by Shannon Bender

You know that old saying about how watched pots never boil? That may be true in the kitchen, but your well-managed ETF portfolio still needs a watchful stir now and then if you want it to keep simmering along according to plan.

That’s what rebalancing is for. Let’s say, for example, you start out with a carefully allocated 60/40 stock/bond mix, with tilts to some of your favorite equity factors for added zest. Even if you are the most disciplined, buy-and-hold investor in the world, some of those market factors will heat up faster than others over time until, eventually, your portfolio is out of balance. Through no fault of your own, you end up overweight in some of your holdings and underweight in others.

Unless you happen to have some extra cash lying around to allocate into your existing portfolio (doesn’t everyone??), you typically rebalance by selling some of your overweight holdings and buying some of the underweight ones until you’re back on target – or close enough.

Rebalancing may sound simple enough in principle. In practice, it takes a few button clicks before you’re through. Let’s walk through the process, using the Canadian Portfolio Manager Blog 60% equity/40% fixed income ETF portfolio to illustrate. You can read on, or click below to view the video version, whichever you prefer.

On Your Marks …

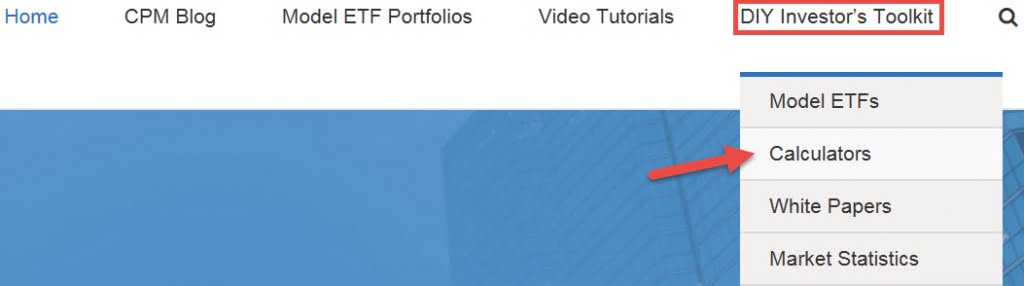

To begin, hover over the DIY Investor’s Toolkit tab found at the top-right corner of the Canadian Portfolio Manager blog. From there, click on the Calculators tab in the drop-down.

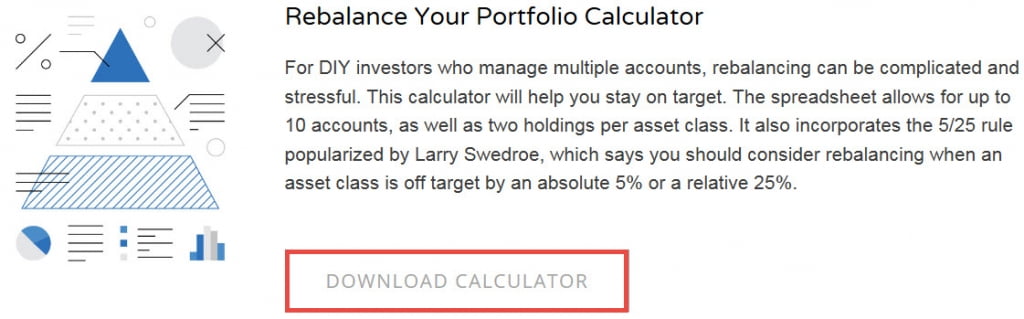

Once you’ve reached the Calculators page, scroll down to the Rebalance your Portfolio Calculator section and click on Download Calculator.

