George Costanza: I’ll sniff out a deal. I have a sixth sense.

Jerry Seinfeld: Cheapness is not a sense.

I have a brother I love a lot … and who reminds me a lot of George Costanza. I’ll bet every family has one. If you don’t think so, look in the mirror; it’s probably you. When it comes to sniffing out deals, my real-life bro is every bit as talented as the fictional George, so I wasn’t surprised when he asked me to create a set of commission-free ETF portfolios he could implement in his Scotia iTRADE account.

Challenge accepted.

Scotia iTRADE gets a massive fail for charging $25 trading commissions on portfolios below $50,000 (unless you’re a loyal customer). Maybe to make up for the price gouging, Scotia offers 50 commission-free ETFs you can trade without fear of depleting your hard-earned nest egg. (And no, that’s not a picture of my brother there … although it could be.)

Before you get too jazzed up about that, the majority of these misfit commission-free ETFs have no place in a prudent portfolio. Luckily for you, I’ve sorted through the mess, back-tested the strategies, and selected five of them that made the cut, and should hopefully track my official model ETF portfolios reasonably well over the long-term. Deal-sniffers of the world, rejoice!

Download the Scotia iTRADE Commission-Free Model ETF Portfolios

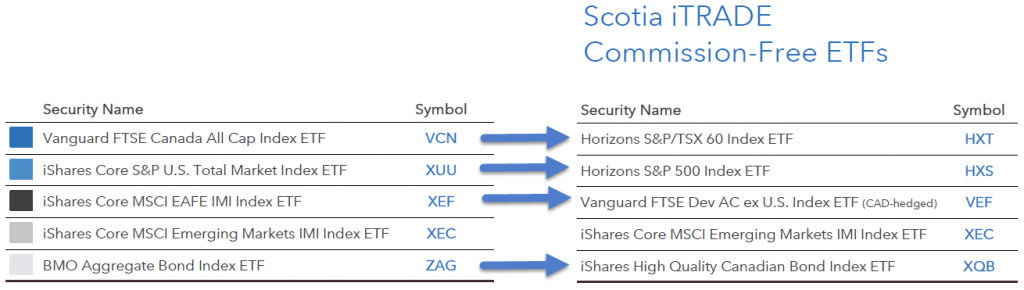

In the commentary that follows, I’ll discuss some of the main differences between the original ETFs and Scotia’s commission-free replacement ETFs for each asset class.

Canadian Equities

The Horizons S&P/TSX 60 Index ETF (HXT) replaces the Vanguard FTSE Canada All Cap Index ETF (VCN) in the commission-free version of my model portfolios. HXT excludes mid-size and smaller companies, making it less diversified than VCN. It also uses a more complicated swap structure to obtain its Canadian equity exposure, which some investors may not like. On the plus side, HXT is the cheapest Canadian equity ETF available, with fees of only 0.03% per year.

U.S. Equities

The Horizons S&P 500 Index ETF (HXS) replaces the iShares Core S&P U.S. Total Market Index ETF (XUU). HXS also excludes mid-size and smaller companies, and uses a swap structure to obtain its U.S. large cap equity exposure. Fortunately, this swap structure allows HXS to avoid the additional tax drag from foreign withholding taxes in registered and tax-free accounts, saving investors roughly 0.30% per year. Unfortunately, this swap structure also adds 0.30% annually to the fund’s trading costs, completely offsetting the initial tax savings. HXS is also slightly more expensive than XUU (0.11% vs. 0.07%).

International Equities

The Vanguard FTSE Developed All Cap ex U.S. Index ETF (CAD-hedged) (VEF) has a number of notable differences from the iShares Core MSCI EAFE IMI Index ETF (XEF). First off, VEF hedges away its foreign currency exposure, while XEF rides it out, for better or for worse. In years when the Canadian dollar has significantly appreciated (depreciated) against a basket of foreign currencies, I would expect that VEF would outperform (underperform) XEF.

Secondly, VEF includes an 8.3% allocation to Canadian equities whereas XEF excludes Canadian equities. In a typical balanced portfolio, this would result in an additional ~1.25% portfolio allocation to Canadian equities. This is not really something to lose sleep over, but I point it out for the record.

Third, VEF (unlike XEF) doesn’t hold its underlying stocks directly – it simply holds its US-listed ETF counterpart, the Vanguard FTSE Developed Markets ETF (VEA). Although this may seem like a reasonably efficient way for a Canadian fund company to avoid reinventing the wheel, it results in an additional layer of foreign withholding taxes. If you hold VEF in a registered or tax-free account, I would estimate the additional tax drag at around 0.37% per year, relative to holding XEF.

