In today’s video, we’re taking a deep dive into the 2025 calendar-year performance of two of Canada’s most popular all-equity ETFs: the iShares Core Equity ETF Portfolio (XEQT), and the Vanguard All-Equity ETF Portfolio (VEQT). These funds have become go-to solutions for Canadians who want simple, globally diversified stock portfolios in a single ETF.

space

space

They’re also massive. VEQT manages roughly $10 billion, while XEQT is closer to $12 billion. And as if that weren’t enough to attract investors, both funds actually became cheaper in 2025. Vanguard reduced VEQT’s management fee from 0.22% down to 0.17% in mid-November. Then, about a month later, BlackRock followed suit and lowered XEQT’s fee from 0.18% to the same 0.17%. With identical fees and broad diversification, it’s easy to see why these ETFs continue to dominate.

Before we look at how they performed, let’s quickly talk about the market environment, because 2025 did not unfold the way many investors expected.

Early in the year, the Trump administration announced tariffs on imports from Canada and Mexico. Many investors assumed this would be bad news for North American stock markets. But that isn’t what happened.

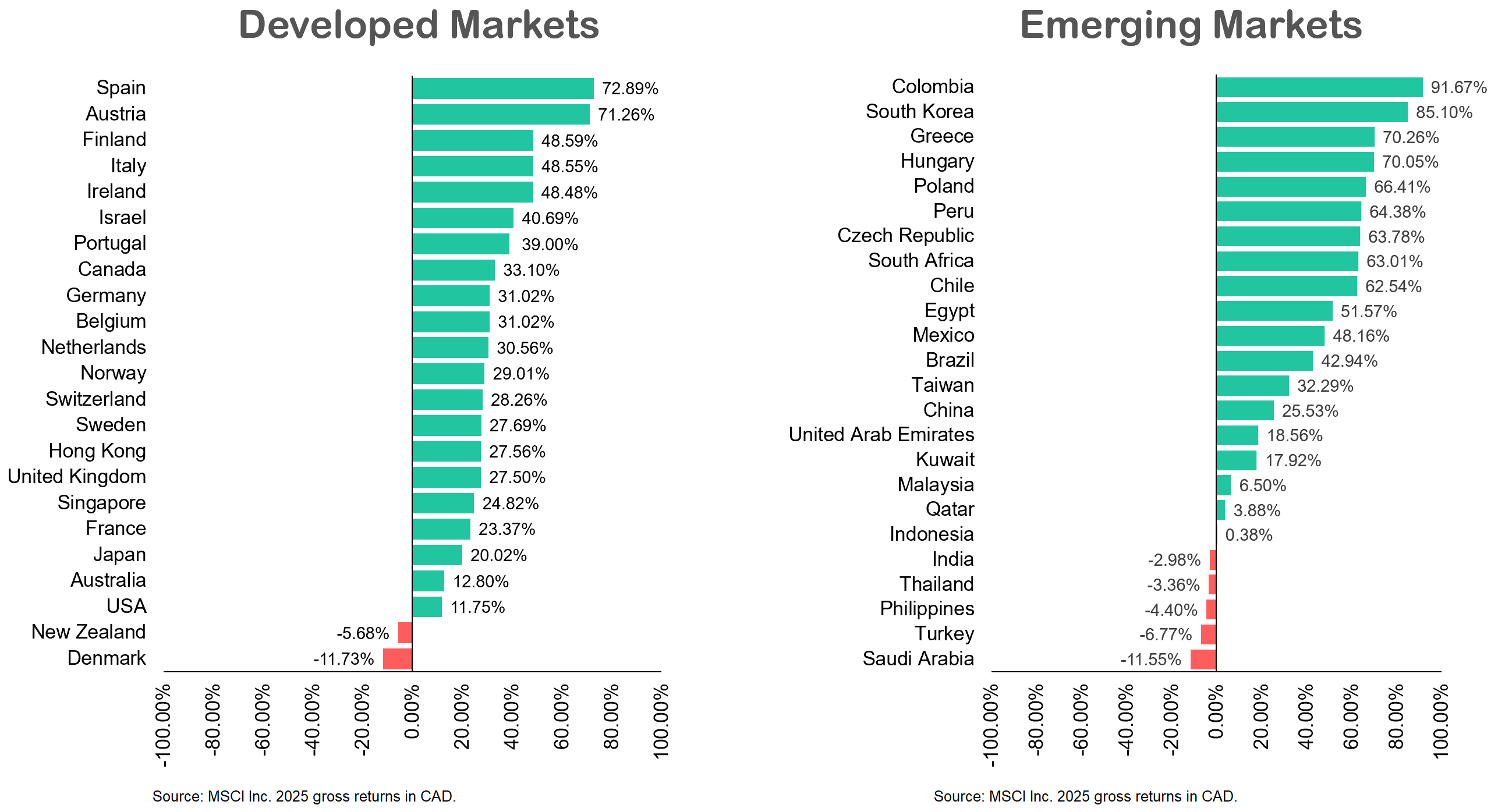

In Canadian-dollar terms, U.S. stocks delivered a perfectly respectable return of roughly 12%. However, Canadian stocks almost tripled that return, coming in around 33%. Mexico did even better, returning roughly 48% in Canadian-dollar terms. And it wasn’t just North America. Many other developed and emerging stock markets outside the United States also outperformed.