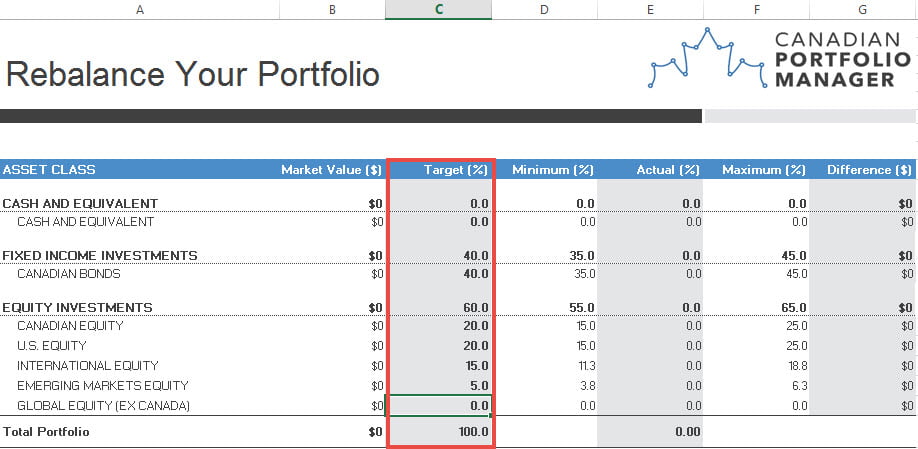

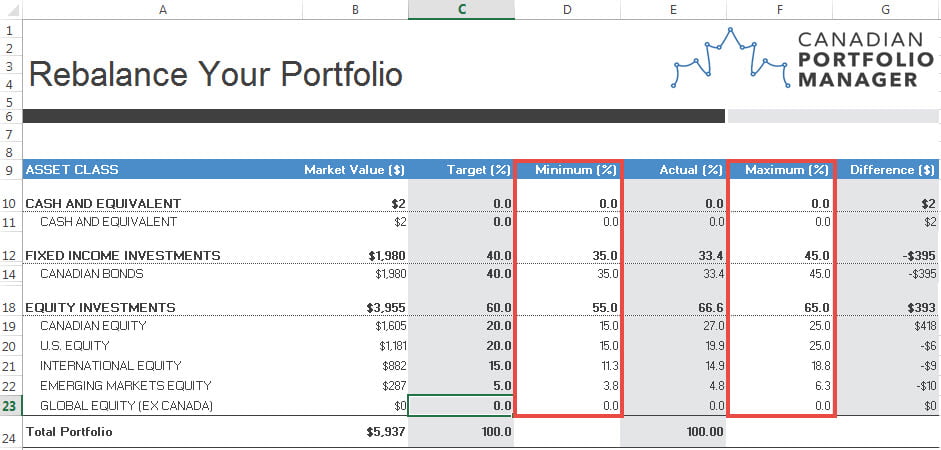

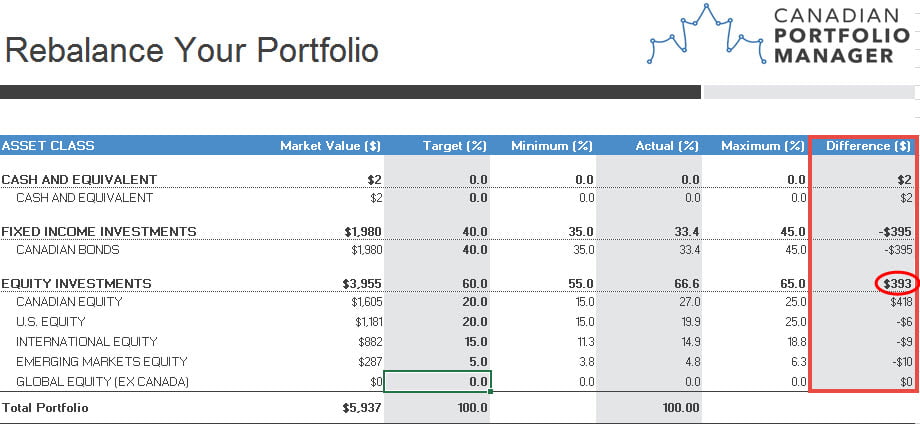

We’ll get to the other columns on this page soon but, for now, you need only enter your target asset allocation in the Target (%) column, next to the relevant asset classes. For our example, our target asset mix is 40% Canadian Bonds, 20% Canadian equities, 20% U.S. equities, 15% international equities, and 5% emerging markets equities.

Next, click on the Input tab at the bottom left of the spreadsheet. This is where you’ll enter your market values for each ETF.

