When it comes to leading passive investment products in Canada, two names quickly come to mind: Dimensional Fund Advisors (DFA) and Vanguard. Over the past couple of decades, I’ve had the opportunity to build portfolios using funds from both providers, gaining firsthand experience with their unique approaches. After spending countless hours analyzing their strategies, performance, and structures, one thing is clear: there’s no one-size-fits-all solution.

While both DFA and Vanguard are known for their low-cost, passive approach to investing, their philosophies and product structures differ in meaningful ways. Depending on your investment style, goals, and preferences, one may be a better fit than the other.

In this blog/video, we’ll explore the key differences you should consider when deciding which provider might be right for your portfolio. We’ll keep things at a high-level—that means less financial jargon, and absolutely no factor regressions.

space

space

Investment Philosophy: Dimensional Fund Advisors (DFA) vs. Vanguard

Let’s begin with how Vanguard and Dimensional differ in their investment philosophies and portfolio construction.

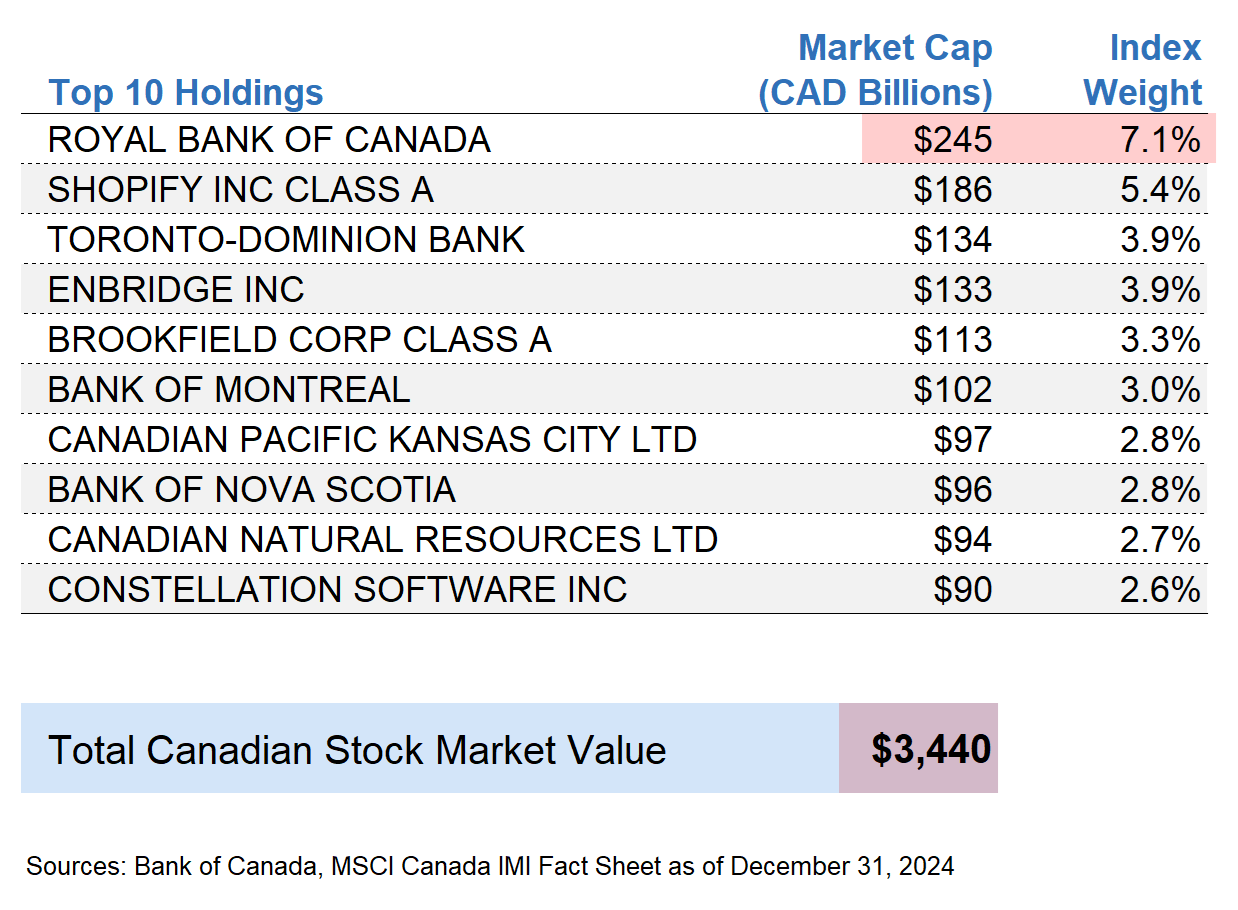

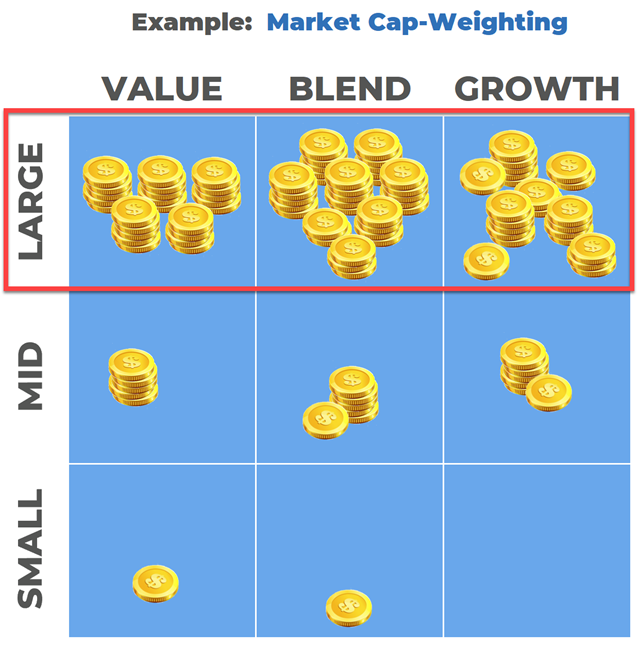

Vanguard follows a traditional market capitalization-weighted indexing approach. In this strategy, each company’s weight in the index is proportional to its market value. For example, if RBC’s market cap is approximately $245 billion and the total Canadian stock market’s value is $3.44 trillion, RBC would represent roughly 7.1% of the index.

This approach naturally biases portfolios toward larger companies. So, if you invested $100 in a broad Canadian equity ETF, the majority would go to large-cap companies like RBC, Shopify, and TD, while small- and mid-cap firms would receive comparatively less.

