If there were ever a contest held for “Canada’s Most Boring Investment Ever,” I’ll bet that bond ETFs and guaranteed investment certificates (or GICs) would duke it out in the final round. We buy one or the other, or maybe some of both, to offset our more glamorous (and more risky) stock funds with some sensible dependability. Then, thankless crowd that we are, we cringe at their related paltry returns.

So in the boring battle between them, which should you use? Laugh at the humble GIC if you must, but GICs may just help save the day in today’s fixed income markets.

Consider this. Between January 1st and April 30th, 2022, the 10-year Government of Canada benchmark bond yield has more than doubled, rising from 1.4% to 2.9%. As yields increased, bond prices dropped, causing Canadian broad-market bond ETFs to suffer double-digit losses so far this year, losing over 10% of their value.

Now, seasoned investors may be used to the gut-wrenching double-digit drops we periodically see in the stock markets, but some of you haven’t had to stomach seeing your supposedly “safe” bond ETF holdings show up in bright red when you login to your online accounts. If fixed income is going to be so boring, the least it can do is keep its head above water.

I don’t typically recommend switching up your holdings every time a market disappoints. But if your bond funds are giving you serious heartburn, GICs may be worth a second look.

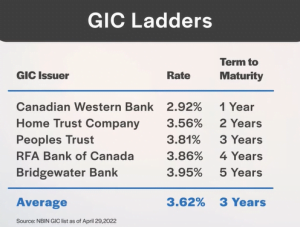

Let’s start off by talking about returns. Many GICs have yields that rival those of your favourite bond ETFs, but with a much lower average maturity. In fact, a 1–5 year GIC ladder currently boasts an average yield of 3.6%, with an average maturity of just 3 years. It’s called a “ladder” because you typically spread your GIC purchases evenly across 1-to-5-year maturities. This eliminates the need to predict future interest rate movements. So, if you have $100,000 to invest in GICs, you buy a $20,000 1-year GIC, a $20,000 2-year GIC, and so on, until you’ve built each “rung” in your 1-5 year ladder. As each GIC matures, you continue the ladder by reinvesting the proceeds into another GIC maturing in 5 years.

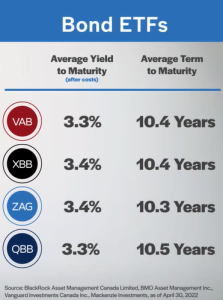

With a bond ETF, the best estimate we have of its future return is its weighted average yield-to-maturity. These days, in spring 2022, the yield-to-maturity on a broad-market Canadian bond ETF is about 3.4% after costs. And at 10.3 years, the weighted average maturity of the underlying bonds is significantly higher than a GIC ladder, exposing your investment to more interest rate risk.

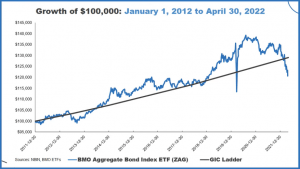

With the GIC ladder, you can currently expect similar returns with far less term risk than what you’ll find in a bond ETF. In fact, since the end of 2011, a ladder of GICs has actually outperformed a broad-market Canadian bond ETF, with a much smoother ride along the way. It’s interesting to note that both options had the same 2.3% yield at the beginning of this measurement period.

Looking forward, there’s no guarantee that a ladder of GICs will always outperform a bond ETF over your specific investment timeframe, but there are still additional advantages of the strategy worth noting.

Advantages of GIC Ladders

GICs have shorter maturities. As mentioned earlier, the average maturity is 3 years for a typical 1–5 year GIC ladder (with an equal investment in each of the ladder’s “rungs” or years). In comparison, the average maturity is 10 years for a broad-market Canadian bond ETF, like the BMO Aggregate Bond Index ETF (ZAG). This makes the bond ETF more vulnerable to interest rate increases than a GIC ladder. If you’re concerned with the potential of further interest rate hikes down the road, a ladder of GICs may be more appropriate for your risk appetite. Keep in mind that if bond yields decrease from their current levels, bond ETFs could recover some of their losses (while your GIC ladder won’t experience the same price pop).

GICs won’t experience gut-wrenching price drops. Investors hate seeing their “safer” bond ETFs in the red, but it happens. The losses can show up due to increasing interest rates or a liquidity crisis (such as during March 2020 of the pandemic, when bond ETFs lost over 16% of their value in less than two weeks). Either way, it’s enough to send conservative investors running for the hills … or worse, into high-dividend-paying equity ETFs.

