In 1997, George Lucas decided to “improve” the original Star Wars trilogy. He added new CGI creatures, tweaked the lighting, cleaned up the visuals — and, of course, changed who shot first.

Technically, these were upgrades. But to many fans, it felt like Lucas had tinkered with something that was already perfect. And honestly, that’s a pretty good way to think about XTOT.

The iShares Core S&P Total U.S. Stock Market Index ETF (XTOT) is BlackRock’s newer Canadian-listed ETF that tracks the exact same index as the iShares Core S&P U.S. Total Market Index ETF (XUU) — the S&P Total Market Index.

It doesn’t change the story, the characters, or the ending. What it does change is how that exposure is delivered.

So XTOT isn’t really a sequel to XUU. It’s the Special Edition.

Same movie. A little more polish. A few smoother edges. Whether that’s an upgrade… or just a remaster… really depends on the investor.

space

space

Why Did BlackRock Launch XTOT?

One of the main reasons people choose index investing is predictability. There’s a certain comfort in knowing your ETF should move almost perfectly in line with its benchmark.

And when it doesn’t — even temporarily — it can feel unsettling, especially for more detail-oriented investors. That’s where XUU occasionally rubbed some people the wrong way.

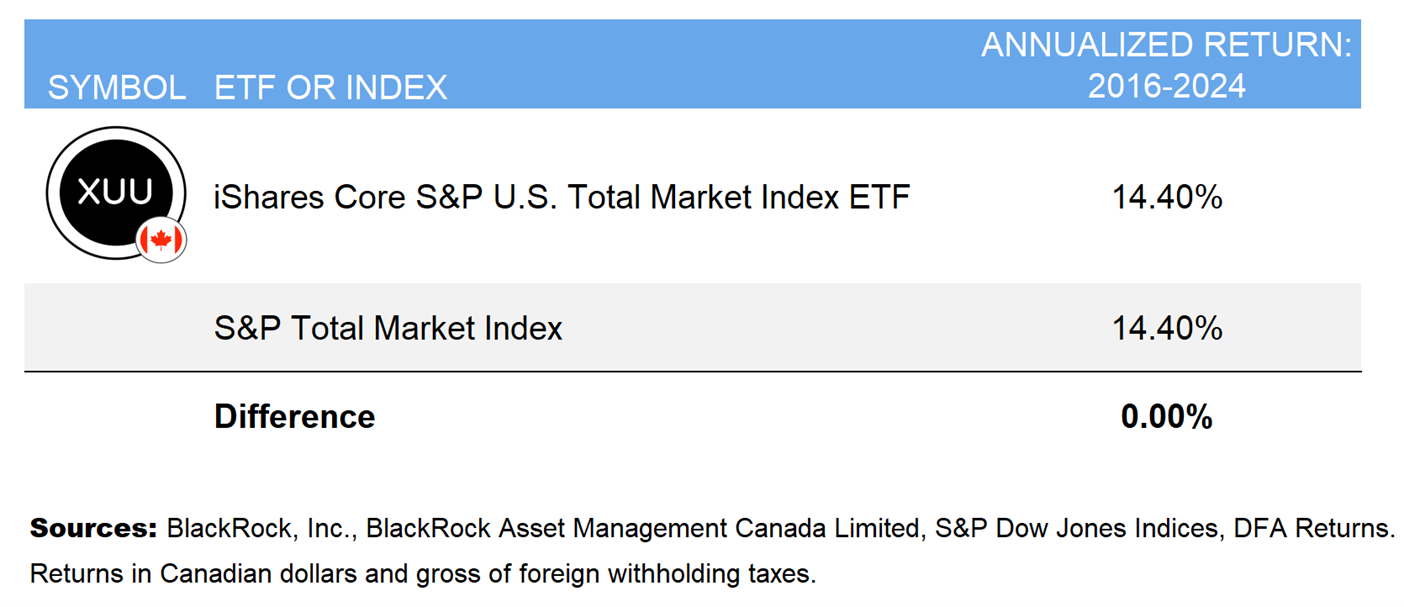

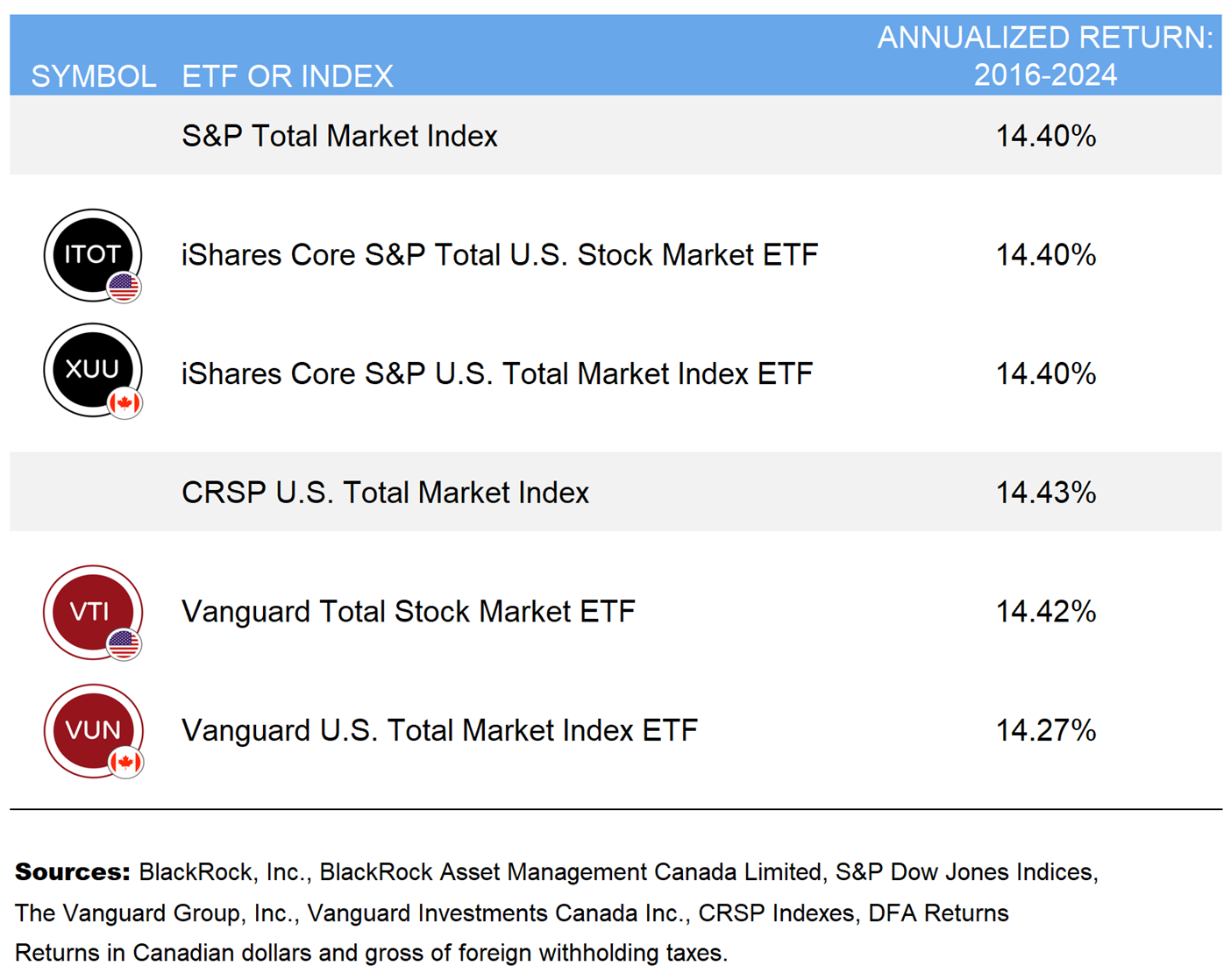

Now, to be very clear: over the long term, XUU did its job perfectly. From 2016 through 2024, it matched the S&P Total Market Index exactly after fees.

