One of the most complicated and tedious tasks you get to do as an investor is to calculate the adjusted cost base (or ACB) for each security in your taxable accounts. Let’s just say, keeping track of your ACBs is NOT as easy as learning your ABCs … but it’s every bit as essential as far as your ETF investments are concerned.

So, how do you do it? You start with the original cost of your investment. Then, you adjust your base upwards for any new purchases – such as lump-sum buys, dividend reinvestment plans, or reinvested distributions. You also adjust it downwards for any sells, or return of capital distributions.

While calculating your securities’ ACBs is complex and time-consuming, it’s also extremely important. If you don’t adjust them upwards, you’ll pay too much tax when you sell a security. If you neglect to adjust them downwards, you’ll pay too little. That part may sound appealing, but the Canada Revenue Agency is not likely to share your enthusiasm.

Like it or not, if you are a do-it-yourself ETF investor, accurately tracking your adjusted cost bases, or ACBs, is ultimately your privilege and responsibility. It would be nice if your brokerage did it for you. Unfortunately, you can’t count on that, and your brokerages are not entirely to blame: Because your ACBs must be calculated for identical securities across all your taxable accounts, no single brokerage can see your entire picture.

That said, while your brokerages can only help so much, you do have our sympathies here at Canadian Portfolio Manager … along with today’s video/blog combo to make it easier for you.

Are you ready to dive in?

First, let’s talk about the timing. We recommend completing your ACB record-keeping tasks annually, every March, before you file your personal tax return. By then, ETF providers should have had enough time to report the tax breakdown of their funds’ distributions, which factor into your ACB calculations.

Your first step is compiling all the required information from your monthly or quarterly non-registered account statements. (Remember, it’s not necessary to track your ACBs for securities held in TFSAs, RRSPs or other registered accounts).

Focus on the account activity section of each statement: This will include any buys or sells that took place during the calendar year, plus any dividend reinvestment plans, or DRIPs.

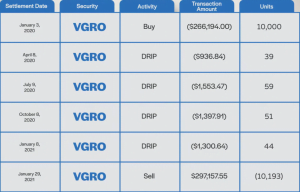

Let’s illustrate. Imagine you invested in the Vanguard Growth ETF Portfolio (VGRO) on January 3, 2020, and sold it on January 29, 2021. Along the way, there were six relevant transactions. First, there was the buy, settling on January 3. Then there were four DRIPs: Three of them settled in April, July, and October 2020, and one more settled in early January 2021. Finally, on January 29, you sold your VGRO units.

CDS Tax Breakdown Service

So far, so good. Next, we’ll obtain the tax breakdown for all ETF distributions recorded during the calendar year. CDS.ca provides an online resource that allows Canadian investors to download tax breakdown spreadsheets for their ETF distributions. These spreadsheets include return of capital and reinvested distribution breakdowns that help you calculate your ACB.

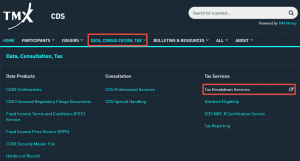

When you visit the website, hover over the DATA, CONSULTATION, TAX tab, and then click on the Tax Breakdown Services option.

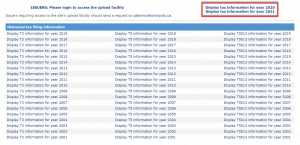

Click the link Display tax information for year 2020 (or whichever year you’re working on) and accept the conditions on the Terms of Access, Disclaimer and Legal Information page.

You will then be brought to the Mutual Fund and Limited Partnership Tax Breakdown Posting page. You can sort the funds alphabetically by clicking on the Security name heading. Scroll until you find your ETF, then click on the Excel icon to the right of the fund name. If there are multiple entries with the same name, click on the Excel icon with an “R” to the left of the name. (The “r” indicates a revised tax breakdown).

Statement of Trust Income Allocations and Designations

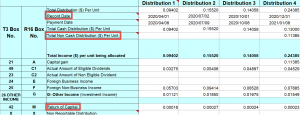

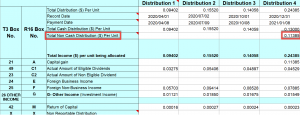

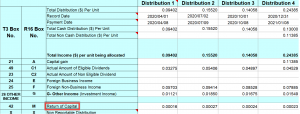

Once you’ve got your spreadsheet, look on the Statement of Trust Income Allocations and Designations for three key pieces of information you may need to calculate and track your ACB. These include: (1) the Record Date, (2) the Total Non Cash Distribution ($) Per Unit, and (3) your Return of Capital.

We recommend saving a copy of this spreadsheet for your tax records.

Adjusted Cost Base.ca

Now that you’ve armed yourself with all the necessary information to calculate your ACB, it’s time to turn to a free online resource that will do some of the heavy lifting for you.

Adjusted Cost Base.ca allows you to set up an account using only your email address. You can then input and track all buys, DRIPs, sells, reinvested distributions, and return of capital. You can also export this info to Microsoft Excel and download it for your files. (Unless you trust the Internet entirely, we strongly recommend you do so after each annual update, so you’ll always have a backup.)

