I know what you’re thinking: “Do we really need another suite of asset allocation ETFs?” Vanguard, iShares and BMO already dominate the marketplace with excellent products, so what could another fund provider possibly have to offer?

Although Mackenzie’s asset allocation ETFs are similar in many ways to the existing offerings from the big 3, they have a few novel features that set them apart from the others. In this blog post, I’ll compare the Mackenzie asset allocation ETFs with the Vanguard, iShares, and BMO portfolios to see how they stack up.

When I first heard of Mackenzie’s asset allocation ETFs, I assumed they were just like the TD One-Click ETF Portfolios – quasi-passively managed funds with an unhealthy dose of active thrown into the mix. Even the prospectus refers to them as the “Mackenzie Balanced Active ETFs”. However, on closer inspection, it turns out Mackenzie’s portfolio managers aren’t given any more leeway than their competitors. The managers have some discretion to adjust and rebalance the portfolios from time to time, but I think it’s safe to place the Mackenzie ETFs into the same passive category as the others.

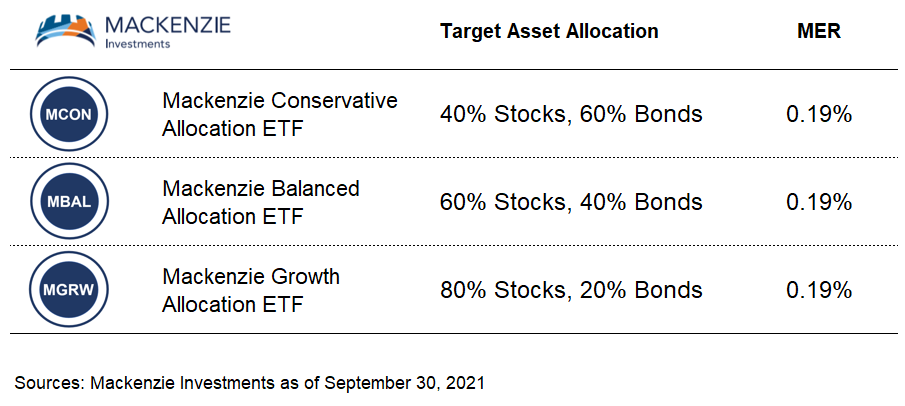

Mackenzie has initially launched three asset allocation ETFs, with options for 40%, 60% and 80% stocks. They all have a management expense ratio (or MER) of 0.19%, which is slightly cheaper than the iShares and BMO portfolios, which charge 0.20%.