GICs largely avoid these behavioural issues. Their daily values tick up (never down) due to the money the GIC issuer owes them in the form of accrued interest. If GICs traded on a stock exchange or in a similar secondary market, their daily values would also rise and fall, just like a bond ETF. Since they don’t, this is really one of those “ignorance is bliss” situations.

GIC deposits have insurance. The Canada Deposit Insurance Corporation (CDIC) covers GICs and other eligible savings up to a maximum of $100,000 in principal and interest at each CDIC member institution – per depositor, per insured category. As long as you stay within these limits, you’ll be made whole if your GIC issuer were to go belly-up.

The same cannot be said for some of the bonds in an ETF. Roughly 70% of the underlying bonds in a broad-market Canadian bond ETF are government-issued, which are unlikely to default. But the funds still invest in about 30% investment grade corporate bonds. While these higher-quality corporate bonds are less likely to default than lower-quality “junk bonds”, the risk is still more than a GIC investment’s default risks which, for practical purposes, approaches zero.

Disadvantages of GIC Ladders

Now all this sounds pretty good, but there are also disadvantages to GICs, relative to bond ETFs.

GICs are more complicated to manage. It’s much easier to purchase one bond ETF instead of managing a multi-GIC ladder. This is especially true if you need to take extra care across many accounts to avoid exceeding the CDIC limits.

I’m also a big advocate of one-fund asset allocation ETFs (which include both stocks and bonds in their funds). With one-ticket funds, you don’t need to worry about rebalancing the individual asset classes within your portfolio, as the ETF company takes care of this for you.

If you include a GIC ladder in your portfolio, you need to manage the individual holdings directly, increasing the likelihood of messing things up. For this reason, most investors should consider sticking with a single asset allocation ETF for simplicity.

GICs are not liquid. You can essentially sell units of your bond ETF any time during regular market hours, whereas GICs are typically locked in until their maturity date. However, you can mitigate this liquidity risk by investing a portion of your portfolio in cash equivalents or bond ETFs – this can potentially address your emergency spending needs or provide liquidity to rebalance your portfolio during a stock market meltdown.

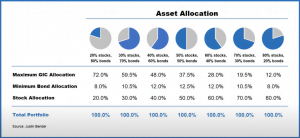

As a rule of thumb, I tend to hold enough of the portfolio in bond ETFs to allow me to rebalance a portfolio back to my target asset mix in the event of a 50% stock market drop. This rule is a bit confusing, so I’ve included a chart with the maximum GIC allocations we use with our PWL Toronto clients for various asset mixes.

Source: Justin Bender

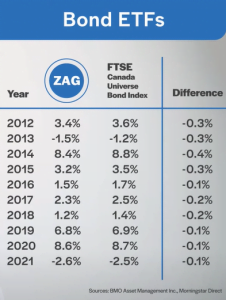

GICs will have benchmarking tracking error. Even if a GIC ladder and a bond ETF end up having comparable returns over your investment horizon, you’ll likely benchmark, or compare, your yearly fixed income returns to a bond index. A bond ETF’s annual returns are expected to closely match the annual returns of its underlying bond index. But a GIC’s returns can be substantially better or worse than the return of a bond index from one year to the next – especially during periods of rising or falling interest rates.

For example, over the past 10 calendar years, a laddered GIC strategy underperformed the FTSE Canada Universe Bond Index in 6 out of 10 years. If you prefer to closely track a bond index with no surprises along the way, GICs may not be for you.

In short, GICs can be a great addition to your portfolio if you prefer less fluctuation in your fixed income holdings. And since the yields seem comparable for GIC ladders vs. bond ETFs, you shouldn’t feel like you’re compromising on returns by including a GIC ladder. If you’ve already incorporated GICs into your portfolio, fill us in on your strategy in the comments below!