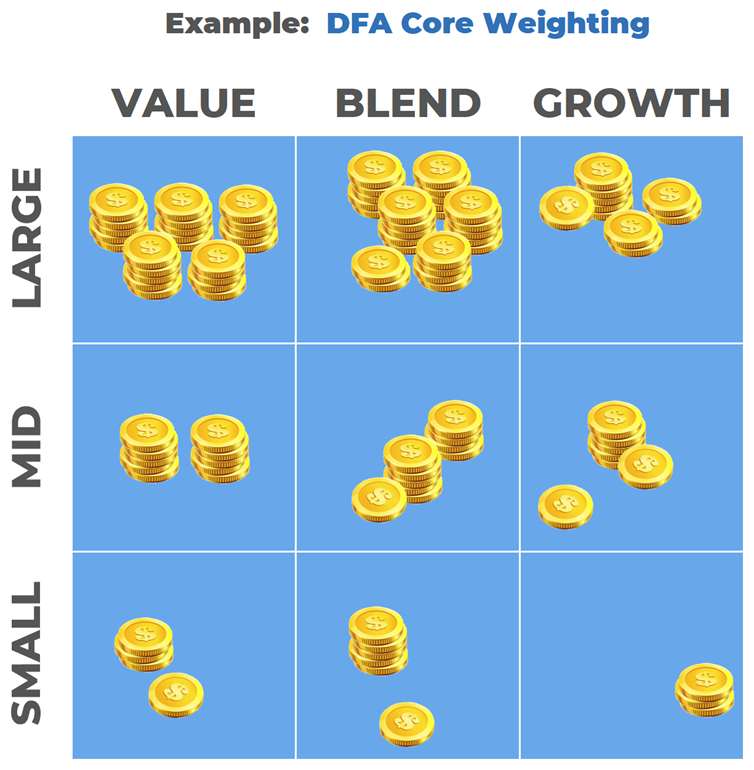

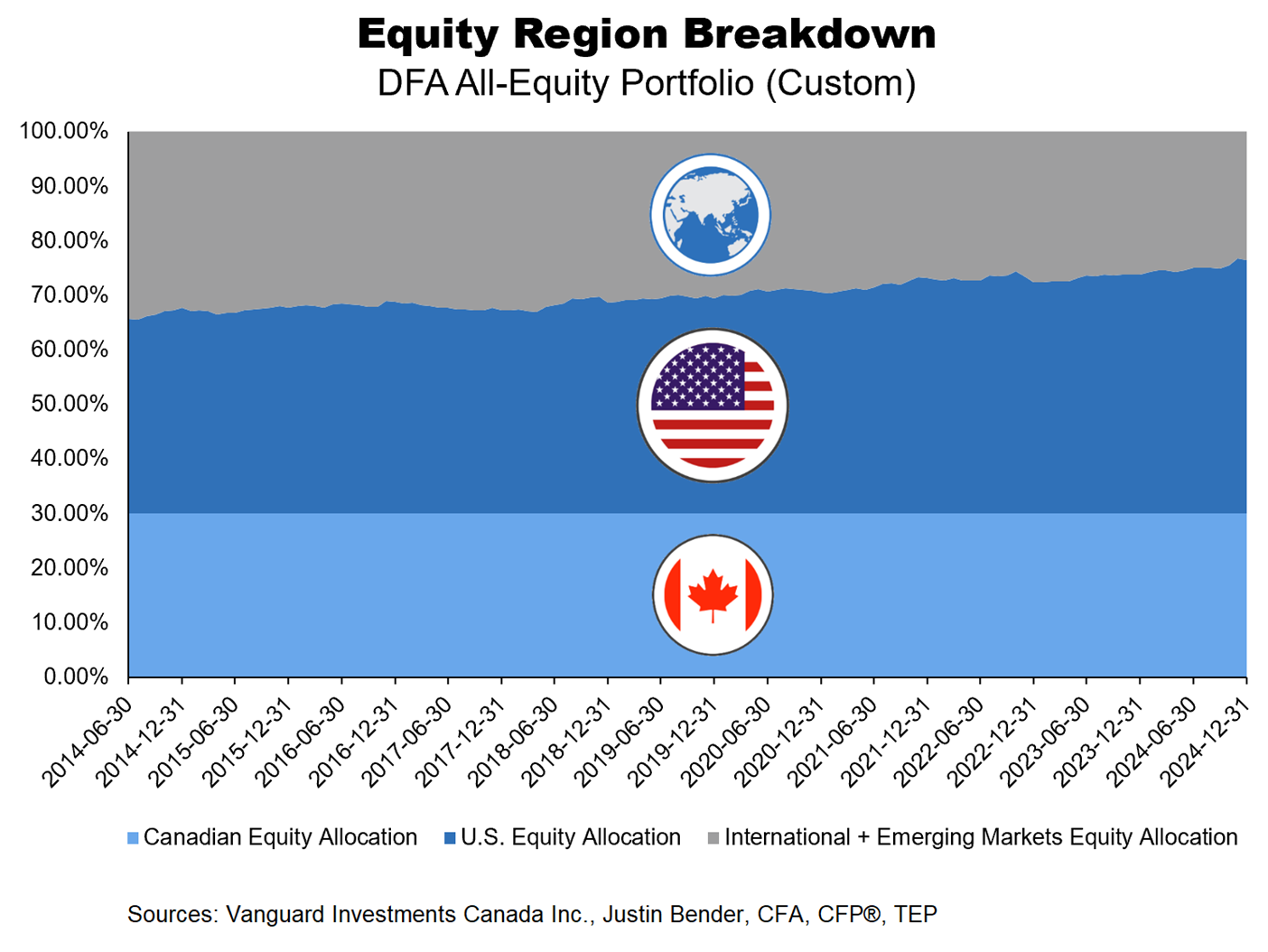

Dimensional Fund Advisors (DFA), by contrast, employs a systematic, evidence-based strategy. Instead of tracking an index, DFA constructs portfolios using decades of academic research. Their funds tilt toward factors associated with higher expected returns—particularly small-cap, value-oriented, and more profitable companies. This means DFA’s Core equity funds underweight large, growth-oriented firms and overweight smaller, lower-priced companies, compared to traditional index funds like those from Vanguard.

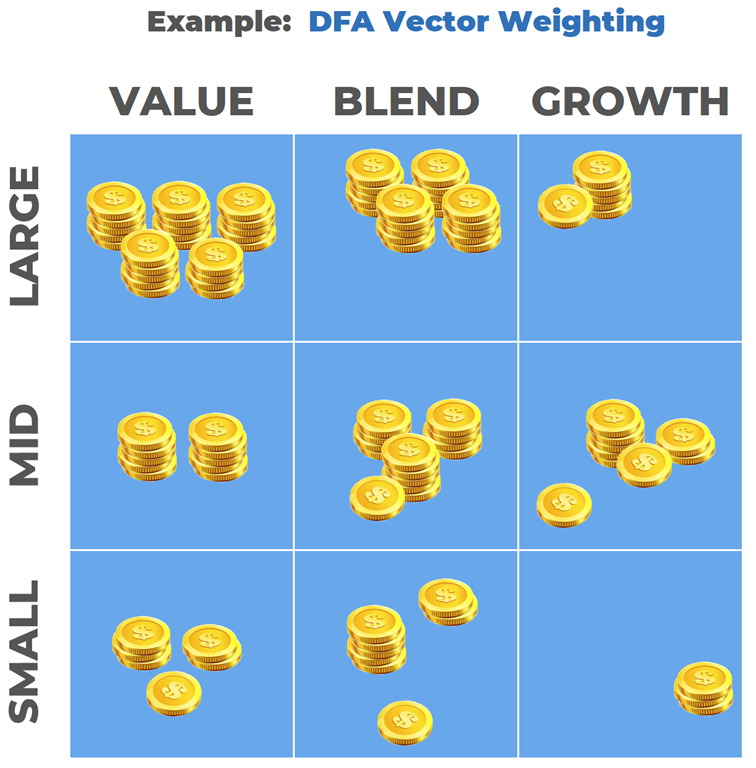

DFA’s Vector equity series amplify these tilts even further, placing greater emphasis on smaller companies and value stocks than the Core series.

Diversification: Dimensional Fund Advisors (DFA) vs. Vanguard

Beyond aiming for higher expected returns, Dimensional’s strategy also has the added benefit of reducing concentration risk. By shifting weight away from the largest companies, DFA’s portfolios are less reliant on the performance of a few dominant firms. And while DFA portfolios contain more individual holdings than Vanguard’s, the raw number of stocks doesn’t tell the full story.

In a previous video, I introduced the concept of the effective number of stocks—a measure that adjusts for concentration by estimating how many stocks meaningfully influence a portfolio’s performance. It’s calculated by summing the squared weights of each holding and taking the reciprocal of that sum. The higher the number, the more diversified the portfolio.

