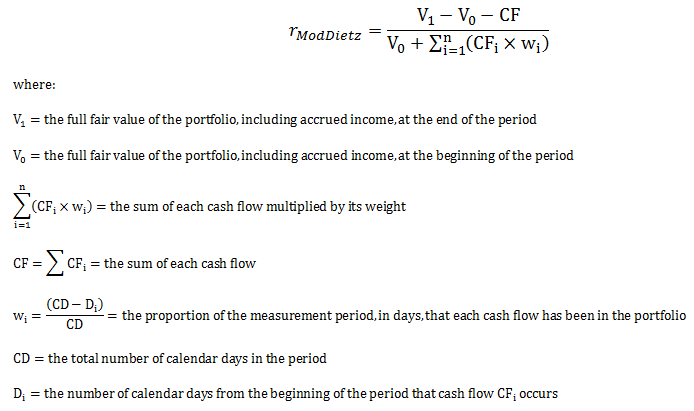

The Modified Dietz rate of return attempts to estimate a money-weighted rate of return (MWRR) by weighting each cash flow by the proportion of the measurement period it is present or absent from the portfolio.

Similar to the money-weighted rate of return, the calculation requires the investor to know the portfolio values at the start and end of the measurement period, as well as the cash flow amounts and dates when each cash flow occurs. Unlike the MWRR, the calculation does not require an exhaustive trial and error procedure, or sophisticated computing power.

Source: CFA Institute

The Modified Dietz rate of return can differ substantially from the time-weighted rate of return (TWRR) when large cash flows occur during periods of significantly fluctuating portfolio values (just like the money-weighted rate of return). This makes the Modified Dietz rate of return less ideal for benchmarking portfolio managers or strategies than the TWRR. For example:

- When a large contribution is made prior to a period of relatively good (bad) performance, the Modified Dietz rate of return (ModDietz) will overstate (understate) a portfolio’s performance, relative to the time-weighted rate of return (TWRR).

- When a large withdrawal is made prior to a period of relatively good (bad) performance, the Modified Dietz rate of return (ModDietz) will understate (overstate) a portfolio’s performance, relative to the time-weighted rate of return (TWRR).

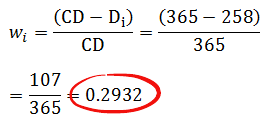

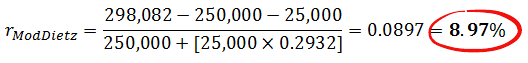

Using the values from our original example, we would plug in the appropriate numbers and calculate the rate of return for each investor.

Example: Calculation of wi

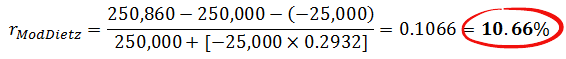

Example: Modified Dietz Rate of Return (MDRR) – Investor 1

Example: Modified Dietz Rate of Return (MDRR) – Investor 2

Performance Results

| Methodology | Investor 1 | Investor 2 |

| Time-Weighted Rate of Return (TWRR) | 9.79% | 9.79% |

| Money-Weighted Rate of Return (MWRR) | 8.98% | 10.64% |

| Modified Dietz Rate of Return (ModDietz) | 8.97% | 10.66% |

As we can see in the chart above, the Modified Dietz rate of return is nearly identical to the money-weighted rate of return. In my final blog post of the series, we will examine how calculating the Modified Dietz rate of return over monthly time periods can help an investor better estimate the time-weighted rate of return.

If at January 31, you have a position worth $3.5M and you sell it entirely during February 1 at $3.6M, is the ending market value for the calculation assumed to be $3.6M, and therefore the Numerator is Zero?

FYI, the drop down for dates does appear to skip the 25th and 26th of each month.

@Hyacinthe – It should work now :)

Hi @justin

What about when you start with 0, have a 100k cash flow, the share price drops by the end of the period to the next cash flow. The calculator ends up with -100%+

Same on the other end, how do you handle when the cash flow might sell down all holdings to 0 before a new cash flow creates a new balance?

Do you simply modify the balance at the relevant start/end period and also remove that cash flow from the formula (numerator and denominator)?

Thanks

Will

Thank you for helpful article and spreadsheet.

I have put my numbers into it and got result -2,5%.

But if I make sum of initial value + contributions I will get for example $630. The final value is greather than that, $657.

So in reality I have more money, but MWR/Dietz is negative. Does it make sense?