Thanks for all the great info Justin

In the current environment with probable decreasing interest rates what is your advice on GIC ladders versus bond ETFs

Thanks for all the info Justin

What is your recommended mix of GICs and bond ETFs in the current environment – ie likely falling interest rates

I have not yet built a GIC ladder, but I intend to when I come over to PWL capital. I have two questions. Firstly, I read a blog post in the Vanguard website that argued that, historically, investors would have done better in bond ETFs or index funds as opposed to GICs. I wonder if that’s true. Perhaps, going forward, bond ETFs might be more attractive than GICs. It is undeniably comforting to have at least a portion of one’s portfolio that doesn’t fluctuate. My second question is perhaps naïve. I have always considered the yield to maturity to be far more important than distribution yield, but I wonder how reliable the figures are in the websites of the leading providers. I hold bond ETFs from BlackRock, Vanguard and BMO. Just for my own amusement, I decided to compare the stated distribution yield with that projected by my TD brokerage account. Most of the BMO ETFs seemed to overstate the distribution yield compared to what TD projected I would earn. BlackRock and Vanguard were spot on. How far can I trust their numbers, both for distribution yield and the more significant yield to maturity?

@David – I would not take the “Average GIC returns” seriously in that article. Investors can obtain much better rates than the average of all providers (and still stay within CDIC limits). For example, the Bank of Canada is currently showing an average 5-year GIC yield of 3.40% as of June 7, 2023:

https://www.bankofcanada.ca/rates/banking-and-financial-statistics/posted-interest-rates-offered-by-chartered-banks/

But investors can buy a 5-year Canadian Western Bank GIC today yielding 4.81%.

In my analysis, I used NBIN’s historical GIC list, and chose the top rate (which is more realistic for an investor or advisor building a GIC ladder at a brokerage).

As for the distribution yield figures, they will never be 100% accurate (due to a constantly changing bond portfolio and number of unitholders).

For an example, I looked at XBB’s December 31, 2022 average coupon interest rate of 2.76% (or about $2,760 on a $100,000 initial investment, which would be around $230 of interest per month). On December 31, 2022, an investor could buy around 3,670 units of XBB.

Here are the monthly distributions so far this year for 3,670 units of XBB (which are relatively close to our estimate of $230 per month):

– January 2023: $250

– February 2023: $253

– March 2023: $253

– April 2023: $257

– May 2023: $253

FYI – I’ve always found BlackRock to post the most reliable average YTM and average coupon data. You can even double-check their figures by downloading the individual bond data in the Excel spreadsheet found in the top right corner of each fund page.

Thank you kindly for that very thorough response.

@David – You’re very welcome – thanks for posting! :)

Hey Justin,

Thanks for all the info you’re sharing with the public. If looking to park cash short term, wondering what you would recommend for a taxable account. Cashable GIC vs short term treasury ETF (SGOV or BIL)? I worry that the foreign witholding tax offsets the difference in yield between the two investments. Would love to know your thoughts.!

@Nathaniel – I tend to just use Investment Savings Accounts (ISAs). Cashable GICs would also work. Just stay within the $100,000 CDIC limits for both.

Hi Justin,

Thanks for this article – came at the perfect time.

Here’s my question: my assumption regarding short-term bond ETFs (VSB and VSC, for example) was that, as interest rates increase the value of the ETF would fall (as you expect). But, conversely, as these are short-term bonds, the fund would be structured in such a way as to take advantage of the increasing rates to be able to increase the yield on the fund. But looking at the last nine months, while the value of these funds have dropped ca. 10%, the yields haven’t budged.

I’m tempted at this point to just cut my losses and build a laddered GIC that take advantage of the higher rates. I only see interest rates going up in the short term, and that will just keep tanking the value of the funds with no apparent gain in yield.

Thanks again,

Matt

@Matt – You might be confusing a bond ETFs “yield-to-maturity” (YTM) for its current distribution payout per unit (as short-term bond yields have risen substantially YTD). The YTM is what’s relevant to investors (it includes an estimate of all coupon interest, plus or minus any expected capital gains or losses on the underlying bonds when they mature).

@Justin As I think about it more, I think the flaw in my reasoning was assuming that there would be a direct correlation between distribution payout and yield-to-maturity. In my simplistic view, over the last year the value of the fund would fall with rising interest rates (as you see with bonds), but that the distribution payouts would increase as the fund bought up newer, higher-yielding bonds. But, as with almost everything else in life, it’s more complicated than that. ;)

I could have disproven my own assumption by just looking at the distribution payout of VSB versus short-term US bond yields since 2015. VSB has been pretty steady at about 2%, while yields have fluctuated between practically 0 and 4%.