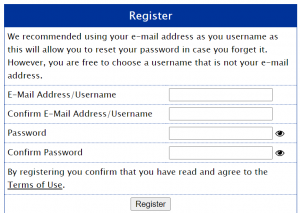

Step 1: Register

To get started with Adjusted Cost Base.ca, the first step is to read and agree to the Terms of Use, and register with your email address. Easy enough.

Step 2: Add a New ETF

Once you’ve registered and logged into the site, add the name of each ETF you hold in your non-registered accounts. To do this, click on “New Security” at the top of the page.

From there, you will be brought to a separate screen where you can input the ETF name and ticker symbol. For today’s illustration, we’ve entered the Vanguard Growth ETF Portfolio in the “Name” field and VGRO in the “Ticker Symbol” field. Click the “Add Security” button to complete the process.

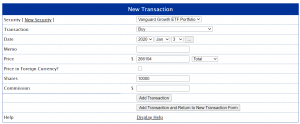

Step 3: Input Buys

Buying shares of an ETF increases the ACB by the cost of the shares, plus any trading commissions. To input all of your share purchases, click New Transaction at the top of the page:

You will be brought to a separate screen that will allow you to input your transactions.

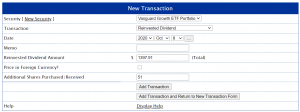

Select the Vanguard Growth ETF Portfolio from the Security drop-down menu. Choose the transaction type. (In this example, you’d select Buy.) Then select the settlement date of the trade. In today’s illustration, that would be January 3, 2020.

We’ll then enter $266,194 in the “Price” field. This was the total cost of our initial buy, including commissions. You also have the option of selecting “Total” or “Per Share.” Choose “Total” for any buy transactions. You can skip the “Commission” field, as the commission (if any) has already been included in the total cost of the trade.

Finally, input the total number of shares purchased. (In our example, that’s 10,000 shares.) We’ll then click “Add Transaction.”

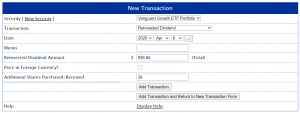

Step 4: Input Reinvested Dividends (DRIPs)

Now, on to our dividend reinvestment plan, or DRIPs. These are referred to as Reinvested Dividends in the adjustedcostbase.ca site. Take note! If you neglect to add your DRIP amounts to your ACB, your future capital gains tax liability will be inflated, and you’ll pay more taxes than you need to.

If you have set up a DRIP, most of your ETF distributions will be paid in the form of new shares. (I say “most,” because only whole shares can be purchased, so a portion of each distribution will also be paid in cash.) New shares received through reinvested dividends increase your initial cost base and lower your future capital gains tax liability.

In our VGRO example, there were four DRIP transactions. The first DRIP settled on April 8, 2020, with a reinvested dividend amount of $936.84. This resulted in 39 new VGRO units purchased. To include this information, click on “Add Transaction”, and then follow the same steps for the remaining three DRIP transactions on July 9, 2020, October 8, 2020, and January 8, 2021.

Step 5: Input Sells

Next, there’s that final sale in our illustration. Selling ETF shares decreases your ACB by the number of shares sold, multiplied by the ACB per share.

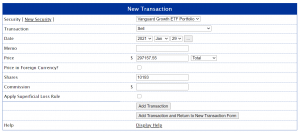

In our example, we’ll again select the Vanguard Growth ETF Portfolio from the Security drop-down menu. We’ll choose the transaction type “Sell,” and then fill in January 29, 2021 as the settlement date of the trade.

We’ll now enter $297,157.55 in the “Price” field. This represents the total proceeds received from the sale, minus commissions. Just as with the “Buy” transaction earlier, you should choose “Total” rather than “Per Share” for any sell transactions, and you can skip the “Commission field,” as we’ve already deducted any commission from the total proceeds received from the sale.

Again, we’ll input the total number of shares sold. In this example, we sold all 10,193 shares. We can then click on “Add Transaction.”

Step 6: Input Reinvested Capital Gains Distributions

We’re not done yet. Sometimes, fund managers don’t distribute all investment income to their unitholders. They might instead reinvest some of it back into the ETF, which increases your ACB, while decreasing your future capital gains tax liability.

These reinvested distributions often occur annually at year-end. They are generally the result of capital gains realized within the fund. That’s why adjustedcostbase.ca refers to them as “reinvested capital gains distributions.” However, these non-cash distributions aren’t always actual capital gains. They could be the result of a reinvested Canadian eligible dividend distribution, a reinvested return of capital distribution, or any other type of reinvested income distribution. For this reason, I prefer to simply call these non-cash distributions “reinvested distributions”, or “phantom distributions” (since they do not appear on your account statements).

In any case, do not simply add the capital gains figure from box 21 of your T3 slip to your ACB – this could lead to tax reporting errors.

Remember that information I had you download from the CDS.ca website earlier – from its Statement of Trust Income Allocations and Designations? You’ll now use it to accurately calculate reinvested distributions. In the report, find the row labeled Total Non Cash Distribution ($) Per Unit. This is also known as the fund’s reinvested distribution per unit. Each reinvested distribution will be multiplied by the number of units of the ETF held on the record date, and then added to the ACB.

