We’re coming in for a landing in our three-part, blog post series on asset location.

In Part 1, we introduced several key concepts to better understand asset location. In Part 2, we showed you how you could use a Ludicrous asset location strategy to increase your investment portfolio’s expected after-tax return … with a twist. By locating stocks in your TFSA first, non-registered account second, and RRSP last, you can essentially trick yourself into increasing your portfolio’s after-tax stock exposure. This means the expected outperformance is simply the result of taking more after-tax equity risk. Not only is it no risk-free lunch, it’s really due more to asset allocation than to asset location.

There is still an asset location strategy that is truly more tax-efficient than any we’ve discussed so far. In this asset location series finale, we’ll show you how to implement the Holy Grail of asset location: The Plaid Strategy.

In Spaceballs, it didn’t get any crazier than “plaid speed” for our intrepid space travelers. The same might be said for a Plaid asset location strategy. And yet, it’s still based on several key concepts from Part 1. Most importantly, the after-tax results in your RRSP behave much like the results in your TFSA. Just like in your TFSA, you never pay tax on any growth earned on the after-tax portion of your RRSP. Also, your after-tax asset allocation drives your after-tax returns, not your before-tax asset mix.

If you don’t believe me, please revisit Part 1 for the full explanation on these mind-bending notions. Once you grasp them, the lightbulb comes on, and you realize the government portion of your RRSP, and all growth on this portion, never really accrues to you.

Going Plaid

Brace yourself, because you can now go plaid with your asset location strategy, as follows:

- Use After-Tax vs. Before-Tax Planning: First, you’ll want to manage your portfolio’s asset allocation on an after-tax, rather than a before-tax basis.

- Embrace Logic-Defying Asset Location: Since the after-tax portion of your RRSP behaves like a TFSA, you’ll want to hold investments with the highest expected returns in your RRSP and TFSA first, and then in your non-registered accounts. In other words, you won’t use the traditional asset location strategy we described in our last post.

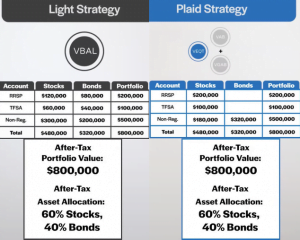

You begin by determining your after-tax total portfolio value. For this example, we’ll use the same before-tax account values from our last post: a $400,000 RRSP, a $100,000 TFSA and a $500,000 non-registered account. We’ll also assume the same 50% average tax rate on the RRSP withdrawals in retirement. Based on this, our RRSP is worth $200,000 after-tax (or 50% of the $400,000 before-tax RRSP value), making the total after-tax portfolio value $800,000.

Like our last post, we’ll use a Light portfolio as our benchmark, with an after-tax asset allocation target of 60% stocks and 40% bonds. And once again, we’ll use the single-fund Vanguard Balanced ETF Portfolio (or VBAL) across all accounts.

We’ll target the same asset mix for our Plaid portfolio, using the same funds we used for our Ludicrous portfolio. So, for our stock allocation, we’ll hold the Vanguard All-Equity ETF Portfolio (VEQT). For bonds, we’ll hold the Vanguard Canadian Aggregate Bond Index ETF (VAB) and the Vanguard Global Aggregate Bond Index ETF (CAD-hedged) (VGAB).

A Plaid Asset Location in Action

In both our Light and Plaid examples, we’ll allocate $480,000 of the after-tax portfolio value to stocks, and $320,000 to bonds, for a total of $800,000.

In our Plaid portfolio, we’ll locate $200,000 of stocks to the RRSP first and $100,000 to our TFSA next, for a total of $300,000 in stocks. (Practically speaking, the RRSP is actually worth $400,000 before-tax, so this is the amount of VEQT we’ll purchase in the RRSP.) We still need another $180,000 in stocks, so we’ll purchase this amount in our non-registered account.

Next, we’ll purchase the entire $320,000 bond allocation in our non-registered account. We’ve now created a 60% stock, 40% bond after-tax asset allocation for both our Light and Plaid strategies.