Hi Justin. Currently VEQT is down more than it was January last year. With inflation high (8%?) and the stock market worse than two years ago, it’s hard not to feel like the average citizen (ie me) has the short end of the straw right now with money being worth significantly less no matter whether it was invested or not. Just wondering if you have any insight regarding times like these, or maybe an article? Obv there is no choice but to keep money in the market, I guess your average person doesn’t really win during such a time period…

@Vince – There will always be periods where stocks don’t perform well over the short to mid term. This is why it’s important to know the risks of investing in stocks before investing in them (and how long these bad periods can potentially last). I’d recommend revisiting our video on risk tolerance (unfortunately, many investors ignored the advice in this video):

How to Choose Your Asset Allocation (ETF): https://www.youtube.com/watch?v=JyOqqtq12jQ

Hi, I’m struggling to find info on two fundamental aspects of bond ETFs (compared with individual bonds):

1) how do bond ETFs address capital gains of the underlying bonds as they mature, and

2) how is the income stream paid by a bond ETF affected by fluctuations in its market value (if at all).

For the first one, I understand how capital gains (or loss) occur for individual bonds, both at maturity and if sold earlier. I’m struggling however to find specific details about how this affects a bond ETF and its income payments. Looking at info like Vanguard’s websites for VAB or VSB, their distribution history indicates that capital gains were a rare and very small portion of the total income paid, which was dominated by interest income. But these funds are still young and maybe it’s just a product of the prevailing conditions. So how are capital gains supposed to work for bond ETFs? Does rising interest rates make bond ETFs increasingly tax efficient, just as it does for individual bonds?

For the second one, about the impact of fluctuating bond ETF market values upon their income stream, I see comments posted here and on other sites that make me increasingly confused. Specifically I see so many posts that, because bond ETF market values have dropped, they are considering dumping them for something else (such as GIC or dividend stocks) or already have. I instinctively cringe when I read the latter, locking in losses like that and abandoning the fixed income stream and comparatively low volatility (compared to equities).

I’m seeing this often, and it doesn’t appear that sites such as this are openly calling it out, so I’m starting to feel like there is something I really don’t understand about bond ETFs. As a buy-and-hold strategy for income, plus some volatility damping, why would we sell if bond ETF market values are down? Instead of dumping them shouldn’t we be buying more? Are there fundamental reasons for NOT continuing to hold bond ETFs and buy more? (aside from the legitimate alternative of GICs at the moment, as this blog post shows).

Thanks so much for the terrific work with this blog/site and the videos! Cheers!

@Kyle:

1. The underlying bonds held by bond ETFs can also realize capital gains on sale, or at maturity. These capital gains are distributed to unitholders each year. For many years, bonds were trading at a premium to their par value (meaning that it was more likely to realize a capital loss on maturity, rather than a capital gain). This is likely why the historical distributions only have a small allocation to capital gains. As you mentioned, rising rates create a “discount bond” scenario, which is more tax-efficient than a premium bond situation (as more of the return is expected to be comprised of capital gains).

2. Coupons don’t change when bond prices changes. However, over time, the sold or maturing bonds are reinvested at current market rates, which may be lower or higher than before (so this could decrease or increase the coupon interest distributed to unitholders over time).

Dumping a bond ETF for GICs is not really selling low. You’re simply selling one fixed income product with a higher yield to maturity than before (i.e., bond ETFs) and repurchasing another fixed income security with a higher yield to maturity than before (i.e., GICs). Over the next 10 years, both options would be expected to provide similar returns.

There are no fundamental reasons for not holding bonds – after their recent price decrease, their expected returns have increased (this is the same concept when stock prices drop in value).

Thanks so much the informative (and fast!) reply! :)

For 1) I gather the Vanguard site doesn’t show a capital loss as a negative distribution and it just shows zero instead. But I assume the fund issues statements each year that say here are your realized capital losses for the year with this fund?

Still struggling with 2) (or at least what others are doing). Your explanation matches my understanding, however I don’t comprehend how dumping a bond ETF for a GIC isn’t selling at a loss. As you say the bond ETF yield will rise and is anticipated to give comparable return to the GIC going forward. If we sell our bond ETF however we are locking in capital losses because their market price is down. So after moving to GIC, we have comparable return going forward, and at lower risk, but with realized capital losses.

For new money coming in it makes perfect sense to me that the GIC is a competitive alternative to bond ETFs right now. But for existing money already in bond ETFs, in a buy-and-hold strategy (emphasis), I can’t see how selling the bond ETF for a GIC is anything but selling low and locking in capital losses. It feels like a panic response rather than sound strategy. (Maybe that’s editorializing…, I’m just hoping I really do understand it.)