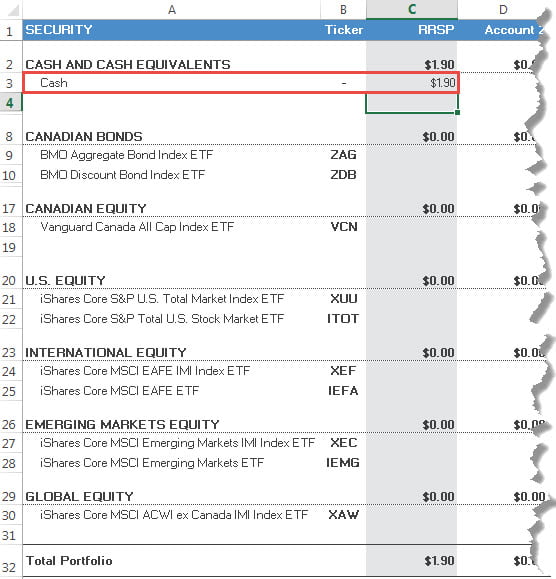

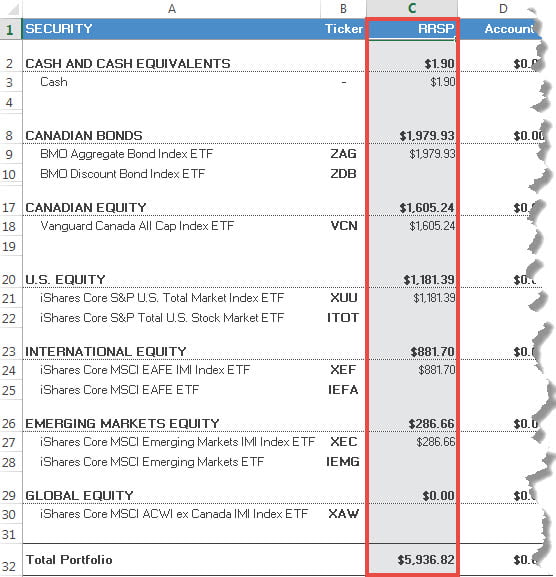

The first column of the worksheet labeled Security comes prefilled with the recommended ETFs from our model portfolios. Feel free to update these if you have slightly different holdings. Row 1 also lets you name the multiple accounts you’re investing in. In our example, we’ll keep it simple and assume your only account is an RRSP.

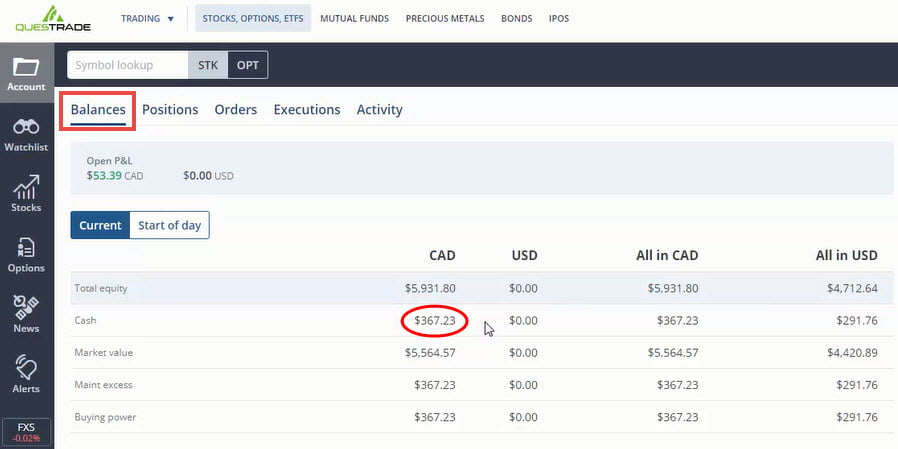

Next, you’ll input each of your holdings’ market values into your account. To start, pull up the Balances section from Questrade and locate your account’s cash balance. In our example, that’s $1.90, so type $1.90 into the cash section of the rebalancing spreadsheet.