In this example, there was a single 2020 VGRO reinvested distribution of $0.11385 per unit. In the NOTES section of the spreadsheet, Vanguard indicated that this particular non-cash distribution was made up entirely of capital gains.

As we held 10,149 units of VGRO on the December 31, 2020 record date, this reinvested distribution will cause our ACB to increase by $1,155.46. That’s 10,149 shares × $0.11385 reinvested distribution per unit. If you fail to make this adjustment, you will pay some unnecessary tax when you eventually sell your VGRO.

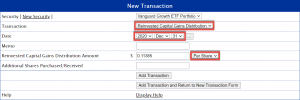

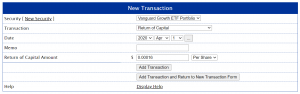

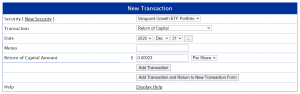

To include this reinvested distribution, add a new transaction for VGRO, this time selecting “Reinvested Capital Gains Distribution.” For the “Date” field, use the December 31, 2020 Record Date of the distribution (not the Payment Date).

Then, enter $0.11385 in the “Reinvested Capital Gains Distribution Amount” field. This time, be sure to select “Per Share” instead of “Total” from the drop-down menu to the right. Then click on “Add Transaction.”

Step 7: Input Return of Capital (ROC)

There’s one more variation on the theme left to cover. When a fund pays a return of capital, or ROC distribution, it is essentially giving you back a portion of your initial contributions. ROC is not taxable in the year you receive it. However, a return of capital distributions decreases your ACB, which in turn increases your future capital gains tax liability.

If you don’t adjust for return of capital, you will pay less tax than you owe, and the Canada Revenue Agency will not be impressed.

Continuing with the example above, let’s adjust the cost basis by accounting for the return of capital for each year. Again, this information can be found on the Statement of Trust Income Allocations and Designations, in the row labeled “Return of Capital.”

In our VGRO example, there were four quarterly return of capital distributions in 2020. Each of these should be entered as separate transactions.

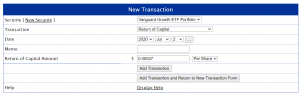

To include them, add a new transaction for VGRO, this time selecting “Return of Capital.” For the “Date” field, input the April 1, 2020 Record Date of the first distribution (not the Payment Date).

Then, enter $0.00016 in the “Return of Capital Amount” field. Similar to the Reinvested Distribution from our last example, select “Per Share” from the drop-down menu to the right, and click on “Add Transaction.”

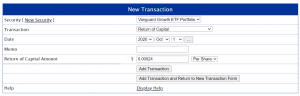

Follow the same process for the remaining three return of capital distributions on July 2, October 1, and December 31, 2020.

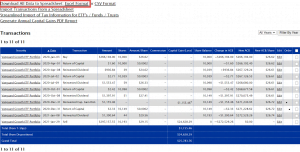

At last, we’re finished inputting all types of transactions. Now, you can click on “View All Transactions” tab near the top of the screen to review your inputs.

For our VGRO example, we inputted a total of 11 transactions to accurately calculate our ACB and the subsequent capital gain on the full sale of our units. Now, “all” you have to do is complete this same exercise for all your holdings, each year. Hey, don’t look at me, I didn’t make the rules; I’m just showing you how to abide by them!

Again, we also recommend clicking on the “Excel Format” link above your transaction history and downloading a backup copy of the data annually for your records.

As Easy as ACB?

Hopefully you now have a better understanding of how to accurately track the adjusted cost base of your Vanguard or iShares Asset Allocation ETF. If you’d like to learn more about calculating your ACBs, check out the white paper I co-authored with Dan Bortolotti.

Hi Justin,

Have you looked into Vanguard’s new mutual fund versions of these asset allocation ETF’s (VIC1000, VIC8020, VIC6040, VIC4060)? It would seem that these would be a more ideal choice for DIY investors in a taxable account, since the ACB tracking should be done at the fund level. Are there any potential downsides other than the slightly higher MER’s and having to pay $9.95 per trade at brokerages like Questrade? Are the significantly smaller AUM’s (compared to their ETF counterparts) something to consider before investing in these funds? Would love to hear your thoughts.

@Carson – These are great investment options as well (I wouldn’t worry about the smaller AUM…I expect these to be very popular products going forward).

I was using the adjustedcostbase.ca website for a non registered account and entering the info for VEQT. Once I finished the calculations using your white paper I noticed at the bottom of the page ‘Streamlined Import of Tax Information’. It also said: This feature allows you to import tax information for ETF’s, publicly traded funds and trusts including the following data:

Return of Capital

Phantom Distributions

Capital Gains Distributions

This is not typically applicable to other types of securities including shares of corporations.

Is this something I could use going forward for VEQT or is it better to manually input the information?

Thank you Justin for your detailed article on tracking the ACB which I used every year to obtain the tax breakdown for all my ETF’s on the CDS.ca website. Today, I noted that they don’t offer this service anymore, they have changed their website and no longer have the Data, Consultation, Tax Tab where you could click on Tax Breakdown Services option. I would appreciate your suggestion on where I might be able to obtain this information for the tax year 2023.

Looks like it’s still there: https://www.cds.ca/solutions/tax-services

Hello Justin,

I have started the calculation of my ACB and I stumbled upon a problem.