When we apply this to our custom all-equity portfolios, Dimensional’s effective number of stocks is nearly double that of Vanguard’s, indicating a less concentrated portfolio:

- Vanguard: Effective number of stocks ≈ 169

- Dimensional: Effective number of stocks ≈ 329

In short, if you’re concerned about the large-cap concentration typical of market-cap-weighted indexing, DFA offers a compelling alternative—one that provides both broader diversification and exposure to sources of higher expected returns.

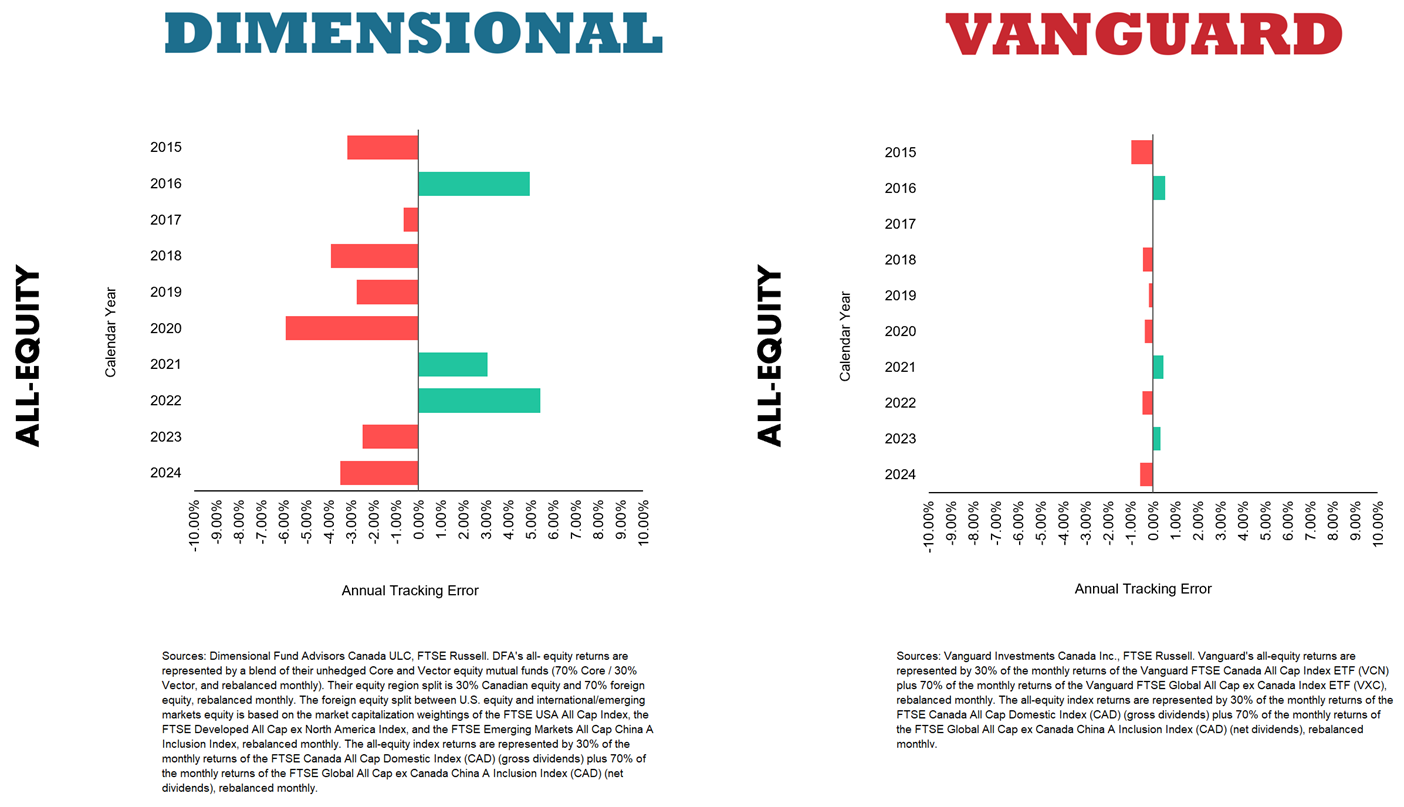

Tracking Error: Dimensional Fund Advisors (DFA) vs. Vanguard

As mentioned earlier, Vanguard aims to closely replicate the performance of a market-cap index, minus fees. The goal isn’t to outperform but to match the market’s returns as close as possible.

DFA, on the other hand, doesn’t seek to track an index. Its focus is on long-term outperformance—even if that means short-term returns may deviate, sometimes significantly, from the market. This deviation is known as tracking error.

For many investors, tracking error can be unsettling. If the Canadian stock market is up 10% in a year, a Vanguard ETF might return something close to that—say, 9.95% after fees. DFA, however, could deliver a return that’s higher or lower, depending on how its factor tilts performed. That might mean a 15% return—or just 5%.

We’ve seen this in practice. Our custom Vanguard All-Equity Portfolio has shown minimal tracking error year after year. In contrast, our custom DFA All-Equity Portfolio has experienced wider return swings—both above and below market performance.

For investors who track their portfolio frequently and benchmark it against the market, this volatility can be challenging. If that sounds like you, Vanguard’s consistency and transparency may be a better fit.

But if you’re a patient, disciplined investor who trusts in the long-term expected advantages of factor-based investing—and can stay the course even through long periods of underperformance—DFA’s approach may be worth considering. Just be prepared for short-term return deviations relative to the index (and the possibility that excess returns may never materialize).