Equity Breakdown of the Mackenzie Asset Allocation ETFs

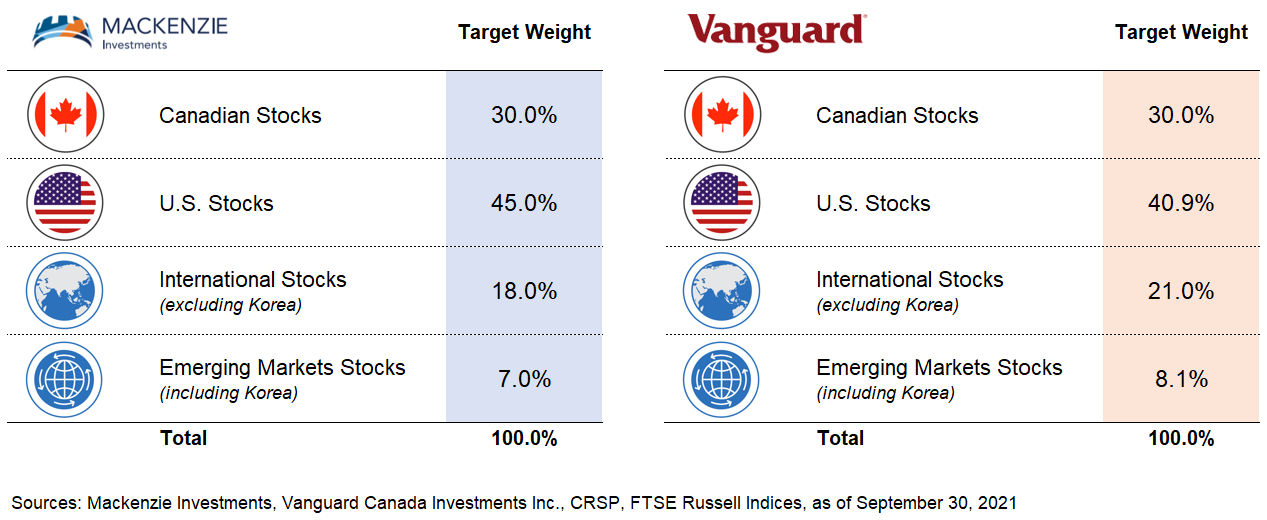

For the equity breakdown, Mackenzie has targeted 30% Canadian stocks and 70% unhedged foreign stocks, which is the same as Vanguard’s split. And although Mackenzie has static target weights for its 70% foreign equity allocation, they are very similar to Vanguard’s current market-cap weights, with Mackenzie’s U.S. equity allocation being slightly higher, and their international and emerging markets a bit lower.

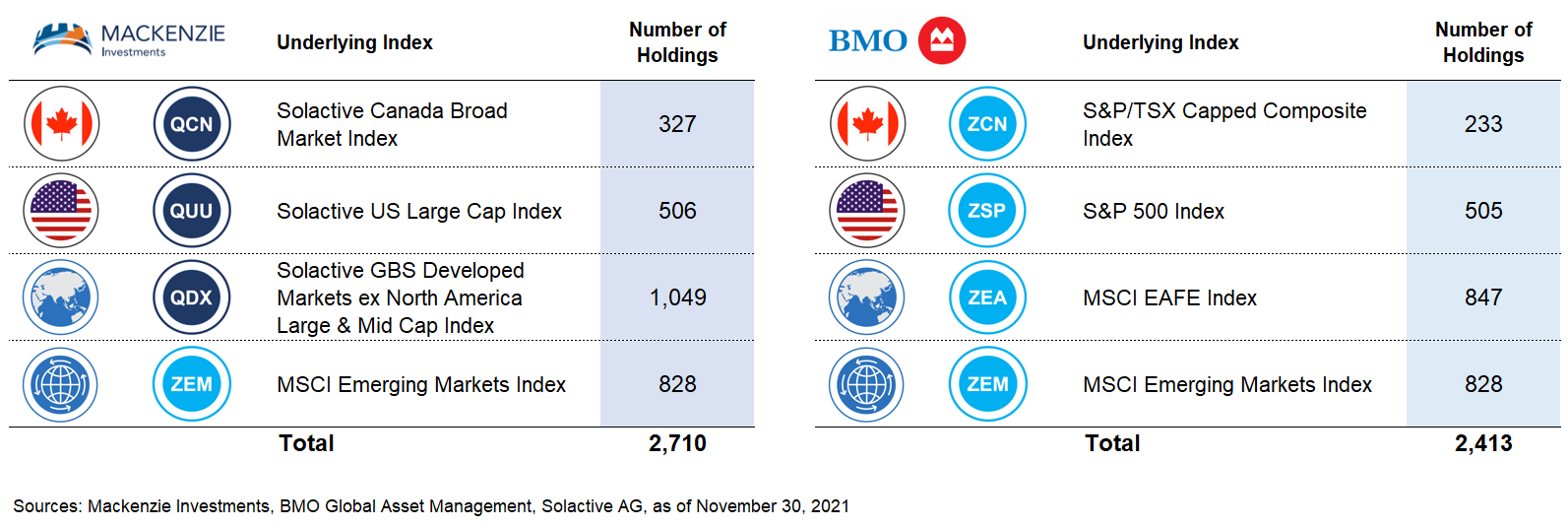

Mackenzie’s portfolios include several underlying equity ETFs that track indexes provided by Solactive. These measure the performance of thousands of companies across the globe.

With about 327 companies, the Solactive Canada Broad Market Index actually contains more small-cap stocks than the benchmarks used by Vanguard, iShares and BMO.

But when it comes to foreign equities, the Mackenzie portfolios are closer to BMO’s, with a focus on large- and mid-cap stocks.

For example, the Solactive US Large Cap Index and the S&P 500 Index both include around 500 large-cap U.S. companies.

