It’s been over two years since I first wrote about using Norbert’s gambit in client accounts to cheaply convert Canadian dollars to US dollars (and vice-versa). Various white papers followed, showing DIYers how to get around the big banks’ high currency conversion costs. I even spoke with a few advisors and portfolio managers who had recently started implementing gambits in their own client accounts.

After the switch-over from TD Waterhouse Institutional Services (TDWIS) to National Bank Correspondent Network (NBCN) in early 2014, I was forced to learn the process at yet another brokerage firm. I still tend to favour the Horizons ETF products (rather than inter-listed stocks) when converting currencies, but this choice is totally up to the advisor. I’ll start off by briefly discussing the products I use and then go through the various steps required to implement the Norbert’s gambit in a taxable NBCN account.

DLR and DLR.U

The Horizons U.S. Dollar Currency ETF (DLR) is an ETF that holds cash and cash equivalents that are denominated in U.S. dollars. It is traded on the TSX and priced and transacted in Canadian dollars.

The Horizons U.S. Dollar Currency ETF (US$) (DLR.U) is the exact same ETF as DLR. It holds cash and cash equivalents that are denominated in U.S. dollars and also trades on the TSX. The only difference is that it is priced and transacted in U.S. dollars.

Both DLR and DLR.U have the same International Securities Identification Numbers (ISIN), which is basically the DNA of the security. The first two characters are the country code (CA), the next nine characters are the Committee on Uniform Securities Identification Procedures (CUSIP) number (44049C302), and the final character is the check digit (1).

| ETF | Ticker | Market | ISIN |

| Horizons U.S. Dollar Currency ETF | DLR | Canadian | CA44049C3021 |

| Horizons U.S. Dollar Currency ETF (US$) | DLR.U | Canadian | CA44049C3021 |

Source: OSS-NBCN

Now that you have a quick overview of the products we will be using, let’s walk through the steps an advisor would take if they needed to convert $50,000 Canadian dollars to US dollars in a client account at NBCN.

Step 1: Log-in to the NBCN member site at www.nbcn.ca and obtain an exchange rate quote

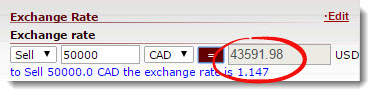

In this example, NBCN was offering $43,591.98 US dollars in exchange for $50,000 Canadian dollars. In steps two and three, we will be determining whether implementing the gambit would be expected to generate more US dollars for our client than the amount offered by NBCN.

Exchange Rate Quote from NBCN

Source: NBCN

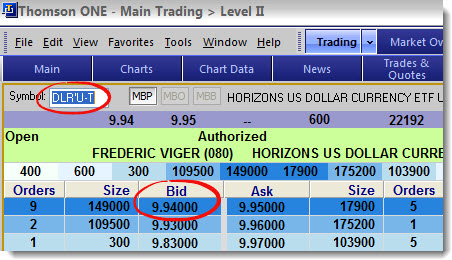

Step 2: Calculate how many shares of DLR you could purchase for $50,000 CAD at the current ask price

By dividing $50,000 by the current ask price of $11.35, we determine that we could purchase 4,405.2863 shares of DLR. This is a purely hypothetical calculation, as we cannot purchase partial shares.

Horizons U.S. Dollar Currency ETF (DLR) Quote

Source: Thomson ONE

Step 3: Multiply the number of shares from step two by the current bid price of DLR.U

If we sold 4,405.2863 shares of DLR.U at the current bid price of $9.94 USD, we would receive US dollar proceeds of $43,788.55. This transaction would leave the client with an additional $196.57 US dollars in their account ($43,788.55 minus $43,591.98). In this example, implementing the gambit would be the preferred choice.