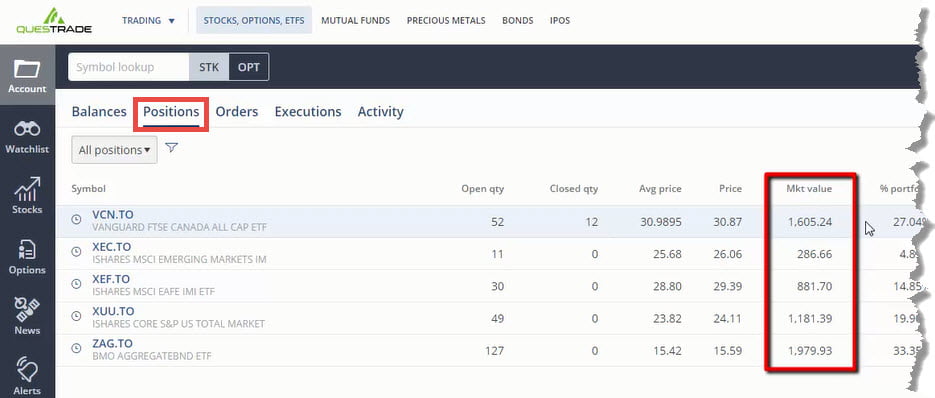

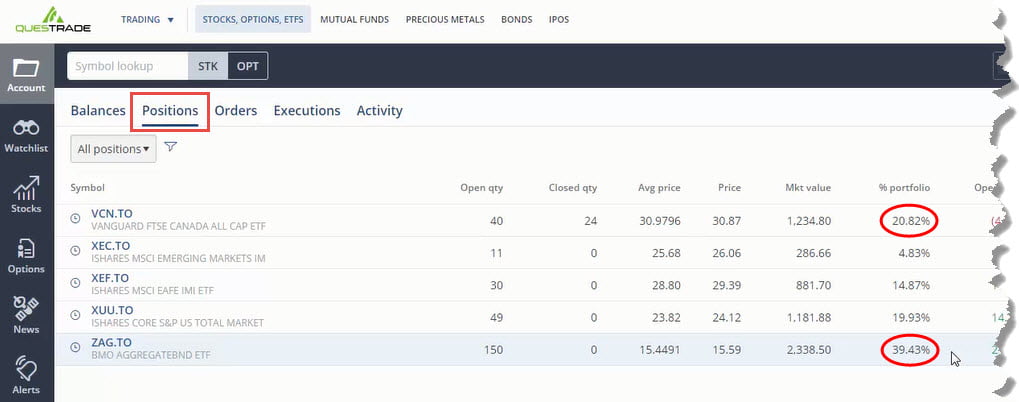

Continue this process for each ETF in your RRSP by clicking on the Positions tab to view the market values of each one. In our example, you can see that we hold VCN, XEC, XEF, XUU and ZAG. Returning to the spreadsheet, simply type in the market value for each corresponding security.

Get Ready …

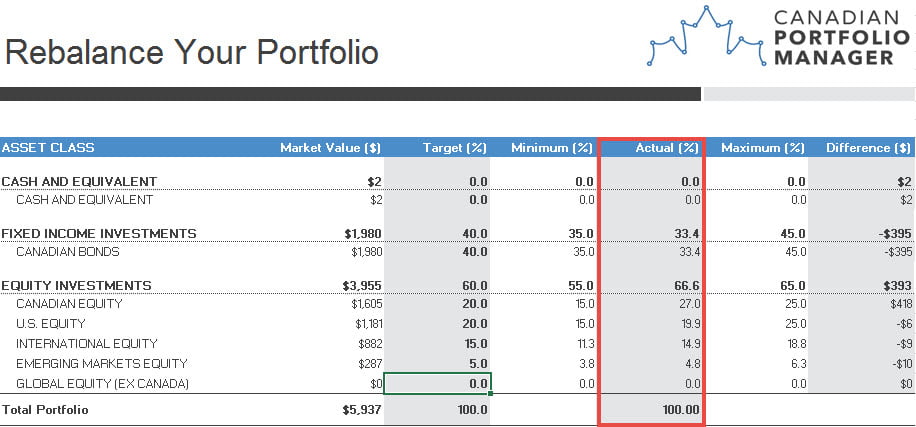

Once you’ve added the market values to your spreadsheet, the Rebalance Your Portfolio table will do the heavy lifting for you, suggesting which asset classes need to be rebalanced.