@Kyle:

1. Canadian ETFs are structured as trusts, and therefore, they can’t distribute capital losses to unitholders. However, they can carry them forward and use them to offset gains within the fund (they provide these capital loss figures in their annual financial statements).

2. If you hold your bond ETF, and it earns 4% on average for the next 10 years, this would be the same as selling your bond ETF, buying a GIC, and earning 4% on average on the GIC for the next 10 years (selling your bond ETF at a loss doesn’t change the math). If you realize the loss in a non-registered account, this could actually make the “sell the bond ETF” slightly better from a tax perspective.

I think many investors are hoping that bond yields drop again (increasing bond prices over the short-term, eliminating their capital losses). If this happens, GIC yields will also decrease, so switching to GICs at this time will likely not be a better scenario than the first. In other words, I see both strategies (bond ETFs and GICs) as having similar outcomes at most times (so investors should just choose the security they’re most comfortable with, or hold a mix of both).

Thanks for the added clarification, especially about how capital losses are booked in bond ETFs.

Think I’ll just have to accept I have a different mindset than “many investors”, as hoping for yields on bonds to drop just to erase a paper capital loss (not a realized one) just seems bizarre to me! :o But I realize not everyone has the same situation. And point taken about the tax loss harvest opportunity.

Thanks again so much for sharing all the knowledge! Cheers :)

Great article, thanks a lot!

Just wondering what short term bond fund you would recommend? I’m unhappy with loss on bond fund and thinking i’d be more comfortable with short tetm one.

Thanks for answering everyones questions! I’ve learned a lot. I’m just wondering what short term bond etf you would recommend. I hold vab but i am not liking the fact it is losing money. I think i may feel more comfortable with something shorter even though the return is lower.

@Christina – Any short-term bond ETF from Vanguard (VSB), iShares (XSB) or BMO (ZSB) would fit the bill.

Hi Justin. Currently I have 6.6k in my non-registered acct with VEQT and it is down about 10%. I’m just wondering for the new year, when my TFSA room expands, is there any reason to not just make a transfer in kind since it would be (a very small) tax deduction?

I don’t really have $6k in cash as a college student but if I waited til the spring or summer I might be able to scrounge that up, but I understand earlier investing is better. I also am not sure what the argument would be even if I had $6k in cash to not use the non-registered funds since it is down in value anyway (since if it was up, it would be a capital gain, right? and have tax consequences)

Thanks for any input regarding this!!

@Vince – If you’re comfortable forgoing the small capital loss, I don’t see any other issues with your plans to contribute VEQT in-kind to your TFSA.

If you did want to claim the capital loss, you could sell VEQT, wait for settlement, contribute the cash, and then repurchase something similar, like XEQT. The risk of this strategy is that you’d be out of the market for a few days (which could end up costing you more than any tax benefit from claiming the capital loss, if VEQT were to increase in value during this time).

Ahh, so I did not realize that a capital loss is not possible for nonregistered -> TFSA in kind transfers until your explanation just now. Okay, in January earlier this year I made an in-kind transfer of VEQT for around $3000 of my TFSA, up 10% or so from when I bought it, which to my understanding triggers a (small) capital gain. Is there any recourse now due to the stock market declining and continuing to decline, or am I SOL on owing taxes on that small amount since it’s now in the TFSA and tax-free?

I think I understand the option you’re mentioning regarding an in-kind transfer forgoing the small capital loss. If the prices in January are currently similar to now (or worse) it’d be nice to be able to claim a bit as a loss especially if I’m moving $6,000 from the nonregistered account, by selling VEQT in the nonregistered and buying XEQT in the TFSA instead. That would be kind of tax loss harvesting?

I imagine these are small numbers compared to what you’re working with daily although anything helps for a college student lol. I was debating trying to work more right now to maximize my TFSA but might just focus on school now that you’ve provided some guidance, provided my understanding is correct.

The other option is Questrade afaik allows the choice for transfers in-kind to be done using the low-of-the-day value of the ETF when the transfer is initiated, though would be forgoing any capital losses that way.

Thank you for all the help!

Your 3.6 average is valid only 1st year that you are doing the GIC, after four years it will be average of last five years of five years GIC rates,

There wasn’t much or any talk about tax efficiency. I have a substantial non-registered portfolio that’s a bit of a Frankenstein mess of USD and CDN ETF’s, since I started investing in 2009 and there wasn’t a lot of great CDN options back then. I had been doing a small portion of the fixed income as a 5 year GIC ladder, but when rates cratered with the pandemic I stopped buying new GIC’s, so there’s only a few left. The rest of my fixed income is in HBB, which is a few percent below cost currently.

