“Dot-U” Equity ETFs

Today on our Canadian Portfolio Manager blog, we reach the final part in our 3-part series on ETF investments and their foreign currency exposures. (Or check out the podcast or YouTube versions below, if you prefer.) Before you receive your diploma from the university of currency exchange, there’s one more topic to tackle: the “dot-U” funds.

What’s a dot-U fund? They are another version of many of the existing ETFs that trade in Canadian dollars. The only difference is, they trade in U.S. dollars under the ticker symbols that include a “dot-U” at the end.

For example, here are three common funds that trade in Canadian dollars:

- iShares Core S&P U.S. Total Market Index ETF (XUU)

- iShares Core MSCI EAFE IMI Index ETF (XEF)

- iShares Core MSCI Emerging Markets IMI Index ETF (XEC)

And their dot-U equivalents, trading in U.S. dollars, are:

- iShares Core S&P U.S. Total Market Index ETF – USD Units (XUU.U)

- iShares Core MSCI EAFE IMI Index ETF – USD Units (XEF.U)

- iShares Core MSCI Emerging Markets IMI Index ETF – USD Units (XEC.U)

What Does a Dot-U Do for You?

Don’t let the dot-U ticker symbols fool you. These ETFs transact in U.S. dollars, similar to U.S.-based ETFs like the iShares Core S&P Total U.S. Stock Market ETF (ITOT), the iShares Core MSCI EAFE ETF (IEFA), and the iShares Core MSCI Emerging Markets ETF (IEMG). But once again, their underlying stock markets determine their currency exposure – not the currency in which they transact.

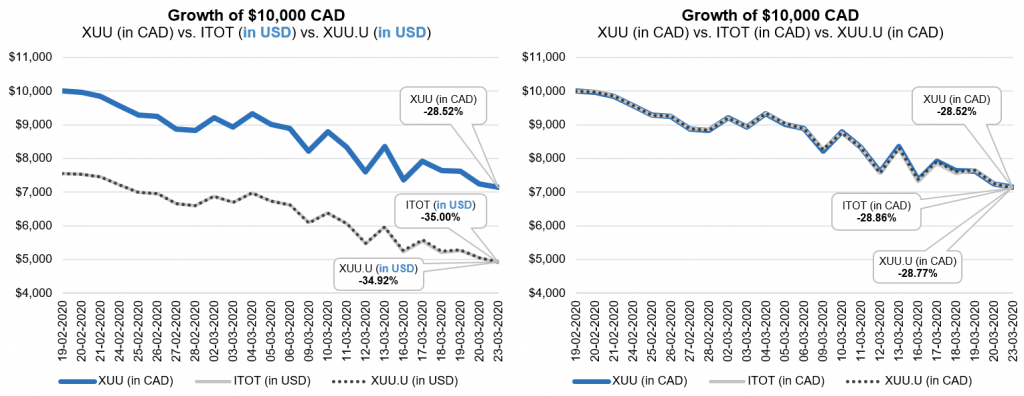

For example, when comparing their returns in U.S. dollars, we would expect XUU.U to have nearly identical performance to ITOT. And, in fact, during the first quarter 2020 stock market crash, ITOT and XUU.U both lost around 35% of their value in U.S. dollar terms.

But once you convert both funds’ performance to Canadian dollar terms, XUU.U and ITOT provided similar returns to their Canadian-based counterpart, XUU. In fact, during the worst of the downturn, all three ETFs dropped by essentially the same amount – just under 29% in Canadian dollar terms.

Sources: Bank of Canada, BlackRock, Inc.