On the international equity front, the MSCI EAFE Index and its Solactive counterpart both track the performance of hundreds of large and mid-cap developed companies operating outside of North America.

And for emerging markets equity exposure, Mackenzie actually holds the BMO MSCI Emerging Markets Index ETF (ZEM). However, they have filed a preliminary prospectus for the Mackenzie Emerging Markets Equity Index ETF (with ticker symbol QEE) and they plan to replace ZEM once this new fund is launched. QEE will track a Solactive large and mid-cap equity index, and like ZEM, it will also hold the underlying stocks directly, resulting in one less layer of unrecoverable foreign withholding taxes across all account types). This makes QEE more tax-efficient than either of the emerging markets equity ETFs found in the Vanguard or iShares portfolios.

While we’re on the topic of foreign withholding taxes, let’s switch to the fixed income side of the portfolios, where Mackenzie has made several interesting ETF choices to improve tax-efficiency.

Fixed Income Breakdown of the Mackenzie Asset Allocation ETFs

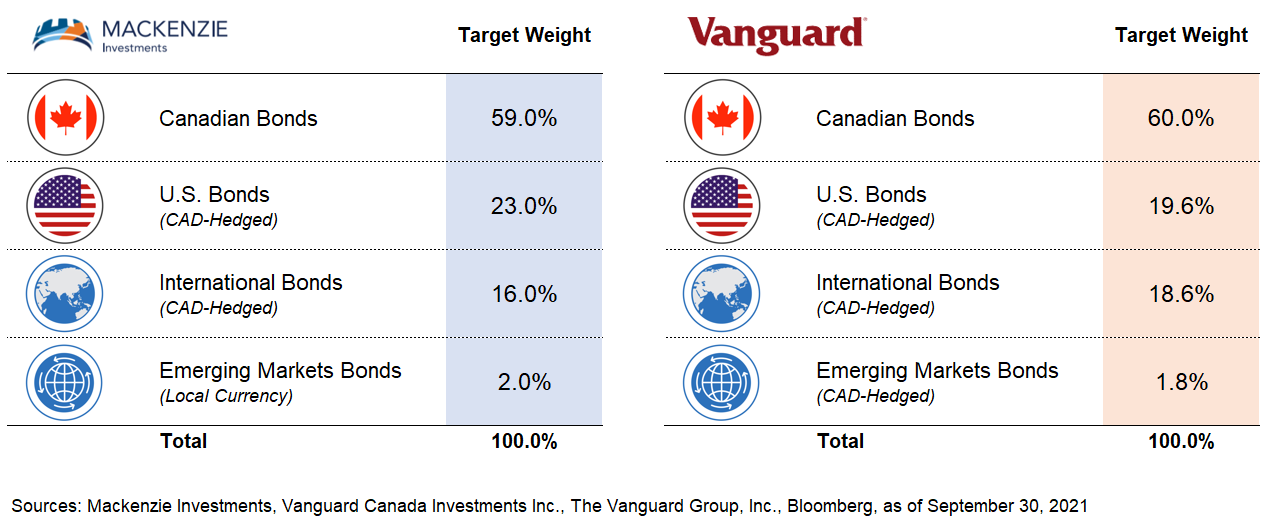

In addition to Canadian bonds, Mackenzie also includes U.S., international and emerging markets bonds. The target weights are similar to those found in Vanguard’s portfolios. Here again, Mackenzie’s target weights are static, whereas Vanguard targets a 60% Canadian, 40% foreign bond mix, but allows the regions within the foreign allocation to fluctuate, based on their current market caps.

However, within Mackenzie’s fixed income allocations are two notable differences.

First, Mackenzie has decided to leave the currency exposure of their emerging markets bonds unhedged, whereas Vanguard hedges away the currency risk.

When I asked Mackenzie’s team about their decision, they explained that exposure to emerging markets bonds in their local currency offers a diversification and yield advantage. They also claim that currency has been a key contributor to the total return of local currency emerging markets bonds.

Whatever your preference, this difference is likely to have minimal impact on the fund’s overall returns, as emerging markets bonds make up less than 1% of both the Mackenzie and Vanguard balanced ETF portfolios.