Horizons U.S. Dollar Currency ETF (DLR.U) Quote

Source: Thomson ONE

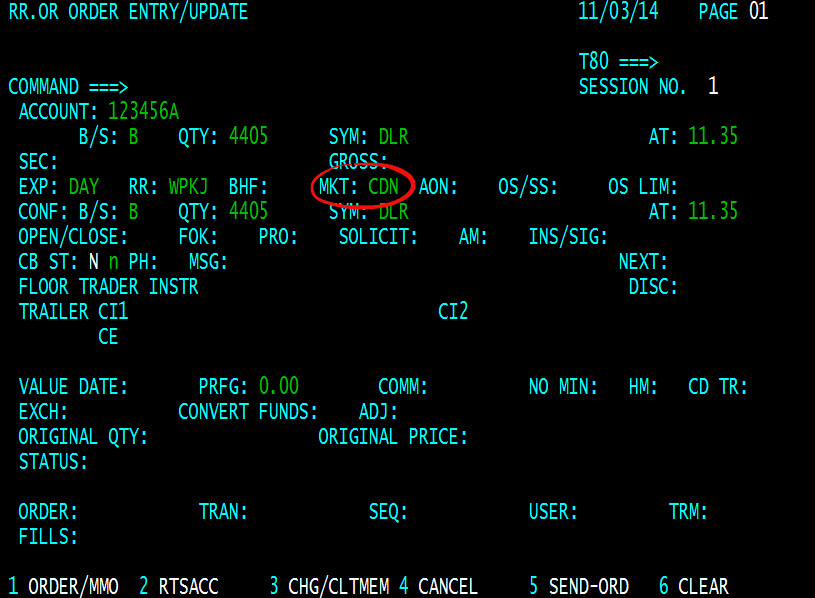

Step 4: Buy 4,405 shares of DLR in the Canadian dollar “A” account

Since we can’t buy partial shares, we will round down the number of shares of DLR from step two to the nearest whole share. We recommend placing a limit order directly at the current ask price. Ensure that the market is “CDN” and that you are in the client’s taxable Canadian dollar account (the one ending in “A”).

OSS Order Entry Screen: Purchase of 4,405 shares of DLR in the Canadian dollar account

Source: OSS-NBCN

Step 5: Sell 4,405 shares of DLR.U in the taxable US dollar “B” account

Once you have noticed the purchase of 4,405 shares of DLR has been accepted, immediately switch to the US dollar “B” side of the same client account. Once there, place a limit order at the current bid price to sell 4,405 shares of DLR.U. One tricky part of placing this trade at NBCN is that the market must be “TF” (it stands for Toronto Foreign). If you type in “CDN” instead, the trade will be rejected.

Every so often, this trade will not be accepted right away. If this happens, feel free to pick up the phone and contact an NBCN trader, who will be able to push the trade through.

At this stage, you may also want to purchase a US-listed ETF with the US dollar proceeds; this is generally okay, as long as all trades settle on the same day. Beware of settlement periods that contain a market holiday for either the Canadian or US stock market.

