people, an investing newbie, that tended to over analyze every little detail of all the ETF’s out there, having a hard time deciding which one to pull the trigger on. Through all my research I found I was leaning toward a broad market, long term investment strategy and ultimately settled on VGRO, so it makes me feel good that someone as knowledgeable as yourself is also recommending this option. Now my question is this, say me and my wife each have a TFSA and an RRSP, should we be looking to diversify among those 4 accounts? Should each account be set up with a different equity to fixed income ratio? Would investing in VGRO in all 4 accounts be putting too many eggs in one basket so to speak? Is this something that is worth stressing about or not so much? Thanks for your help!

@Chris: VGRO is diversified across thousands of stocks and bonds, so the class investing advice of “not putting too many eggs in one basket” does not apply here (it’s more relevant for an undiversified portfolio).

Thank you for the comparison between the two very different portfolios. I’ll be sticking with my four ETF model. My life is complicated enough as it is, and the difference in returns of the more complex portfolios just aren’t worth it to me.

Julien’s comment is relevant on this day! But what if I was a bit more daring and wanted to invest more with this market downturn? How should a 30-something y.o. passive investor take advantage of this?

I’m considering contracting a leveraged loan on my home equity line of credit, but am wondering if investing the loan in VEQT is a good way to go, and whether to invest in a cash account, TFSA or a RRSP account.

Obviously the loan, which I would work form day 1 to repay, would be kept within the AMF recommendations with regards to net worth, income, available cash.

Hubert: You do not want to place borrowed money in tax advantaged accounts (TFSA, RRSP, etc.). If you do so, the interest on your loan is not tax deductible. Borrowed money should only be invested in a non-registered (cash) account.

IMO, if your tax advantaged accounts are not full yet, I would focus on filling those with your own money first before even considering leveraged investing.

Staying the course is absolutely important with the current market challenge (TSX is down 10% today?!).