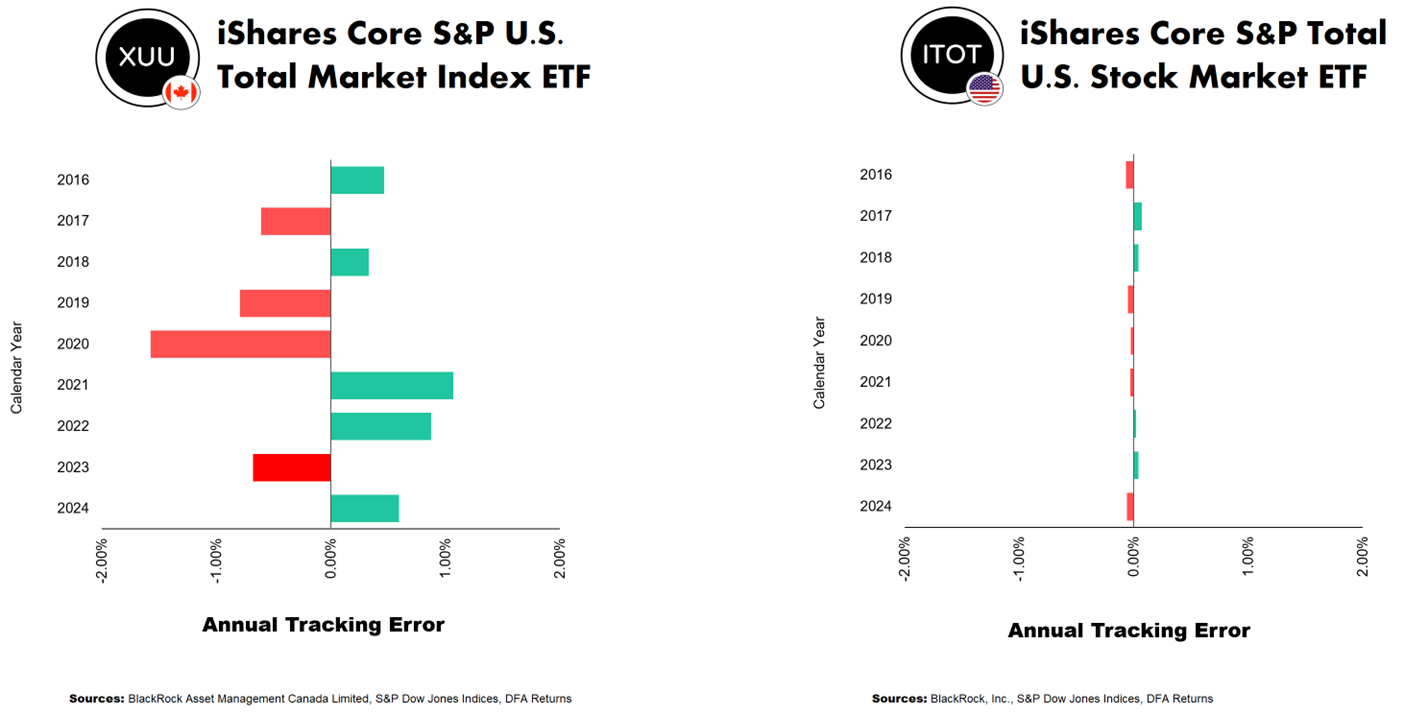

But on a year-by-year basis, its tracking could look a bit uneven compared to its U.S. counterpart, the iShares Core S&P Total U.S. Stock Market ETF (ITOT).

Some years it slightly beat the index. Other years it slightly lagged. Long-term investors didn’t really care — because those differences evened out over time. But indexing purists noticed. And the reason for that comes down to how XUU was built in the first place.