Plaid Asset Location: Adjusting for the Government’s Take

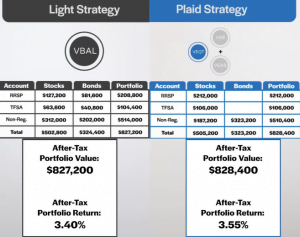

Let’s now assume stocks return 6% over the next year, and this return is comprised of a fully taxable 2% dividend yield, plus a 4% capital gain with a 50% inclusion rate. We’ll also assume our bonds return a fully taxable 2% over the next year. Our average tax rate is 50%, and since the $200,000 RRSP value is an after-tax figure (and again, the after-tax RRSP behaves like a TFSA for tax purposes), there will be no taxes payable on this amount, or on any of its investment growth.

After paying all taxes owing at the end of the year, we find Plaid outperformed Light by 0.15% after-tax. By allocating the stocks with higher expected growth to the RRSP and TFSA first (while keeping the after-tax asset allocation the same), the Plaid portfolio was able to outperform the Light portfolio with a truly more tax-efficient approach.

One year later … after-tax

So, aside from the fact that this level of asset location is ridiculously complicated, why isn’t everyone managing their ETF portfolio this way?

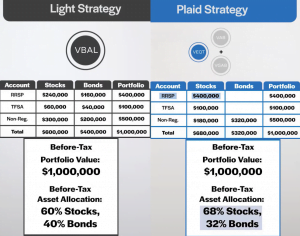

Even though both strategies had the same after-tax asset allocation, the Plaid asset location strategy required a higher before-tax allocation to stocks. If we look at the portfolio from a before-tax perspective, you’d need to fill your entire before-tax RRSP with $400,000 of stocks, resulting in a before-tax asset allocation of 68% stocks and 32% bonds. Even if you end up a year later with a 60/40 after-tax mix, it doesn’t take a financial whiz to notice you’re starting out with a riskier, before-tax allocation.

Realistically, this is a tough pill to swallow. Most investors are used to thinking about their accounts on a before-tax basis, especially since that’s how the numbers get reported to you. To manage a Plaid strategy requires a mind-bending leap into another dimension: You’ll need to look past those seemingly riskier, before-tax numbers in your RRSP statements, and accept that the government is taking on that extra equity risk for you.

As with our other portfolios, let’s review the advantages and disadvantages of a Plaid asset location strategy:

Advantages of the Plaid Asset Location Strategy

- It is officially the most tax-efficient asset location strategy. Even with our three-ETF portfolio, there are noticeable tax benefits to employing the strategy. And now that you’re prioritizing equities in your RRSP, there may be additional opportunities to reduce the withholding tax drag on foreign dividends by investing in U.S.-based foreign equity ETFs.

- You can expect lower capital gains from rebalancing. Since you can hold most of your equities in your RRSP and TFSA, you can also do most of your portfolio rebalancing there. This can reduce the tax drag from occasional rebalancing. This is especially advantageous if you’re not adding enough new cash to your portfolio, to rebalance organically over time.

Disadvantages of the Plaid Asset Location Strategy

- We can’t predict future tax rates. Without a time-traveling DeLorean, you will never know for sure what the future average tax rates will be for your registered account withdrawals and taxable capital gains. However, you can work with a financial planner to make some reasonable assumptions.

- As touched on above, you will need to take more before-tax equity risk. To go Plaid, you’ll have to allocate a higher percentage of your before-tax portfolio to stocks, understanding it’s eventually a lower, after-tax allocation. Steely-nerved investors can live with that by understanding it’s ultimately the government, not them, taking the extra equity risk. But not all investors can peer past their financial statements into this mind-bending dimension. Or you may just decide you have better things to do with your time than to even try. If you might blink at the first sign of stock market trouble, you’ll probably want to stick with a single asset allocation ETF across all accounts.

- You need to love number-crunching. Personally, I love numbers, but even I got a little dizzy writing this post. And that’s using simplified examples. Your real-life, portfolio management will be much messier. You will need to continually update your after-tax ETF values. And when unrealized capital gains start to accumulate in your non-registered account, they’ll create lower after-tax values for the appreciated funds you continue to hold, further complicating your calculations.

We’ve now reached the end of our asset location blog post series. Our Plaid asset location strategy overshoots the complexity of other strategies by about a million miles, so no one will blame you—and I may even applaud you—if you decide to stick with a Light asset location strategy. As I’ve said before, by using a single asset allocation ETF in each of your accounts, you’ll still be light years ahead of most DIY investors.

What else can I answer for you about asset location, asset allocation, and before- and after-tax portfolio management? Let me know, and we’ll keep the conversation going.

Hey Justin,

Thanks for all the info! Would love if you could help clarify a few things for me.

