DIY investing can be intimidating. Sure, I post model ETF portfolios on my blog that readers can download and implement at their favourite brokerage, but novice investors may still find the process overwhelming.

That’s why I’ve decided to set-up a DIY investing channel on YouTube (the videos have been produced by Tara Hunt and edited by Unbuttoned Media). My initial videos will focus on the basics of implementing an ETF portfolio at each of the big bank discount brokerages. Viewers will learn how to calculate the number of ETF shares to purchase and also how to place limit orders (this is great stuff for beginners). Please be sure to subscribe so that you don’t miss any of them – the videos are scheduled for release over the next few weeks.

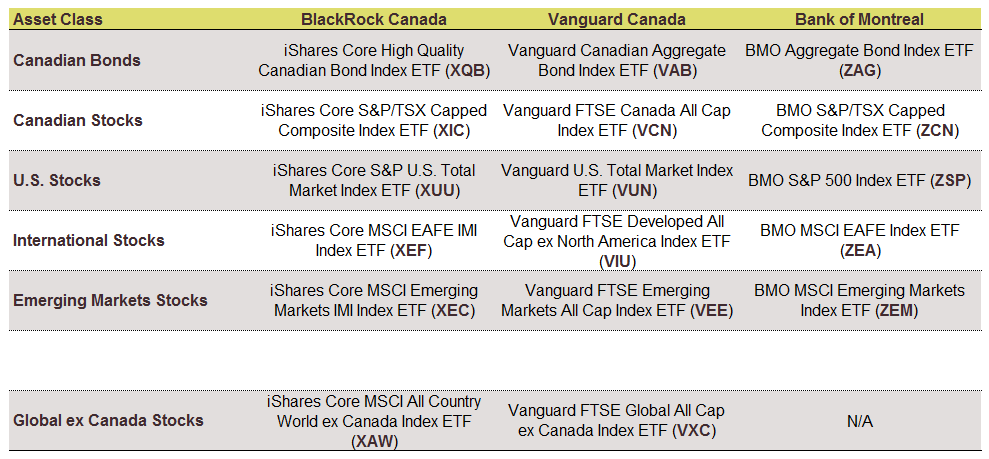

Although I’ve used the actual ETFs from my model portfolios, please feel free to substitute any of the recommended ETFs for similar ones in the same asset class (I’ve included a list below of alternative ETF choices).

Alternative ETF choices

Sources: BlackRock Canada, Vanguard Canada, BMO

If you’re an investor with a smaller portfolio, you may also want to consider swapping out your US, international and emerging markets ETFs for a single global fund, such as the iShares Core MSCI All Country World ex Canada Index ETF (XAW) or the Vanguard FTSE Global All Cap ex Canada Index ETF (VXC) (the Canadian Couch Potato uses VXC in his model ETF portfolios). This should help reduce trading commissions as you continue to manage your new ETF portfolio.

The first video in the series will be on How to Build an ETF Portfolio at TD Direct Investing.

Hi Justin ! I’m not yet investing in a DIY ETF portfolio. Almost. :) Before, I would like to know if you think my strategy is good. I want to put around 55K$ of TFSA and 55K$ RRSP in a model portfolio of CCP. For the 20k$ I have in a non-register account, I want to put it at Wealthsimple because I don’t want to think too much about tax-efficiency strategy and calculate ACB for the moment even if I will pay 0.5 more. So, I go like this ?

@Charles Messier: I’m not certain that Wealthsimple will add any value on the tax-efficiency side of things, so you may be paying 0.50% plus tax for a similar portfolio to what you are planning to implement in your TFSA/RRSP accounts.

Hi Justin,

Among the ETFs suggested is XEC. The BalckRock Canada website is, however, showing what seems to be a large variation between XEC and its benchmark (returns). Any explanation for this and is it something we should be concerned going forward.