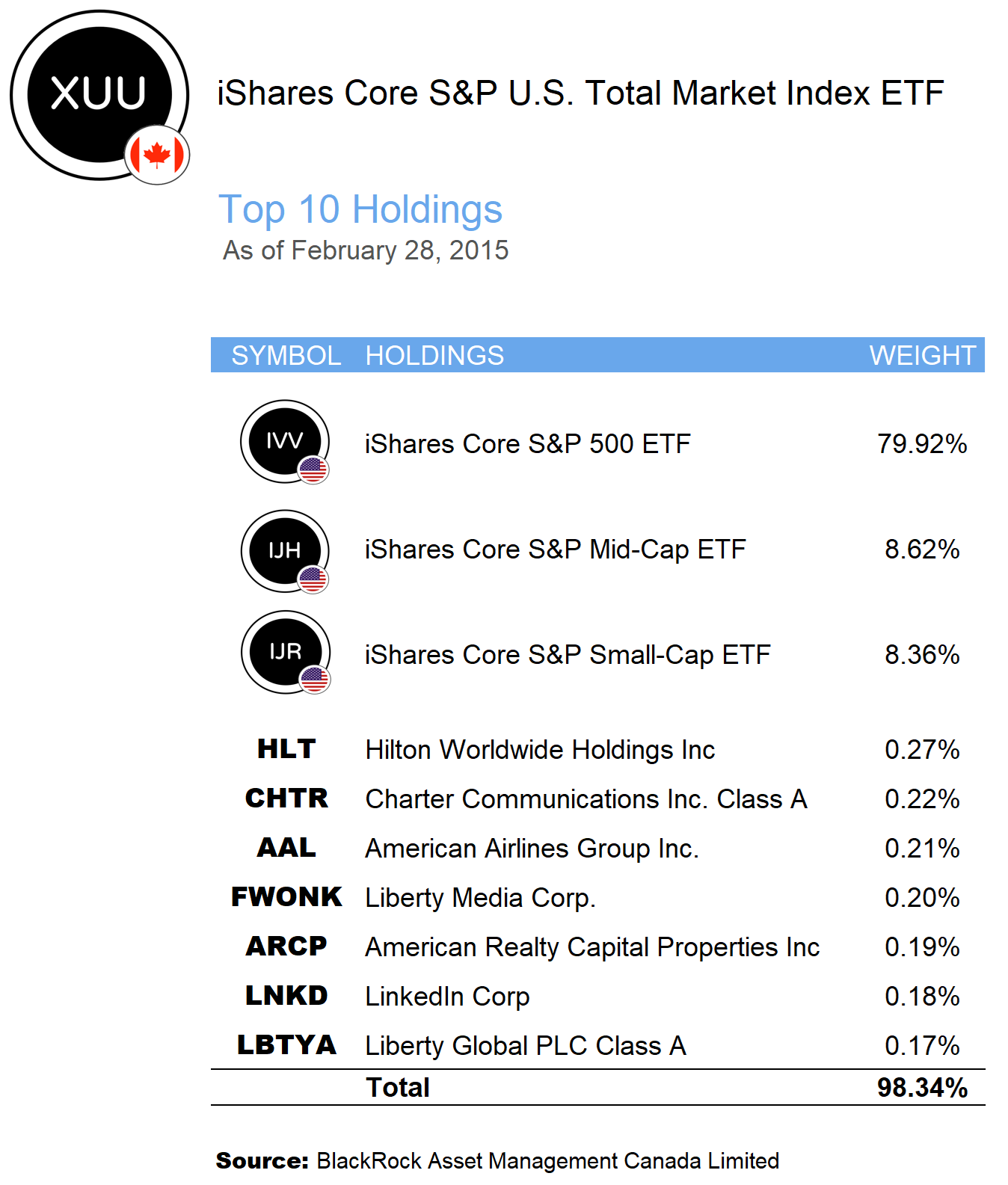

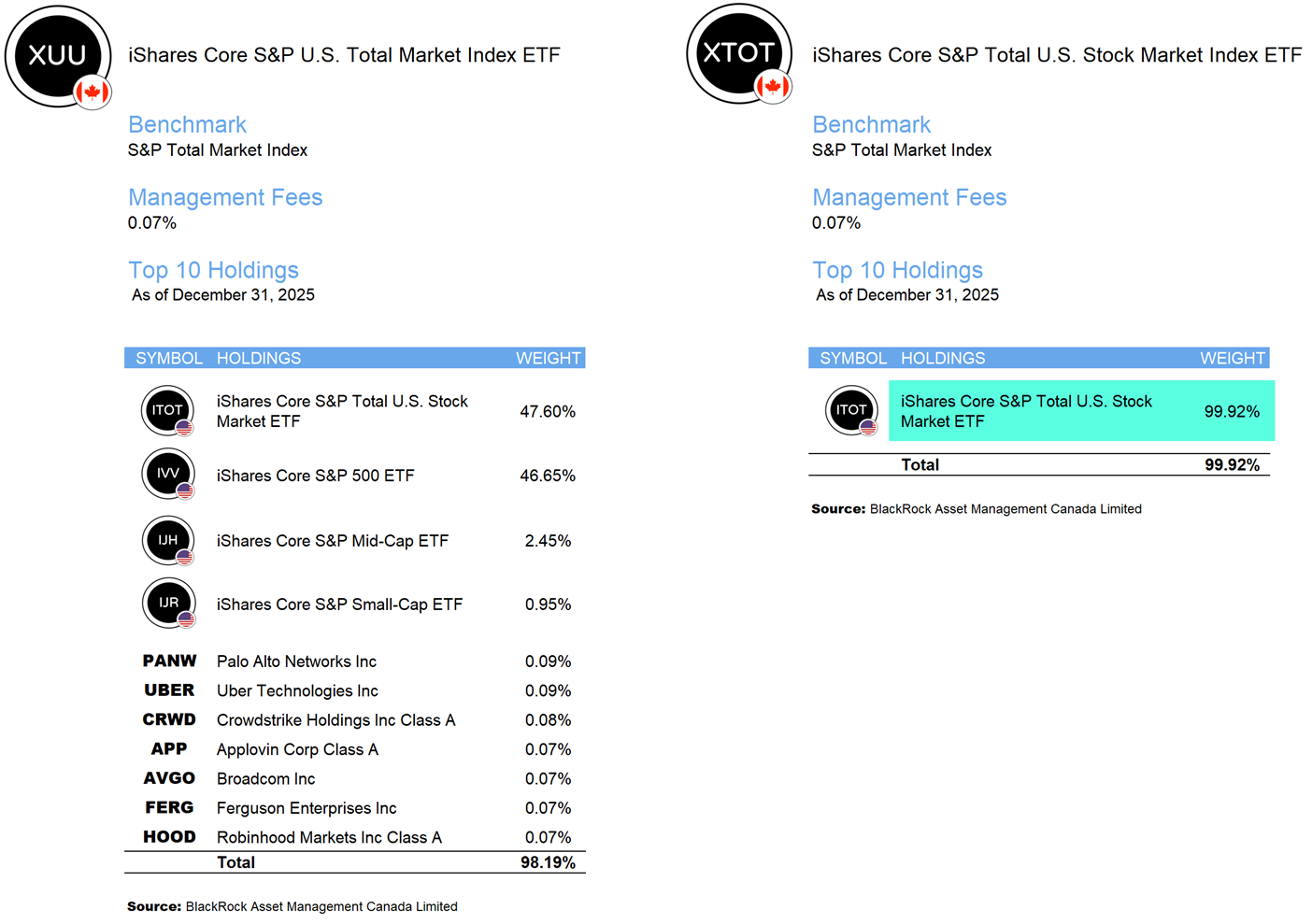

When XUU launched back in February 2015, BlackRock wanted to give Canadian investors broad exposure to the entire U.S. equity market — large-cap, mid-cap, small-cap, and even micro-cap stocks.

But instead of buying thousands of individual U.S. stocks directly, the managers took a more efficient route. They used existing U.S.-listed iShares ETFs wherever possible, leaning on BlackRock’s scale to keep costs low.

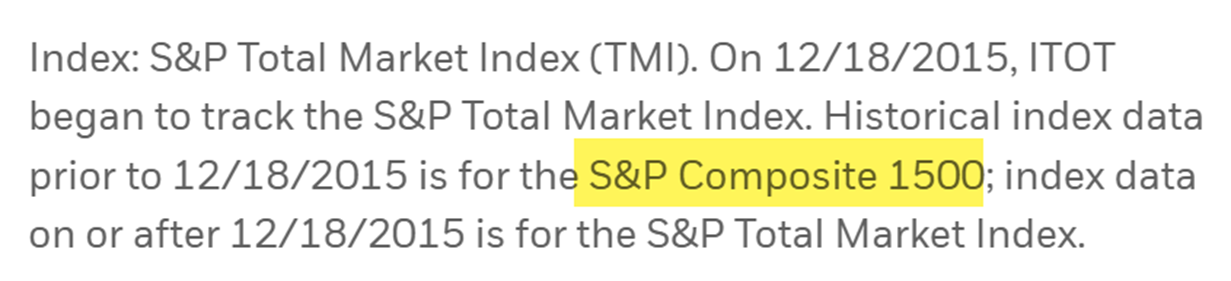

At the time, though, there was a problem. BlackRock didn’t yet offer a U.S. ETF that directly tracked the S&P Total Market Index. ITOT was still tied to the S&P Composite 1500 Index. So XUU’s managers had to get creative.

Source: BlackRock, Inc.

They built a proxy for the total market by combining the iShares Core S&P 500 ETF (IVV) for large-caps, the iShares Core S&P Mid-Cap ETF (IJH) for mid-caps, the iShares Core S&P Small-Cap ETF (IJR) for small-caps — and then filled in the remaining gaps with a basket of individual U.S. stocks generated using BlackRock’s Aladdin modeling system.

It was clever. It worked. And it delivered exactly what it promised.

But by the end of 2015, things changed. ITOT switched to tracking the S&P Total Market Index directly — offering a much simpler way for XUU to get the same exposure. Even so, XUU’s structure stayed the same. What started as a smart workaround eventually became a permanent design — effective, but more complex than it needed to be.