OSS Order Entry Screen: Sale of 4,405 shares of DLR.U in US dollar account

Source: OSS-NBCN

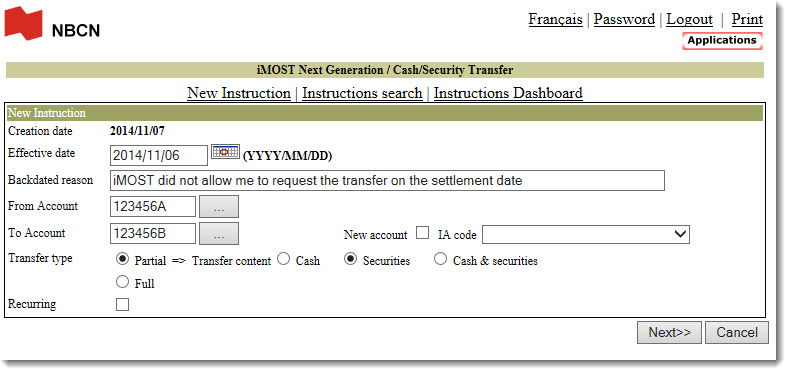

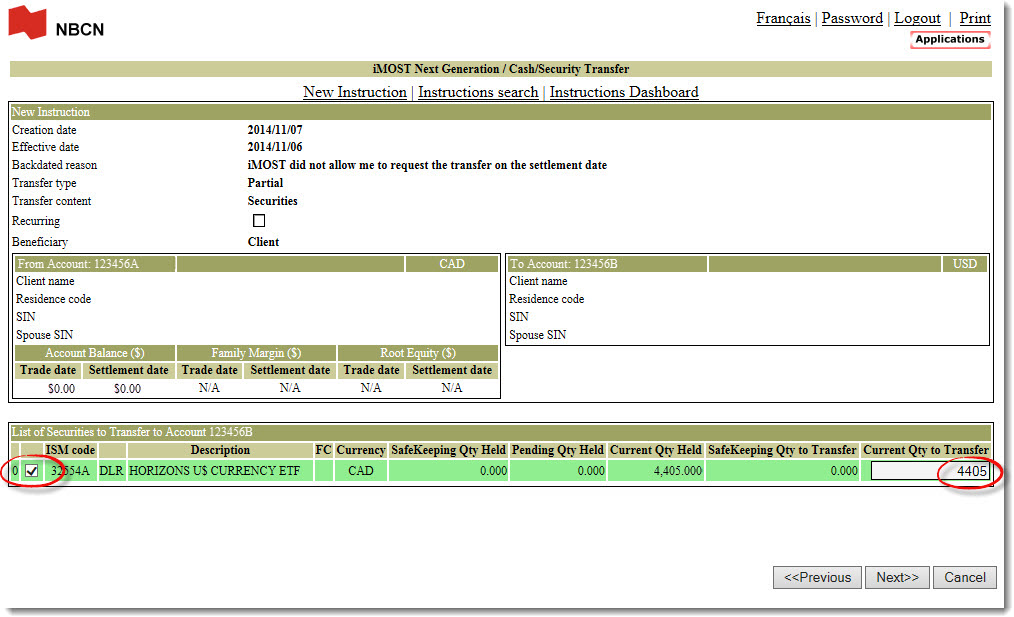

Step 6: On T+4, log-in to iMOST Next Generation and transfer 4,405 shares of DLR from the Canadian dollar account to the US dollar account

In order to avoid debit interest, this step would be required by the trade date plus three business days (T + 3). Unfortunately, iMOST will not let advisors request a journal on T + 3 (it has to be done the next day). To get around this, change the effective date in the request to one business day earlier, giving the reason that iMOST did not allow you to request the transfer on the settlement date.

Request to Transfer a Security

Source: NBCN

Request to Transfer 4,405 shares of DLR

Source: NBCN

Does this strategy work with any online trading account? I have one held with Questrade.

@AZ: I don’t have a Questrade account, but moneygeek has posted a video of the process on his blog: http://www.moneygeek.ca/weblog/2013/10/18/how-exchange-usd-cad-cheaply-using-questrade/

@Justin: do you have detailed instructions for a DIYer performing NG at NBDB?

@Luc – unfortunately, I have only performed Norbert’s gambit at the big 5 banks (and NBCN) and am unfamiliar with the process at the National Bank discount brokerage.

Thanks Justin! Can you suggest which white paper would be best/closest to use to try to NG at NBDB in a taxable account?

@Luc – I really wouldn’t know which one is closest without trying it out for myself. If I receive more requests from readers about Norbert’s gambit at NBDB, I may open another account and try it out (I already have 6 different discount brokerage accounts, so it’s starting to get unwieldy ;)

LOL, I was just thinking the same thing, “wow, that’s pretty cool that Justin opens all these trading accounts with multiple discount brokerages to produce these tutorials.” I’m not sure if the account opening information required is the same or not but perhaps opening “practice accounts” with other discount brokerages might be better? I’m assuming the “practice accounts” are a full and true simulation of regular trading accounts, of course. ;)

I liked the Norbert’s Gambit tutorial you produced for RBC Direct Investing that allowed you to simultaneously place the “buy” and “sell” orders, which would get cleaned up on when the trades settle in 2-3 days presumably. That seems to save a few steps from what I’ve read elsewhere about contacting the discount broker via their online form and having them “journal” your positions to the USD version of the TSX-listed DLR and DLR.U. Does that strategy work with any other discount brokers (i.e., Scotia iTRADE, Qtrade or Questrade)?

Speaking of DLR and DLR.U, I wonder if those two securities have the shortest duration of unitholders (i.e., less than a day to a few days). I’m trying to see how they benefit – I guess they benefit by showing up in the TSX’s “Most Actives” chart and they have a constant unitholder base, even if it fluctuates to a high degree by the day. ;)

Cheers,

Doug

@Doug Mehus: Unfortunately, the brokerage practice accounts do not always simulate a true trading environment. A good example of this is trying to implement Norbert’s gambit in an RBC Direct Investing practice account (it doesn’t work). So I’m stuck opening multiple accounts in order to illustrate certain processes to viewers in my videos.

RBC DI is the easiest place to implement a Norbert’s gambit. BMO is next up, while the rest of them require waiting until settlement, and then requesting a transfer of DLR from the CAD side to the USD side of the same account.

I’m assuming Horizons makes most of their money off of the bid-ask spread on DLR/DLR.U

There seem to be necessary tricks that differ from one discount broker to another. The back-dating of the transfer request is non-obvious and quite helpful.

@Michael James: I should have been more clear about this particular procedure – it is for National Bank “Correspondent Network” (not for National Bank “Direct Brokerage”). The post is really only relevant for advisors who use NBCN as their back office.