I was thinking that this would be an opportune time to liquidate HBB and move to a non-swap product, for the reasons you’ve mentioned before. (targeting by CRA/Feds etc.) The changes they made a couple years ago cost me a few thousand bucks in accounting fees for my hold-co’s holdings at the time. I’m not changing my overall asset allocation, nor am I ditching HBB because it’s down, but it’s a convenient time to harvest a small tax loss and change the product.

Is ZDB still the way to go for tax efficient fixed income in a non-registered account? Maybe I’ll put a portion in GIC’s because rates are so high right now (4.5% for even a 2 year @ Oaken), but I’m probably not going to do a ladder again, I’d likely just go 2-3 years as the rate curve is pretty flat for longer.

Thanks as always for the wonderful information you provide.

@Marcel – ZDB and GICs are both good options for non-registered accounts. I tend to have more invested in GICs, as they’re currently yielding more and have less term risk.

Hi Justin,

Thanks for this GIC vs Bond ETF comparison!

I was curious–with GIC rates getting up quite a bit higher than Bond ETFs (currently I see 5-yr GICs in the 4.6% range and rising while according to Vanguard a fund like VAB is only 3.5% YTM) I was wondering if it makes sense to move a fair bit of my fixed income allocation over to GICs. I was already going to start a very modest ladder with new funds monthly to take advantage of these great rates while I could, but with GIC rates going up and up I wonder if I should move over some money from my bond etfs as well (I have a mix in VAB, VBAL, and even in a TD-E fund from the old Couch Potato days).

A second question: I would expect GIC rates to keep rising as BOC keeps increasing rates and banks raise their Prime Rate. On the other hand, I am also worried that the mortgage market might hit a wall if we get a recession along with high mortgage rates, and the demand for money from the banks will drop and GIC rates will go down. So would it be advisable to wait to take advantage of continuing rate hikes, or is it better to lock in before the demand for mortgages softens? I’d hate to lock up $20,000+ at 5% if the GIC rates end up going above 6%.

Thank-you.

@Perter – I tend to only build a GIC ladder if it’s a significant amount of money (i.e., A portfolio where I can buy at least a 1-5 year GIC ladder with $95,000 invested in each rung). If you have less than this, you may want to keep things simple and just use a bond ETF (or better yet, an asset allocation ETF).

Not sure why the dollar amounts matter. A 1 year GIC at 4% guaranteed return is theoretically better than a bond index fund with YTM of less than that where there is also a risk of negative returns after 1 year. This holds true at $1K or $100k. My question is, If you dont need liquidity, why would people hold bond index funds when GICs have higher guaranteed rates than the bond fund’s YTM?

@John – I’m trying to discourage investors with small portfolios from overcomplicating things for a relatively small potential return benefit (which will not translate into noticeably more actual dollars for them). A simple asset allocation ETF would arguably be a better choice for them, and easier to manage.

Hi Justin,

thank you for the updated follow-up from your previous blog post about GIC vs bond ETF, now that the market conditions has changed.

I had a few specific questions about the strategy:

1- What would be the minimum assets to implement the GIC/bond ETF mix in the fixed income portion of a portfolio? Some brokerage firms requires a minimum of $5,000 per GIC, which means a minimum of $25,000 to create the ladder. For an 80 equity/20 fixed portfolio and respecting the maximum 12% allocation for GIC, that would mean $208,333 in total assets. So, if I don’t have this level of asset in my account, should I wait before reaching this threshold and stay 100% in a broad-market bond ETF in the meantime? Or would it be acceptable to go up to 100% in GICs in the fixed income part of a portfolio, which mean I would need at least $125,000? I don’t want the GICs to be spread across different bank accounts that don’t require the $5,000 minimum.

2- For smaller portfolio, if I don’t want to be fully invested in a single broad-market ETF like XBB or ZAG, would it make sense to have a part of the fixed-income allocation in a short-term ETF like XSB or XSH, to have the lesser volatility and shorter maturity one would get from a GIC ladder?

Thank you very much for all the insights you have given over the years!

@Alex:

1. I wouldn’t likely include GICs in a more modest-sized portfolio, as the additional complexity is probably not worth the effort. I tend not to include a ladder of GICs until a portfolio is worth around $1,000,000.