How XUU Actually Performed (and How It Compared)

From 2016 through 2024, the S&P Total Market Index delivered an annualized return of 14.40% in Canadian dollars. Both ITOT and XUU matched that return exactly — even after fees. So performance was never the issue.

I also find it helpful to look at their competitors’ performance. The Vanguard Total Stock Market ETF (VTI), which tracks the CRSP U.S. Total Market Index, delivered a nearly identical 14.42% annualized return in CAD. And its Canadian wrapper, the Vanguard U.S. Total Market Index ETF (VUN) — which simply holds VTI — lagged its index slightly more, largely due to its higher 0.17% MER.

All of this reinforced an important takeaway: There was nothing wrong with XUU’s results. But when you compared XUU’s multi-ETF-plus-stocks structure to VUN’s clean “one underlying ETF” design, XUU started to look… busy.

So XUU wasn’t broken. It just wasn’t simple. And in the world of passive investing, simplicity sells.

That’s where XTOT enters the story.

Episode XTOT: A New ETF Hope

XTOT isn’t a new strategy. It doesn’t change the exposure, the index, or the fee. What it does change is the plumbing.

Instead of stitching together multiple ETFs and individual stocks, XTOT simply holds ITOT directly.

Same exposure as XUU.

Same management fees.

Cleaner design.

For investors who were bothered by XUU’s occasional short-term tracking noise, this structure offers something valuable — peace of mind. And for many investors, that’s all they ever wanted.

How XTOT Fits Into a Portfolio

So where does that leave investors today?