Finally, as VEF follows a FTSE index, it includes Korea as a developed market. (XEF follows an MSCI index, which still considers Korea to be an emerging market.). This only becomes an issue if you combine a FTSE-following developed markets ETF with an MSCI-mimicking emerging markets ETF; you’ll end up holding Korea in both ETFs. Which brings us to our next asset class …

Emerging Markets Equities

The iShares Core MSCI Emerging Markets IMI Index ETF (XEC) is the only fund you’ll find in both my regular model portfolios and on the Scotia iTRADE commission-free ETF list – so no substitution required. As I mentioned above, MSCI treats Korea as an emerging market, resulting in a double allocation to the country’s stocks. The end result for a balanced portfolio would be an additional ~0.75% allocation to Korean stocks. I think even an index investing purist can live with this.

Fixed Income

Plain-vanilla, broad-market bond ETFs tend to be highly interchangeable, so it was an easy decision to ditch the BMO Aggregate Bond Index ETF (ZAG) and replace it with the iShares High Quality Canadian Bond Index ETF (XQB). XQB does have a few slight differences, such as a 40% allocation to corporate bonds, versus ZAG’s allocation of just under 30%. If you’re holding your fixed income in a taxable account, you may want to ditch these ETFs entirely and consider a more tax-efficient product, like the BMO Discount Bond Index ETF (ZDB). Even if you have to eat a trading commission, the trade-off seems worth it.

Dimes worth of difference

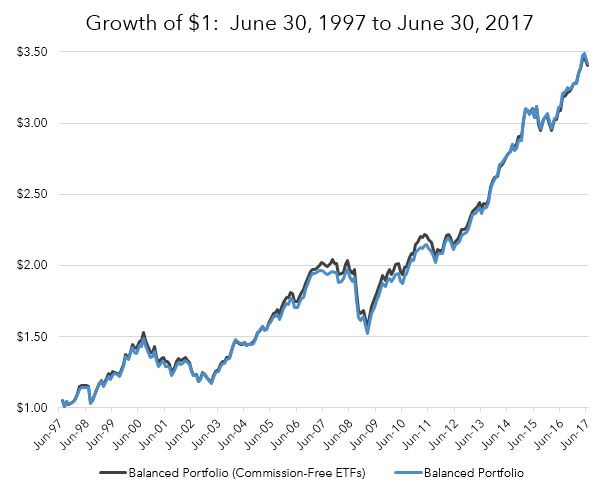

So brother against brother, which of “our” portfolios is expected to come out ahead after costs? Although the above differences may result in over- or under-performance from year to year, I would expect both of us to share similar performance over the long term. That should make my parents happy, as they always hoped we’d eventually learn to share.

Here are a back-tested return comparison table and chart for the balanced portfolios from each model. As you can see, the results were almost identical over the past 20 years.

Model ETF Portfolio Return Comparison as of June 30, 2017

| Measurement Period | Balanced Portfolio (Scotia iTRADE Commission-Free ETFs) | Balanced Portfolio | Difference |

|---|---|---|---|

| YTD | 3.98% | 4.29% | (0.31%) |

| 1-Year | 10.14% | 9.74% | 0.40% |

| 3-Years (Annualized) | 7.04% | 7.10% | (0.06%) |

| 5-Years (Annualized) | 9.43% | 9.74% | (0.31%) |

| 10-Years (Annualized) | 5.41% | 5.75% | (0.34%) |

| 20-Years (Annualized) | 6.32% | 6.34% | (0.02%) |

Update……the Canadian government did indeed change the rules on the swap-based funds…….however, Horizons was able to keep the funds pretty much the same simply by morphing them into a corporate class structure. So, the HXS and HXT have turned out to be a continuing good investment, with no surprising tax bill.

@ken: It’s way too early to determine whether the Horizons ETFs (HXS and HXT) are still a tax-efficient investment after the changes. Even if there are no distributions, corporate taxes within the structure could erode the net asset value.

I moved all my investments from Scotia to questtrade except for $50,000 in RESPs where I just gave up on the transfer after 2 failed attempts – (RESP transfer benefiicary and owner mismatches). I decided to leave the remaining funds in VGRO and as it pays dividends I purchase VRE, in this way I have stopped having to pay commissions.

My kids are 15 and 17 so I feel like I need to move out of VGRO now (at least partly). It looks like you would recommend XQB for this switch. If I sell all of my VGRO and then split the proceeds between XQB. and one of the other funds I will only pay for one transaction. I would then be able to rebalance if needed over the next 10 years without paying commissions. Any thoughts

@Greg: I don’t provide specific investment advice on my blog, but perhaps this RESP article will help:

https://www.theglobeandmail.com/globe-investor/funds-and-etfs/etfs/the-abcs-of-building-an-resp-using-etfs/article32474800/

Hi Justin,

Thank you for this strategy. I like it and have implemented it in my scotia iTRADE TFSA account. I’m just wondering if the strategy differs when used for an RRSP, RESP,TFSA or non registered account. Currently I use iTRADE and also have Wealthsimple accounts (RRSP and RESP). Your thoughts are always appreciated.

@John: These commission-free ETFs would be adequate for all other account types as well. However, there are many more ETF tax nuances that I have discussed elsewhere throughout my blog (i.e. premium bond issues, foreign withholding tax drag, etc.) that you may want to familiarize yourself with.