I have some ZDB in my portfolio, and the Return of Capital reported in the downloaded CDS file is larger than 1. It seems to be reported as a percentage. How should I treat this value in the calculation?

Thank you

Hi, thank you as always.

I am using Adjustedcostbase.ca but I can’t see how a dividend cash distribution should be treated. My understanding is that it doesn’t affect the ACB, as such it can’t be a return or capital or anything alike.

Thank you

@Rc – A cash distribution could include a portion of return of capital, so you may need to make adjustments to your ACB (this is explained in the blog/video).

I use RBC Direct Investing for my non-registered accounts. I see the non-cash reinvested ETF capital gains and ROC reported on the annual T3s. I also notice that on my April or May statements, RBC adjusts my Book Cost up for the reinvested capital gains and down for the ROC by the amounts reported on the previous Dec 31st T3s. Does this mean all this work is done automatically for me by RBC and that my Book Cost will be correct when I eventually sell the ETFs?

@Rexx – I would suggest not relying on your brokerage to accurately track your ACB – they often make mistakes or omissions, so be sure to double-check their work.

Hello Justin. I have done everything required to calculate the ACB. Now, what information should I give my accountant for my taxes?

@Charles – I would ask your accountant what information they need from you.

Hi Justin, If I don’t drip the VGRO dividends, but reinvest the money, does it get entered as reinvested dividend or a simple buy.

@Pat – As a buy.

Follow up to this… I’m holding the ETF with Wealthsimple, and they didn’t have “DRIP” until fairly recently. However from the activity after switching it on, what they are actually doing is just making a purchase for fractional using the cash. Previously I just manually do this.

Is there anything fundamentally different that I have to start entering them as re-invested dividends, or in this case it doesn’t matter?

I’ve come to this site looking for information on how to deal with phantom distributions that are made up of capital gains AND foreign non-business income. (This has been happening with my relatively recently acquired holding of CI First Asset MSCI World ESG Impact ETF (CESG).) Am I correct in assuming that the TOTAL phantom distribution figure always gets added to the ETFs ACB even if it’s a “blended” distribution made up of various tax type components? Or does one possibly break out the capital gains component and add only it to the ACB? (My brokerage seems to have just added the total sum.)

@Cliff – Great question! You would add the total “non-cash distribution” to the cost base of each unit held on the record date. It’s irrelevant whether the non-cash distribution is made up of capital gains, interest, dividends, or even return of capital.

Thanks for your quick reply Justin. Glad to hear that US-listed ETFs don’t have ROC or reinvested distributions. Less things to worry about :)

I have a follow up question about the exchange rate to use. I’ve seen some websites that say to use the exchange rate of the

settlement date, some say to use the trade date, others say it doesn’t matter as long as I keep it consistent. I have yet to find an official CRA statement on this. What’s you take on this?

Thanks again.

@Jay – You should use the FX rate on the settlement date of the trade (which is when the cash is “officially” transacted).

Hi Justin, thanks for this article. It’s extremely helpful.

I hold US-listed ETFs such as VTI and VXUS. How can I find the Reinvested Capital Gains Distributions and Return of Capital for these funds? I noticed that the cds.ca website only lists Canadian-listed ETFs.

Also, I see comments above about the premium service from http://www.adjustedcostbase.ca. I’m interested in it for importing spreadsheets of my transactions rather than entering them in one by one (which has been very time consuming and error prone, given most of my transactions are in USD) and for importing data on Reinvested Capital Gains Distributions and Return of Capital. For the importing transactions spreadsheets, do you find that it works well? I hold accounts on Questrade, Interactive Brokers, and WealthSimple, and I’m finding that the format doesn’t always match. For importing data on Reinvested Capital Gains Distributions and Return of Capital, I also do not see US-listed ETFs (probably because they don’t exist in cds.ca?). What can be done for this?

Thanks for your insight and help.

@Jay – U.S.-listed ETFs generally do not have ROC or reinvested distributions (so you don’t need to worry about these adjustments).

The importing feature works well, but you still need to manually adjust your import spreadsheet (so some work is still required).

Justin, Thank you for so much valuable information, I’ve been a fan for many years!

My spouse and I each have a non-registered account. VCN in one, held and bought monthly in the past two years. The second non-reg account is now starting. I am debating whether to buy “Identical property VCN” in both, or ZCN in the other.

1 – to calculate ACB across both accounts, if both hold VCN, they will have a single ACB, calculated with transactions from both accounts. Am I correct?

2 – Tax Loss Selling – Long-term hold plans (we are both under 50 years old but sick of working), not sure if it makes more sense to buy “Identical Property” in both accounts (VCN/VCN), or (VCN/ZCN). Thoughts on Superficial Loss rules during TLH events?

Thanks so much!

@Svend – If the non-registered accounts are not joint (i.e., they are individual), you could each hold the same ETF and not be required to track the cost base across both accounts. If they are joint non-registered accounts, then yes, you should likely hold different ETFs, like VCN and ZCN. I would try to avoid a situation where you are required to calculate the ACB of a security held across multiple accounts.

For tax-loss selling, you may need to use more caution to avoid the superficial loss rules. Switching to an entirely different ETF (like the Mackenzie Canadian Equity Index ETF, QCN) would be an option.