Hi Justin,

Your paper & blog brings clarity in calculating portfolio returns.

But how should I consider accrued income in calculating rate of return with modified diet calculator. For instance dividend reinvested in mutual funds is already included in the month’s closing market value of the portfolio however dividend received in cash is not a part of portfolio’s closing market value.

My question is should I subtract (adjust) the dividend received in cash from the respective month’s closing market value before entering cash flows or it has to be accounted as cash withdrawal along with other cash flows without adjusting the month’s closing market value? In order to ensure accuracy can you please provide some assistance.

Kind Regards

Harsh

@Harsh: If you are withdrawing the cash dividends from the portfolio, they should be included as withdrawals in the spreadsheet. If the cash dividends form part of the cash allocation in your overall portfolio, you need to also include the cash value in the total portfolio value month-end figures.

Justin, just wanted to say thanks for the explanations and calculators. You have been most helpful!

@Rick Wells: You’re very welcome – glad the resources have helped :)

Wouldn’t it be simpler to show people how to use Excel’s built-in Internal Rate of Return (XIRR) function? All they need is two columns – dates and transaction amounts, with the last row being the latest date and balance (as a negative number). Using XIRR the transactions don’t have to be at fixed intervals.

@Russ McGillivray: An XIRR function calculates a money-weighted rate of return (which is not useful for benchmarking). However, I would agree that it is one of the easiest returns to calculate. There are countless articles online that show investors how to calculate this type of return.

I also calculate the money-weighted IRR of the benchmark, which in my case are two Couch Potato portfolios (including yours). For each cash flow in or out I calculate the number of units of the 3 or 5 ETFs I would have been bought or sold at the unit price at that time. Then i simply sum the units and multiply by the current value of the ETF to get the benchmark closing balance. This gives the dollar gain or loss of my portfolio versus the benchmark. I also use that balance in the XIRR calculation to get the money-weighted rate of return of the benchmark. It might sound complicated, but it is only one Excel table to calculate the units of each ETF and a table of the ETF closing values by month, easily downloaded from Yahoo finance.

Hi,

Thanks for your very illustrative example and a calculator. One question about dividends in Dietz calculation; how should they be treated? And same question with coupon payments. Should I use separate cash account and calculate Cash account Dietz for that?

Best regards,

Juha

@Juha: When you include the month-end market value of the portfolio, this should include the cash balance as well (which will include any dividends/interest paid but not yet reinvested).

@Justin: I love the simplicity of the Dietz Rate of Return Calculator. I would love to use it on separate accounts and track multiple years within a single spreadsheet. But unfortunately the entire worksheet is locked which means one Excel file per calculation. Any chance we could get an unlocked version for those that want to expend the calculation and historically track things in a single Excel file?

@Milan: For compliance reasons, I can’t provide investors with an unlocked Modified Dietz spreadsheet.

If you are taking a fee using the Buffett Formula, 25% over 6% hurdle, how do you calculate your fee. What are the profits here?Can you show with an example? Thank you.

[…] How to Calculate Your Modified Dietz Rate of Return … […]

[…] However, if you really think you can outperform the index by actively choosing your stocks, you should track you returns using the Modified Dietz method. […]

Justin,

Thank you for you quick reply. I finish to read 4 Pillar of Investing and the formula given in the book was

If there are no additions to or withdrawals from you portfolio, simply divide the end value by the beginning value and subtract 1.0. For example, if you start- ed the year with $10,500 and ended with $12,000, your return was (12,000/10,500) -1.0 = 0.143 =14.3%.

If you had inflows or outflows during the year, this must be adjusted for. (This is the mistake made by the Beardstown Ladies, who did not make this correction.) This is done by first calculating the net inflow. In the above example, if you added $1,000 and then took out $700 during the year, your net inflow was $300. You subtract half of this, or $150, from the top of the fraction, and add one-half to the bottom. So, (12,000 – 150)/(10,500 + 150) = 1.113; your return was 11.3%. If you had a net outflow of $300, then you do the reverse—add to the top, subtract from the bot- tom. So, (12,000 + 150)/(10,500 – 150) = 1.174; your return was 17.4%.

What do you think about this formula vs MWR & Dietz?

P.S. For my portfolio, I’m doing the calculation of a monthly return under MWR; Dietz & the 4 Pillar formula. The Dietz monthly sub-period return rate is almost the same as 4 Pillar formula (with small fluctuations). But there is a big discrepancy if I’m looking on the total annual return rate Dietz vs 4 Pillar…Based on the formula, 4 Pillar doesn’t look like a TWR more likely like a MWR; but as you mentioned earlier Dietz monthly sub-period return rate is closer to MWR where the overall rate for the return is TWR

Thanks & Great Post Justin!