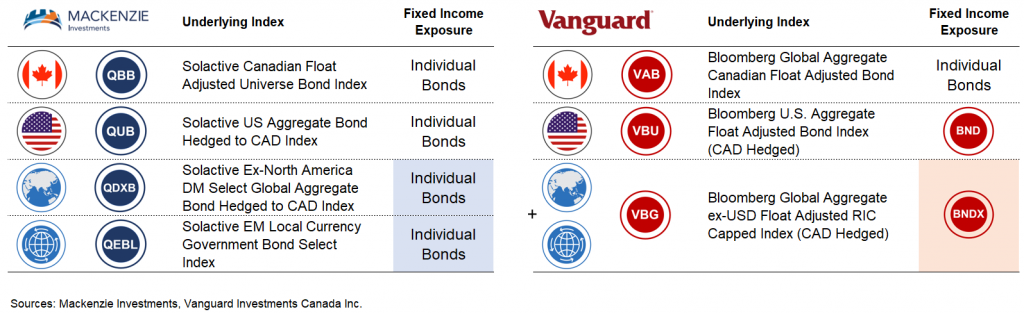

The second difference is much more exciting. Mackenzie has chosen to hold their underlying foreign bonds directly, while Vanguard simply holds U.S.-listed ETFs to gain exposure to these asset classes.

Now, the structure of Mackenzie’s bond funds is not expected to impact the tax-efficiency of the U.S. bonds: treaties between Canada and the U.S. already significantly reduce the amount of U.S. withholding tax applied to interest payments. However, it is expected to eliminate the second layer of 15% U.S. withholding tax applied when a Canadian-listed ETF receives distributions from a U.S.-listed ETF that holds international and emerging markets bonds.

For example, when held in an RRSP or TFSA, Mackenzie’s international and emerging markets bond ETFs, QDXB and QEBL, would only lose one layer of foreign withholding taxes on interest paid from the foreign countries to Canada. By comparison, investors in Vanguard’s international and emerging markets bond ETF, VBG, would be subject to two layers of unrecoverable foreign withholding taxes. This translates into an additional tax drag to VBG investors of around 0.3% per year.

Rebalancing Thresholds for the Mackenzie Asset Allocation ETFs

As with our other asset allocation ETF providers, Mackenzie plans to top-up underweight asset classes with any cash flows, so the ETFs should stay close to their targets during most periods. If necessary, the managers will rebalance the portfolios during their quarterly review.

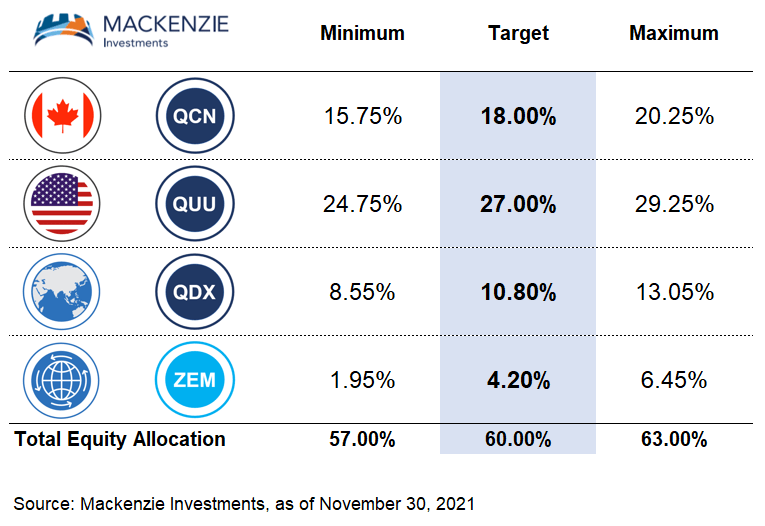

Mackenzie has a 3% absolute rebalancing threshold between the fund’s target equity and fixed income allocations. For example, the Mackenzie Balanced Allocation ETF (with ticker symbol, MBAL), which has a 60% equity target, will be rebalanced if equities have increased to more than 63%, or less than 57%.

As well, the individual asset classes will be rebalanced if they deviate by at least 2.25% above or below their target weights. For example, Canadian equities, which have an 18% target weight in MBAL, will be rebalanced if they increase to at least 20.25%, or decrease to 15.75%.