2025 Country Returns (gross div.) (in CAD)

The big takeaway from this is that headlines often feel meaningful, but markets don’t always react in the way our intuition expects. What felt like a clear negative catalyst simply didn’t derail the global rally.

Now let’s move on to what these two ETFs actually hold, because understanding the building blocks makes their performance much easier to explain.

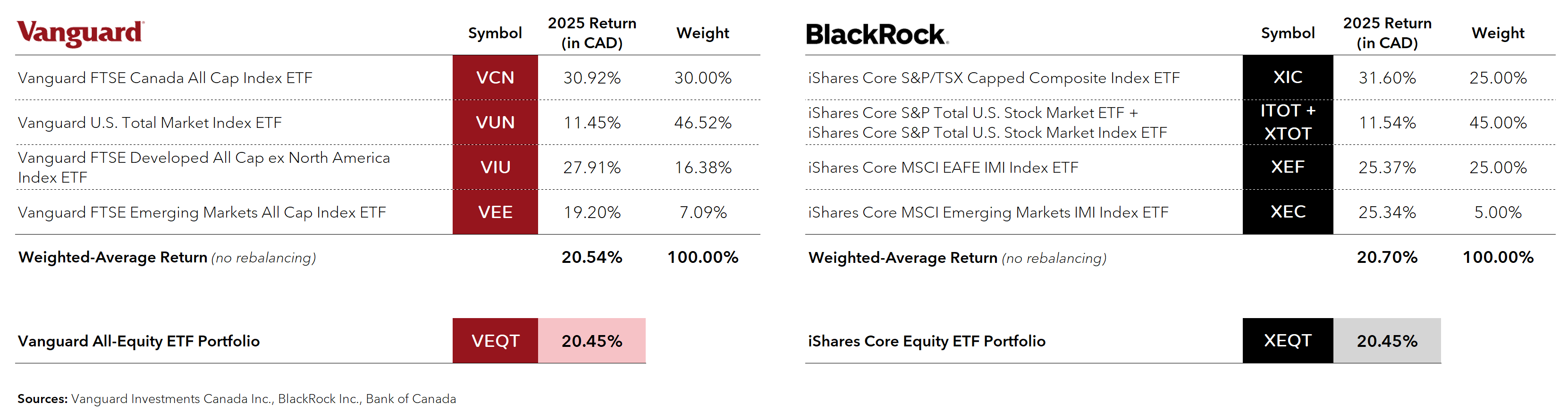

VEQT is built using four underlying Vanguard ETFs. It holds Canadian stocks through VCN, U.S. stocks through VUN, developed markets outside North America through VIU, and emerging markets through VEE. The weights you see in the chart below are target weights, and they naturally drift over time as markets move.

XEQT uses a slightly different lineup. For Canadian stocks, it holds XIC. For U.S. stocks, it holds ITOT, and—more recently—XTOT, which is a newer ETF that launched in May of 2025. XTOT simply holds ITOT inside it, so from an exposure standpoint, they’re effectively the same. XEQT also holds XEF for developed markets outside North America, and XEC for emerging markets. Because XTOT didn’t exist for the full calendar year, I’m using ITOT’s return as a reasonable stand-in for the combined U.S. exposure. I’ll actually have a separate video dedicated to XTOT and how it fits into the lineup, so keep an eye out for that.