Any chance you can just have a single joint account for both of you (or would this not be appropriate in your situation)?

Thanks Justin, for the quick reply!. As one income is >120k, the spouse <40k, the accounts are indeed Individual, but only for tax reasons (the <40K income was 100% invested, and taxes attributed to lower income the past two years). There are no personal reasons to instead hold a single joint account and only VCN, and TLH'ing it for ZCN. But then the tax rates will be applied to the higher income for the next few years of work, no?.

Our savings rate is such that the high income also needs to grow non-registered starting now. (TFSA/RSP full) There is also a 1-year EF in non-reg 4.35% HISA, so I'm trying to set things up as tax efficiently as my engineer head can allow (having only studied tax law from blogs and CRA website).

@Justin – the CDS site seems to be back up today – looks like it was a temporary issue yesterday. I sent them an email and whatever the issue may have been seems to be resolved.

@George – Thanks for confirming! :)

Hi Justin – this is excellent. Do you know of an alternative to cds.ca for the tax information? Their “Tax Breakdown Services” link seems to be broken.

@George – I’m not having any issues accessing the tax breakdowns at CDS.ca – have you tried again this morning?

If you do not have a DRIP set up in the non-registered account can you skip step 4?

@Darby – If you don’t have any DRIPs set-up on your ETF, there should be no DRIP transactions to input.

For those of you who have used adjustedcostbase.ca, are you receiving any reply when you use “Contact us” on the website? When I first started using it, I would receive replies from them. However, I have not received any replies for quite awhile now. I even asked if they have changed their support and if there is a charge now but still no replies.

It would be appreciated if you would share your experience with me and if there has been changes to their support. I am not referring to the Blog but use of Contact us.

Justin,

Please clarify as there is something I’m missing.

Isn’t capital gain $4,169.90 less due to lesser shares ($10,970.61 – $6,800.71 = $4,169.90)?

83.627 Shares $4,350 Book Value $52.0167 Average Price $133.3386 Share Price $11,150.71Market Value $6,800.71 CG

114.90 Shares $4,350 Book Value $37.859 Average Price $133.3386 Share Price $15,320.61 Market Value $10,970.61 CG

No need to reply. It is because they are trading at different market prices.

AGF switched one of my funds. The Unit Balance was reduced and new ACB unchanged. The New ACB/Unit is now higher, which means I will have less profit when I sell these units. It seems to me that this exchange of funds has had an adverse impact on my investments. Is a mutual fund company allowed to arbitrarily make such changes? I informally heard that they have done so to issue a new class of funds with no trailing fees. I wasn’t really aware of these trailing fees as I have never consulted with or received any advice from a financial advisor. I would appreciate your feedback and insight on this matter.

@Norman – if the total ACB remained unchanged, there shouldn’t be any issues (as your overall capital gain will also be similar).

Justin,

Please clarify as there is something I’m missing.

Isn’t capital gain $4,169.90 less due to lesser shares ($10,970.61 – $6,800.71 = $4,169.90)?

83.627 Shares $4,350 Book Value $52.0167 Average Price $133.3386 Share Price $11,150.71Market Value $6,800.71

114.90 Shares $4,350 Book Value $37.859 Average Price $133.3386 Share Price $15,320.61 Market Value $10,970.61

HI Justin,

I started using ETFs in a corporate account in 2020 and I am currently trying to go back and track the ACB for the accounts. Right now I hold ZDB, VCN and VXU (and some previously purchased TD e-series). I am with TD Direct Investing and I have gone through the “account activity” section of all my statements. For my ETFs, when the activity says “Distribution”, how do I know if that is a DRIP or just money paid out to me? If it is money just paid out to me, how does that get recorded?

It seems that I get a monthly distribution from ZDB and quarterly from VCN&VXU.

I also just wanted to confirm that when my TD e-series account activity says Dividend re-investment plan that I can ignore that because ACB should be calculated at the fund level?

Thank you for your time and all of the helpful information!

@Stephanie – If it’s a DRIP, the transaction will usually indicate this, and provide details (i.e., “DRIP”, or “DRP”). If you’re unsure, just review the number of units you held from month to month. If they are increasing (and you’re not manually purchasing new units), there is likely a DRIP set-up on the ETF.

If the money is just paid out as cash (which is the default), it doesn’t need to be included in your ACB tracking.

You also do not generally need to track the ACB of the TD e-Series funds (the fund company does this for you).

Oh, and this was an interesting quirk: The CDS spreadsheet for ZDB this year reported Return of Capital as a percentage of the distribution, not as the actual amount. So one must calculate it on their own by multiplying the total distribution by the percentage that is RoC. Entering the exact value in Adjustedcostbase.ca will incorrectly cause a Huge ROC and incorrectly drop one’s adjusted cost base to zero.

Would be worth pointing out this quirk the next time you update a whitepaper, blog post, etc..

Hi Justin,

Using your method (downloading the CDS spreadsheets), I have calculated my Return of Capital for an ETF. The calculated amount matches the amount in box 42 on my T3 that was issued by Questrade, which is great!

I am wondering if I am “double reporting” that amount on my taxes though?