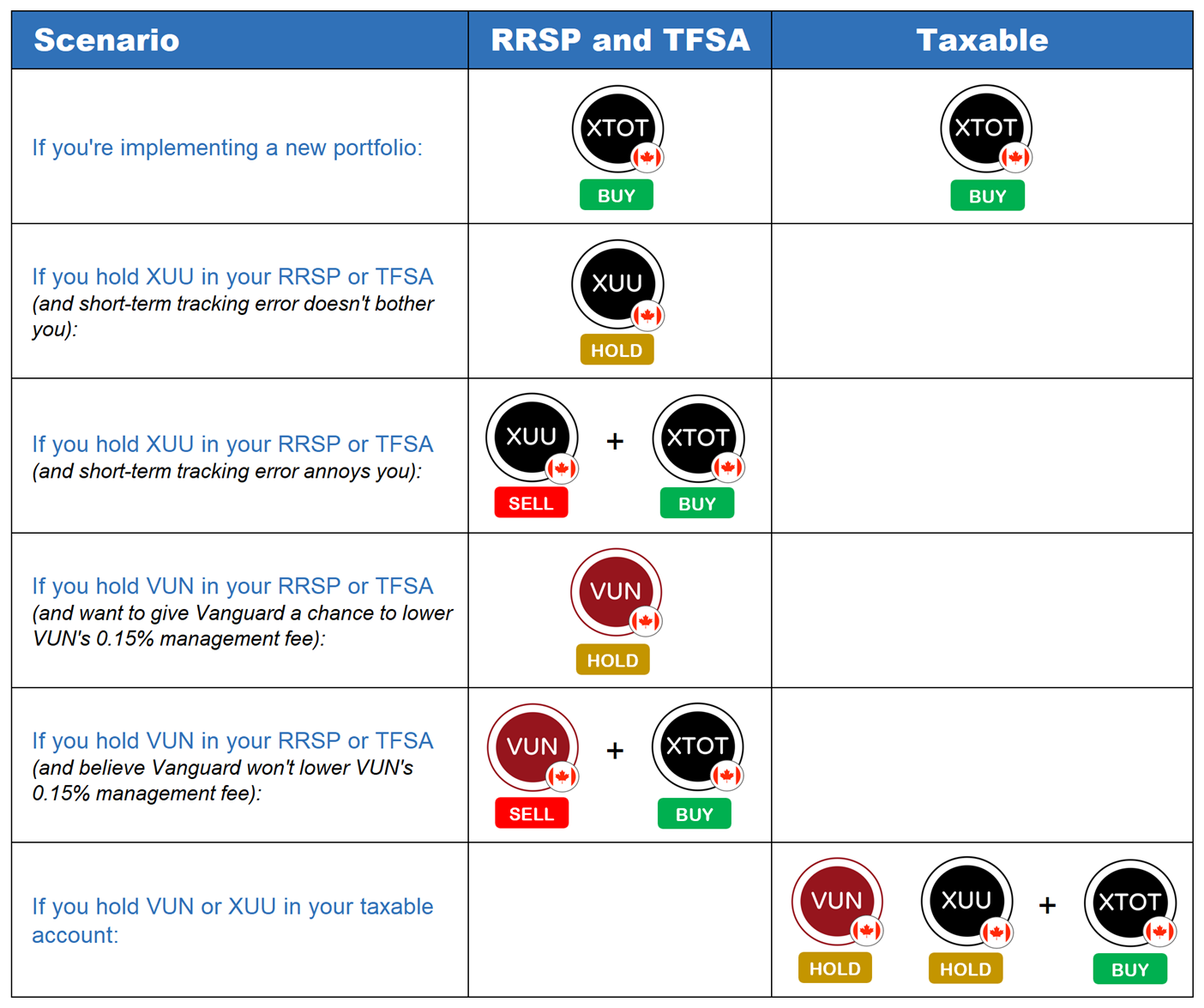

If you’re starting from scratch and looking for a Canadian-listed U.S. equity ETF, XTOT is the obvious choice. It’s simple, clean, and cost-effective right out of the gate.

If you already own XUU in an RRSP or TFSA, there’s no urgency to switch. Over the long term, the two funds are functionally equivalent. But if the short-term tracking differences have always annoyed you, moving to XTOT is a reasonable cleanup.

If you hold VUN in a registered account, it may be worth waiting to see whether Vanguard responds by cutting VUN’s 0.17% MER. If not, switching to XTOT would reduce your ongoing costs.

And in taxable accounts, the math changes. If selling XUU or VUN would trigger a large capital gain, it’s probably not worth it. In those cases, the better move is simply to use XTOT for new purchases going forward.

Final Thoughts

XTOT isn’t a revolution. It’s refinement. BlackRock didn’t reinvent U.S. equity exposure for Canadians — they just cleaned up the packaging.

For long-term investors, that might seem trivial. XUU already did its job beautifully. But in passive investing, perception matters. The smoother an ETF’s tracking appears, the easier it is for investors to stay invested — and that behavioral edge can be just as important as a few basis points.

XTOT is the Special Edition of a classic. Familiar. Polished. Precise. Whether it’s truly better — or just prettier — is up to each investor. But for those who value simplicity and consistency, this may finally be the version they’ve been waiting for.

What about XTOH? Is there some loss over XTOT because of the hedging to Canadian dollars? Do you prefer the unhedged version?

@Phil – XTOH is a great option if you prefer to hedge away your U.S. currency exposure (I generally leave my USD exposure intact for my personal portfolio and my clients’ portfolios).

Does XTOT and XUU have the same withholding tax?

@François Chalifour – XTOT and XUU would have the same withholding tax rate on their U.S. dividends.

Is there withholding tax difference between XUU and XTOt?

Many thanks Justin.

I love the clean Scenario table!

Might it be worthwhile, if one held XUU, to wait until there was a positive tracking error (like the ~+1% in 2021) before exchanging it for XTOT in the second Scenario? Or VUN’s +0.21% tracking error as of December 31, 2025 in the fourth Scenario?

@H. A. van den Berg – Glad you loved the Scenario table :)

I probably wouldn’t overthink the timing. VUN also had negative (not positive) tracking error relative to its benchmark in 2025 (since 2016, VUN has always had negative tracking error to its benchmark, mostly due to its 0.17% MER).

excellent content Justin, thank you. affirms xtot on a going-forward basis.

@nik – You’re very welcome! :)

Great video as always. I have a question that is perhaps a bit off topic, but it has been on my mind lately. I have always believed in the power of passive investing. However, I see that offerings of active ETFs have risen dramatically. The story is that investors are demanding them. Yet, I wonder if this is not simply a demand that has been created by the industry. I see no evidence that active management can consistently produce alpha. Is there a danger that the major providers like BlackRock, Vanguard and BMO will one day lessen their commitment to passive indexing?

@David – Thanks for watching! ETF providers will continue to release ETFs that make them money (whether it’s a passive or active ETF), so I wouldn’t worry about that. None of these companies offer low-cost passively managed ETFs out of the kindness of their hearts – there is always an expectation of profit. As long as they’re still making money, they’ll still be committed to passive investing :)