Justin,

I think I have found the answer in one of you posts, but correct if I’m wrong and looking forward for your insight. Thanks

Dietz rate is closer to approximate time-weighted rate of return (ATWRR)

https://canadianportfoliomanagerblog.com/how-to-calculate-your-approximate-time-weighted-rate-of-return-atwrr/

@Ale: This is a definitely a confusing topic. The Modified Dietz return approximates a money-weighted return. However, if you calculate the Modified Dietz return over monthly sub-periods and chain-link the returns together (which is how my calculator does it), the Modified Dietz return starts to approximate a time-weighted rate of return:

https://www.pwlcapital.com/pwl/media/pwl-media/PDF-files/White-Papers/2015-07-10_PWL_Bender-Bortolotti_Understanding-your-portfolio-s-rate-of-return_Hyperlinked.pdf?ext=.pdf

HI Justin,

I have downloaded both calculators: Modified Dietz & MWR.

Every month I’m calculating the rate of my return based on both methods. The annual rate (JAN 1 to MAY 31, 2018) the Dietz rate is almost double vs MWR. At the beginning of this post you’ve mentioned that Dietz is a money-weighted rate of return. I’m wondering if Dietz is a TWR (timing). Can you explain the difference between Dietz vs MWR/TWR?

Thanks

Hi Justin…I have been using the modified dietsz calculator each year, and find it very helpful. A question came up today, which I can’t answer. For partial years, for instance end of April, the calculator returns a YTD percentage. Is this the annual rate for the full calendar year, if nothing else changes?….we know the values in May to December will go up and down, and I haven’t filled those dates in yet, but I wanted to know if for April 30 the percentage returned is an annualized rate, or just a simple percentage from December 31 of previous year to April 30.

@Darrell Robb: The calculator does not annualize a partial year (so if nothing else changes by December 31st, the annual return should be the same as the YTD return as of April 30th).

Hi Justin

I have the same question as Marcus

Is there a way to change the date of calculator?

Thanks

Hi Justin,

From what I understand Modified Dietz rate of Return gives you are better result than money-weighted rate return which fluctuates based inflow/outflow cash. As you mentioned in your previous paper Modified Dietz is closer to time-weighted rate return and I have downloaded the calculator for Modified Dietz. The calculator is for 2018 and is not allowing to change the dates for 2017; is there a way to change those dates?

Thanks

@Ale: I’ll consider updating the calculator in the future to allow for the changing of dates.

The white paper you and Dan wrote is most helpful. Suppose the example investors in that document each had a USD account as well and they wanted to calculate the monthly modified Dietz return across both CAD and USD accounts in CAD. Is it as straight forward as gathering all 13 month end exchange rates as well as for each USD cashflow event, convert the USD V0, V1 and CF values to CAD and combining them with the respective values derived from the CAD account?

@Kyle: You got it! ;)

Hi Justin,

Are you going to be posting a Modified Dietz calculator for 2018? or do you have one that we would be able to adjust dates. I found your calculator extremely helpful.

As is the information on your blog

Merry Christmas

Andre

@Andre Robichaud: Merry Christmas to you and your family :) I will be posting a downloadable 2018 version of the calculator sometime in January 2018.

Hi Justin, is there anyway to change the date on your calculator from 2017 to 2016? Thanks for the calculator by the way.

@Marcus: I’ll send you an email with a version that you can adjust.

Hi Justin, this is a great blog and it has helped me better understand performance figures! At the end of this blog, you have said your final blog will examine Modified Dietz over monthly time periods. Could you please provide me a link to this?

Kind regards,

Deesha

@Deesha: I’m glad you’ve enjoyed the articles. Here’s a link to the Modified Dietz article, our white paper on calculating rates of return, and a downloadable Modified Dietz calculator:

https://canadianportfoliomanagerblog.com/how-to-calculate-your-modified-dietz-rate-of-return/

https://www.pwlcapital.com/pwl/media/pwl-media/PDF-files/White-Papers/2015-07-10_PWL_Bender-Bortolotti_Understanding-your-portfolio-s-rate-of-return_Hyperlinked.pdf?ext=.pdf

http://www.canadianportfoliomanagerblog.com/calculators/