* The T3 auto imports to Wealthsimple Tax, and has the RoC amount in box 42. (Manually changing this amount doesn’t change anything, so I leave it as it is.)

* I ignore the T5008 and instead manually input everything under “Statement of Securities Transactions”

* I input all my “sell” trades under “Statement of Securities Transactions”, including manually override of Box 20 with the values calculated.

Does this make sense? If I am doing things correctly and not double-reporting anything, what is the purpose of “Box 42” on my T3? Just an easy/convenient way for people to add up/track their RoC year after year? Or perhaps an easy/convenient way for the CRA to track RoC when a sell transaction does eventually happen in the future?

I know you obviously cannot offer specific tax advice, but I am wondering if you can generally comment as to whether it is necessary to use the CDS spreadsheet method for RoC, or if one can simply use the value reported on their T3. And the pros/cons of each method.

Thanks!

Hi Justin,

I own a lot of VGRO in my Corp account. I will be almost eliminating my small business deduction soon. Yes I own this much VGRO.

I probably should have bought VEQT and used laddered GICs instead.

Any other options for people like me? I would have to wait for a market downturn to change my portfolio from VGRO to VEQT!

@Stephanie – You should speak with your accountant – there may be some opportunities for tax-gain harvesting in your corporation:

https://canadianportfoliomanagerblog.com/corporate-taxation-tax-gain-harvesting-crazy-like-a-fox-tax-planning/

Hi Justin, thank you so much for putting this together. I am tracking my first ACB for VEQT shares purchased Jan 2022. When doing ACB calculations for 2021 taxes, do I use the CDS figures from 2021 or 2022?

I tried using 2021 figures and the settlement date for my shares falls AFTER the record date for the distributions. Thanks for your help!

@Kay – You’re very welcome! If you initially purchased your VEQT units in January 2022, you won’t have any adjustments to make for 2021 (so you can push this task off until March 2023, when you’ll be using the 2022 cds.ca T3 figures for the updates).

Thanks for all this great information. I’m a bit confused by some of the terminology. On my monthly statement, some ETFs in my portfolio give distributions. Do I enter these into the ACB spreadsheet as return on capital, or is return on capital something different?

@Doug – The only distributions you should be including from your statements are dividend reinvested plans (DRIPs). The rest of the return of capital and reinvested capital gains distribution information should be obtained from the cds.ca site.

Hi Justin, thanks for the informative post & video! If I buy an ETF (VEQT for example) in my non-registered account today, continue buying for the next 30 years, never sell for the next 30 years until November 2051, how would I approach this for tax reporting purposes? Based on your post & video, it includes a “sell” transaction (whereby a taxable event has been triggered), but what if in my case, I don’t plan on selling for the next 30 years?

Would it be prudent to do Steps 1-4 every year to figure out my annual ACB (as opposed to spending hours doing this all at once sometime in November 2051)? There is no need to actually report an ACB on my tax return until I actually sell in 2051 right?

@Brian – Until you sell units of VEQT, there’s no need to report any unrealized capital gain information to CRA. However, I would recommend tracking your cost base on an annual basis, so it doesn’t become overwhelming when you do sell some units (it will also give you practice with the procedure).

Hi Justin, to clarify, when you say “unless [I] sell units of VEQT, there’s no need to report any unrealized capital gain information to CRA”, does this also refer to the ROC, DRIPs, etc. as well (i.e. no need to do anything you’ve mentioned in this article/video)? Or do the ROC, DRIPS, etc. need to be reported every year, regardless of whether I sell?

Further, is it correct that if I sell in 2051, I’d only have to get the TMX spreadsheet for that year to input into the adjustedcostbase website? Or would I need to get the spreadsheet every year, for 30 years, and input the information for all 30 years into the adjustedcostbase website?

@Brian – You still need to claim any income figures provided on your T3 for VEQT each year (with the exception of ROC, as it’s not taxable).

If you sell in 2051, you’d need to update the ROC and reinvested distributions for all 30 years (so I would suggest updating your ACB annually and keeping a record of the CDS.ca spreadsheet and your account statements or transaction history).

Hi Justin,

Thanks for the excellent article, video and whitepaper. This is the only mention of non-cash distributions that are something other than capital gains; that’s incredibly helpful. I have a few questions.

1. In Step 4, you say to use the settlement date of Apr 8, but that is also the payment date. Is the payment date the same as the settlement date, or is the example just a coincidence? I called Alliance about one of my funds and they said that since the units are issued from Treasury the settlement is T+0 but that implies that for units purchased on the open market there is a T+n settlement period.

2. In Step 6, if the non-cash distribution had been 100% return of capital instead, what is the effect? Non-cash distributions increase your ACB, return of capital decreases your ACB, so is it a wash (no net change in ACB)? And if it’s a wash do I even

3. EIT.UN had some odd non-cash distributions “related to warrants”. See 2014 for example ( https://services.cds.ca/applications/taxforms/taxforms.nsf/0/C3F3EDEAD2D82B4285257DFF0067982C/$File/CDSP-9UBQ58_T3_R16_TY2014_2015_03_05_13_51_31.xls ). They are listed as being 100% return of capital. I have a vague memory of receiving some warrants and then letting them expire unexercised. Is the tax treatment for these the same as the 100% return of capital non-cash distribution from my Question 2 (potentially a wash), or something else because warrants were involved?