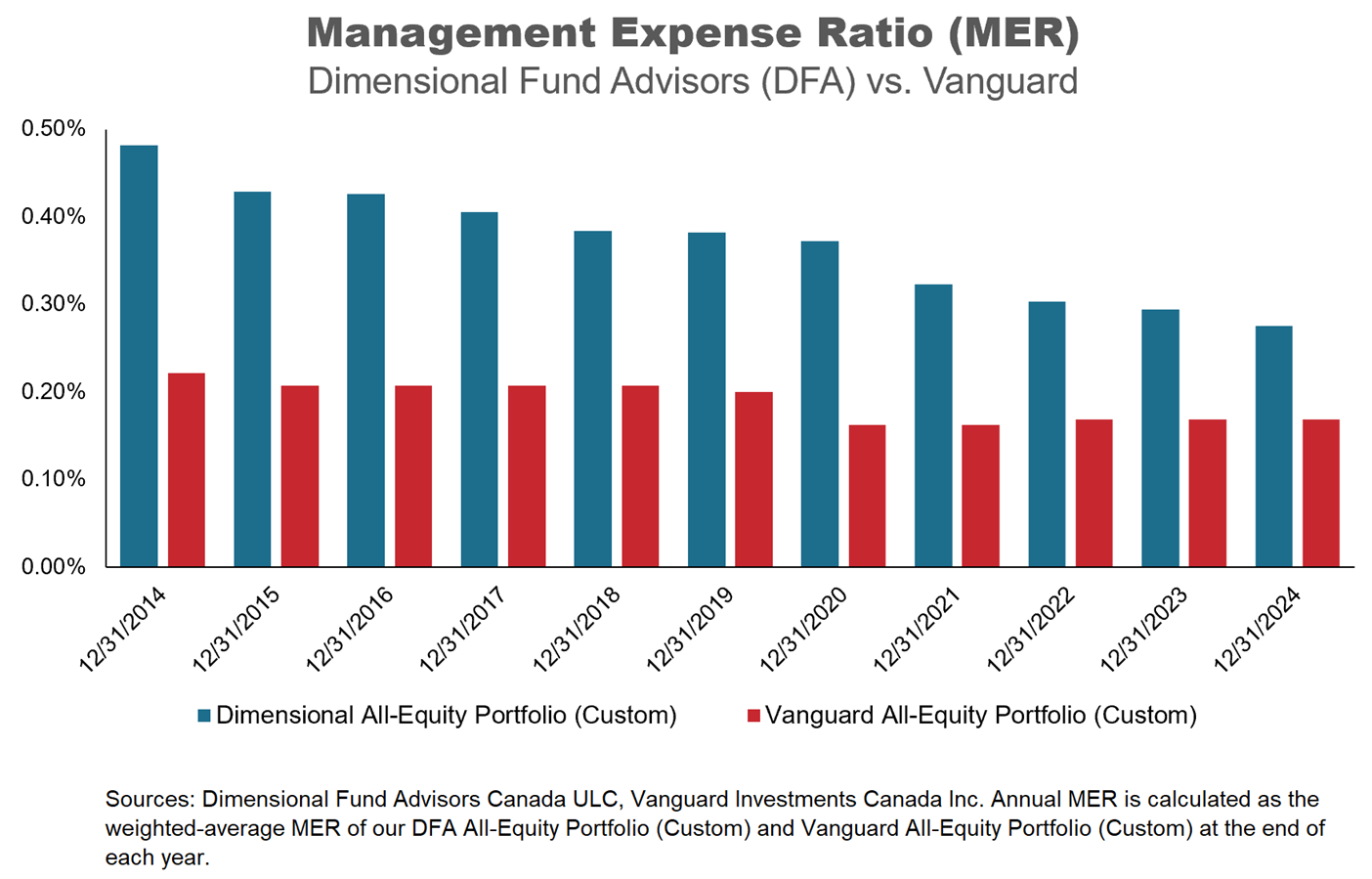

Management Expense Ratios (MERs): Dimensional Fund Advisors (DFA) vs. Vanguard

Fees are also an important consideration. Vanguard has built its reputation on low-cost products, with many of its ETFs charging well under 0.30%.

DFA, while traditionally more expensive, has significantly lowered its fees over time. At the start of our review period, DFA’s average MER was over 0.48%. Today, that’s down to 0.28%. While still higher than Vanguard’s 0.17% weighted average MER for a VCN/VXC mix, it’s in line with VEQT’s 0.24% MER.

With both providers now offering cost-efficient options, these small fee differences alone shouldn’t be a deciding factor for most investors.

Historical Performance and Risk: Dimensional Fund Advisors (DFA) vs. Vanguard

Now, we’ve intentionally left performance for last—because past returns shouldn’t drive your investment decisions.