2. If you don’t want to take as much term risk with your fixed income allocation, including a short-term bond ETF would certainly be an option. I’m not sure if it would reduce the volatility of your total portfolio over your holding period, but the bond allocation would be expected to be less volatile.

Hi Justin, good comparison. I regret holding the 1-5 year corporate bond ladder ETF CBO.TO, because it has dropped a lot. Can you please comment on how that compares with the GIC ladder? One problem is that CBO’s MER is quite high, relative to other short-term bond ETFs, and I guess as such its performance is worse than those. Thanks.

@Joe – CBO would have similar term risk to a 1-5 year ladder, but it has more credit/default risk (as the underlying issuers could potentially default). However, this risk is reasonably low (as they are all investment grade issuers with a low likelihood of default).

Due to CBO’s higher cost, you may want to consider a lower cost alternative, like the Vanguard Canadian Short-Term Corporate Bond Index ETF (VSC).

now that you talked about Yields, maybe another time another video about covered call ETF with 5~6% Yields.

Thanks – this is very timely! I have been an ETF devotee for the last 5 years or so and as a recent retiree, I set up a GIC ladder as part of my portfolio. This killed me over the last few years due to the low interest rates. As I find myself spending much less than I anticipated (thanks, covid), I am now at the point where my maturing GICs, designed to supplement my income, are being reinvested instead. At least the rates are better now, but my bond ETFs, which I assumed would hold their value fairly consistently (I really didn’t think about it much) have lost a considerable amount. I like the liquidity of these, but honestly, if I needed money I would sell some equity ETFs since they have done so well. Does the ENTIRE market ever crash, or is it usually a balance (if equities tank, bonds do better and vice versa)?

As the theory goes, if I am prepared to hold on to these bond ETFs in spite of their recent performance, I should be prepared to buy more since the price is right. Does this still hold?

Thanks!

@Lise – Bonds generally go up when stock markets crash, but there have been some recent examples where this didn’t happen (i.e., March 2020, YTD 2022). Still, even with their recent 10% drop, this is still a far cry from how much equity ETFs can lose in a stock market meltdown (i.e. 50% losses or more).

And the theory still holds – bonds now have higher yields than they did before the drop, so their expected returns going forward are also higher. But like buying stocks at a discount, there is always the possibility their prices drop further before recovering.

Hi Justin,

For our corporate account, if our capital dividend account is at $0.00, but our ZDB or other etfs are down 10% and $10,000, is it more prudent to just hold them until we have a positive balance in our cda account, even if that could be a long way off, or is it more prudent to just sell these now and not worry about the cda account becoming negative? Which one is more important to consider in this situation??

@Nicole – I would suggest speaking with your accountant regarding your personal/corporate tax question.

Hi Justin,

“I don’t typically recommend switching up your holdings every time a market disappoints. But if your bond funds are giving you serious heartburn, GICs may be worth a second look.”

But now that the bond funds have already suffered a 10% plus loss, aren’t investors locking in these losses if they switch over to GIC’s? Or, do you think these bond funds losses are more permanent and may even get worse?

Thanks,

John

@John Tittel – There’s always a possibility bond losses could get worse, but it’s certainly not a reason to panic and make a switch. Bond prices could also recover some of their losses if yields were to decrease (which is also a possibility). If you have a prudent investment plan in place, staying the course is generally the best option.

Thank you for another excellent article, Justin. I have often thought of building a GIC ladder. It is definitely on the horizon. I am not in the slightest tempted to sell any of my bond ETFs although, obviously, I am underwater. I think that ultimately higher interest rates have to be a good thing. As bonds mature they are replaced by newer ones with a higher coupon. It is interesting that BlackRock had been warning for some time that bonds were losing their value as a hedge against equity risk. However, I think in future negative correlation will once again reassert itself. I like EQ bank for their high interest savings account. One question I have is, why not consider direct ownership of treasury bills? Money market funds are unappealing at the moment.

@David Dalton – Treasury bill rates in Canada are still lower than comparable GIC rates, so if an investor doesn’t need the liquidity, the GIC option may be more appropriate.