The Minimum (%) and Maximum (%) columns display … guest what? You’ve got it: The minimum and maximum thresholds for each individual asset class, compared to the Target (%) asset allocation column. (We based these minimum and maximum thresholds on Larry Swedroe’s “5/25 rule,” which you can read all about in our past blog, “When should I rebalance my portfolio?”)

Next, check out the Actual (%) column, which unsurprisingly displays your portfolio’s current asset allocation.

Are the numbers there way out of balance, a little bit off, or right on target? In our illustration, we can see that we are under our minimum threshold of 35% for Canadian bonds. Additionally, we are over our maximum threshold of 25% for our Canadian equities. Our U.S., international and emerging market equities are all within their thresholds, so there is no reason to rebalance these holdings.

So, in this example, we’ll sell some of our overweight Canadian equities and use the proceeds to buy more underweighted Canadian bonds. To achieve perfect balance, the Difference ($) column at far right suggests we’d need to sell $418 of Canadian equities and buy $395 of Canadian bonds. Since “close enough” is fine when rebalancing, we’ll instead sell $393 of Canadian equities to buy the bonds.

Go (Trade)!

At last … we’re ready to place our trades.

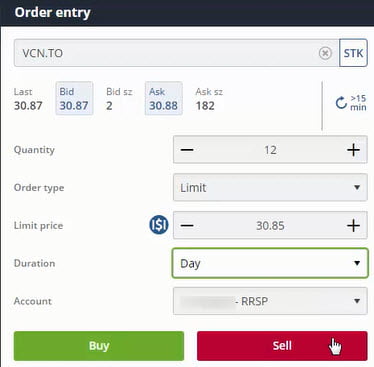

First, we’ll sell those Canadian equities to generate the cash we need to buy more bonds. To begin, enter “VCN” in to the Order Entry field and click on the fund name when it appears. This will generate a quote directly below the stock ticker. When selling an ETF, focus on the Bid price, which is the price per share someone will pay us for our ETF.

To calculate the number of shares to sell, use any convenient calculator, such as the one on your computer. Remember, we decided to sell $393 of equities, so we’ll divide $393 by VCN’s current bid price of $30.87. Rounded down to the nearest whole number, that’s 12 shares. Time to proceed.

- Enter 12 into the Quantity field.

- In the Order type, select Limit, to put a limit on how much you are willing to sell the ETF for.

- In the Limit price field, enter an amount two cents below the bid price – $30.85 in our example.

- Set the Duration to Day; your order will expire at the end of the trading day if it goes unfilled.

- Last but not least, make sure you’re trading in the correct account – the RRSP in this case. It’s easy to overlook that, and important that you don’t!

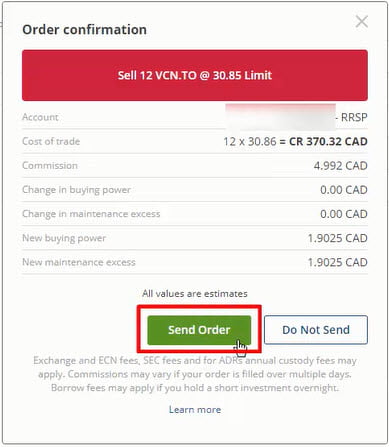

- Click on the red Sell button and an order confirmation box will appear. Once you’ve had a chance to review the details, click on the green Send Order button.

Once your order has been filled, you’ll receive a confirmation at the bottom, right-hand corner of the screen. Close this notification and click on the Balances tab at the top left of the page.

Your cash balance should now include the proceeds from the 12 shares of VCN you just sold. Once it does, you can place your second trade, to purchase ZAG. Click on the Positions tab and enter ZAG in the order entry search field and click on the fund name when it appears.