When we take the 2025 returns of all these underlying ETFs and weight them according to their target allocations, we get results that line up very closely with the final returns of the all-equity portfolios themselves. For VEQT, the weighted average return of the underlying holdings was just over 20.5%. For XEQT, it was around 20.7%. Those numbers don’t include rebalancing effects or the additional management fees, but they give us a really good sense of what we should expect.

So what did the final numbers look like?

Both VEQT and XEQT returned 20.45% in 2025. In other words, they were essentially identical. When you have similar fees, similar global allocations, and low-cost index funds underneath, you shouldn’t expect dramatic differences. And in 2025, that’s exactly what we saw.

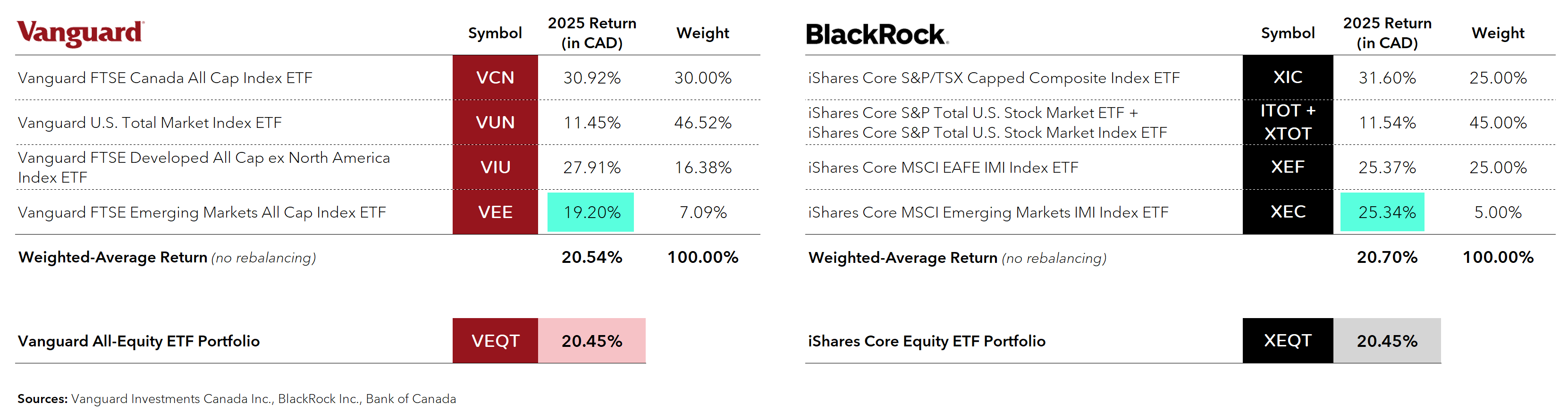

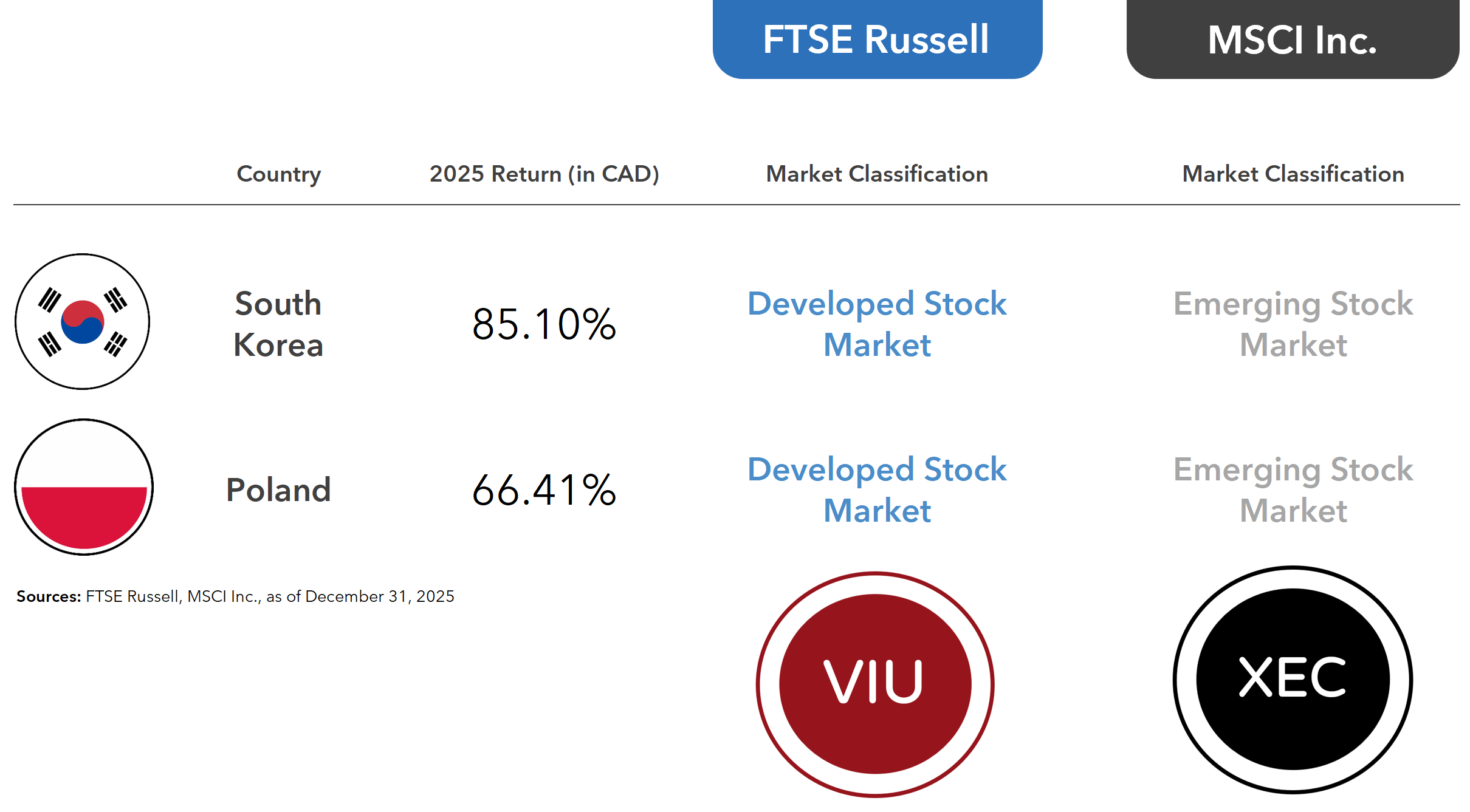

There was, however, one interesting performance difference inside the portfolios, and it came from the emerging-markets component.

XEQT’s emerging markets ETF, XEC, significantly outperformed VEQT’s emerging markets ETF, VEE. That wasn’t because one provider was more skillful than the other. It came down entirely to how their index providers classify countries.

XEC tracks an index created by MSCI, and MSCI still considers South Korea and Poland to be emerging markets. VEE tracks an index created by FTSE Russell, and FTSE classifies those same countries as developed markets. That means FTSE removes them from emerging markets and places them in the developed-ex-North-America index instead.