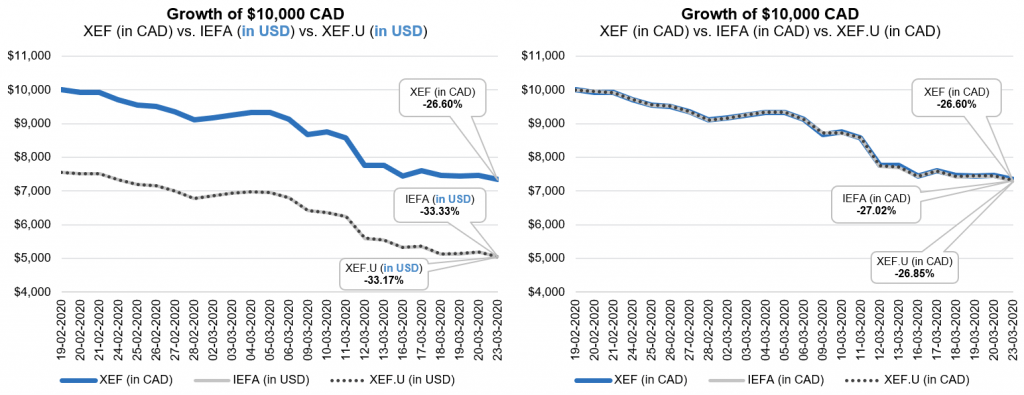

The same would apply for international equity ETFs that transact in U.S. dollars. Both XEF.U and IEFA dropped by around 33% during the worst of the 2020 downturn. But once their performance was converted to Canadian dollar terms, both funds lost around 27%, which was nearly identical to XEF’s return over the same period.

Sources: Bank of Canada, BlackRock, Inc.

And on the emerging markets front, XEC.U and IEMG each fell by just under 32% in U.S. dollar terms. When their performance was converted to Canadian dollar terms, XEC.U, IEMG, and XEC all lost around 25% in Canadian dollar terms.

Sources: Bank of Canada, BlackRock, Inc.

This brings us back, yet again, to my central theme: Your currency exposure is not impacted by whether you buy your foreign equity ETFs with Canadian dollars, U.S. dollars, or any other currency. The same rules would apply, even if BlackRock were to release a series of “dot-Y” Japanese yen-traded ETFs, or “dot-E” euro-traded ETFs.

There is one more point you can take from all of this: Since investing in Canadian dollars is usually much more practical, doing so should usually be the default choice for most Canadian DIY investors.

DLR Takes All in a Norbert’s Gambit

While we’re on the topic of dot-U funds, you may have noticed that the Horizons U.S. Dollar Currency ETFs also come in two currency flavours: the Horizons US Dollar Currency ETF (Cdn. currency) (DLR), and the Horizons US Dollar Currency ETF (US currency) (DLR.U).

Both funds hold cash and cash equivalents denominated in the U.S. dollar. As we’ve learned, this provides investors with U.S. dollar exposure, whether they purchase DLR or DLR.U. So, just like our other pairs of equity ETFs, both DLR and DLR.U provide Canadian investors with U.S. currency exposure, even if they purchase DLR with Canadian dollars.

Although either fund provides a quick way to gain exposure to the U.S. dollar, the main reason most DIY investors hold DLR and DLR.U over the short-term is to perform the popular currency conversion strategy, Norbert’s gambit. You first purchase DLR with your Canadian dollars on the Canadian-dollar side of your account. You then sell the same number of shares of DLR.U on the U.S. dollar side of your account, thus converting your Canadian dollars to U.S. dollars very cheaply.

The reverse is also true. You can buy DLR.U with U.S. dollars on the U.S. dollar side of your account, and sell DLR on the Canadian dollar side of your account to cheaply convert your U.S. dollars back to loonies.

Unfortunately, there’s a hitch in the process. Most brokerages make you wait until your DLR purchase settles before allowing you to sell DLR.U. This creates a delay of around 2–3 business days. If you had planned to purchase U.S.-based equity ETFs with your U.S. dollars, this may cause you to miss out on potential stock market growth while you’re waiting.

When BlackRock launched the dot-U versions of XUU, XEF, and XEC in October 2019, investors were excited. They assumed – or at least hoped – they could now use the Canadian- and U.S.-dollar versions of these funds to perform the Norbert’s gambit strategy, while maintaining their stock market exposure over the entire settlement period.