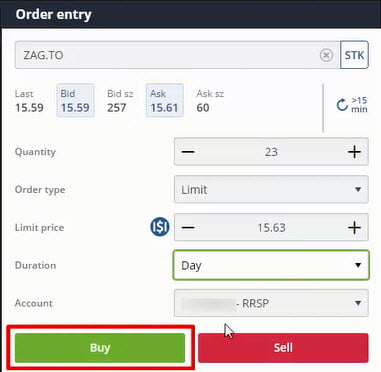

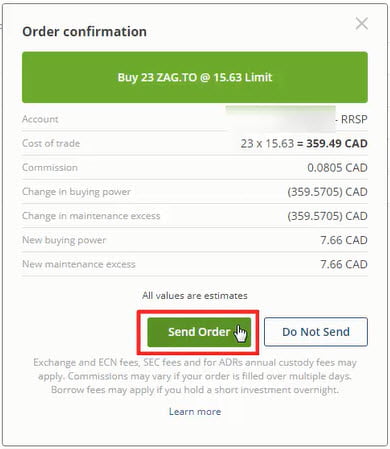

To buy this ETF, go ahead and enter your full cash balance of $367.23 into your calculator, and divide it by the current ask price of $15.61. This equals about 23 shares. Enter 23 into the Quantity field, with a Limit price of $15.63 (two cents above the ask price). Click on the green Buy button. Review the details to ensure they reflect your desired trade (including doublechecking that you’ve got the right account) and, when you’re ready, click on Send Order.

Your Questrade Positions page now shows that you have a 39.43% allocated to ZAG and 20.82% allocated to VCN in your RRSP account. Congratulations, you’re back in balance!

Shannon Bender, CFP®, CIM®, is an Associate Portfolio Manager and Financial Planner with PWL Capital in Toronto, where she and her colleagues manage portfolios using the same strategies described in this blog.

Hi Justin, thanks for sharing. Would you be able to email me an unprotected version? Thanks.

@Adrian: My colleague, Dan Bortolotti, has posted a similar unlocked spreadsheet on his blog: https://canadiancouchpotato.com/2019/02/04/a-new-rebalancing-spreadsheet-for-etfs/

Hi Justin,

Happy new year Justin!

First let me say, thank you and Shannon for creating this blog post, as I use Questrade and is immensely useful.

I was about to email you based on our previous email communications over a year ago, but I just read your message that you no longer take emails, so I am submitting this question here as it pertains with rebalancing and I want to respect that you no longer take emails. I’m sure you get inundated with so many.

I am currently using a 3 ETF portfolio in my TFSA at Questrade, allocated at 50% XAW, 30% VSB and 20% VCN with $400/month. I have always rebalanced with the fresh cash that I contribute each month without having to sell any stocks or bonds to regain my original target allocation, which meant that on a few occasions I’ve had to double, even triple my monthly contributions.

However, with the current market changes that have recently happened, to rebalance my portfolio using fresh cash, it would require approximately $4,500+ which I cannot afford to do.

So my question is this.

In my current situation, in order for me to rebalance, I would need to sell some bonds to add to my stock allocation, however, my bonds have also gone down in value (in the red) and therefore would be selling at a LOSS.

So what do I do? Do I still sell some of my bonds (or stocks, if situation was reversed) at a LOSS for the sake of rebalancing? This would be locking in my loss. Its one thing if one goes up (in the black) and the other goes down (in the red), but when both go down, what do you do?

Thanks Justin & Shannon, all the best for 2019!

ps. Please keep the Questrade (or any educational) videos going.

@Vito: Happy New Year! Your investment in VSB is likely not at a true loss. The underlying bonds in most bond ETFs trade at a premium to their par value, which means that they will mature at a loss (but that doesn’t mean you necessarily lose money on your investment). The higher coupon interest on these premium bonds is expected to more than offset the losses.

If your portfolio needs to be rebalanced, selling your bond ETF and purchasing equity ETFs seems appropriate.

Hi Justin,

thank you for your prompt reply! As for your explanation, it is a bit confusing, but trust me when I say that is a me problem (my ignorance), not a you problem. I do seem to remember you, and if memory serves me right Dan @ CCP as well, where you posted about the topic of premium bonds, so perhaps I should scour and revisit the topic again to get a better understanding.

However, if you don’t mind, what if the role was reversed? That is, both stocks and bonds have gone down (in the red) and if my portfolio requires to be rebalanced by selling stocks and purchasing bonds, would this scenario still be appropriate? Is this scenario also not considered a true loss?