In 2025, South Korea and Poland had extraordinary returns—around 85% and 66% in Canadian-dollar terms. Because MSCI included those countries in emerging markets, XEC benefited more than VEE. And because FTSE placed them in developed markets, VIU ended up looking different than XEF. This is a great reminder that even plain-vanilla index funds can behave differently simply because of how their indexes are defined.

So what’s the big lesson from 2025?

If you were invested in an all-equity ETF, the key to success was simply staying invested. There was no need to make tactical bets, chase whatever market segment looked strongest, or try to outguess the future. In fact, many investors who tried to tilt toward the S&P 500 because it had dominated for years would have actually lagged a globally diversified investor in 2025. If you had asked most Canadians early in the year whether Canada and Mexico would dramatically outperform the U.S., very few would have said yes.

If you found yourself second-guessing your portfolio last year, consider 2025 a valuable learning opportunity. A disciplined, diversified strategy did exactly what it was supposed to do.

That’s going to wrap up this review of XEQT and VEQT in 2025. If you enjoyed the breakdown, feel free to like the video, subscribe to the channel, and share it with someone who’s building a long-term portfolio. And stay tuned for that upcoming video on XTOT, where I’ll go deeper into how it works and whether it changes anything for investors.

Thanks for watching, and I’ll see you in the next one!

What are your target allocations for an all equity portfolio using XIC/XTOT/XEF/XEC ?

Instead of bonds/GICs are HISA equally good. For example the etf CASH?

@Darby – HISA ETFs are a cash investment, which is a different asset class than fixed income (so they are not comparable).