Overall, the Mackenzie asset allocation ETFs have earned a place alongside their counterparts from Vanguard, iShares and BMO. They even include several new tax-efficient features that make them stand out from their competition. For this reason, I plan to add Mackenzie’s Asset Allocation ETFs to my model portfolios in the new year, so keep an eye out for those.

As well, after hearing about this blog/video, Mackenzie has offered to contribute to SickKids Foundation, so I wanted to take a moment to thank them for this donation.

If one has chosen to work with an advisor, is it reasonable to invest in something like the DFA Global Equity Portfolio (Class F)? More specifically, do the factor tilts in such a portfolio, in your opinion, defeat the purpose of market-cap weighted indexes?

Thanks

@Jamieson – It is perfectly reasonable to invest in something like the DFA Global Equity Portfolio (Class F) with an advisor. The fund is extremely diversified, relatively low-cost, and tax efficient.

However, factor-tilting is a form of active management, and will either underperform or outperform a market cap-weighted index strategy over an investor’s time horizon (unfortunately, no one knows in advance what their outcome will be). Most of the unhedged DFA equity funds have been around for 10-20 years in Canada, and none of them have outperformed a suitable index benchmark since their inception.

So in my opinion, investing in low-cost ETFs that track broad or total market cap-weighted indexes is still the most prudent approach for investors.

I would love a detailed comparison of the tax efficiency of Mackenzie funds compared to Vanguard / iShares, and where gains could be made by using separate funds in specific account types. I understand the added complexity might not be worth it to most investors, but I’d like to know how much we’re leaving on the table.

For example, I think I understand foreign equity should be more tax efficient in Mackenzie funds when held in a taxable account. Is this automatically taken care of by the investment firm and do they send out T3/T5? Same question regarding US bonds. You mention that holding the bonds directly shouldn’t impact the tax-efficiency of the U.S. bonds. Is that true regardless of the account type?

Thank you!

@Julien B. O. – Unfortunately, a complete response to your questions would be too overwhelming. I would suggest starting off by learning about foreign withholding taxes, and then asset location strategies (I’ve included links below to my videos):

Foreign Withholding Taxes: https://www.youtube.com/watch?v=NSkub4OqkuM

Asset Location (Part 1): https://www.youtube.com/watch?v=lQBpRLlEmGg

Asset Location (Part 2): https://www.youtube.com/watch?v=ScoLiJOeL6A

Asset Location (Part 3): https://www.youtube.com/watch?v=ezDWpZ6HNyk

Hey Justin,

I find Canadian Portfolio Manager content straight forward and intuitive. On the other end of the DIY blog spectrum, the Rational Reminder community focuses a lot on factor tilts and the content is dense and often complicated. Do you see any merit combining and asset allocation ETF with a couple factor tilt funds?

Some examples could be:

70% VCNS, 15% AVUV, and 15% AVDV

40% VGAB, 30% VEQT, 15% AVUV, and 15% AVDV

I’m trying to think of a portfolio that is diversified, has some factor exposure, but is still easy to manage over a couple accounts. I know DFA has some asset allocation funds that achieve this but unfortunately I don’t have access to those. What are your thoughts? Is the behavioral risk to tinker or act on factor underperformance not worth the small potential increase in returns?

Thanks!

@Jamieson Jones – I used to obsess about factor regressions and tilting, but over the years, I found myself coming back to broad-market index investing. Stock markets have too much noise (meaning they’re just way too complicated) for investors to feel confident in any active strategy (like factor investing). I encourage investors to stick with index investing, as it is incredibly hard to beat.

Thanks for the reality check!

A little unrelated… do you have any thoughts on ZBAL.T? From the BMO website:

ZBAL.T is the first of its kind in Canada, bringing popular T Series solutions to the ETF space

ZBAL.T pays out a 6% annual distribution via a fixed monthly distribution based off year end Net Asset Value (NAV) (NAV *6% / 12 months)

If you bought $1000 of ZBAL.T and $1000 of ZBAL and sold them both at the end of the year would your total end up being the same? Would love to see a video on this, especially if they release more T series ETFs.

@Jamieson Jones – With a 6% annual distribution, I would expect the majority of the income to be comprised of return of capital. At such a large distribution rate, it’s unlikely the fund can sustain the withdrawals, and the distributions would be expected to erode the capital of your holding over time.