Cheers!

@Vito: I’ve never witnessed a situation like this before (at least with government bonds), so I’m not sure if it’s something you need to be concerned about.

Understood, thank you. I’m in my previous situation, (ie. sell bonds to buy stocks) but was wondering if the roles were reversed.

If you ever host a live talk in TO, as Dan is doing at the beginning of next month at TPL (I’m going), please make a post about it, I’d be there in a heartbeat!

Thanks again!

Hi Justin,

Can I get a copy of the unlocked version of the spreadsheet as well please? Thanks!

Dan

Hi Justin

Can you email me your unlocked version of this spreadsheet please.

I tried using the calculator but when I went to enter the securities I hold and could not add additional lines . Is there a way to use this calculator with the securities that I hold. Do I repeat the process for each securites in RRSPS, ETFS ETC.

.

@Sulana: I’ve emailed you an unlocked version of the spreadsheet.

HI Justin, can I get a copy of the unlocked version of the spreadsheet as well please. Thanks!

Would love to have the password to unprotect so I can add other calculations of my own. Possible? Thank you!

Hey Justin,

Great tutorial! My question is this… How does the calculator account for rebalancing ETFs that are in US $? Since I am using your RRSP recommended portfolio that has US listed ETFs, as well as Canadian listed ETFs, how does it work when you have to sell Canadian to buy US? Or vice versa?

@Ian Bremner: If you hold US-listed ETFs, you would need to convert their value to Canadian dollars before inputting the figures into the spreadsheet.

And when you need to buy or sell a US-listed ETF, you would need to take the Canadian dollar overweight/underweight figure and convert it to US dollars in order to determine the number of shares to buy or sell.

Instead of rebalancing and having to pay your online broker (such as Questrade) every time, how about balancing with every investment? I tried finding a calculator that tells me based on my current portfolio, how many ETFs of each type need to be purchased based on the cash I have to invest to bring my portfolio towards my target allocation.

I found no such calculator! So I made my own. It’s a bit crude (it can be broken), but it does the job for my ETF portfolio. Please see the link I provided as my website for access.

Notes:

– You must show at least 1 ETF being owned, otherwise the calculator will have a DIV 0 error

– You can choose your own portfolio allocation (the green boxes)

– This only works for 3 assets.

– Feel free to make changes! If you can fix the equations, go for it. Maybe make a copy first.

Can’t you achieve that by simply putting your extra amount into the cash field in Justin’s excel and then see which ones it shows to buy in order to balance the whole portfolio?

Hi Justin, I have a question and was hoping you could give me a bit of a sanity check for a plan:

I understand that there are tax efficient places to hold various assets (such as VTI in RRSP, or VCN in non registered etc as per your model portfolios). However, as someone who makes regular contributions it not practical to maintain this efficient architecture monthly. So my plan was to once a year rebalance all my stuff into the optimal formation… then throughout the year I just contribute monthly into VGRO. At the end of the year I sell my VGRO and rebalance “optimally” again. Does this make sense or am I missing something? I don’t mind doing the math or spending the time once a year… my portfolio is about 500k CAD.

@John: I don’t see any significant issues with this approach.

I tried using the calculator but when I went to enter the securities i hold which are a little different i got a message that the sheet was password protected and I couldn’t alter anything under securities or add additional columns. Is there a way to use this calculator with the securities that I hold.

@Enid Grant: I’ll email you a version that is unlocked.

Hi,

What time of the day do you suggest we trade each asset classes? I know that we should avoid 9:30 AM-10:00 AM EST and 3:30 PM-4:00 PM EST. What time is it best to trade:

1. Canadian Bonds

2. Canadian Equity

3. US Equity

4. International Equity

Thank you.

@Sébastien: Canadian bonds, Canadian equities and US equities can be purchased during market hours (as you mentioned, probably best not to trade within the first 30 minutes and the last 30 minutes of the trading day). International equities can be purchased during market hours as well, but the most price discovery would be during 10:00 am and 11:00 am: https://www.pwlcapital.com/en/Advisor/Toronto/Toronto-Team/Blog/Justin-Bender/May-2012/What-time-of-day-should-you-trade-International-ET