That is an extremely smart written article.

Thank you very much – this is exactly what I was looking for.

Good motivational advice, just what i need.Thanks

What are your thoughts on CIB519 for monthly contributions?

@Bob: CIBC Emerging Markets Index Fund (CIB519) vs. the iShares Core MSCI Emerging Markets IMI Index ETF (XEC):

– Management Expense Ratio (MER): CIB519 = 1.39%, XEC = 0.26%

– Diversification: CIB519 = Large and Mid Cap Companies, XEC = Large, Mid and Small Cap Companies

– Commissions: CIB519 and XEC both have zero trading commissions at Scotia iTRADE

XEC seems like a better option as long as you don’t mind placing a trade each month.

Hi Justin,

Thanks for the great information, I have had an Itrade account nearly identical to this new portfolio you propose for quite some time now. Your article raises some good points for me to follow-up with myself on forcing a diversified balanced distribution, some bond inclusion, and some serious questions about fee efficiency of the 50 free ETF options (even once we qualify for the 9.99$CAD trade fee rate).

I hoped you would indulge the following analysis/ questions ?

1)

Incorporating additional consideration for readers looking at the Free-Itrade model vs your US-listed RRSP model:

Utilizing US listed funds, Scotia would force us to use their RRSP friendly option (as per your Norbert White Paper on Scotia) creating a 0.5%+$9.99 transaction fee to complete a buy or sell action beyond the bond/Canadian portion (for a total of 1%+$19.98) on each internationally invested dollar every time it is rebalanced, 1%+$19.98 on each new dollar invested over its lifetime (0.5%+$9.99 conversion fee on stock purchase, and again 0.5%+$9.99 on future sale conversion back to CDN to withdrawal). Further, this approach guarantees an additional drag of $120/year. These additional fees come with one big advantage versus the free-ETF trading Scotia RRSP Portfolios greater annual drag (Scotia Portfolio (0.22%+0.20%), compared against US listed RRSP Portfolio (0.06%+0.08%).

My impressions suggest the US-listed RRSP portfolio in an Itrade account would then have to be quite large for the collection of these fees to overcome this 0.28% less annual drag benefit ?

-US friendly account fee alone, will eat up some of the advantage versus the scotia model with rebought each year to rebalance, that’s an additional 0.10% annual drag?)

2)

Starting with a comparison of the Free-ETF Scotia Model (same in RRSP or TFSA) (0.22+0.20) versus your new model portfolio for TFSA (0.12+0.20, which also isn’t avoiding any withholding taxes), again assuming 100% stock allocation:

– MER: the big jump here is the large HXS portion of the portfolio (0.11+swap 0.3) vs XUU (0.07), since HXT and VEF actually have slightly lower MERs than VCN and XEF?

-Withholding Tax: This washes as a coincidence of the portfolio weight and the competing effects on HXS (34% weight)(withholding tax now MER swap fee vs XUU, -0.3 ) and VEF (25% weight)(extra layer of with-holding tax vs XEF , ~+0.37 ):

The question that arises then is how I and readers interested can optimize the ScotiaItrade Free-ETF Model to balance Free-ETF’s with Fee-ETFs as the portfolio grows and the trade fees become less significant compared to various drags:

-In a TFSA:

-XEF over freely traded VEF ? (you avoid 0.37 the extra layer of the US withholding on top of the international withholding * 0.25 portfolio weight = ~ 0.1% drag on overall portfolio)

-In a RRSP:

-XEF over freely traded VEF ? (you avoid 0.37 the extra layer of the US withholding on top of the international withholding * 0.25 portfolio weight = ~ 0.1% drag on overall portfolio)

-XUU over freely traded HXS ? (you would not be able to reap the advantages of foregoing the withholding tax with HXS because it incorporates it in the Swap Fee ? another ~ 0.1% drag on overall portfolio)

-In a Taxable:

-XEF over freely traded VEF ! (you would avoid both layers of the US and International withholding taxes because of, I must assume the overall drag would be closer to ~0.2% drag on overall portfolio ? )

-XUU over freely traded HXS ? (you would not be able to reap the advantages of foregoing the withholding tax with HXS because it incorporates it in the Swap Fee ? another ~ 0.1% drag on overall portfolio)

How comfortable should we be with putting a big part of our eggs in swap-based ETFs such as HXT and HXS?

Wouldn’t you be afraid of future fiscal rule changes regarding swap based ETFs (since there are no distributions and it will be all capital gains)?

What about counterparty risk?

D

@D: For investors with larger taxable portfolios, they may feel more comfortable avoiding the swap-based ETFs (in case future tax changes result in a realized gain on the securities in a single tax year). I would assume that the majority of investors interested in the commission-free ETFs at Scotia iTRADE have more modest-sized portfolios (where trading commissions can significantly erode their returns).

For investors who are uncomfortable with the additional counterparty risk, I would recommend switching to a cheaper brokerage (like Questrade) and implementing the standard model ETF portfolios.