4. This is a bit of a silly question since the impact of being wrong is, literally, a rounding error. In the very early days of holding one fund, I owned one share while waiting to make an optional cash purchase. There were two distributions during that period both in the same tax year, with 0.004 return of capital each time. My T3 reflects 0.01 return of capital (0.004 * 2 rounded). How do I account for that in my ACB tracking which must go transaction by transaction? A) Round each 0.004, which goes to 0.00, and have no return of capital. Con: doesn’t match the T3 value by a difference of -0.01. B) Round each 0.004 to 0.01 because there was some return of capital so it can’t round to 0.00 for a total of 0.02. Con: doesn’t match the T3 value by a difference of 0.01. C) Round one to 0.00 and one to 0.01. Con: ACB is inaccurate between the 0.00 and 0.01 transactions. Selling calculations will have errors. D) Don’t round. Cons: My total ACB now has fractions of a cent which I don’t think is okay, and, doesn’t match the T3 by a difference of -0.002. All of those have flaws. I think the algorithm I’m going to use is this: E) calculate rounding error (0.01 – (0.004 * 2) = 0.002). Distribute the error equally between all transactions. This would make for two each of 0.004 + 0.001 = 0.005, and the total would match the T3. Con: ACB has fractions of a cent for an interim period.

What method do you suggest?

Thanks in advance.

@Stuart MacDonald:

1. The settlement date of the transaction will be the date included in the transaction history of your official statements (so just use this date if there is any confusion).

2. It would be a wash, but I would still enter both (I’ve seen this with some BMO ETFs before).

3. I’m not familiar with the tax impact of this particular transaction.

4. I would ignore the rounding on the T3 and be more accurate with your cost base tracking.

Hi Justin,

Thanks for the reply, and apologies for the truncated question #2; I think I meant to finish that “…do I even bother to report it?”

As for #2, I’ll take your advice and enter both sides.

For #3, I’m seeking further advice; the Canoe employee I talked to talked to their Finance Team and the advice there was “treat it as return of capital” which is what their website says already. I saw some other advice that if all share/unit holders get the same rights/warrants then there is no reportable value, which is perhaps why it’s to be treated as return of capital, to have a wash on the value.

As for #4, that is the method I settled on. T3/5/et als seem to be more advisory than authoritative. I have one holding where my T5 is denominated in USD which isn’t useful for filing income tax returns; I figure out the exchanged-rate CAD values throughout the year and make my own T5s instead. So I’m doing the same here; figuring out the accurate return of capital values throughout the year, and then make my own T3s to match the real values.

@Stuart MacDonald:

#4 – If your T5 is denominated in USD, you can simply convert the figures to CAD by multiplying them by the average annual exchange rate available on the Bank of Canada site: https://www.bankofcanada.ca/rates/exchange/annual-average-exchange-rates/ (FYI: For the 2020 tax year, the rate is 1.3415)

Return of capital doesn’t technically need to be reported to CRA, so I wouldn’t put too much work into created updated T3s with this information.

Hi Justin,

I am a complete newbie when it comes to investing. I have my rrsp and tfsa accounts with Wealthsimple Invest and I recently opened a personal non-registered trade account with them as well.

Which etf’s are the best to hold in this taxable account? Many thanks for your help with this.

@Parveen – There’s no magic ETF to hold in taxable accounts. You would need to start by determining what your total portfolio should look like, and then allocate your ETFs across your various accounts to maximize the tax efficiency of the portfolio. I’ll be releasing several videos shortly that discuss asset location.

Alternatively, you can just hold the same asset allocation ETF across all accounts, which would be the easiest method (and still a decent option).

Thank you for the great video. I just started investing in ETF a few months ago with VGRO in a taxable account. I see on my transaction sheet of the bank platform some cash distribution. Is this the same thing as ROC ? Is there a place to enter it in the adjusted cost base.ca ? Or it is different and just something to pay tax on it and it does not change the ACB?

@Marie-Noël Primeau – You’re very welcome! If the cash distribution is not reinvested through a dividend reinvestment plan, it does not need to be entered in the adjustedcostbase.ca website (however, it can contain return of capital, but this is dealt with separately as I’ve shown in the video).

Tracking ACB is one reason to go with the Horizons total return ETFs. Just need to track buy, sell, and splits

Hi Justin,

I have an accountant who does my corporate and personal taxes. I only hold VGRO. Would I still need to use a service like ACB.ca?

My accountant makes me send them all my brokerage statements.

Even if I use ACB.ca, I don’t do my own taxes. Am I missing something?

Or should I still be using ACB.ca as well?

@Stephanie – You should also be tracking the ACB of VGRO for your accountant (they will require this whenever you sell shares of VGRO).

I’ve used CDS.ca data for many years. Usually, it’s straightforward as shown in your example for VGRO: the Total Non Cash Distribution ($) Per Unit is the same as the Capital Gain (in Box 21) and this distribution happens at the end of the year. But for some ETF’s, there are quarterly or monthly capital gains distributions (ZDB is a good example of this). Don’t you have to account for these distributions in the ACB?