In one of your comments you recommended treating a CCPC as a non-registered account. However, in your plaid example, you use the same 500000$ amount as both the before and after tax amount in the non-registered account. For a CCPC, wouldn’t you have to account for the personal income tax rate when withdrawing funds from the corp? Secondly, the plaid allocation method doesn’t factor in tax loss harvesting strategies that could offset capital gain taxes in the CCPC.

Am I correct in both these observations or could you please clarify if there’s anything I’ve misunderstood?

Much appreciated for everything you do!

@Nathaniel – My apologies – I should have clarified. What I meant was if you have a corporate investment account, the order of the accounts (i.e., where to hold equities/bonds) would be the same as a personal investment account. But yes, you would need to adjust the corporate value downwards for the future taxes payable (if managing a Plaid strategy). The calculations over time would start to become very tedious – which is another strike against the Plaid asset location strategy.

Tax-loss selling strategies and adding new money could both reduce the occurrences of capital gain realization.

THANK YOU! This is fantastic content. However, my question is that given dividends are taxed more heavily than capital gains, the heavier allocation to bonds in non-reg means that you will be paying more taxes every year so if the equity markets underperform you may end up worse than going with the light strategy if you’re a high income earner/higher tax bracket?

Thank you so much for this post! Wow its dizzying though. I think it would be amazingly helpful for your readers to have an order of operations on what to put where with commonly held ETF types: IE What is the most important asset type to hold in each account type IE: RRSP: First fill it with US held dividend payers then put them in your non-registered. TFSA: First Canadian ETFs then put them in your RRSP (I have no clue if that is correct, but I recently sold a business and finally will be able to max out my Registered fund and more… I love this stuff, but having an order of operations on what to put where would be an amazing tool!.

In follow up to your response to my previous question – I suppose I am just a bit confused, because you said that VGRO would be taxed the same as the individual ETFs, but in discussing asset location, I thought that interest from fixed income sources is taxed at full marginal rate and Canadian equities have dividends that are taxed at a more favourable rate than interest or foreign dividends in taxable accounts?

@Stephanie – Your initial question asked “How does an all-in-one ETF like VGRO get taxed when you sell it…”, which is why the discussion turned to capital gains (which are not the same as interest or dividend income).

If you meant “How do VGRO’s quarterly dividends get taxed in a non-registered account compared to the income received when holding the underlying ETFs: VAB, VBU, VBG, VCN, VUN, VIU and VEE?”, VGRO’s dividends will be comprised of interest income from the bond ETFs, Canadian eligible dividends from the Canadian equity ETFs, and foreign dividends from the foreign equity ETFs (so it will have similar tax implications compared to holding the individual ETFs directly).

However, holding individual ETFs in different accounts can change the tax situation, which is an entirely more complicated discussion about asset location.

How does an all-in-one ETF like VGRO get taxed when you sell it in a corporate (or personal) account given that it holds Canadian/US/Foreign equities/fixed income which normally would all be taxed differently if they were individual ETFs?

Doesn’t VGRO use a DRIP? My previous understanding was that you should try to avoid using ETFs with DRIPs in a taxable account – can you speak to this as well please?

@Stephanie – 50% of all capital gains realized on VGRO would be taxable as regular income (it doesn’t matter if the capital gain was the result of growth on Canadian or foreign equities). If you held the individual ETFs and sold them, the tax implications would be the same.

A dividend reinvestment plan (DRIP) is just an administrative convenience that you can arrange with your brokerage – they will reinvest VGRO’s cash distributions into additional shares of VGRO. The downside of this in a taxable account is that you have more transactions to include when tracking your adjusted cost base (other than that, there’s no issues with setting up a DRIP in a taxable account:

https://www.youtube.com/watch?v=84qCOhMuA8g

Hi Justin,

Just to add to Brad’s comment and your reply – for a person with CCPC, TFSA, and RRSP, do you recommend treating them separately? and purchasing an all in one ETF in each? Or an all in one stock ETF with an additional bond ETF in each? The theoretical tax consequences of US/Foreign income/Bonds in CCPC seem to make this really unattractive but maybe it’s less of an impact than I understand.

@Stephanie: The asset location decisions would depend on the asset location strategy chosen. A CCPC should be treated as a regular non-registered account for the purposes of asset location order.