I feel as though the Mackenzie All-In-One ETFs are some of the most underrated. The MER definitely is a huge plus even if it is just 1 basis point. I wish they had a little less North American equity bias. When I’ve looked at forward P/E emerging markets and some EAFE countries seem to have more attractive valuations moving forward.

First off, I really enjoy your content. Thanks for all great sensible advice.

What do you think about current lower volume of MBAL/MGRW compared to even BMO 1-ticket ETFs when it comes time to sell, in terms of liquidity? On the plus side, I have been watching the volume for last few days and it seems to be going up. This is good for this new ETF. I am just starting out investing so it is exciting for me at least.

I noticed is that US small and mid cap are totally missing, is that something to be concerned about?

I have auto withdrawal from by bank account with $500/mo to my RRSP and $500/mo to my TFSA. I buy MBAL in my RRSP and MGRW in my TFSA.as it comes up to around 30% bonds/70% stocks total mix. I also had DRIP setup recently with these ETFs. Would you recommend executing trades monthly with lower number of stocks or buying quarterly with larger lot size so orders fill quickly? What about dollar cost averaging in this senario?

My commission free brokerage, Disnat, has real time stock prices included for free so I just place order at asking price and orders fill right away. How would you recommend buying these stocks, at asking price or current real-time price (or just +5 cents above current price)?

Thanks!

@Amarinder – Thanks for checking out the blog. I’m not overly concerned with lower trading volume (as long as you use limit orders and not market orders). I would be more concerned that an unpopular fund is shut down, and taxable investors are left with a big capital gains tax bill.

I would recommend investing your cash when you make your contributions (if you’re not paying commissions). If you are paying commissions, you may want to consider other no-commission brokerages, like National Bank Direct Brokerage. I tend to place limit buy orders directly on the current ask price (or 1 cent above).

@justin

Thank you! For someone who needs the money in 3-5 years, Moneysense suggested XINC but I’m worried with the increasing rates that I may be making a poor choice… do you think it would be better to pair XSB/XSH with EQT or just shut my brain off and use XINC. Your opinion is appreciated! Thanks again :).

@Leo: If you require the funds in 3-5 years, avoiding asset allocation ETFs is generally the best advice. Sticking with 1-5 year GICs (depending on your liquidity needs) and liquid investment savings accounts is the prudent choice.

If you haven’t done so already, feel free to watch our video on choosing an appropriate asset allocation ETF (we discuss time horizons in the video as well): https://www.youtube.com/watch?v=JyOqqtq12jQ

Hey Justin! Thanks for all the work you do, it’s much appreciated. I have a question, which company (BMO, iShares, Vanguard etc) do you think is best set up to be resilient in a raising rate environment? I was thinking about doing XSB and XEQT in a 60/40 split but I love the simplicity of the all in ones. Thank you!

@Leo – The iShares Core ETF Portfolios have the lowest fixed income duration, so they would be expected to fare the best if interest rates were to rise (although there is no guarantee of this outcome).

Hi Justin, I am trying to click on the McKenzie pdf on model portfolios but it is not opening up

@Pete – Sorry about that! The portfolios should now be updated as of December 31, 2021 (although I still need to include the newly released ZEQT in the BMO Asset Allocation ETFs).

For a long-term strategy with MBAL would you choose to hold it in Wealthsimple Trade or Questrade? I prefer the look and reliability of Wealthsimple after a couple months but have noticed most serious investors tend to switch to Questrade at some point. I plan on making a $10,000 RRSP contribution if the account type matters. Any thoughts on the platforms?

Thank you for your detailed explanation of asset allocation ETFs, your videos got me interested in long-term financial planning.

@Jamie – I wouldn’t get too bogged down with the platform. If you’re just investing in a single asset allocation ETF, you really don’t need anything too fancy.

Also have a look at National Bank Direct Brokerage – they don’t charge commissions for ETF trades, and they waive account administration fees if you’re aged 30 or under:

https://nbdb.ca/pricing/general-fees.html

I will look into that service! My last question is whether the low trading volume of Mackenzie Asset Allocation ETFs is a cause for concern?

I’ve read that sometimes it could be a liquidity issue but since Mackenzie owns the underlying security it may not be an issue.