If you require liquidity, cash is king. If you don’t require as much liquidity, but don’t want to take equity risk, bonds may be appropriate (and if don’t require any liquidity until the maturity date, GICs may be appropriate).

Thank you Justin! I split my portfolios 50/50 XEQT and VEQT just to diversify fund management risk.

@H. A. van den Berg – Thanks for sharing – that works too!

Thanks Justin – I was going to request an XTOT review but you read my mind – looking forward to it :)

@Steve – Excellent! It should be released in the next week or so :)

I ALWAYS enjoy watching your videos…. I feel more informed and bright after 😀

Question : What do you think about the use of one of these funds into non-registered accounts?

Thanks !

@Francis Lagacé – That’s so amazing – thanks for sharing! :)

These all-equity ETFs are great options for non-registered accounts as well. I personally like to split up the Canadian equity (XIC), U.S. equity (XTOT/ITOT), international equity (XEF), and emerging markets equity (XEC) ETFs to maximize the tax-efficiency of the overall portfolio (i.e., holding certain assets classes in certain account types to increase the tax-efficiency of the portfolio, otherwise known as asset ‘location’), but this is probably overkill for the majority of DIY investors (where an asset allocation ETF is arguably a better choice).

Justin – I notice you have removed the Light/Ridiculous etc portfolios. Is there somewhere you show people who want to break it up to maximize tax efficiency ?

@Joel – For the equity allocation of my personal portfolio (and the majority of my clients’ portfolios), I typically target 1/3 Canadian equities and 2/3 foreign equities (the allocations for U.S., international, and emerging markets equity are market cap-weighted). However, I don’t think I’d argue with a Canadian investor who chose anywhere between around 15% Canada / 85% Foreign all the way up to 40% Canada / 60% Foreign. Here’s a link to the model portfolios from our team website:

https://benderbenderbortolotti.com/model-portfolios-december-31-2025/

For Canadian equity ETFs, we typically use XIC, VCN, or ZCN. For U.S. equities, we’ve been using XTOT these days (along with ITOT for RRSPs). For international equities, XEF or IEFA (depending on the account type and size of the registered accounts). And for emerging markets equities, XEC or IEMG (depending on the account type and size of the registered accounts). For bonds, XBB, ZAG, and VAB (for taxable accounts, ZDB). We also have a healthy dose of GICs typically thrown into the mix (to reduce the volatility of the overall portfolio, and to be available for cash flow in the event both stocks and bonds are down in value in the same year).

You can check out the YouTube channel for several ‘Asset Location’ videos, which discuss our strategy (we typically use the ‘Ludicrous’ asset location strategy with our clients).

Justin, there is so much talk of equity ETFs these days and few investors care about bonds. Seemingly even from the experts. Have your opinion about bonds changed, perhaps due to tthe 2022 bear market? I mean, you aren’t writing about vbal here…

@James F – Great question – to tell you the truth, the original video concept started out as a recap of all the main asset class returns (equities, bonds, GICs, cash), but I got a bit lazy and just went for the low hanging fruit of an ‘all-equity’ video. It shortened the video length considerably, as well as the time it took to release it (since it was based on past 2025 performance, I didn’t want the content to get too stale by the time it was released).

I know many investors (and advisors) are obsessed with equities, and that makes sense (as they are the best way to build long-term wealth in your portfolio). But most investors still need a dose of bonds/GICs to keep them invested when equity markets tank (or if they’re retired, to provide them with stable cash flow during prolonged stock market downturns).

But my opinion about bonds/GICs hasn’t changed – I personally hold them in my portfolio, and less than 5% of my clients have an all-equity portfolio (most of their portfolios include some bonds/GICs – the specific allocation depends on their personal ability, willingness, and need to take risk, as well as their goals for the funds).

Justin, Thanks for all you blogs and videos! As always, I appreciate you digging into the ETF structures for us DIY investors. I look forward to your XTOT analysis.

@J Prospect – You’re so very welcome! I’m happy to dig into the details (I really enjoy it), and even happier that other investors enjoy learning about it too :)

Great content as always! will the upcoming content on XTOT compare it to XUU by chance? how doess it look in various account types like TFSA or RRSP vs XUU and ITOT?

@Mark H – Thanks! Yeah, XUU steals most of the camera time in the next video (ITOT gets some love too…VUN gets less love ;)

Fantastic, can’t wait to see that one!