Methodology

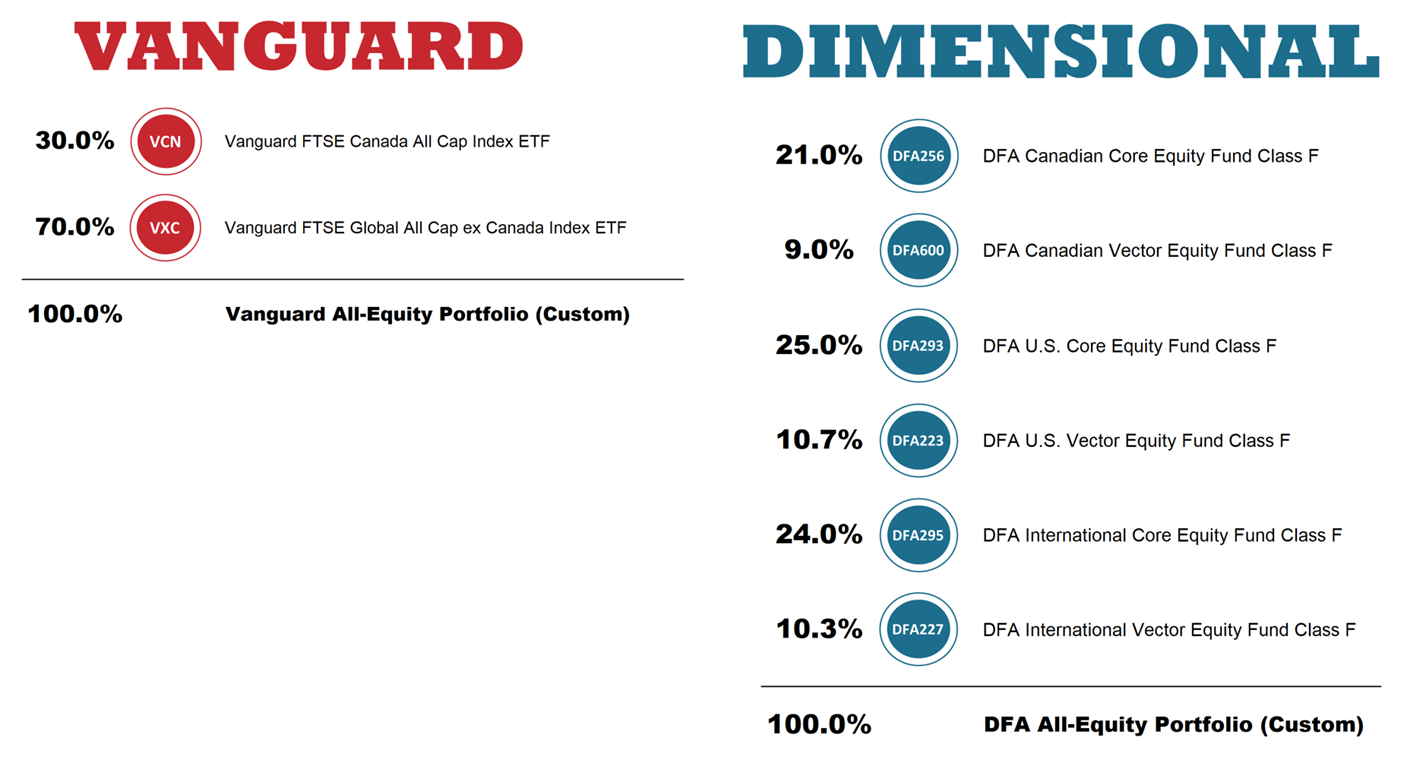

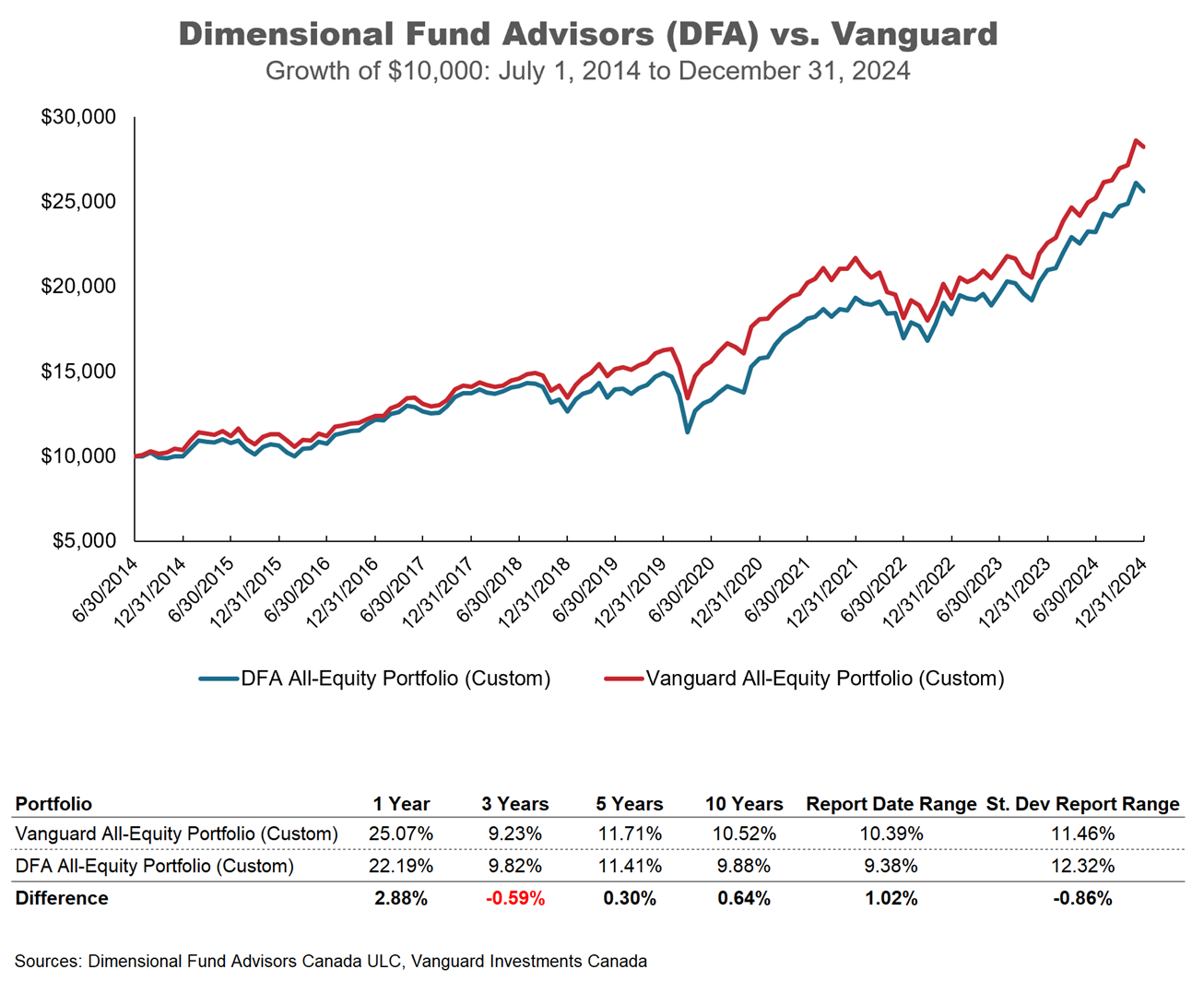

To make a fair comparison, we created two custom portfolios:

- Our Vanguard portfolio is a mix of 30% VCN + 70% VXC, rebalanced monthly (which mirrors the returns of VEQT without its shorter track record).

- Our DFA portfolio is a blend of DFA Core and Vector funds (Canadian, U.S., and international), matched to the Vanguard allocations, rebalanced monthly, and excluding currency hedged and real estate funds.

Since July 2014, Vanguard’s portfolio outperformed DFA’s by about 1% per year, with lower volatility. But again, this tells us little about what to expect going forward.