@Smithson – Quarterly or monthly capital gains distributions do not increase the ACB, unless they are reinvested (i.e. “non-cash distributions”). You will need to check the appropriate CDS.ca spreadsheet to confirm if this is the case.

Thanks for the reply. I think I understand now. The monthly or quarterly capital gains distributions I receive are reflected by a decrease in the ETF price whereas the re-invested non-cash distributions don’t impact the ETF price and therefore I have to use the CDS data to make the appropriate upward adjustment to the cost base. Is that correct?

@Smithson – Correct – the fund company reinvests the cash for you, so similar to a DRIP, you need to increase the cost base to avoid unnecessary taxation.

@Justin – Many thanks for your help and all the other things you do to help Canadian investors. It’s much appreciated.

@Smithson – You’re very welcome! It’s always a pleasure helping Canadian investors better understand a complicated topic :)

Thanks for this great resource! Not too sure how this could be kept organized without help from sites like yours.

@Adam – You’re very welcome – glad it helped! :)

I have used the Adjusted Cost Basis.ca website for a couple years when I had a lot of non ETF assets and needed to transition off them. The price for the paid version is extremely helpful to just upload a spreadsheet at the beginning of the tax year and you are done. It automatically calculates your US dollar etfs transaction date rate and also provides a breakdown for T1135. I was able to just use the report generated to do my taxes as I had 3 brokerages to consolidate from. I must have saved 1000s of dollars in taxes since I did it myself as compared to letting my brokerage do it for me since they did not have all my positions. Questrade can’t even consolidate the Questwealth and Margin account ACBs so relying on your brokerage is foolish and dangerous as you could be potentially lying on your tax return. I hate paying for things that can be done with a spreadsheet but this software has saved me easily 100s of hours of number crunching. Worth the paid version especially if you have a ton of inputs to do to begin with.

@Anuraag – Thank you for sharing your ACB tracking experience with everyone. At the risk of sounding like a paid AdjustedCostBase.ca spokesperson, I have also saved hundreds of hours of time using their premium service.

Question: If you purchase the ACB.ca Premium service for $49/annum, all this is accurately done for ETFs, is that correct?

@Patti – I’ve never found any errors with the AdjustedCostBase.ca Premium service (I would highly recommend it for taxable ETF investors, especially if they hold multiple ETFs in their non-registered account):

https://www.adjustedcostbase.ca/blog/streamlined-import-of-return-of-capital-and-phantom-distributions-and-for-exchange-traded-funds-etfs-publicly-traded-mutual-funds-and-trusts/

Thanks a lot for the explanation Justin. I noticed that in My HSBC direct invest the “reinvested capital gain distribution amount” is already calculated in the ACB cost…

Thanks, as always, Justin. I’m trying to understand what we all need to do this for Canadian brokerage firms but in the US the brokerage are able to (and, in fact required to by the IRS) report the (I assume adjusted) cost basis when we sell securities? Am I missing something and in the US we should be doing this as well? (I know you mention the potential to hold securities across multiple brokerage firms but I’m not sure why each firm can’t calculate it for the securities held there.) Thanks!

Hi – I read up more on this and, as you obviously know, it seems that in the US we can use FIFO, while in Canada the average cost needs to be used (and across all accounts). Seems from a policy perspective Canada should adopt a system that is simpler and doesn’t require all of us to do all these calculations (since obviously most people won’t and will do it wrong).

@Jeremy – Yeah, it’s a very tedious task for Canadian investors. AdjustedCostBase.ca’s premium service (which Patti mentions in the comments) makes things much easier for investors:

https://canadianportfoliomanagerblog.com/easier-than-acb/

I can’t tell you how helpful this is! ACB is so intimidating.

A question – when I look up ZDB on CDS.ca I get a monthly RoC of about ~7. something (rather than 0.00 something in other funds). This seems outrageously high and makes the capital gains amount 10s of thousands of dollars a month on my roughly 2K shares. What am I doing wrong?

Thanks, love your blog.

No worries, I figured it out. That sheet was set to “percent” while all the other sheets are set as “rate”. :)

@Lise – You got it! I wish BMO would just drop their “percent” tax breakdown reporting (as it’s very confusing).

So I have a similar problem with a BMO ETF (ZPR). So I should just change the Percent setting to Rate and that will give me the proper amounts for ‘return of capital’ entries??

So I just toggled to ‘Rate’ in the spread sheet and the numbers didn’t change. So I’m guessing that it’s up to me to calculate the return of capital for each distribution? So if the total cash distribution for a month was $0.045 and the return of capital that month was 13.84813, and the spreadsheet is set to percent calculations, then I should multiply $0.045 by 13.84813% to get 0.00623166 for ‘return of capital’ that month?? Sorry to be so elementary, and thanks for the help!

@Stephen – Correct! It’s an extra annoying step for BMO ETFs ;)

Thanks Justin. I came across the PWL Easy as ACB whitepaper a few years ago and I still use it for reference whenever I need to double check an ACB concept or when someone has a question on tracking it themselves. The CRA doesn’t make any of this easy but I’m glad there are resources like the whitepaper and now this blog post to help Canadians with their taxable investments recordkeeping.

@Brenda – I’m so glad to hear the ACB resources have been helpful :)