Foreign dividends do not integrate perfectly when earned in a CCPC, causing an additional tax drag (but most investors with CCPCs may need to hold some foreign equities in this account type):

https://canadianportfoliomanagerblog.com/taxation-of-foreign-income-in-a-corporate-account/

Question regarding the definition of foreign dividends. Recently was looking at my investment income statements, and see that many of the ETFs (i.e. XEF) distribute foreign income box 25. Isn’t this taxed at income marginal rate? effectively income?

If so, doesn’t that change the calculus around dividend tax rate and income tax rate (i.e. making foreign distributions similar to bond distributions?)

As a specific example, for those with corporate accounts, would box 25 returns increase the notional neRTDOH accounts?

Reposting from an earlier blog Comments section as this one is more recent.

Truly amazing work with your asset location deep dive.

Two things I am thinking about:

1) Tax rate: it appears in your example you use the “top tax bracket” example with Pat from Ontario. You quote a tax rate of 53.x%. Is this not the marginal tax rate and wouldn’t the average tax rate be a better rate to estimate taxes paid in the years that one is withdrawing from RIF? For instance, true top tax bracket of $315,000 in Ontario has a marginal tax rate of 53.53% but an average tax rate of 37.83%. Also, how many retirees have $315k of passive income! I wonder what the return difference would be in the case of using average tax rate or if someone lives on a more modest income in retirement.

2) What to you recommend for PLAID with people who are incorporated with a CCPC? Do you make some estimate of after tax investment income during decumulation years? This would get exceedingly complex I imagine with things like dividend, vs interest vs capital gains in CCPC, whether one begins to lose small business deduction by surpassing $50k annual passive income, whether they employ capital gains stripping or tax loss harvesting. Do you have a general recommendation for how to go about CCPC in PLAID??

Thanks, thanks, thanks

@Brad:

1) You can use any tax rate – the lower the tax rate, the less the impact from after-tax asset allocation calculations (so if you’re in a low tax bracket in retirement, these concepts are not as relevant for you). This is why I chose a high tax rate.

2) I don’t generally recommend a Plaid approach for any investor, as it’s way too complicated (and theoretical at best). I wrote the blogs/videos to explain the tax concepts, not to encourage investors to implement a similar portfolio. If you also have a corporate account, things get even more complicated (so I wouldn’t get bogged down with implementing this type of strategy).

As someone who just maxed out their TFSA and is now looking at opening an RRSP and Taxable account, this was a great read, thanks!

But it is also a little hard to put this to use (as you note) for someone who’s just a light DIY investor. I was trying to determine what simpler approach I want to take with my own investments. If I did the following, would I be shifting my after-tax allocation? Any major drawbacks?

TFSA: Target equities first

Taxable: Target bonds first

RRSP: Maintain pre-tax allocation same as total portfolio

This was a super interesting series! One thing I wonder is how these different strategies affect your withdrawal strategy at retirement. The light strategy seems easy: pick your favourite account and sell assets in the same percentage their allocated. For example if you want $50k and you have a 60/40 split, then you would sell $30k in stocks and $20k in bonds. Done!

What the heck happens with any other location strategy? Let’s say I prioritize stocks in my RRSP and TFSA, as per the plaid strategy. Now it’s time to withdraw $50k. One withdrawal strategy is to empty your RRSP first to reduce/eliminate minimum withdrawals at age 71. By that logic I should withdraw $50k from the RRSP, which is all equity. Now it’s out of balance and I have rebalance. So in practice, one would withdraw $30k from their RRSP (all equities) and $20k from their cash account (bonds). What are the tax implications there?

My head hurts!

@Bryan – You would first determine the most efficient withdrawal strategy for your situation (a financial planner can help you run projections).

Let’s say they determine withdrawing $50,000 from your RRSP is the best strategy. Let’s also assume you have a 60/40 split – your RRSP is worth $500,000 and is invested entirely in equities, your TFSA is worth $100,000 and invested entirely in equities, and your non-registered account is worth $400,000 and invested entirely in fixed income (for a total portfolio value of $1,000,000).

If you sell $50,000 of equities in your RRSP and withdraw this amount, your portfolio would be worth $950,000. You target allocations would then be $570,000 equities and $380,000 fixed income. Since you only have $550,000 of equities, you would also need to sell $20,000 of fixed income in your non-registered account, and buy-back $20,000 of equities.

That seems reasonable, though I think it starts drifting from “optimal” asset location since you end up with more equities in the taxable account. I don’t see a way around it though.