Thanks for this post; it’s one I’ve been hoping for. As a retiree that has no government or company pension plan, I rely on my savings plus CPP and OAS for my money. This places an entirely different importance on portfolio management than someone saving for the future. I have been invested in the markets for over 40 years and have been self managed for the last 10 years. I have typically found most investment advice is focused on savers, planning their retirement versus retirees who are focused 100% on income and security. As a retiree, of course I have a much higher percentage of my portfolio in fixed income versus equities than a “saver” And yes, yields are an essential criteria. Up until the 2020 market crash, I used a bond ETF for about 50% of my fixed income holdings, together with GICs and equity ETFs. When the bond ETFs, which I had subconsciously thought of as “relatively secure”, quickly lost 10%, I cashed out and moved over to all GICs for my fixed income. Because interest rates were so low, I bought short term GICs and as they have matured, I have now migrated to a more standard 5 year ladder. Now I sleep easier each night. (PS i would sleep even easier if my Equity ETFs would start to grow again.)

@Bob Clark – I’m so sorry to hear about your negative experience with bond ETFs (I wish I had released this video earlier!). However, I am glad to hear you’re now invested in something that you’re more comfortable with (and in 2-3 years, the interest from the GICs should offset the initial losses on your bond ETFs, so hopefully this will help you sleep better as well :)

Hi Justin

A great explanation as always. My GIC ladder broke down over the last three years because rates were so low. I have shifted to using a ladder of 5-year reset preferred shares instead, and learned a lot about how they interact with fluctuating interest rates. They have a higher risk profile than either GICs and Bond ETFs of course, but this is offset somewhat by higher dividend rates and the potential for capital gain (or loss). I prefer individual holdings rather than Preferred ETFs as they are easier manage the term risk. A great resource for anyone looking to learn about the Canadian preferred market is: https://premium.canadianpreferredshares.ca/#

Thanks always for your well thought-out insights.

@Don Dufault – Thanks for watching (and for sharing your comments)! I agree, GICs and bond ETFs are a different breed than preferred shares, so investors are best to familiarize themselves with the differences before investing in them.

Hi Justin,

Thanks again for another blog post.

One bank that I think needs some love on here is “EQ Bank.”

No fee unlimited online banking (free e-transfers, no minimum balance, pre-authorized deposits) AND an every day savings rate currently at 1.5% (the highest by far compared to any other bank in Canada.)

The reason I’m writing this is because they currently offer GICs at 1yr – 3.65% to 5yr – 4.35% and are CIDC insured as well.

The only downside is there are no bricks an mortar locations, or debit cards for this bank – but that’s what free e-transfers are for :)

Cheers,

Billy

@Billy – Thanks for the suggestion! EQ Bank is definitely a great option for those investors who won’t go over the CDIC limits building a 1-5 year ladder with a single issuer (and who don’t mind the additional complexity of opening a separate account from their discount brokerage).

If they’d rather keep things simple (or they need to diversify across issuers), I’m finding comparable GIC rates to EQB’s on 1-year and 5-year rates at the various discount brokerages (around 3.64% for a 1-year and 4.25% for a 5-year).

Hi Justin,

Great post.

Forgive my slow understanding of the facts but please tell me if I am misunderstanding something.

I am considering investing in Hamilton’s enhanced U.S. covered call etfs (HYLD) in the near future. I expect the value of the etf to still go down (and the yield to increase) as interest rates continue to rise by a couple more leaps and bounds as inflation remains high for a while yet. It currently is paying a yield of 14.18% with an etf price at 11.35$CAN. In a couple years I expect the reverse to happen with the HYLD’s etf value to go back up while yields retreat, yet leaving me with my initial high % yield on the original amount invested. Add to this the added value because of the higher prices giving me an even greater profit when I sell and a high yield on my investments until I do sell. This sounds really great. Almost to good to be true!? Am I missing something in my understanding here?

Thanks for the review. I sold all my ZDB about 6 months ago to buy laddered GIC in my corp account. Not sure if the tax issues make a difference, I just figured bond etfs were going down. Only hold GIC ladder in my RRSP. Very timely and helpful as always.

@Kyle Raab – Thanks for sharing your experience, Kyle :)

Hi Justin,

I have been using the wealthsimple invest option for the last few years. They have the bond portion of my portfolio heavily invested in ZFL which has performed terribly. I am considering switching to vgro or vbal instead. Any thoughts? Thanks.

@TANNER – If you’re comfortable investing on your own without the help of a robo-advisor, asset allocation ETFs (like VGRO or VBAL) are a great option (they are also cheaper and have a more consistent investment strategy that Wealthsimple).