As more and more ETF providers jump on the smart-beta bandwagon, Manulife had an even better idea – why not team up with the pioneers of factor-based investing, Dimensional Fund Advisors (DFA)?

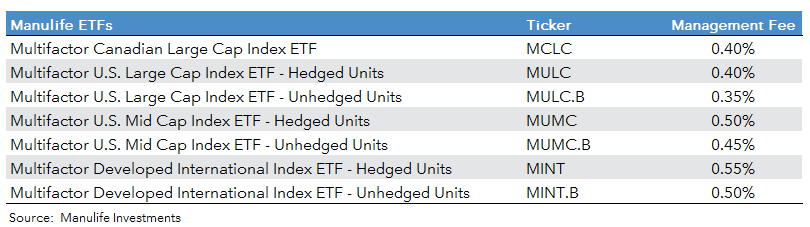

And they did just that. For years, investors could only gain entry to the exclusive Dimensional party if they hooked up with a DFA-approved advisor. Now, do-it-yourself investors have easy access to at least a portion of DFA’s secret sauce through Manulife’s Multifactor ETFs:

The DFA factor

Staying true to DFA’s approach, Manulife’s ETFs target factors that have historically generated higher returns (such as smaller cap, lower relative price and higher profitability). As DFA is arguably best known for the small cap tilts in their funds, it’s interesting to note that Manulife’s ETFs generally exclude smaller companies (this is likely due to the difficulty trading smaller companies within an ETF structure).

Put your John Hancock here

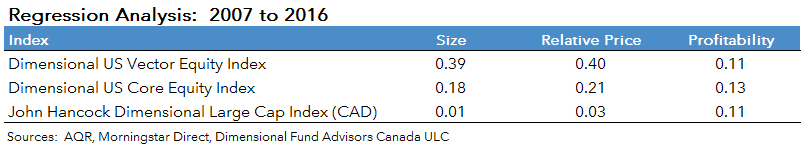

Manulife’s ETFs follow the John Hancock Dimensional Indices, which are fairly new and have very little historical performance data. I did manage to scrape together over ten years of monthly returns for the US large cap index, so we can use this data to run a regression analysis for comparison purposes (basically, we are trying to determine whether the Manulife ETFs are expected to be comparable to DFA funds in terms of small cap, relative price and profitability factor tilts).

In the chart below, I’ve included the historical factor tilts for the Dimensional US Vector Equity Index (which is similar to the DFA US Vector Equity Fund), the Dimensional US Core Equity Index (which is similar to the DFA US Core Equity Fund) and the John Hancock Dimensional Large Cap Index (which is similar to the Manulife Multifactor U.S. Large Cap Index ETF). A higher value indicates a greater exposure to each of the academic factors.

The Dimensional US Vector and Core Equity Indices have a significant exposure to the size, relative price and profitability factors, while the John Hancock Dimensional Large Cap Index has significant exposure to only the profitability factor. This would indicate that a DIY investor using the Manulife Multifactor ETFs is not expected to have a similar investment experience to someone using the DFA mutual funds.

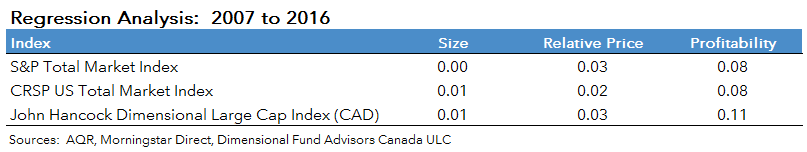

As I generally recommend broad-market ETFs to DIY investors, I’ve also included a regression analysis in the chart below that compares the S&P Total Market Index (similar to the iShares Core S&P U.S. Total Market Index ETF), the CRSP US Total Market Index (similar to the Vanguard U.S. Total Market Index ETF) and the John Hancock Dimensional Large Cap Index (which is similar to the Manulife Multifactor U.S. Large Cap Index ETF).

Beta in disguise

The results above would indicate that the John Hancock Dimensional Large Cap Index has very similar factor tilts to plain-vanilla broad-market indices. In other words, you’re paying a steep premium to Manulife for market returns that are available for much cheaper.

Although these new Manulife ETFs have a great deal of hype behind them (thanks in part to DFA’s reputation), they don’t appear to offer anything close to the factor tilts available in DFA mutual funds. For DIY investors, sticking to the boring Couch Potato investment philosophy is likely your best bet.

Good review Justin – another product that has a poor value proposition. It seems everyone needs, or wants, to be in the ETF industry today.

I love the new cleaner look CPM logo! Join the dots!

@Marko Koskenoja: Thanks for the feedback, Marko! The blog/logo redesign was the impressive work of Meredith and Christian from Merian Media: https://merianmedia.ca/

Can I buy these at Questrade?

@Norbert: The Manulife Multifactor ETFs are now available for purchase at Questrade.