Taxable accounts make everything complicated because you can’t dramatically alter strategies without incurring capital gains. Your stuck with your previous decisions for a while. Oh well ¯\_(ツ)_/¯

Great series Justin, have implemented it,

Justin, Great work on asset allocation and asset location series.

Many forget that both work hand in hand

@FPC – Thank you so much :)

Great series, Justin, and very clearly explained! Just to clarify – you’d also suggest looking at the post tax value of your taxable account as well as your RRSP? Not to mention if you are also juggling a Corporate account! Yikes!

Depending on your circumstances, there can also be lower capital gains taxes from rebalancing with the Ludicrous strategy. As bull markets tend to be slower and longer than bear markets (escalator up, elevator down), in a crash, with bonds in your RRSP, you can buy stocks to rebalance then switch back to bonds when the market recovers with no tax consequences. This can work well keeping the portfolio in balance with cash flow during long slow bull markets, and do bear market rebalancing, when indicated, in your RRSP.

@Grant – I’m glad you enjoyed this asset location series! As you mentioned, once you have to calculate after-tax values for non-registered securities (and corporate accounts), the portfolio management becomes even more complicated ;)

Thanks for the series, Justin! I think I’m more for simplicity. Right now as I’m starting to max out my TFSA and RRSP accounts, I’d probably open up a non-reg. account at some point in the near future. I’m currently holding a bunch of index ETFs which I may end up converting to Z/XEQT, etc. for simplicity. I’m also looking towards starting with some bonds in my future non-reg. account. Would you recommend ZDB over ZSDB, or anything else for non-reg. accounts?

Thanks!

@Sam – If you’re looking for a traditional Canadian bond ETF for your non-registered account, ZDB is a good choice. If you’d rather keep your bond maturities shorter-term, you could consider ZSDB instead.

Haven’t you ignored the benefit of the dividend tax credit in the Non-Reg account by assuming the 50% tax rate across all components?

@Richard: Canadian equity ETFs currently have a net eligible Canadian dividend yield (after MER) of 2.53%. The top tax rate for eligible dividends (Ontario) is 39.34%. The taxes payable on a 2.53% net eligible Canadian dividend yield would be 1% (2.53% x 39.34%).

In my example, I assumed a 2% net dividend yield taxable at 50%, for total taxes of 1% (2% x 50%).

Thanks Justin for another pretty interesting post. As a long time reader / listener of your content, I am already implementing a version of plaid I would call ludicrously plaid and I’d like to know what you think of it. Basically, it is breaking down the stock component into the different components and choosing which etf version has the lowest MER (US or CAD) whilr optimizing for reduced tax drag on distributions. As a result, international developed goes in registered accounts first (with US version in RRSP), then a mix of US and emerging markets (for a little diversification). As with the plaid, everything else then comes in registered.

It took a few hours to set up my spreadsheet so everything is allocated on a post tax basis (registered was the most intensive), but after a few years managing my portfolio this way, I’m finding it quite easy (basically press “refresh” once a month and allocating new cash based on numbers presented).

@QcFI – Most investors implementing an after-tax asset location strategy would tend to use individual Canadian, U.S., international and emerging markets ETFs (instead of a single all-equity ETF), as this would provide more flexibility. I just used a simple example using VEQT for illustration purposes, but it sounds like you’re on the right track ;)

Hi Justin,

I’m thinking of implementing this strategy as-is (without breaking down the equity ETF) – do you really think it would be too restrictive to have just 3 ETFs to balance?

For my own situation, I have a portfolio of ~$225K and the Light strategy seems a little too tax-inefficient for this size. However, I don’t have the motivation or confidence to get really involved (like performing Norbert’s Gambit regularly), so I’m looking for a happy medium. Plaid or Ludicrous look like the ticket if I don’t have to break the ETFs down further.

Bonus question: any suggestions for iShares equivalents? XEQT and ???

Amazing resources that you’ve put together here! Us Canadians are lucky to have you! Feel free to inform me if I’m totally out to lunch on this question.

@Rebecca: Vanguard rebalances the underlying components of VEQT for you, so as long as you keep your overall fixed income and equity weights on target, you should be fine (although nothing beats a one-fund asset allocation ETF for simplicity).

You could team up XEQT with XBB and XGGB (the iShares Global Government Bond Index ETF (CAD-Hedged)) to get similar exposure to the VEQT/VAB/VGAB combo.