For example, let’s say you wanted to eliminate the 15% withholding tax on U.S. dividends by purchasing ITOT in your U.S. dollar RRSP. At your brokerage, you could use DLR and DLR.U to cheaply convert your Canadian dollars to U.S. dollars. But the transaction would take a few days to complete. And over those few days, you would only have exposure to the U.S. dollar – not to the U.S. stock market.

Instead, what if you could purchase XUU in the RRSP? This would give you instant U.S. dollar and U.S. stock market exposure, while you waited 2–3 business days before you could transfer the XUU shares to your RRSP’s U.S. dollar side. Then you’d sell XUU.U, and buy ITOT with the U.S. dollar proceeds.

Unfortunately, it wasn’t meant to be. At least not yet. Here’s why: Norbert’s gambit only works if the security pairs are identical, with the exact same CUSIP number. (This is the number that identifies North American financial securities to facilitate trade clearing and settlement.)

DLR and DLR.U have the same CUSIP number. But the same cannot be said for XUU/XUU.U, XEF/XEF.U, or XEC/XEC.U. These ETFs have different CUSIP numbers for their dot-U counterparts. So, unfortunately, they cannot be used to perform Norbert’s gambit.

The Fascinating World of Foreign Currencies

Congratulations, you should now be relatively fluent in the language of foreign currency. You’re now especially familiar with the relationship (or more precisely, the lack thereof) between foreign currency transactions versus foreign currency exposure. You also know this concept remains valid, regardless of the number and kind of foreign currencies being considered.

Okay, so you still may not be ready to become a professional forex broker. But at the very least, you’ve now got a fascinating topic of conversation to bring up at your next social gathering, be it on Zoom or in person. Now go forth, to impress and amaze all your friends.

Hi

Great materials.

Can you describe how ETFs implement currency hedging in practice?

Assuming I am Canadian (I am not) I want to invest in an unhedged US ETF. Depending on the USDCAD exchange rate I will be able to buy sometimes more and sometimes less of ETF shares. Stronger CAD would be an opportunity to buy more ETF shares with the same nominal CAD amount.

But in case of the hedged ETF things start to get tricky. If I want to buy hedged ETF shares how many shares will I actually get of an underlying ETF? What will be an internal exchange rate? If ETF uses monthly forward contracts will it be exchange rate from the beginning of the month?

What will happen when the interest rate in Canada changes but not in the USA? How will carry cost impact TER and the tracking error? In fact what index will be tracked as the carry cost will make it impossible to track accurately?

@Adam: The ETF provider will sell currency forwards on a monthly basis to offset their exposure to the fund’s underlying foreign currency (or currencies). There will certainly be performance differences, due to being over or underhedged, or from changes in interest rates/forward contract pricing. Steven Leong of BlackRock explains the process in Episode 9 of the podcast:

https://canadianportfoliomanagerblog.com/podcast-9-hedging-your-bets-with-currency-hedged-etfs/

Hi Justin,

Although we can’t get exposure to the entire market with an ETF listed on both exchanges, we could perform Norbert’s gambit with something like TD .TO and maintain some market exposure that way? You would not have very good diversification during this process, would you recommend against it for that reason?

@Steve: I wouldn’t recommend using individual stocks to perform the gambit (as the stock price could fluctuate considerably during the settlement period), unless your brokerage allows you to immediately sell the stock on the U.S. exchange after purchasing on the Canadian exchange (and even then, you need to be very comfortable trading under this time pressure).

I still use DLR/DLR.U for this reason in our client accounts (although our brokerage allows the gambit to be completed on the same trading day).

Hi Justin

Great info as usual.

So if I understand correctly, the only benefit of holding ITOT vs XUU is to save the 15% withholding tax on dividends?

So if you have a sizable investment, wouldn’t it still be worth it to do norberts gambit to hold ITOT?

Norman

@Norman: If you have a sizeable RRSP, and have decided to hold a U.S. equity ETF in your RRSP, this can save you on foreign withholding taxes and product costs (if you properly execute the Norbert’s gambit strategy).