@Jamie – Low trading volume is generally not a concern for ETFs if their underlying holdings are relatively liquid (just make sure you’re always using limit orders when placing trades, not market orders). Here’s a good article to read on the topic of ETF liquidity:

https://www.vanguardcanada.ca/documents/understanding-etf-liquidity-and-trading-en.pdf

QEE (https://www.mackenzieinvestments.com/en/products/etfs/mackenzie-emerging-markets-equity-index-etf-qee) is now live. No fanfare. Nothing.

I’m planning on waiting a couple of months before I switch all my VEE to QEE (even though Solactive classifies S.Korea as an Emerging Market). I hope Mackenzie can avoid the same issues as ZEM.

@David – Thanks for the heads-up! It will be interesting to see how/if the emerging markets equity ETF structure evolves with Vanguard and iShares.

Justin, looking at Mackenzie’s website I see that they also have MGAB – Mackenzie Global Fixed Income Allocation ETF.

What are your thoughts on using MGAB with VEQT instead of VAB for those of us seeking an asset allocation other than what VGRO or VBAL etc. provide such as 70% Equity and 30% Bonds?

@Rob – I think MGAB could have been a great product if Mackenzie had just kept it simple. In my opinion, there’s way too much going on in the fund. If I could offer them a suggestion, I would simplify the product so that investors could do exactly what you’re proposing (i.e., team it up with VEQT, XEQT or ZEQT) while still having a more tax-efficient offering than Vanguard. I think it would be easiest to mimic Vanguard’s fixed income strategy in their asset allocation ETFs (i.e., 60% Canadian bonds, 40% market-cap weighted foreign bonds) – it would look something like this:

– 60.0% Mackenzie Canadian Aggregate Bond Index ETF (QBB)

– 17.6% Mackenzie US Aggregate Bond Index ETF (CAD-Hedged) (QUB)

– 17.4% Mackenzie Developed ex-North America Aggregate Bond Index ETF (CAD-Hedged) (QDXB)

– 5.0% Mackenzie Emerging Markets Bond Index ETF (CAD-Hedged) (QEBH)

Hello Justin,

What if a DIY investor wanted to complement/diversify their CAD bond holdings in a non-reg account. I already hold ZDB in such an account (as per your guidance), but I like the idea of additional diversification, and particularly US bonds. Would VBU be inappropriate for this role? Or VGAB to capture global diversification? I like the tax efficiency of the Mackenzie products noted here, but as you indicate, MGAB is complicated, and the thought of holding 4 bond ETFs (as described above) in my non-reg account gives me a headache…

And thank you for all the information you provide.

@Christian – I don’t see any big issues with diversifying your taxable bond holdings. VBU/VBG or VGAB would all be reasonable options (please note that Mackenzie’s international and emerging markets bond ETFs are more tax-efficient than Vanguard’s in an RRSP, but their tax benefit is expected to be modest in a taxable account).

Any opinion on Horizon’s ETF Portfolios (e.g. HGRO, HBAL)? They have performed better than Vanguard, and do not have distributions so are tax efficient. But they are thinly traded. I don’t understand why they are not more popular. What am I missing?

@Jack – The government has already attempted to shut-down the tax-efficient structure of these ETFs. When they finally succeed, there could be large capital gains distributions to investors.

I also don’t like the general construction of the portfolios (i.e., allocations to unhedged U.S. bonds, heavy NASDAQ 100 tech over-weighting, a “Europe 50” allocation, etc.).

Hey Justin! Great video and blog post.

These ETFs (and the underlying ETFs) look really appealing because of their foreign withholding tax efficiency. I checked the performance of QCN compared against VCN (which I’m currently holding). QCN seems to consistently underperform compared to VCN.

Can this be explained by the increased holdings of QCN? I think I remember Dan once posting that too much diversification can drag on your returns. I wonder if that’s happening here.

@Kyle Slinn – Thanks!

I’m not sure what performance figures you’re looking at. As of December 31, 2021, QCN had 1-year and 3-year returns of 25.6% and 17.5%, while VCN had returns of 25.6% and 17.2% (so QCN had the same return as VCN over the past year, and outperformed VCN by 0.3% annualized over the past 3 years.