Thanks,

@Andre: The 3-year annualized return as of November 30, 2016 for XEC is 4.73%, while the annualized return for the MSCI Emerging Markets IMI Index (in CAD) is 5.16% (for a difference of 0.43% per year, which is higher than XEC’s MER of about 0.26%).

The benchmark index return could be before foreign withholding taxes (i.e. “gross” dividends). A more appropriate benchmark (although still not perfect) would arguably be the MSCI Emerging Markets IMI Index (in CAD) (“net” dividends), which had a 3-year annualized return of 5.01% over the same period (for a difference of 0.28% – which is more in line with expectations).

For what it’s worth, XEC simply holds the US-listed IEMG. IEMG had a return over the same period of -2.90% in USD. It’s benchmark, the MSCI Emerging Markets IMI Index (in USD) (net dividends) had a return of -2.89 in USD (for virtually no tracking error).

@Sam: The index ETFs should follow the indice they track minus the management expense ratio (MER).

I made an Excel Workbook for tax optimisation (you should ask a professional to make sure it applies to your situation). There is a tab called “Funds” where I listed most funds and ETFs in each asset class. I included TD, Scotia, CIBC, PH&N, Beutel Goodman and Mawer funds + iShares, Vanguard and BMO ETFs. You’ll find some statistics about the funds including the MER.

Here is the link for you to download: https://drive.google.com/open?id=0B6x4qQK9cyjheDNXY29SeEtSS3M

Hello Justin,

The model portfolios you posted include Vanguard funds that are relatively young. For example VCN and VUN have data starting only from 2013-08-02 (though VAB has data starting from 2011).

What would be roughly equivalent iShares ETFs for VCN, VUN and VAB? (iShares has funds with longer track records, some going back to 1999).

Alternatively, could you post a model portfolio that uses only iShares ETFs?

Thanks.

@Sam: I’ve already included a chart in this blog post that addresses your question. Please let me know if you have any additional questions.

Hello Justin, thanks for this.

Data for XIC and XQB are available from 2001 and 2009 respectively, but the rest of the funds are quite young (data are available from 2013 for XEC and XEF, and from 2015 for XAW and XUU).

In place of these younger funds, could you suggest iShares ETFs with longer track records (say, at least 6 years?). Thanks.

@Sam: The index ETFs should follow the indice they track minus the management expense ratio (MER).

I made an Excel Workbook for tax optimisation (you should ask a professional to make sure it applies to your situation). There is a tab called “Funds” where I listed most funds and ETFs in each asset class. I included TD, Scotia, CIBC, PH&N, Beutel Goodman and Mawer funds + iShares, Vanguard and BMO ETFs. You’ll find some statistics about the funds including the MER.

Here is the link for you to download: https://drive.google.com/open?id=0B6x4qQK9cyjheDNXY29SeEtSS3M

Thanks for this information Justin. I greatly value your and Dan’s work educating DIY investors.

@Erik: Thank you for the feedback – it’s great to hear that you’ve found our information to be helpful :)

Hi Justin,

Just found your blog and really enjoying it! Can’t wait for the tutorial videos. Just wanted to also vote for the different size portfolios and where to put each ETF for tax efficiency. Looking forward to your recommendations of what should go under RSP\TFSA\ Non-registered accounts etc..

Thanks!

@Mary R, @Mike F: Thank you both for your suggestions. The tutorials will be starting from the very beginning (I want to cover the basics first, as there are many DIY investors that are just starting out). From there, I will turn to rebalancing basics, currency conversions (using Norbert’s gambit, where available), and then get into more advanced topics, like calculating your adjusted cost base, calculating your rate of return, benchmarking your portfolio, foreign withholding taxes, tax loss selling, premium bonds in taxable accounts, corporate taxation, asset location, etc.).

I will be recording videos for each of the six big bank brokerages in many of these examples (RBC, TD, BMO, Scotia, CIBC and NB), so this should make things easier for the viewers.