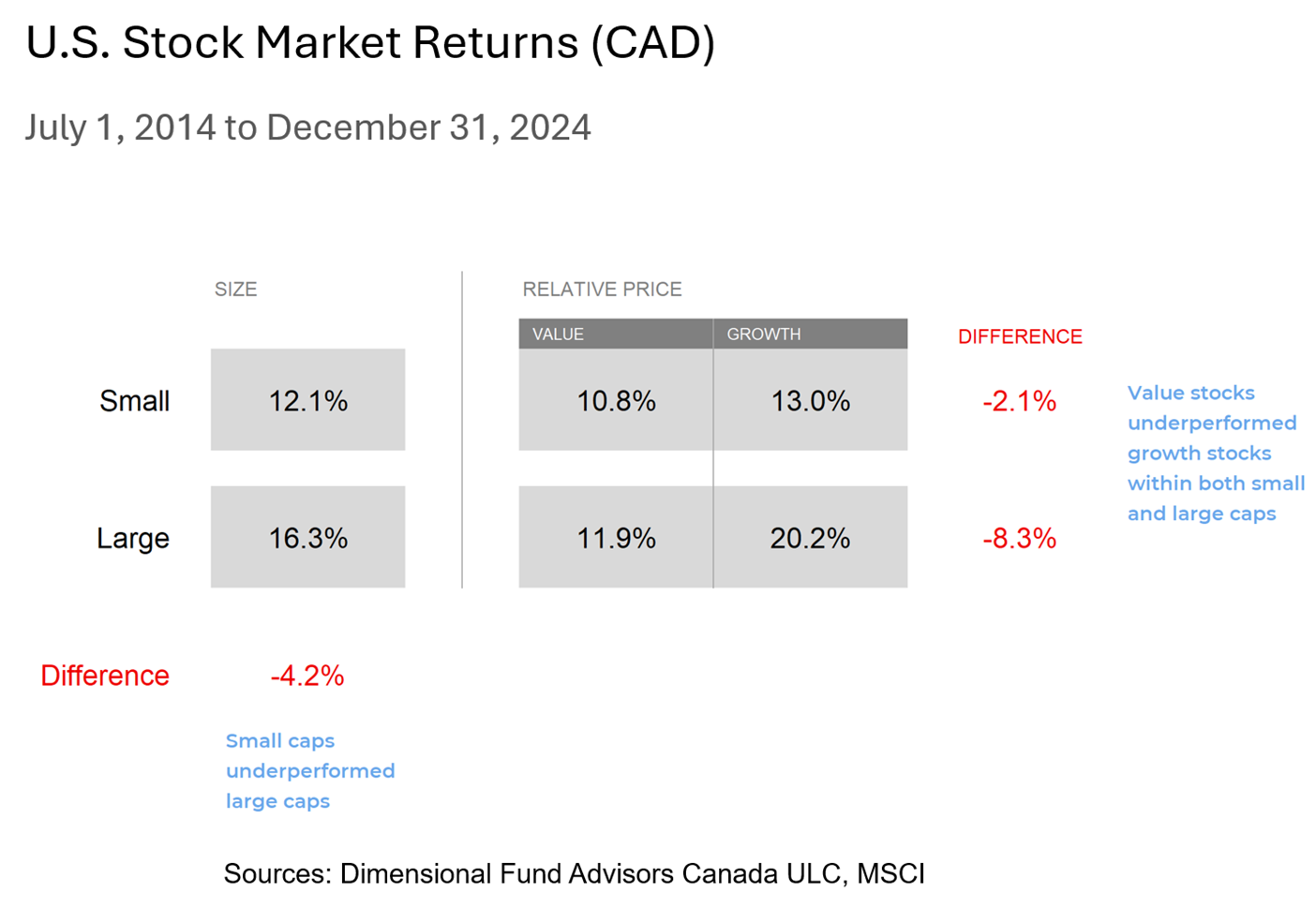

Much of the performance gap can be attributed to the negative small-cap and value premiums in the U.S. over this period, where:

- Smaller companies underperformed larger ones by 4.2% annually

- Small value trailed small growth by 2.1%, and

- Large value lagged large growth by 8.3%

These headwinds historically hurt DFA’s factor-based strategy. Going forward, those trends could reverse.

Final Thoughts: Which Is Right for You?

In my opinion, diversification and tracking error are the two most critical differences between Vanguard and DFA.

Personally, I put more weight on tracking error, because investor behaviour often derails even the best-designed strategies. If you can’t stick with a portfolio through tough times, its long-term potential doesn’t matter.

Ultimately, the best investment strategy is the one you can stick with—through good markets and bad. Both Vanguard and DFA offer low-cost, diversified, tax-efficient portfolios. Choose the one that aligns best with your personality, goals, and investment philosophy.

Every investor comes to their own conclusions. For me, the default option is market cap weighted index funds. I will consider a factor product as alternative. It has to be well designed; DFA may possibly design better factor products than anyone else. It has to be cost efficient, and DFA products aren’t at the level of Vanguard, but they’re reasonably good. Finally, it has to be tax efficient. I’m a DIY investor, so that means using US domiciled ETFs. With the exception of US domiciled ETFs that invest in US securities, that results in a loss of tax efficiency.

@Park – Thank you for providing your thoughts (you make some very good points).

In terms of tax-efficiency, some DFA mutual funds are structured more tax-efficiently than comparable Vanguard ETF products (i.e., DFA’s international/emerging markets equity funds, DFA227 + DFA295, hold the EM stocks directly, whereas Vanguard’s EM ETF, VEE, still uses an outdated wrap structure).

DFA’s global fixed income mutual fund (DFA449) also has a tax advantage over Vanguard’s global fixed income ETFs (VBU + VBG, or VGAB), as DFA’s fund managers are free to purchase bonds with lower coupons (while Vanguard needs to simply track its index).

I own American domiciled factor products that invest within the USA. Why?

I don’t expect that they will greatly increase my return. Factor products, including those of DFA, are designed for the mass market. As a consequence, the factor tilts are not highly pronounced. If you want highly pronounced factor tilts, you have to DIY. Also, I expect factor tilts to result in less return than they historically. There are risk based arguments for some of the increased historical returns. But a good part of the increased historical returns of factors come from the fact that they were unknown. That is no longer true.

The real reason I own these products is diversification. In a secular bear market that can last for more than a decade, the return from the market factor is zero. That’s where I’m hoping that factor investing will bail me out.

I have no problem with someone who wants to stick to market cap weighted index funds.

I think it unlikely that future factor returns will be negative. For example, I doubt that growth stocks or unprofitable companies will have increased future return. The worst case scenario is that future long term factor returns will be zero. In that situation, if I stick to well designed cost and tax efficient factor products, I should get comparable results to a market cap weighted index strategy.

Thanks for the analysis!

I wonder if DFA will look to offer ETFs as it looks like it’s currently only mutual funds in Canada which… seems old fashioned at this point!

@Liam – I wouldn’t be surprised to see DFA Canada launch ETFs in the near future :)

Thank you ao much for this post, Justin. Excellent analysis as always. For some years now, I have been puzzling over this question of whether indeed DFA outperforms over time and can therefore justify its fees. I have always been quite happy with my results from Vanguard and I remain skeptical about supposedly superior returns from factors. I know that I would not have the patience to ride out years of underperformance waiting for a factor to prove its merit. I tried Avantis ETFs, but quickly abandoned them. Too much work dealing with Norbert’s Gambit. I must confess, however, that I succumbed to tempation and bought Vanguard’s value and momentum ETFs: VVL and VMO. The latter has performed very well, but we’re in a bull market and a rising tide lifts all boats. They’re a very small percentage of my portolio and they’re really just for my own amusement.

@David – Thank you so much for your personal insights (they will likely save at least several DIY investors from a frustrating experience dealing with Norbert’s gambit, USD book value tracking, etc. :)

Fantastic analysis Justin. Keep up the good work!

@Constantine – I’m glad you enjoyed the article/video – thanks for reading/watching! :)