Yes, this will be great. I saw a previous blog where you provided a tFSA, RRSP and taxable portfolio investing. Based on best efficiency. I cannot find the thread anymore but it was what I need. I have approx 500k in taxable, RRSP, RESP, TFSA and about 130k of this is in US dollars. My thought was when I retire I plan to spend a fairly large portion as a snow bird. So my thought was to leave it in USFunds for that reason. Is this a good idea or do you have a better idea. Finally where would you put the US dollar / US exchange investment ( tax/ RRSP/TFSA)

@Pat M: Your questions are very specific to your personal situation, so unfortunately I would not be able to offer any useful general advice.

I’m wondering what your thoughts are on Questrade given no commissions on buying ETFs and then $9.95 to sell them (hopefully decades later)? I’m attracted to this option as it would be great to contribute/rebalance monthly without expensive commissions and utilize dollar cost averaging. I also like the notion of “paying yourself first” to maximize savings within registered accounts!

Excited for the video series coming up! Any chance Questrade could be added to the mix just to ensure us DIYers are selecting the right options when purchasing ETFs?

Many thanks! Fantastic resources and I think I speak for most when I say your blog really demystifies the world of low cost DIY index investing with ETFs!

@Muchski: Questrade is a decent brokerage, although I would like them to offer limit orders without additional fees.

I’ve had countless other requests for a Questrade tutorial, so I’ll be coming out with this in the next month or so – stay tuned! :)

Awesome thank you so much!

When you say additional fees, I assume you mean the ECN fees?

@Vito: Exactly – Questrade charges additional ECN fees for marketable limit orders.

@Mary R: You could try my Excel workbook. It allow you to rebalance with tax efficiency in mind. All my learning about index investing is part of this workbook. Give it a try:

https://drive.google.com/open?id=0B6x4qQK9cyjheDNXY29SeEtSS3M

Please download it before use as some features are not available when used with Google Sheets.

If you find any problem, leave me a message and I’ll try to fix it quickly. As I use this workbook on a monthly basis, you can be sure I will update it when needed.

Excellent post. I agree with John Lubber. I would to see different size portfolios and where to put each ETF for tax efficiency. Thanks for your great work.

I’m going to be away for the next week (without access to internet), but please feel free to leave any comments and I will respond to them when I return.

Hi Justin,

Looking forward to this series! I’m curious about your thoughts on a US dollar ETF (ex: VTI) as opposed to a CDN dollar US ETF (ex:VUN)

Thanks!

@Serena: A US-dollar ETF like VTI is more tax-efficient in an RRSP than a Canadian-listed ETF (like VUN). However, that is assuming an investor converts their CAD to USD cheaply. In a future series, I will show intermediate investors how to do this at their favourite brokerage (but for the first series, I’ve stuck with Canadian-listed ETFs).

Great news Justin. What might help the novice investor would be putting forth portfolios of different dollar values. Let’s say a modest $50,000 to start and then put fort portfolios that have an additional $200,000, $400,00 etc. up to the million dollar portfolio.

By varying portfolio dollar size an investor would appreciate the variables of investing and where to invest.

The YouTube touch is an excellent idea. I’ll be watching.

@John lubber: Thanks for the great ideas, John!

Justin:

Thanks for all of your blogging on this. I am a self directed investor and it has been a great help.

I have one question. You suggest that if you are a small investor you should consider swapping out your US, Int’l and Emerging funds for a global fund. Why shouldn’t everyone use the global fund? Is there an advantage to having several funds? I realize that this would allow you to control allocation but I’ve been assuming that I basically want a capital weighted allocation and that this is what the global fund does. Is this true?

Thanks,

@Dennis Cloutier: There may be tax-efficient reasons for splitting up the mix into its individual components. For example, in taxable accounts, holding Canadian and US ETFs is generally more tax-efficient than holding international and emerging markets equities (due to the available tax credit on Canadian dividend income, and the lower dividend yield on US stocks). If you have decided to hold a portion of your equities in RRSPs, it may be more tax-efficient to hold the international or emerging markets ETFs there first.